Sai Silks (Kalamandir) Limited

KALAMANDIR NSE

Weekly Summary

Sai Silks (Kalamandir) Limited closed at 158.5600 (-1.81% WoW) . Data window ends Mon, 22 Sep 2025.

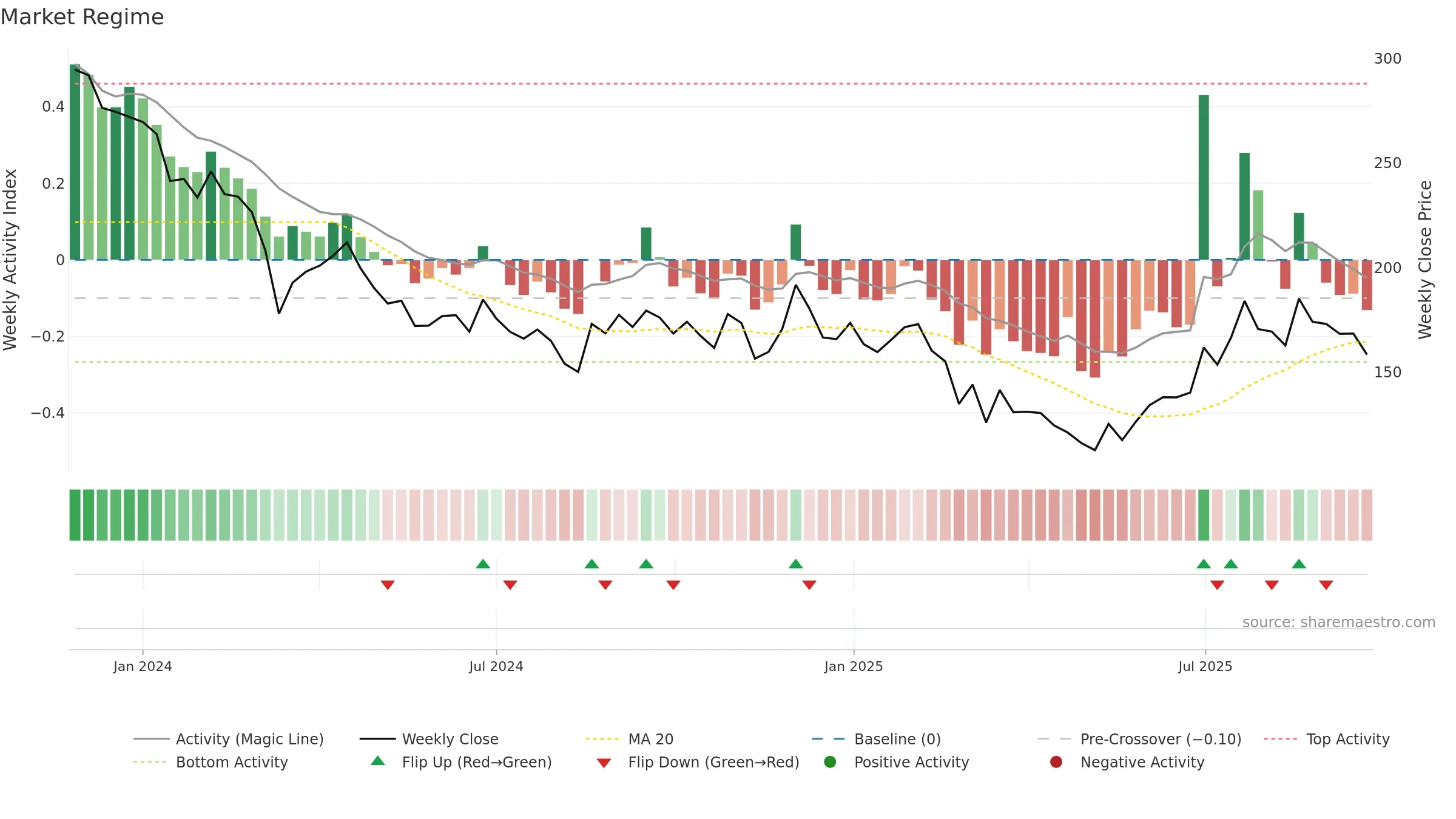

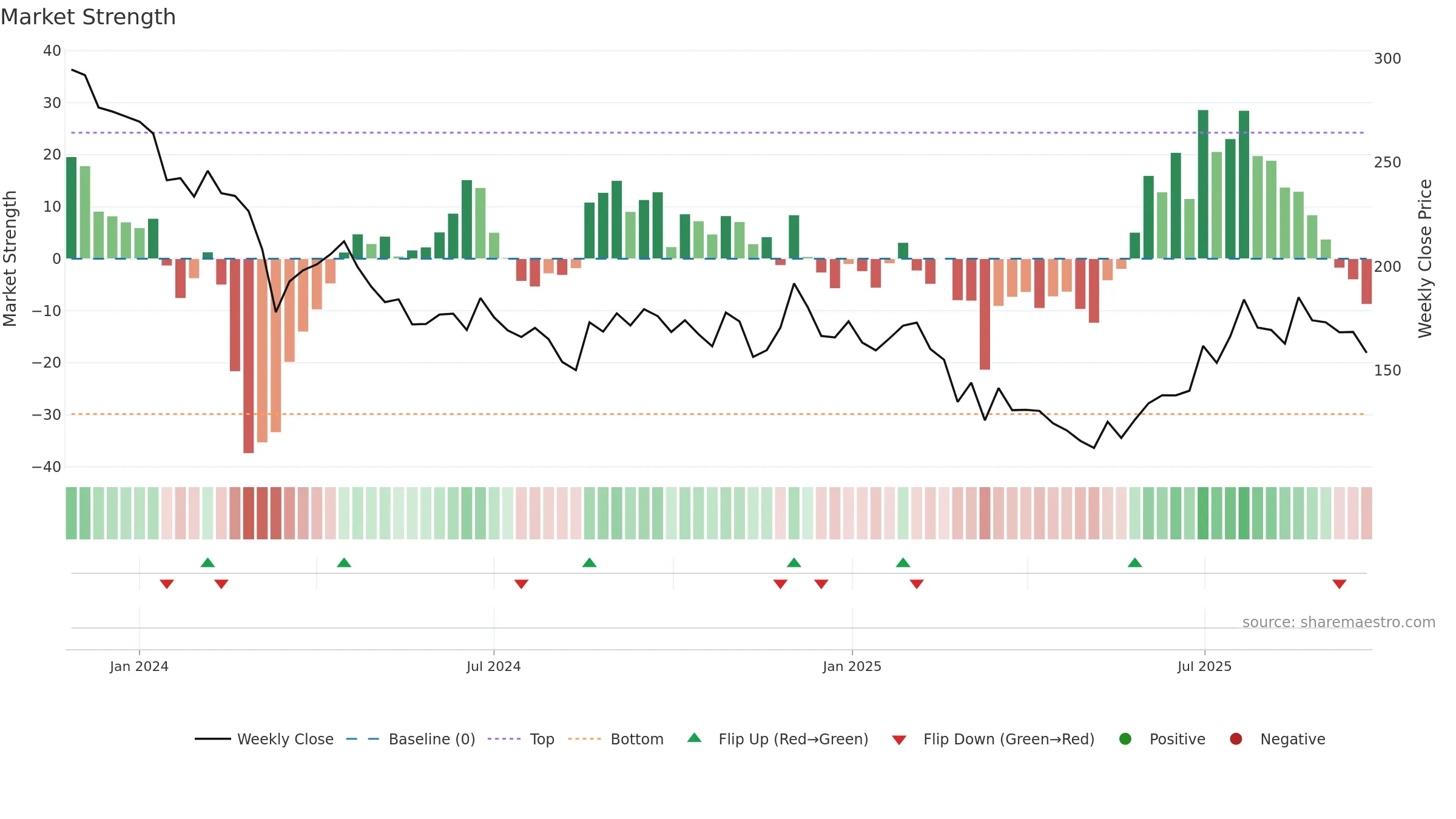

How to read this — Price slope is downward, indicating persistent supply pressure. Elevated weekly volatility increases whipsaw risk. Volume and price are moving in the same direction — a constructive confirmation. Returns are positively correlated with volume — strength tends to arrive on higher activity. Price is extended below its baseline; rebounds can be sharp if demand improves. Distance to baseline is narrowing — reverting closer to its fair-value track.

Down-slope argues for patience; rallies can fade sooner unless participation improves.

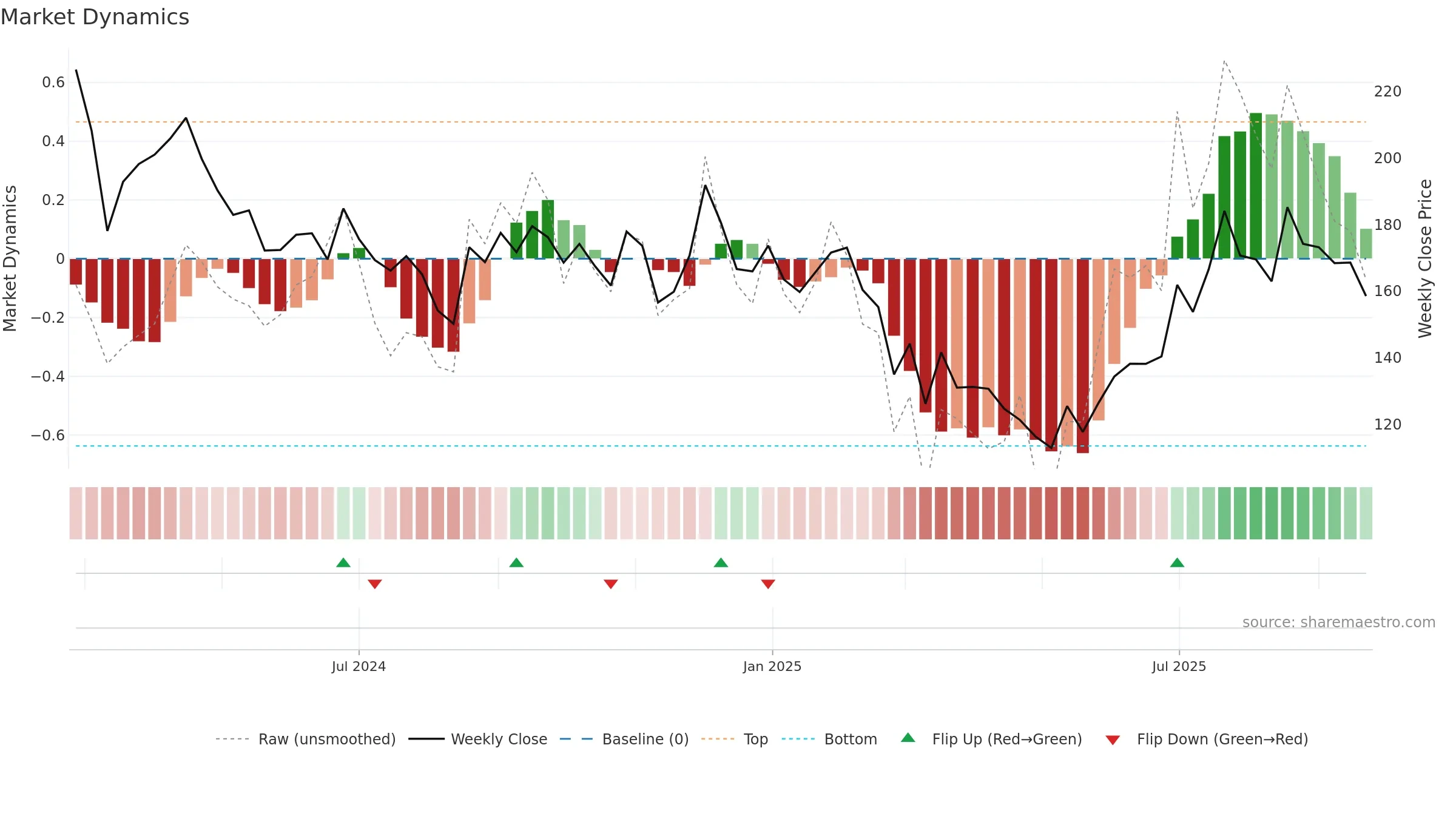

Gauge maps the trend signal to a 0–100 scale.

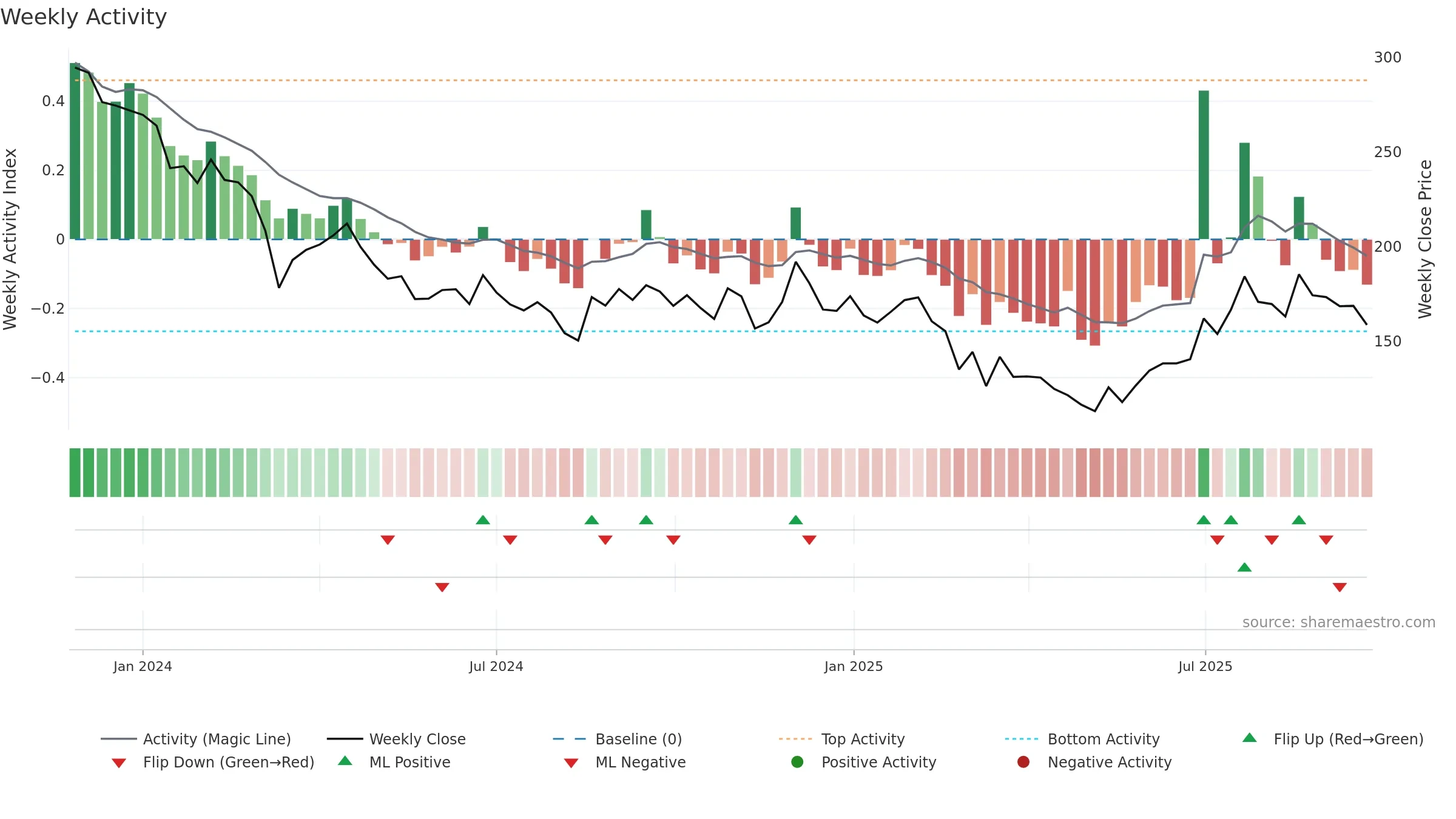

How to read this — Range-bound conditions; conviction is limited until a break or acceleration emerges.

Wait for a directional break or improving acceleration.

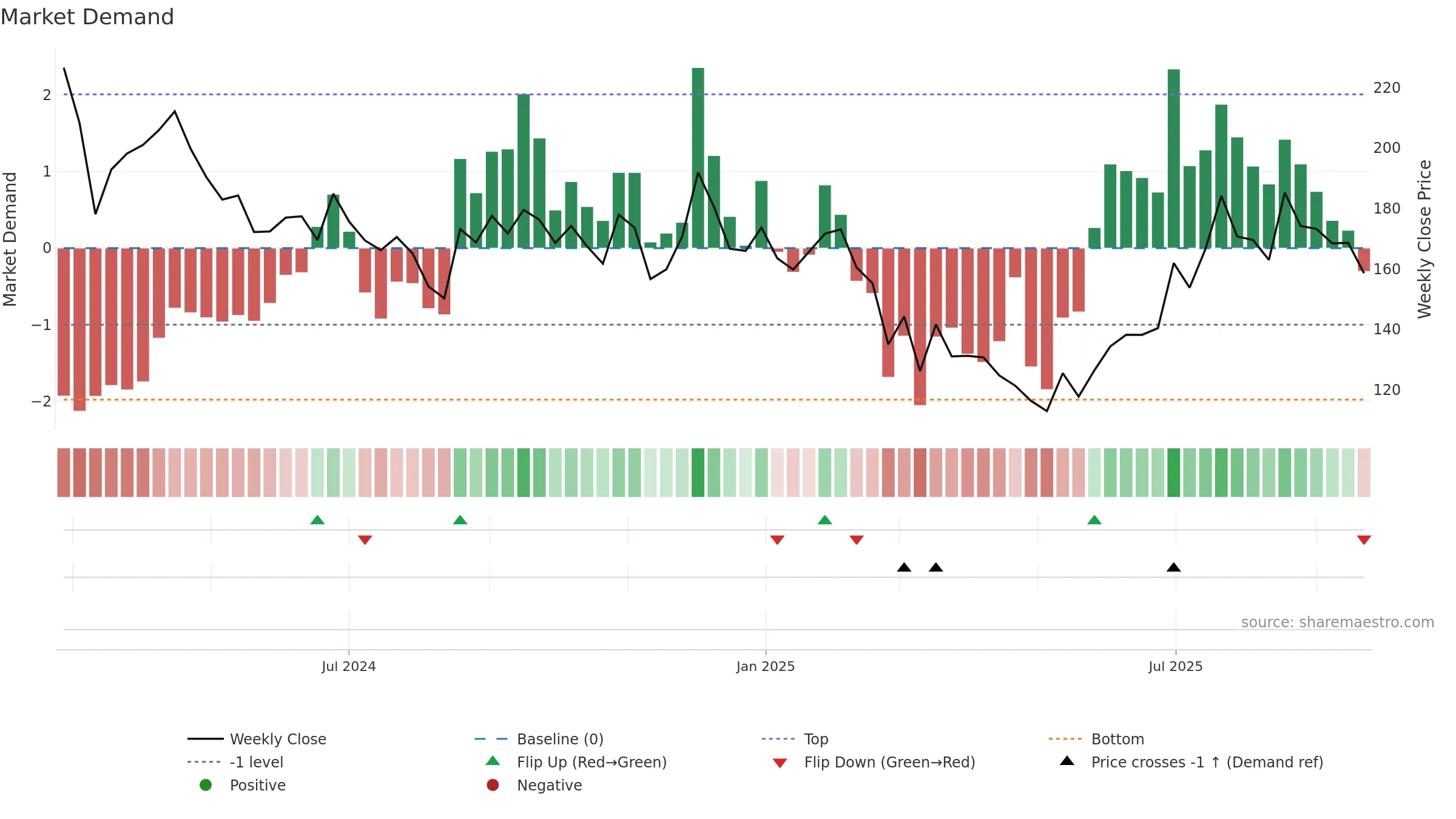

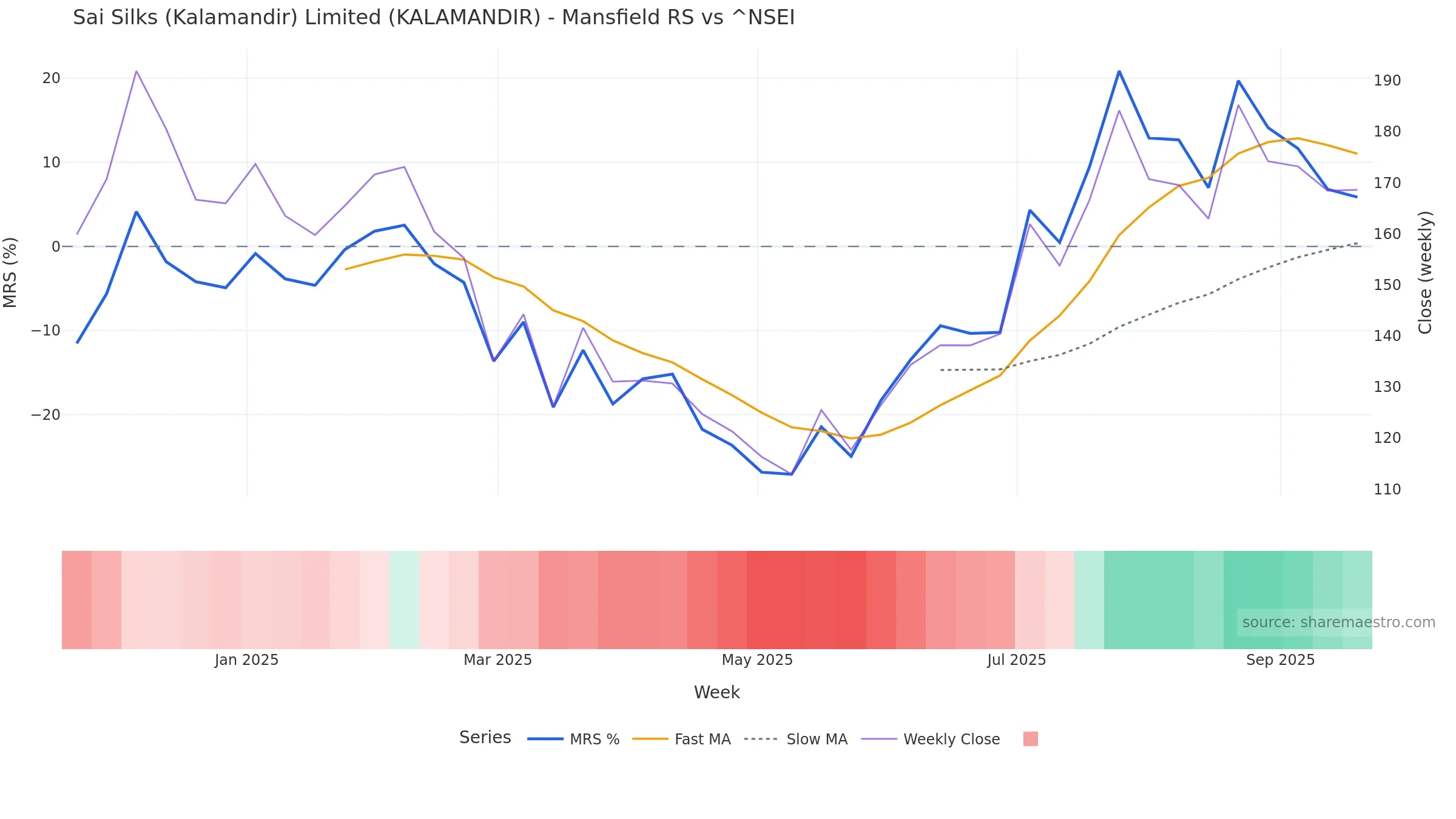

Relative strength is Positive

(> 0%, outperforming).

Latest MRS: 5.85% (week ending Fri, 19 Sep 2025).

Slope: Falling over 8w.

Notes:

- Holding above the zero line indicates relative bid.

- MRS slope falling over ~8 weeks.

Price is above fair value; upside may be capped without catalysts.

Conclusion

Neutral setup. ★★★⯪☆ confidence. Trend: Range / Neutral · -6.48% over window · vol 4.96% · liquidity convergence · posture mixed · RS outperforming · leaning positive

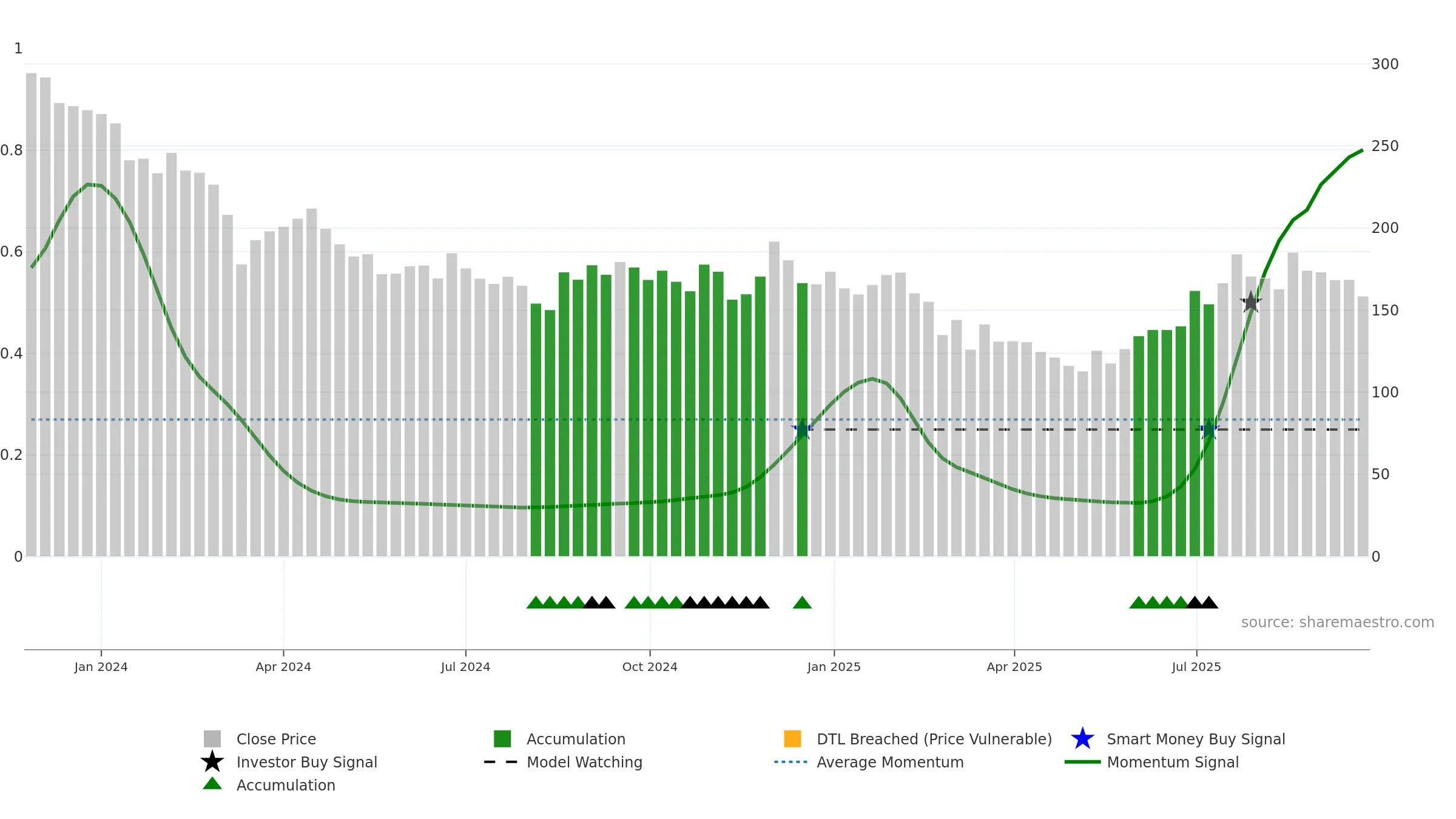

- Momentum is bullish and rising

- Liquidity confirms the price trend

- Mansfield RS: outperforming & rising

- Price is not above key averages

- High return volatility raises whipsaw risk

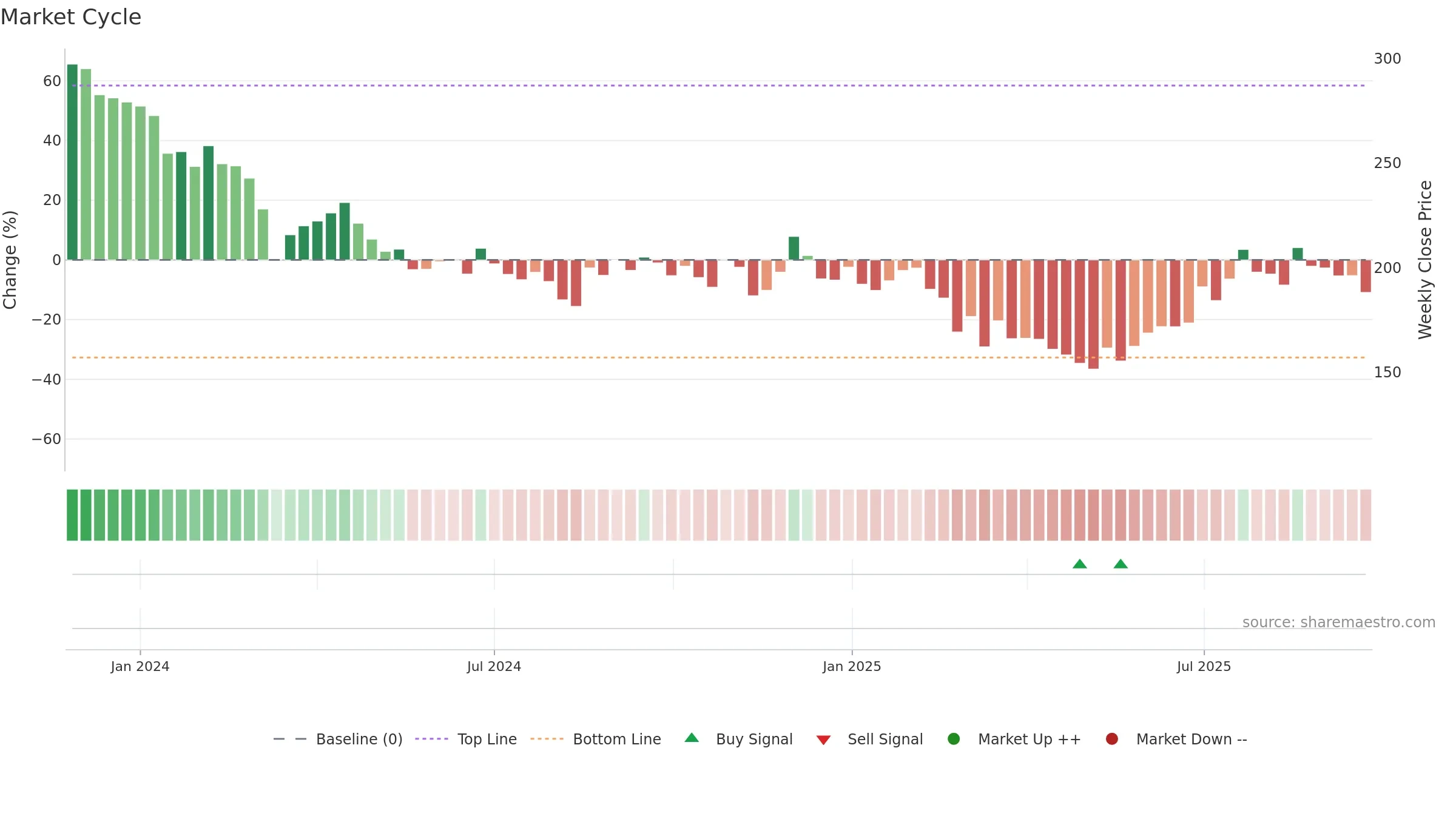

- Negative multi-week performance

Why: Price window -6.48% over w. Close is -14.41% below the prior-window high. Return volatility 4.96%. Volume trend falling. Liquidity convergence with price. Trend state range / neutral. Momentum bullish and rising. Valuation limited upside without catalysts.

Tip: Most metrics include a hover tooltip where they appear in the report.