Perpetua Resources Corp.

PPTA NASDAQ

Weekly Report

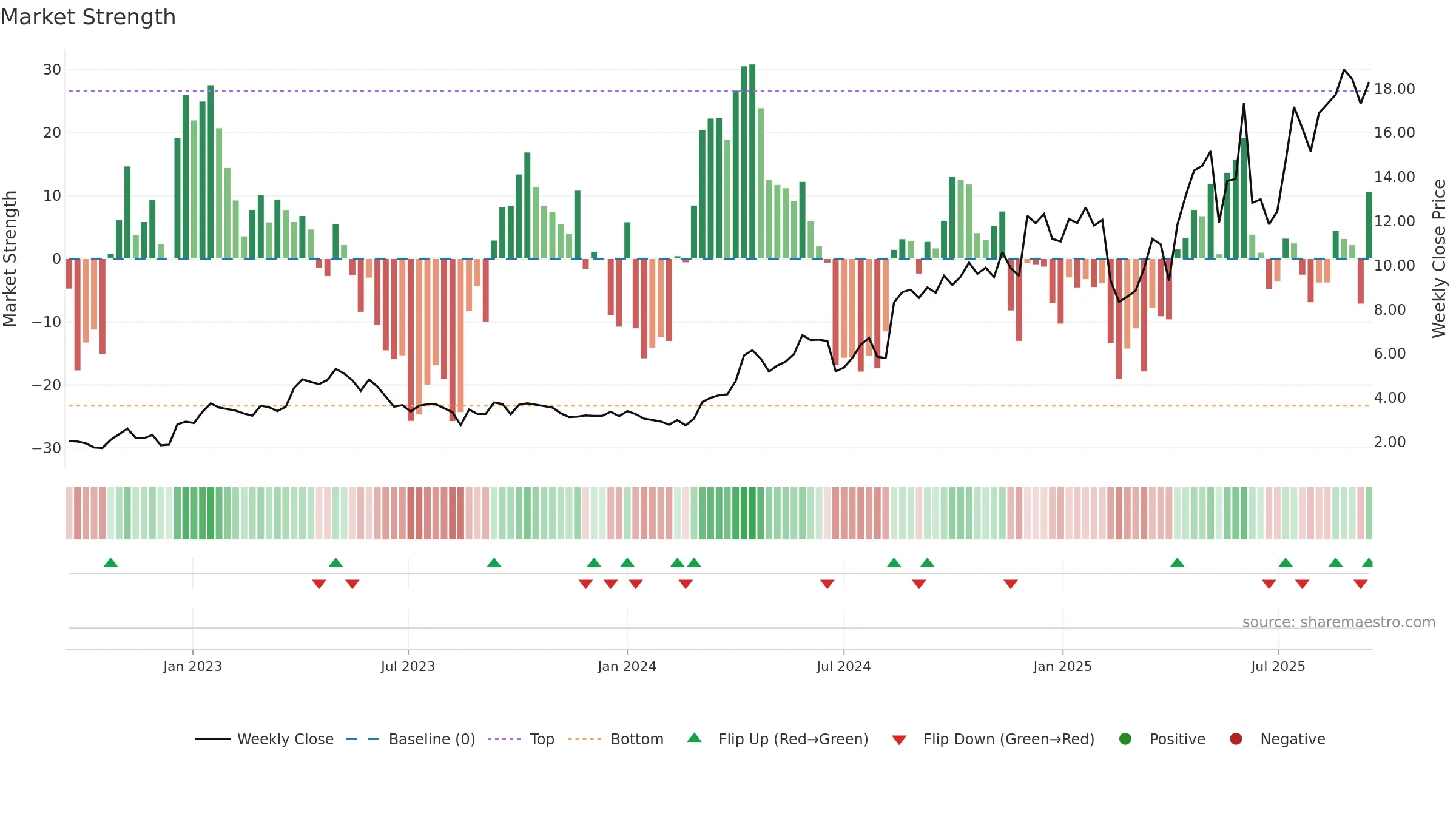

Perpetua Resources Corp. closed at 18.3100 (5.47% WoW) . Data window ends Mon, 15 Sep 2025.

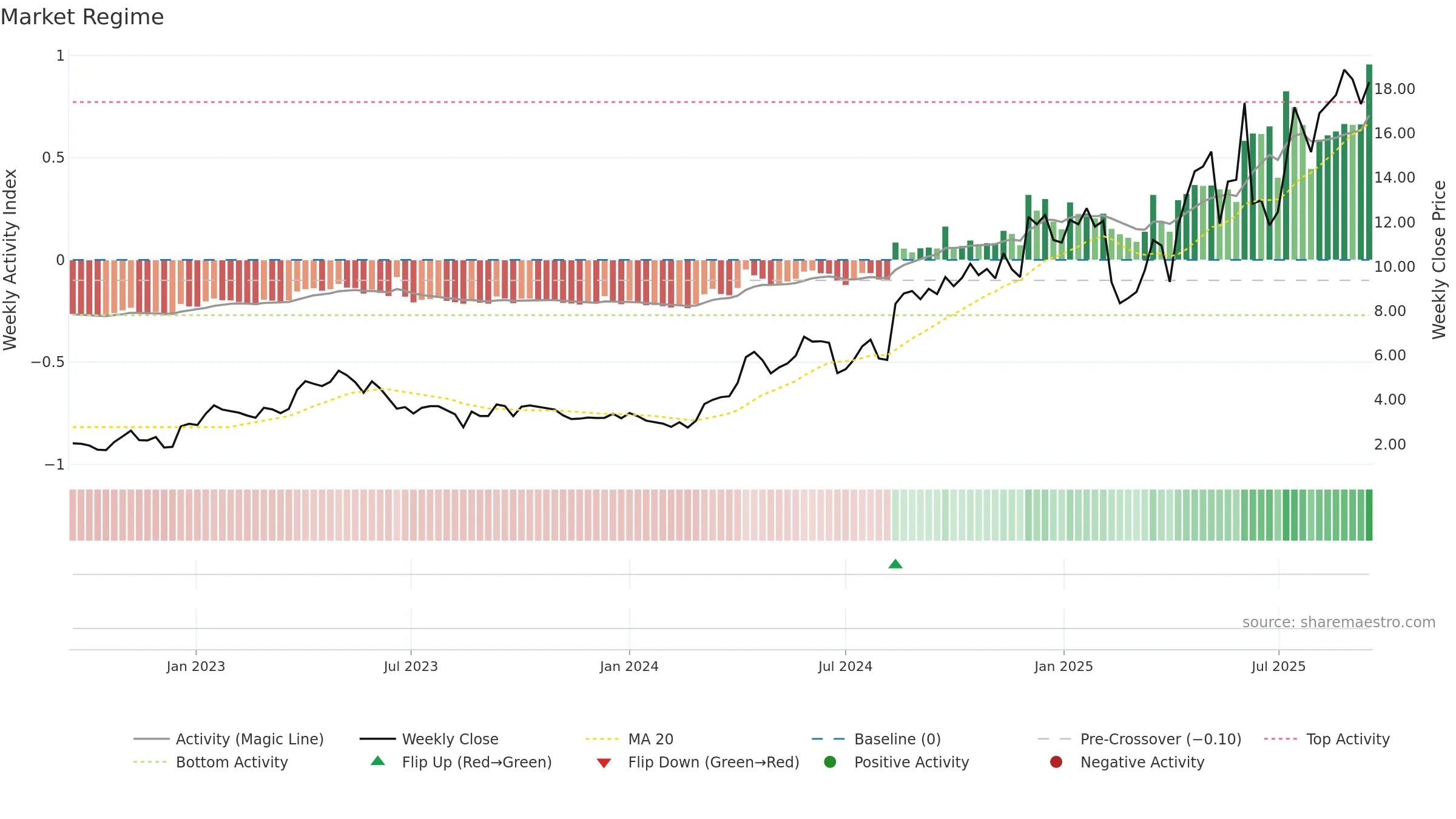

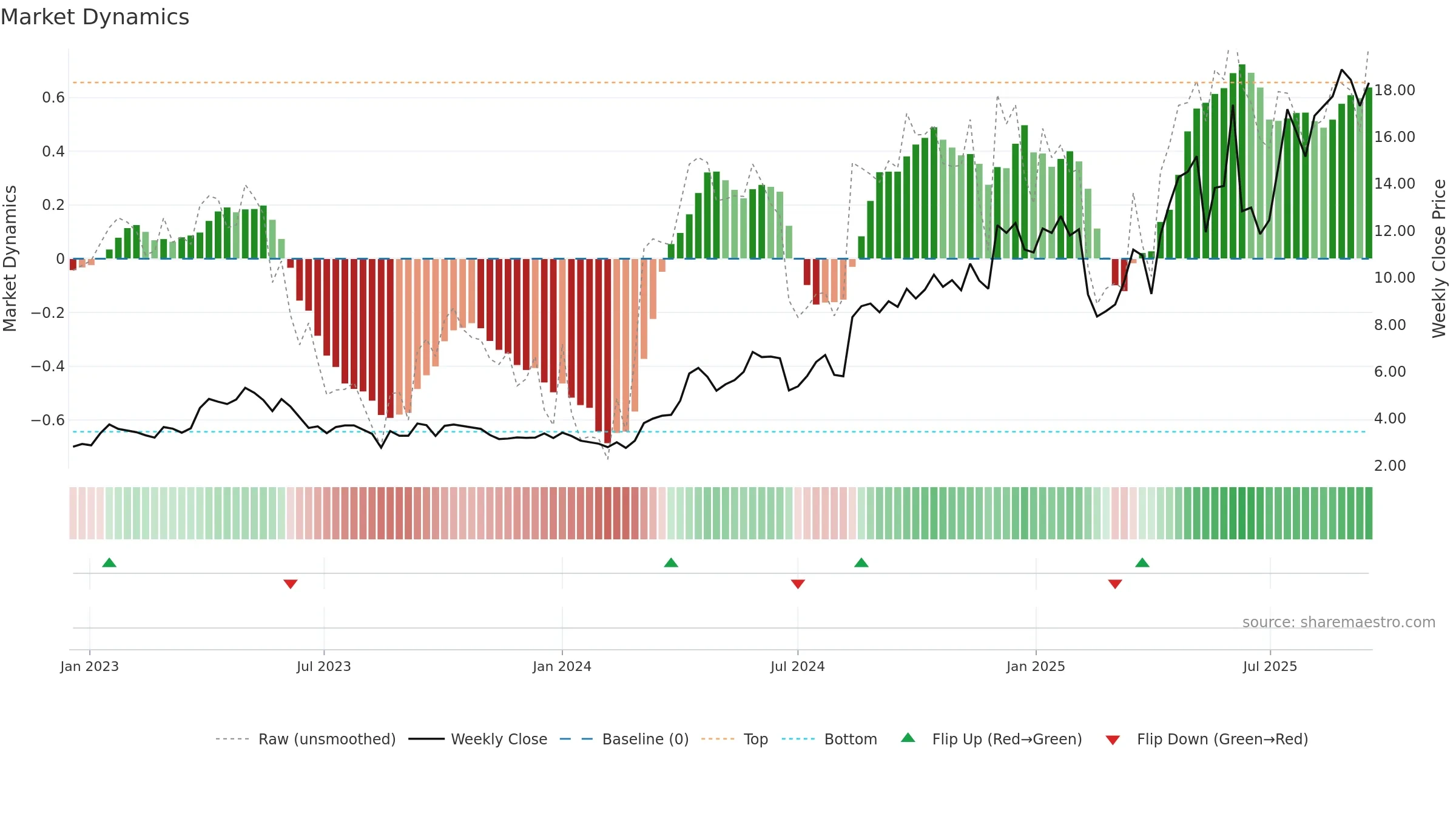

How to read this — Price slope is upward, indicating persistent buying over the window. Elevated weekly volatility increases whipsaw risk. Volume and price are moving in the same direction — a constructive confirmation. Distance to baseline is narrowing — reverting closer to its fair-value track. Constructive MA stack supports the up-drift; pullbacks may find support at the 8–13 week region. Price holds above key averages, indicating constructive participation.

Up-slope supports buying interest; pullbacks may be contained if activity stays firm.

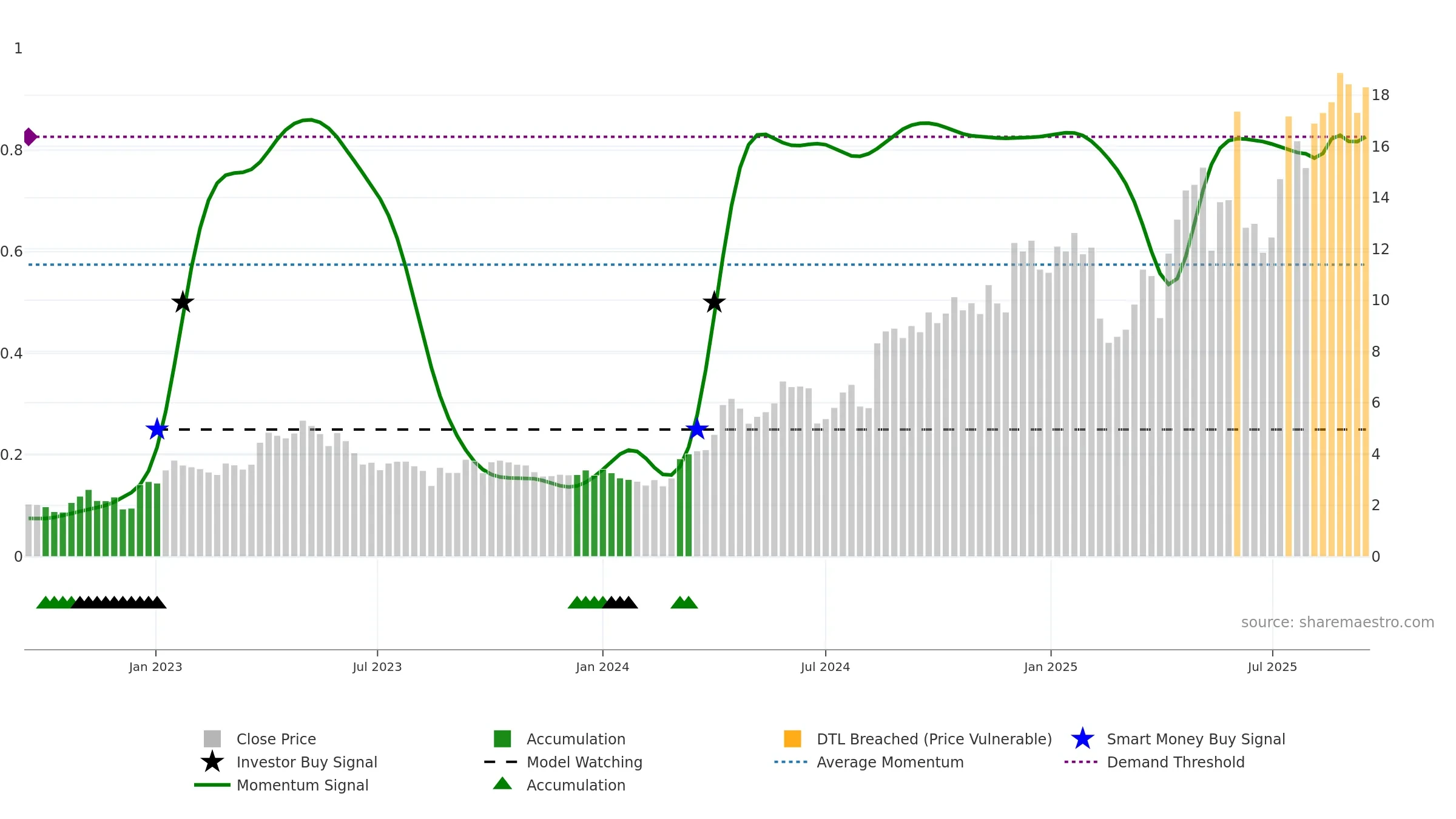

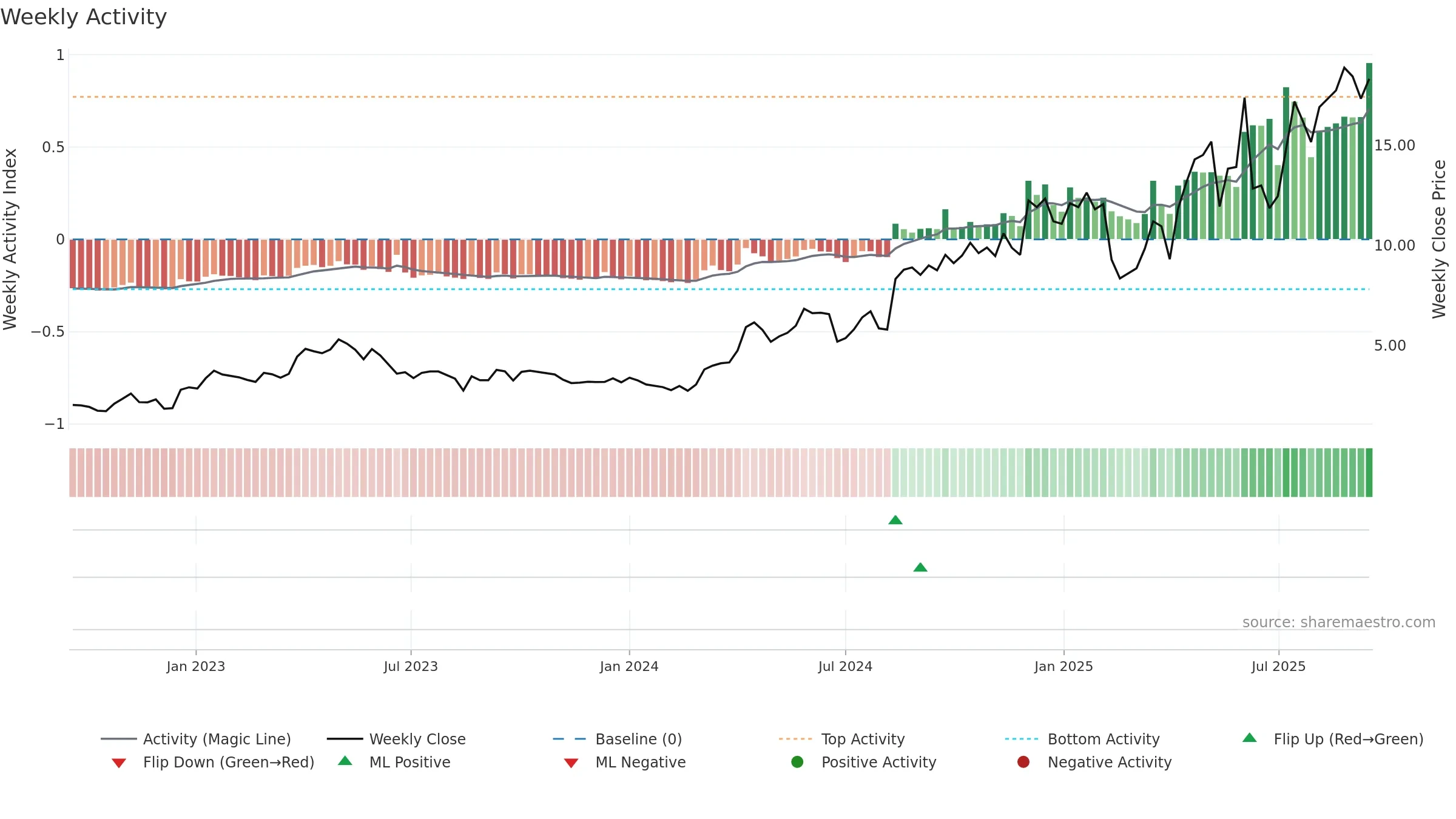

Gauge maps the trend signal to a 0–100 scale.

How to read this — Gauge is elevated but momentum is rolling over; topping risk is rising.

Stay alert: protect gains or seek confirmation before adding risk.

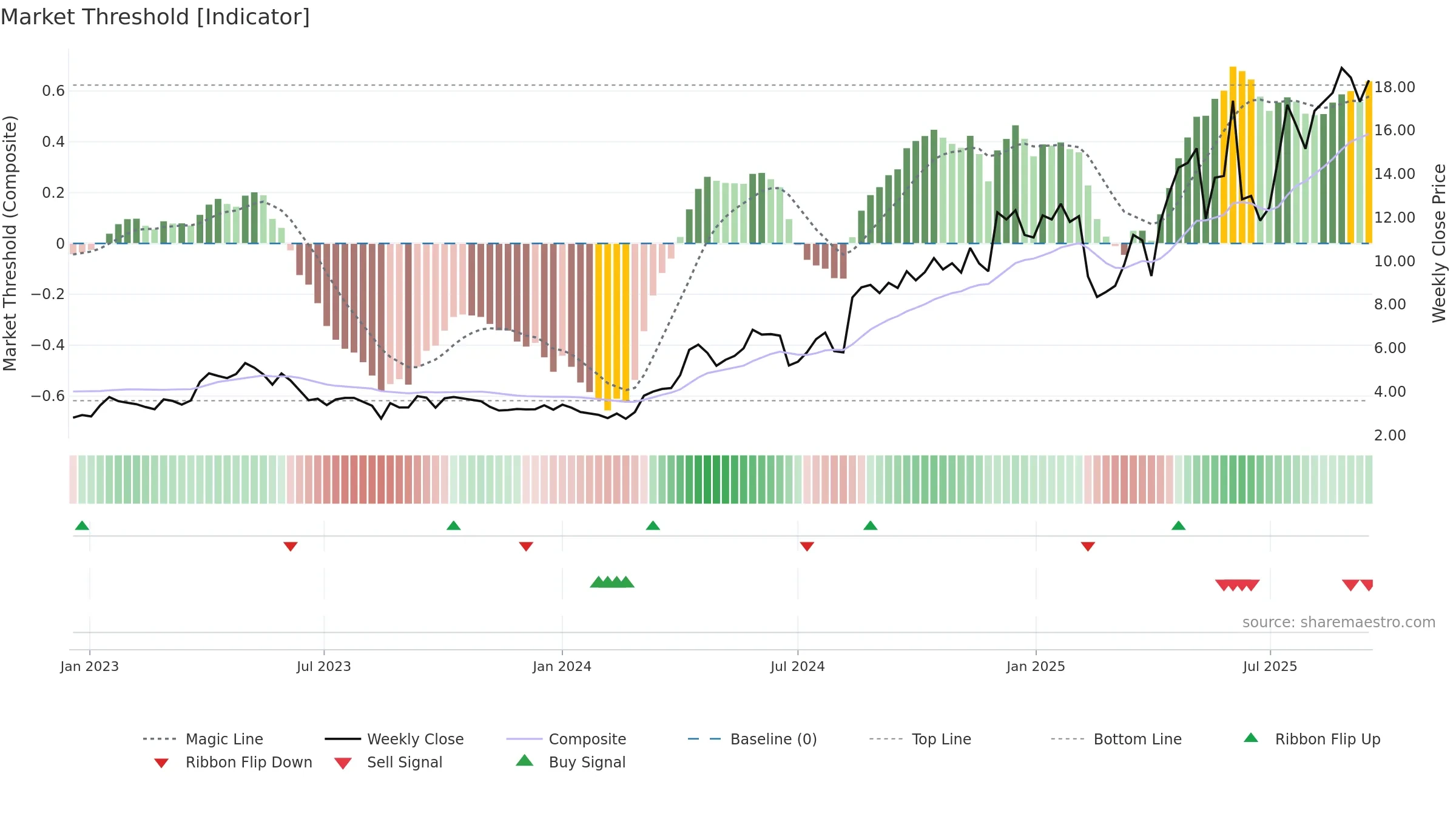

Conclusion

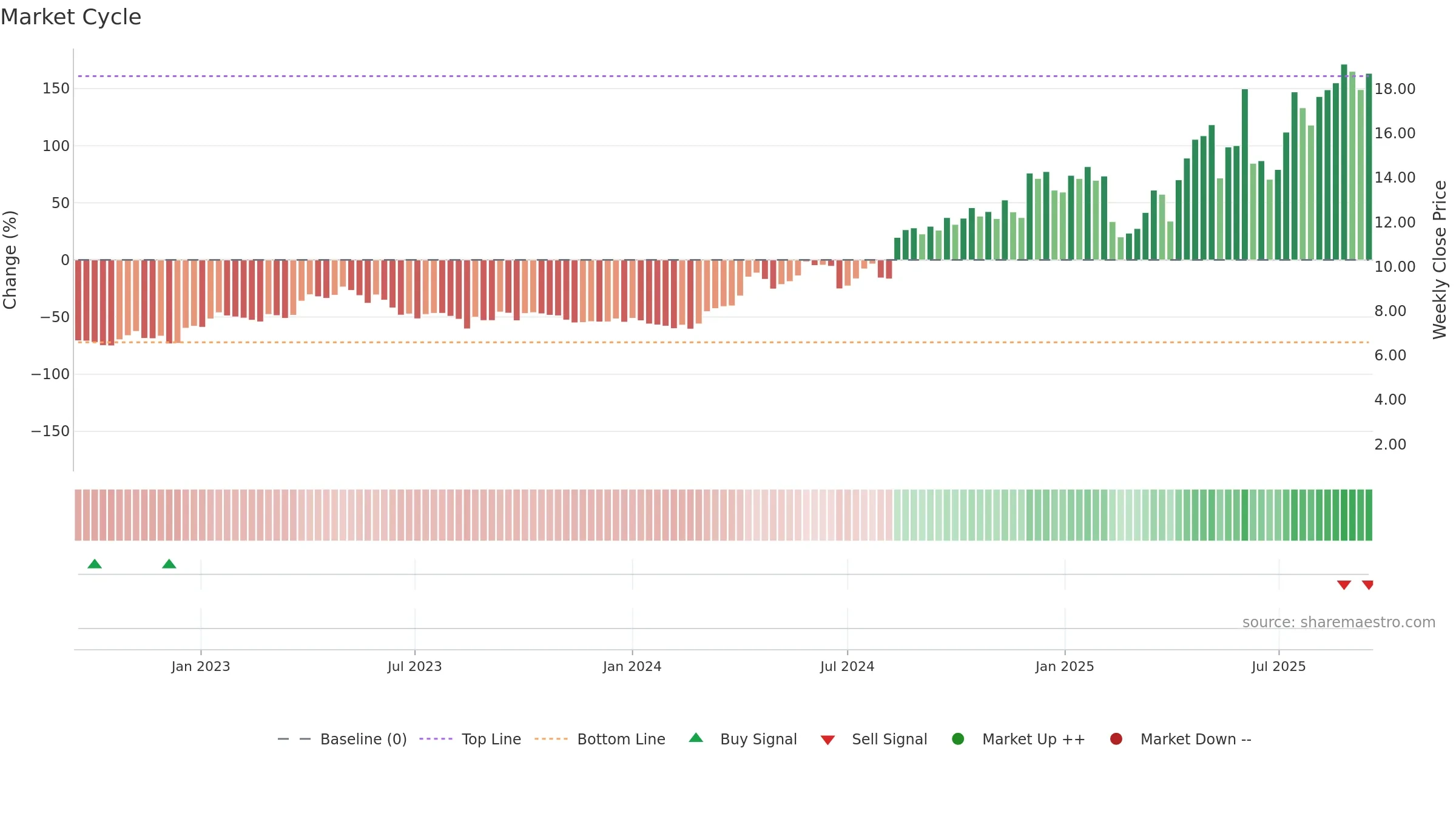

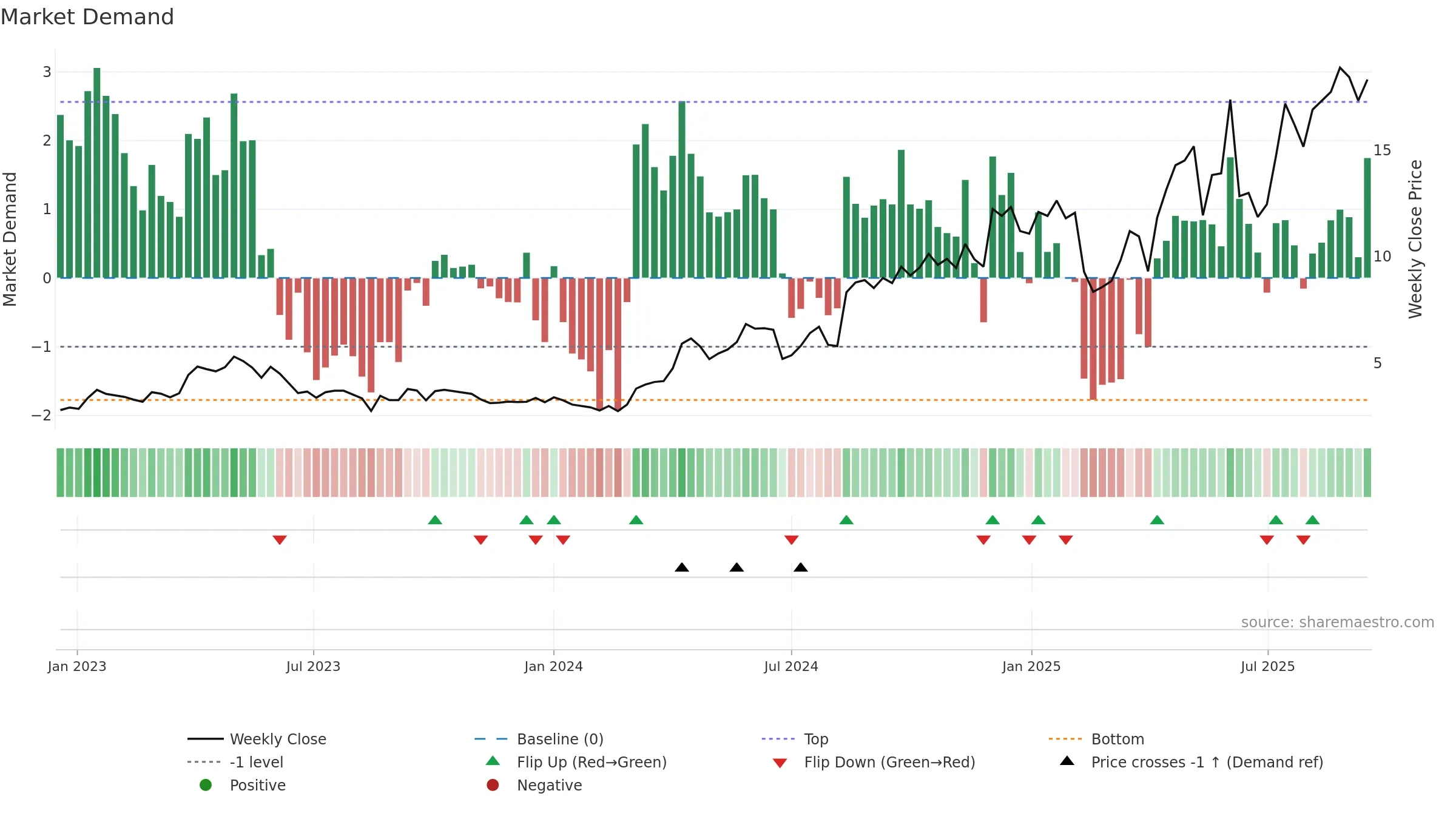

Negative setup. ★★☆☆☆ confidence. Price window: 20. Trend: Uptrend at Risk; gauge 82. In combination, liquidity confirms the move.

- Momentum is bullish and rising

- Price holds above 8w & 26w averages

- Constructive moving-average stack

- Liquidity confirms the price trend

- High-level but rolling over (topping risk)

- High return volatility raises whipsaw risk

- Sellers active at elevated levels (distribution)

Why: Price window 20.78% over 8w. Close is -2.97% below the prior-window high. Return volatility 5.66%. Volume trend rising. Liquidity convergence with price. Trend state uptrend at risk. High-regime (0.80–1.00) downticks 2/4 (50.0%) • Accumulating. MA stack constructive. Baseline deviation 1.61% (narrowing). Momentum bullish and rising.

Tip: Most metrics include a hover tooltip where they appear in the report.