Sino Medical Sciences Technology Inc.

688108 SHA

Weekly Report

Sino Medical Sciences Technology Inc. closed at 30.4500 (-1.74% WoW) . Data window ends Mon, 15 Sep 2025.

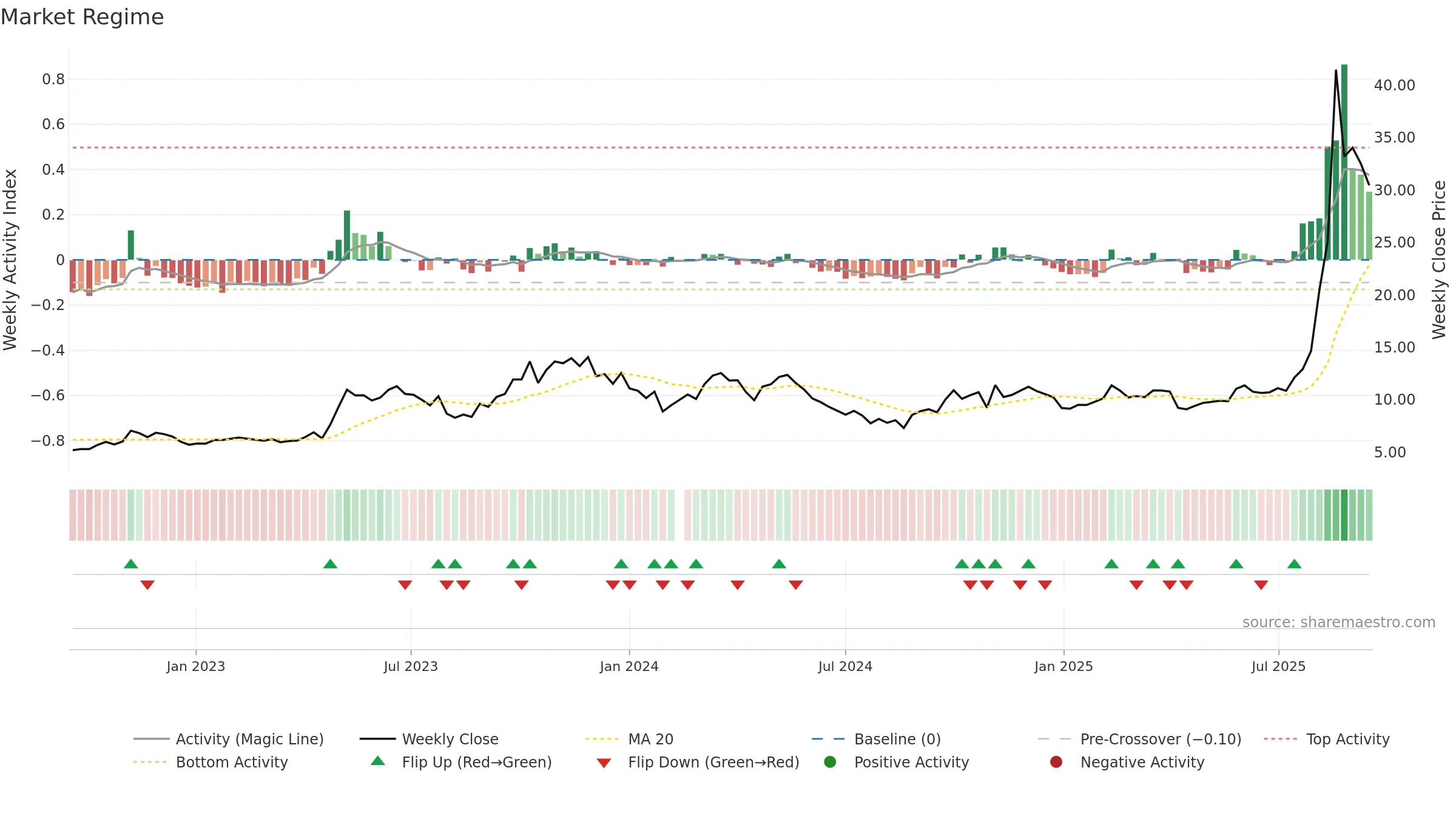

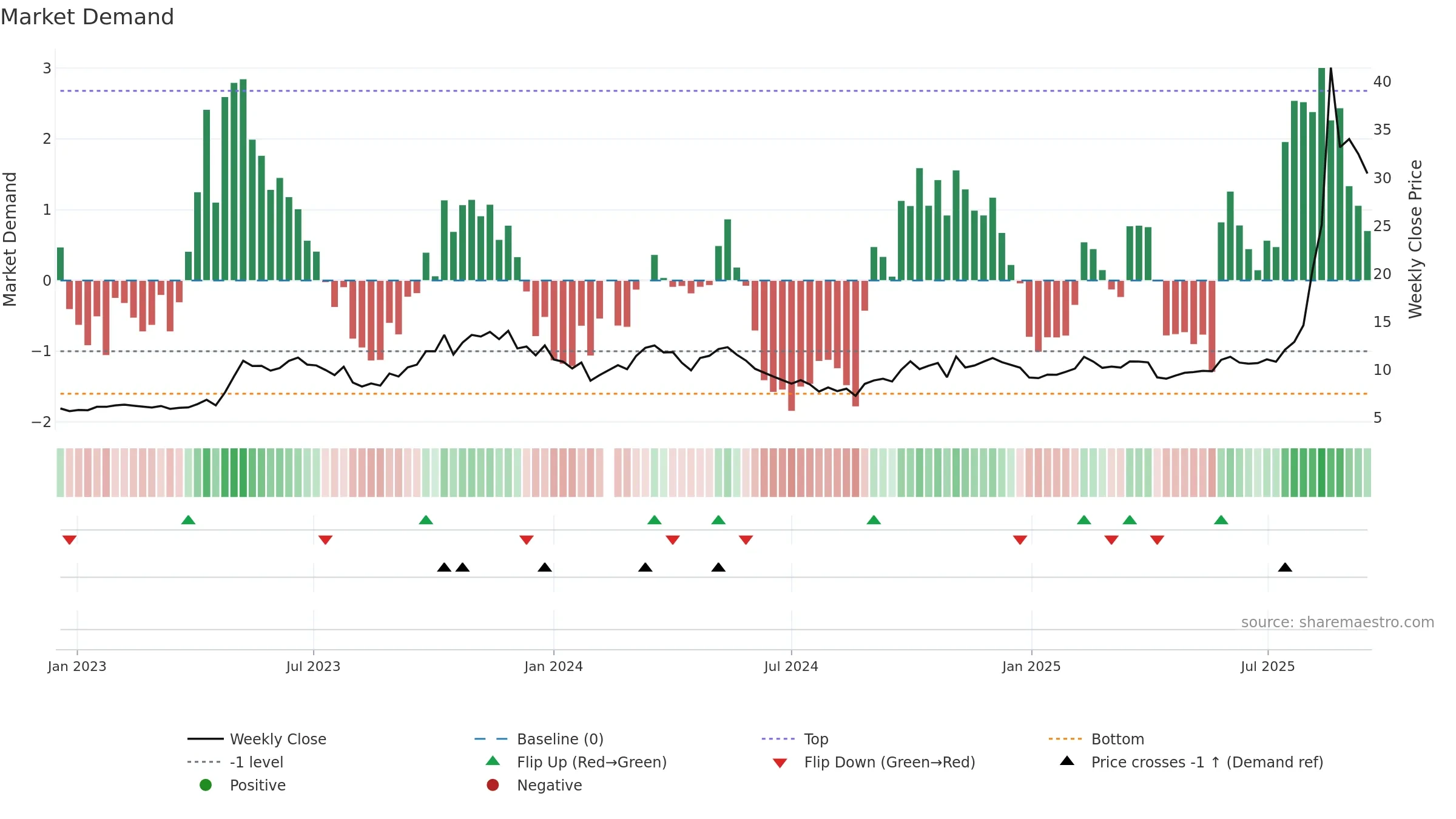

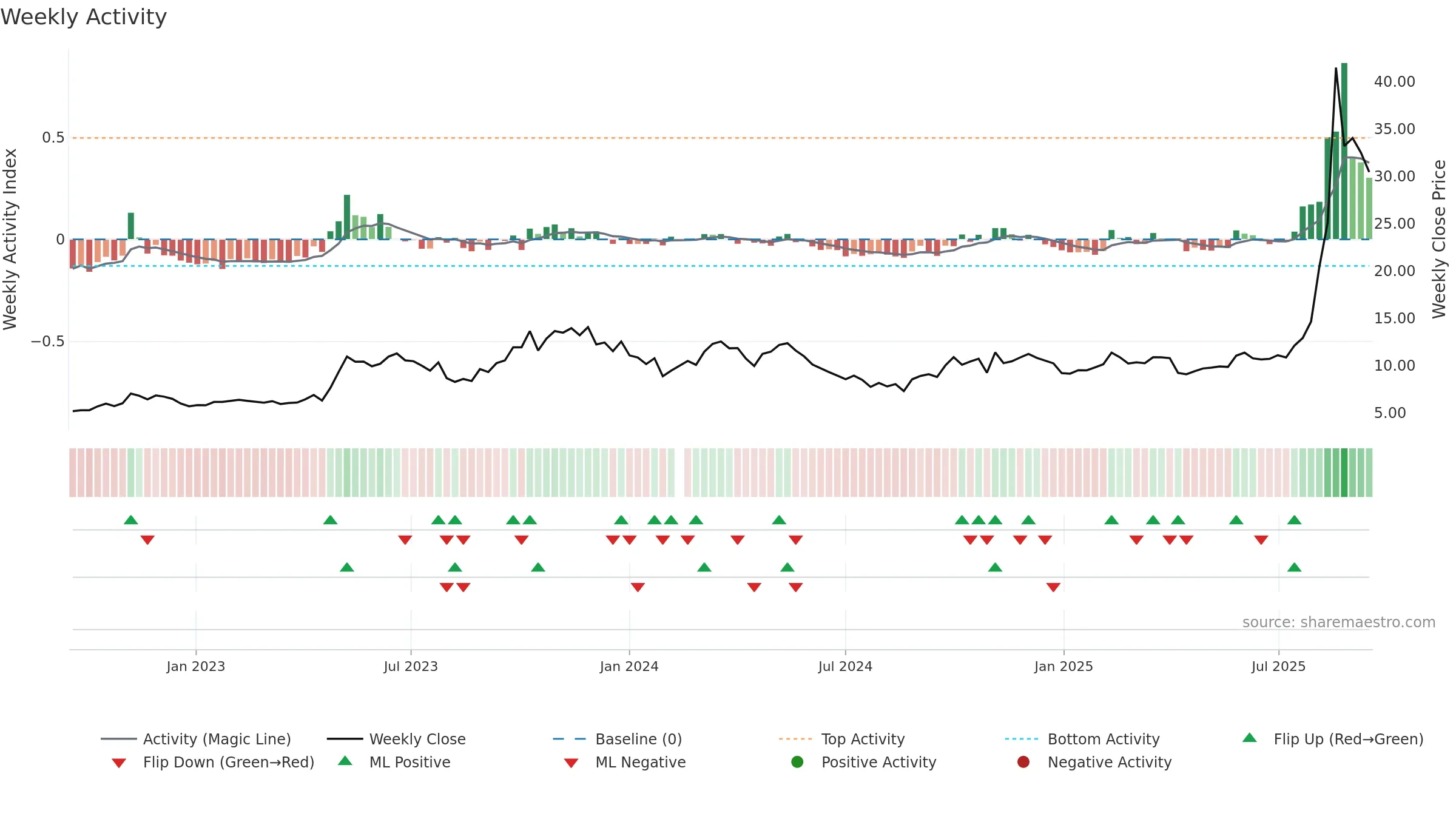

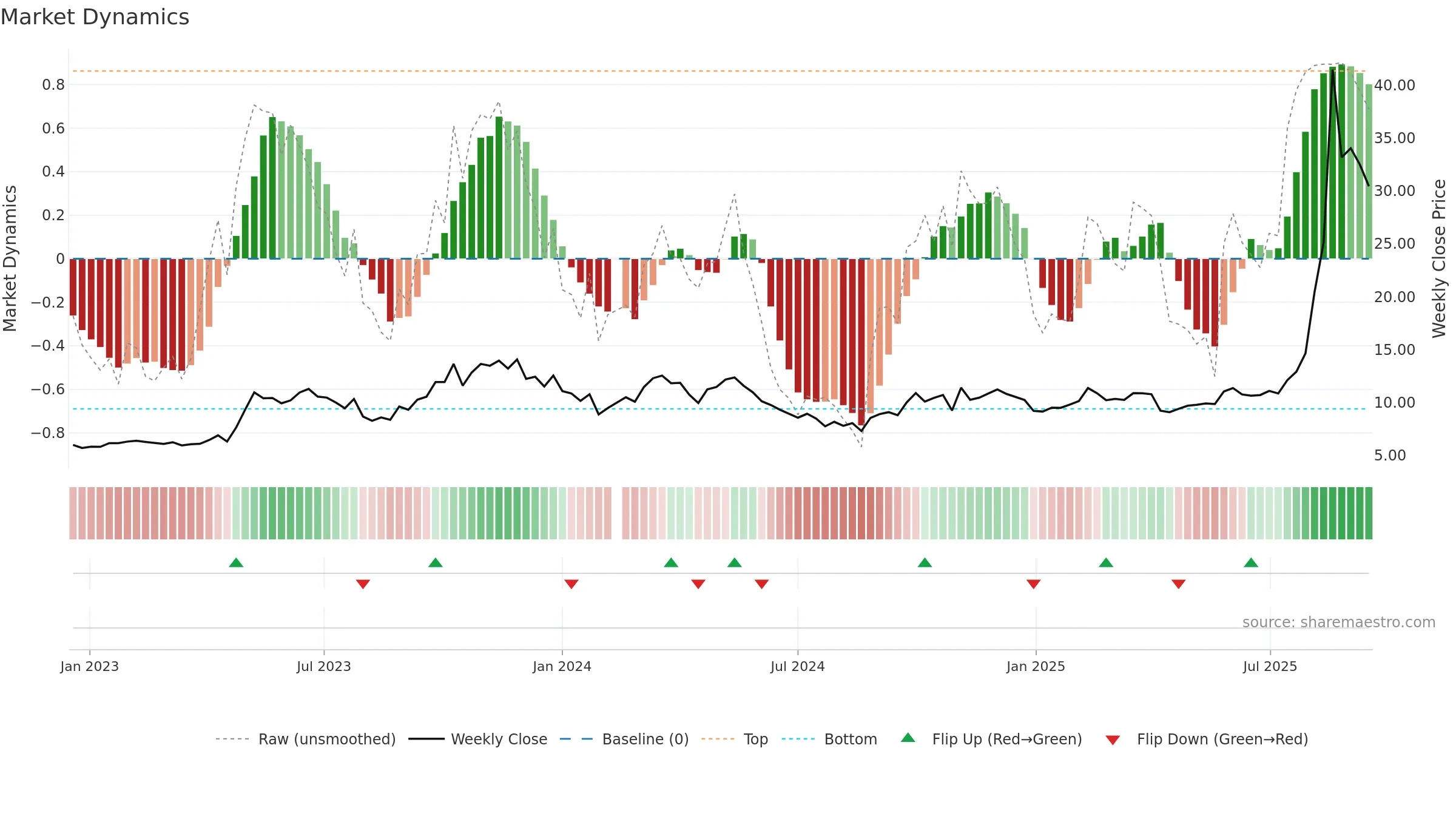

How to read this — Price slope is upward, indicating persistent buying over the window. Elevated weekly volatility increases whipsaw risk. Volume trend diverges from price — watch for fatigue or rotation. Constructive MA stack supports the up-drift; pullbacks may find support at the 8–13 week region. Price holds above key averages, indicating constructive participation.

Up-slope supports buying interest; pullbacks may be contained if activity stays firm. Because liquidity isn’t confirming, prefer evidence of fresh demand before chasing moves.

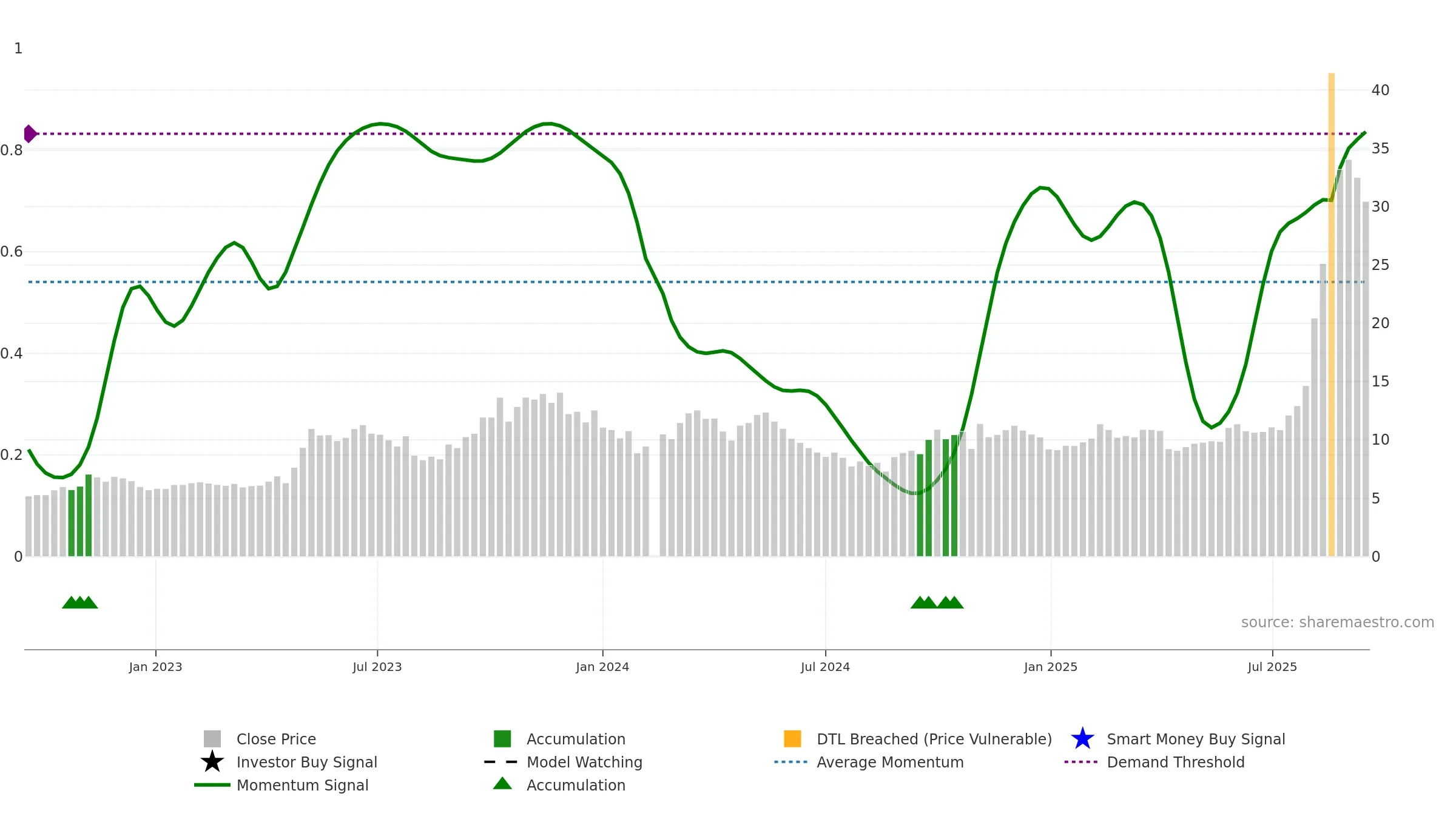

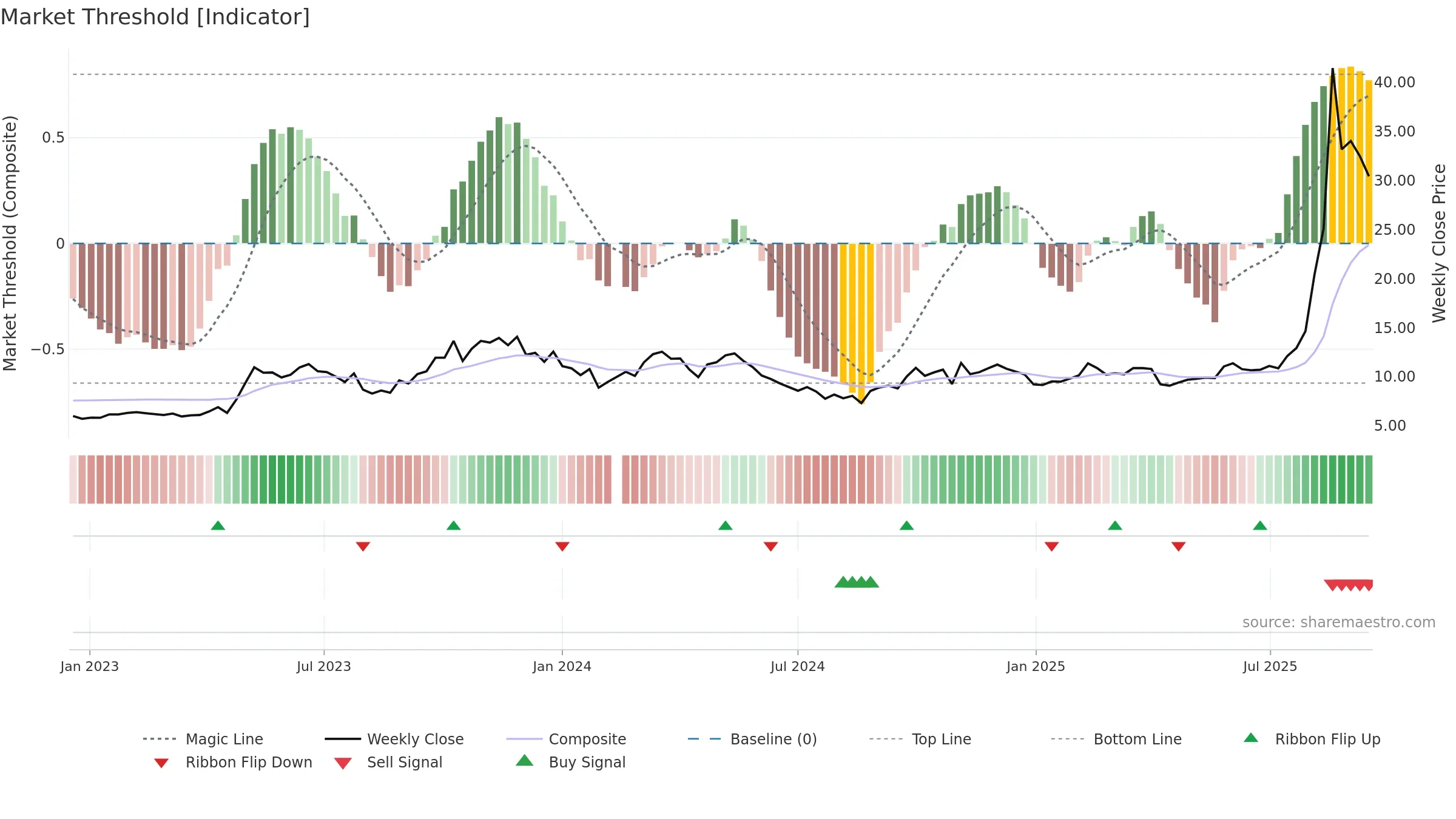

Gauge maps the trend signal to a 0–100 scale.

How to read this — High gauge and rising momentum — buyers in control.

Bias remains higher; pullbacks could be buyable if participation holds.

Price is above fair value; upside may be capped without catalysts.

Conclusion

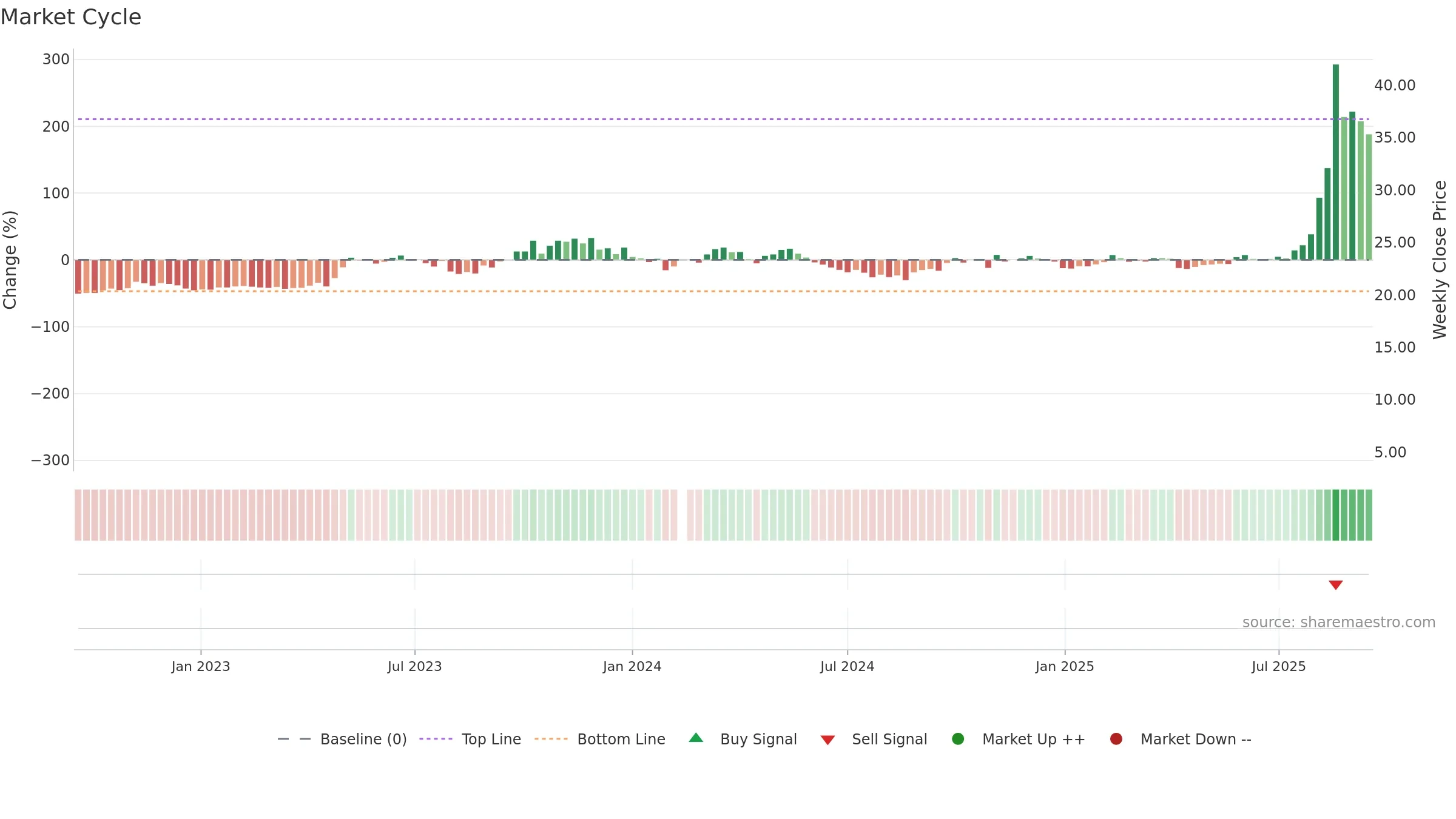

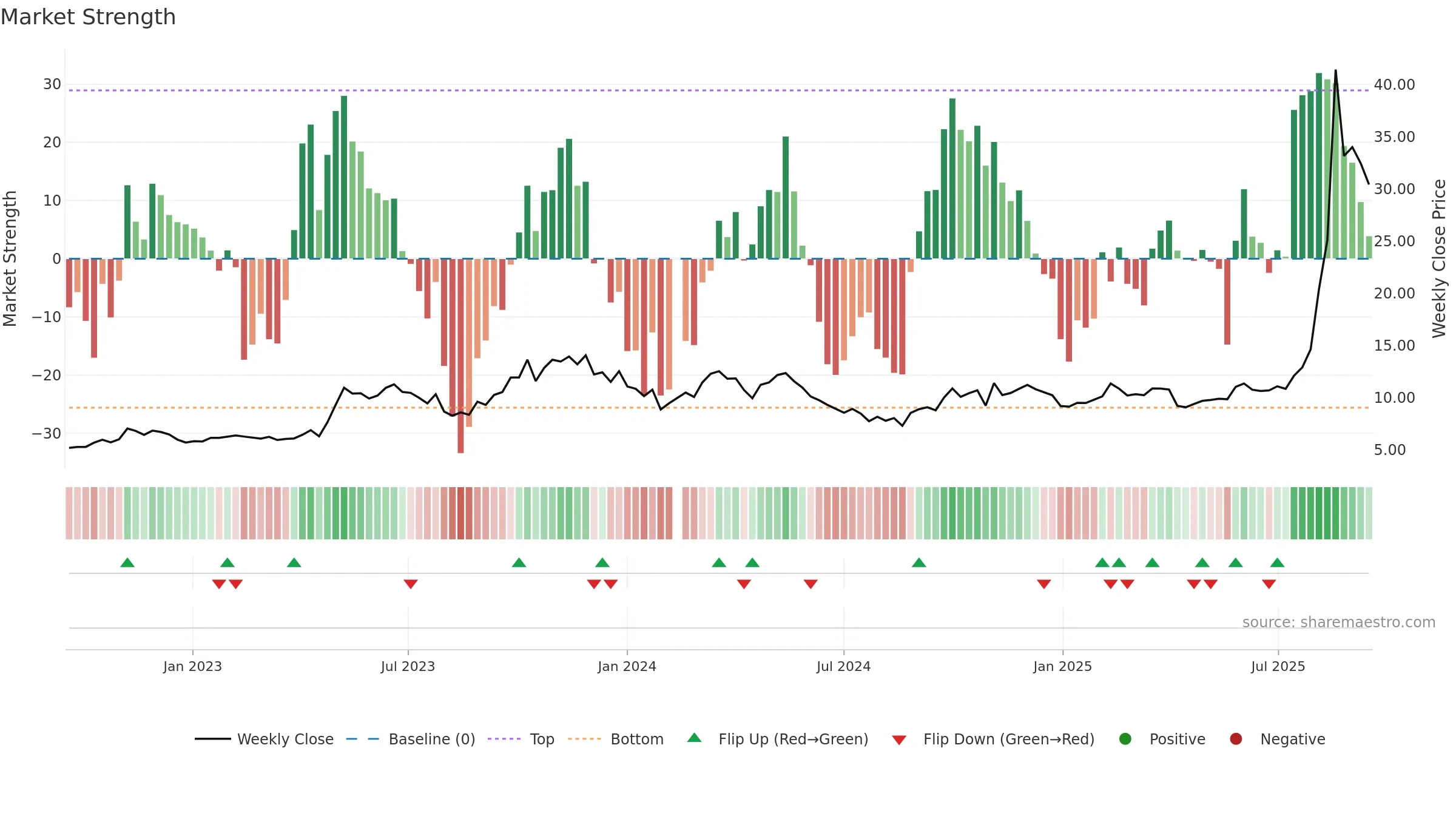

Neutral setup. ★★★☆☆ confidence. Price window: 107. Trend: Strong Uptrend; gauge 83. In combination, liquidity diverges from price.

- High gauge with rising momentum (strong uptrend)

- Momentum is bullish and rising

- Price holds above 8w & 26w averages

- Constructive moving-average stack

- Liquidity diverges from price

- High return volatility raises whipsaw risk

Why: Price window 107.85% over 8w. Close is -26.59% below the prior-window high. Return volatility 12.85%. Volume trend falling. Liquidity divergence with price. Trend state strong uptrend. High-regime (0.80–1.00) downticks 0/2 (0.0%) • Accumulating. MA stack constructive. Baseline deviation 1.88% (widening). Momentum bullish and rising. Valuation limited upside without catalysts.

Tip: Most metrics include a hover tooltip where they appear in the report.