Miller Industries, Inc.

MLR NYSE

Weekly Report

Miller Industries, Inc. closed at 38.1900 (-6.60% WoW) . Data window ends Fri, 19 Sep 2025.

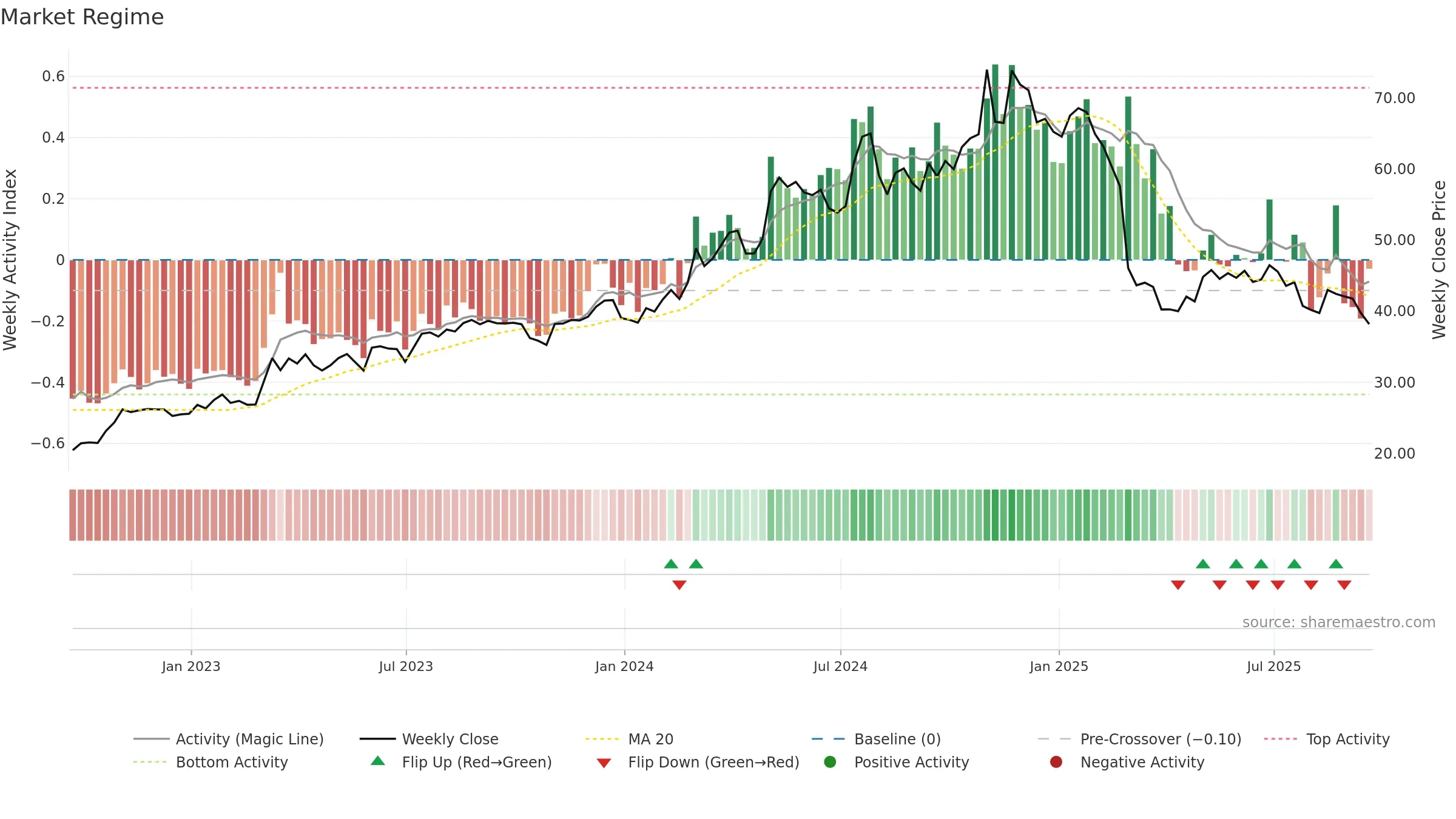

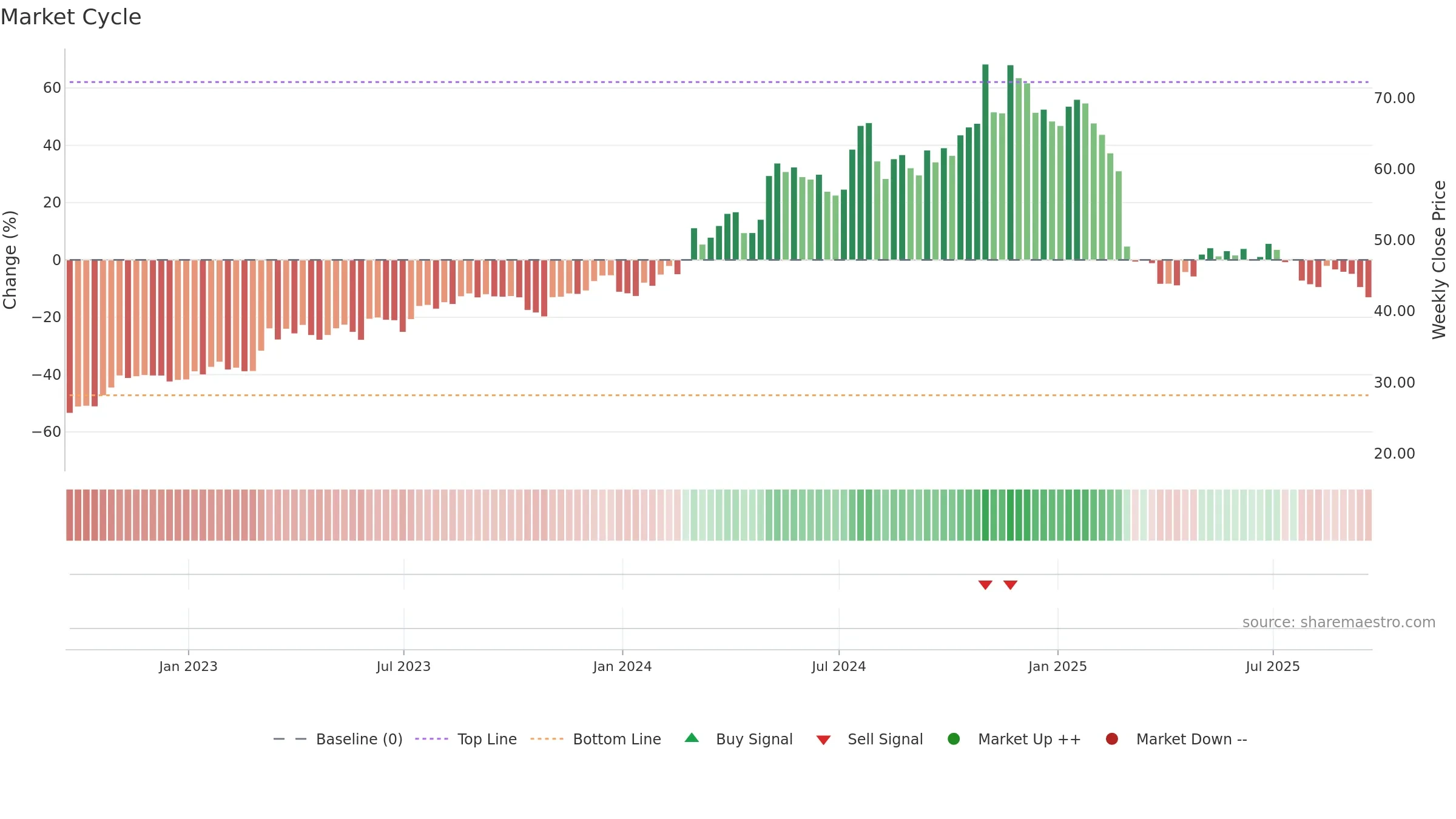

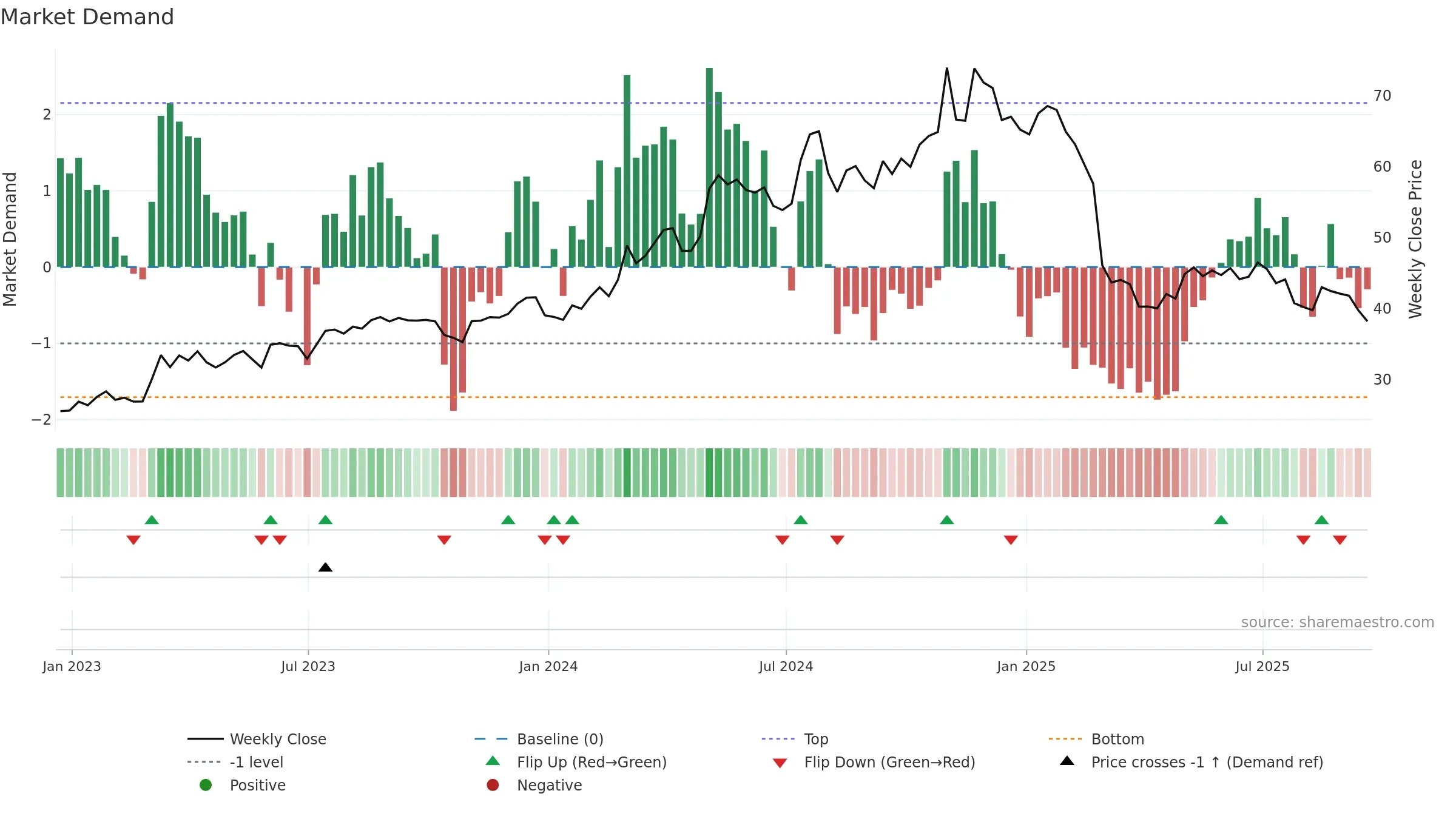

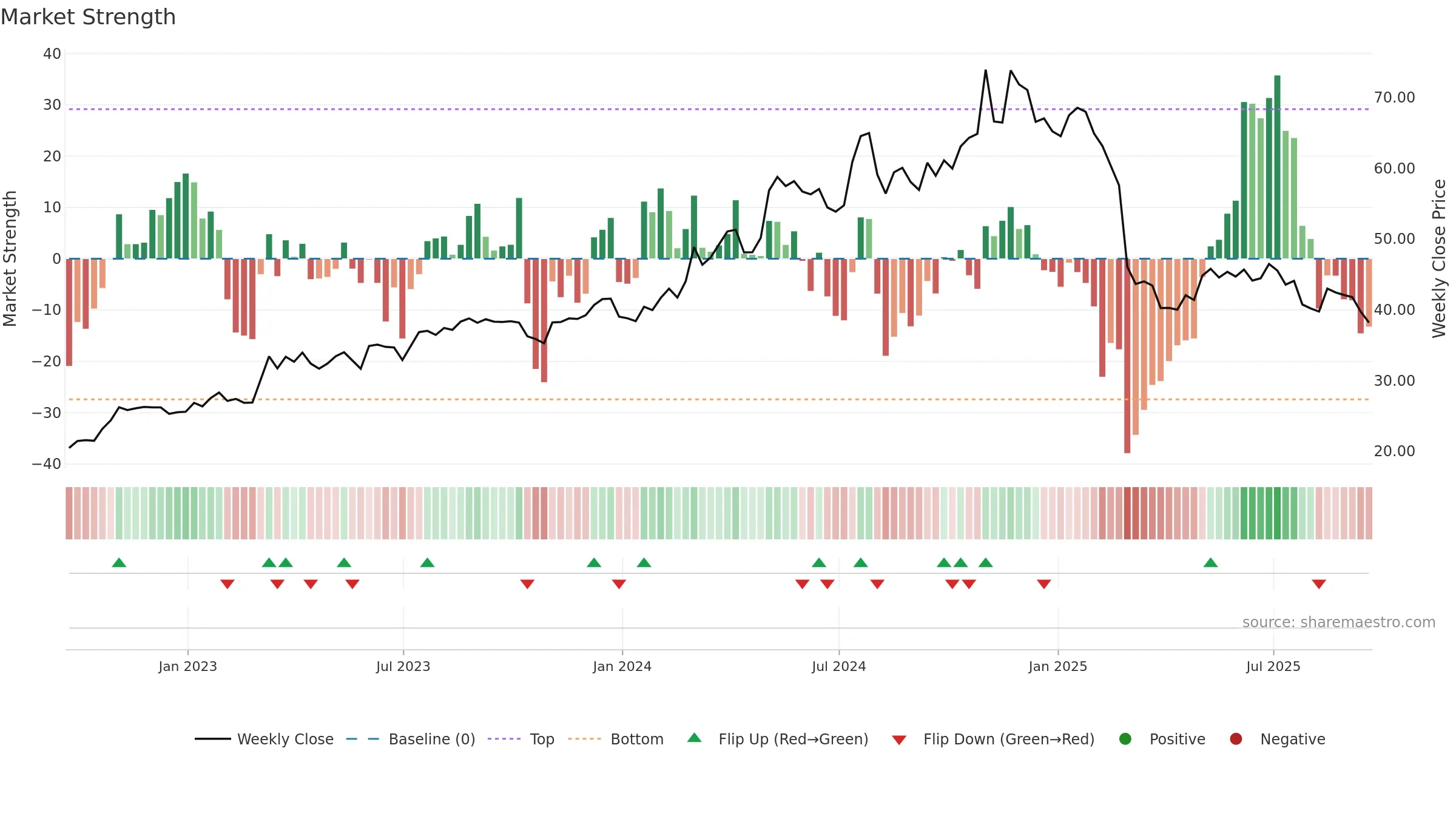

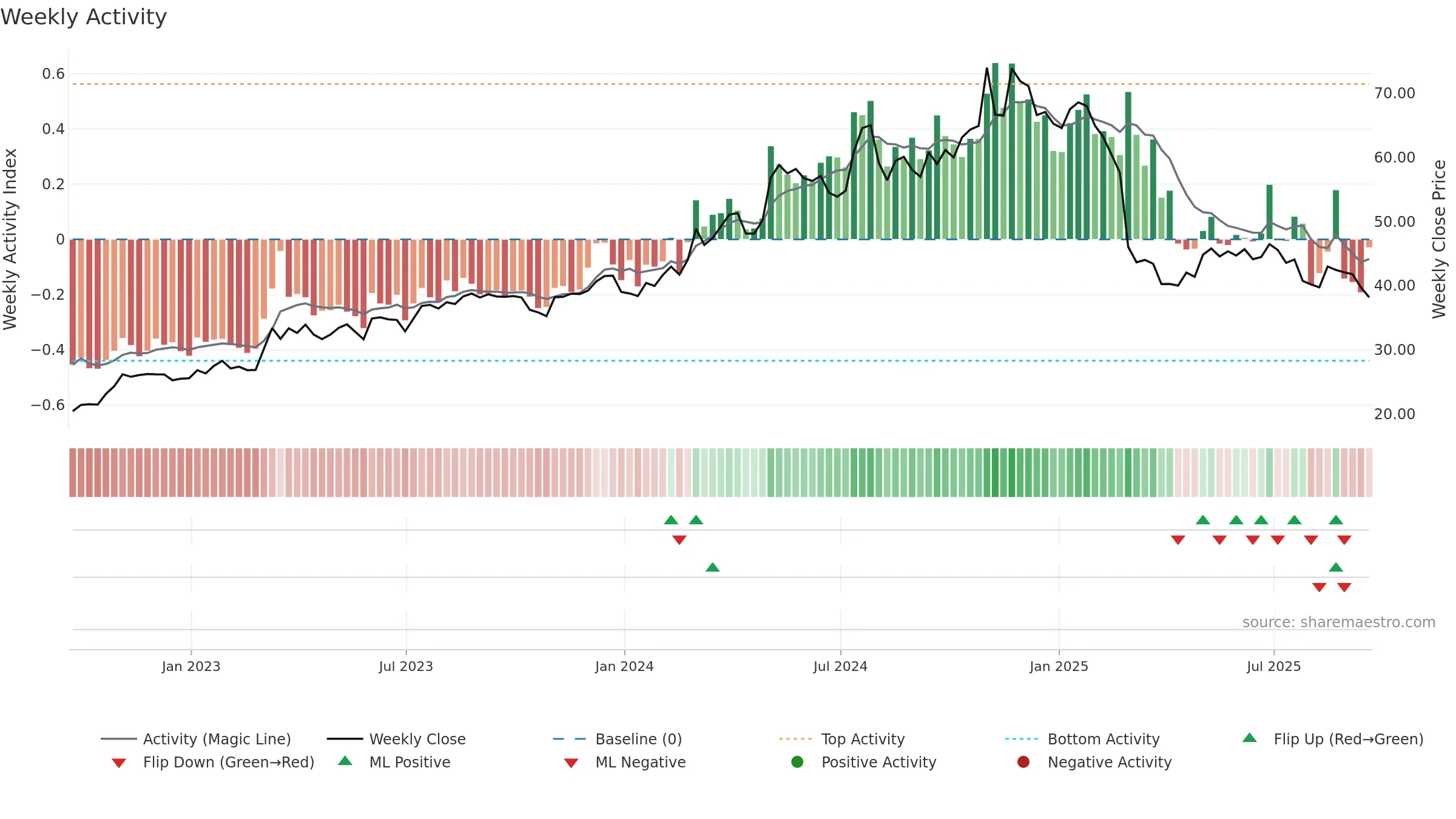

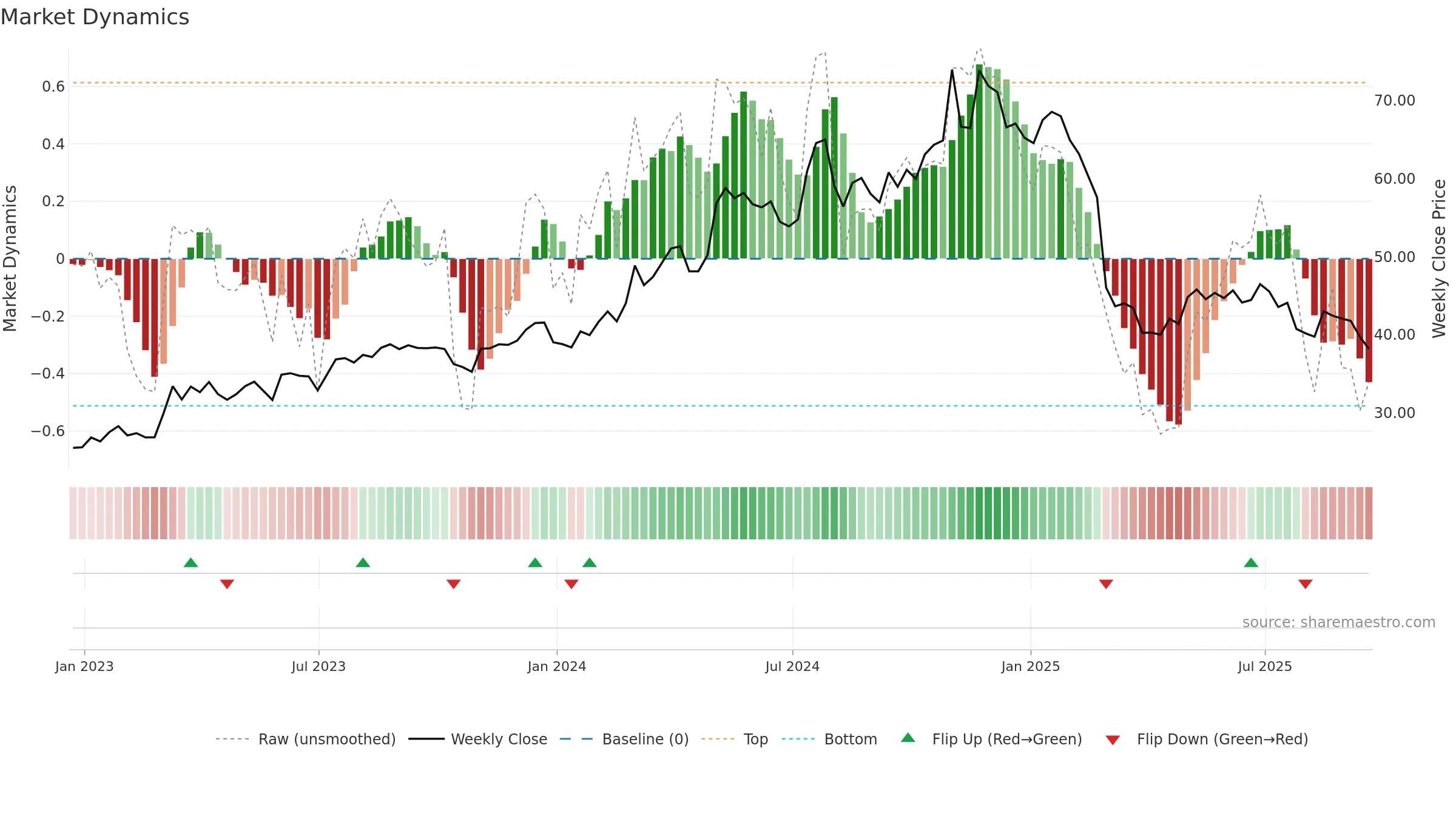

How to read this — Price slope is downward, indicating persistent supply pressure. Volume trend diverges from price — watch for fatigue or rotation. Returns are negatively correlated with volume — strength may come on lighter activity. Price is extended below its baseline; rebounds can be sharp if demand improves. Distance to baseline is narrowing — reverting closer to its fair-value track. Weak MA stack argues for caution; rallies can fail near the 8–13 week region. Fresh short-term downside crossover weakens near-term tone. Price sits below key averages, keeping pressure on the tape.

Down-slope argues for patience; rallies can fade sooner unless participation improves. Because liquidity isn’t confirming, prefer evidence of fresh demand before chasing moves.

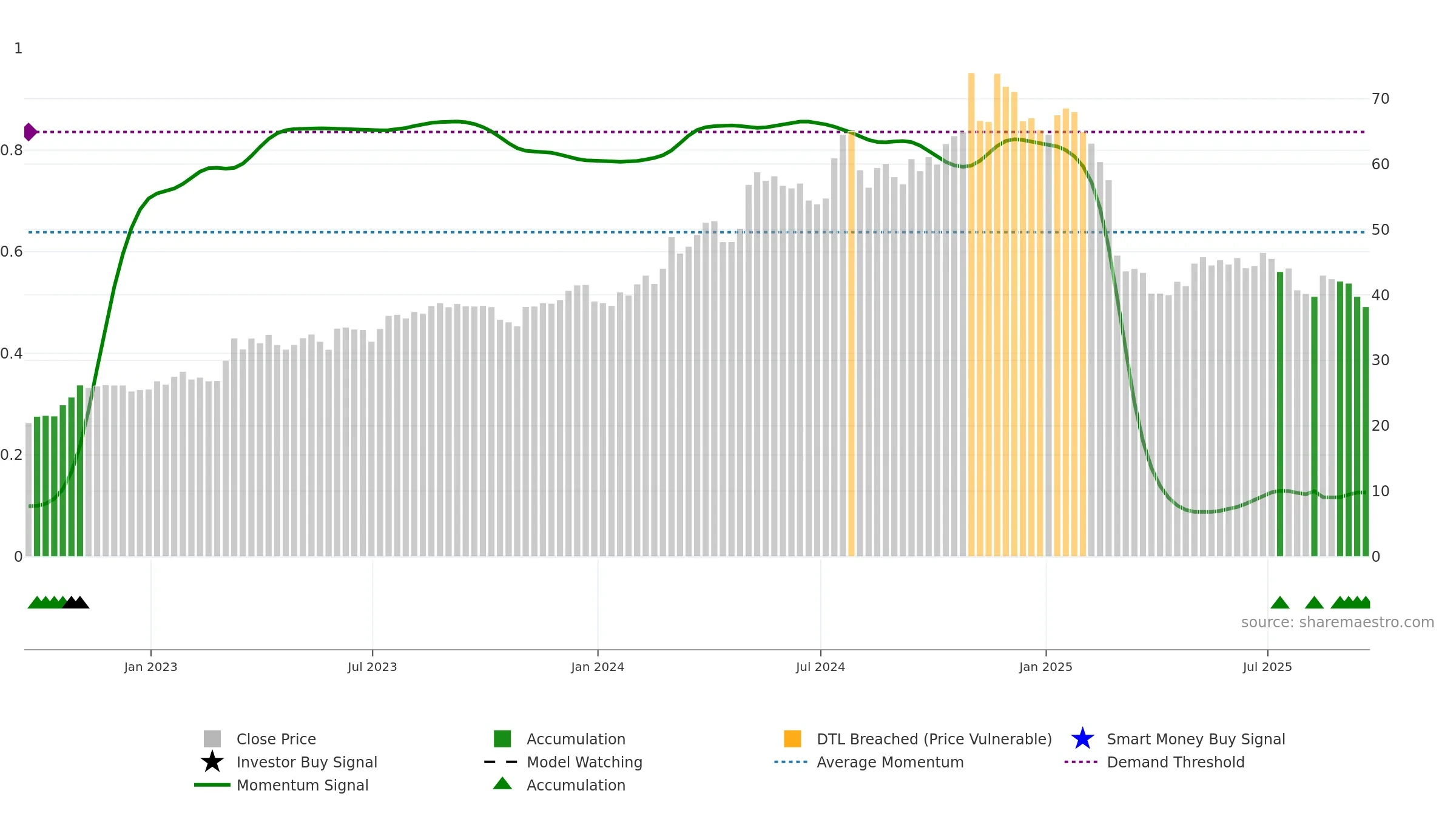

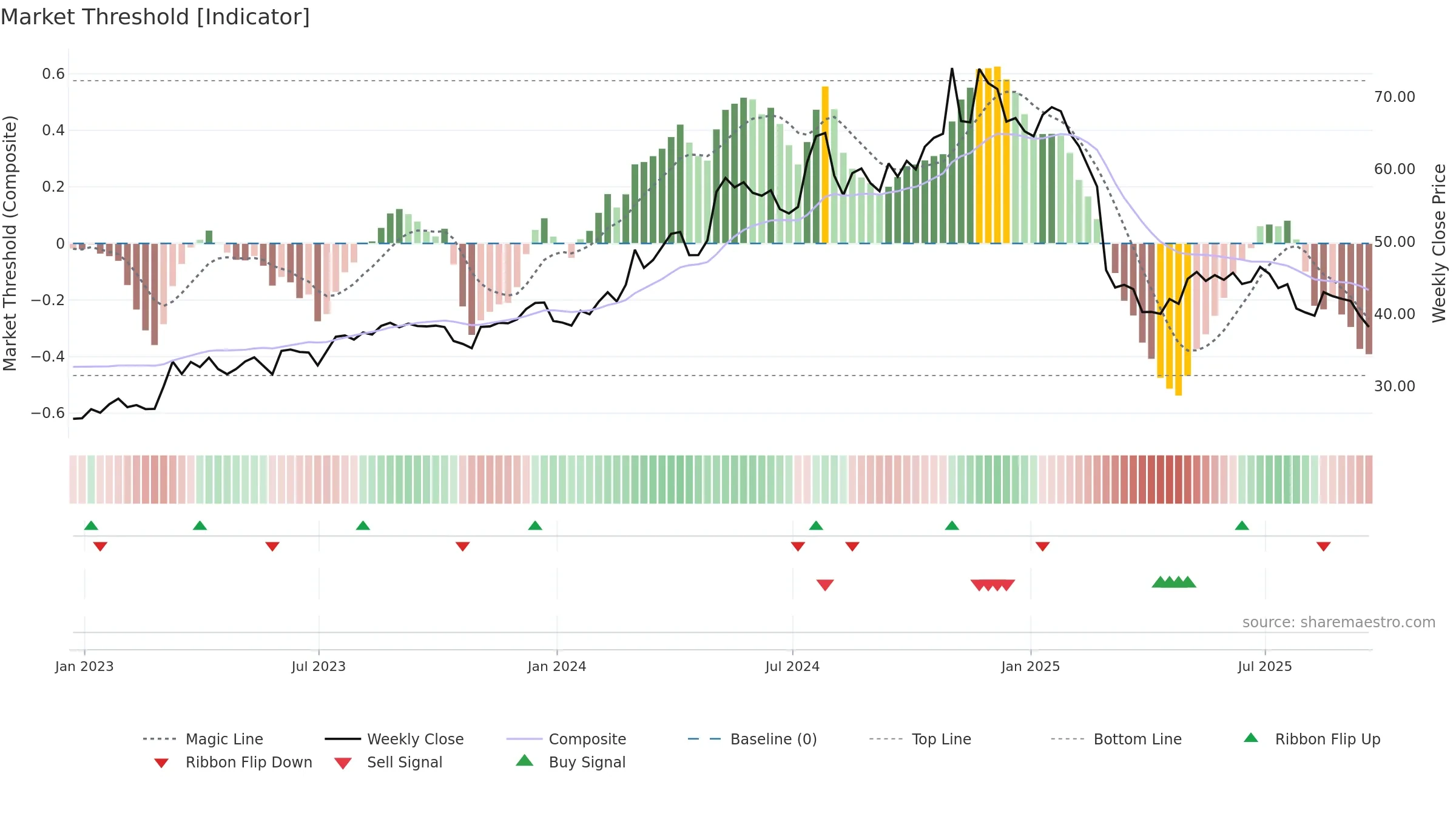

Gauge maps the trend signal to a 0–100 scale.

How to read this — Bearish backdrop but short-term momentum is improving; confirmation still needed.

Early improvement — look for a reclaim of 0.50→0.60 to validate.

The flag is positive: favourable upside skew with supportive conditions.

Conclusion

Neutral setup. ★★★☆☆ confidence. Price window: -4. Trend: Bottoming Attempt; gauge 12. In combination, liquidity diverges from price.

- Early improvement from bearish zone (bottoming attempt)

- Buyers step in at depressed levels (accumulation)

- Price is not above key averages

- Weak moving-average stack

- Liquidity diverges from price

- Negative multi-week performance

Why: Price window -4.98% over 8w. Close is -11.19% below the prior-window high. Return volatility 2.10%. Volume trend rising. Liquidity divergence with price. Trend state bottoming attempt. Low-regime (≤0.25) upticks 5/7 (71.0%) • Accumulating. MA stack weak. 4–8w crossover bearish. Momentum neutral and rising. Valuation stance positive.

Tip: Most metrics include a hover tooltip where they appear in the report.