CKI HOLDINGS

1038 HKG

Weekly Report

CKI HOLDINGS closed at 52.1500 (-0.48% WoW) . Data window ends Mon, 22 Sep 2025.

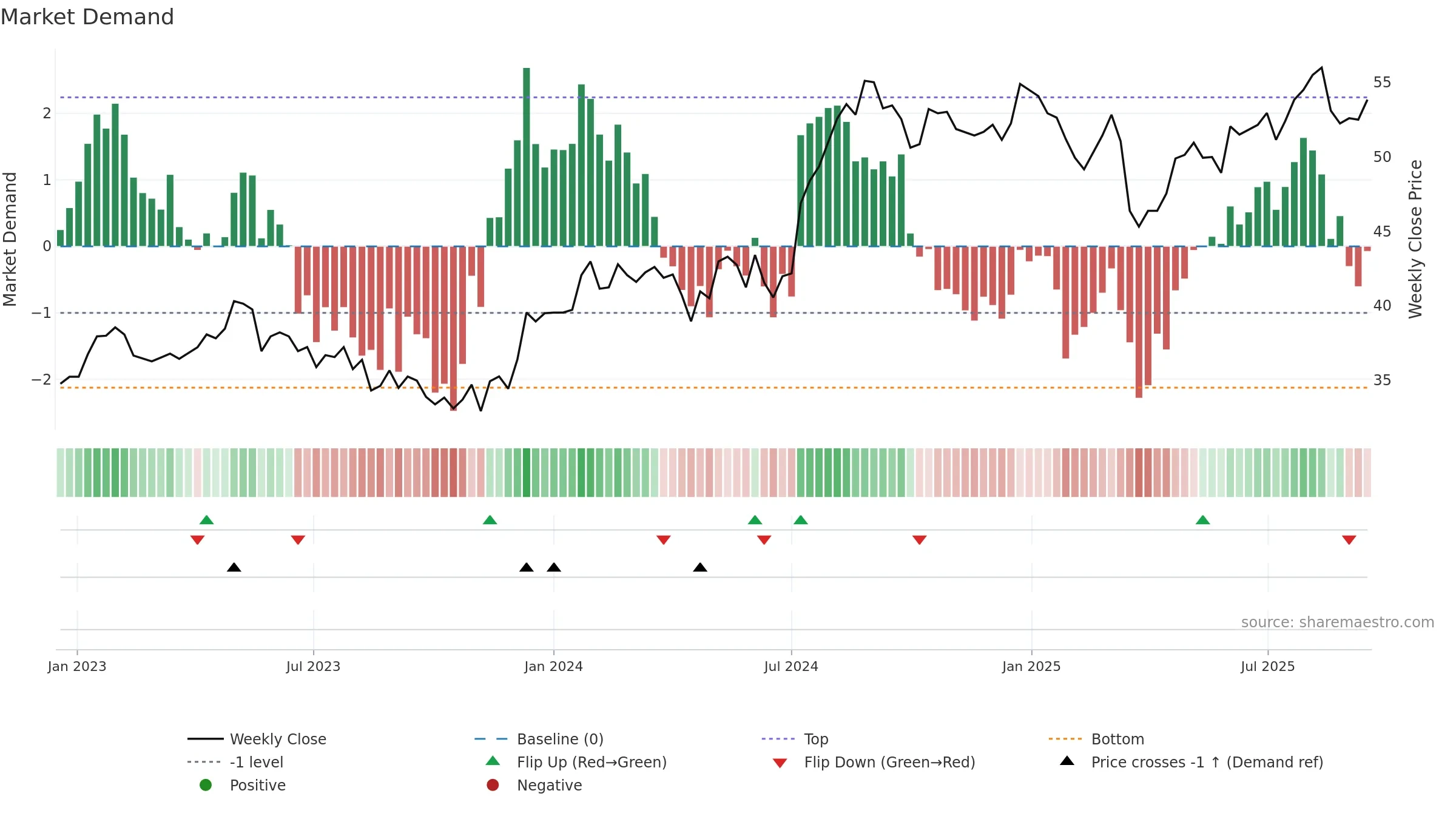

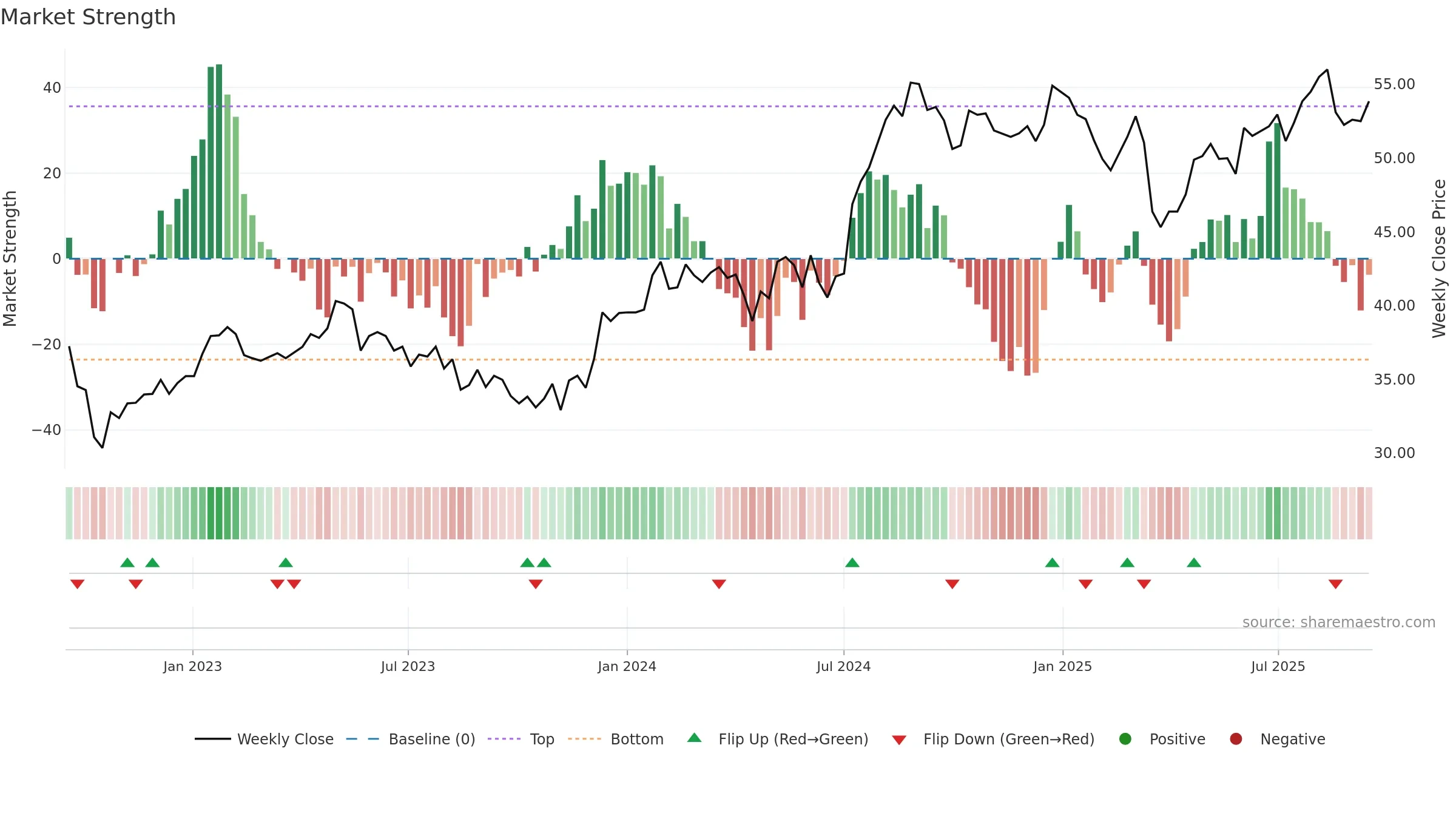

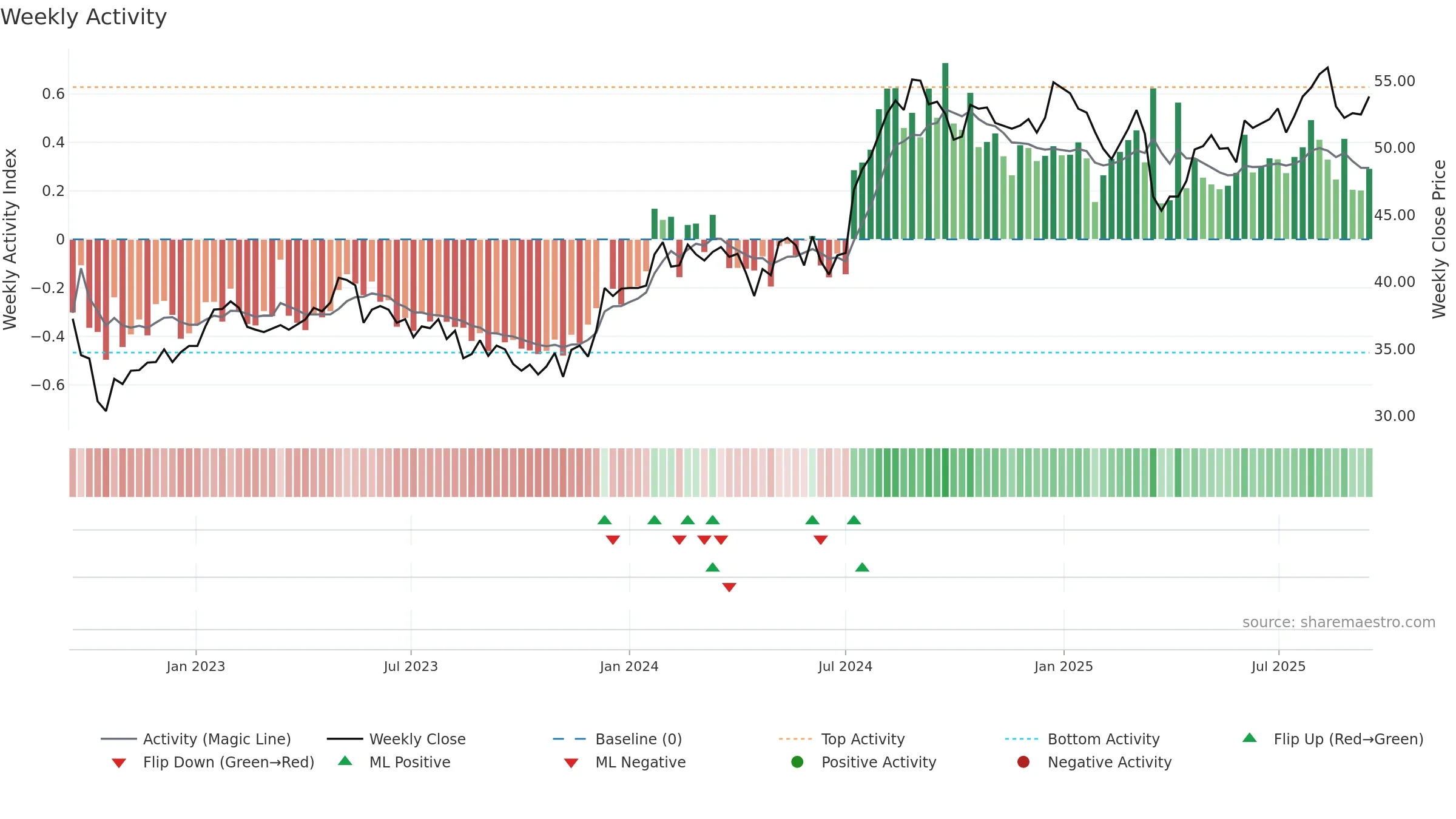

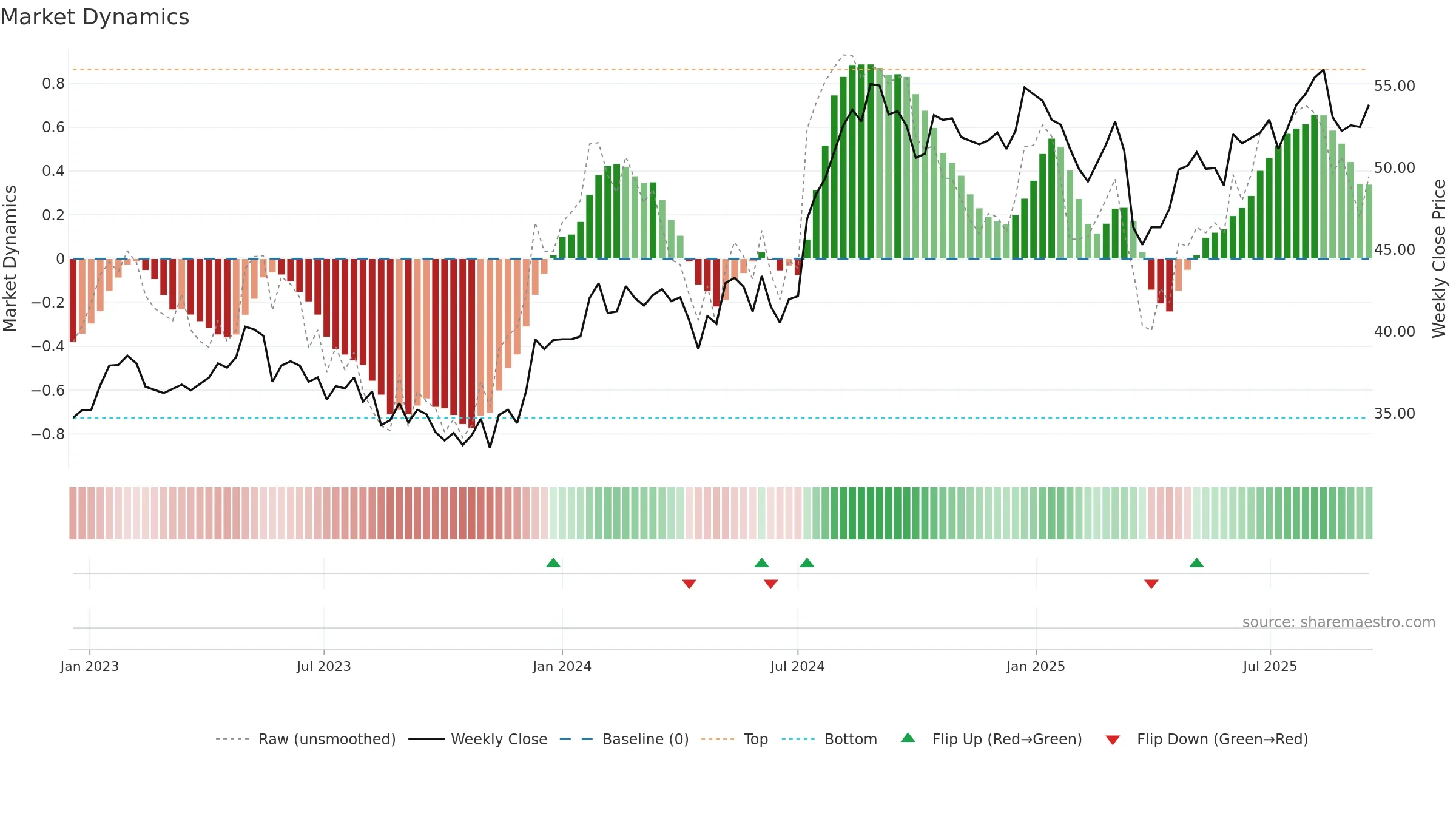

How to read this — Price slope is downward, indicating persistent supply pressure. Low weekly volatility favours steadier follow-through. Volume and price are moving in the same direction — a constructive confirmation. Distance to baseline is narrowing — reverting closer to its fair-value track.

Down-slope argues for patience; rallies can fade sooner unless participation improves.

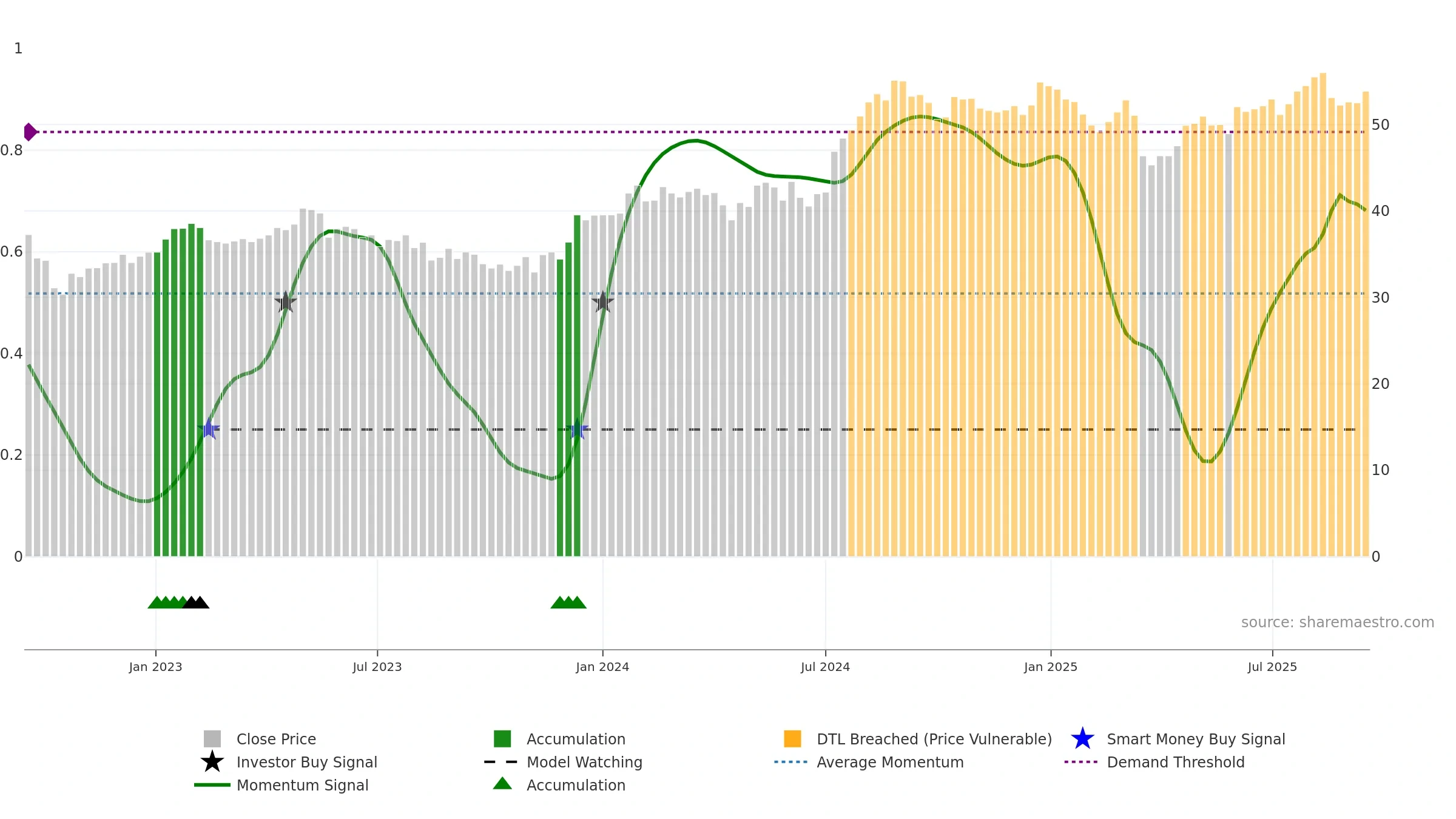

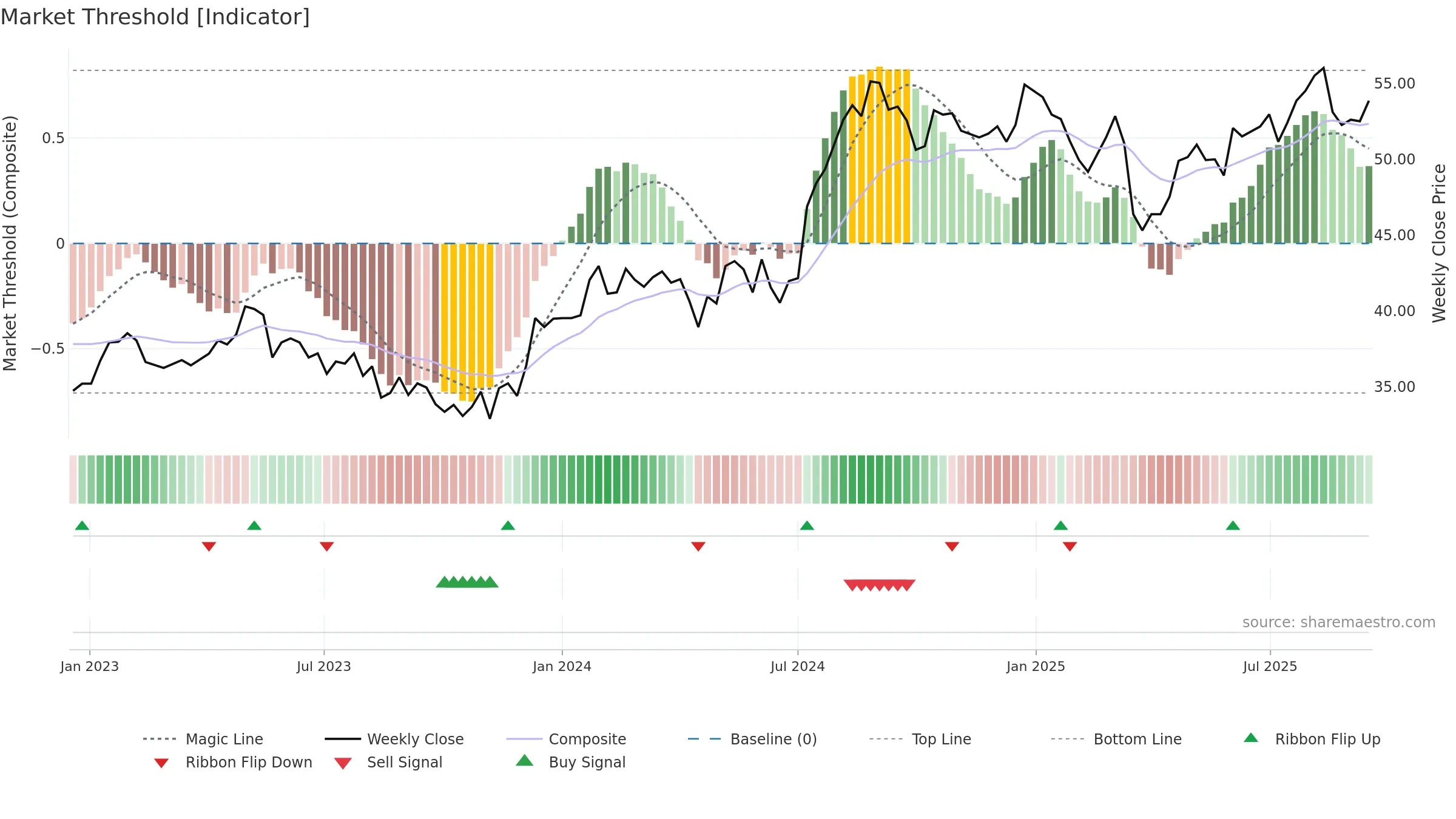

Gauge maps the trend signal to a 0–100 scale.

How to read this — Gauge is elevated but momentum is rolling over; topping risk is rising.

Stay alert: protect gains or seek confirmation before adding risk.

Conclusion

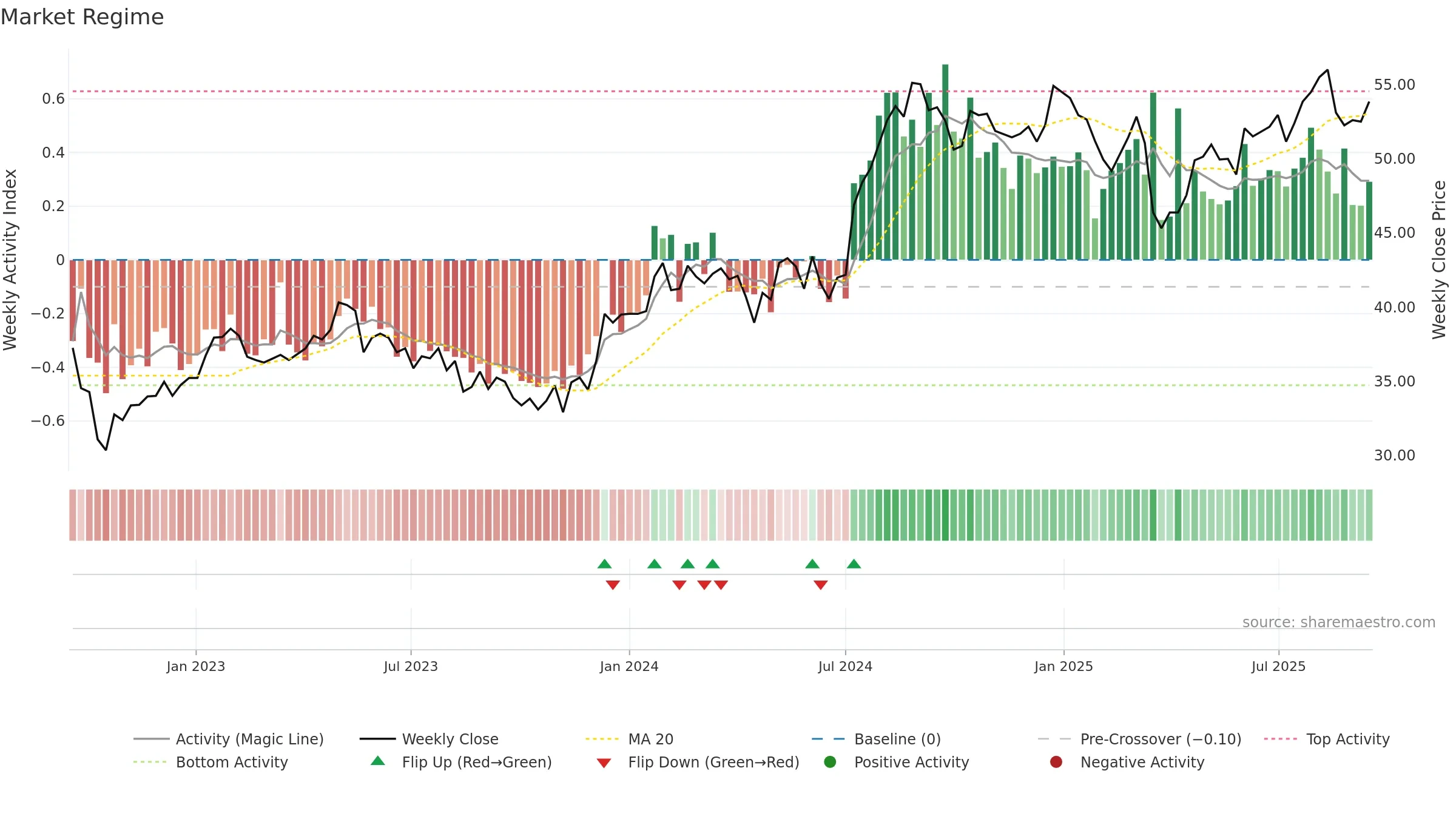

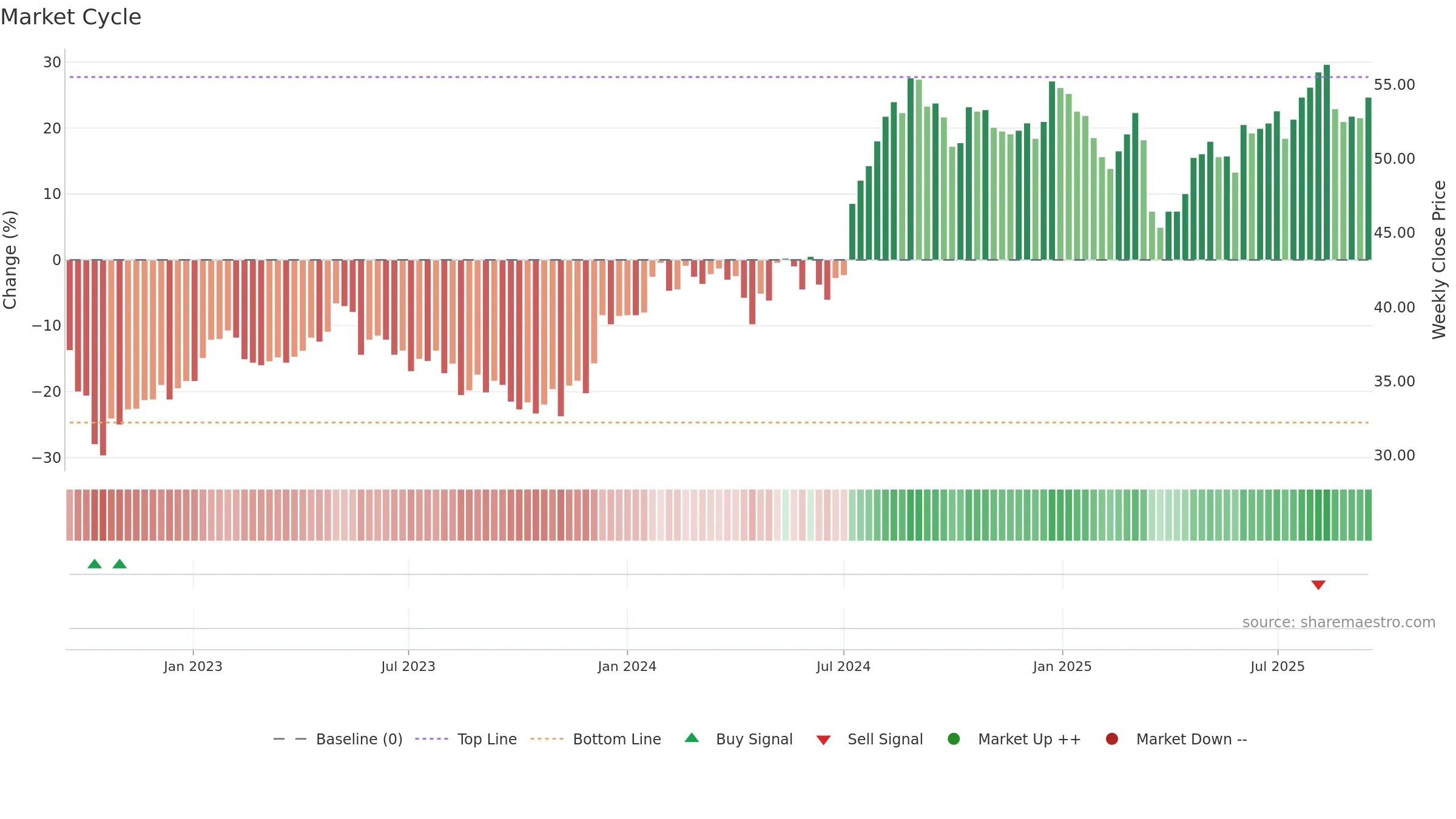

Neutral setup. ★★★☆☆ confidence. Price window: -6. Trend: Uptrend at Risk; gauge 67. In combination, liquidity confirms the move.

- Momentum is bullish and rising

- Liquidity confirms the price trend

- Low return volatility supports durability

- High-level but rolling over (topping risk)

- Price is not above key averages

- Negative multi-week performance

Why: Price window -6.04% over 8w. Close is -6.88% below the prior-window high. Return volatility 1.54%. Volume trend falling. Liquidity convergence with price. Trend state uptrend at risk. Momentum bullish and rising.

Tip: Most metrics include a hover tooltip where they appear in the report.