Wipro Limited

WIT NYSE

Weekly Report

Wipro Limited closed at 2.8000 (-1.06% WoW) . Data window ends Fri, 19 Sep 2025.

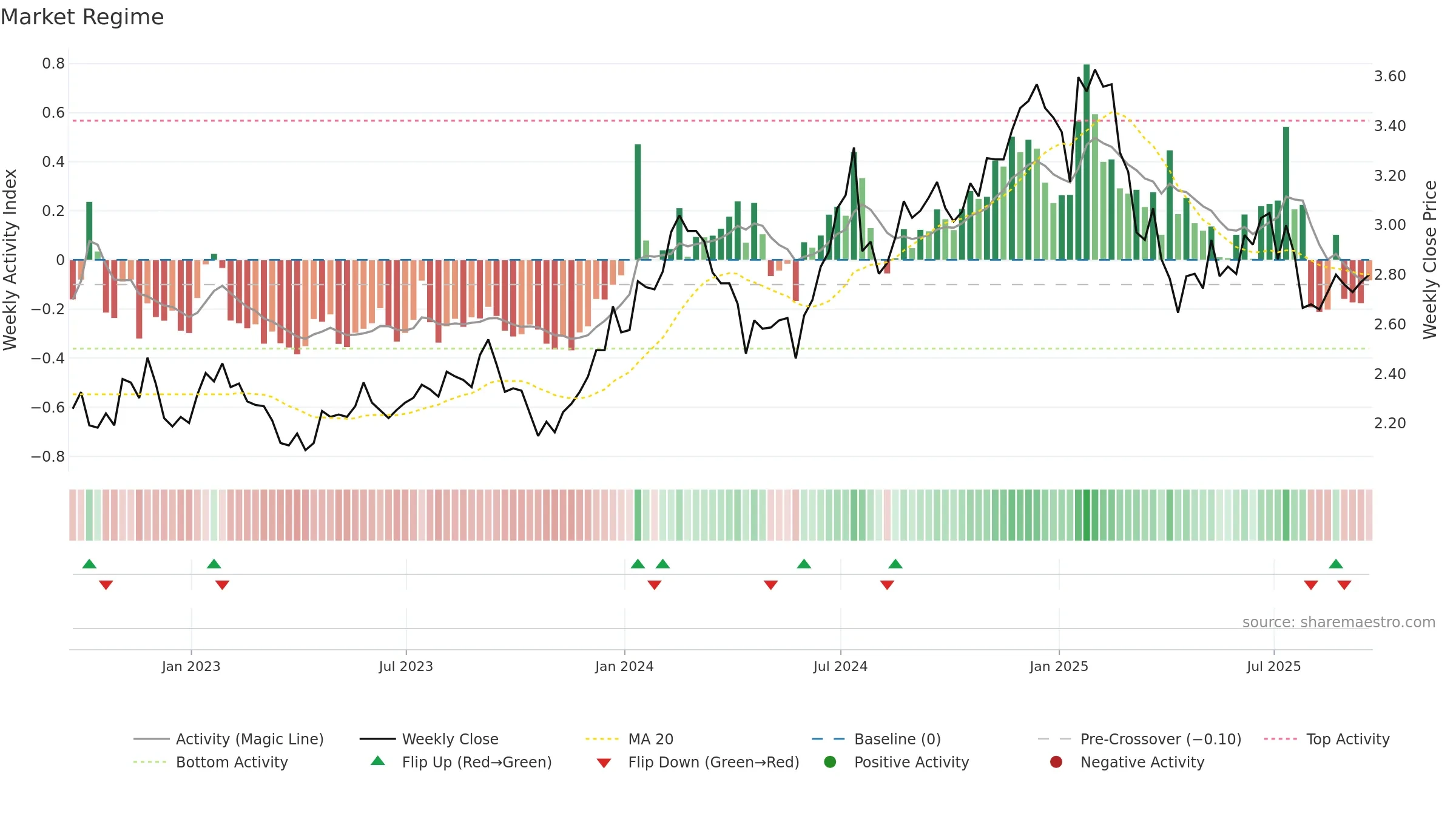

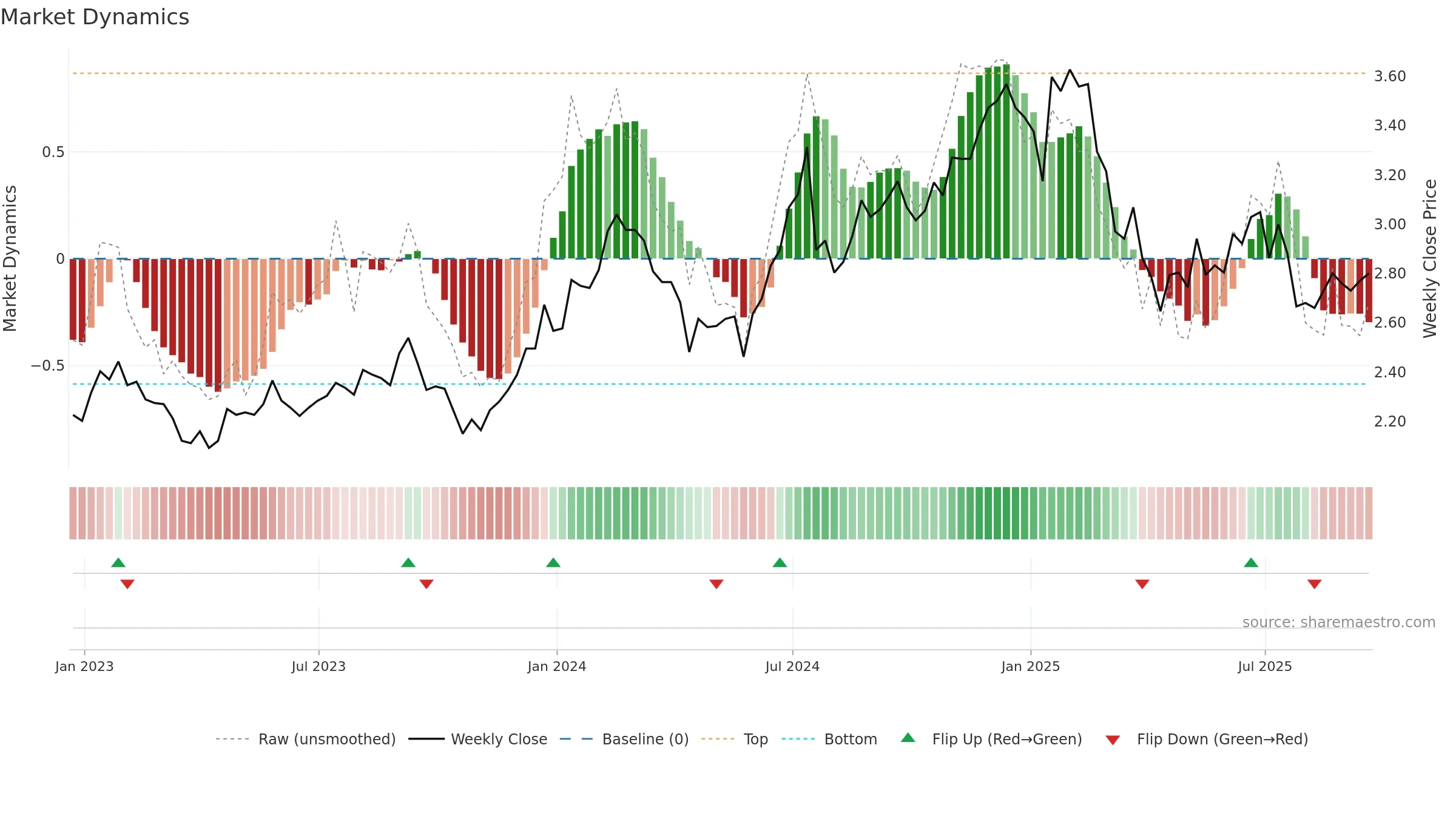

How to read this — Price slope is upward, indicating persistent buying over the window. Low weekly volatility favours steadier follow-through. Volume and price are moving in the same direction — a constructive confirmation. Returns are positively correlated with volume — strength tends to arrive on higher activity.

Up-slope supports buying interest; pullbacks may be contained if activity stays firm.

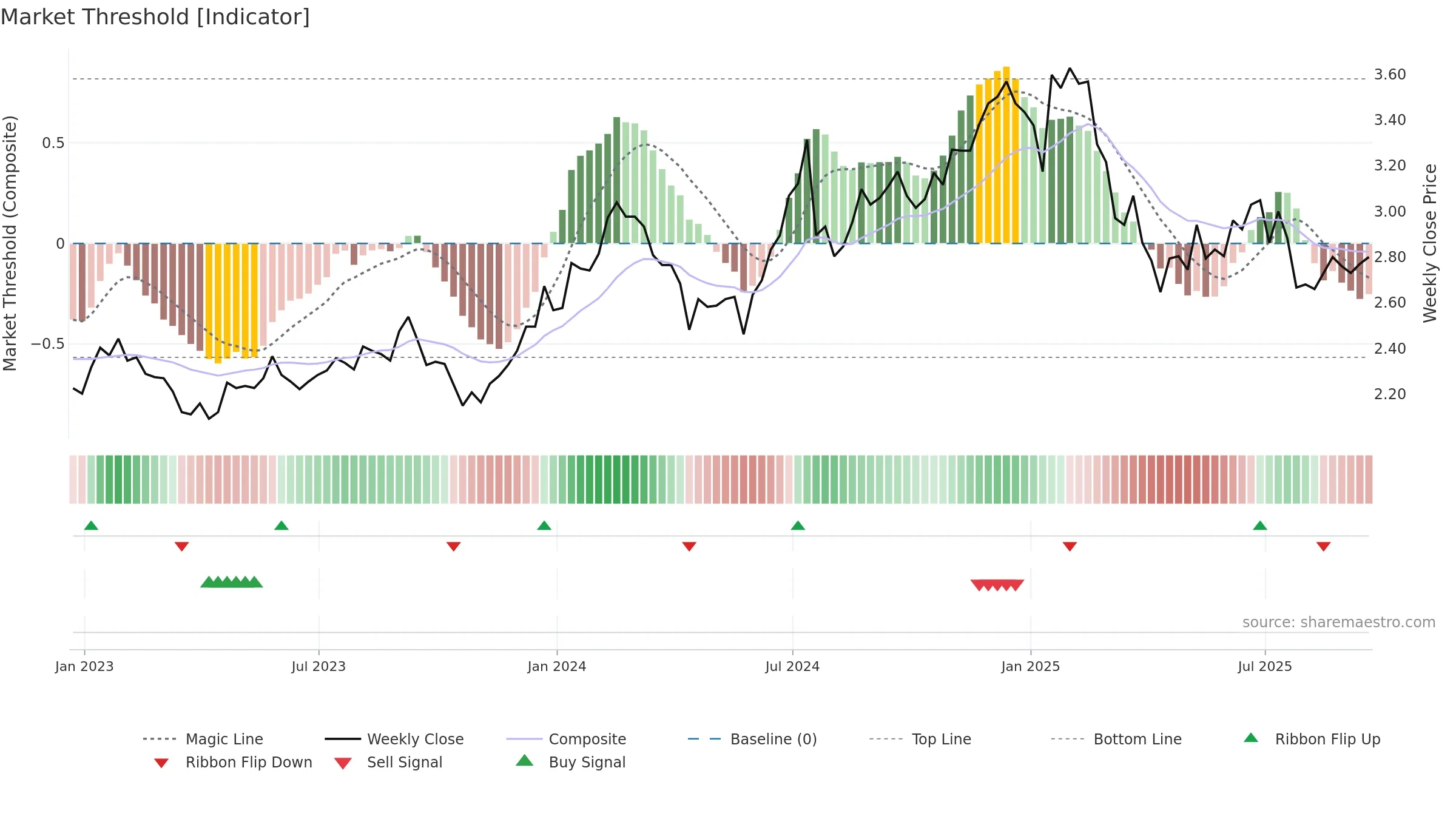

Gauge maps the trend signal to a 0–100 scale.

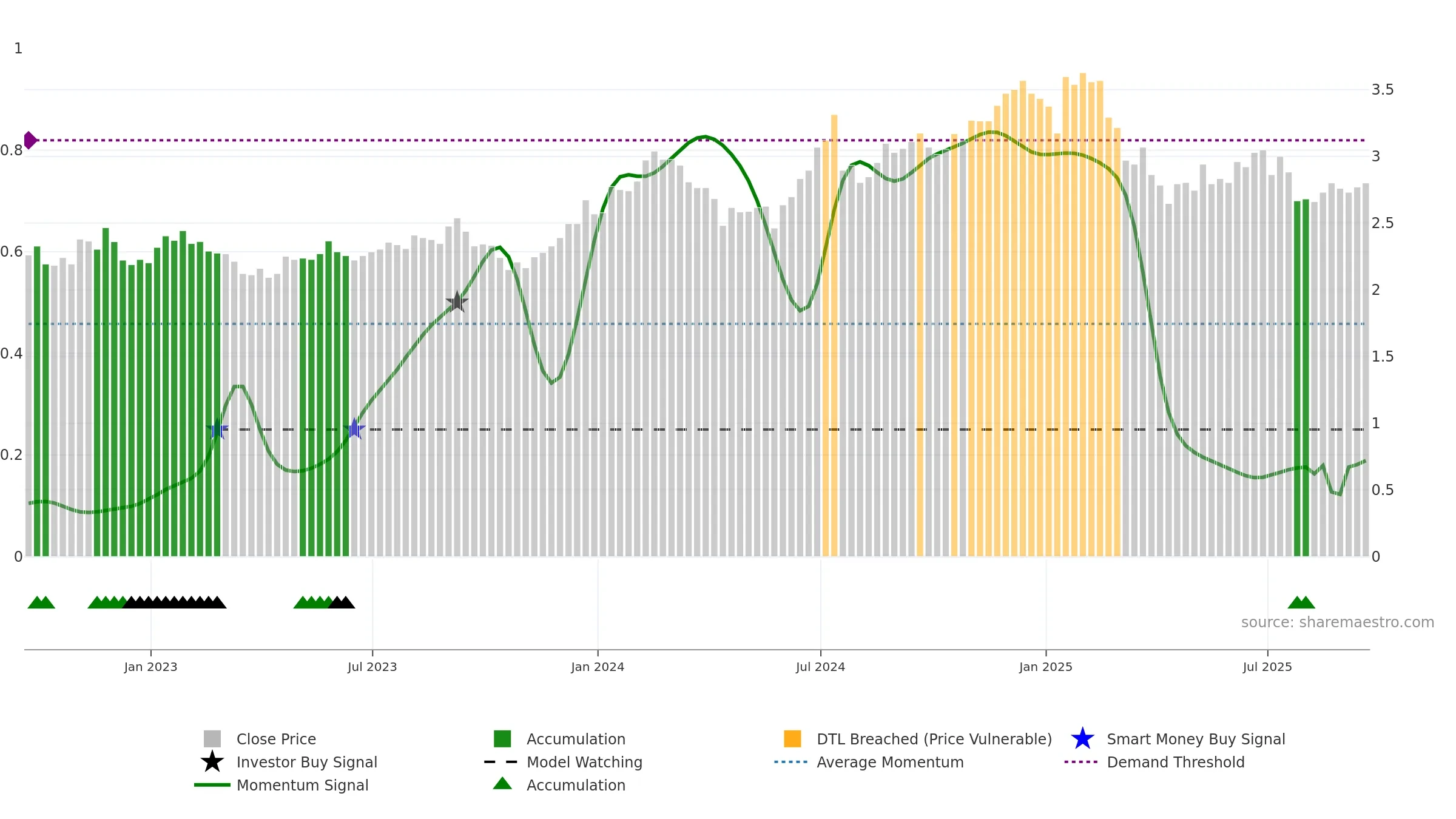

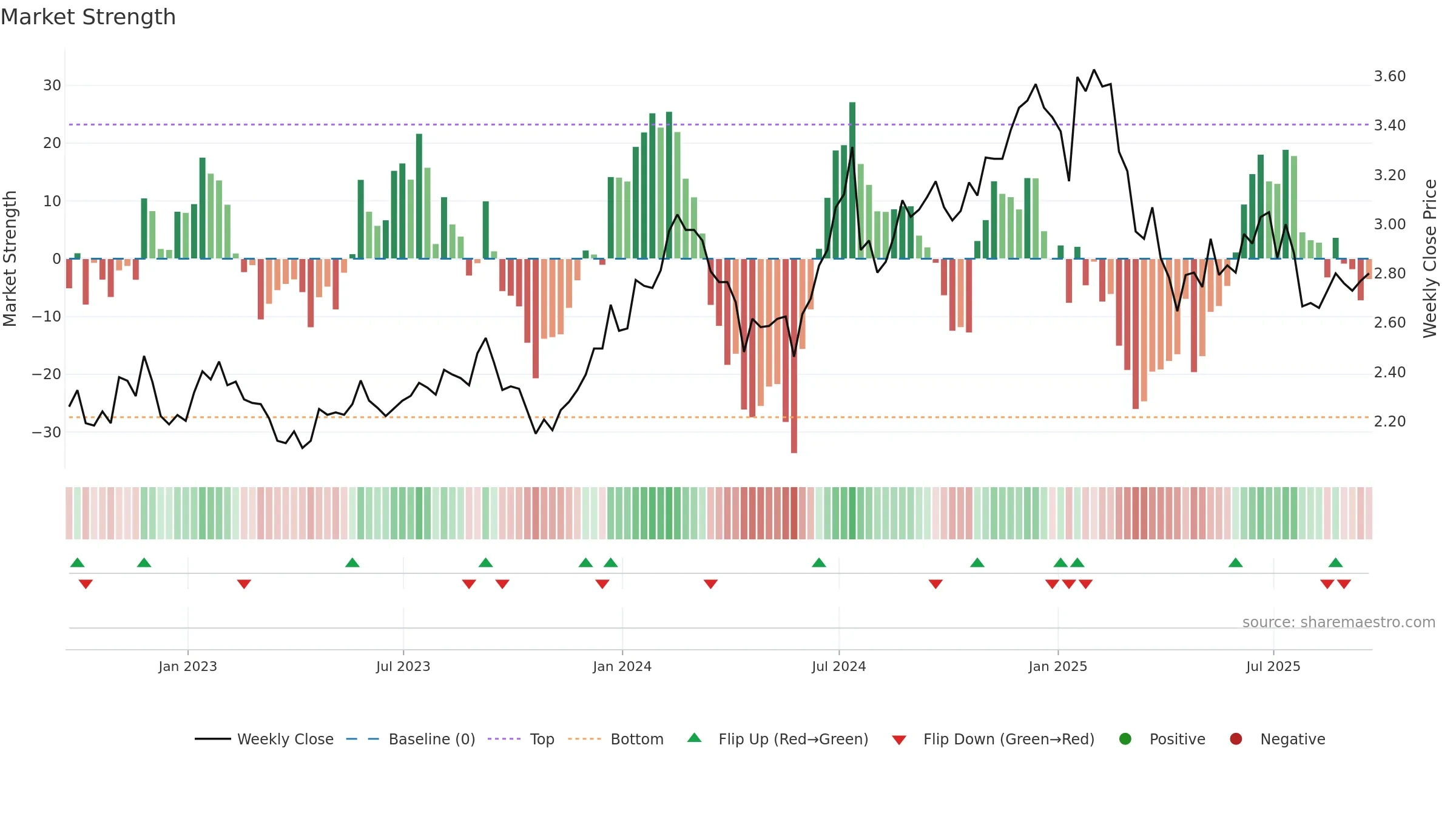

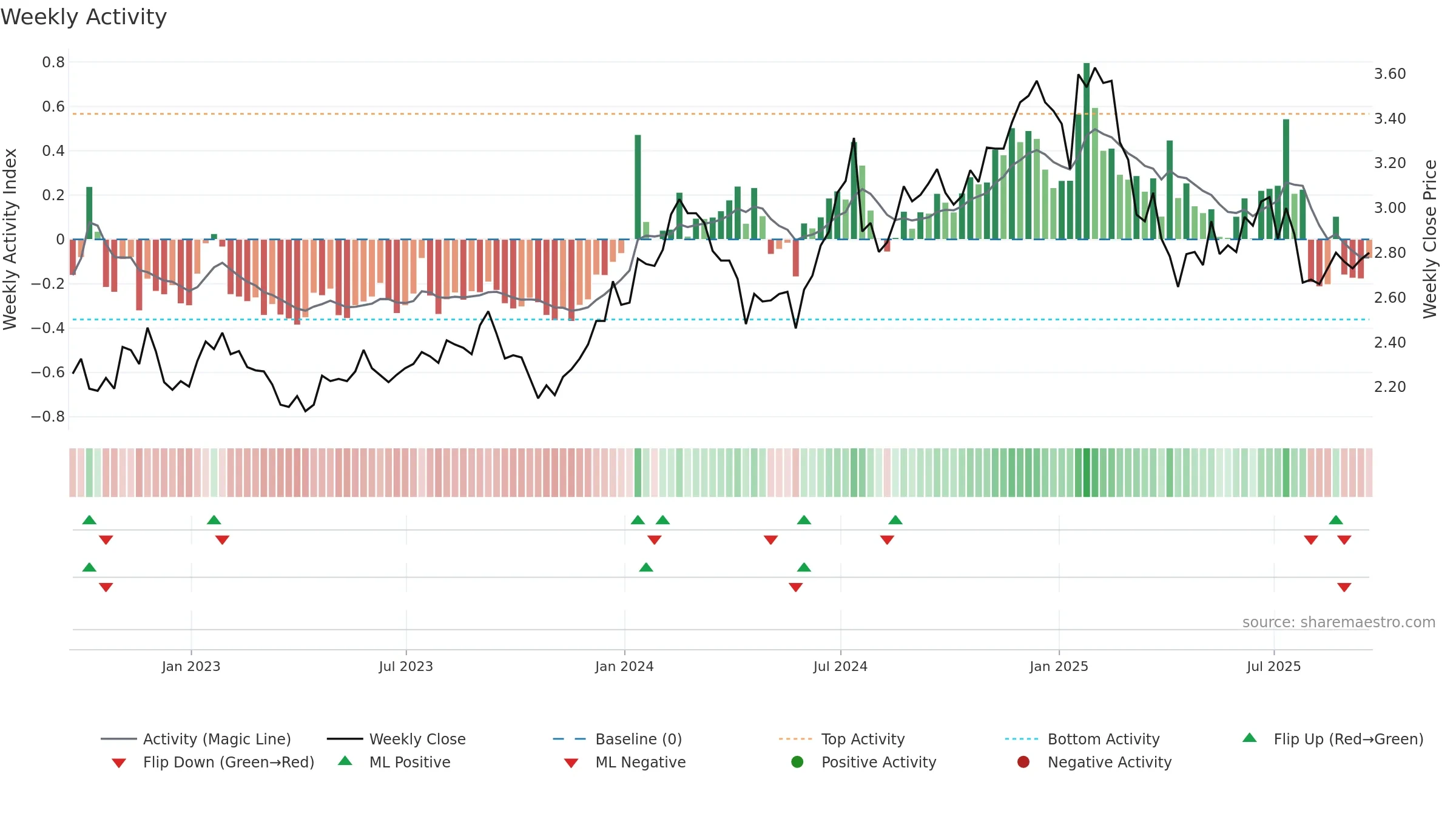

How to read this — Bearish backdrop but short-term momentum is improving; confirmation still needed.

Early improvement — look for a reclaim of 0.50→0.60 to validate.

Conclusion

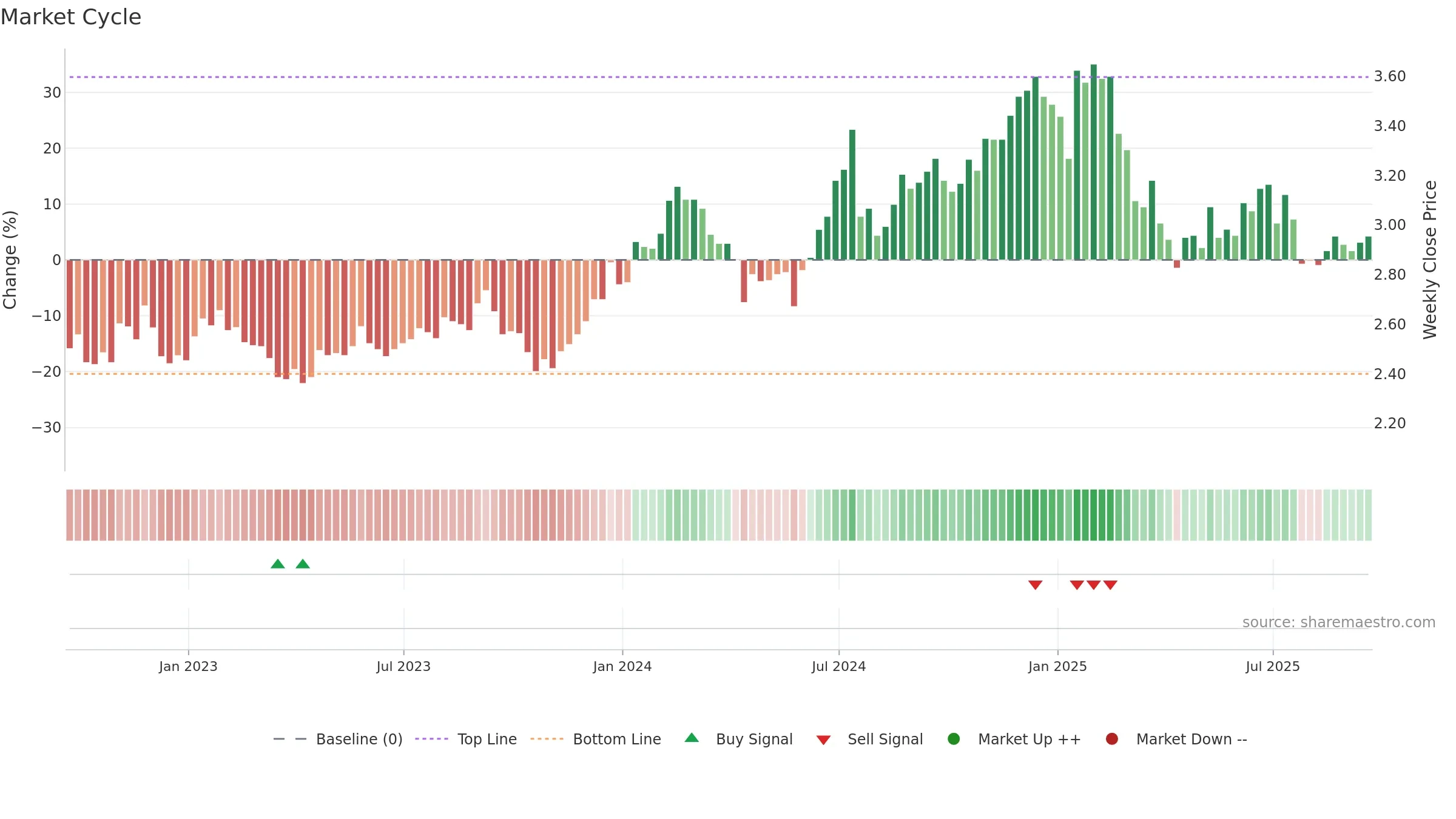

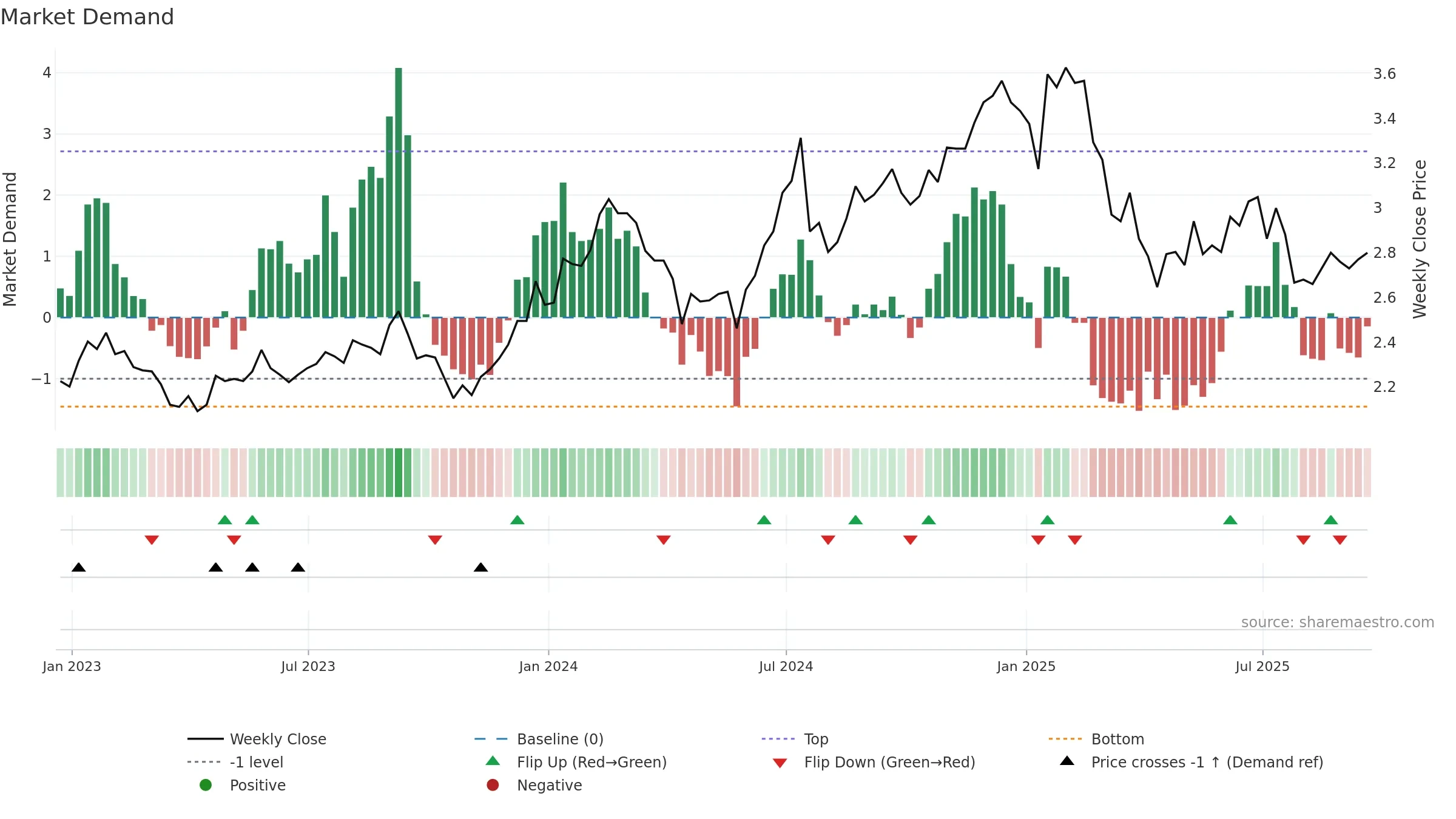

Positive setup. ★★★★☆ confidence. Price window: 4. Trend: Bottoming Attempt; gauge 18. In combination, liquidity confirms the move.

- Early improvement from bearish zone (bottoming attempt)

- Liquidity confirms the price trend

- Low return volatility supports durability

- Price is not above key averages

Why: Price window 4.48% over 8w. Return volatility 0.72%. Volume trend rising. Liquidity convergence with price. Trend state bottoming attempt. Low-regime (≤0.25) upticks 4/7 (57.0%) • Accumulating. Momentum neutral and rising.

Tip: Most metrics include a hover tooltip where they appear in the report.