Weekly Report

Invesco S&P Global Water Index ETF closed at 63.4200 (-0.77% WoW) . Data window ends Fri, 19 Sep 2025.

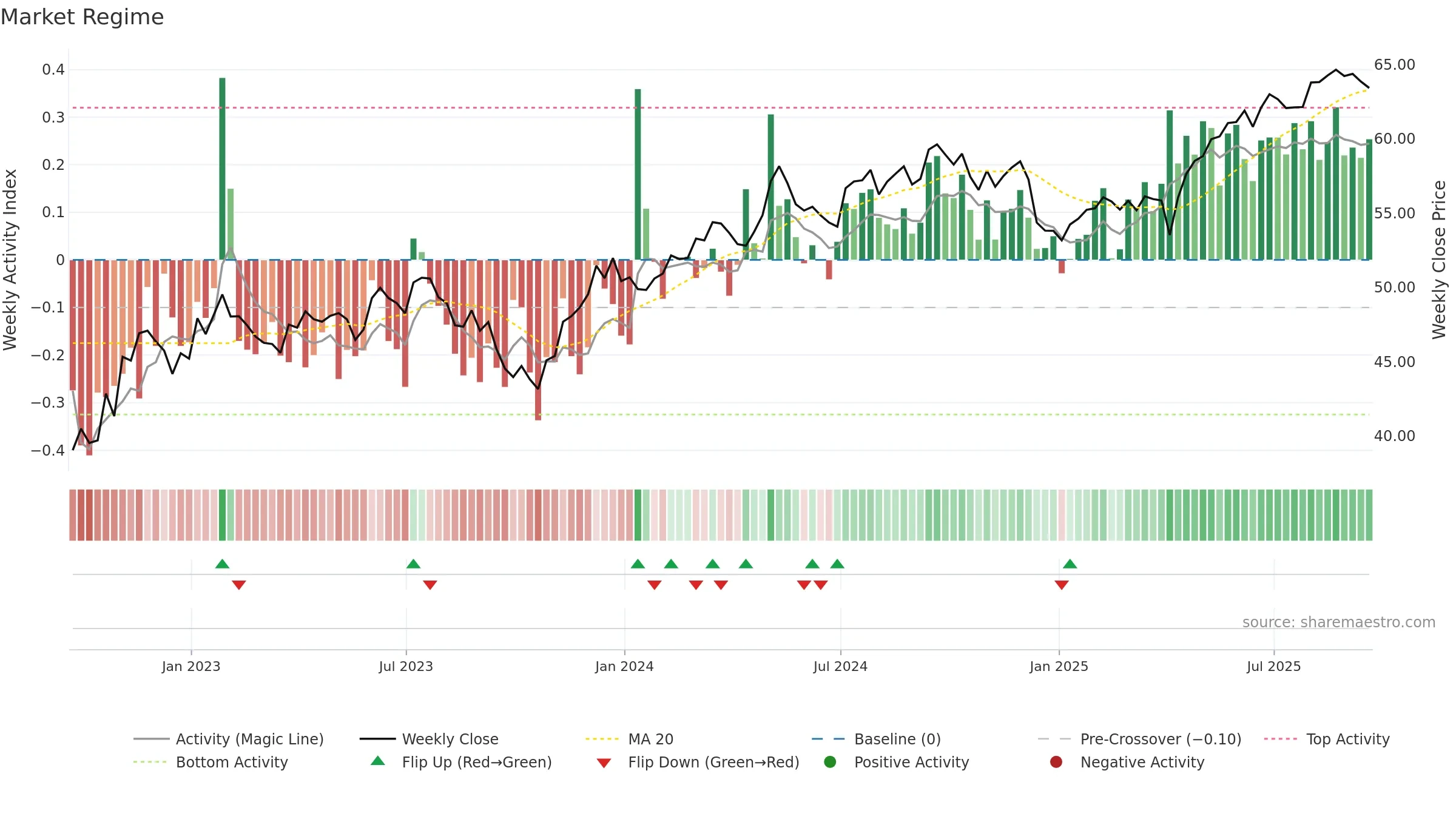

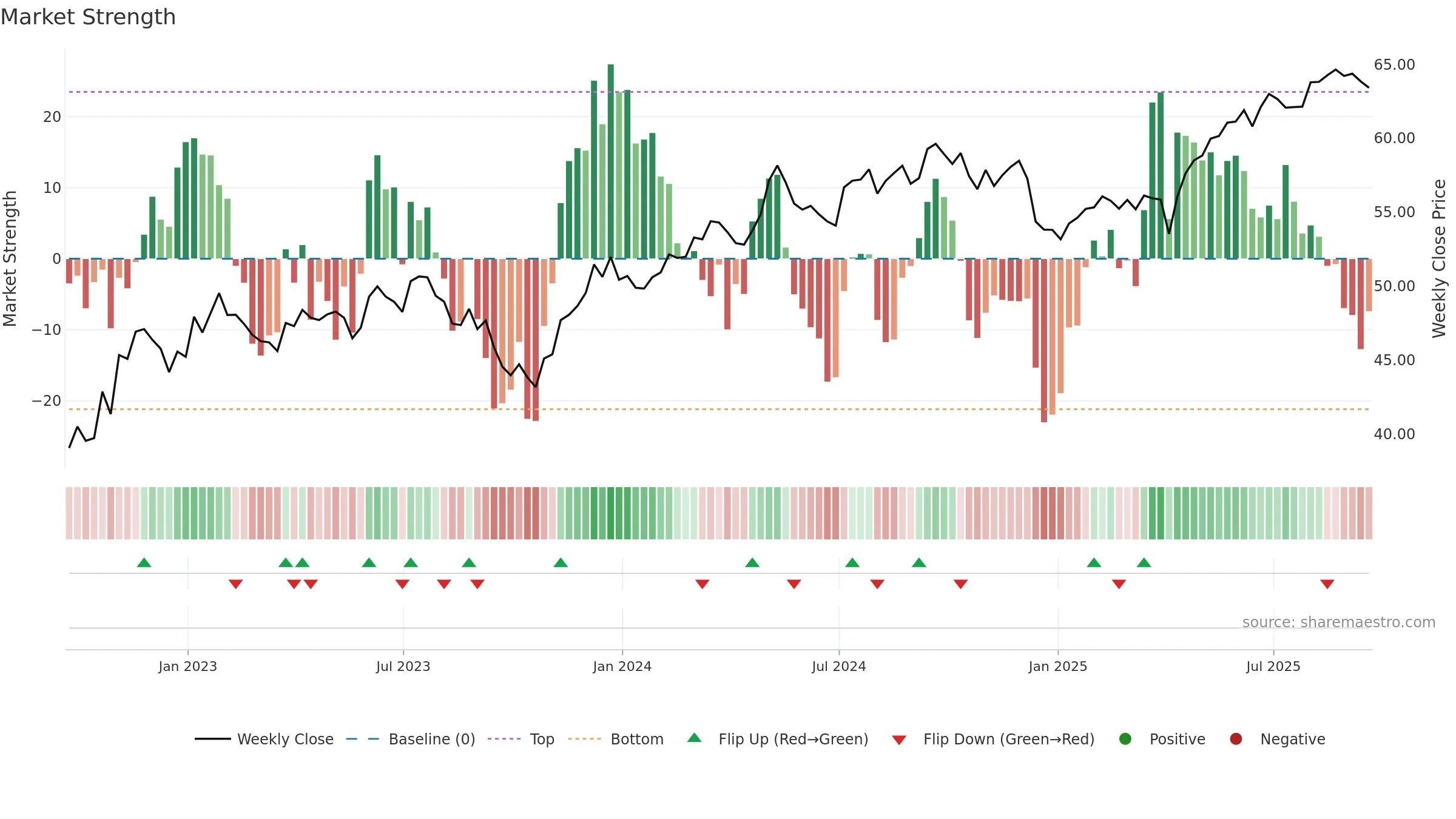

How to read this — Price slope is downward, indicating persistent supply pressure. Low weekly volatility favours steadier follow-through. Volume and price are moving in the same direction — a constructive confirmation. Returns are positively correlated with volume — strength tends to arrive on higher activity. Accumulation weeks: 2; distribution weeks: 2. Distance to baseline is narrowing — reverting closer to its fair-value track. Fresh short-term downside crossover weakens near-term tone.

Down-slope argues for patience; rallies can fade sooner unless participation improves.

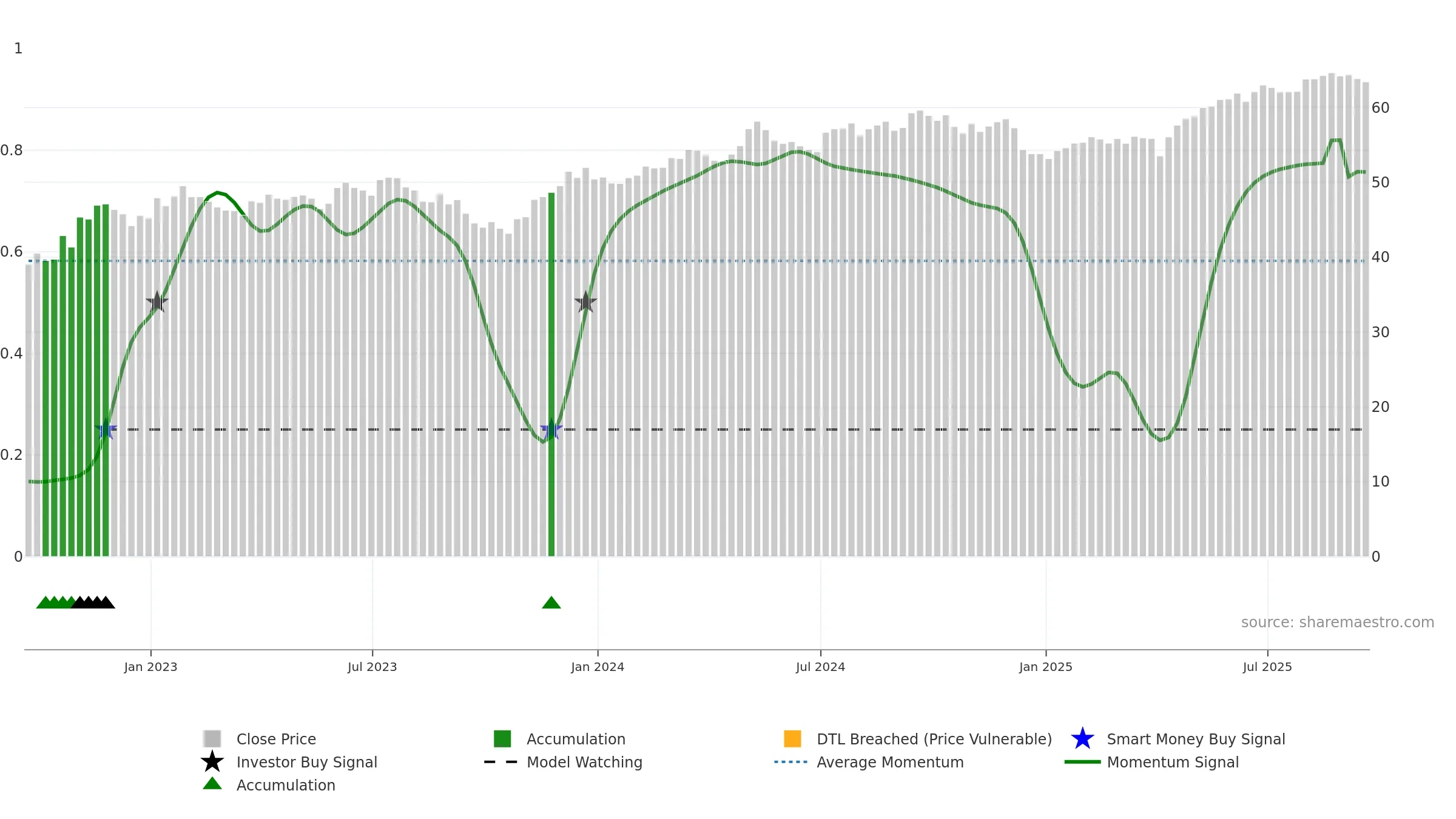

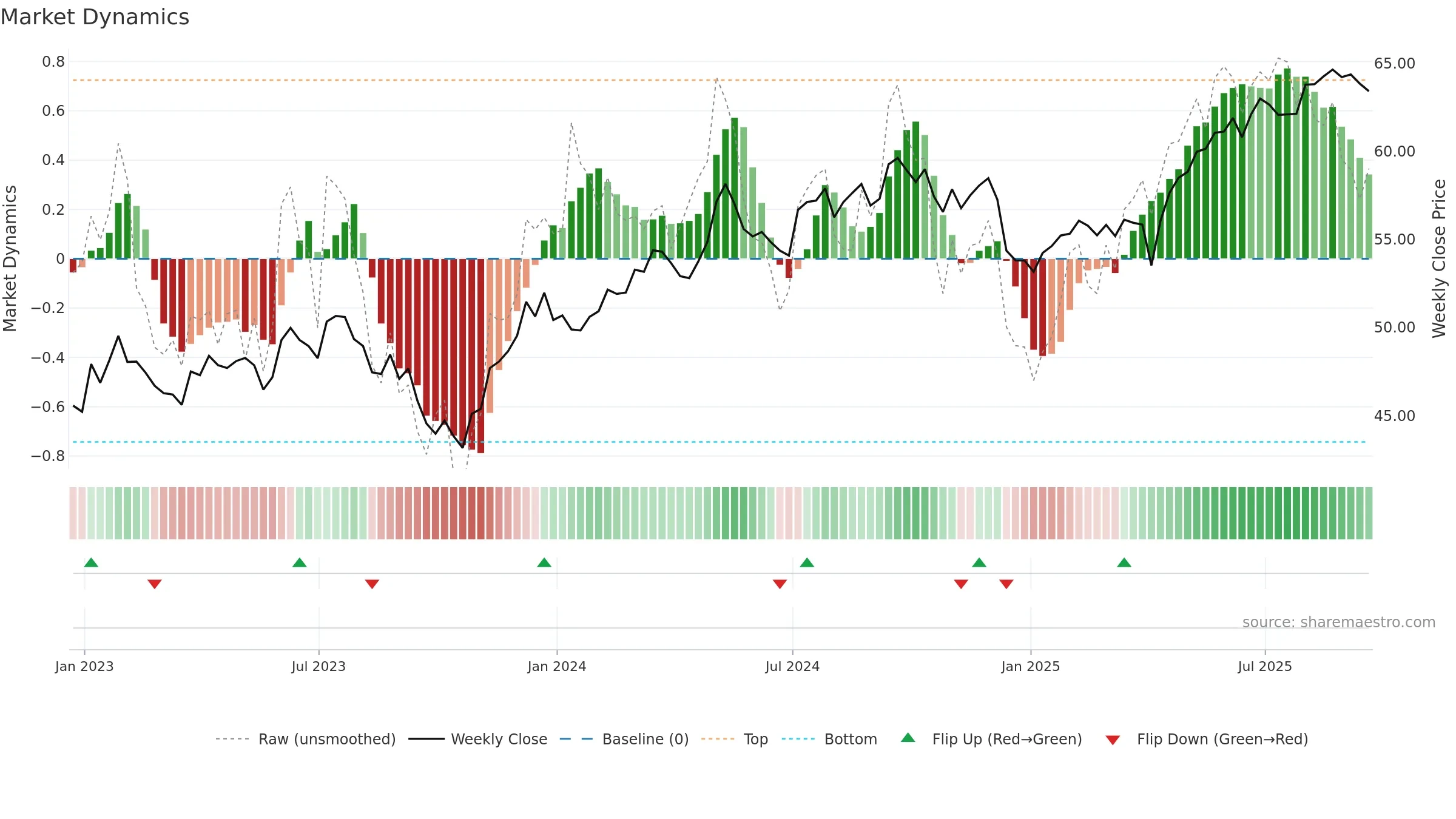

Gauge maps the trend signal to a 0–100 scale.

How to read this — Bullish gauge levels imply persistent upside pressure. A falling gauge warns of momentum fatigue. Deceleration reduces the odds of persistence.

Constructive backdrop; dips are more likely to find support while the gauge stays high.

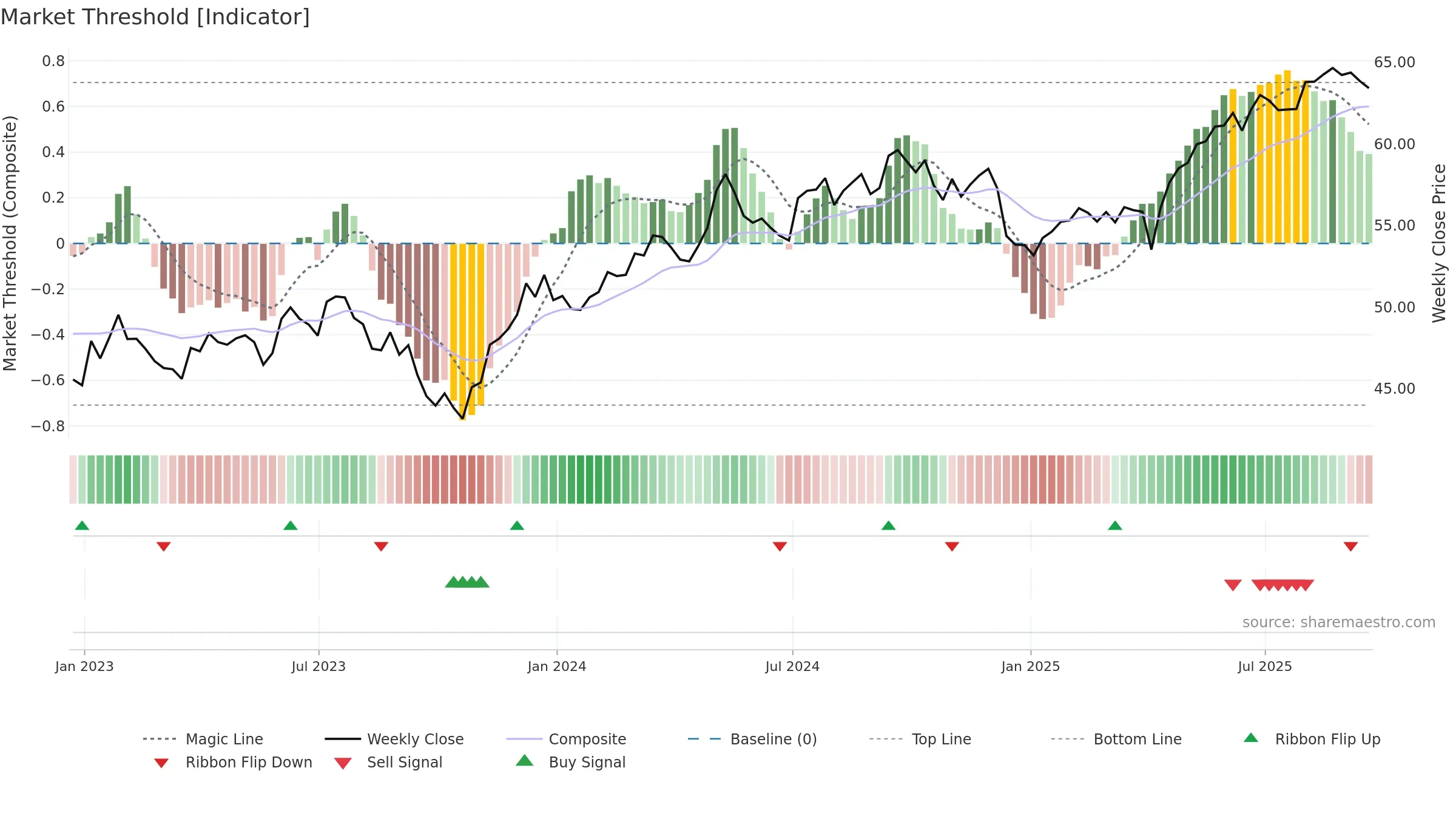

Conclusion

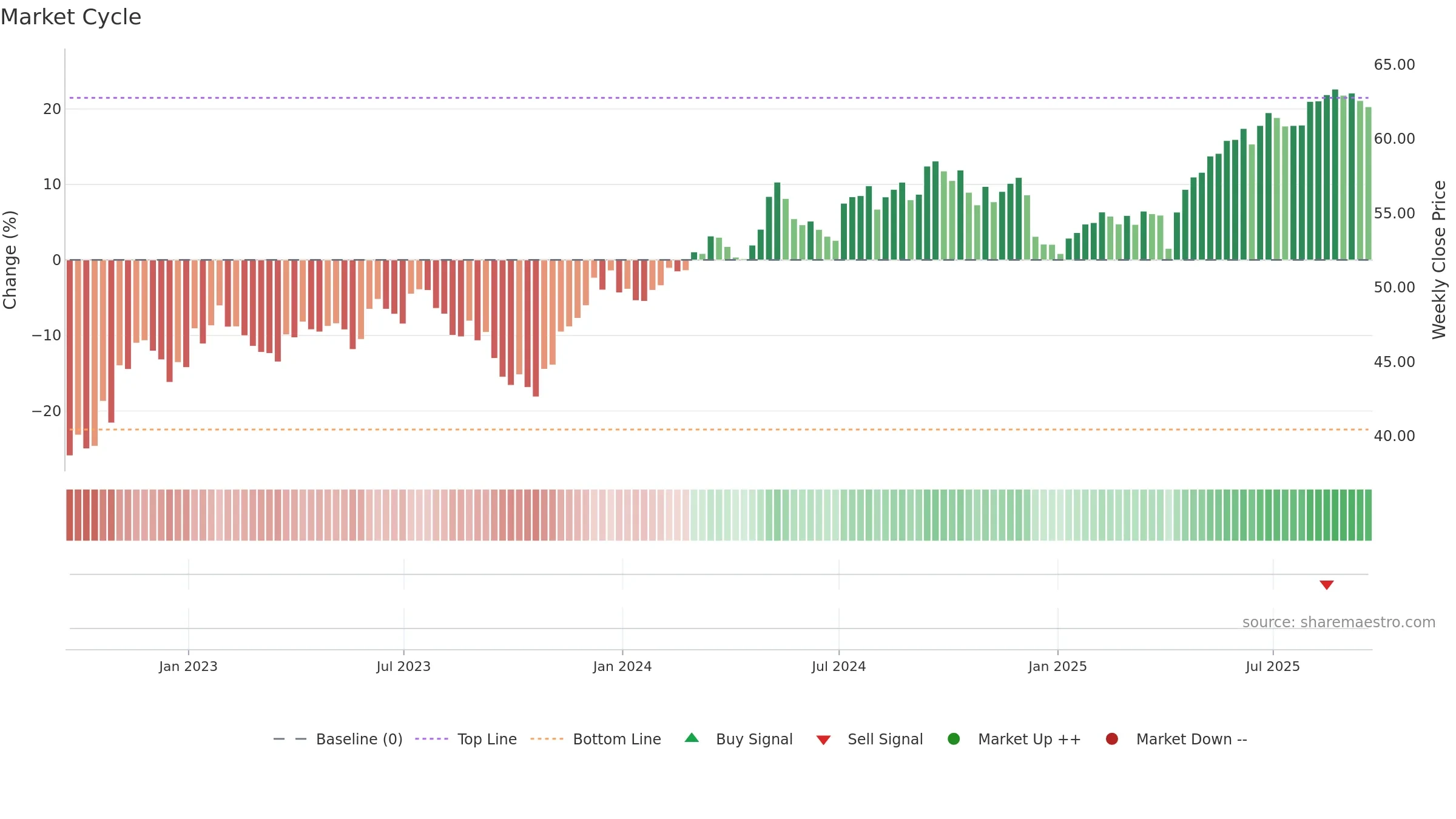

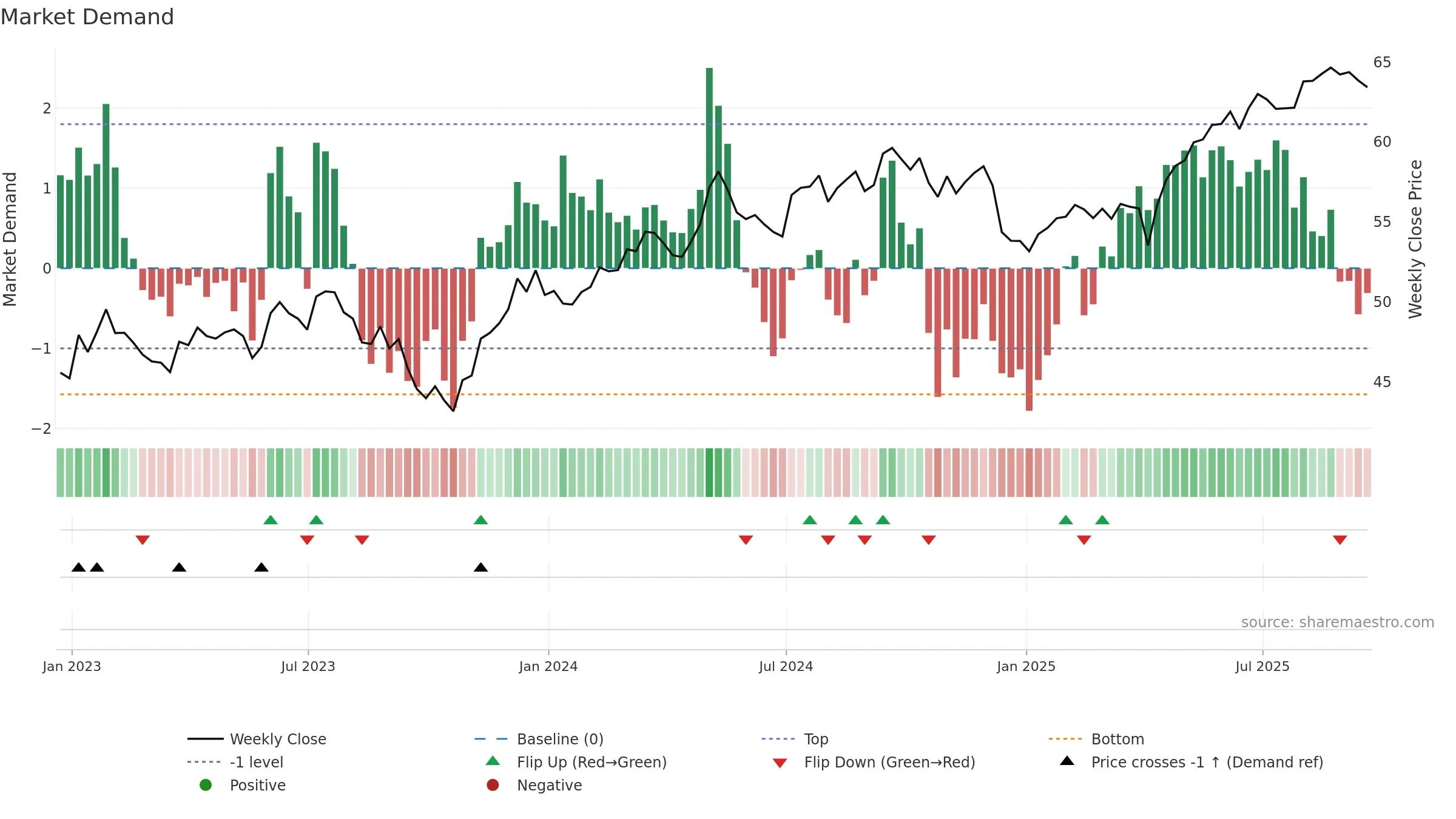

Neutral setup. ★★★☆☆ confidence. Price window: -0. Trend: Bullish @ 87. In combination, liquidity confirms the move.

Why: Price window -0.58% over 8w. Close is -1.90% below the window high. Return volatility 1.04%. Volume trend falling. Liquidity convergence with price. Accumulation 2; distribution 2. MA stack mixed. 4–8w crossover bearish. Baseline deviation 0.20% (narrowing). Momentum bullish and falling. Acceleration decelerating. Gauge volatility low.

Tip: Most metrics also include a hover tooltip where they appear in the report.