Nureca Limited

NURECA NSE

Weekly Summary

Nureca Limited closed at 239.6900 (-4.70% WoW) . Data window ends Mon, 22 Sep 2025.

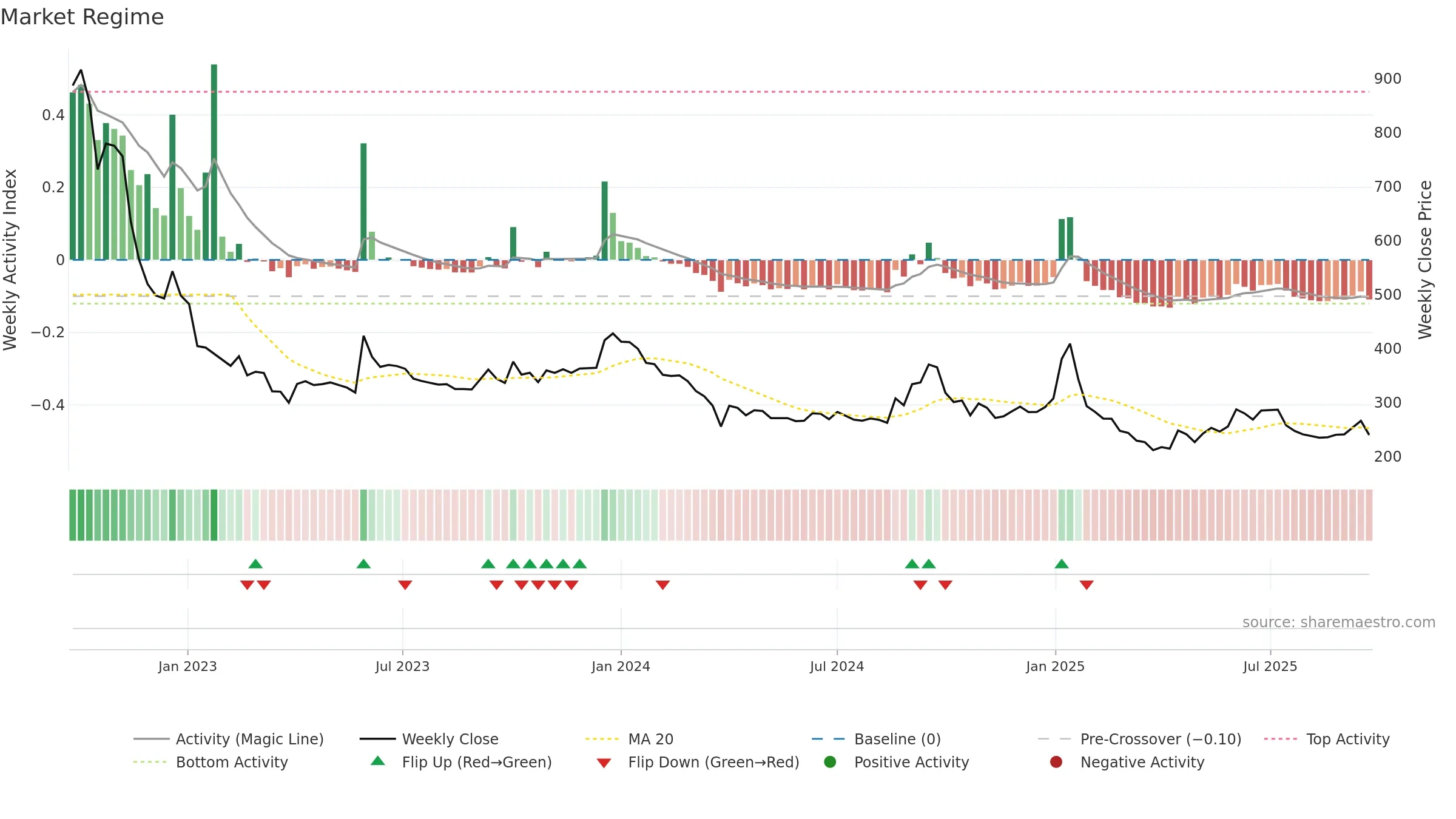

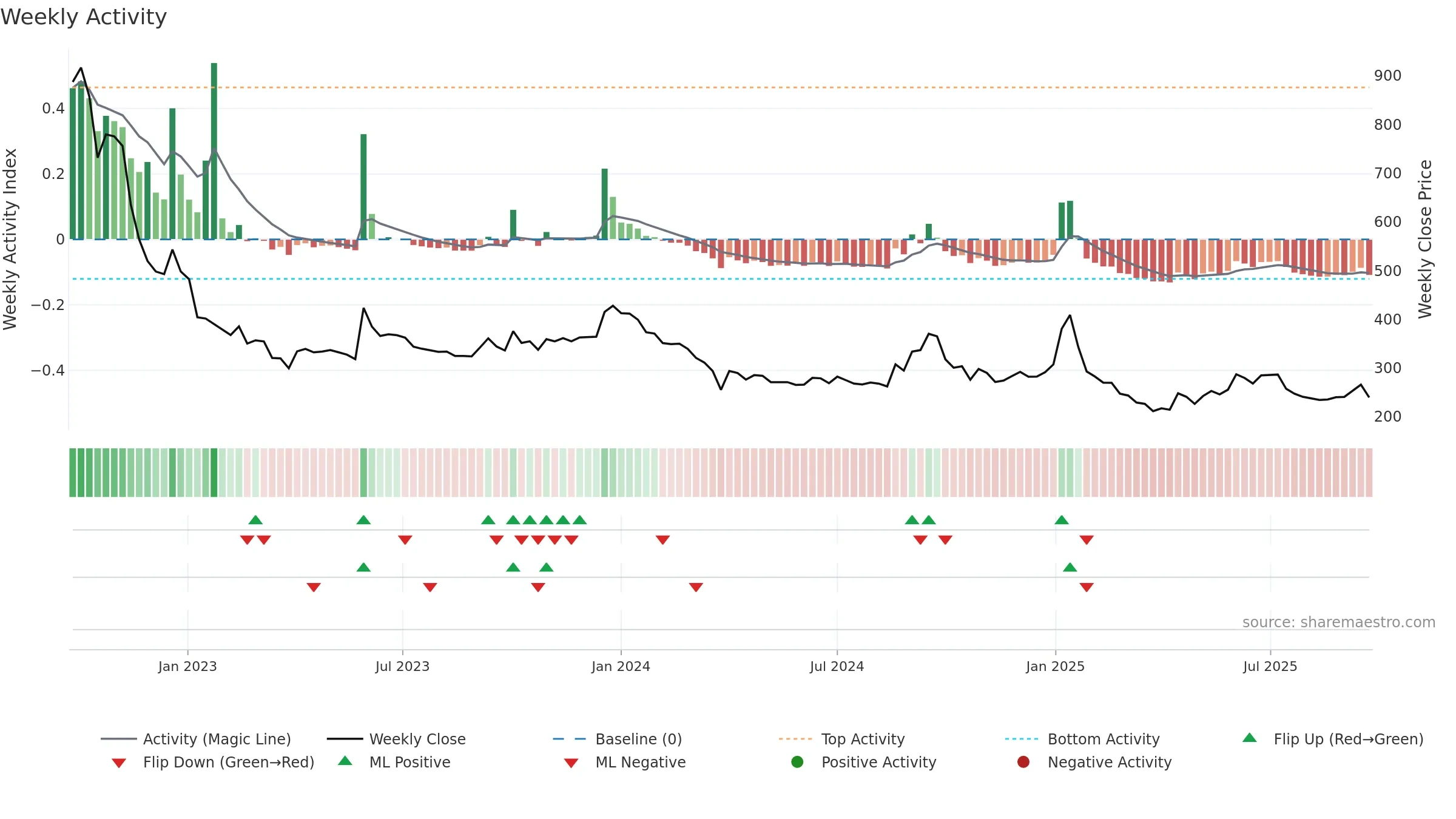

How to read this — Price slope is upward, indicating persistent buying over the window. Volume trend diverges from price — watch for fatigue or rotation. Returns are negatively correlated with volume — strength may come on lighter activity. Price sits below key averages, keeping pressure on the tape.

Up-slope supports buying interest; pullbacks may be contained if activity stays firm. Because liquidity isn’t confirming, prefer evidence of fresh demand before chasing moves.

Gauge maps the trend signal to a 0–100 scale.

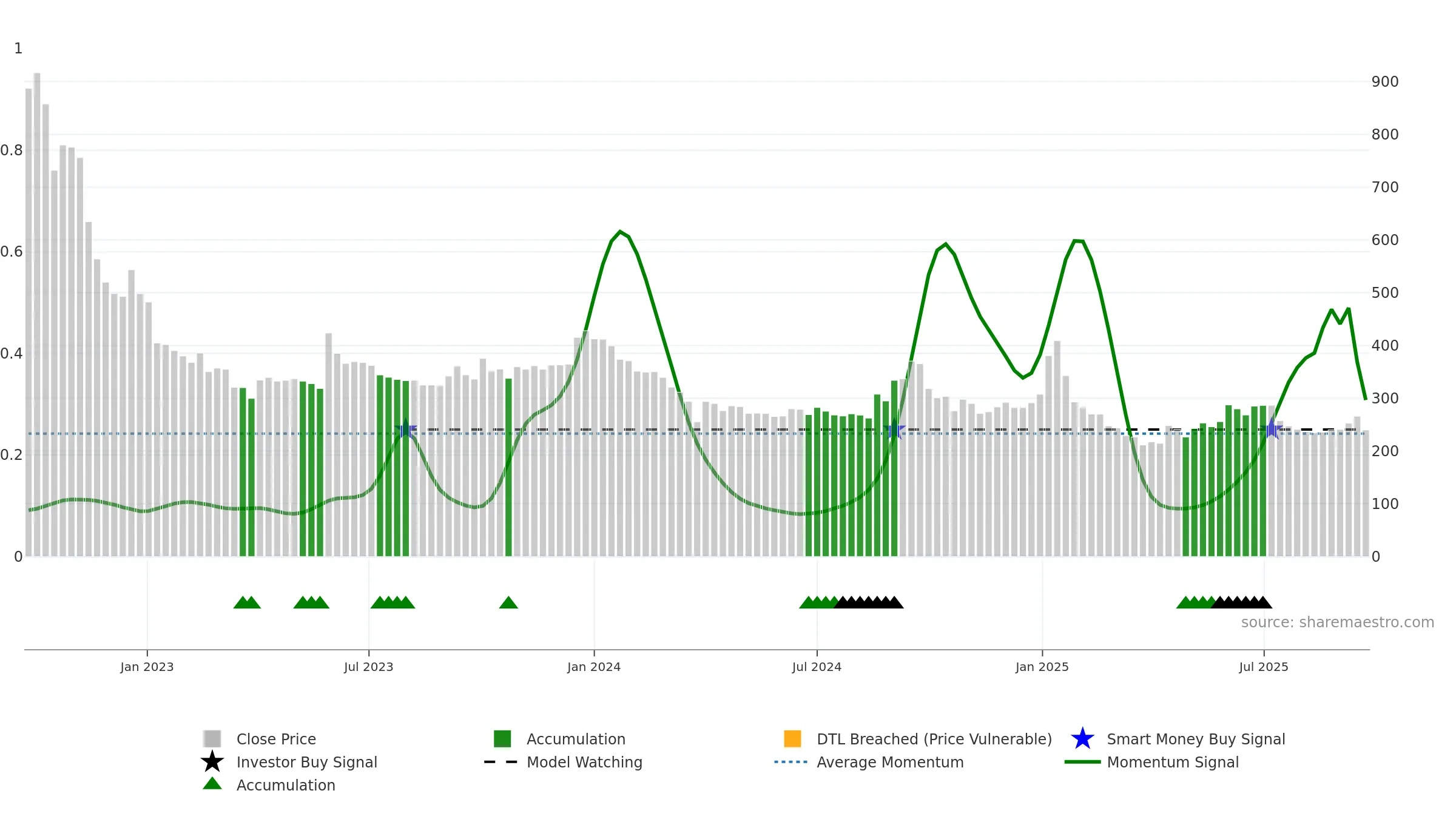

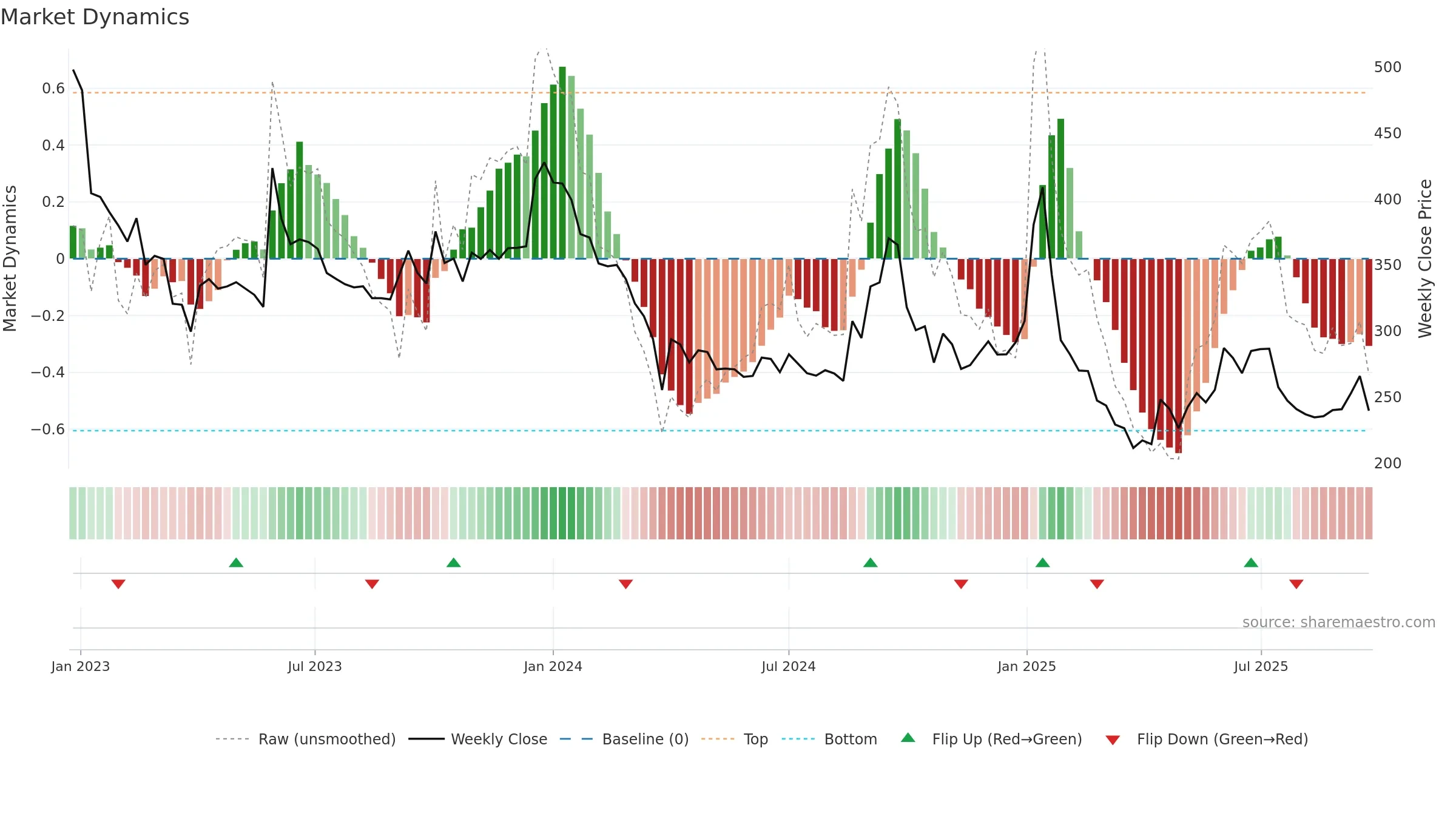

How to read this — Bearish zone with falling momentum — sellers in control. Sub-0.40 print confirms downside control.

Bias remains lower; rallies are suspect unless gauge reclaims 0.50/0.60.

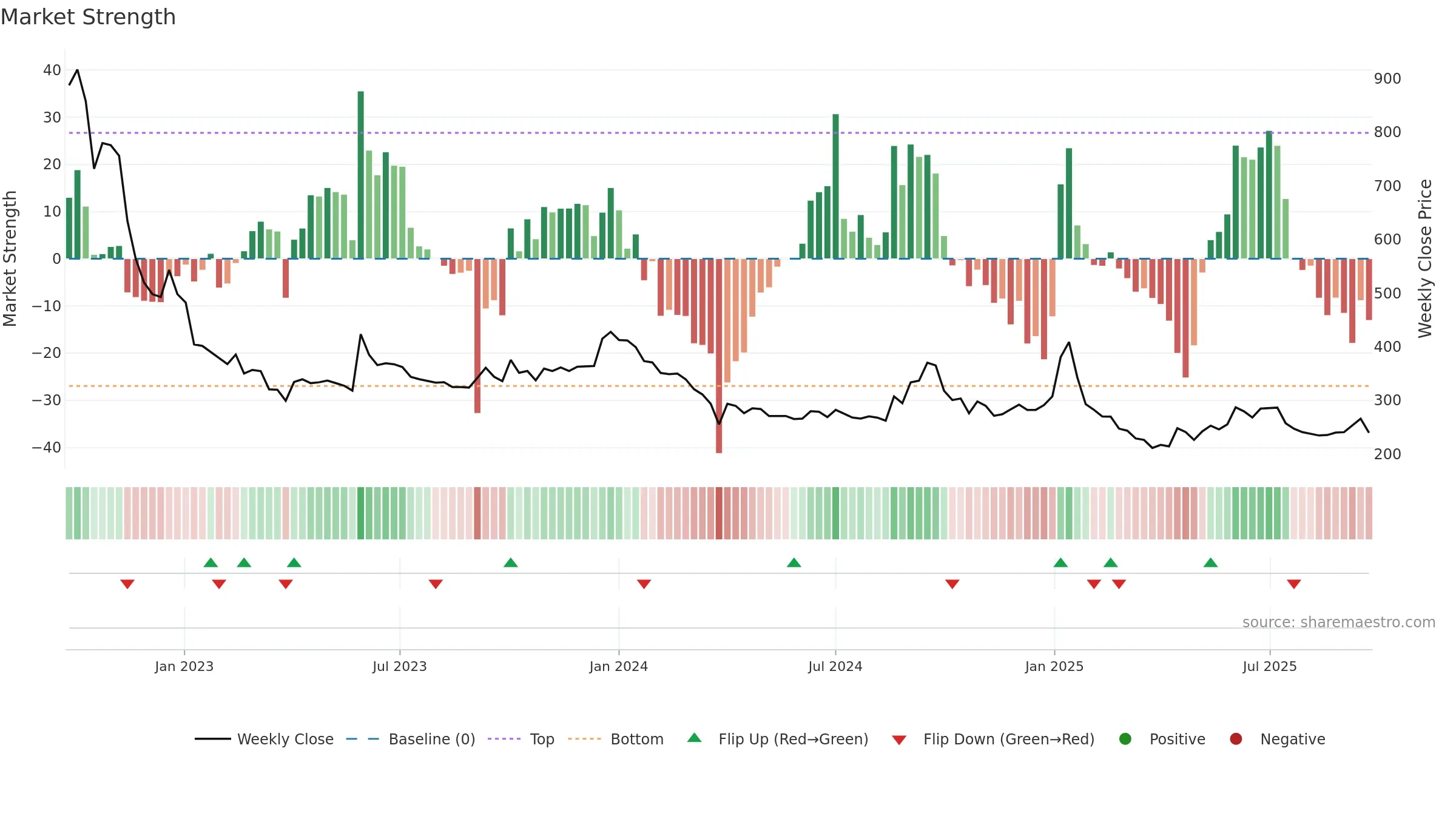

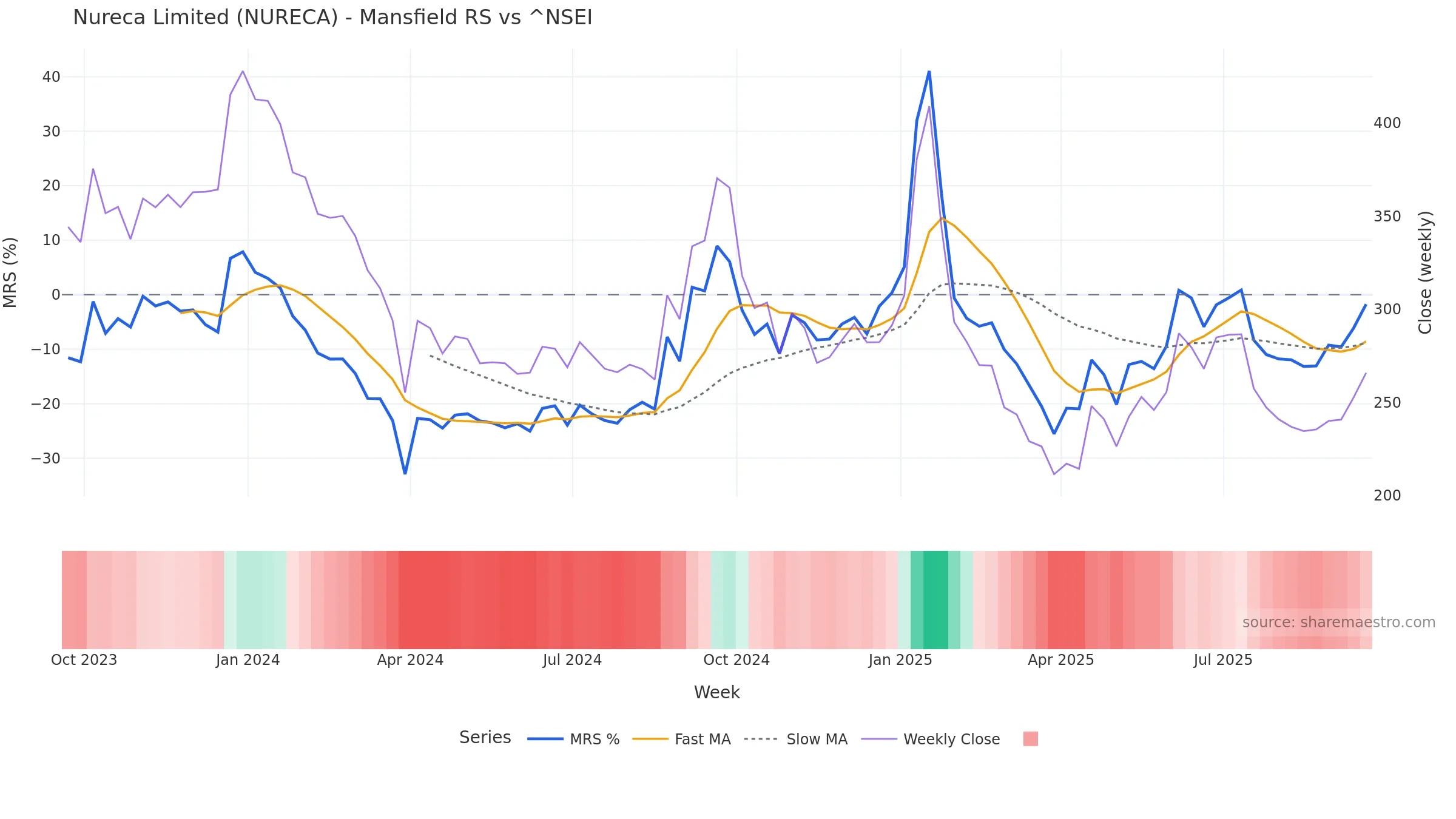

Relative strength is Negative

(< 0%, underperforming).

Latest MRS: -1.75% (week ending Fri, 19 Sep 2025).

Fast/slow crossover: Bullish.

Slope: Rising over 8w.

Notes:

- Fast/slow crossover turned bullish.

- Below zero line indicates relative weakness vs benchmark.

- MRS slope rising over ~8 weeks.

Conclusion

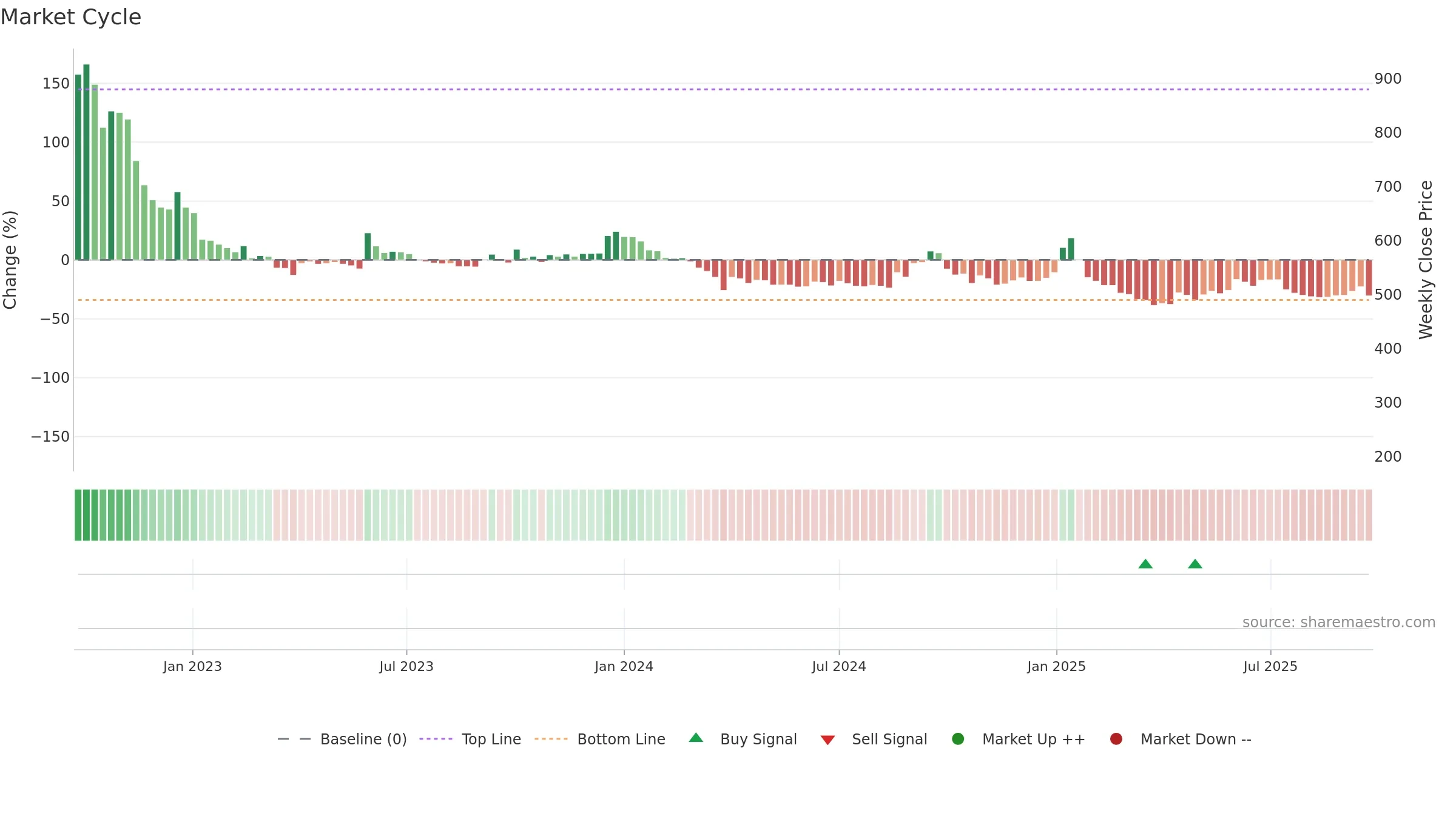

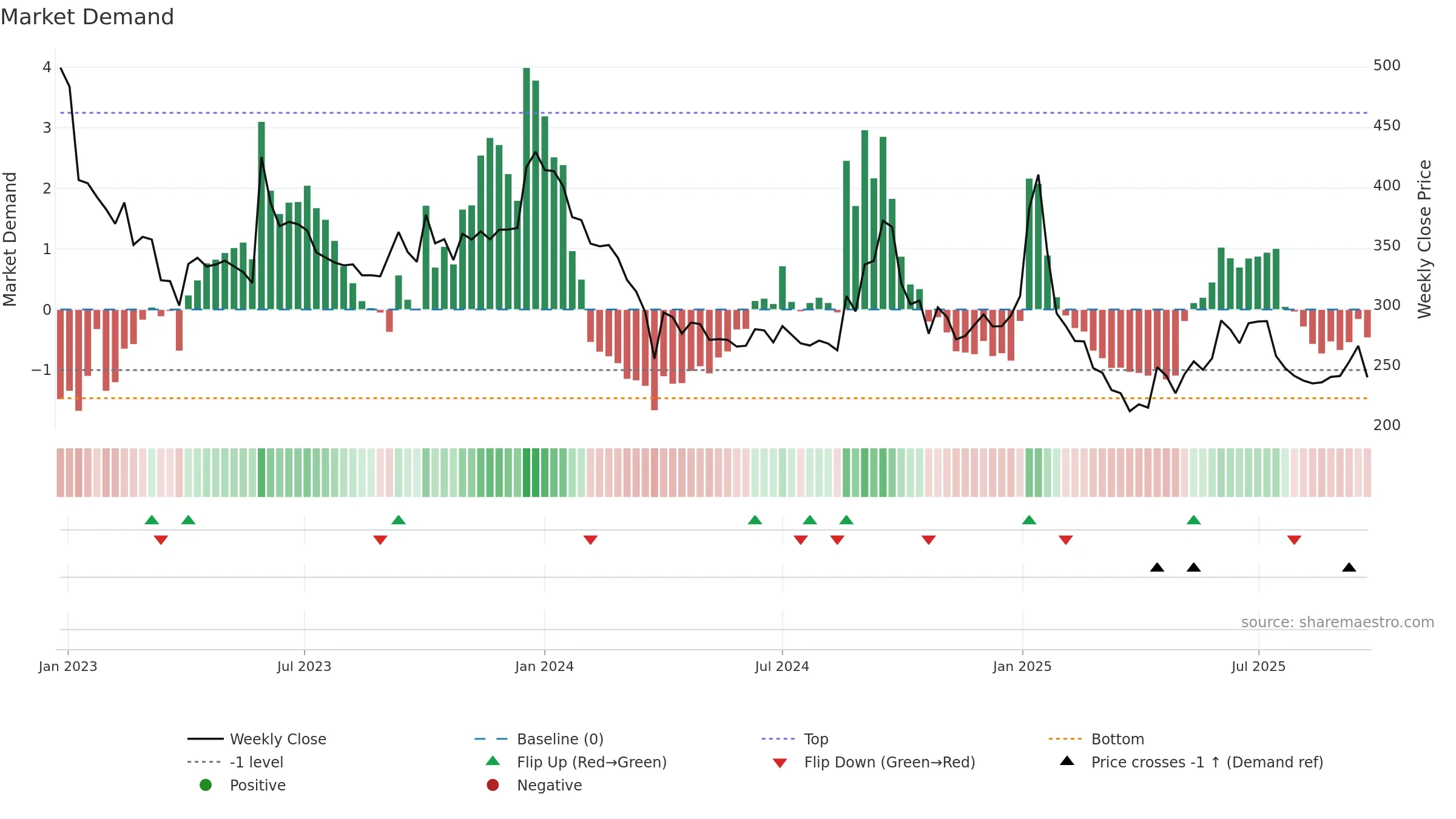

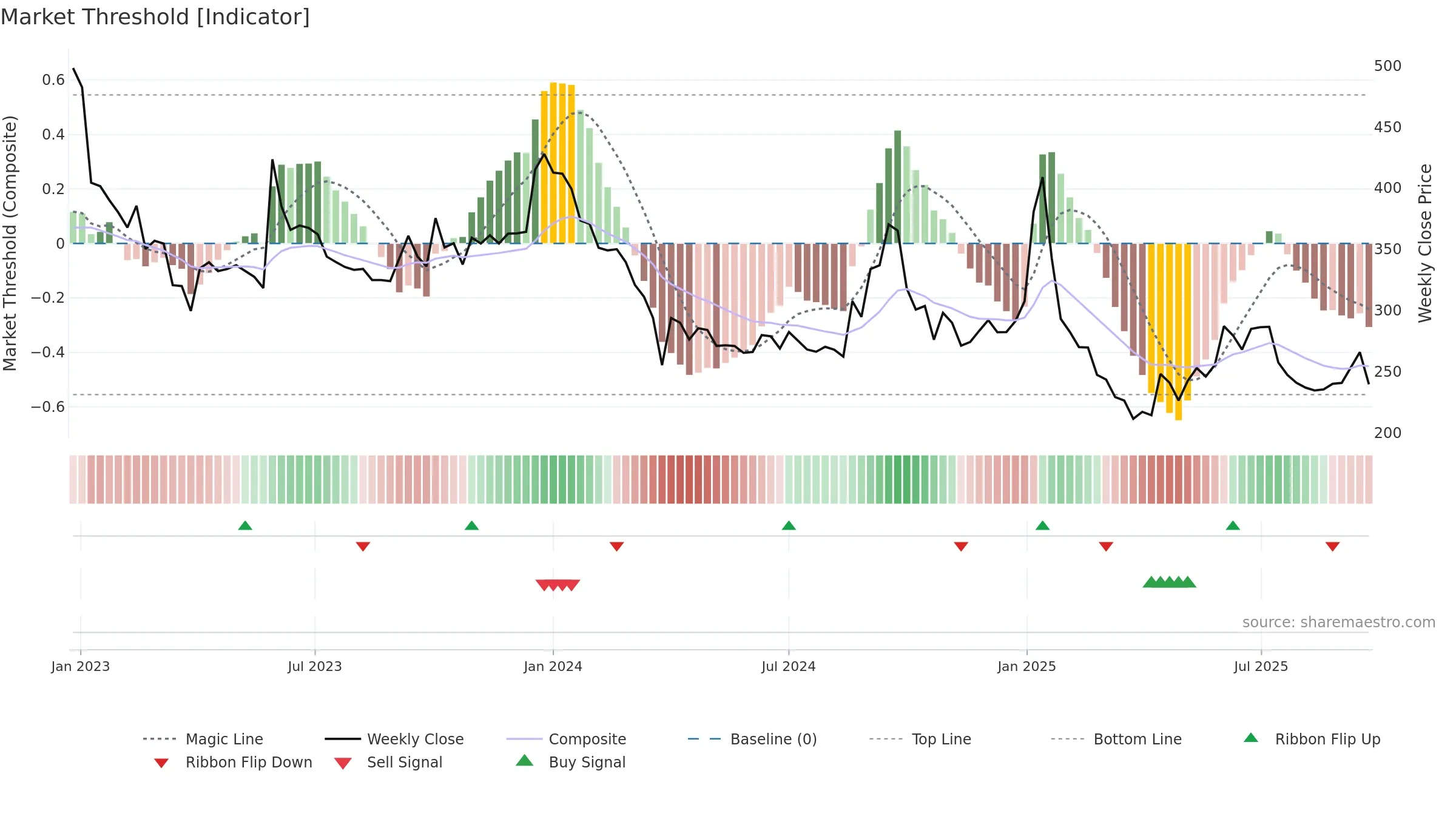

Negative setup. ★★⯪☆☆ confidence. Trend: Downtrend Confirmed · 1.14% over window · vol 2.15% · liquidity divergence · posture below · RS outperforming · leaning negative

- Mansfield RS: outperforming & rising

- Bearish control with falling momentum

- Momentum is weak/falling

- Price is not above key averages

- Liquidity diverges from price

Why: Price window 1.14% over w. Close is -9.86% below the prior-window high. Return volatility 2.15%. Volume trend falling. Liquidity divergence with price. Trend state downtrend confirmed. Momentum bearish and falling.

Tip: Most metrics include a hover tooltip where they appear in the report.