Central Reinsurance Corporation

2851 TPE

Weekly Report

Central Reinsurance Corporation closed at 23.8500 (-0.21% WoW) . Data window ends Mon, 15 Sep 2025.

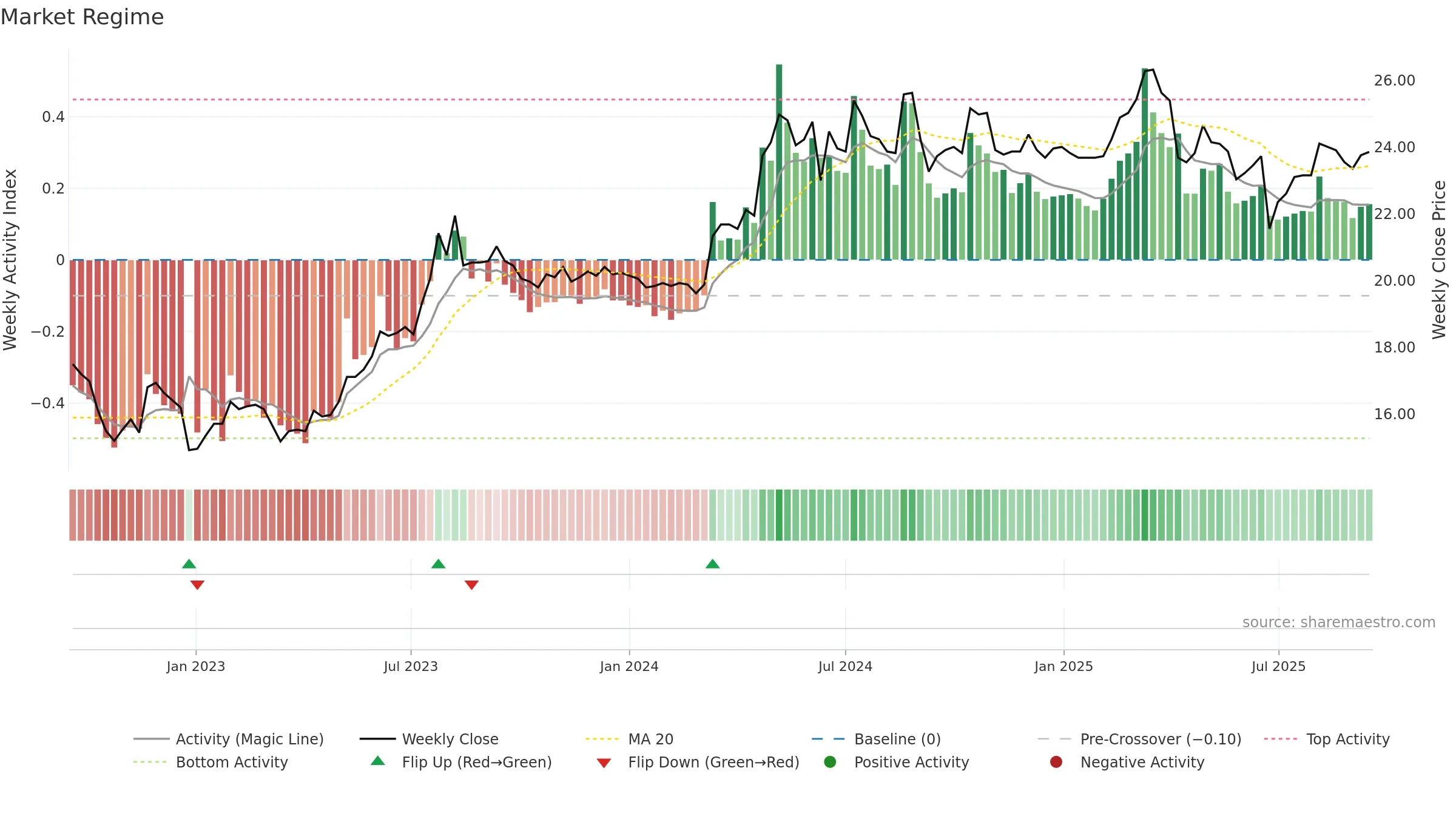

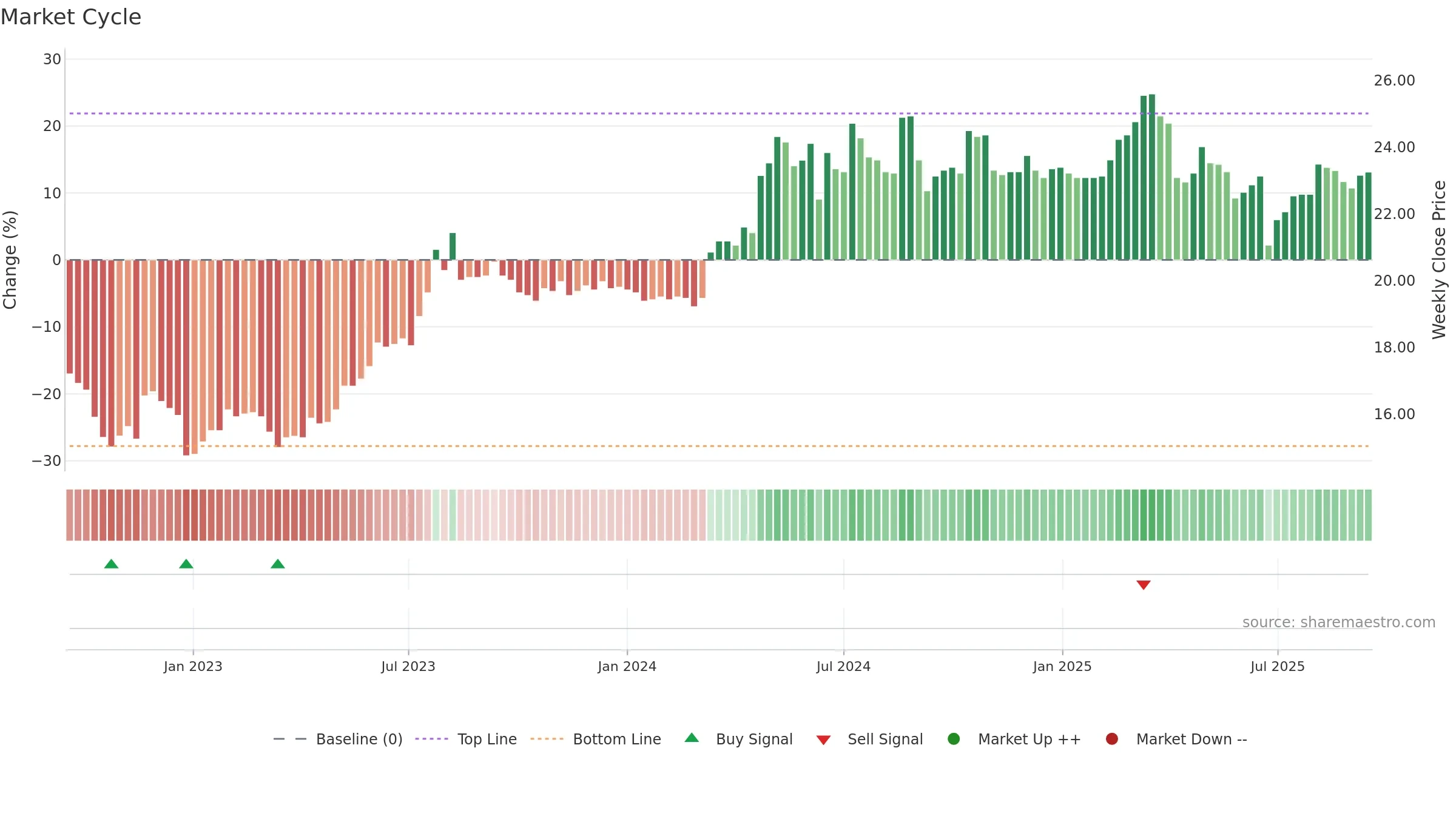

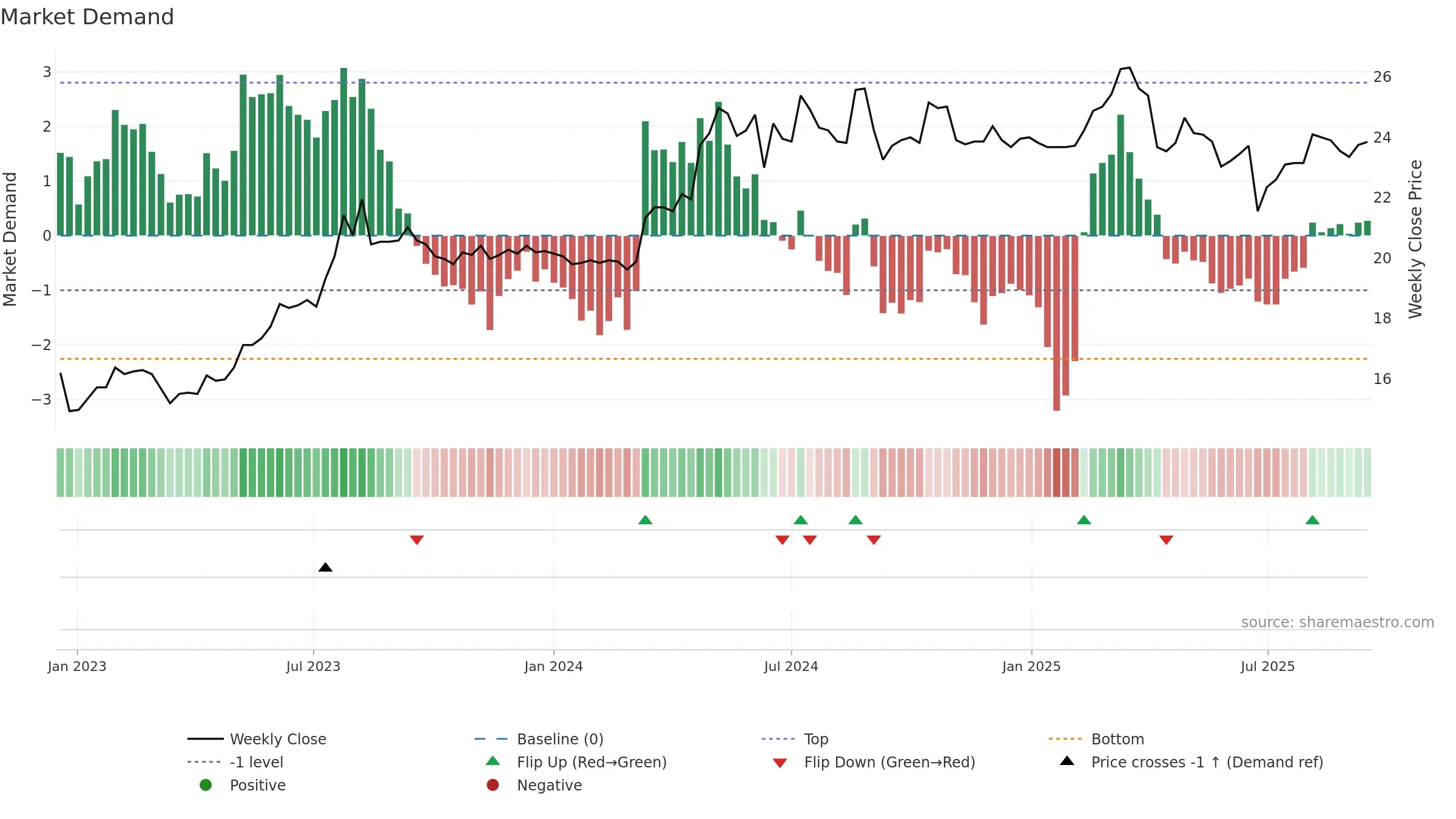

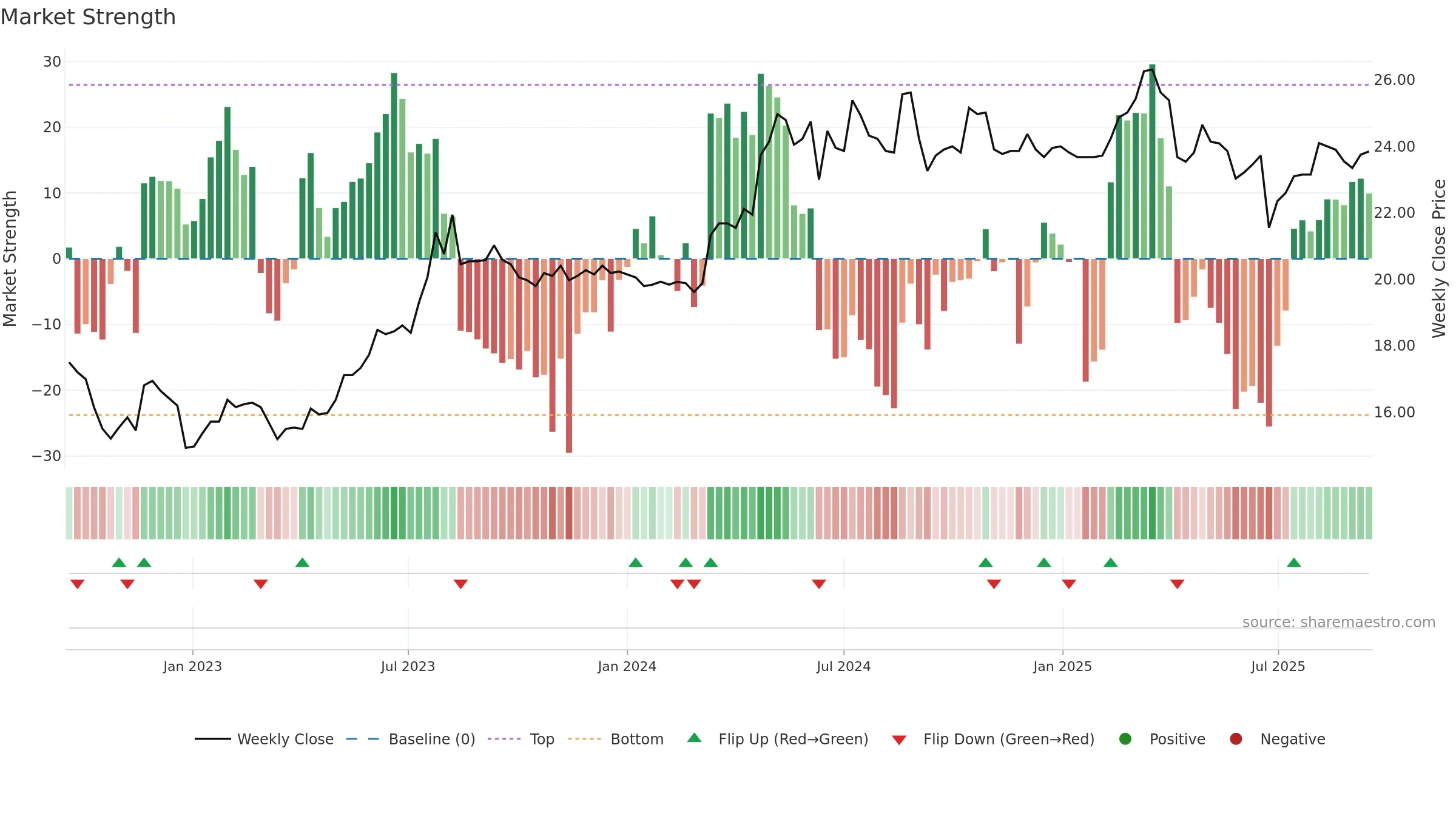

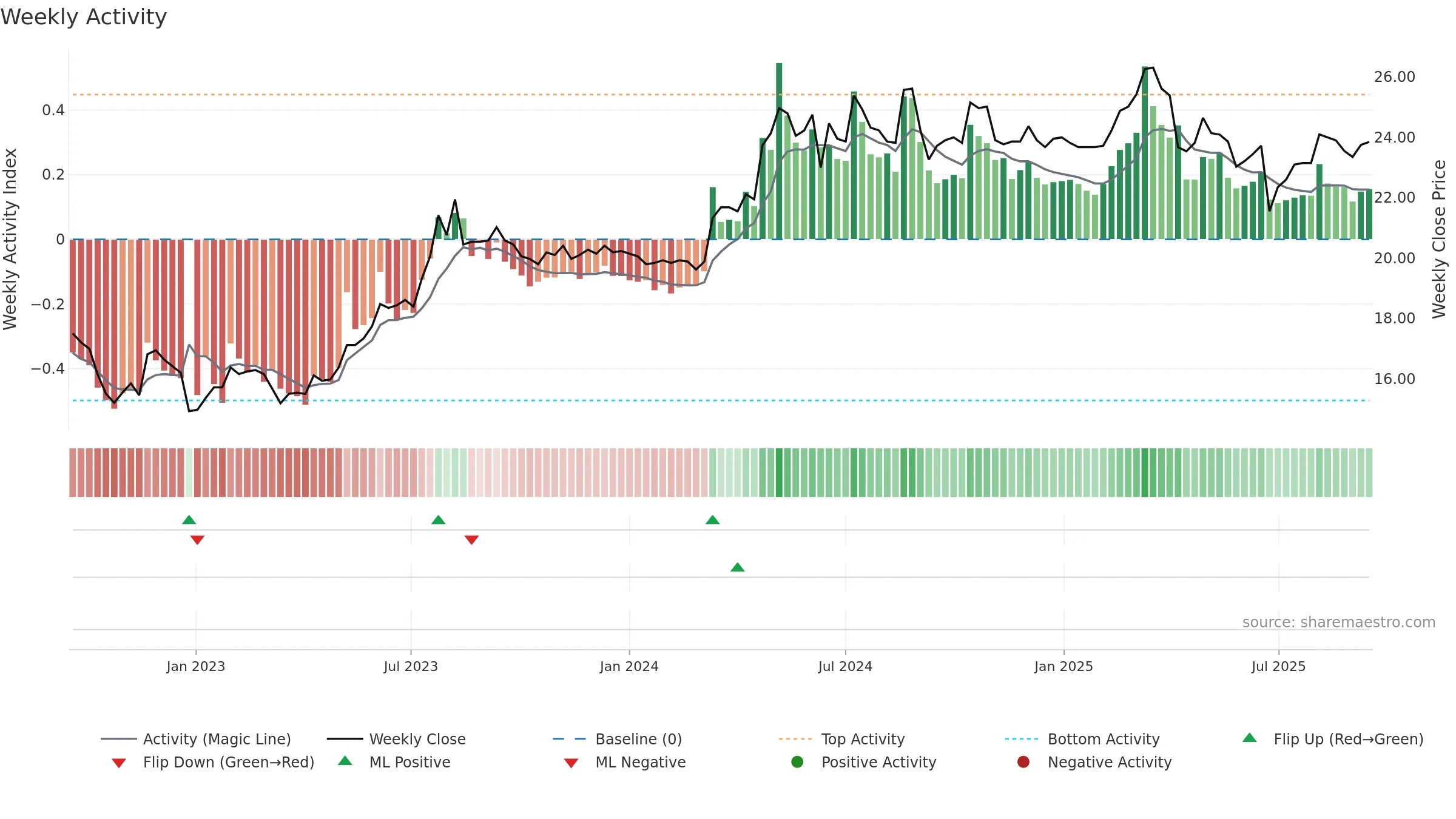

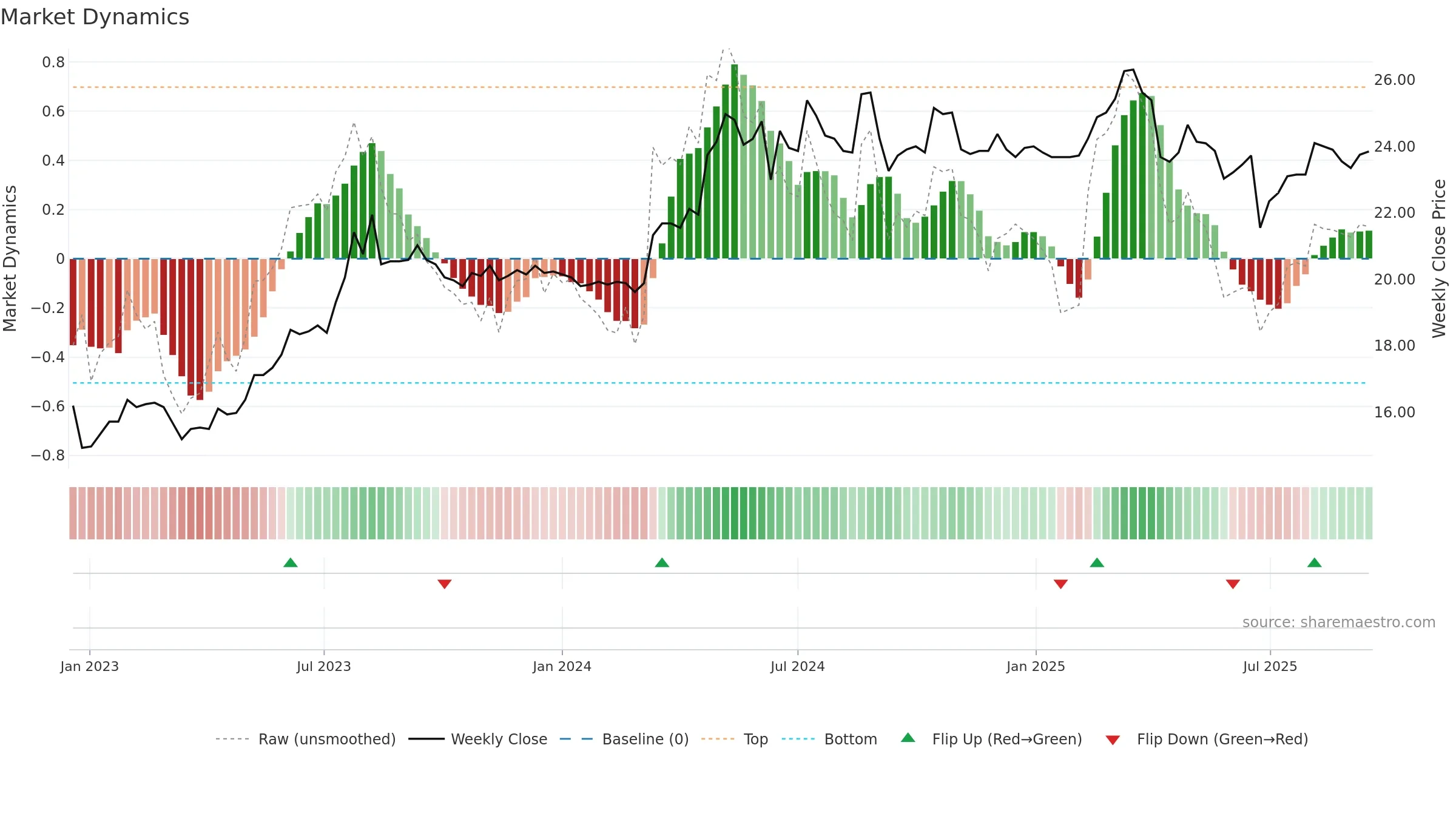

How to read this — Price slope is upward, indicating persistent buying over the window. Low weekly volatility favours steadier follow-through. Volume trend diverges from price — watch for fatigue or rotation. Returns are positively correlated with volume — strength tends to arrive on higher activity. Distance to baseline is narrowing — reverting closer to its fair-value track. Fresh short-term downside crossover weakens near-term tone. Price holds above key averages, indicating constructive participation.

Up-slope supports buying interest; pullbacks may be contained if activity stays firm. Because liquidity isn’t confirming, prefer evidence of fresh demand before chasing moves.

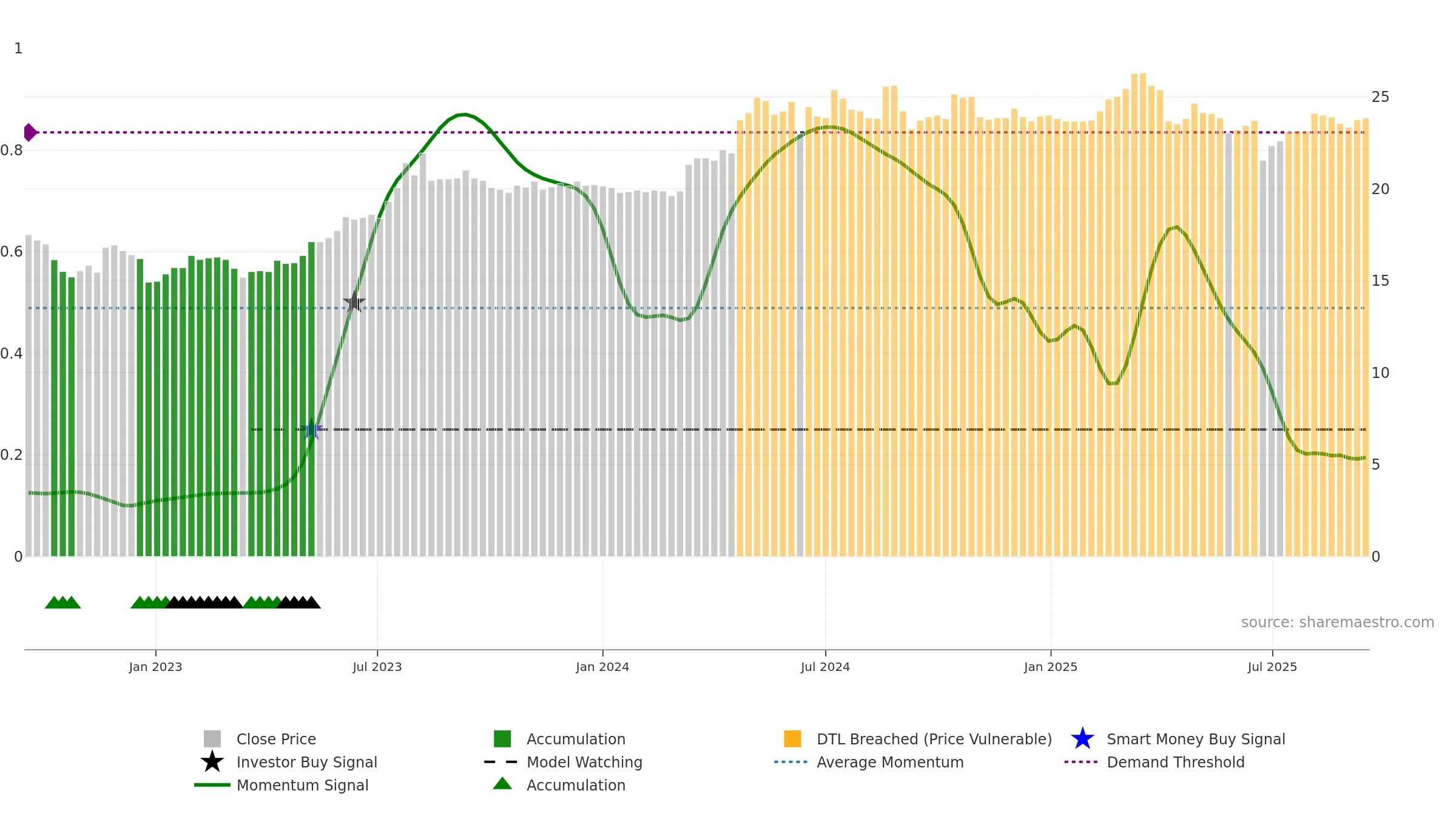

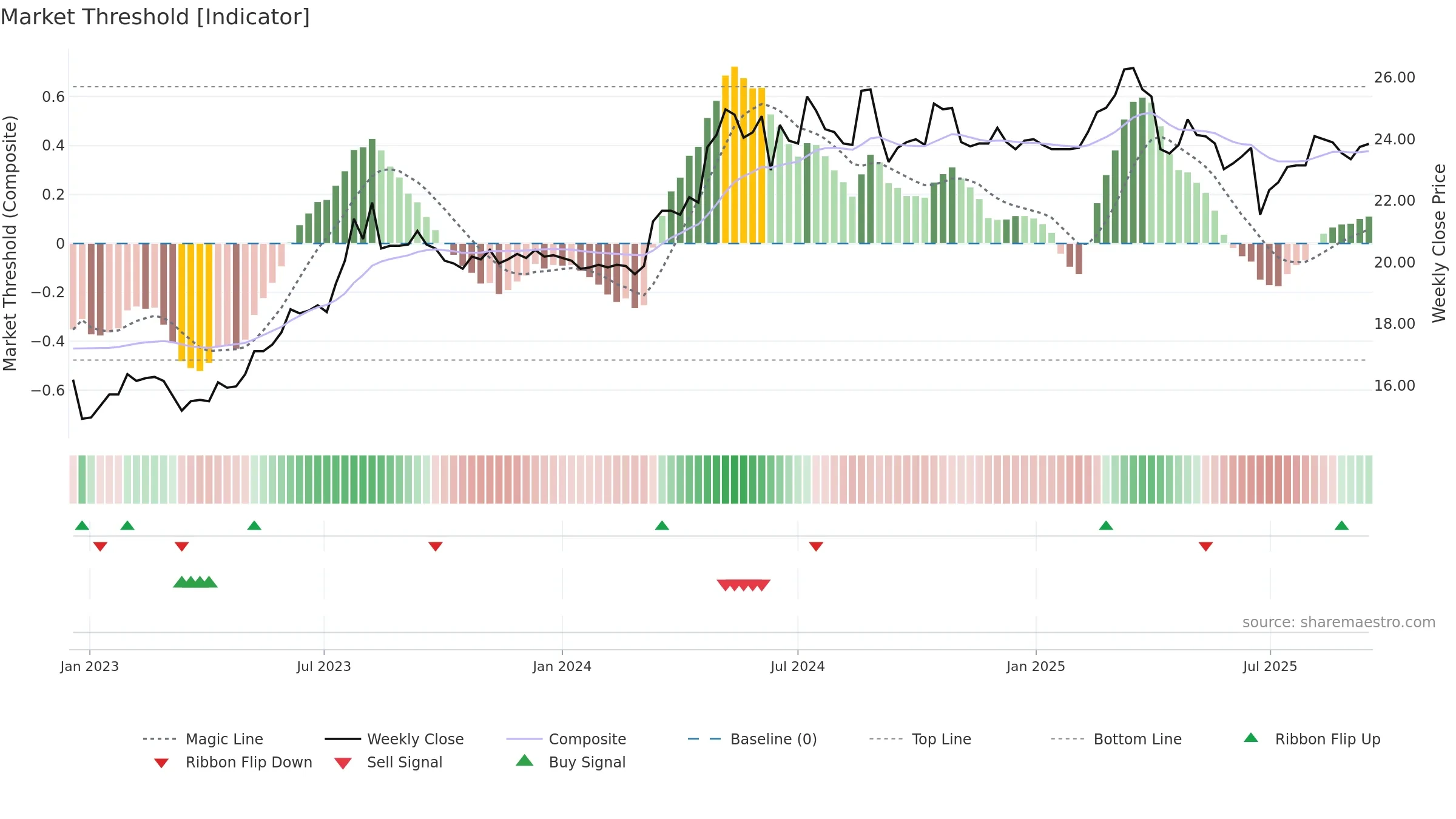

Gauge maps the trend signal to a 0–100 scale.

How to read this — Bearish zone with falling momentum — sellers in control.

Bias remains lower; rallies are suspect unless gauge reclaims 0.50/0.60.

Conclusion

Negative setup. ★★☆☆☆ confidence. Price window: 3. Trend: Downtrend Confirmed; gauge 19. In combination, liquidity diverges from price.

- Price holds above 8w & 26w averages

- Low return volatility supports durability

- Bearish control with falling momentum

- Momentum is weak/falling

- Liquidity diverges from price

Why: Price window 3.02% over 8w. Close is -1.04% below the prior-window high. Return volatility 1.68%. Volume trend falling. Liquidity divergence with price. Trend state downtrend confirmed. Low-regime (≤0.25) upticks 3/7 (43.0%) • Distributing. 4–8w crossover bearish. Momentum bearish and falling.

Tip: Most metrics include a hover tooltip where they appear in the report.