Rajshree Sugars & Chemicals Limited

RAJSREESUG NSE

Weekly Summary

Rajshree Sugars & Chemicals Limited closed at 41.4000 (-0.24% WoW) . Data window ends Mon, 22 Sep 2025.

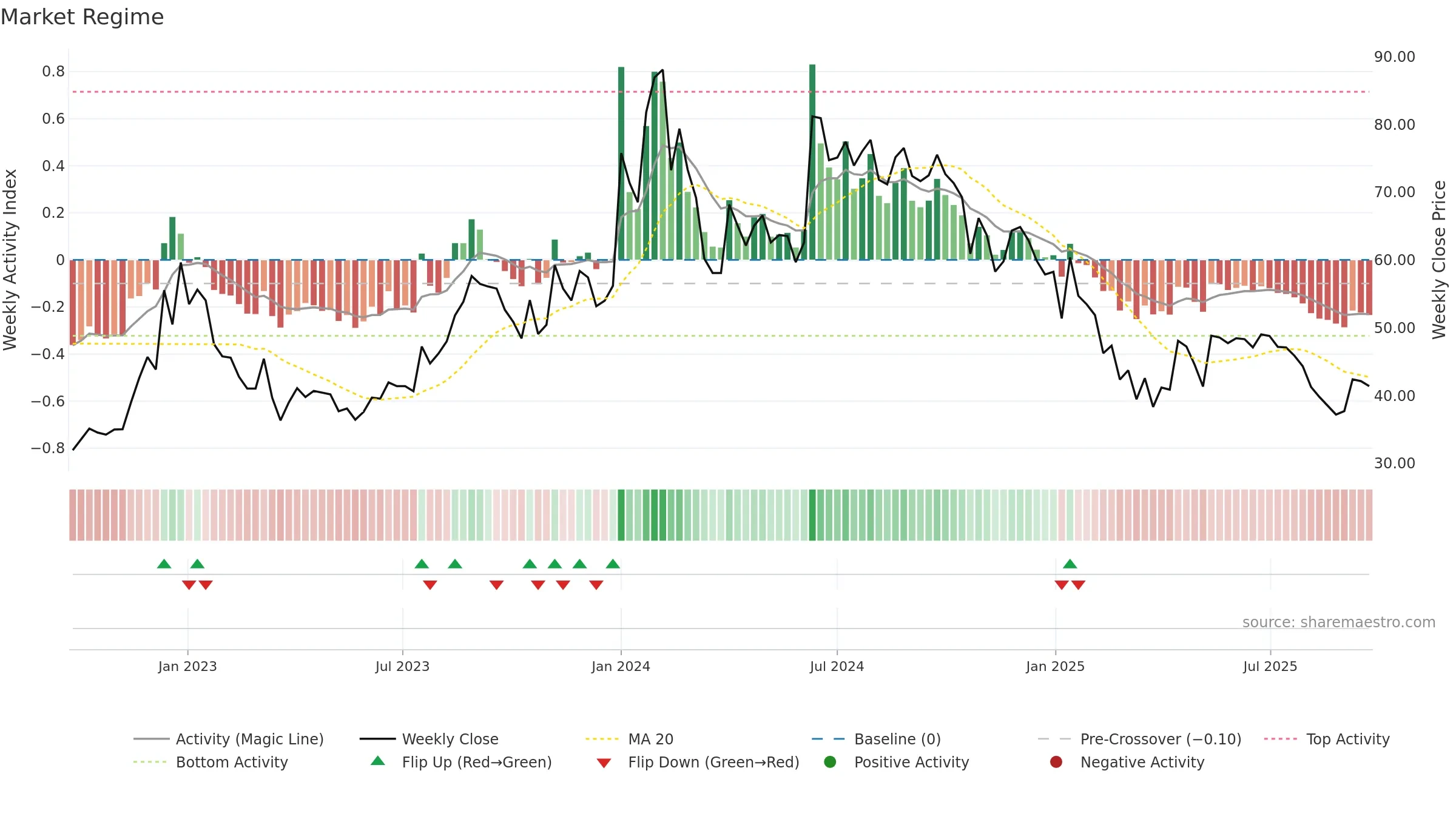

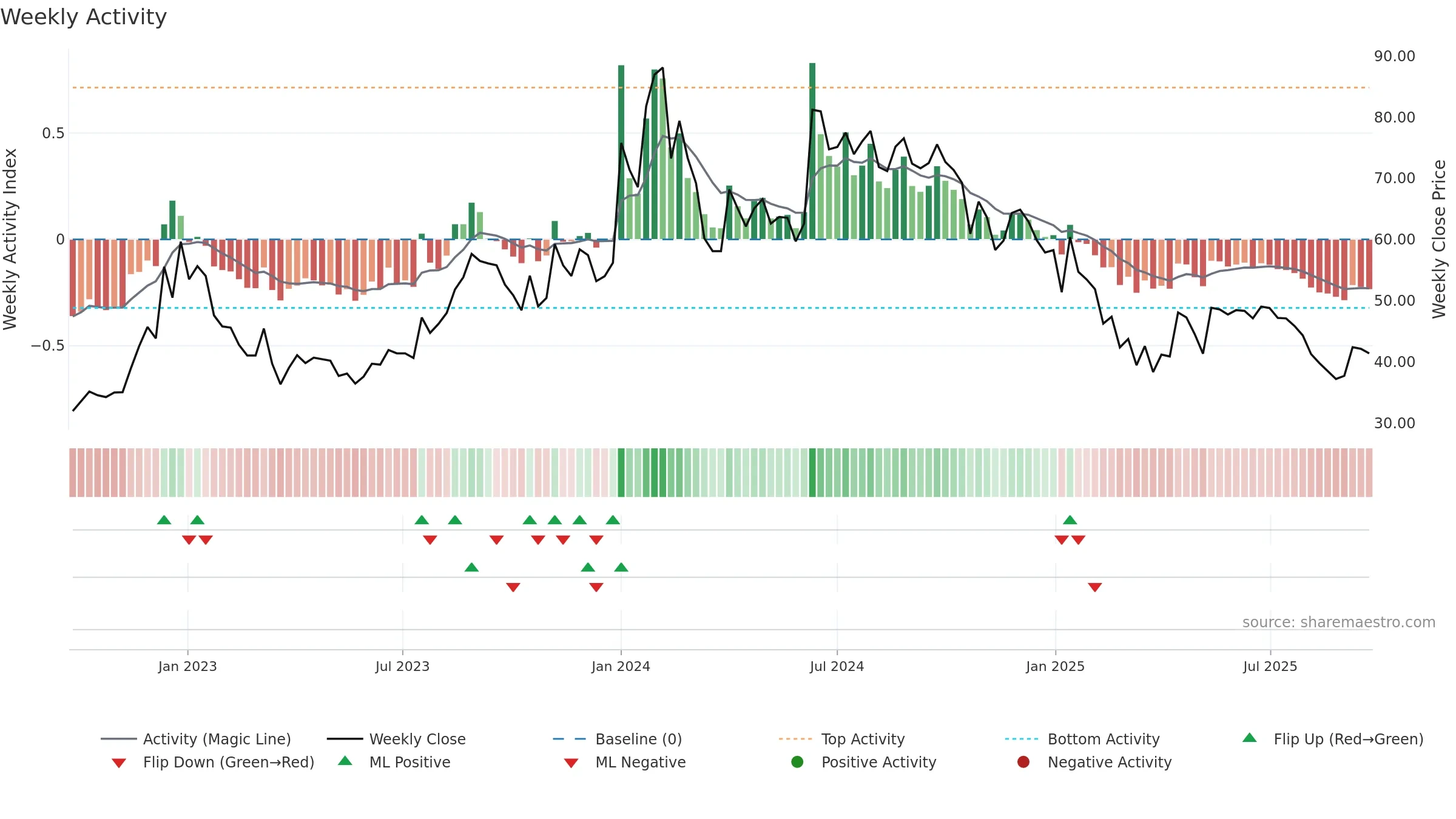

How to read this — Price slope is upward, indicating persistent buying over the window. Volume trend diverges from price — watch for fatigue or rotation. Returns are negatively correlated with volume — strength may come on lighter activity. Fresh short-term crossover improves near-term tone.

Up-slope supports buying interest; pullbacks may be contained if activity stays firm. Because liquidity isn’t confirming, prefer evidence of fresh demand before chasing moves.

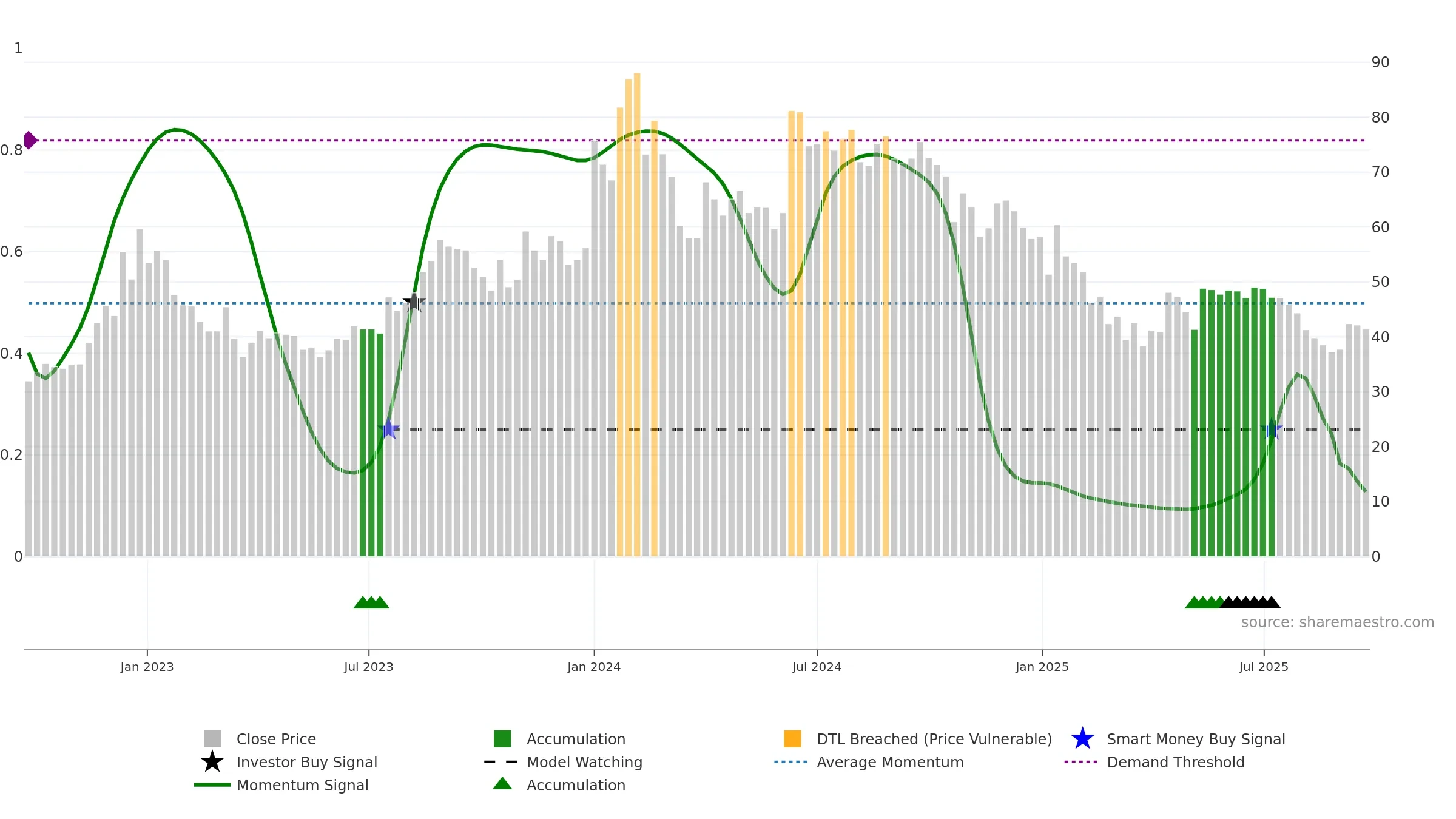

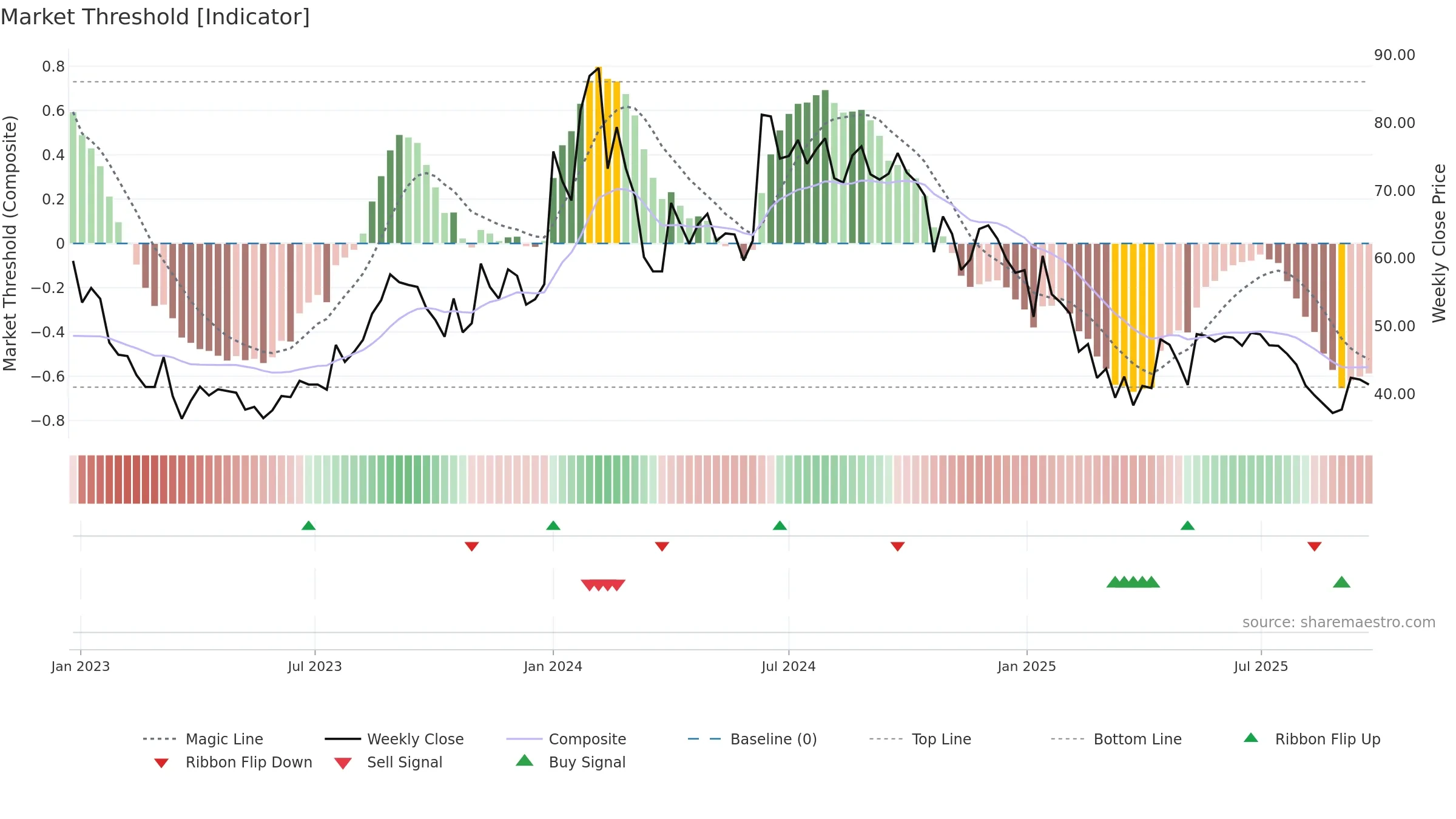

Gauge maps the trend signal to a 0–100 scale.

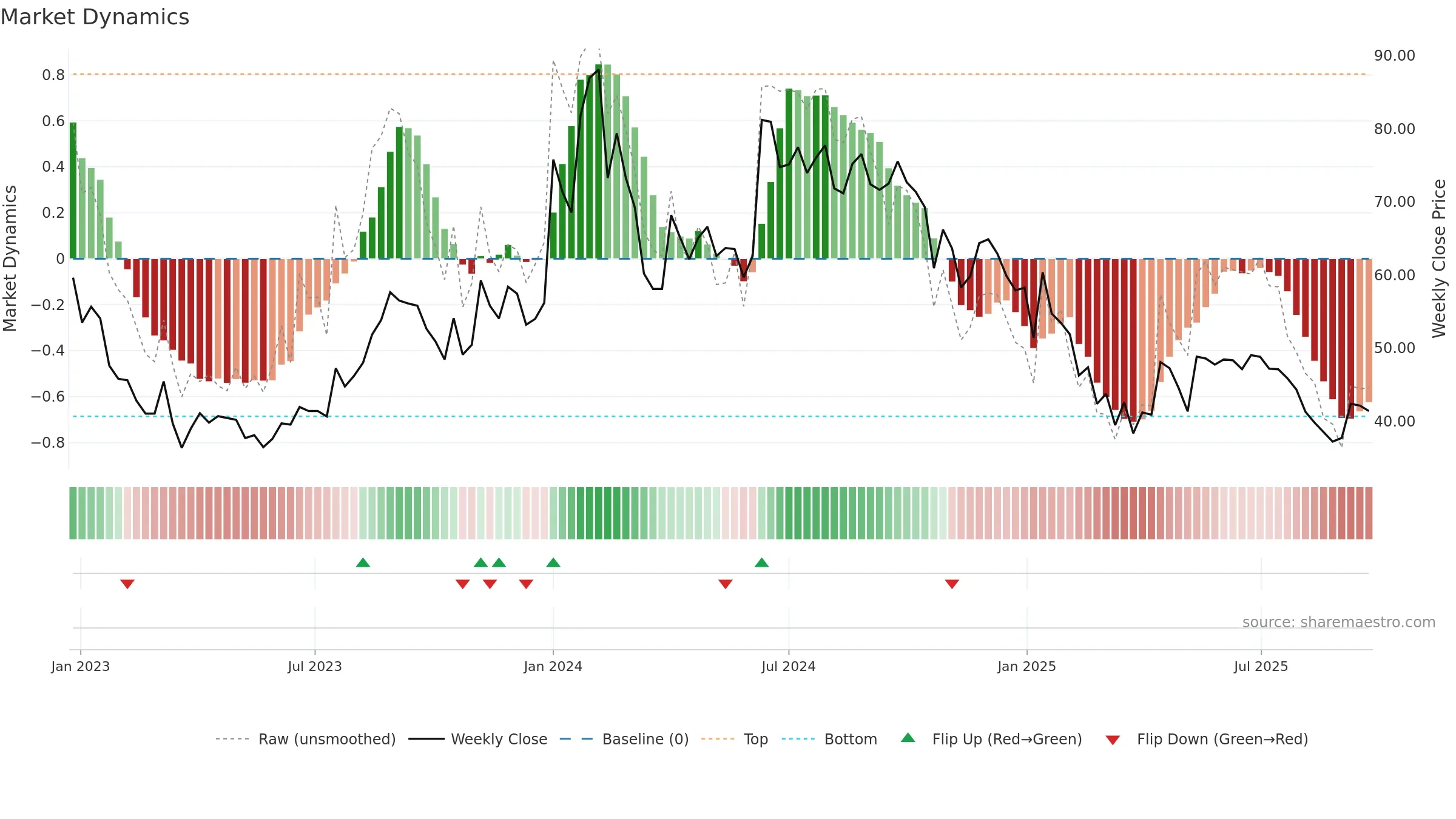

How to read this — Bearish zone with falling momentum — sellers in control.

Bias remains lower; rallies are suspect unless gauge reclaims 0.50/0.60.

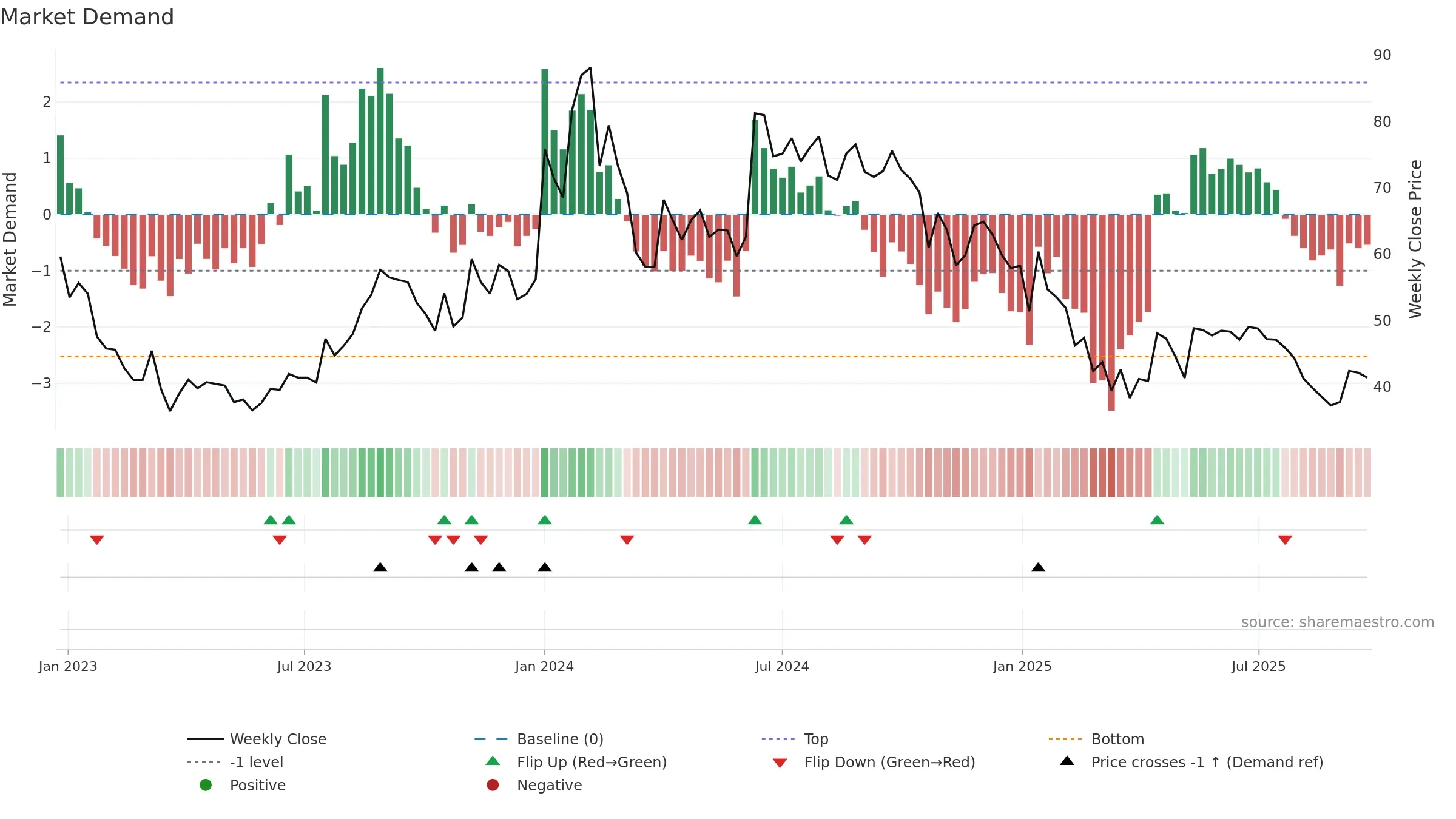

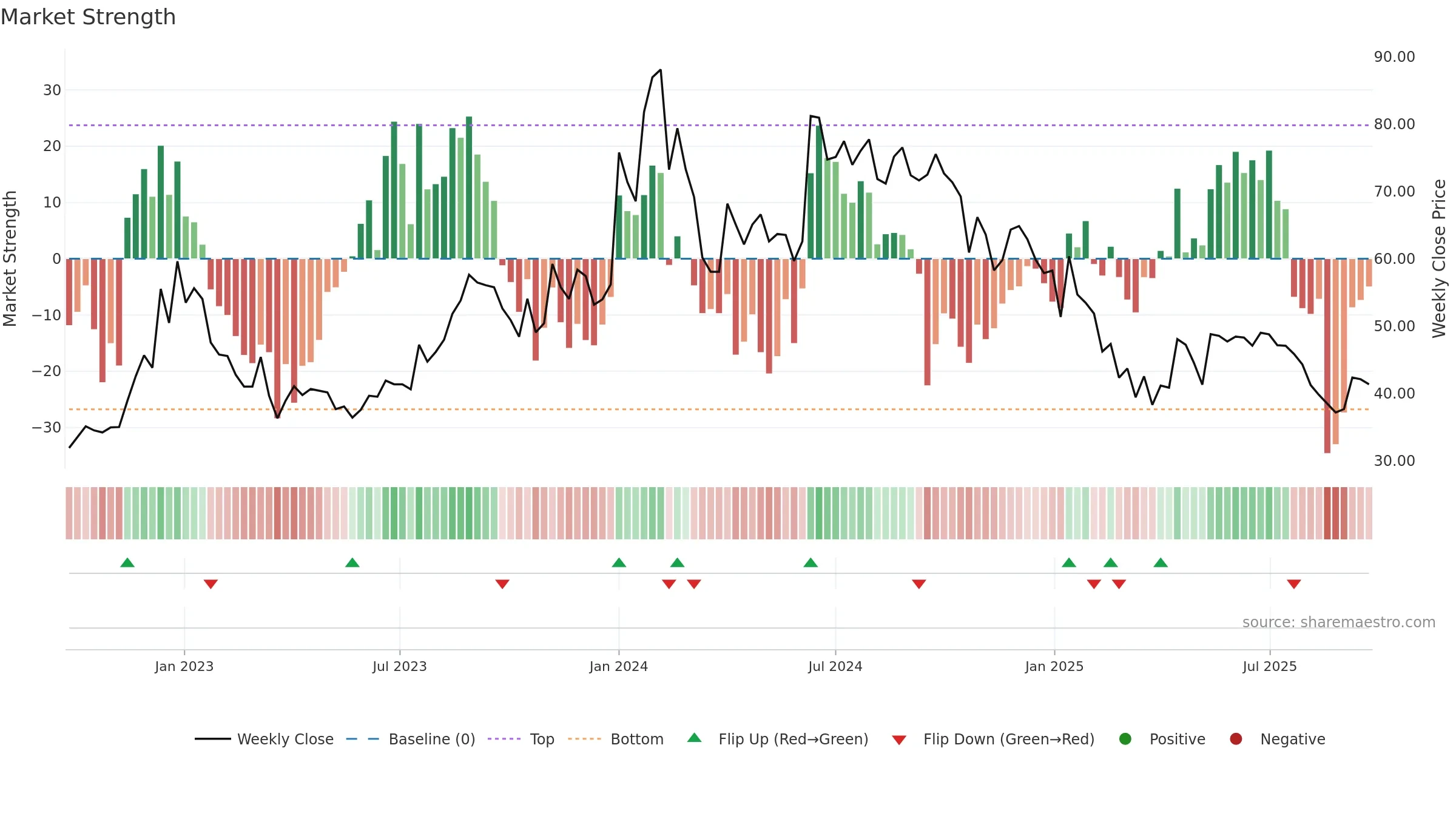

Relative strength is Negative

(< 0%, underperforming).

Latest MRS: -12.59% (week ending Fri, 19 Sep 2025).

Slope: Falling over 8w.

Notes:

- Below zero line indicates relative weakness vs benchmark.

- MRS slope falling over ~8 weeks.

Conclusion

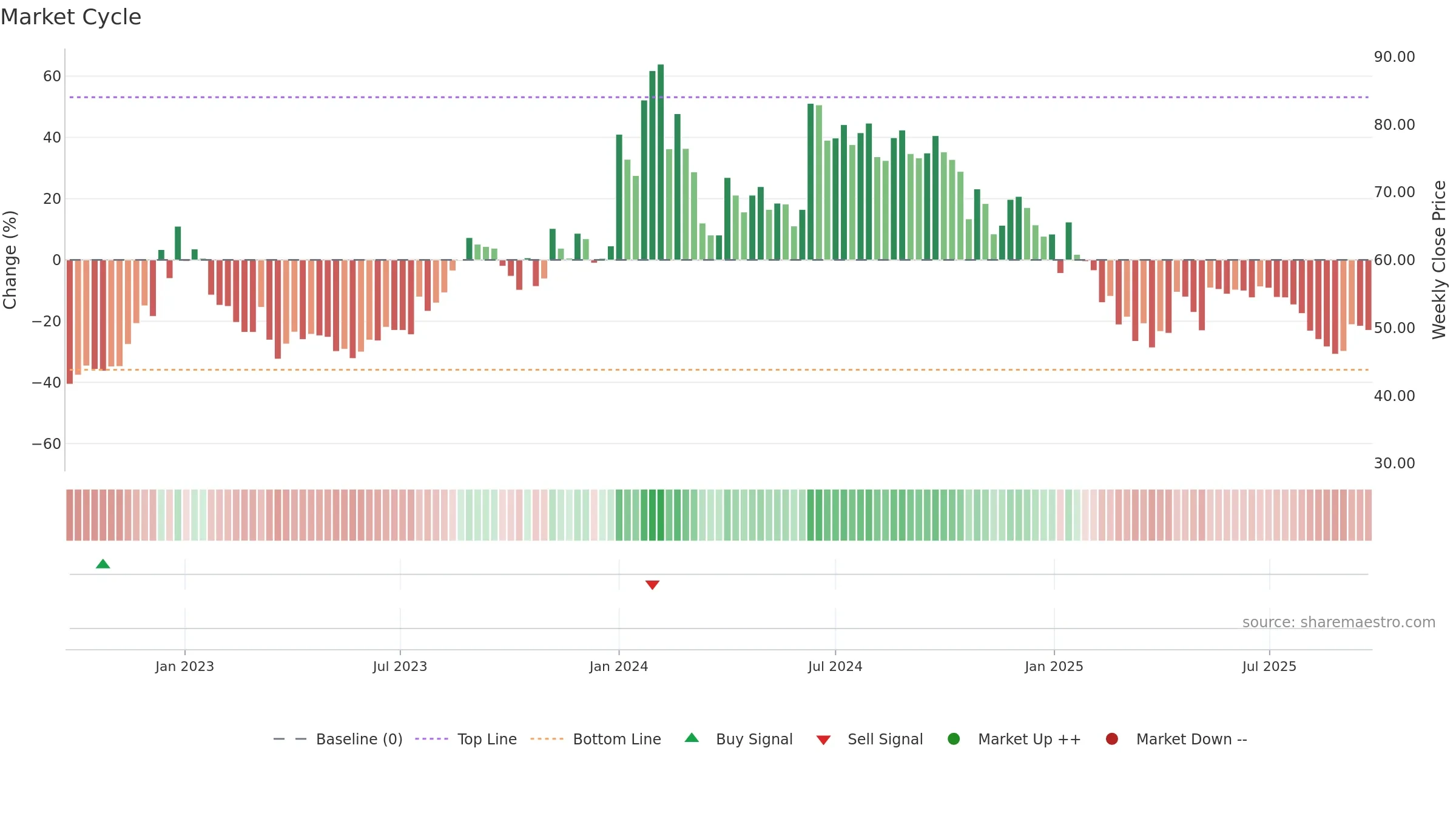

Negative setup. ⯪☆☆☆☆ confidence. Trend: Downtrend Confirmed · 0.29% over window · vol 2.51% · liquidity divergence · posture mixed · RS weak

- Bearish control with falling momentum

- Momentum is weak/falling

- Price is not above key averages

- Liquidity diverges from price

Why: Price window 0.29% over w. Close is -2.36% below the prior-window high. Volume trend falling. Liquidity divergence with price. Trend state downtrend confirmed. 4–8w crossover bullish. Momentum bearish and falling.

Tip: Most metrics include a hover tooltip where they appear in the report.