Jamf Holding Corp.

JAMF NASDAQ

Weekly Report

Jamf Holding Corp. closed at 11.1100 (-4.22% WoW) . Data window ends Fri, 19 Sep 2025.

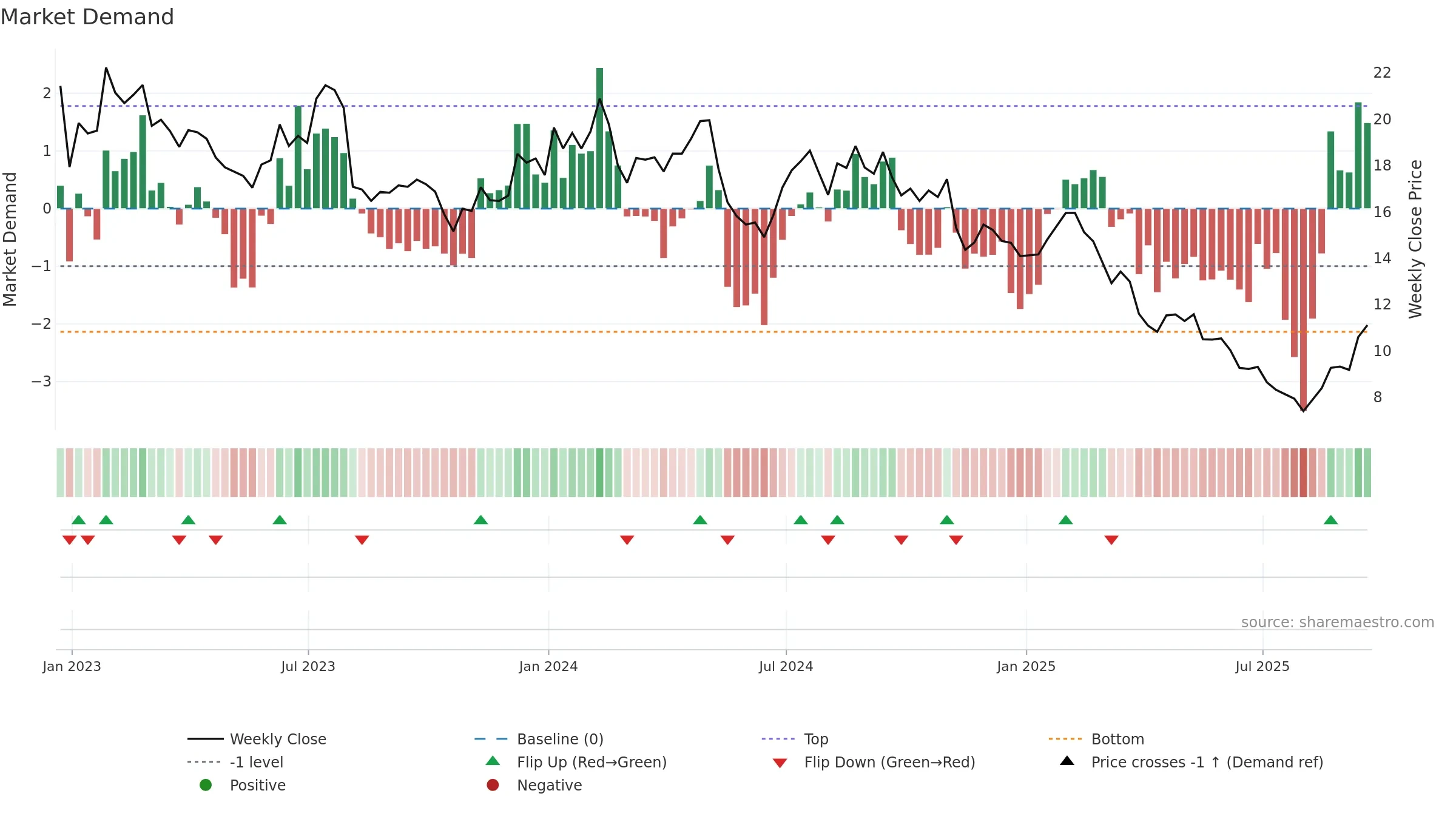

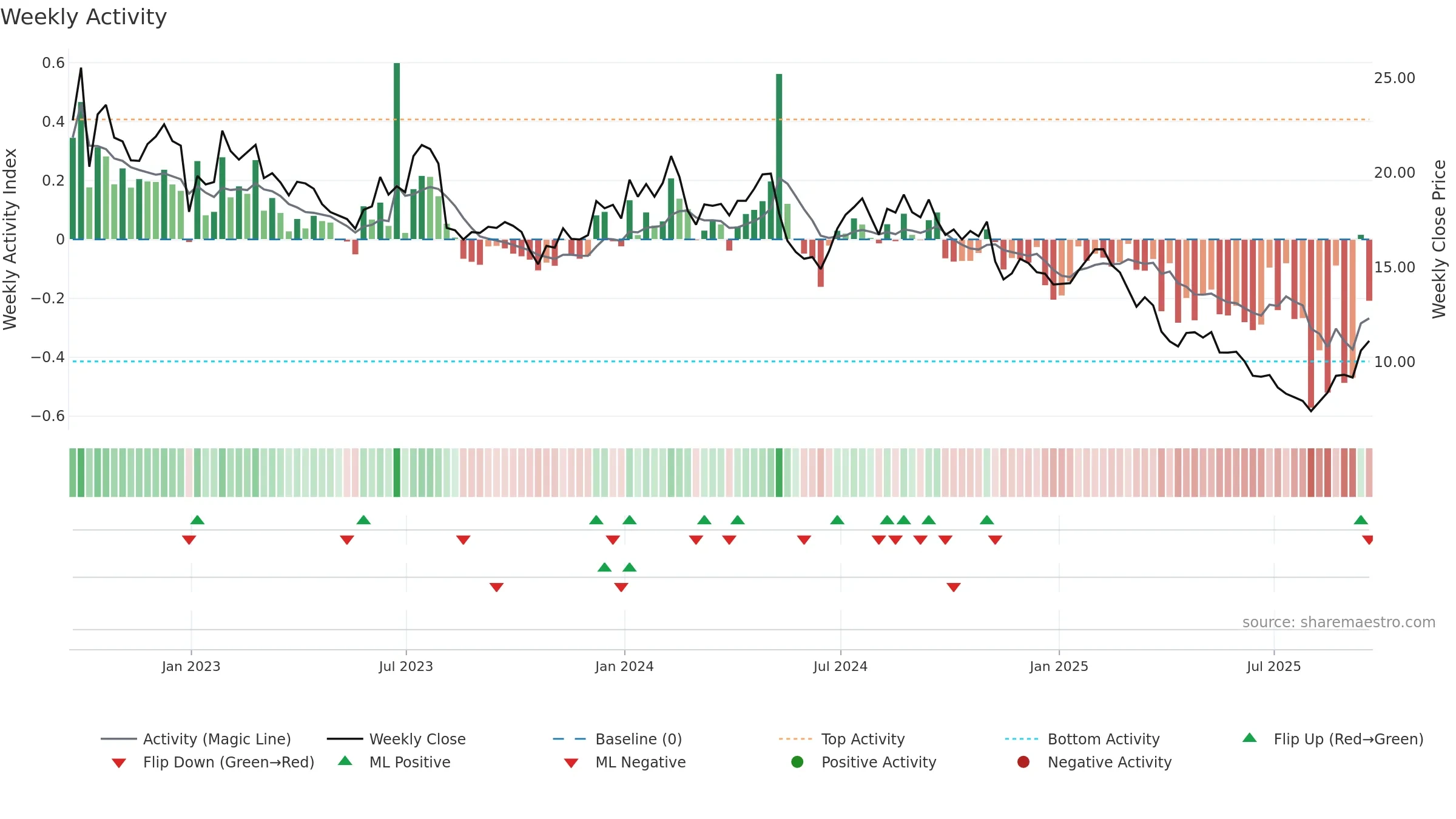

How to read this — Price slope is upward, indicating persistent buying over the window. Elevated weekly volatility increases whipsaw risk. Volume and price are moving in the same direction — a constructive confirmation. Returns are positively correlated with volume — strength tends to arrive on higher activity. Price holds above key averages, indicating constructive participation.

Up-slope supports buying interest; pullbacks may be contained if activity stays firm.

Gauge maps the trend signal to a 0–100 scale.

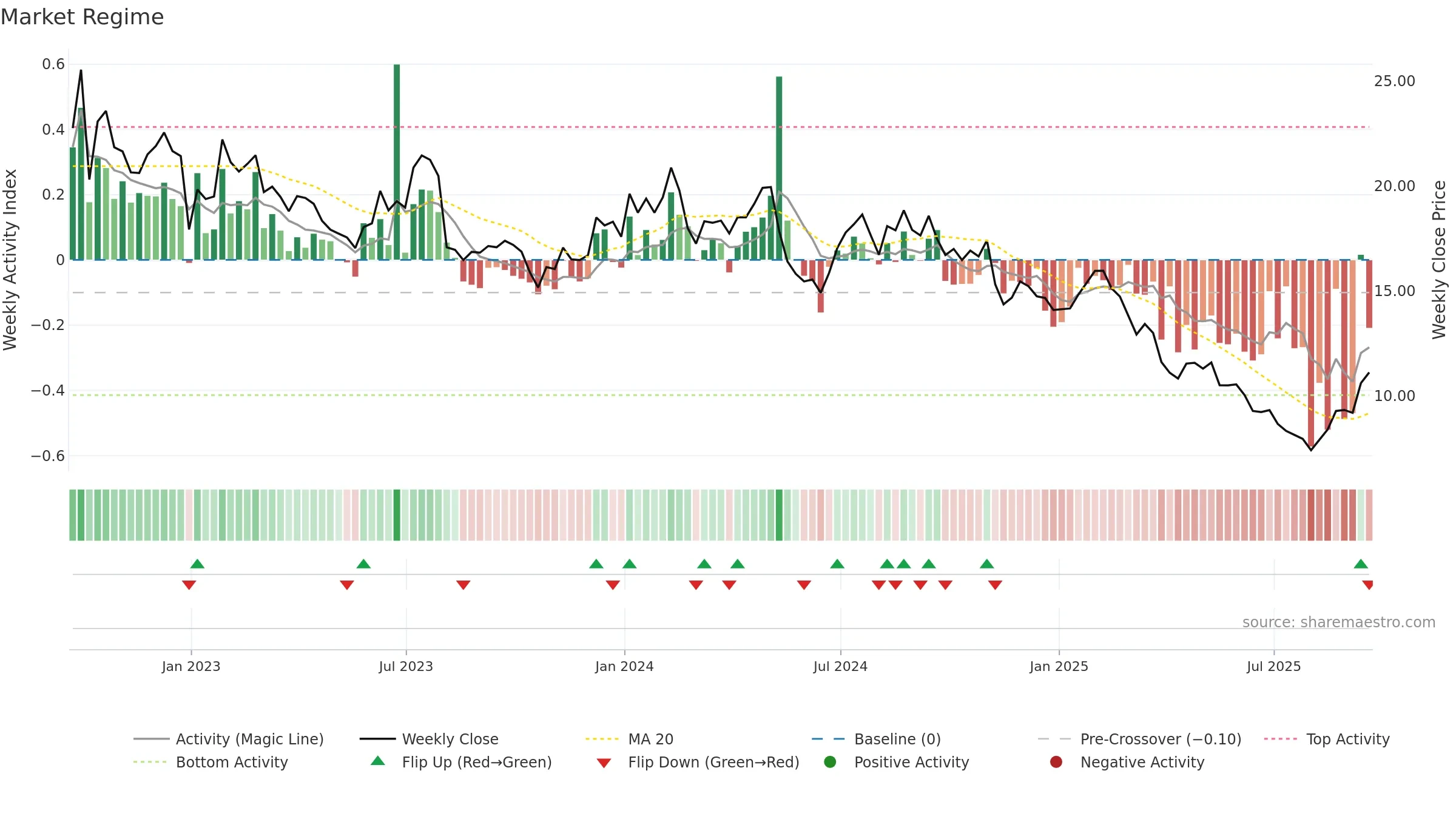

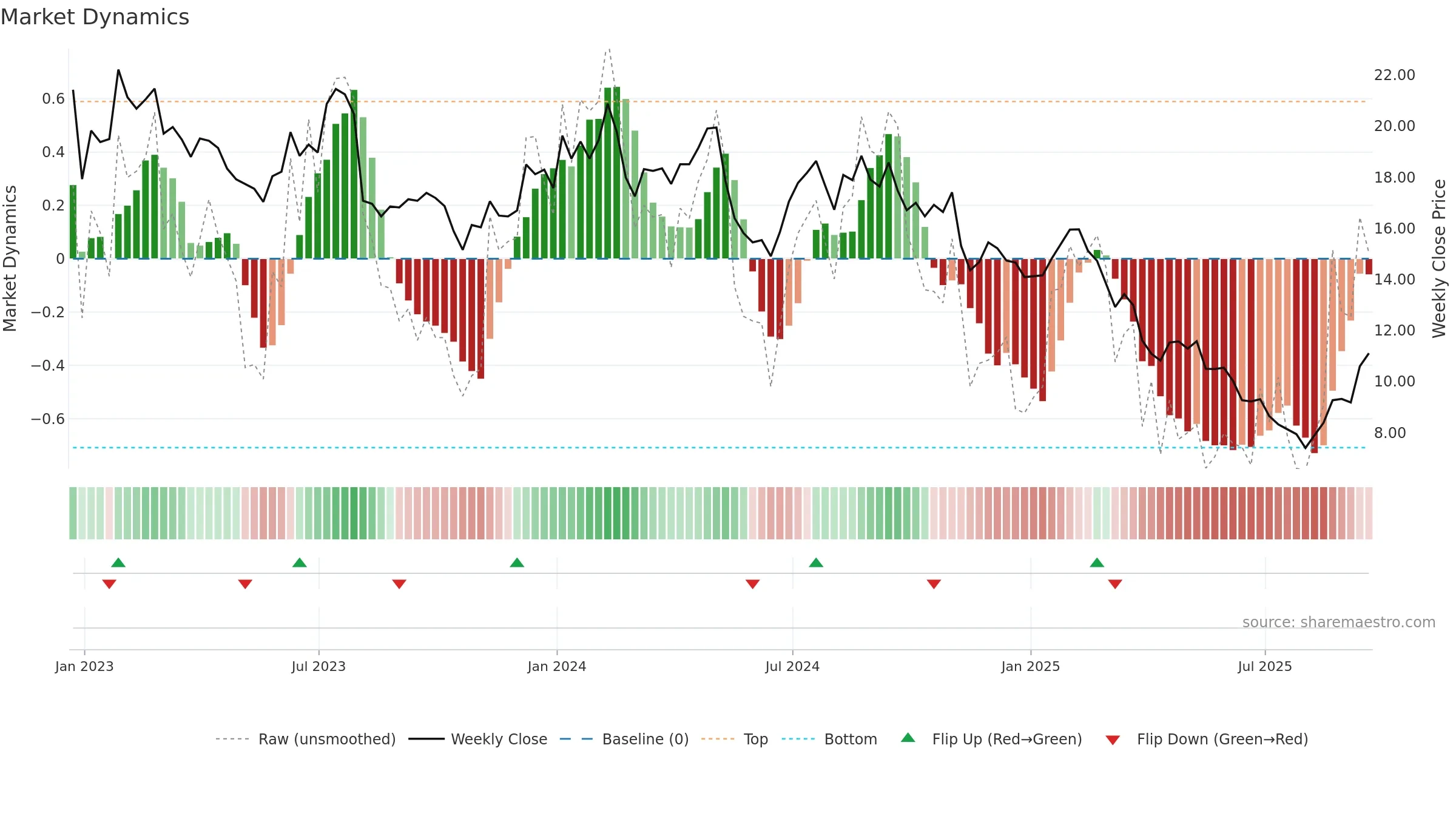

How to read this — Range-bound conditions; conviction is limited until a break or acceleration emerges.

Wait for a directional break or improving acceleration.

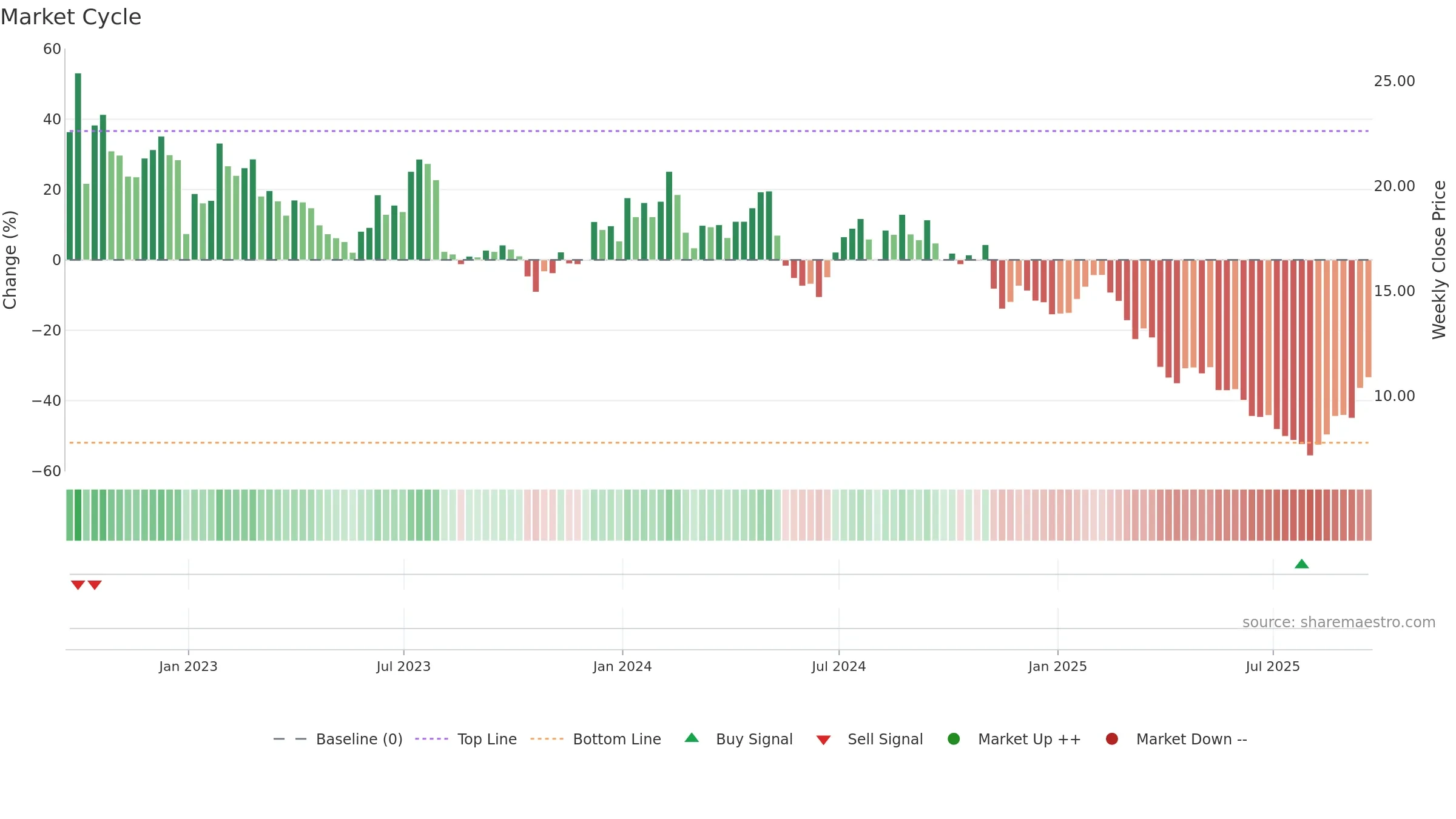

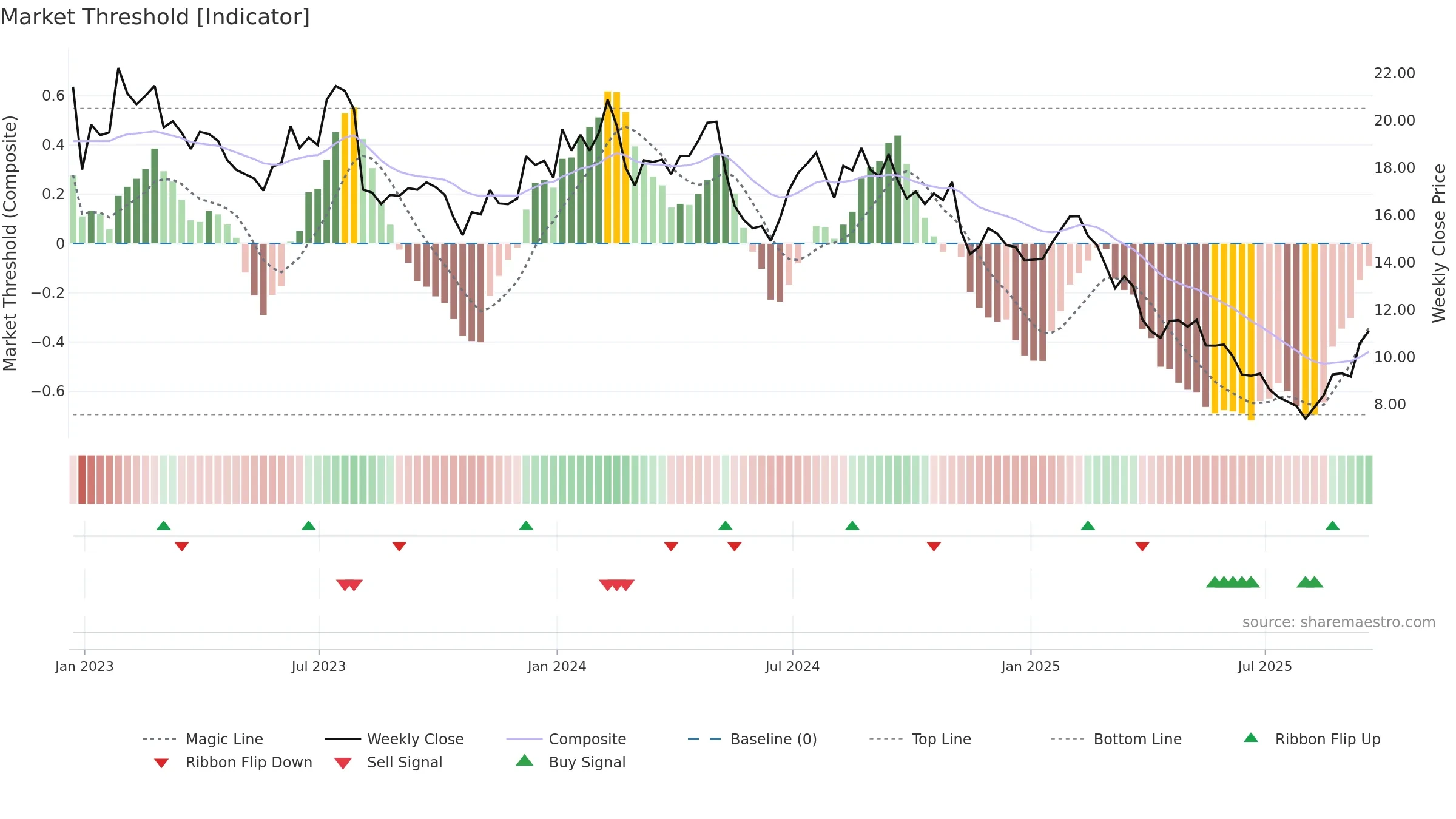

The flag is positive: favourable upside skew with supportive conditions.

Conclusion

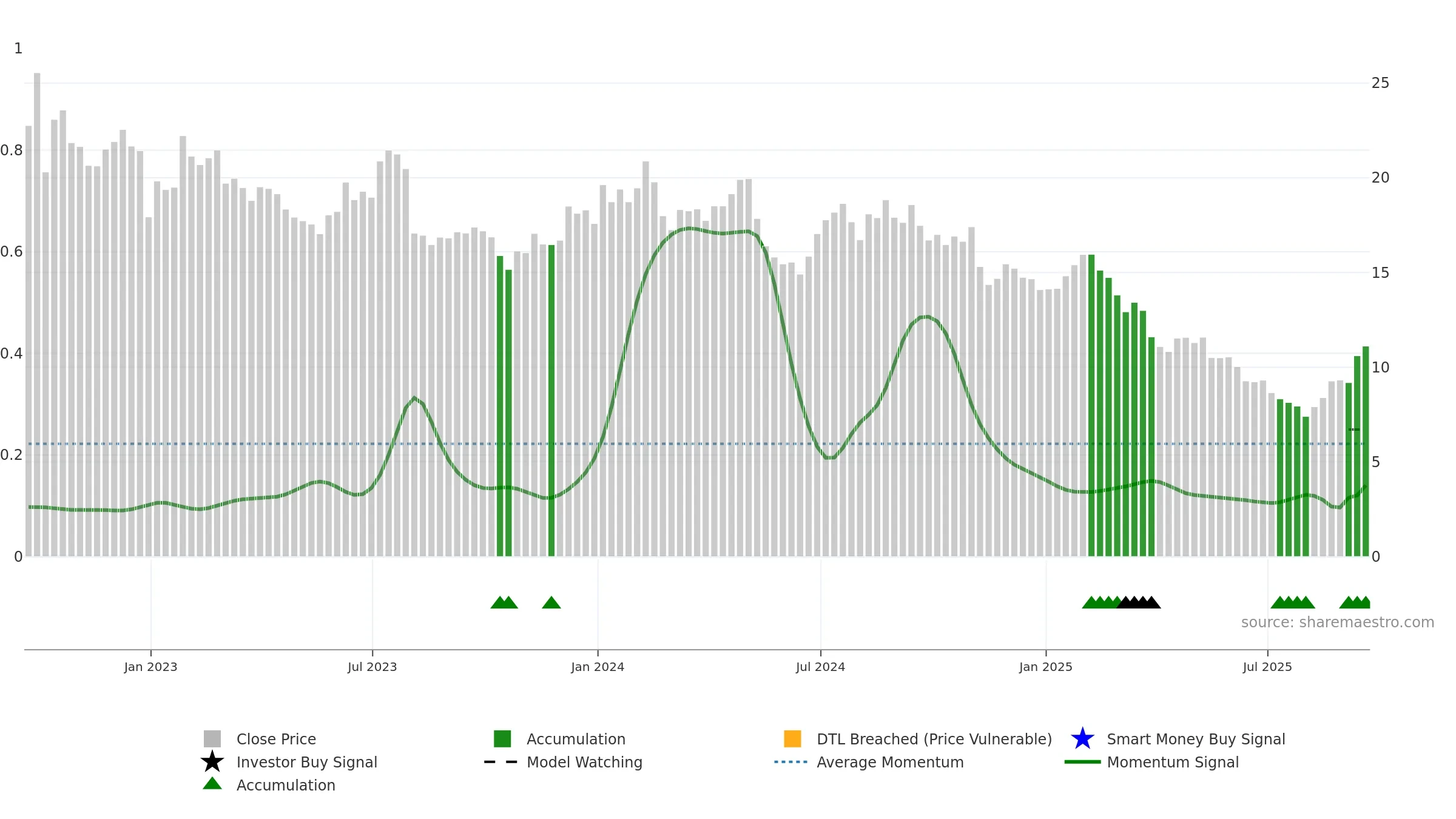

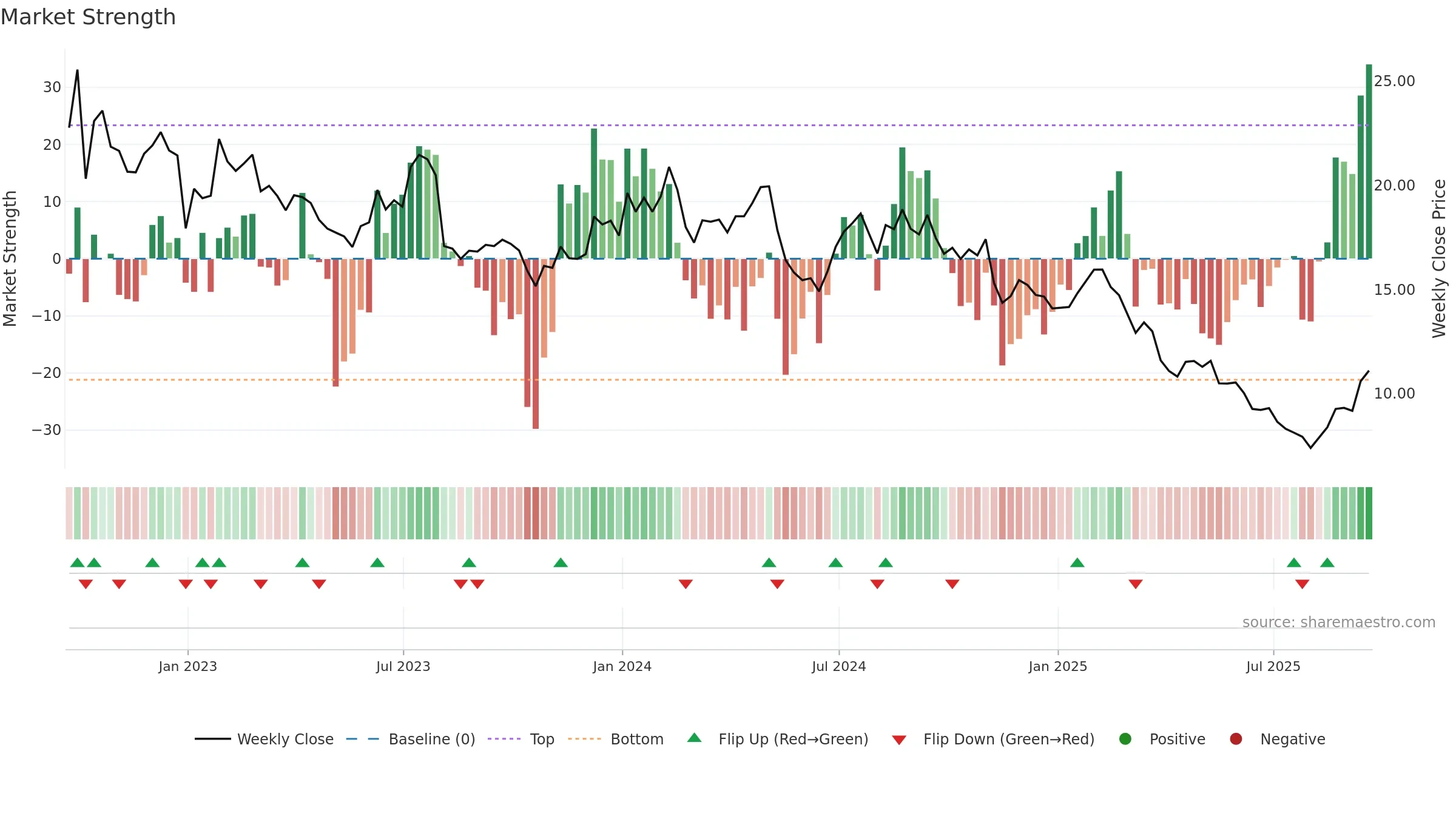

Positive setup. ★★★★☆ confidence. Price window: 50. Trend: Range / Neutral; gauge 14. In combination, liquidity confirms the move.

- Price holds above 8w & 26w averages

- Liquidity confirms the price trend

- Solid multi-week performance

- High return volatility raises whipsaw risk

Why: Price window 50.14% over 8w. Close is 4.81% above the prior-window high. Return volatility 4.51%. Volume trend rising. Liquidity convergence with price. Trend state range / neutral. Low-regime (≤0.25) upticks 3/7 (43.0%) • Distributing. Momentum neutral and rising. Valuation stance positive.

Tip: Most metrics include a hover tooltip where they appear in the report.