Bravura Solutions Limited

BVS ASX

Weekly Report

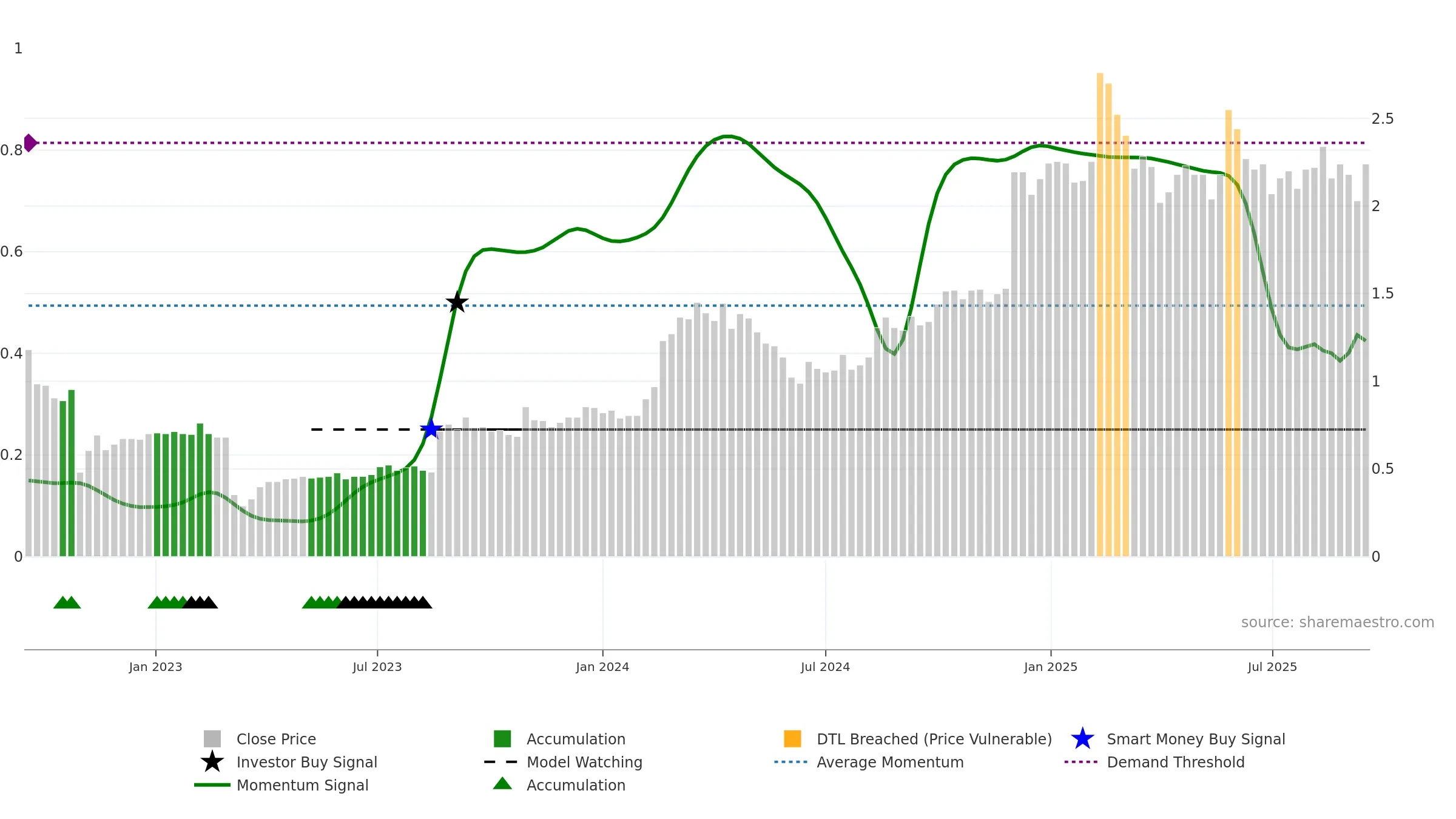

Bravura Solutions Limited closed at 2.2400 (0.45% WoW) . Data window ends Mon, 15 Sep 2025.

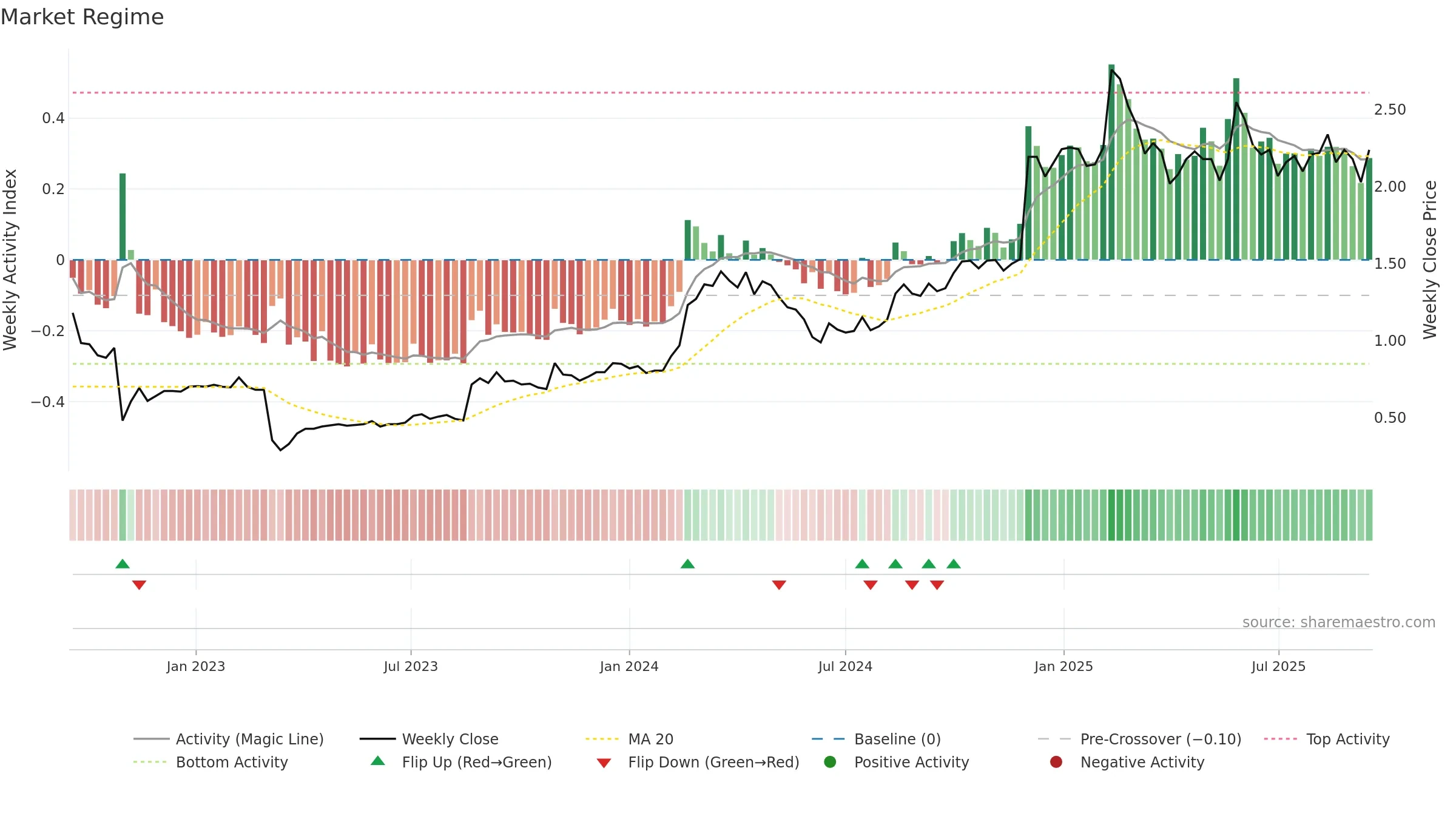

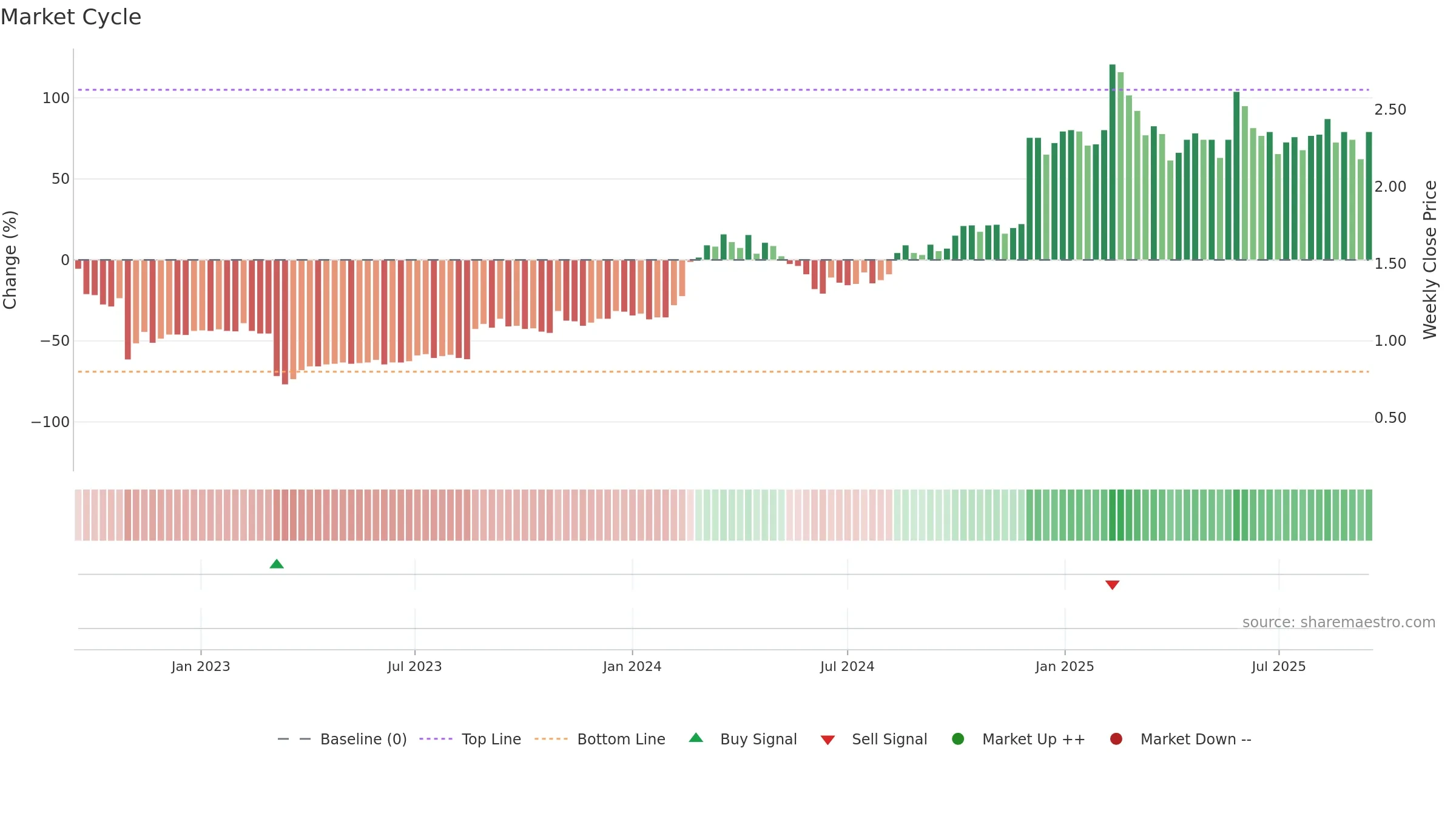

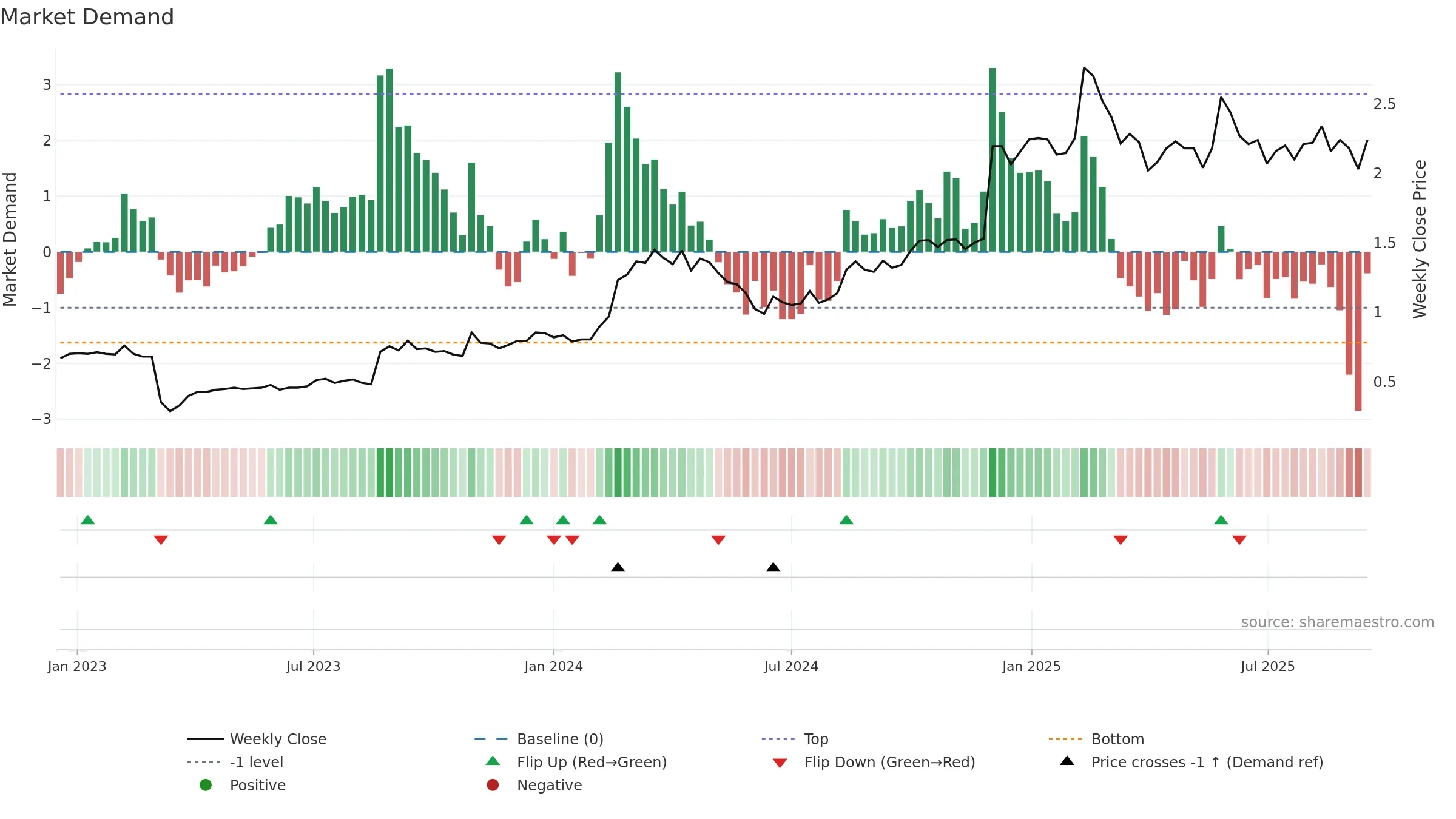

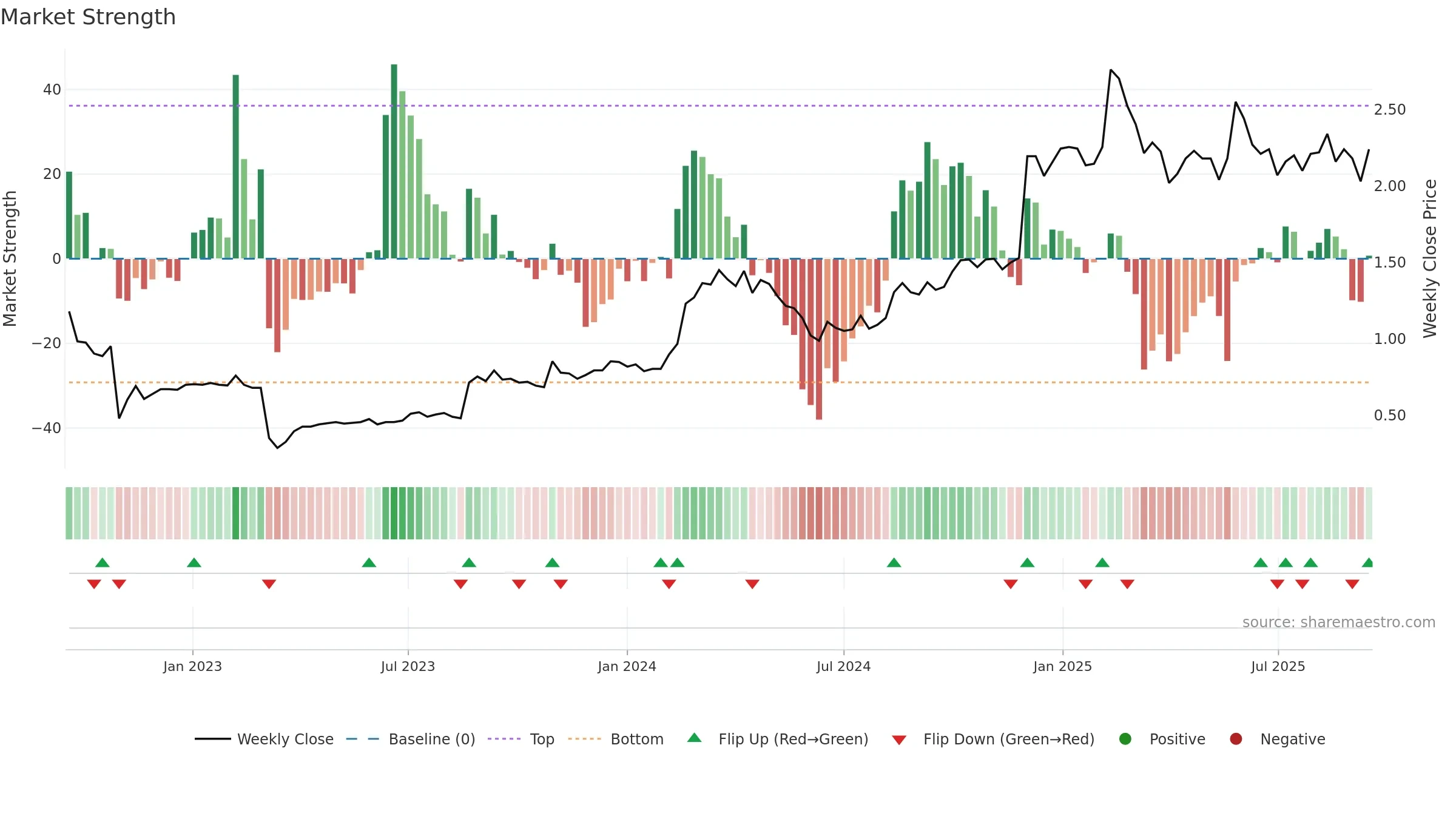

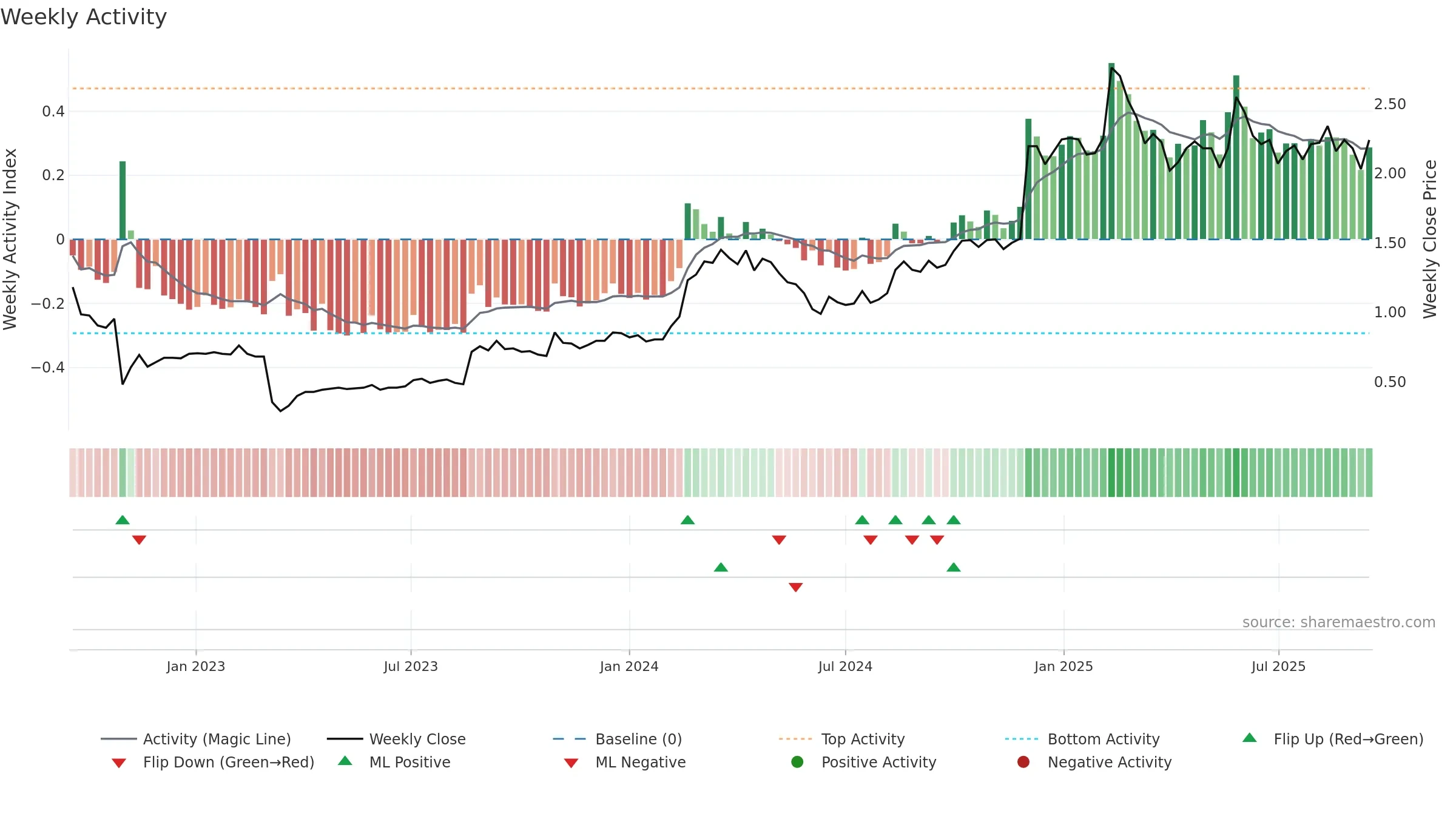

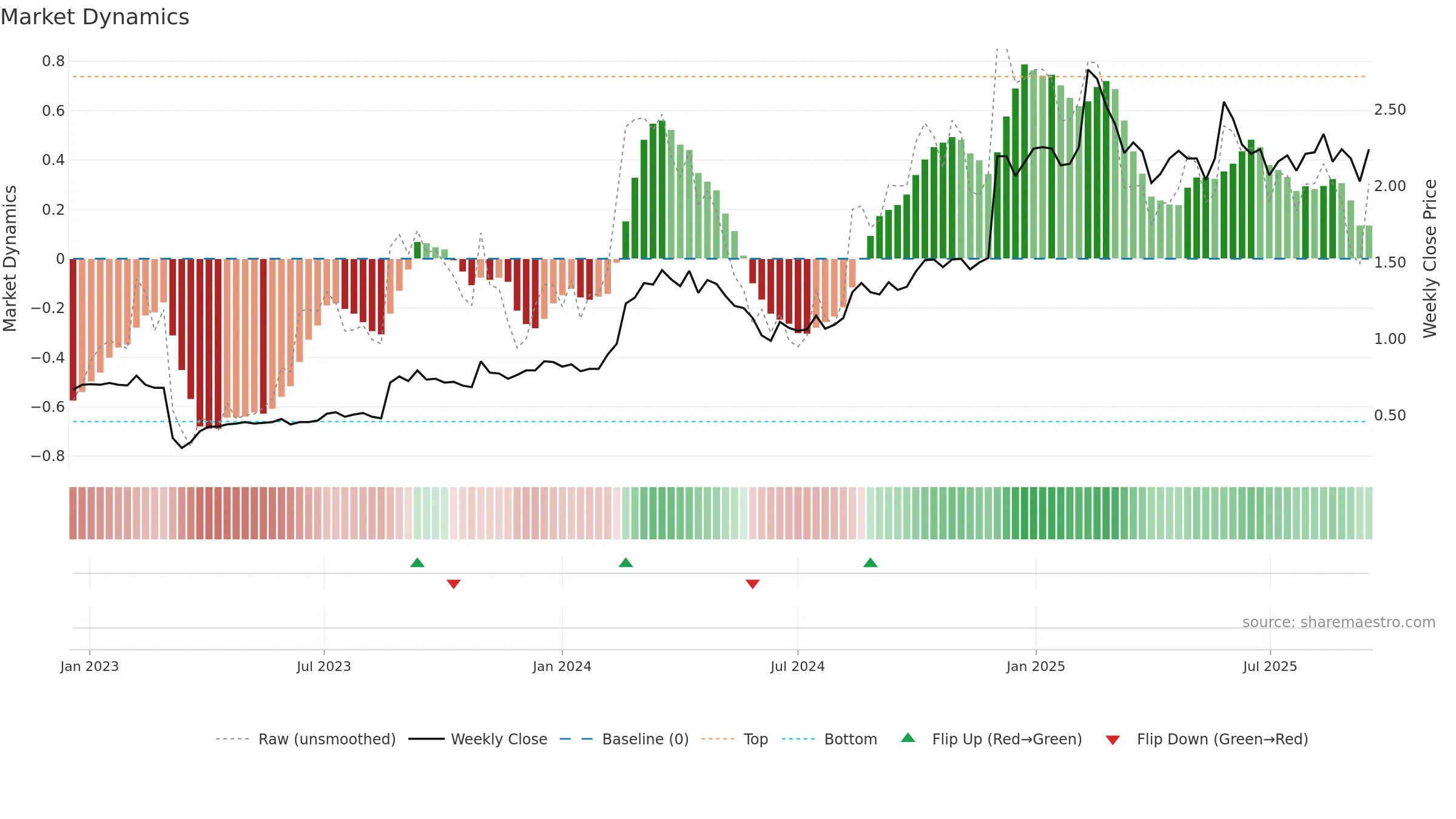

How to read this — Price slope is downward, indicating persistent supply pressure. Elevated weekly volatility increases whipsaw risk. Volume and price are moving in the same direction — a constructive confirmation. Returns are positively correlated with volume — strength tends to arrive on higher activity. Price holds above key averages, indicating constructive participation.

Down-slope argues for patience; rallies can fade sooner unless participation improves.

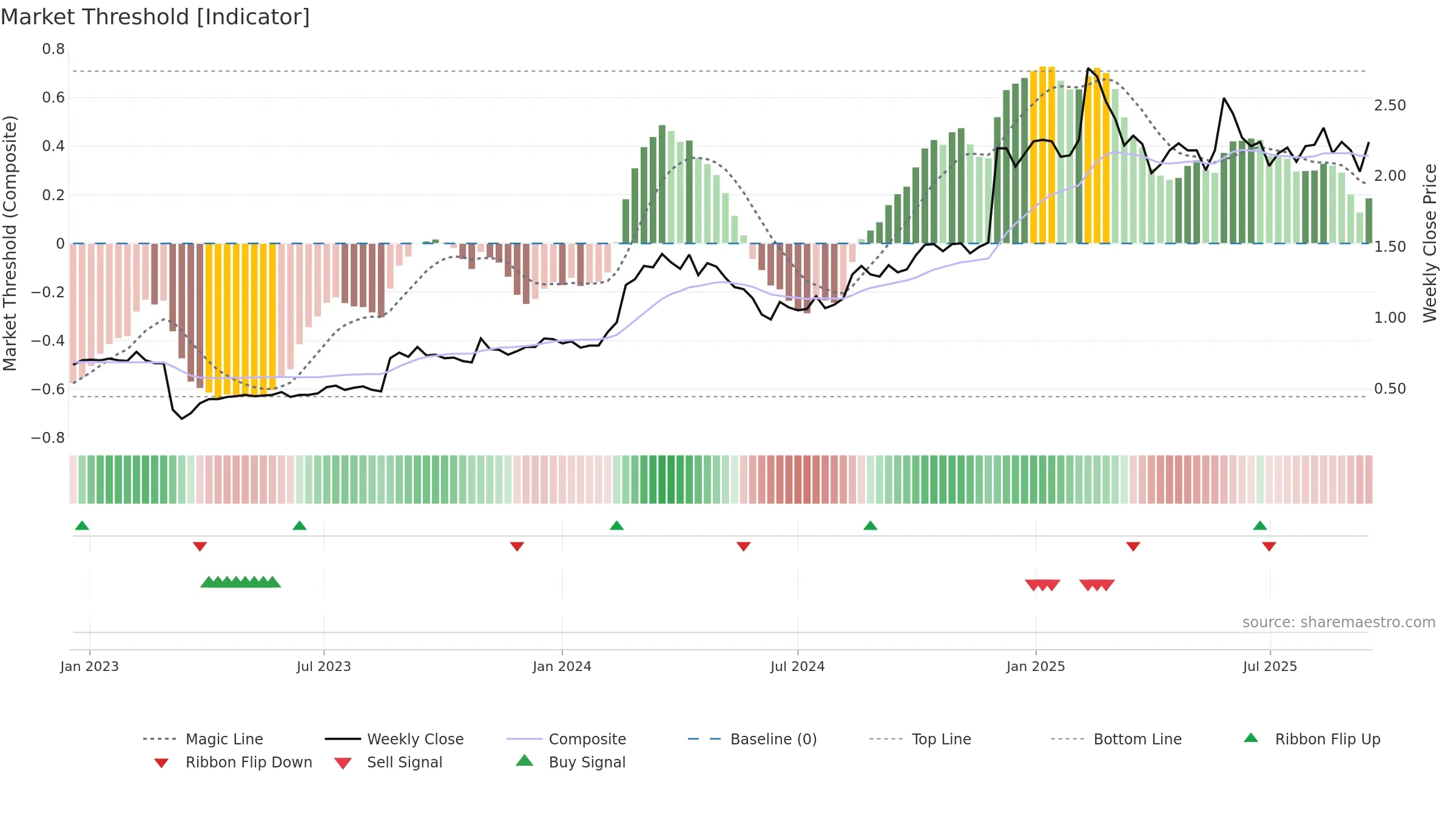

Gauge maps the trend signal to a 0–100 scale.

How to read this — Range-bound conditions; conviction is limited until a break or acceleration emerges.

Wait for a directional break or improving acceleration.

Price is below fair value; potential upside if momentum constructive.

Conclusion

Neutral setup. ★★★☆☆ confidence. Price window: 1. Trend: Range / Neutral; gauge 42. In combination, liquidity confirms the move.

- Price holds above 8w & 26w averages

- Liquidity confirms the price trend

- High return volatility raises whipsaw risk

Why: Price window 1.36% over 8w. Close is -4.27% below the prior-window high. Return volatility 5.12%. Volume trend falling. Liquidity convergence with price. Trend state range / neutral. Momentum neutral and rising. Valuation supportive skew.

Tip: Most metrics include a hover tooltip where they appear in the report.