Ambev S.A.

ABEV3 BVMF

Weekly Summary

Ambev S.A. closed at 12.4600 (-0.56% WoW) . Data window ends Fri, 26 Sep 2025.

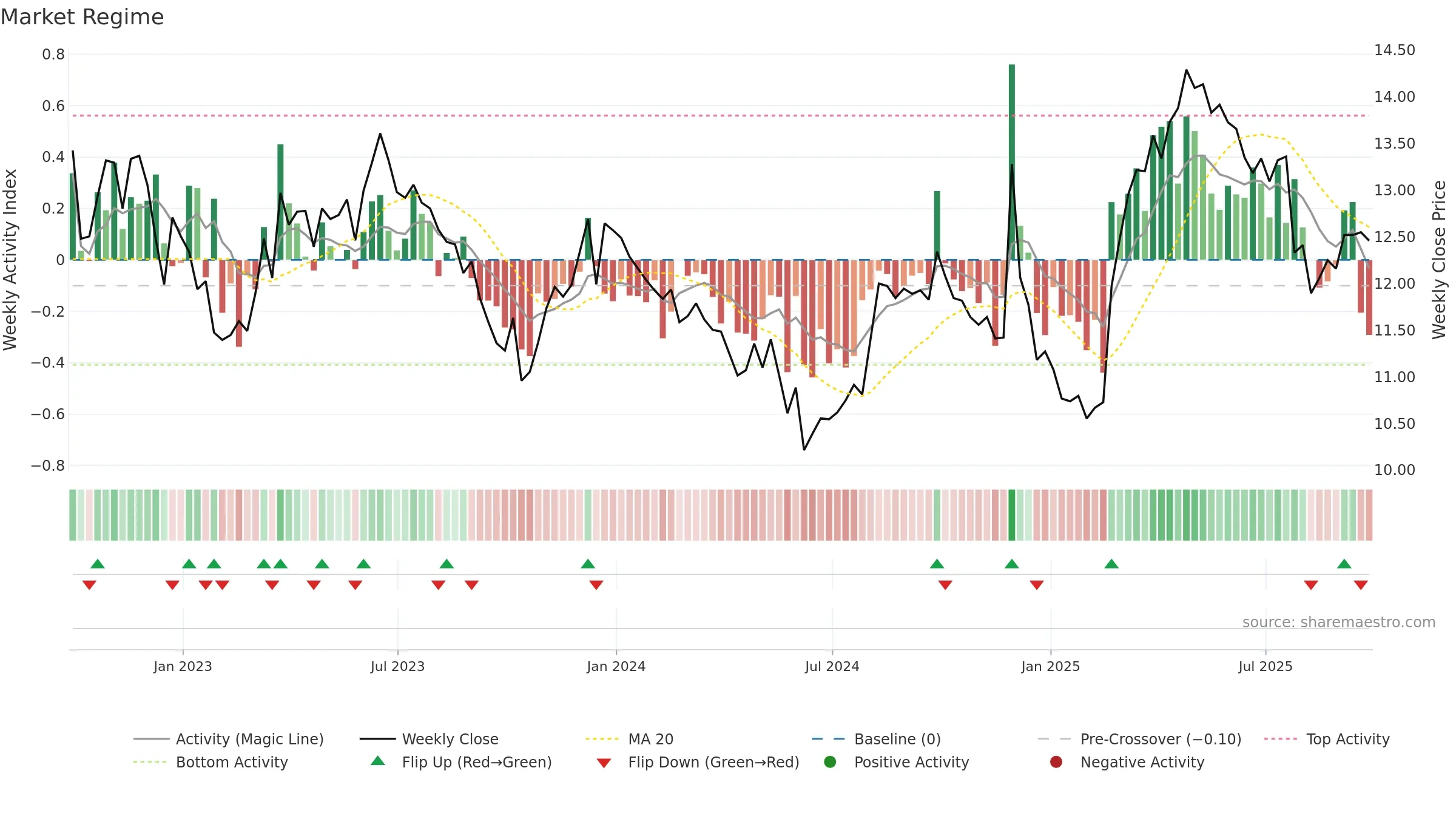

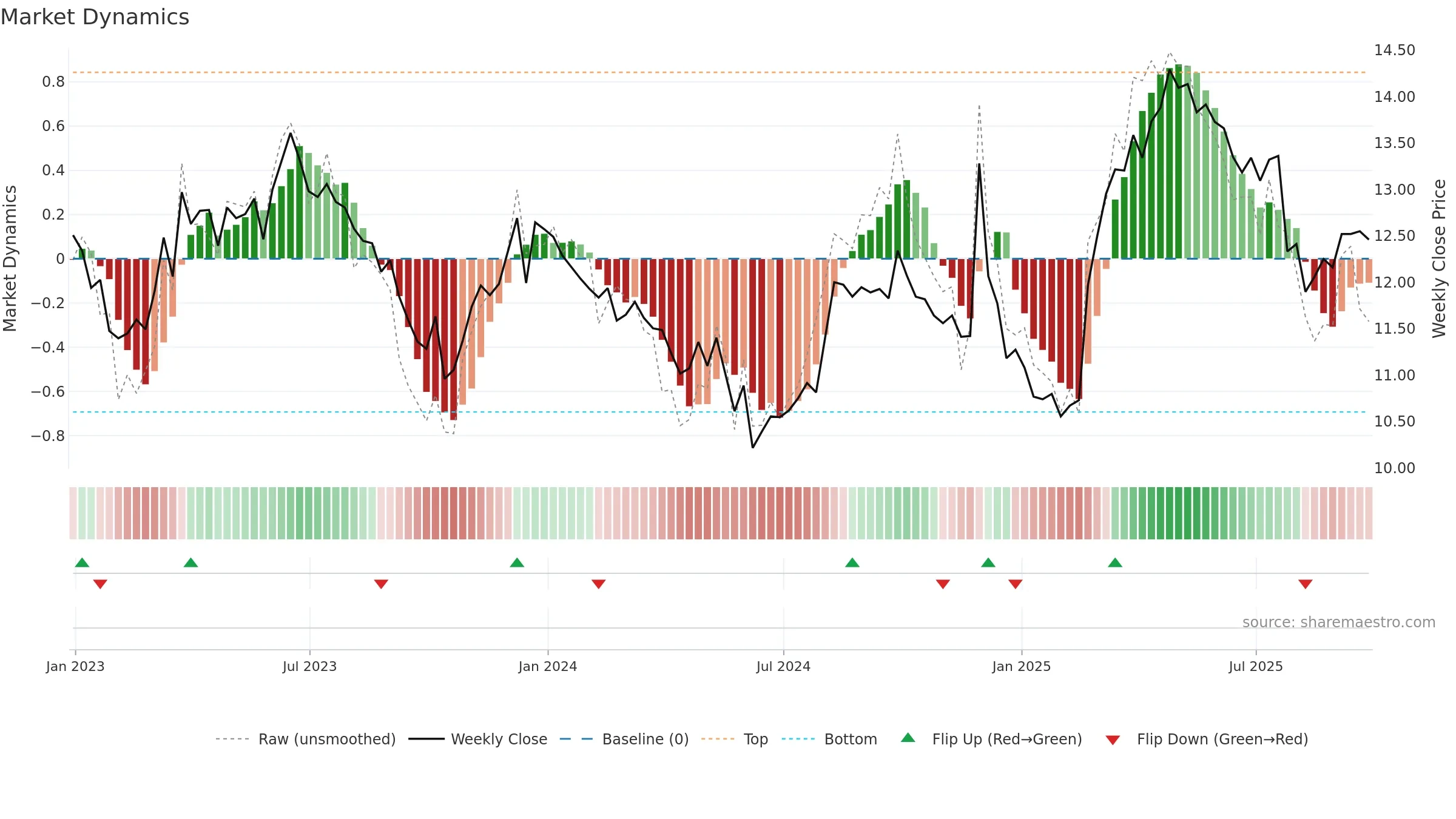

How to read this — Price slope is upward, indicating persistent buying over the window. Low weekly volatility favours steadier follow-through. Volume trend diverges from price — watch for fatigue or rotation.

Up-slope supports buying interest; pullbacks may be contained if activity stays firm. Because liquidity isn’t confirming, prefer evidence of fresh demand before chasing moves.

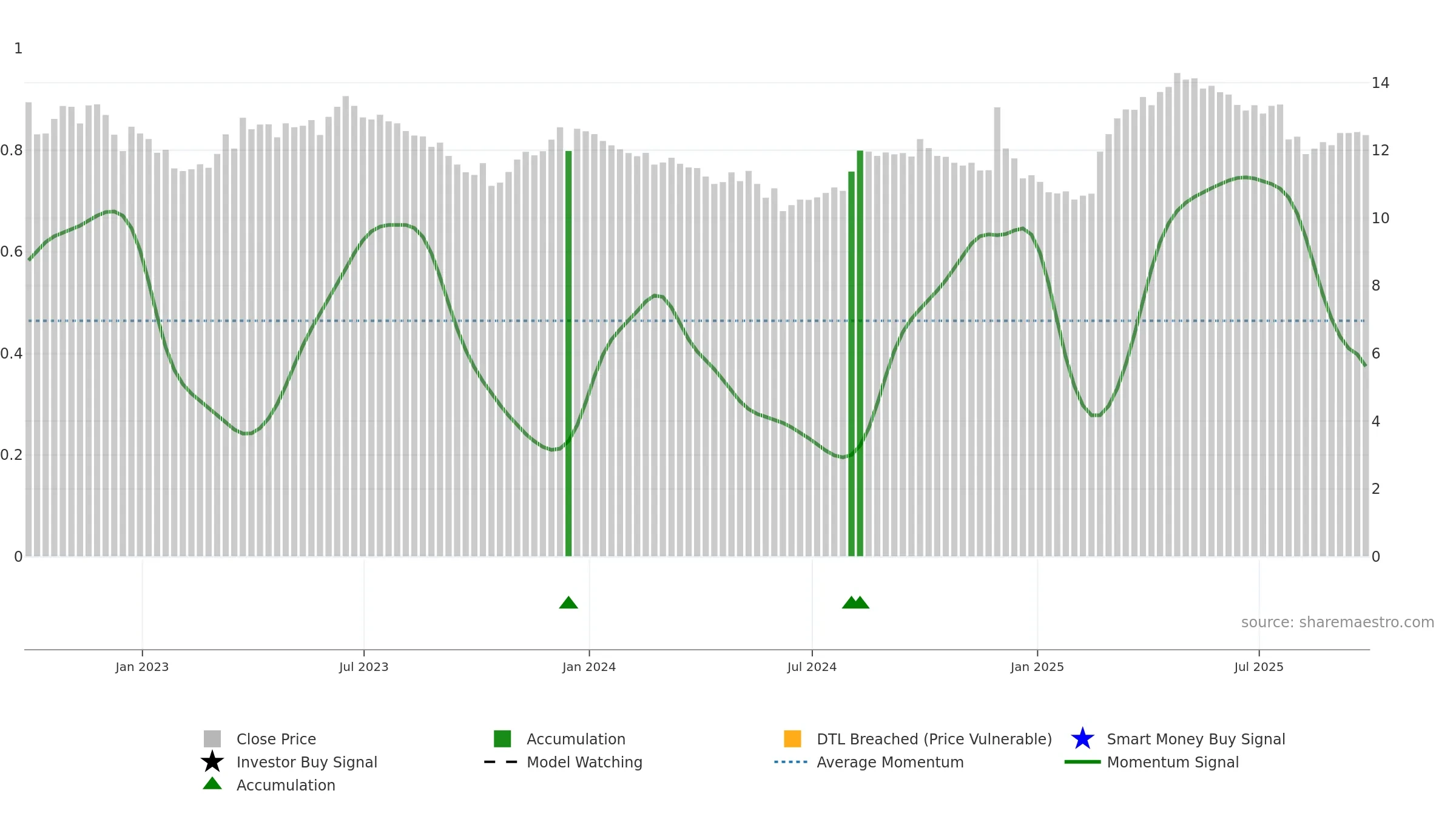

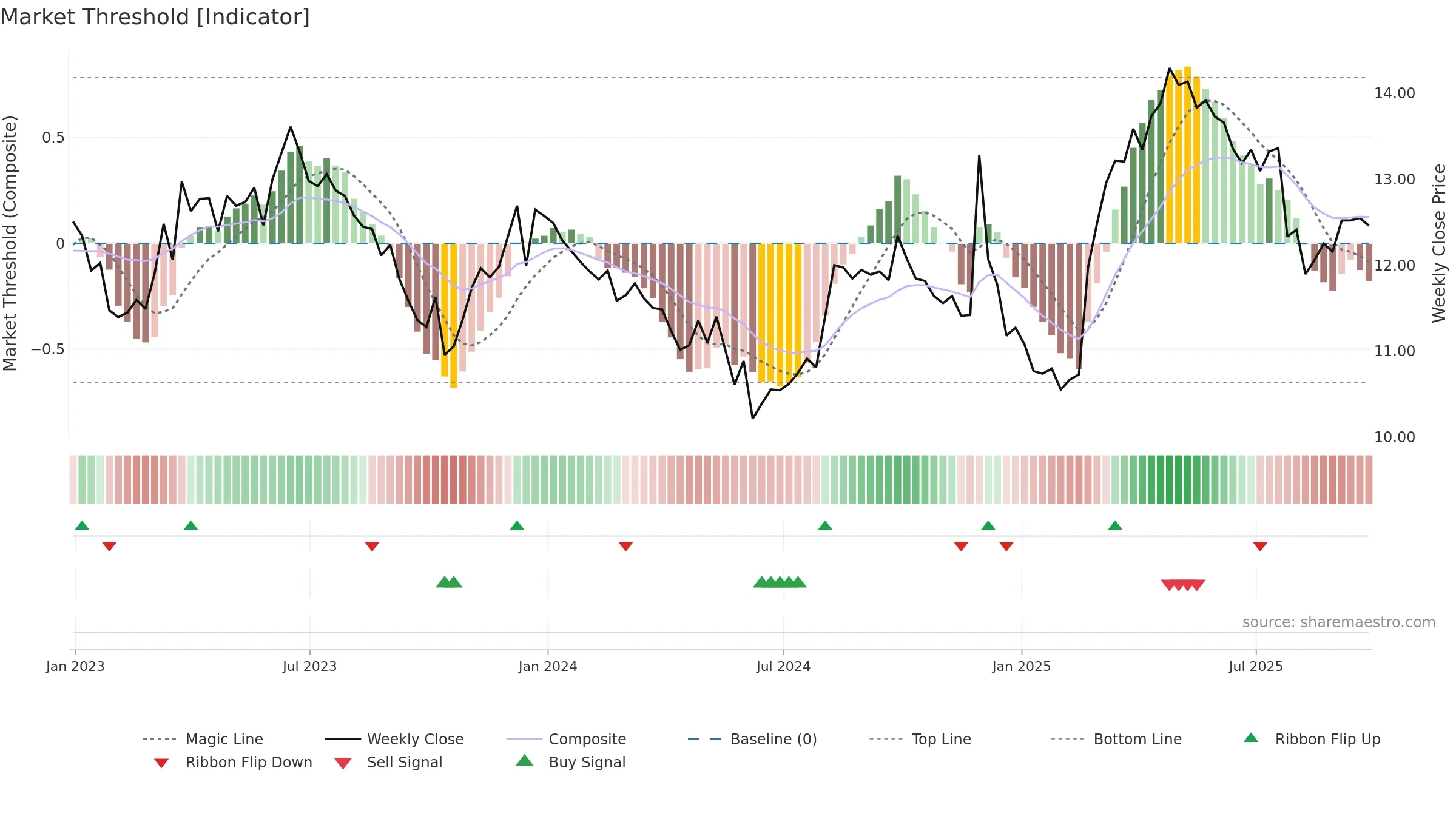

Gauge maps the trend signal to a 0–100 scale.

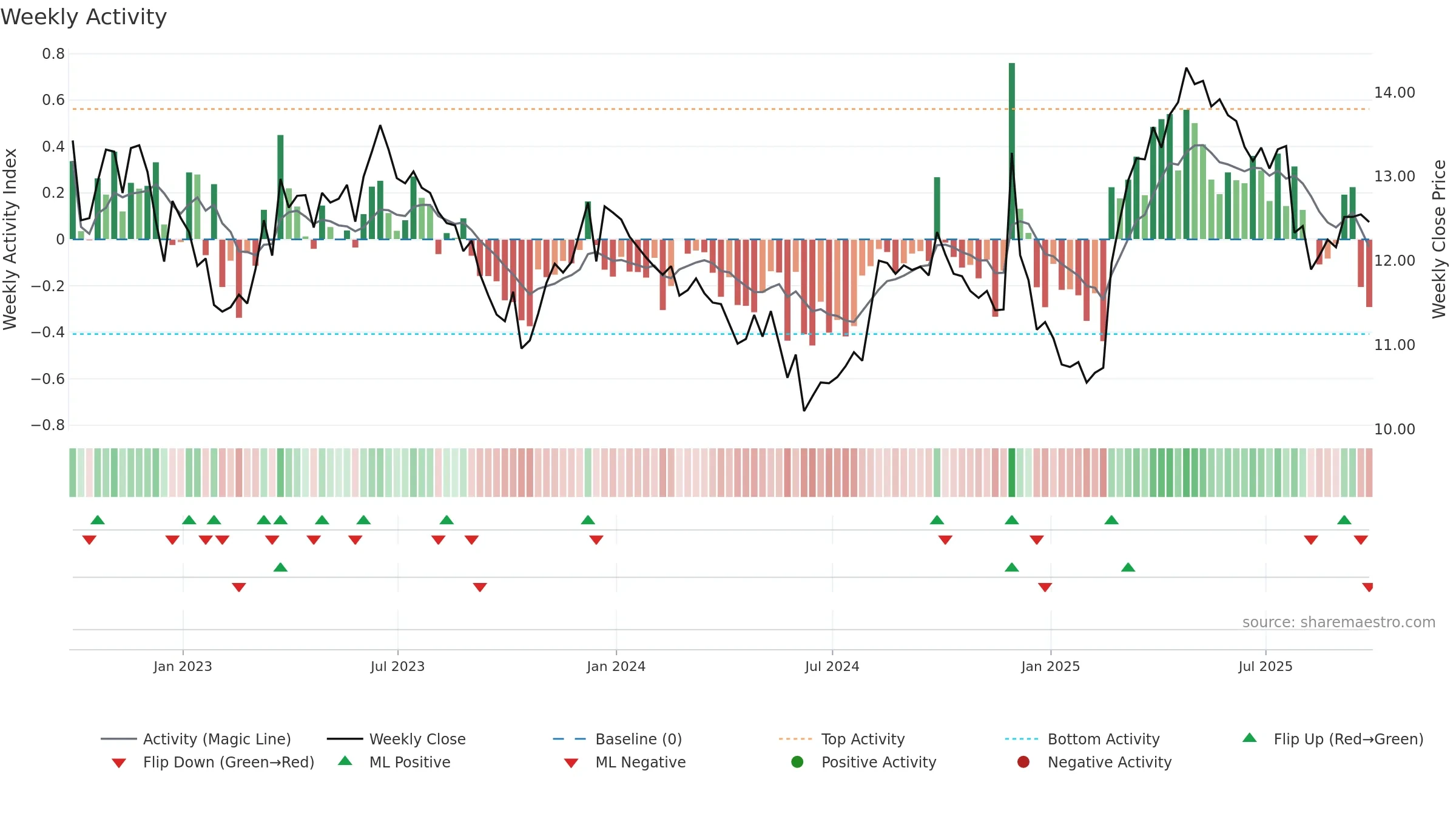

How to read this — Bearish zone with falling momentum — sellers in control. Sub-0.40 print confirms downside control.

Bias remains lower; rallies are suspect unless gauge reclaims 0.50/0.60.

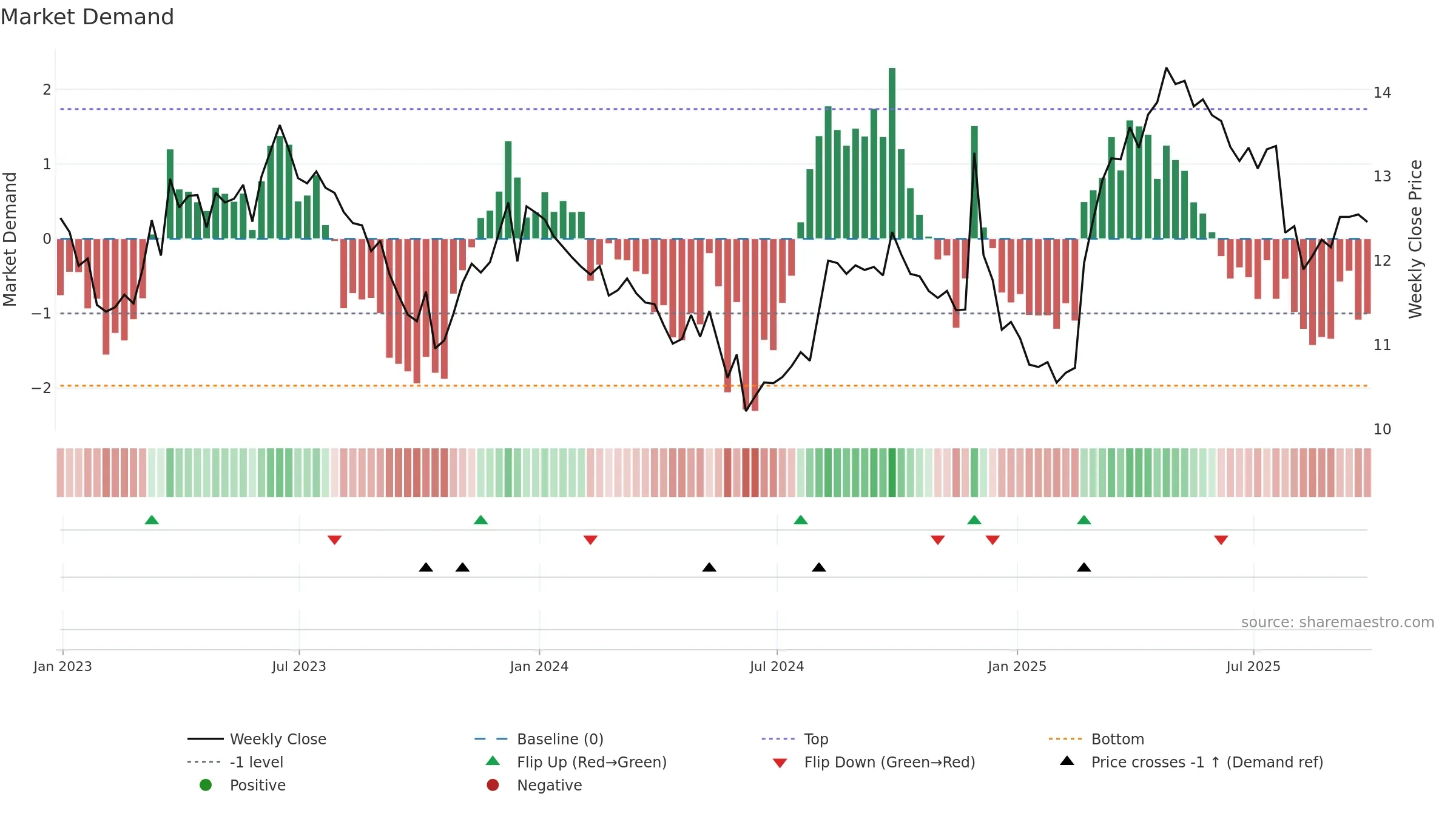

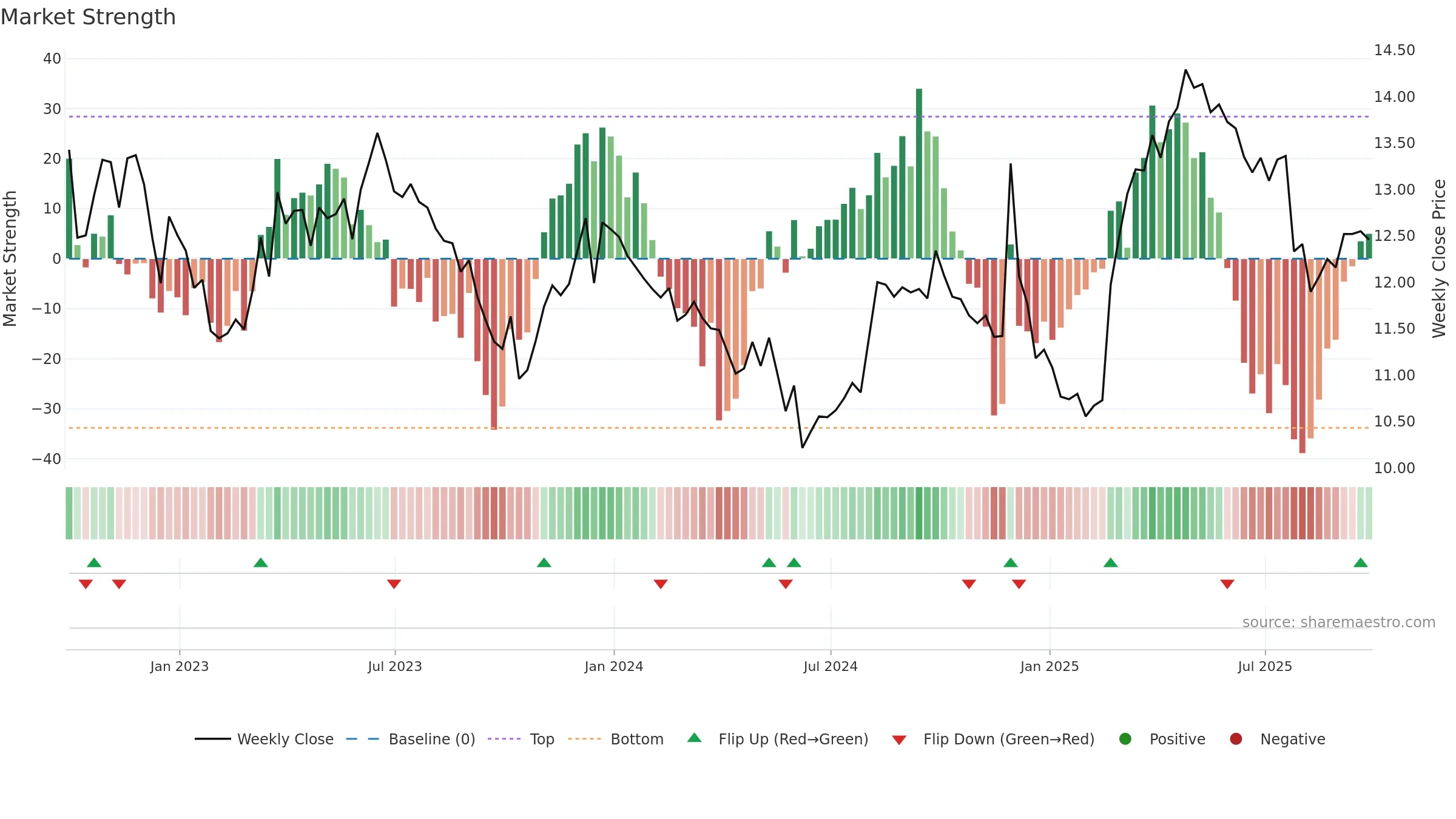

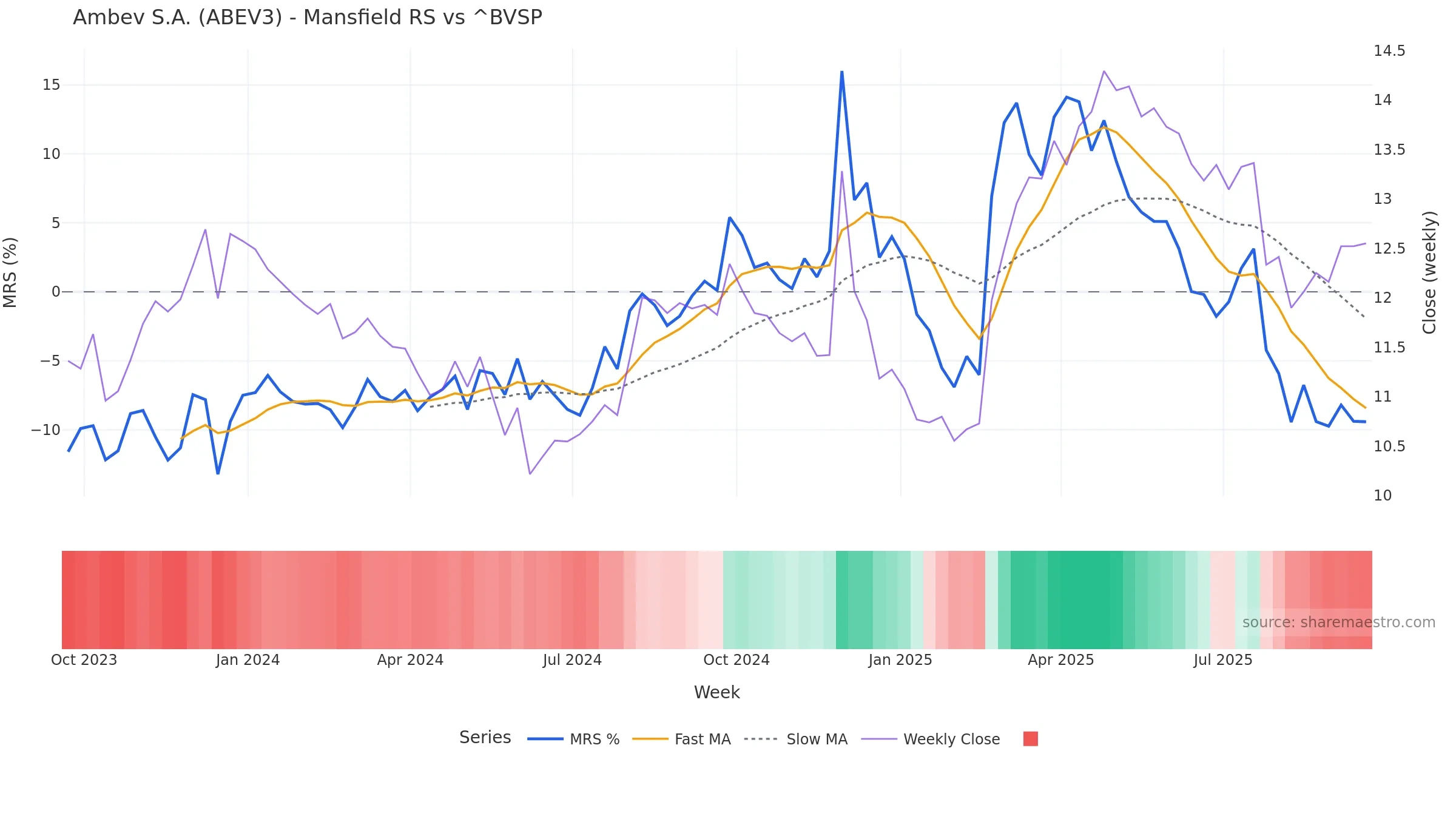

Relative strength is Negative

(< 0%, underperforming).

Latest MRS: -9.42% (week ending Fri, 19 Sep 2025).

Slope: Falling over 8w.

Notes:

- Below zero line indicates relative weakness vs benchmark.

- MRS slope falling over ~8 weeks.

Conclusion

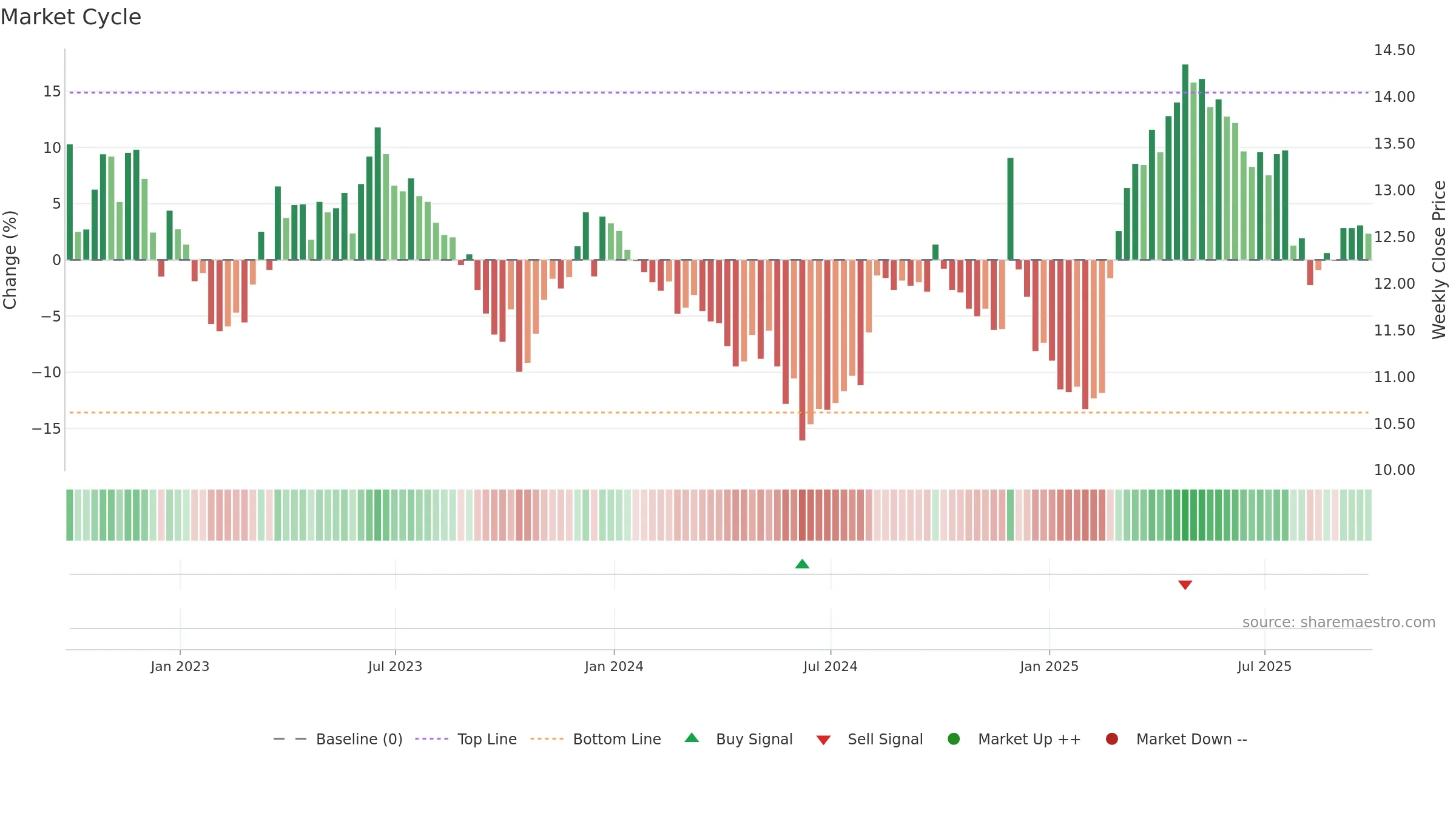

Negative setup. ★⯪☆☆☆ confidence. Trend: Downtrend Confirmed · 4.73% over window · vol 1.85% · liquidity divergence · posture mixed · RS weak

- Low return volatility supports durability

- Bearish control with falling momentum

- Momentum is weak/falling

- Price is not above key averages

- Liquidity diverges from price

Why: Price window 4.73% over w. Close is -0.72% below the prior-window high. Return volatility 1.85%. Volume trend falling. Liquidity divergence with price. Trend state downtrend confirmed. Momentum bearish and falling.

Tip: Most metrics include a hover tooltip where they appear in the report.