Weekly Report

Direxion Daily Regional Banks Bull 3X Shares closed at 108.9300 (-3.37% WoW) . Data window ends Fri, 19 Sep 2025.

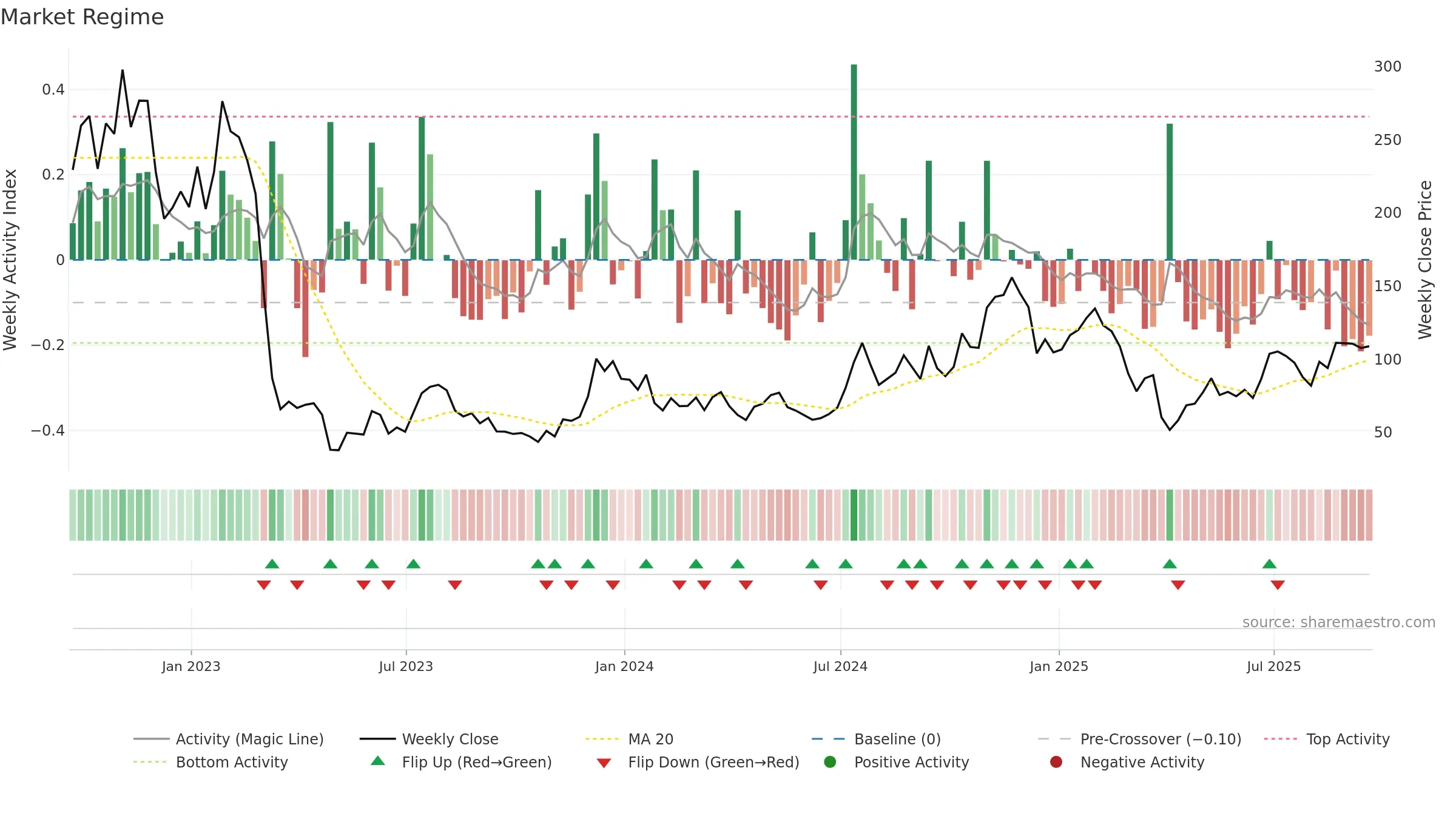

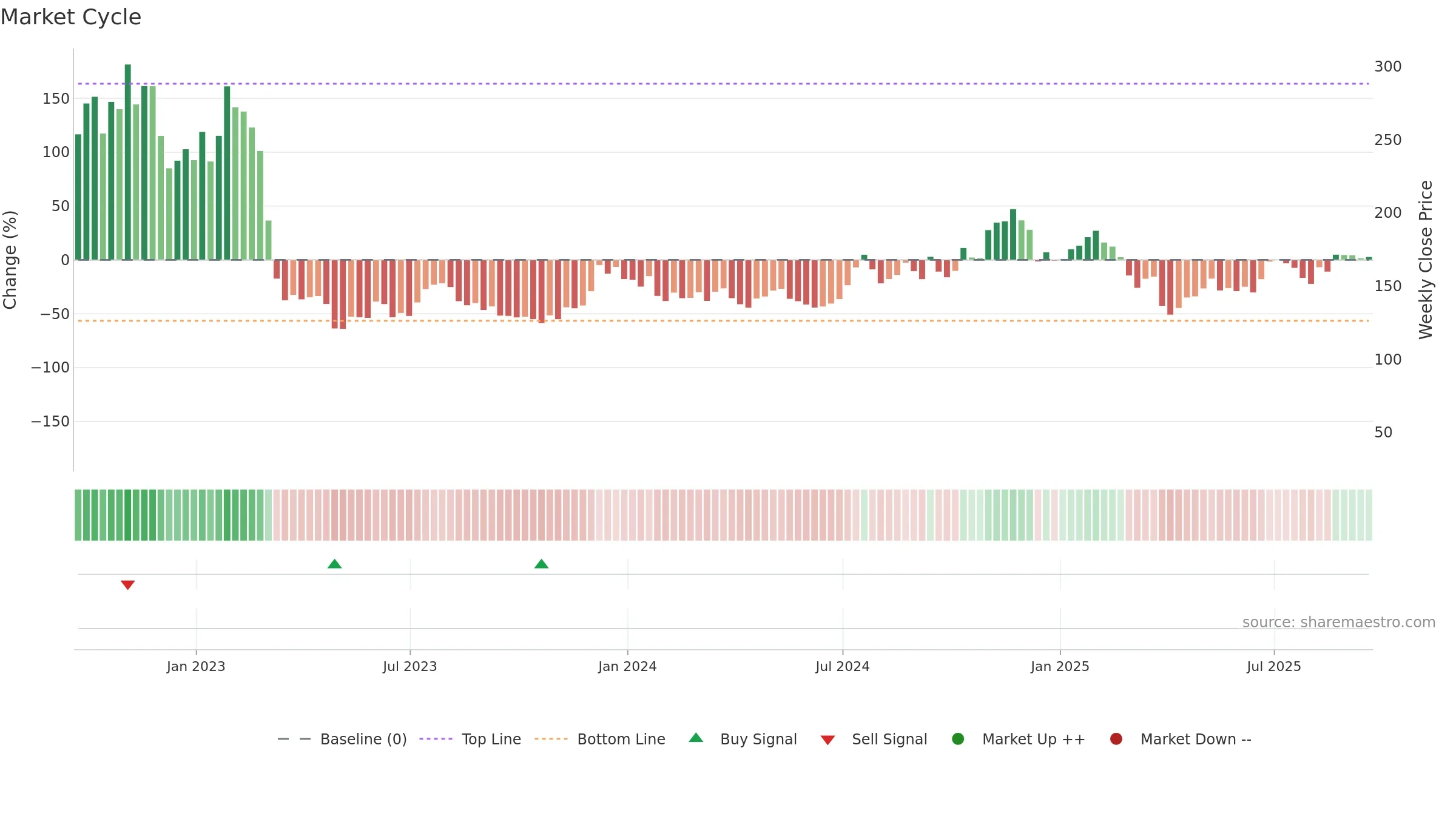

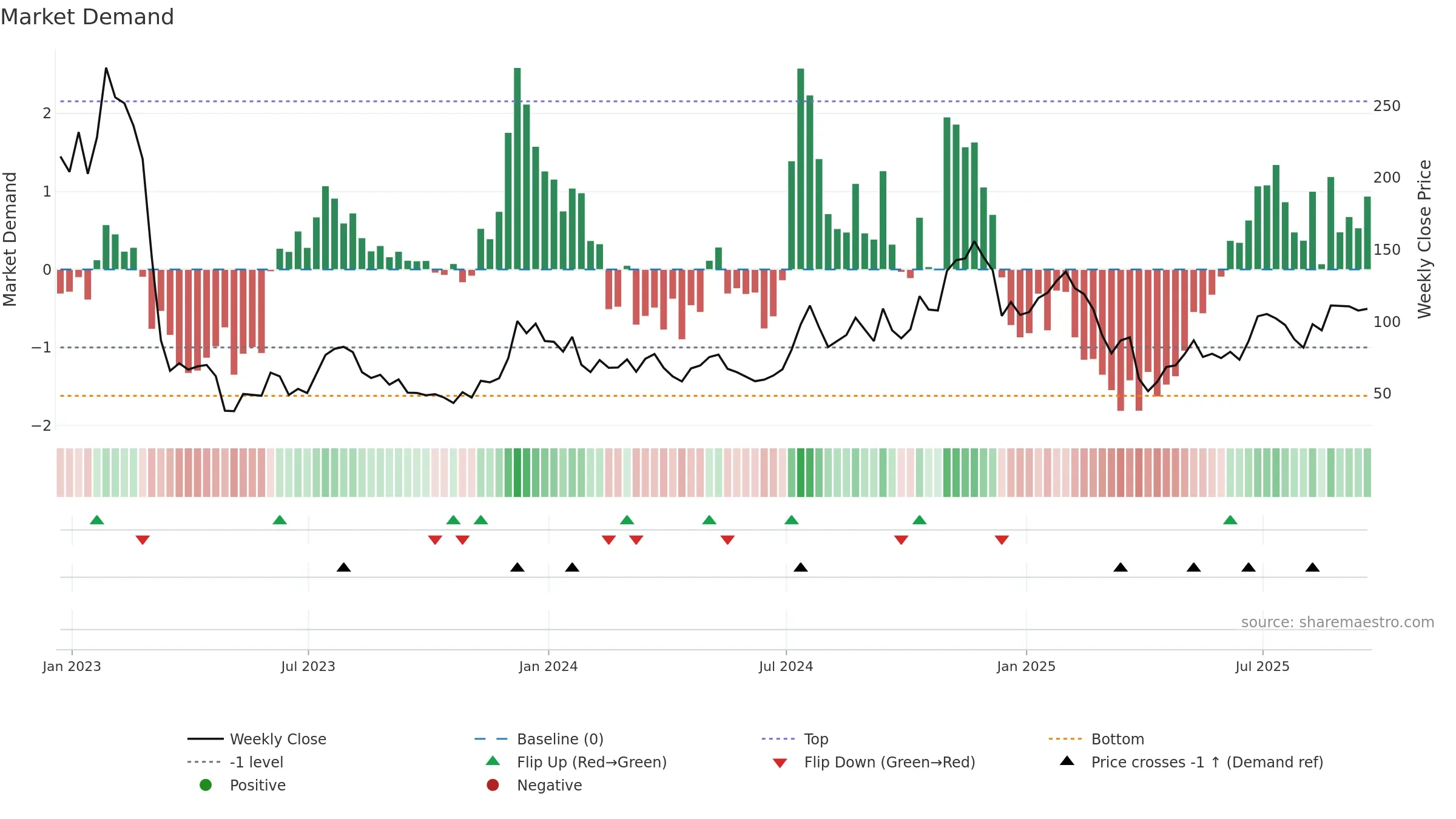

How to read this — Price slope is upward, indicating persistent buying over the window. Elevated weekly volatility increases whipsaw risk. Volume trend diverges from price — watch for fatigue or rotation. Returns are positively correlated with volume — strength tends to arrive on higher activity. Accumulation weeks: 2; distribution weeks: 2. Price-level slope and return-drift differ — moves have been uneven week to week. Constructive MA stack supports the up-drift; pullbacks may find support at the 8–13 week region. Price holds above key averages, indicating constructive participation.

Up-slope supports buying interest; pullbacks may be contained if activity stays firm. Because liquidity isn’t confirming, prefer evidence of fresh demand before chasing moves.

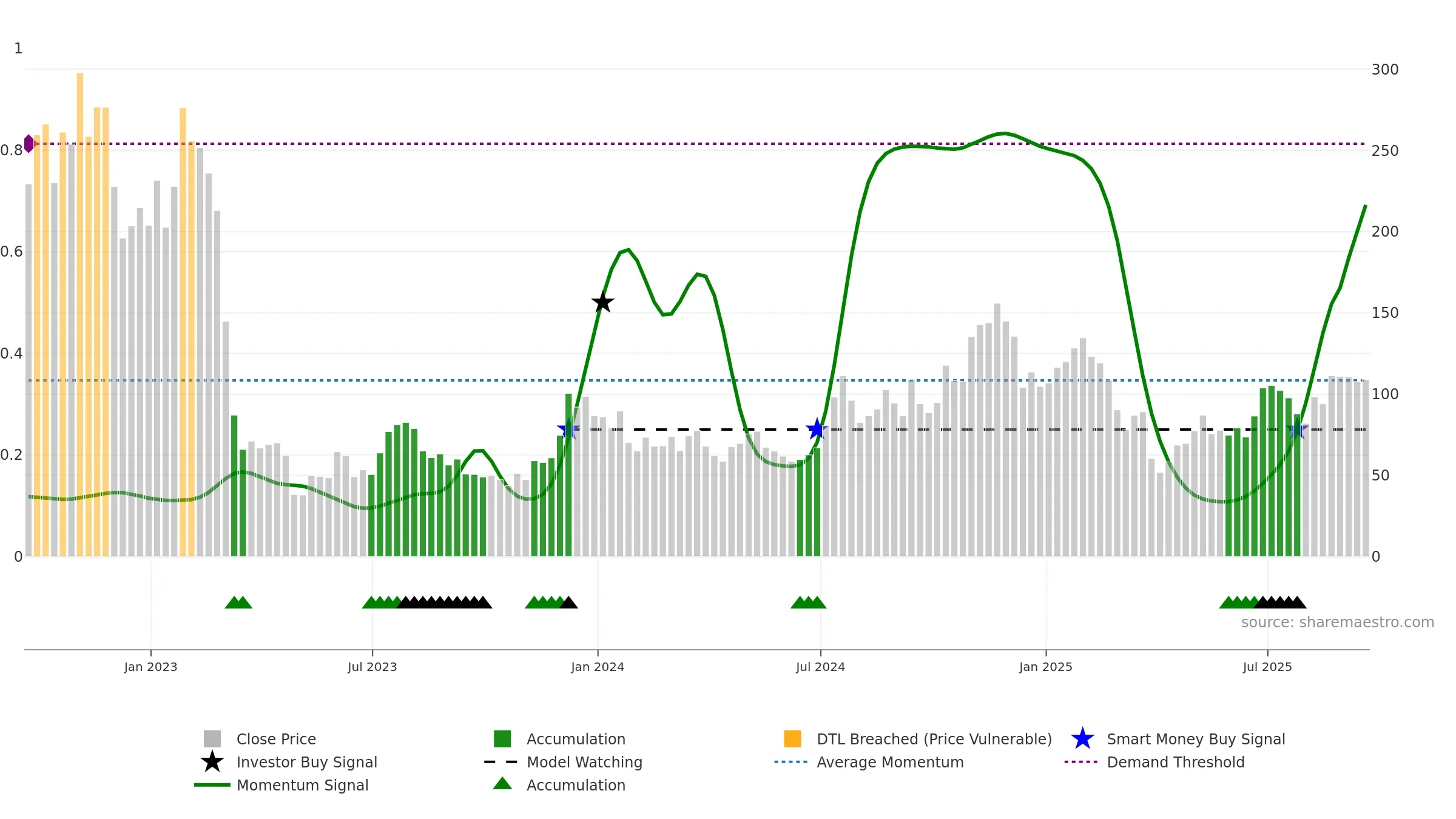

Gauge maps the trend signal to a 0–100 scale.

How to read this — Bullish gauge levels imply persistent upside pressure. A rising gauge shows momentum building rather than fading. Deceleration reduces the odds of persistence.

Constructive backdrop; dips are more likely to find support while the gauge stays high.

Conclusion

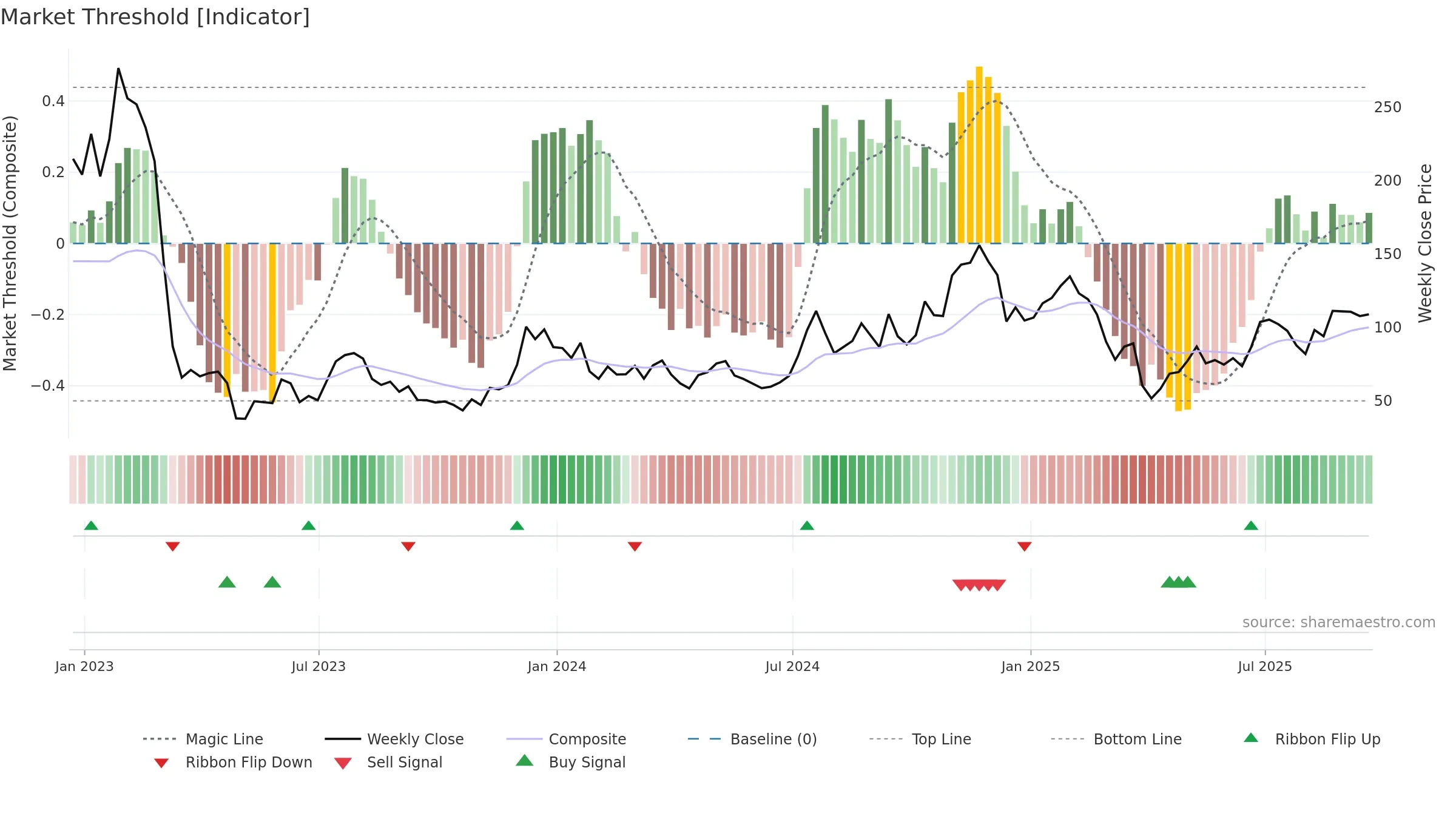

Neutral setup. ★★★☆☆ confidence. Price window: 32. Trend: Bullish @ 84. In combination, liquidity diverges from price.

Why: Price window 32.89% over 8w. Close is -2.09% below the window high. Return volatility 8.46%. Volume trend falling. Liquidity divergence with price. Accumulation 2; distribution 2. MA stack constructive. Baseline deviation 0.05% (widening). Momentum bullish and rising. Acceleration decelerating. Gauge volatility normal.

Tip: Most metrics also include a hover tooltip where they appear in the report.