Nextool Technology Co., Ltd.

688419 SHA

Weekly Summary

Nextool Technology Co., Ltd. closed at 29.4800 (-0.81% WoW) . Data window ends Mon, 22 Sep 2025.

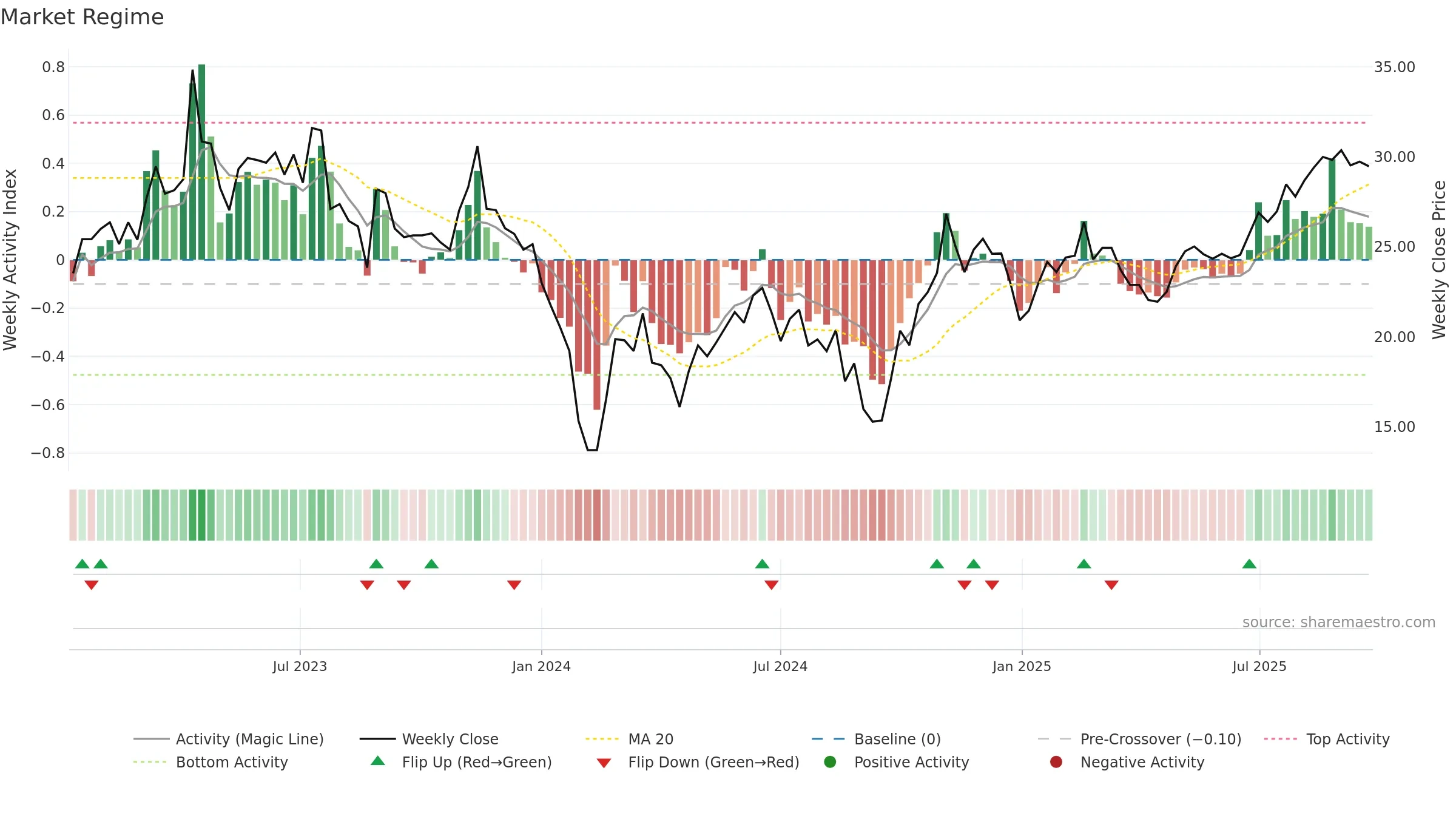

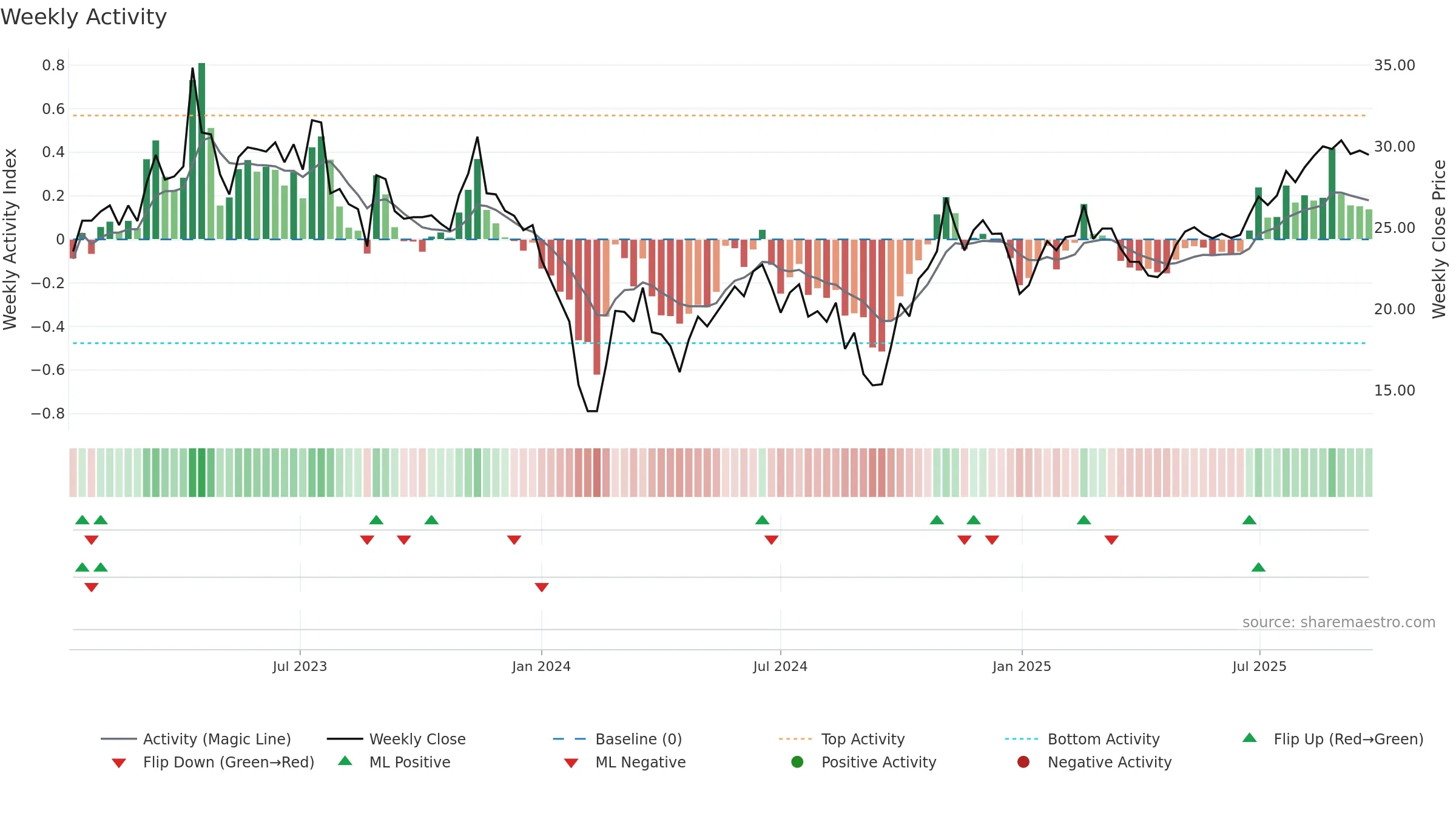

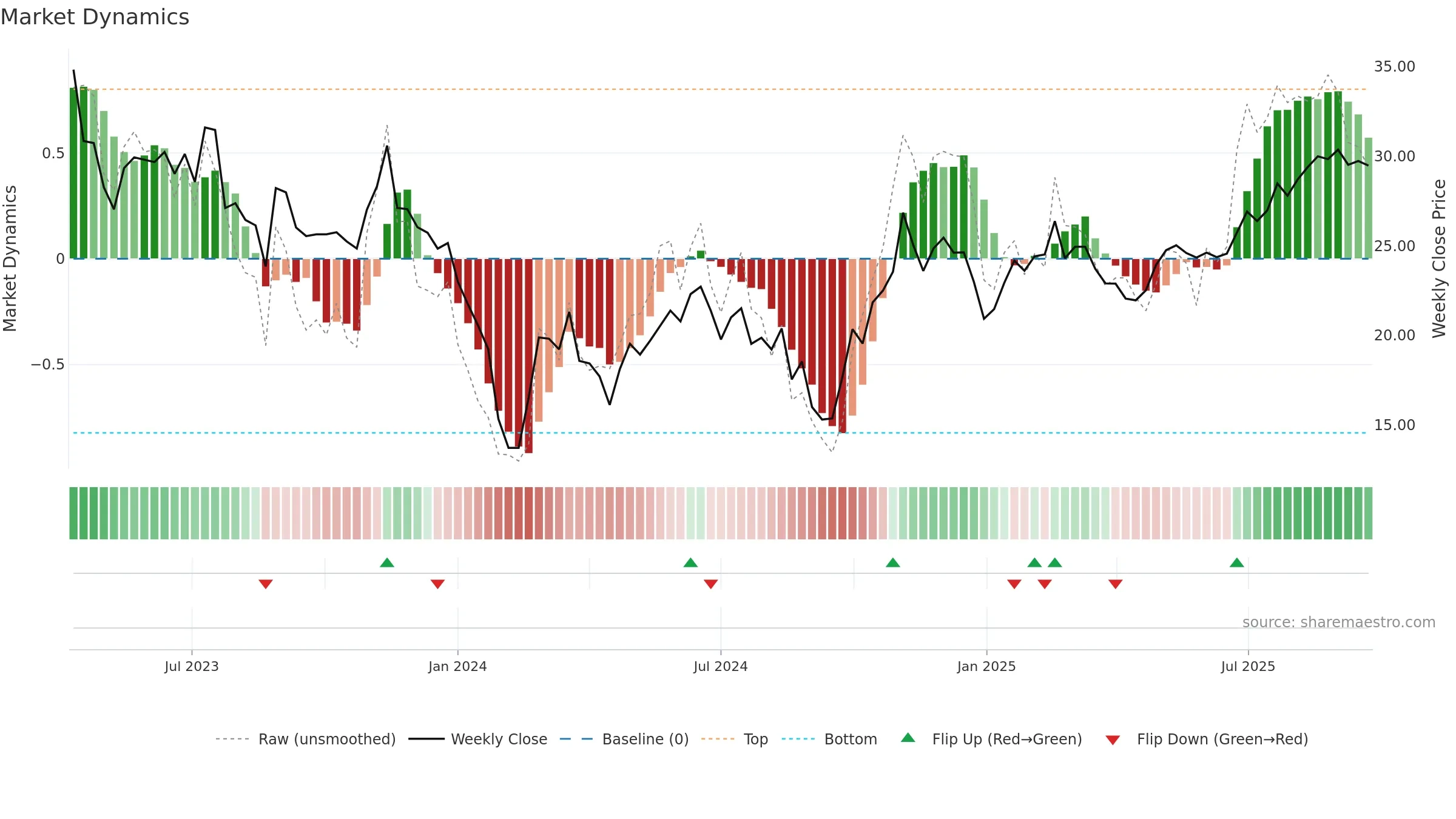

How to read this — Price slope is upward, indicating persistent buying over the window. Volume trend diverges from price — watch for fatigue or rotation. Returns are negatively correlated with volume — strength may come on lighter activity. Constructive MA stack supports the up-drift; pullbacks may find support at the 8–13 week region.

Up-slope supports buying interest; pullbacks may be contained if activity stays firm. Because liquidity isn’t confirming, prefer evidence of fresh demand before chasing moves.

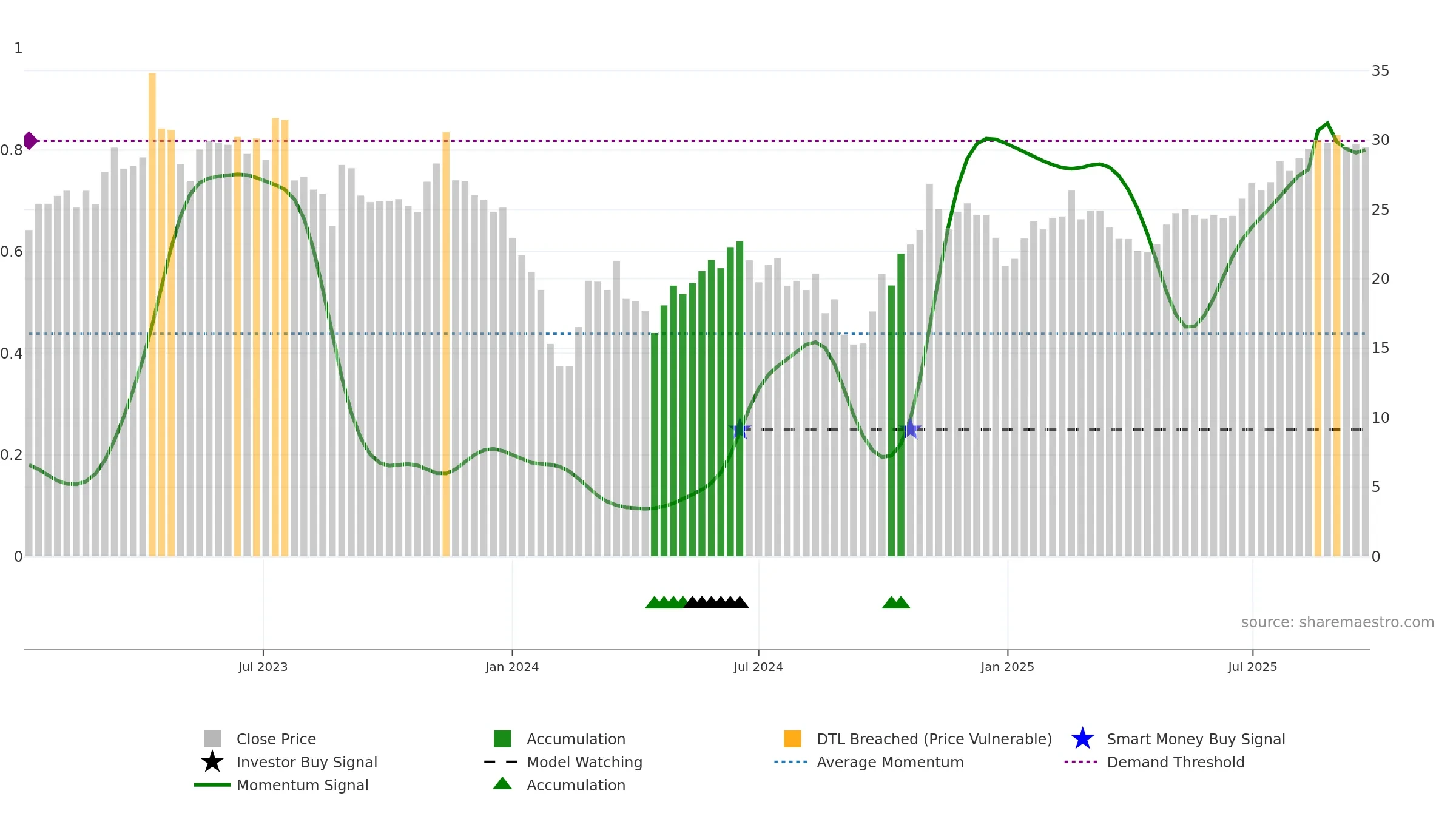

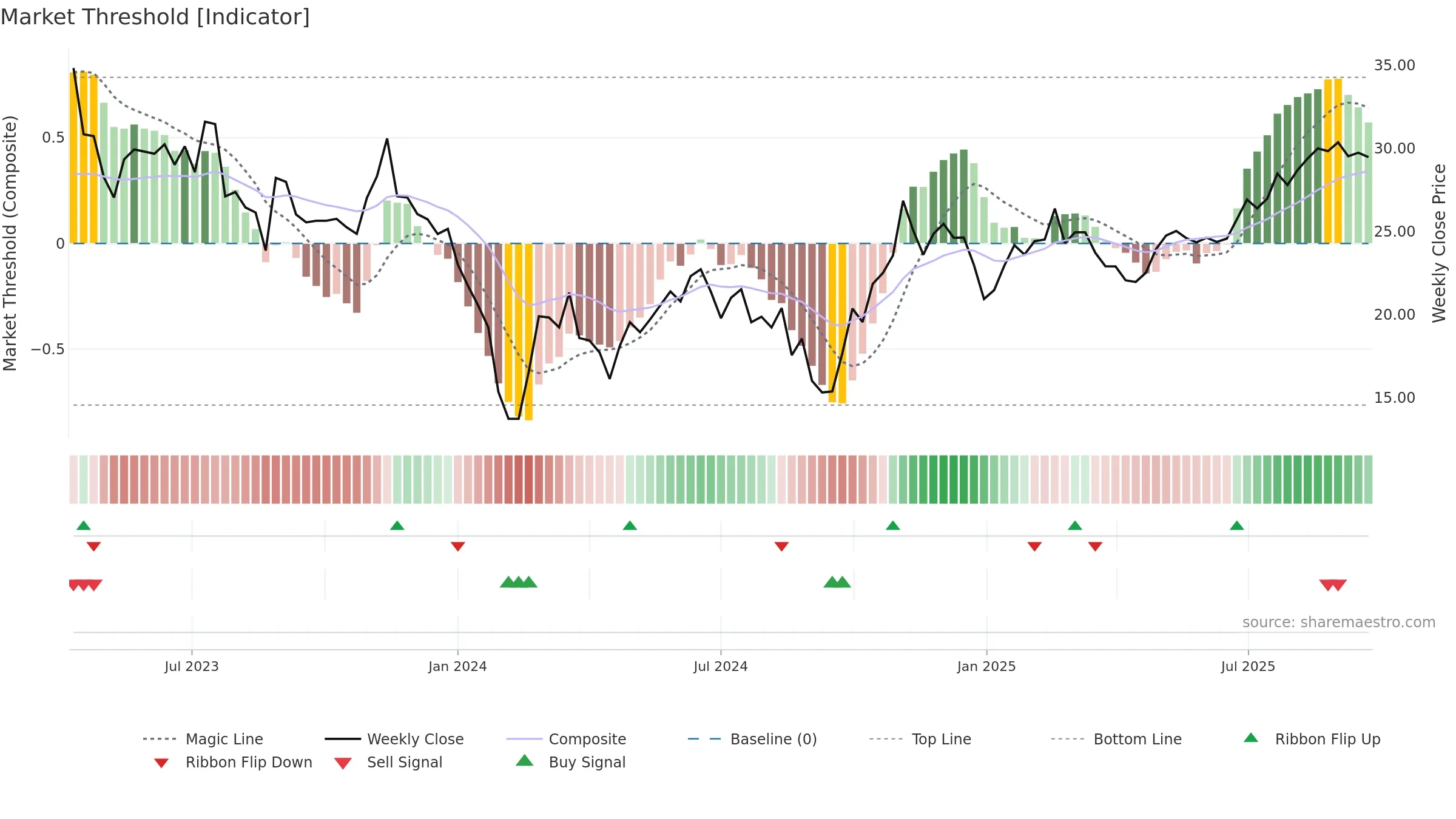

Gauge maps the trend signal to a 0–100 scale.

How to read this — Gauge is elevated but momentum is rolling over; topping risk is rising. Notable breakdown from ≥0.80 weakens trend quality.

Stay alert: protect gains or seek confirmation before adding risk.

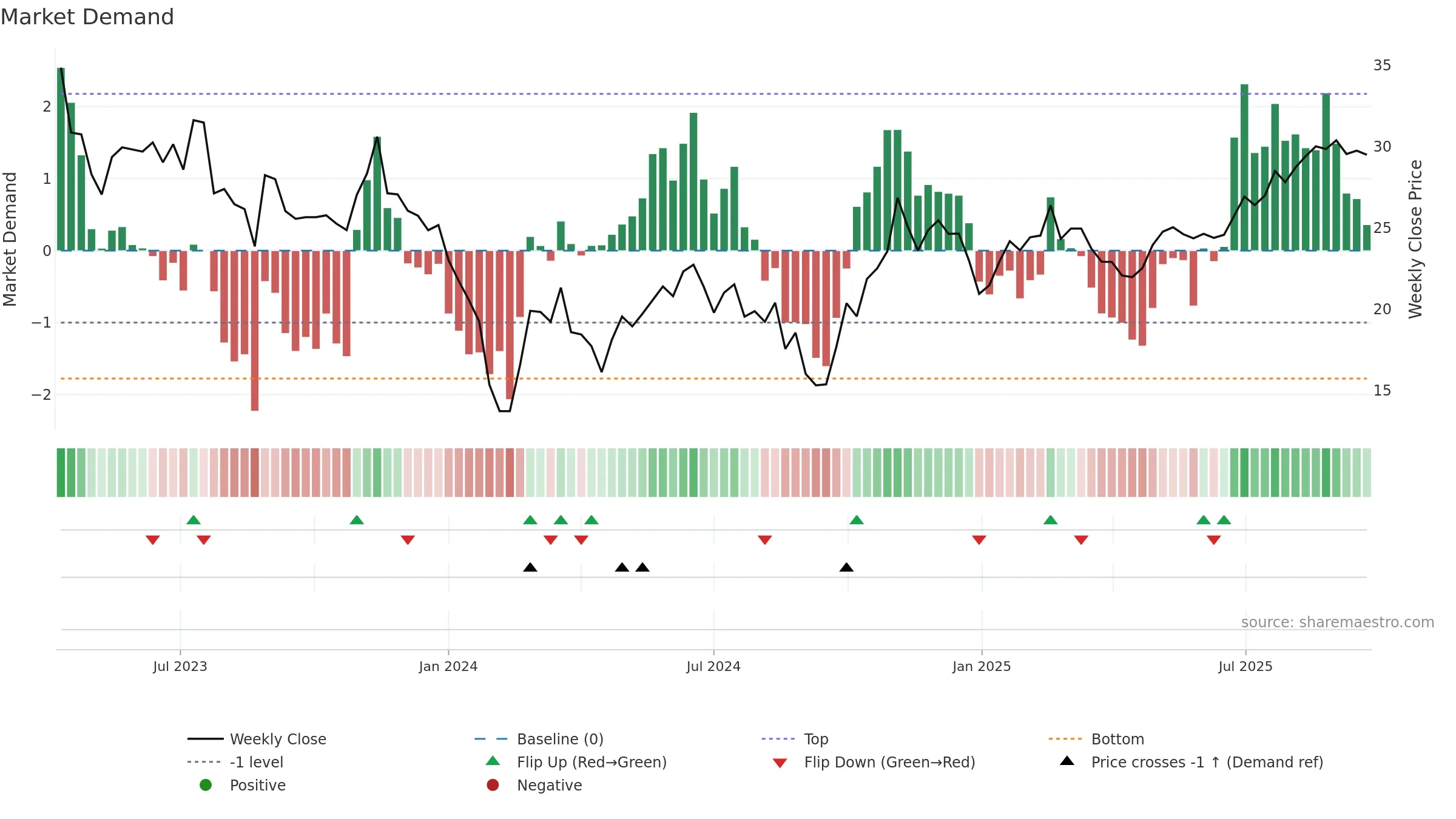

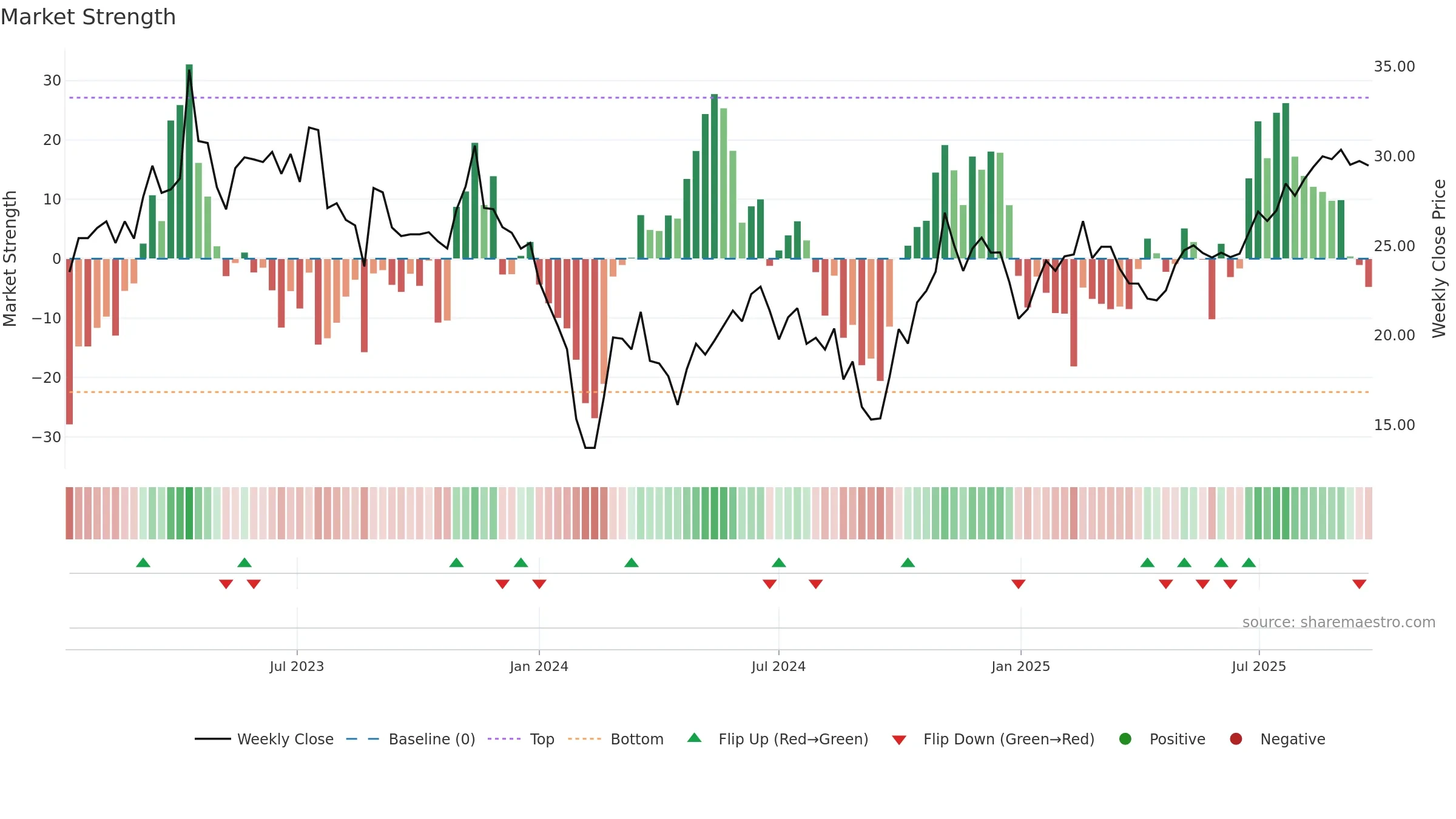

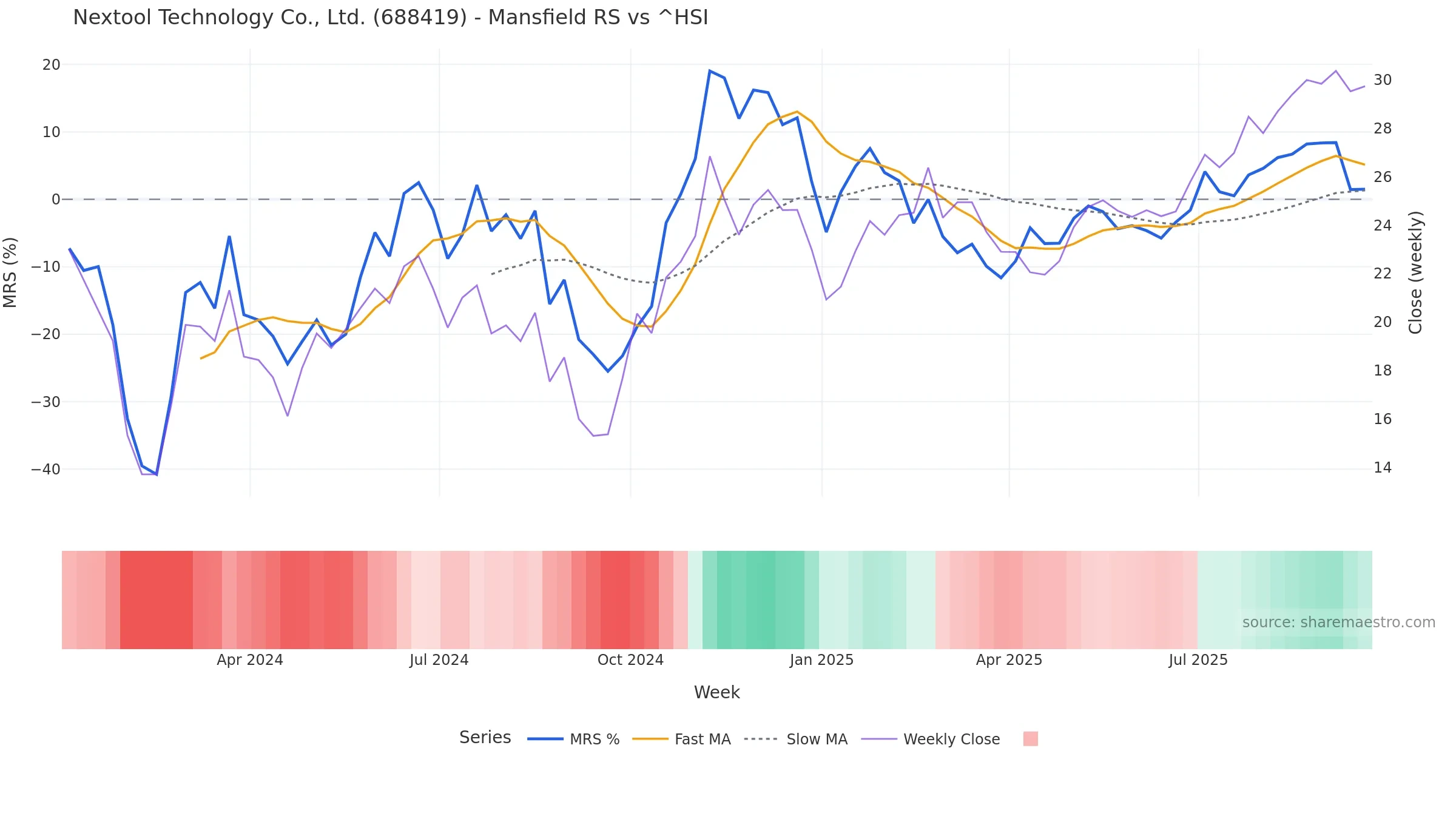

Relative strength is Positive

(> 0%, outperforming).

Latest MRS: 1.50% (week ending Fri, 19 Sep 2025).

Slope: Falling over 8w.

Notes:

- Holding above the zero line indicates relative bid.

- MRS slope falling over ~8 weeks.

Price is above fair value; upside may be capped without catalysts.

Conclusion

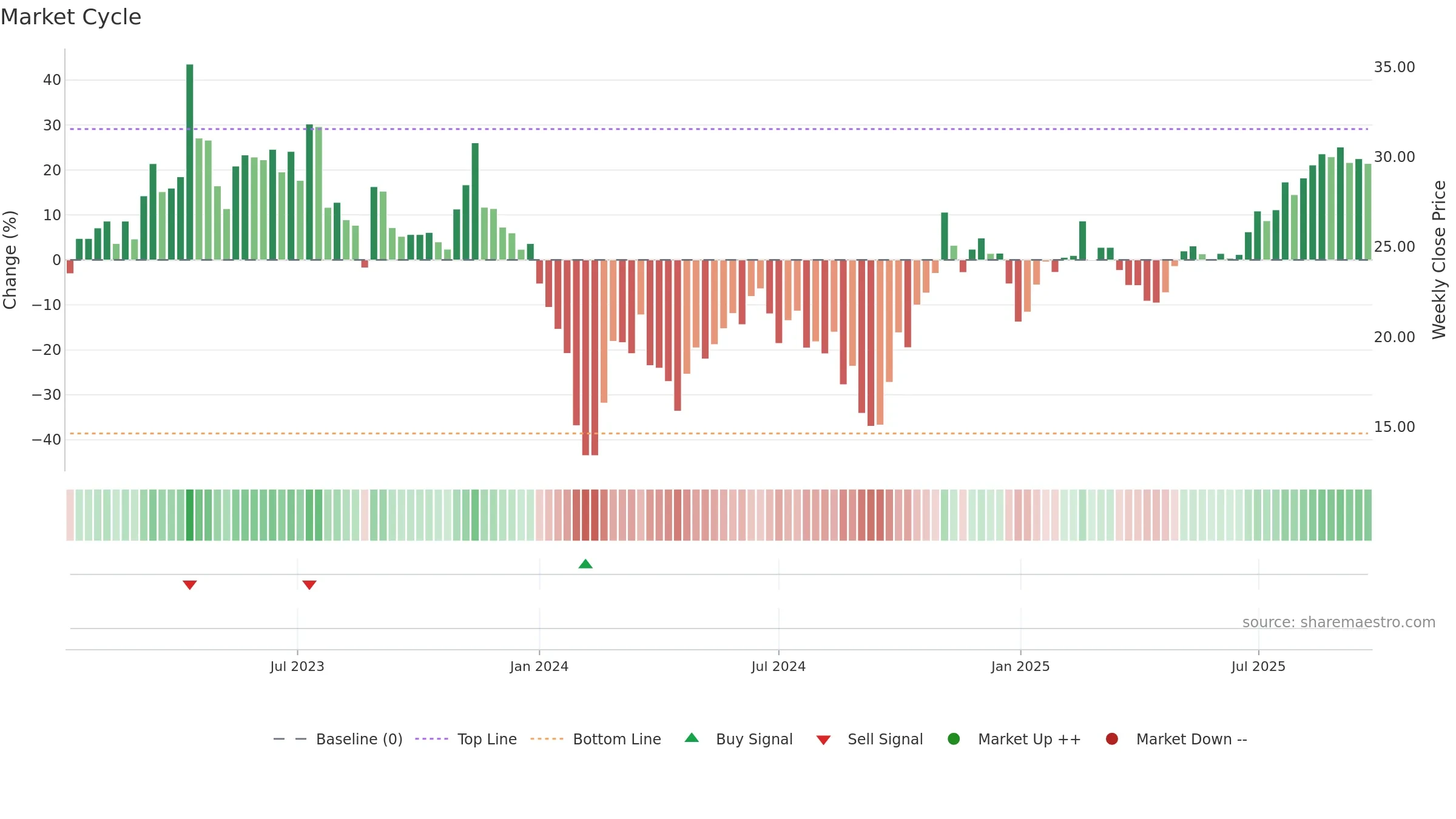

Negative setup. ★★⯪☆☆ confidence. Trend: Uptrend at Risk · 2.72% over window · vol 2.00% · liquidity divergence · posture mixed · RS outperforming · leaning negative

- Momentum is bullish and rising

- Constructive moving-average stack

- Mansfield RS: outperforming & rising

- High level but momentum rolling over (topping risk)

- Price is not above key averages

- Liquidity diverges from price

- Recent breakdown from ≥0.80 weakens trend quality

Why: Price window 2.72% over w. Close is -2.93% below the prior-window high. Return volatility 2.00%. Volume trend falling. Liquidity divergence with price. Trend state uptrend at risk. MA stack constructive. Momentum bullish and rising. Valuation limited upside without catalysts.

Tip: Most metrics include a hover tooltip where they appear in the report.