Weekly Report

Neos S&P 500(R) High Income ETF closed at 52.5900 (0.52% WoW) . Data window ends Mon, 15 Sep 2025.

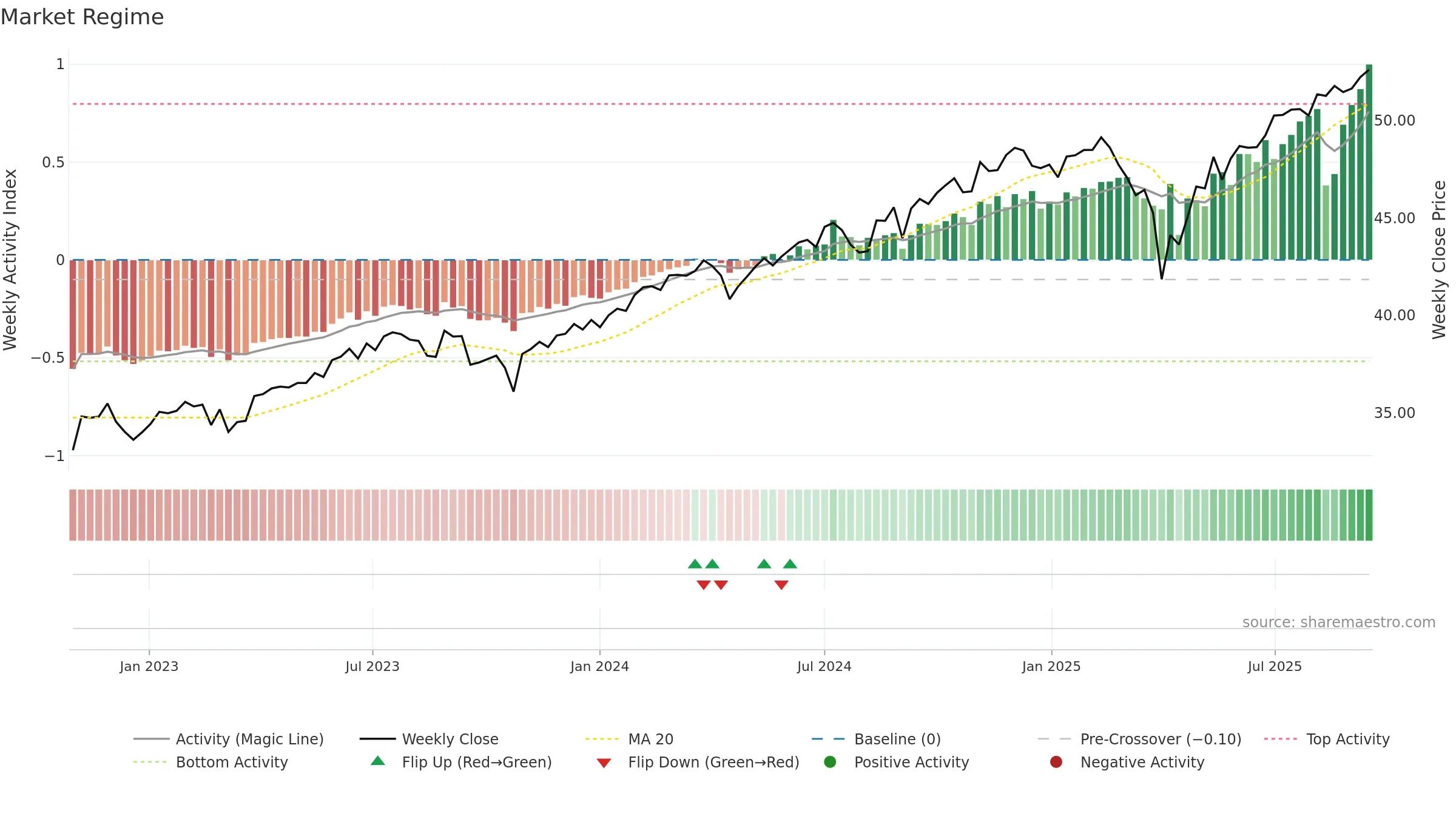

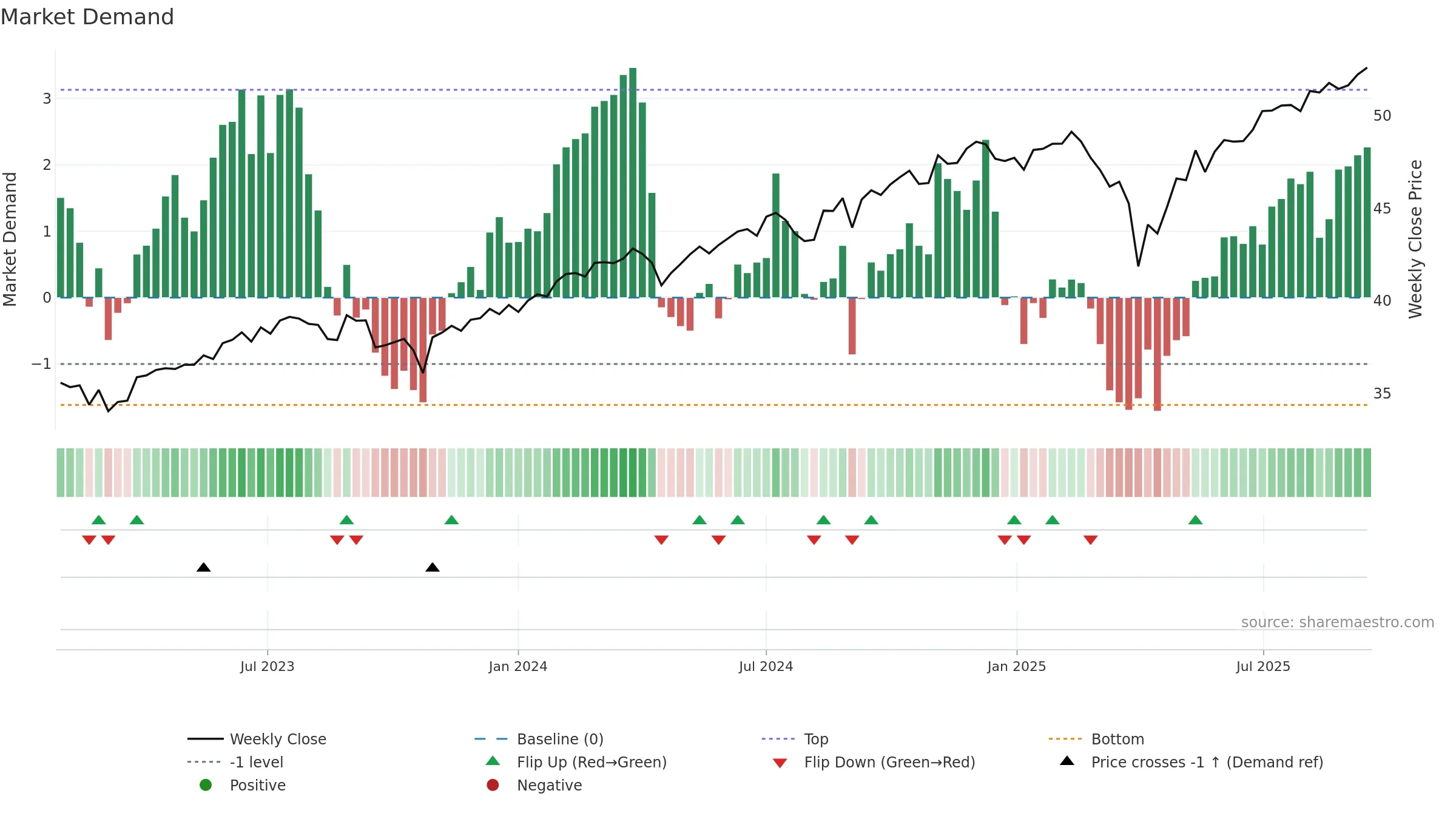

How to read this — Price slope is upward, indicating persistent buying over the window. Low weekly volatility favours steadier follow-through. Volume and price are moving in the same direction — a constructive confirmation. Constructive MA stack supports the up-drift; pullbacks may find support at the 8–13 week region. Price holds above key averages, indicating constructive participation.

Up-slope supports buying interest; pullbacks may be contained if activity stays firm.

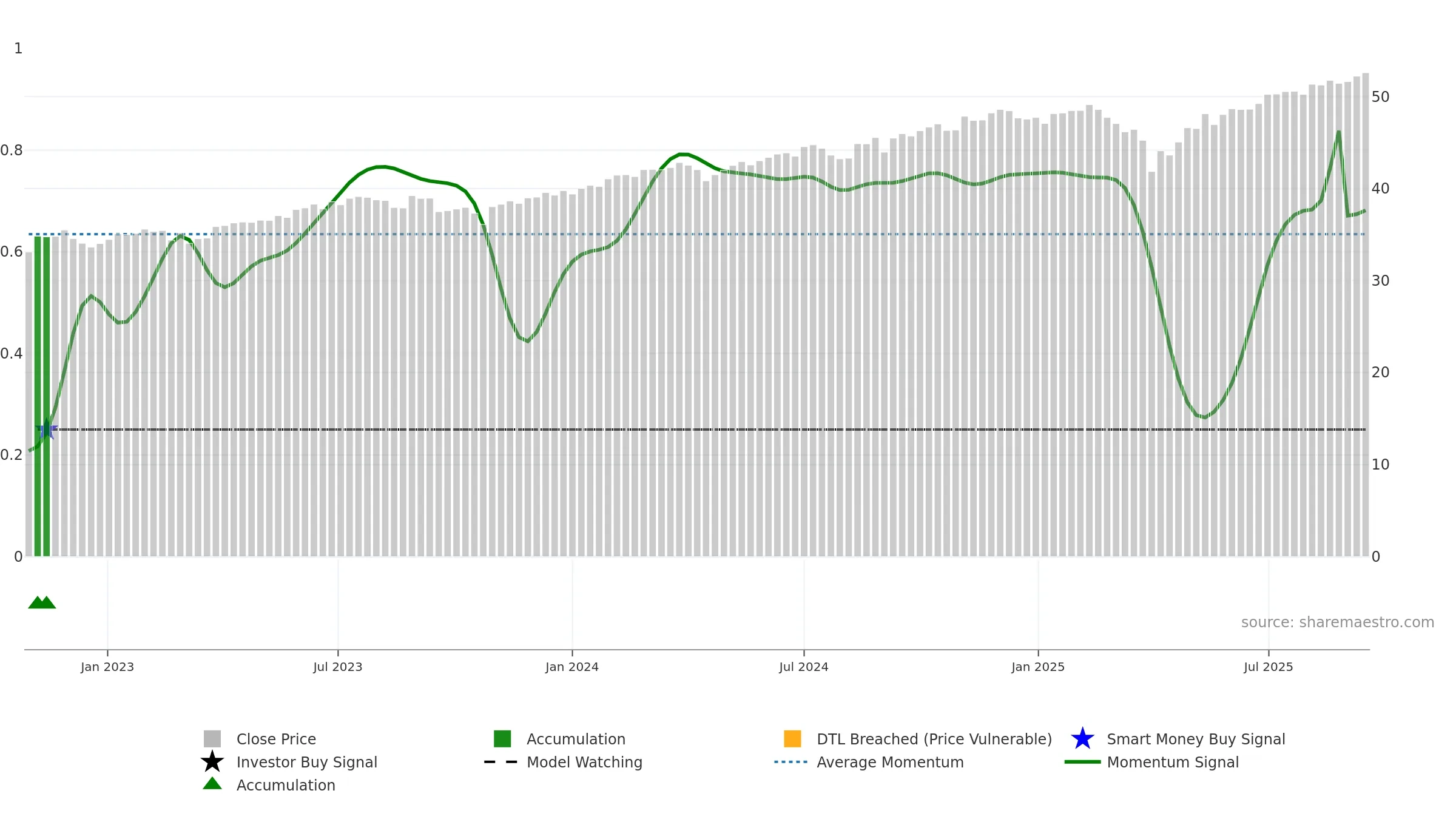

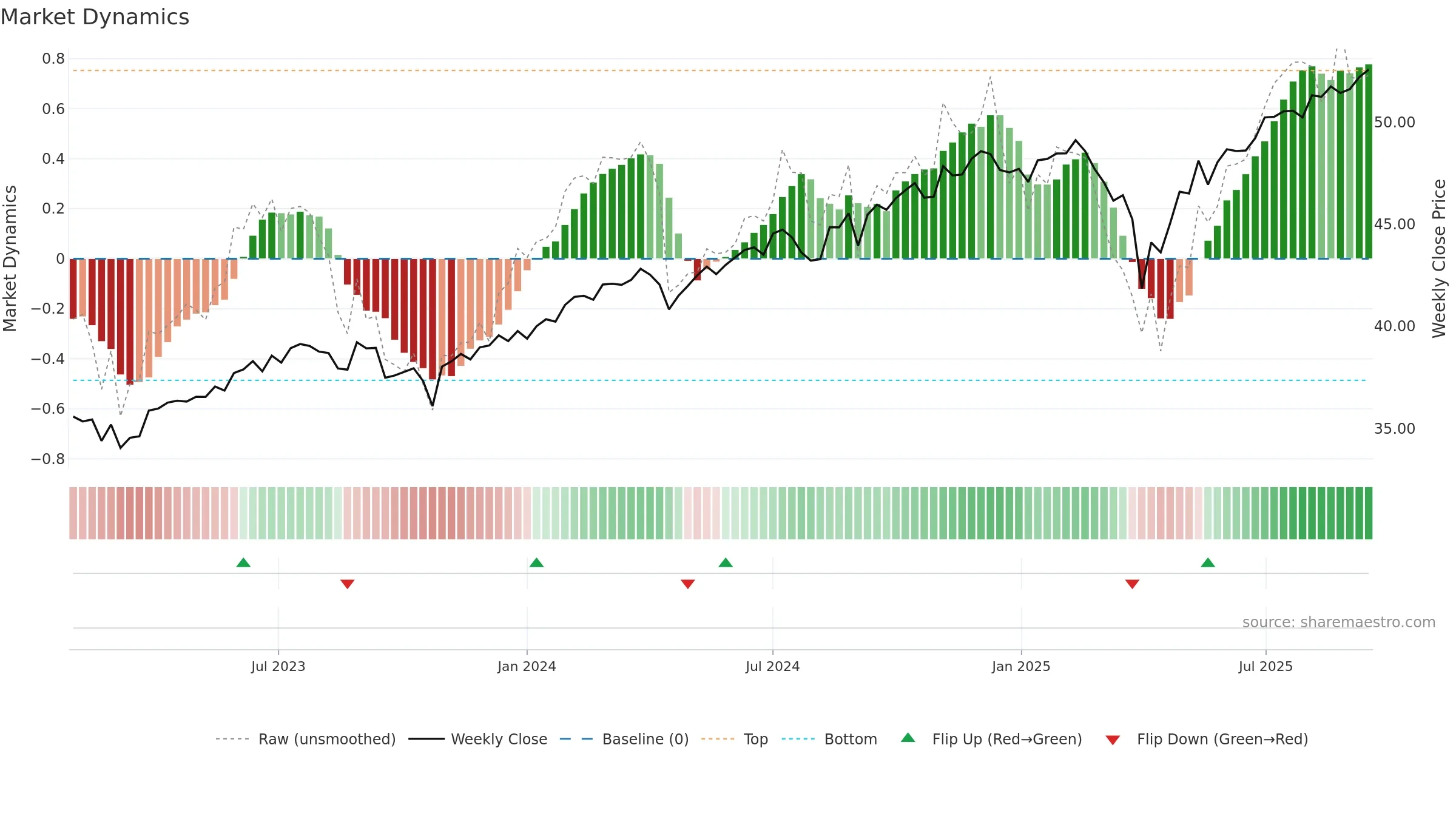

Gauge maps the trend signal to a 0–100 scale.

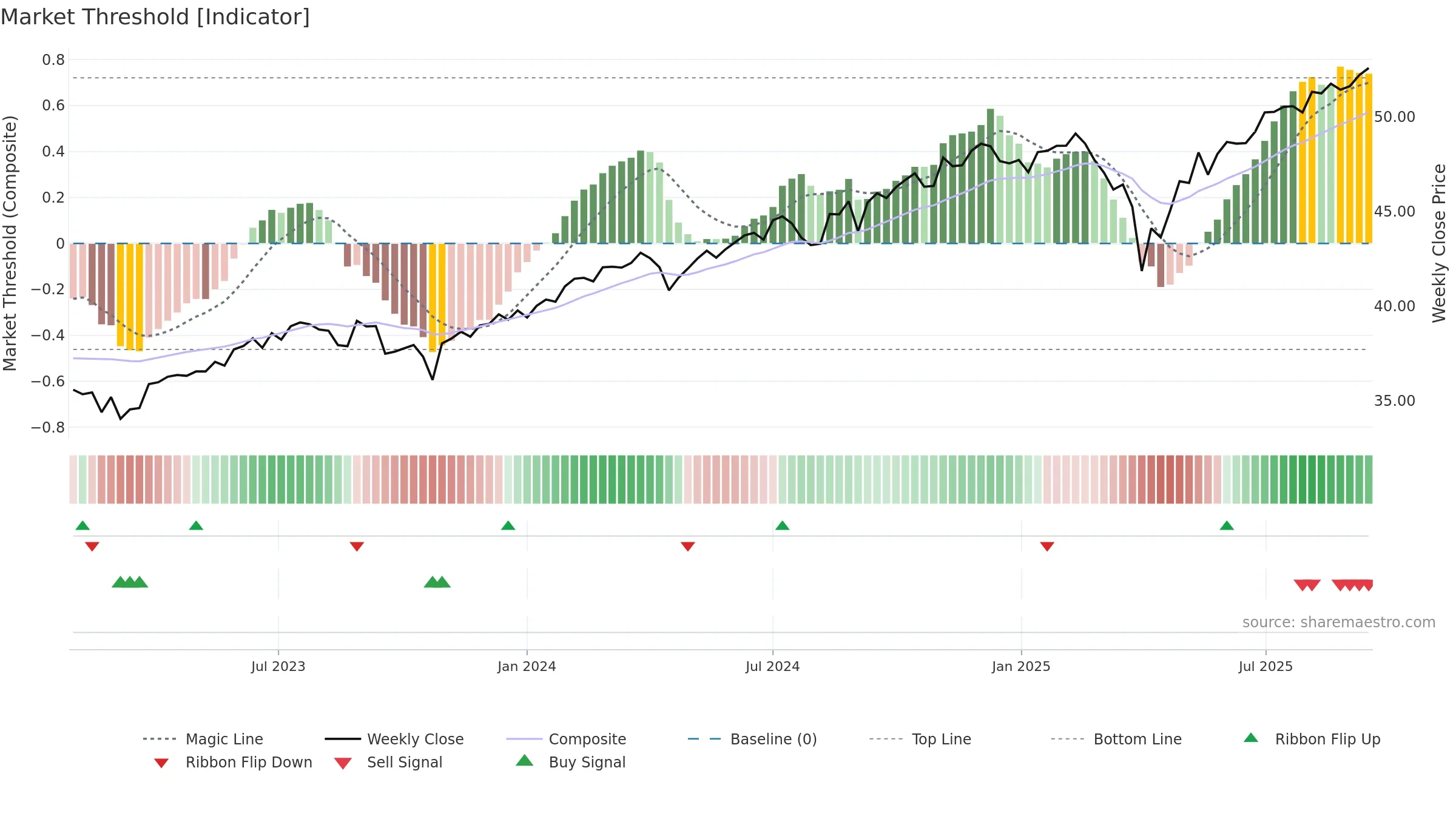

How to read this — Gauge is elevated but momentum is rolling over; topping risk is rising. Notable breakdown from ≥0.80 weakens trend quality.

Stay alert: protect gains or seek confirmation before adding risk.

Conclusion

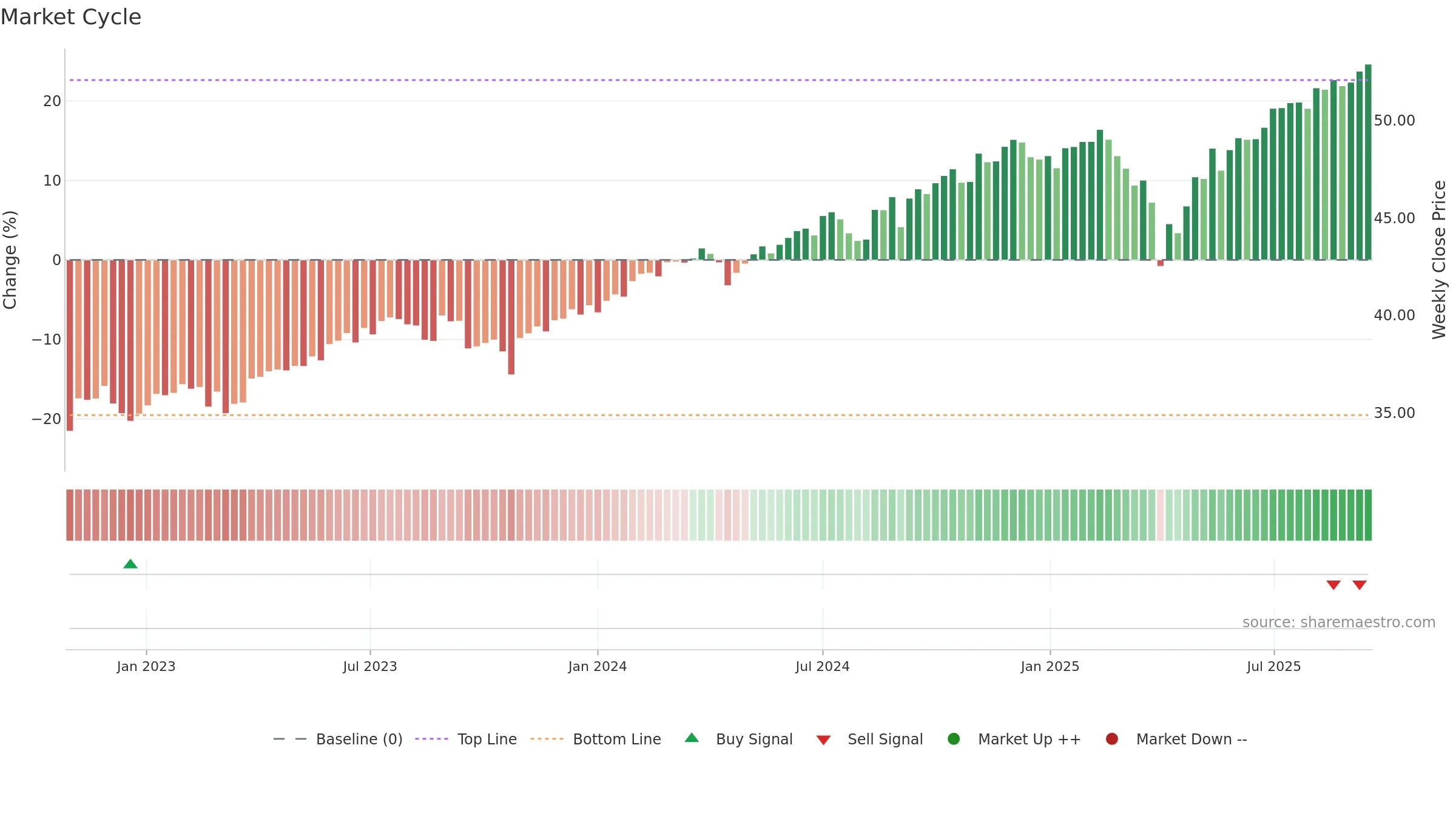

Neutral setup. ★★★☆☆ confidence. Price window: 4. Trend: Uptrend at Risk; gauge 68. In combination, liquidity confirms the move.

- Price holds above 8w & 26w averages

- Constructive moving-average stack

- Liquidity confirms the price trend

- Low return volatility supports durability

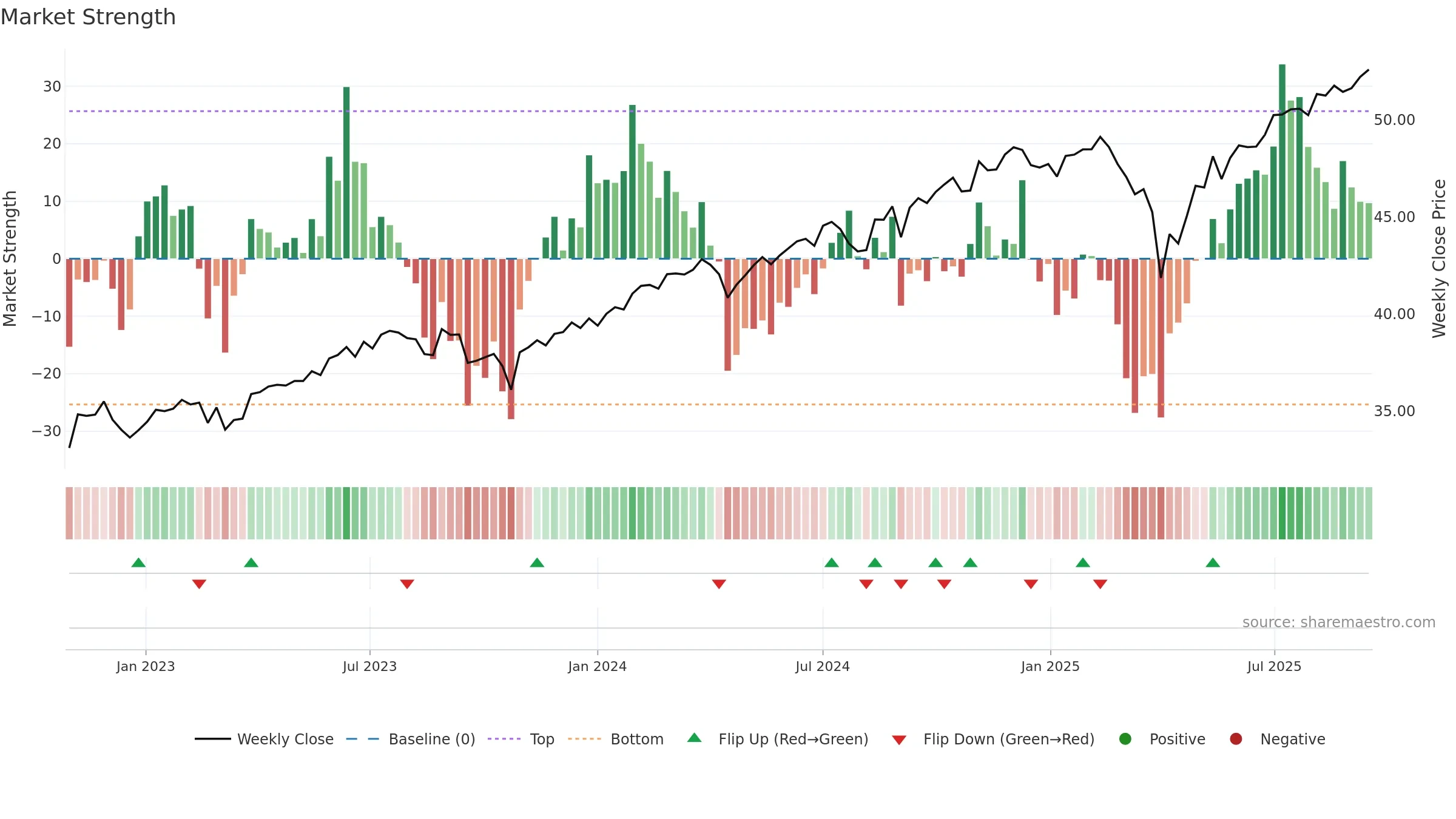

- High-level but rolling over (topping risk)

- Momentum is weak/falling

- Recent breakdown from ≥0.80 weakens trend quality

Why: Price window 4.68% over 8w. Close is 0.72% above the prior-window high. Return volatility 0.98%. Volume trend rising. Liquidity convergence with price. Trend state uptrend at risk. MA stack constructive. Momentum bullish and falling .

Tip: Most metrics also include a hover tooltip where they appear in the report.