Fositek Corp.

6805 TPE

Weekly Summary

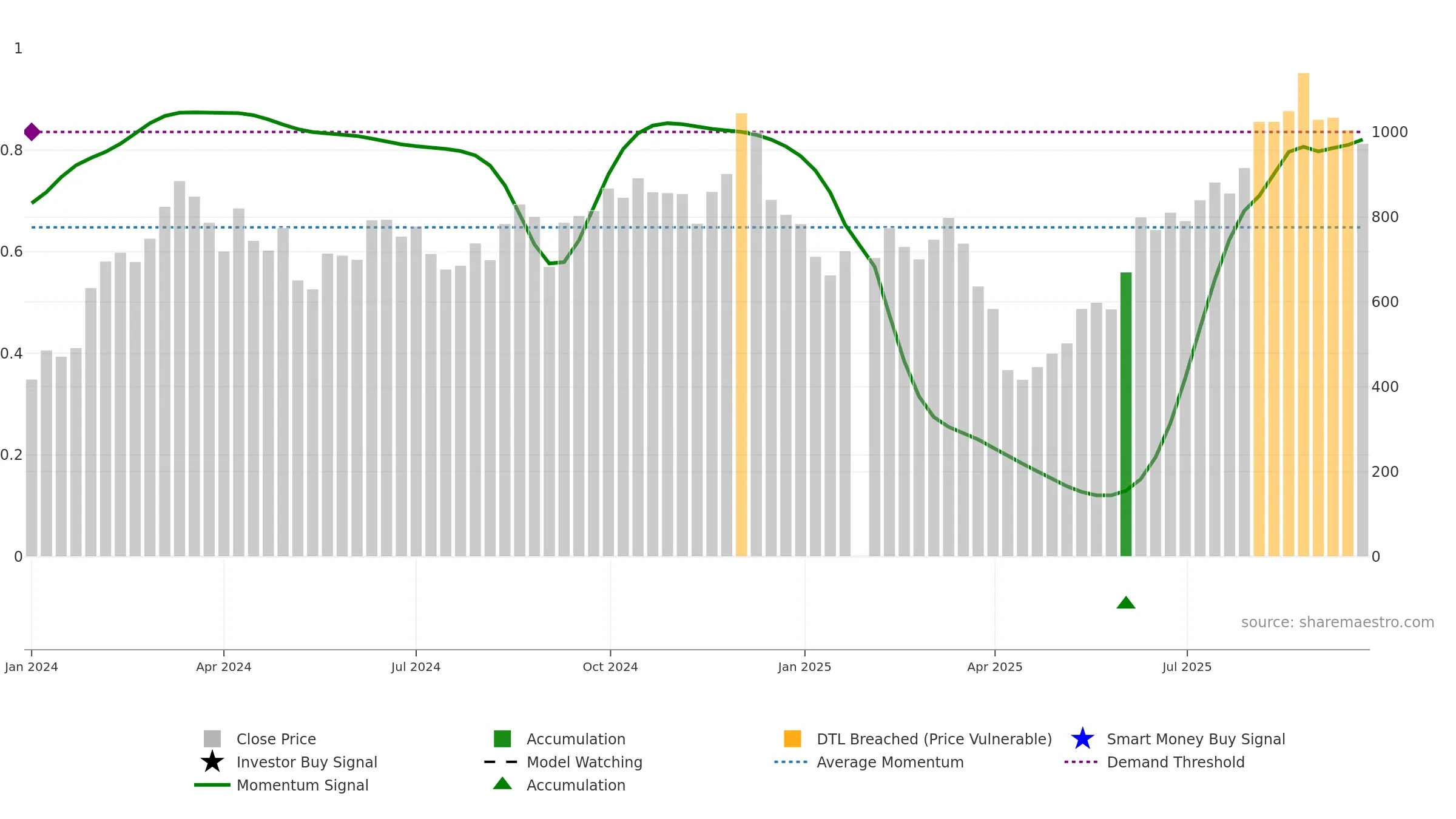

Fositek Corp. closed at 973.0000 (-3.18% WoW) . Data window ends Mon, 22 Sep 2025.

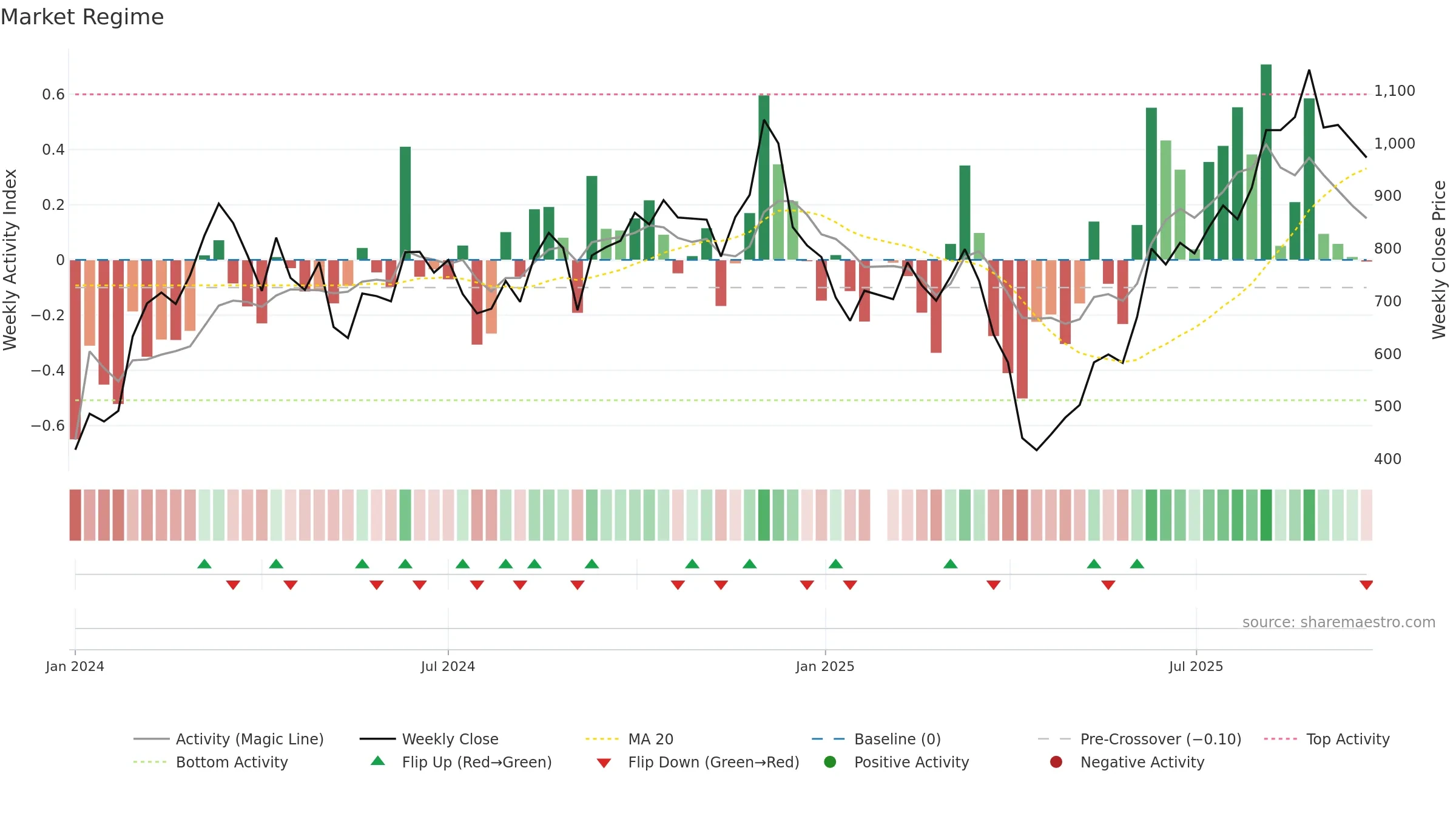

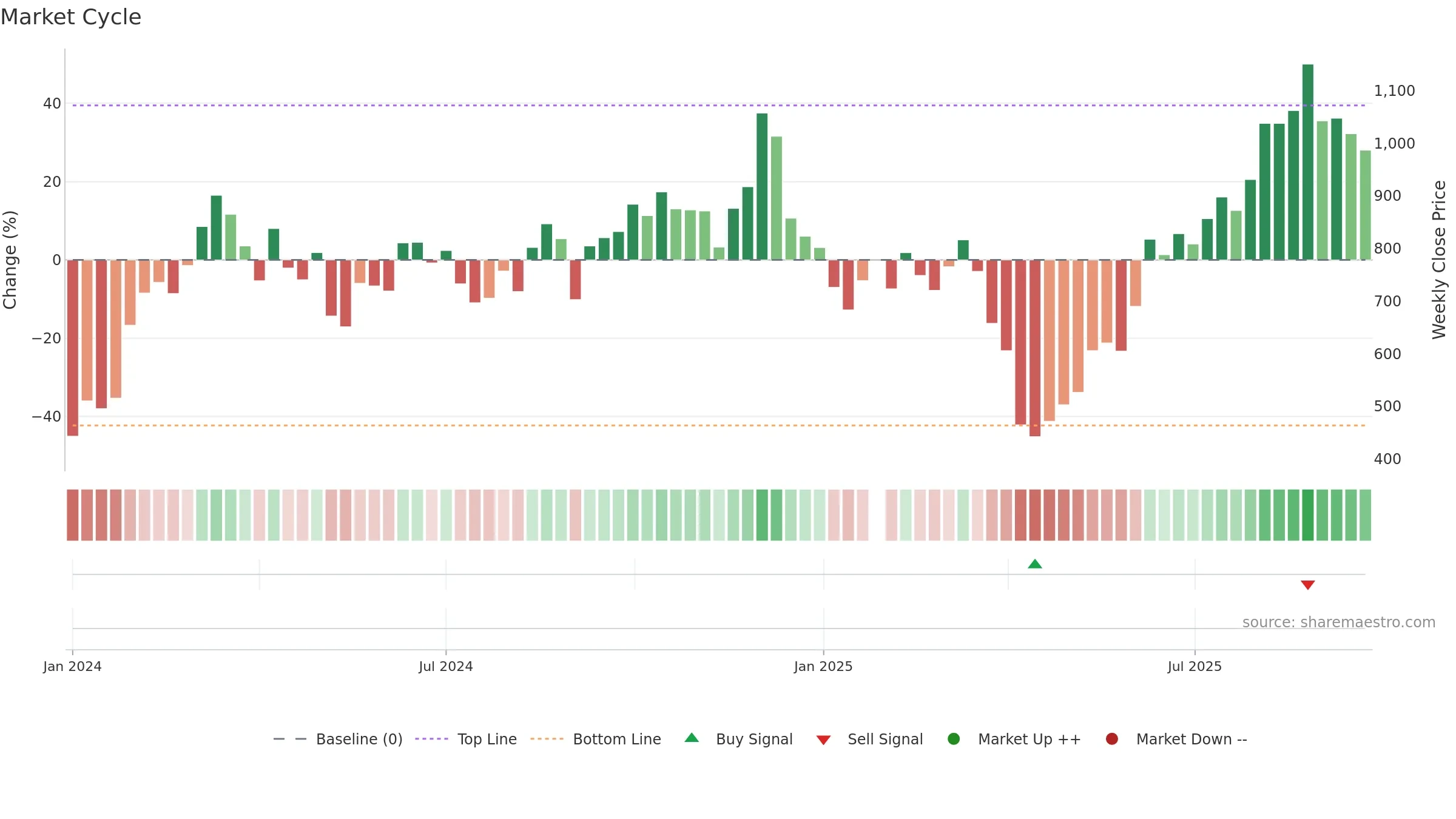

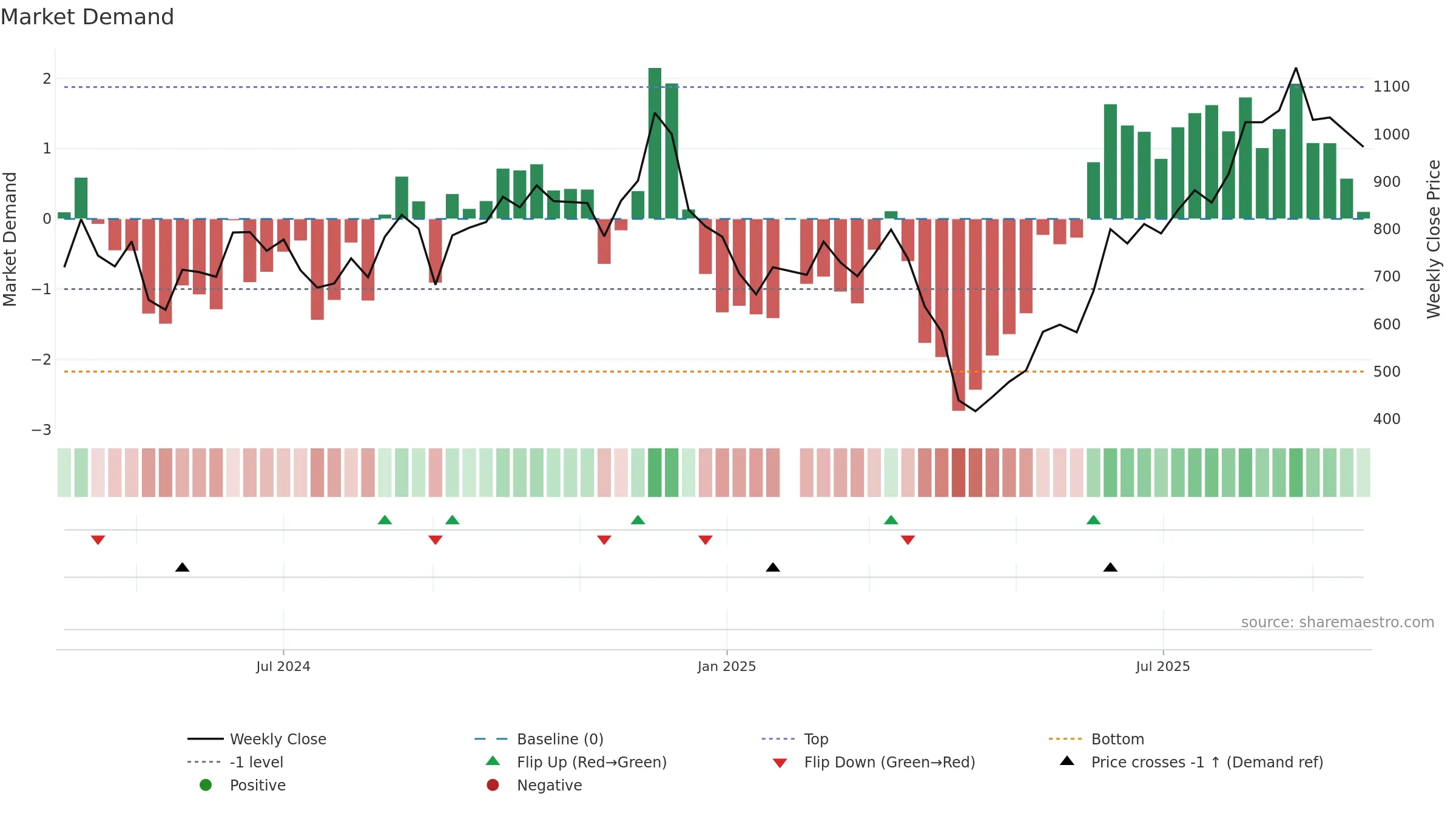

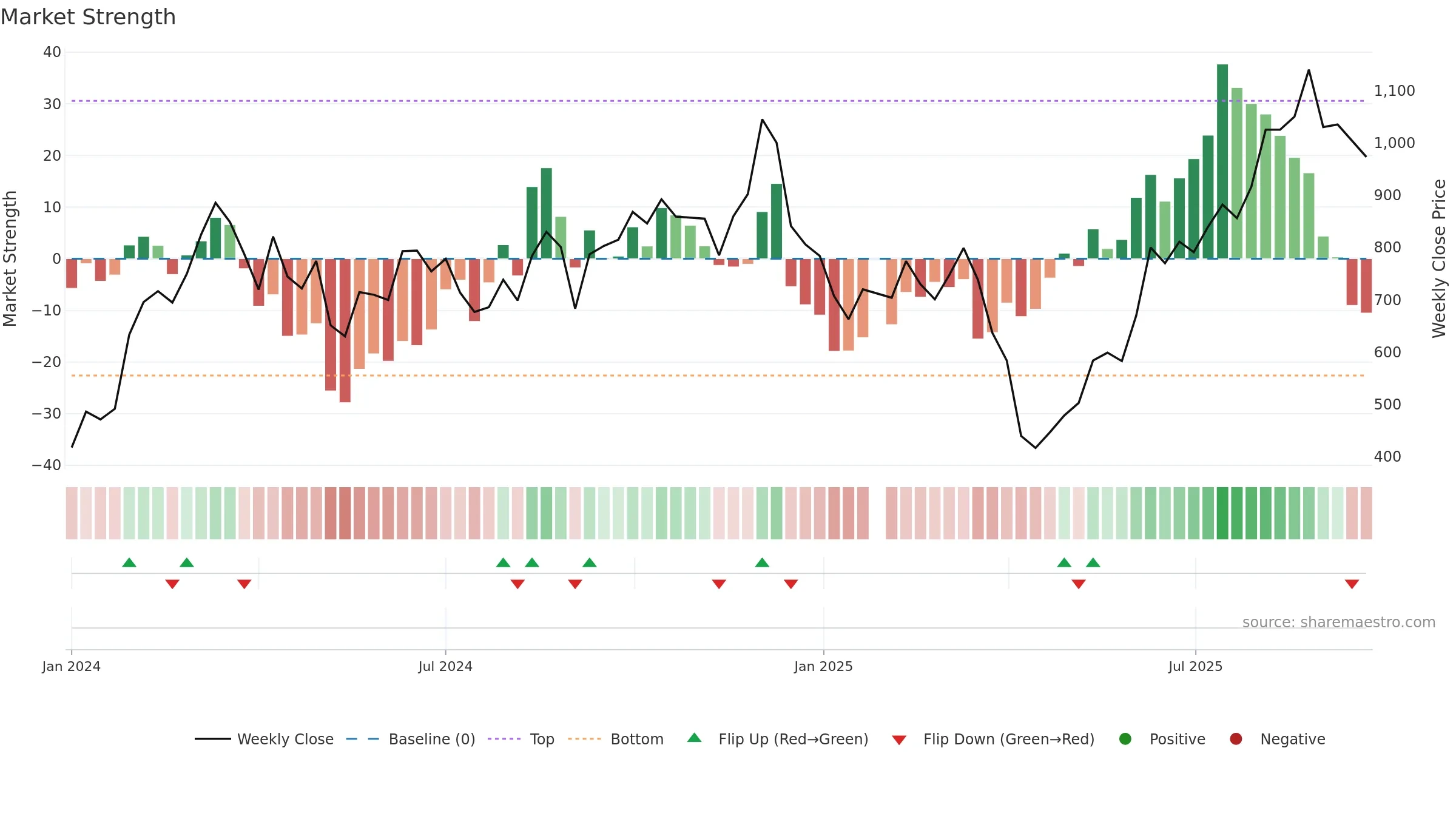

How to read this — Price slope is downward, indicating persistent supply pressure. Elevated weekly volatility increases whipsaw risk. Volume and price are moving in the same direction — a constructive confirmation. Returns are positively correlated with volume — strength tends to arrive on higher activity. Distance to baseline is narrowing — reverting closer to its fair-value track. Fresh short-term downside crossover weakens near-term tone.

Down-slope argues for patience; rallies can fade sooner unless participation improves.

Gauge maps the trend signal to a 0–100 scale.

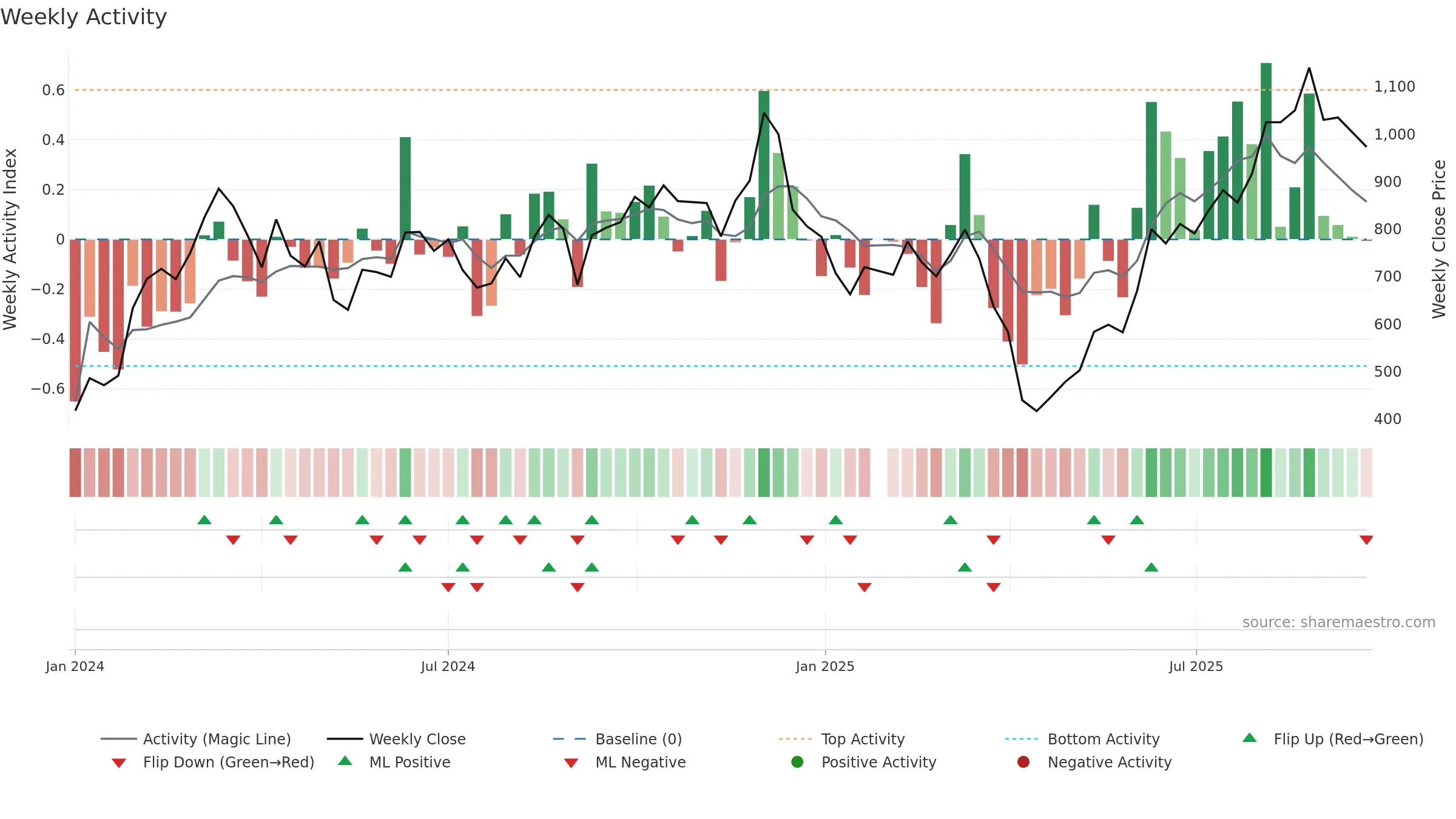

How to read this — Range-bound conditions; conviction is limited until a break or acceleration emerges.

Wait for a directional break or improving acceleration.

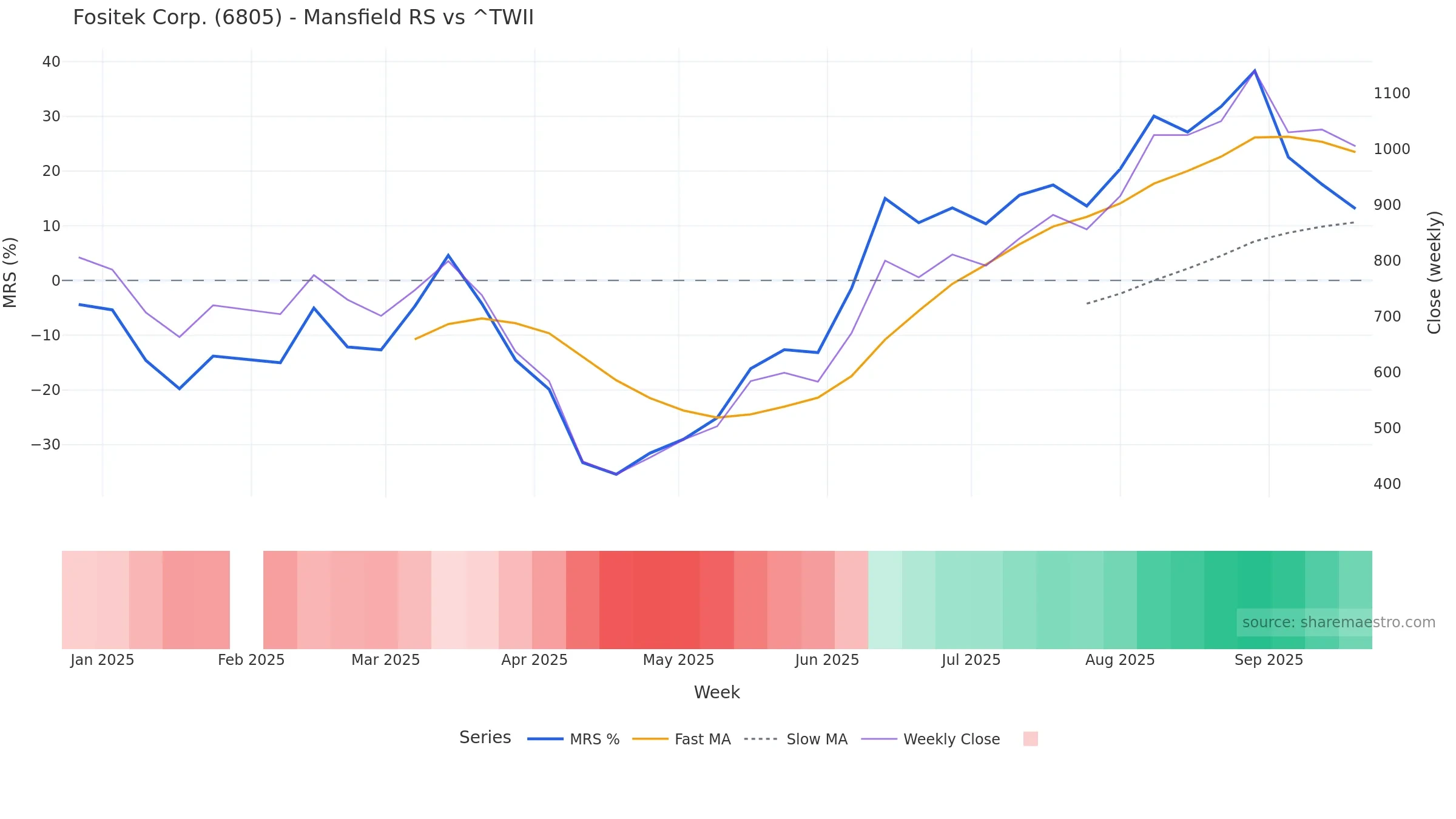

Relative strength is Positive

(> 0%, outperforming).

Latest MRS: 13.11% (week ending Fri, 19 Sep 2025).

Slope: Falling over 8w.

Notes:

- Holding above the zero line indicates relative bid.

- MRS slope falling over ~8 weeks.

Price is below fair value; potential upside if momentum constructive.

Conclusion

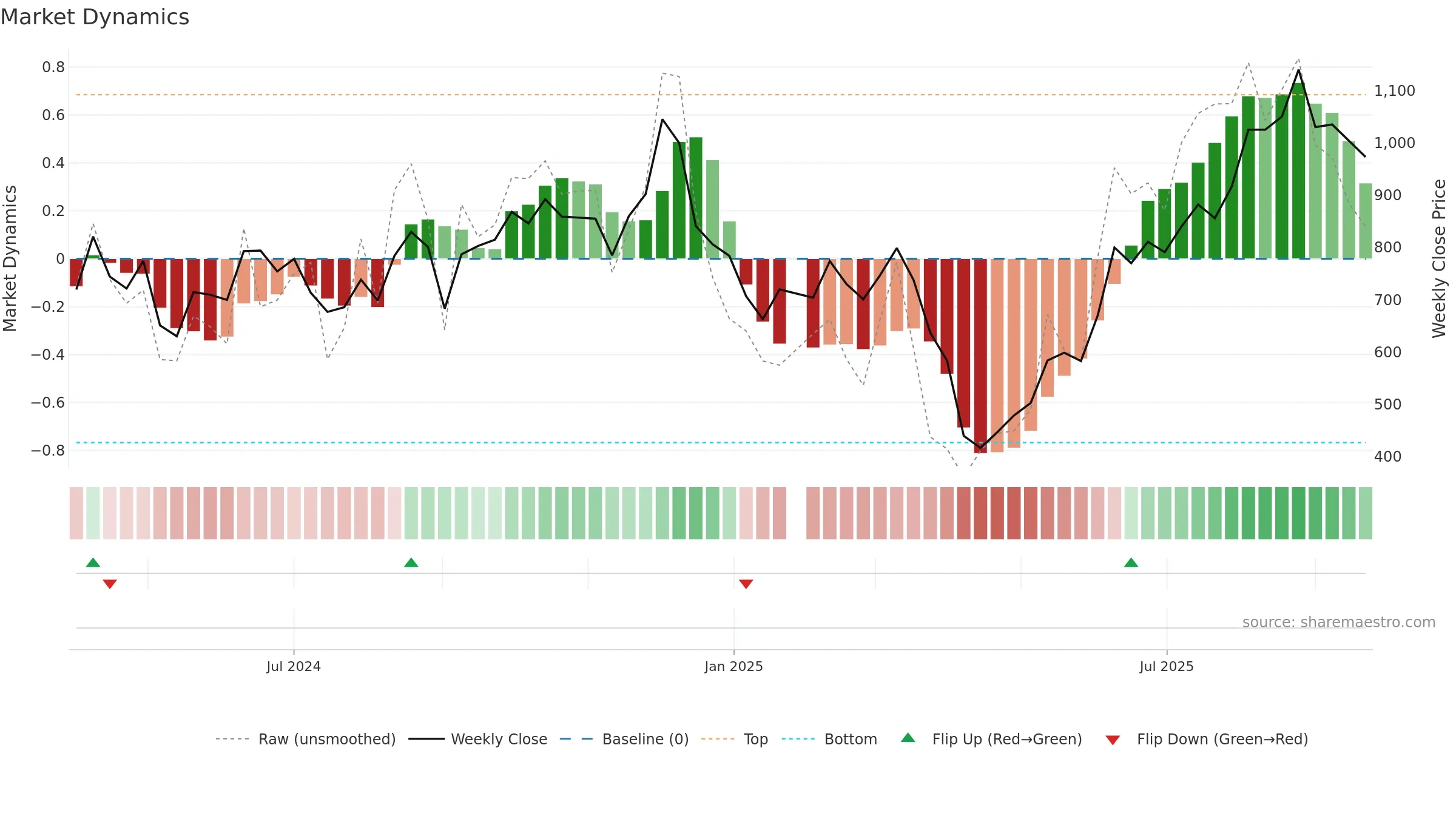

Neutral setup. ★★★☆☆ confidence. Price window: -5. Trend: Range / Neutral; gauge 82. In combination, liquidity confirms the move.

- Momentum is bullish and rising

- Liquidity confirms the price trend

- Price is not above key averages

- High return volatility raises whipsaw risk

- Negative multi-week performance

Why: Price window -5.07% over 8w. Close is -14.65% below the prior-window high. Return volatility 5.99%. Volume trend falling. Liquidity convergence with price. Trend state range / neutral. High-regime (0.80–1.00) downticks 1/3 (33.0%) • Accumulating. 4–8w crossover bearish. Momentum bullish and rising. Valuation supportive skew.

Tip: Most metrics include a hover tooltip where they appear in the report.