Greystone Housing Impact Investors LP

GHI NYSE

Weekly Report

Greystone Housing Impact Investors LP closed at 10.5300 (-1.86% WoW) . Data window ends Fri, 19 Sep 2025.

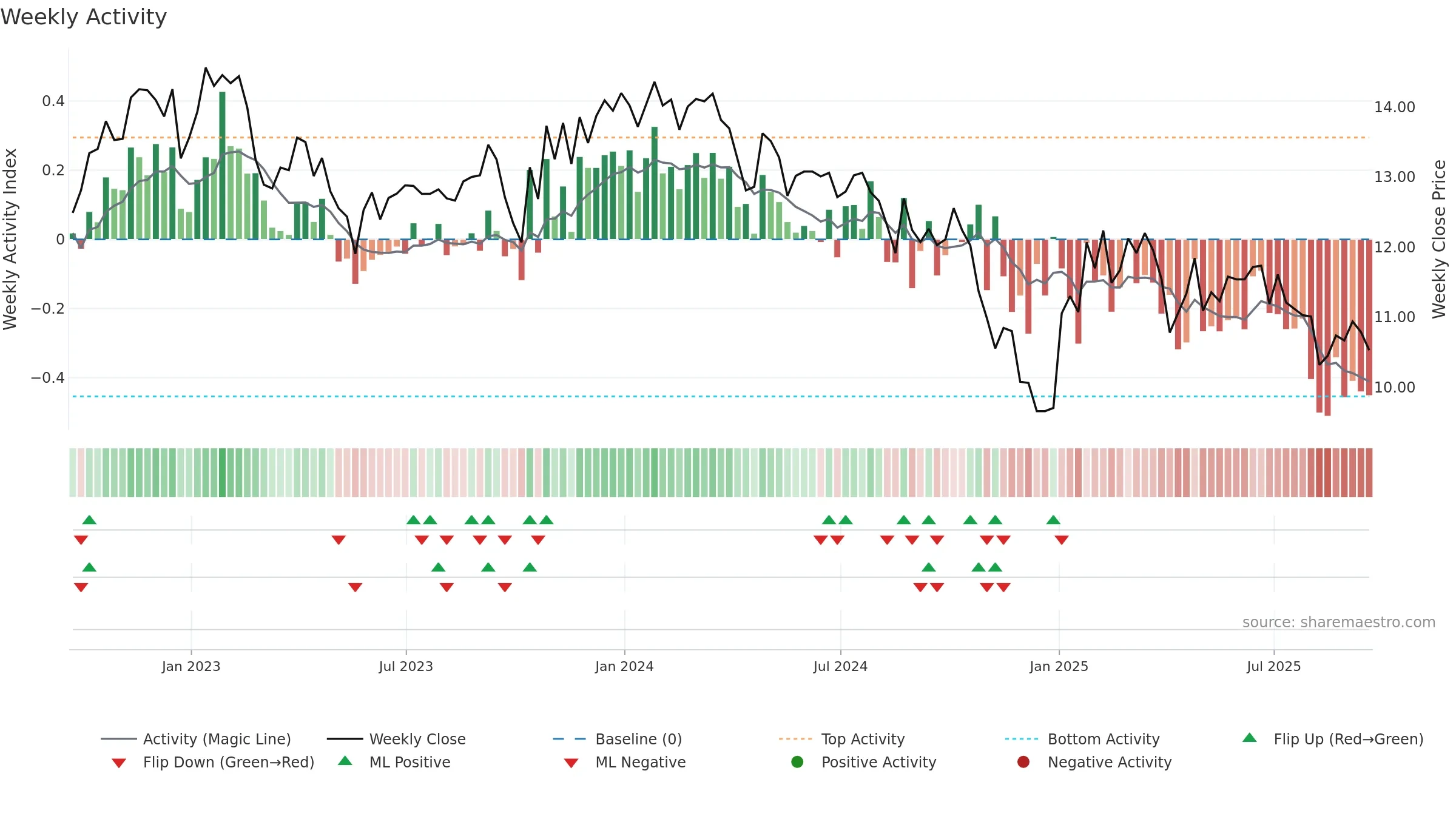

How to read this — Price slope is upward, indicating persistent buying over the window. Low weekly volatility favours steadier follow-through. Volume and price are moving in the same direction — a constructive confirmation. Price sits below key averages, keeping pressure on the tape.

Up-slope supports buying interest; pullbacks may be contained if activity stays firm.

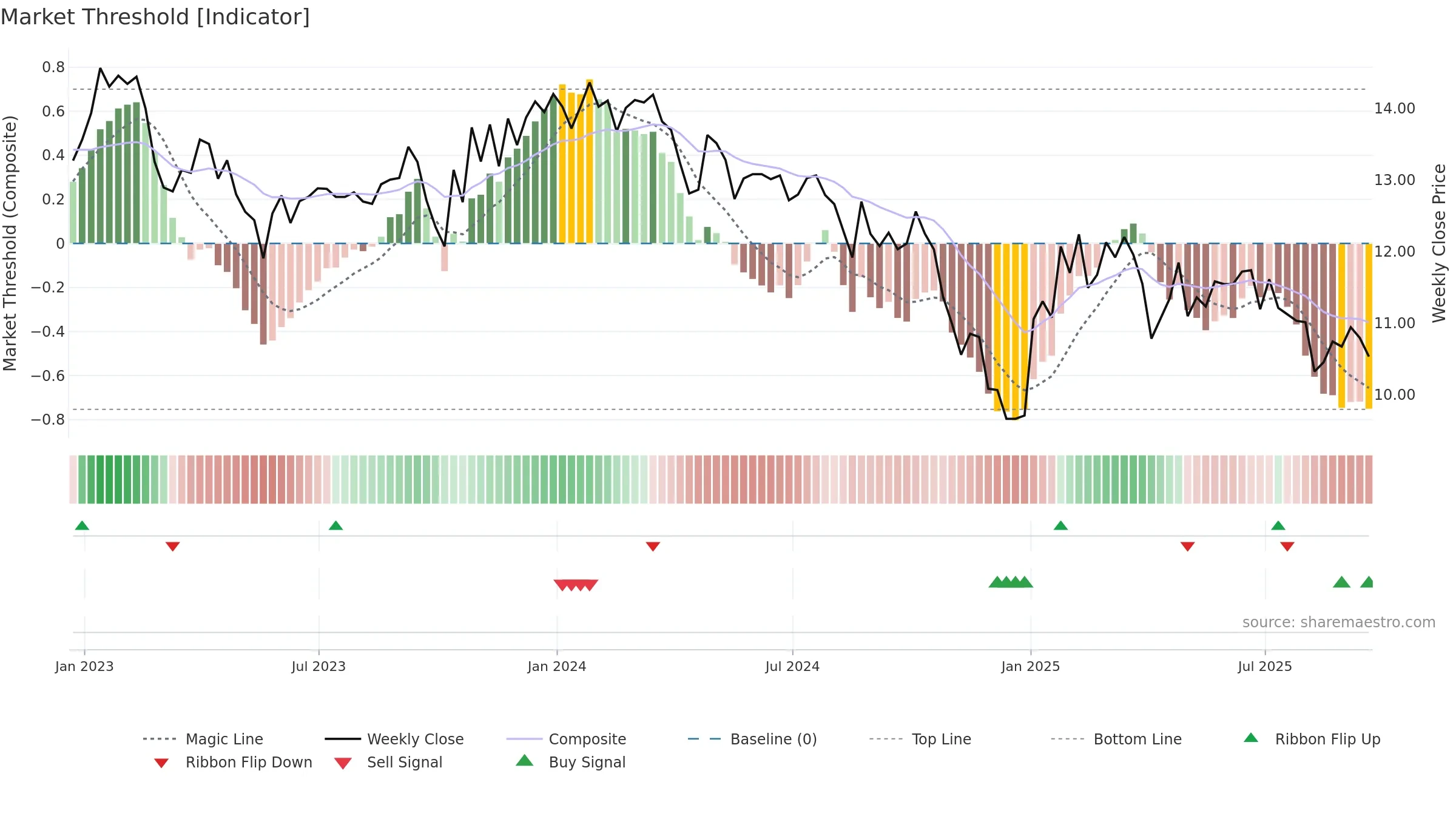

Gauge maps the trend signal to a 0–100 scale.

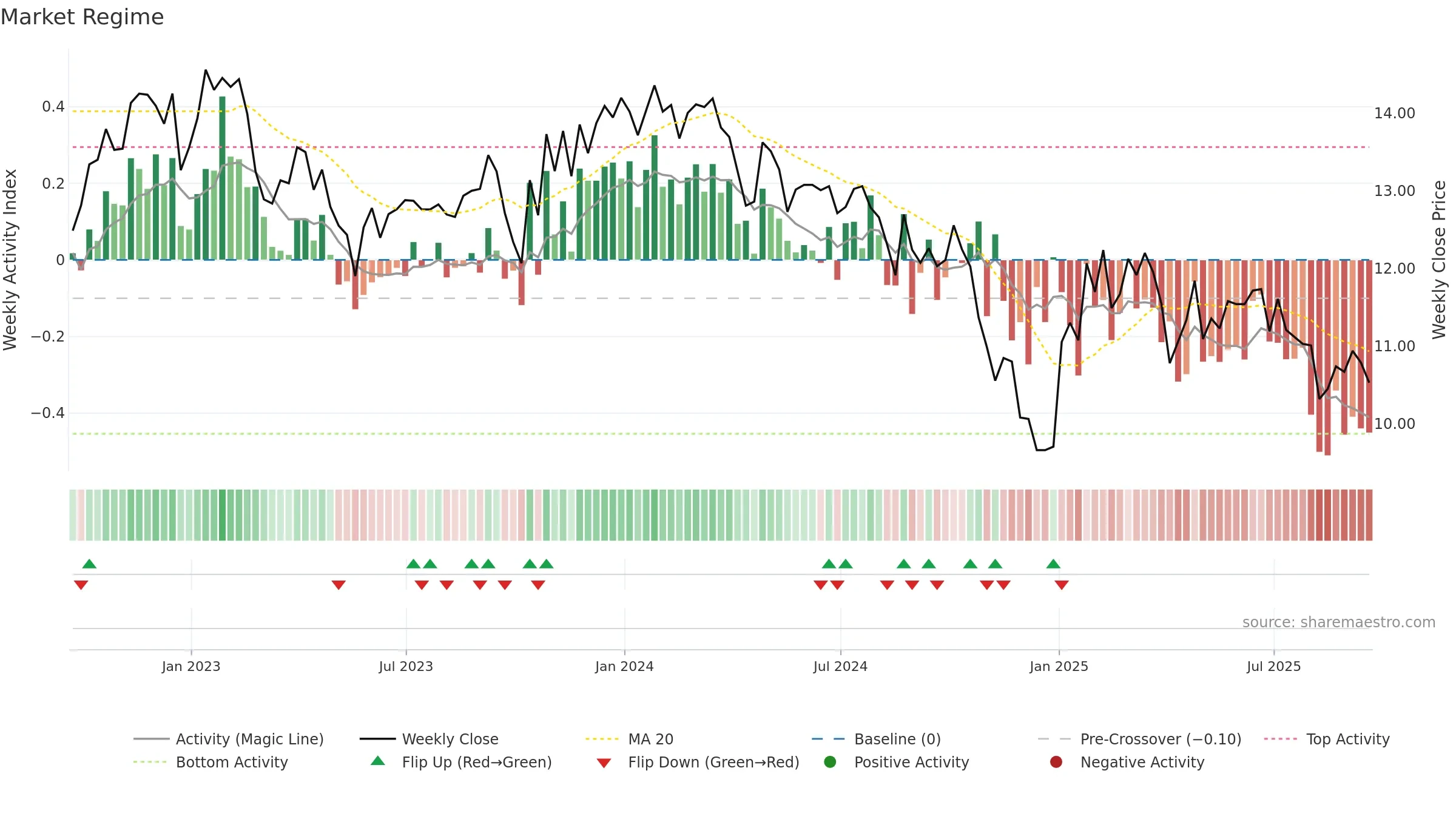

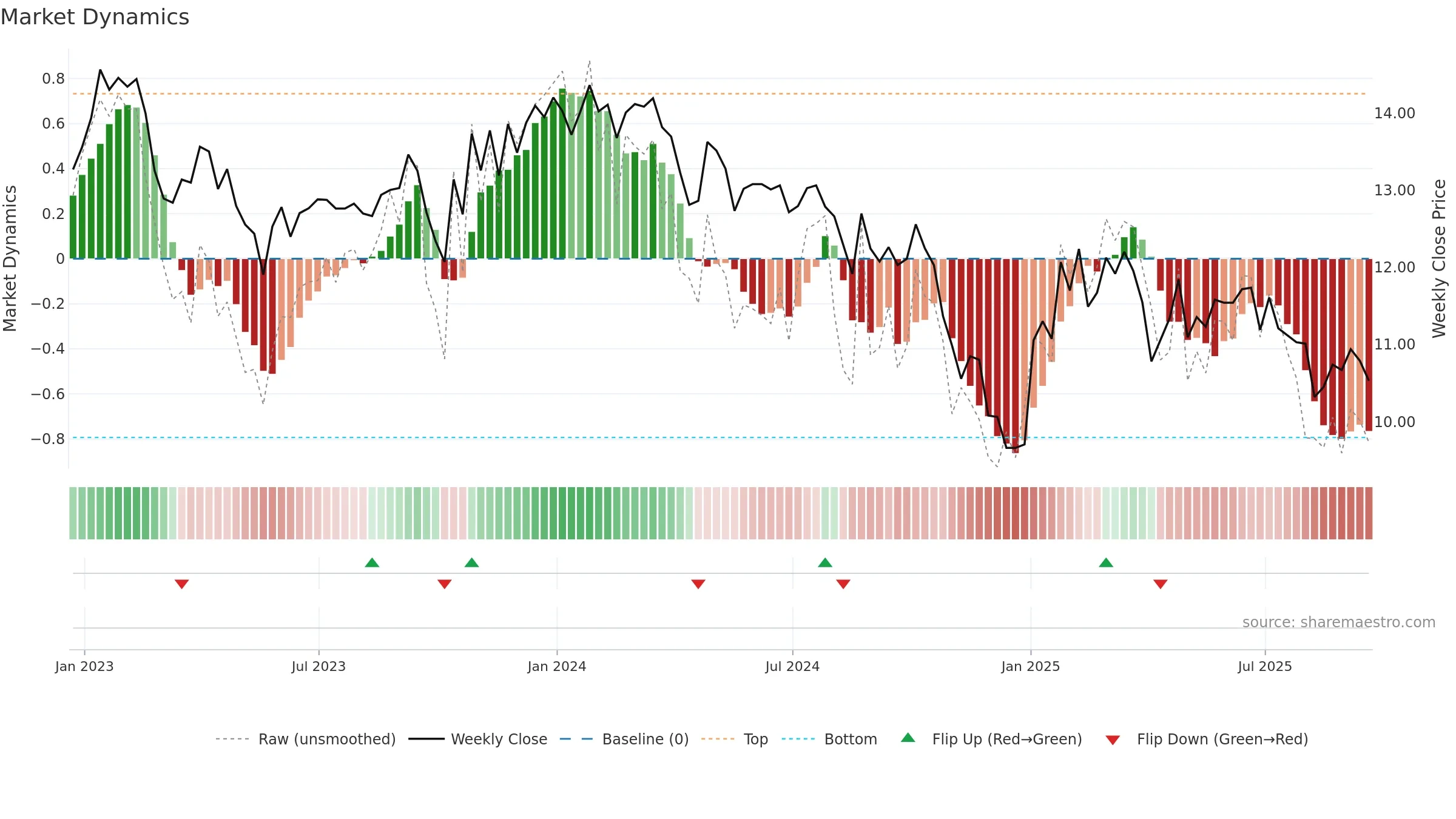

How to read this — Range-bound conditions; conviction is limited until a break or acceleration emerges.

Wait for a directional break or improving acceleration.

Conclusion

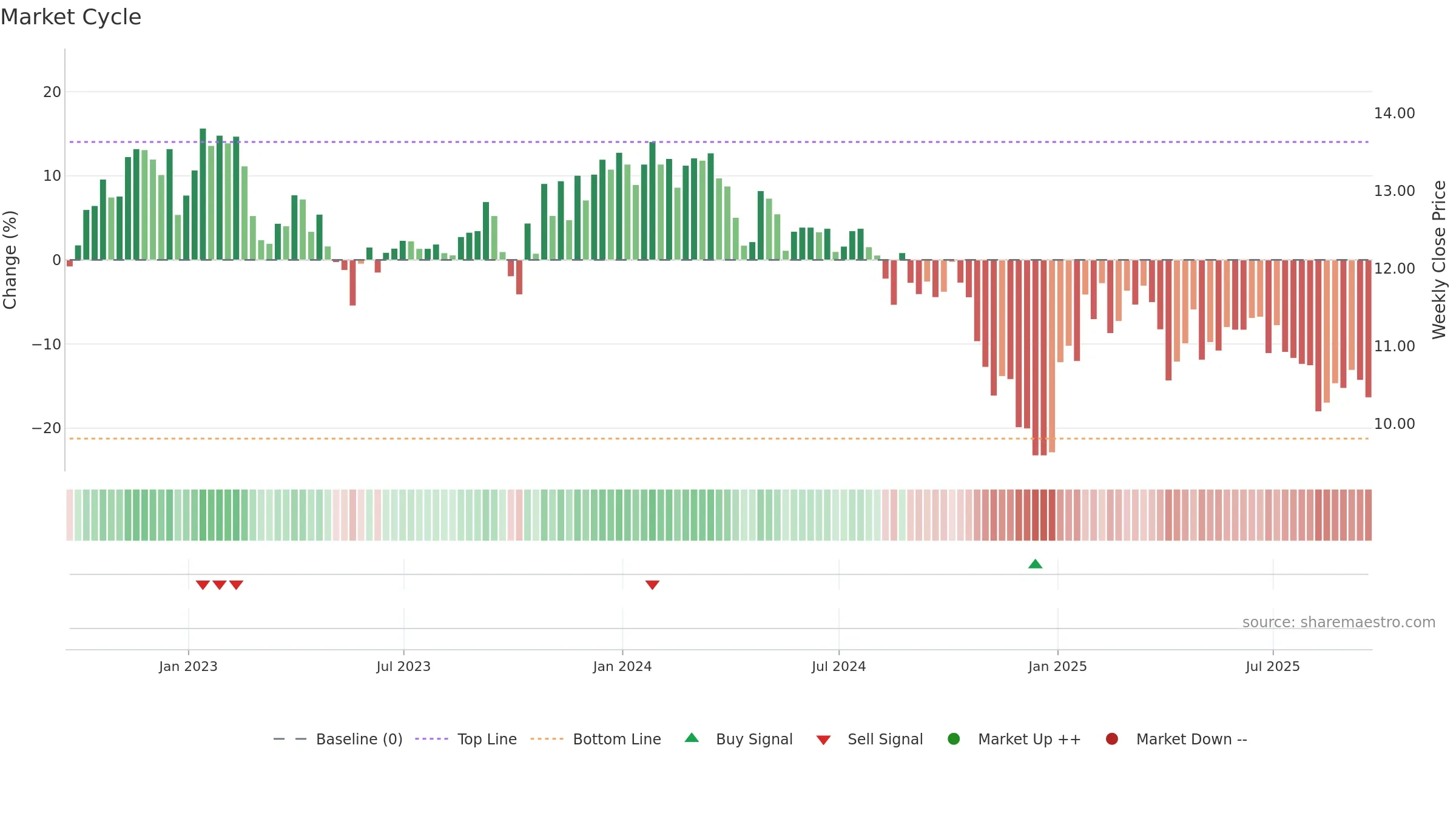

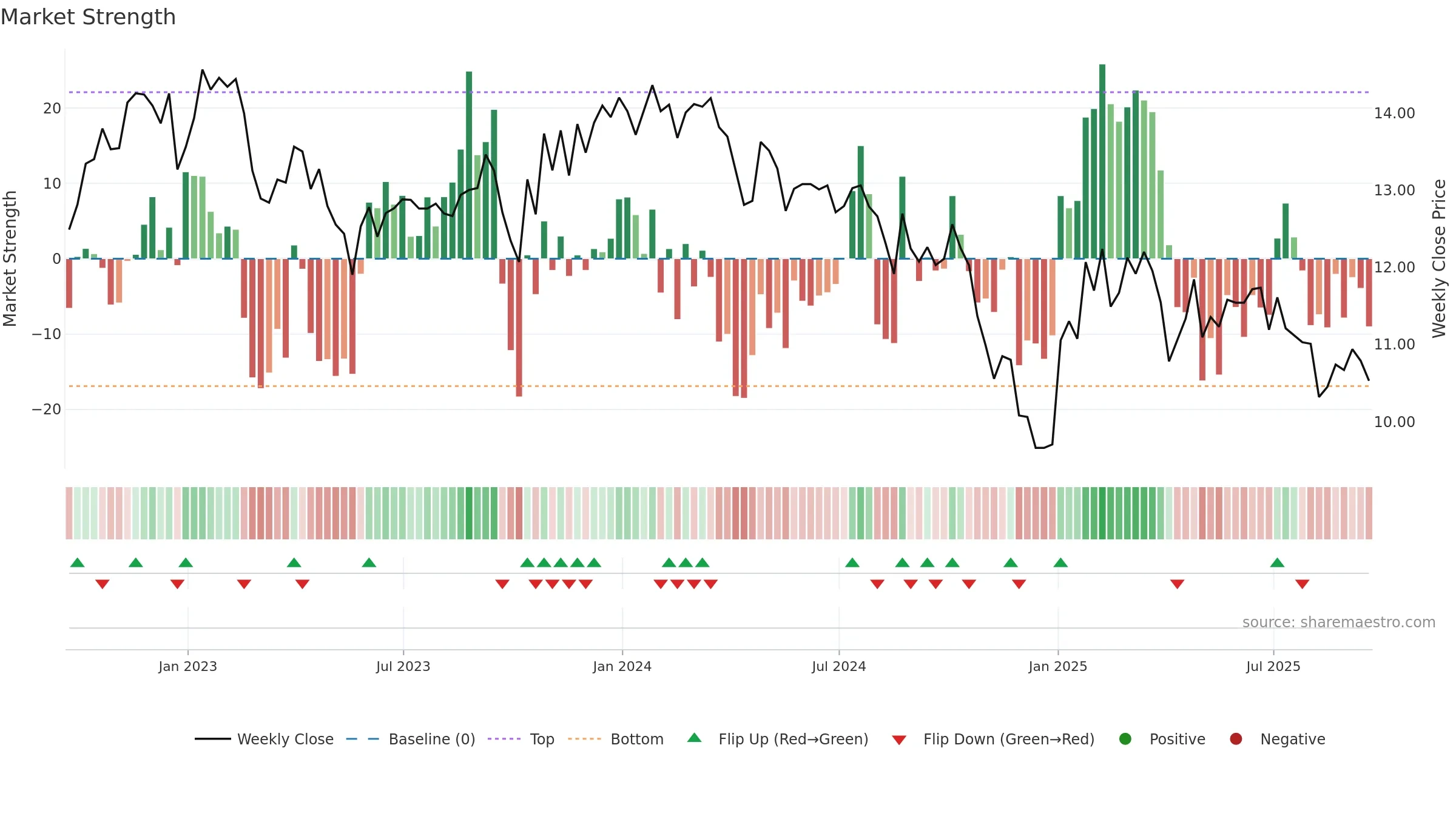

Negative setup. ★★☆☆☆ confidence. Price window: -4. Trend: Range / Neutral; gauge 22. In combination, liquidity confirms the move.

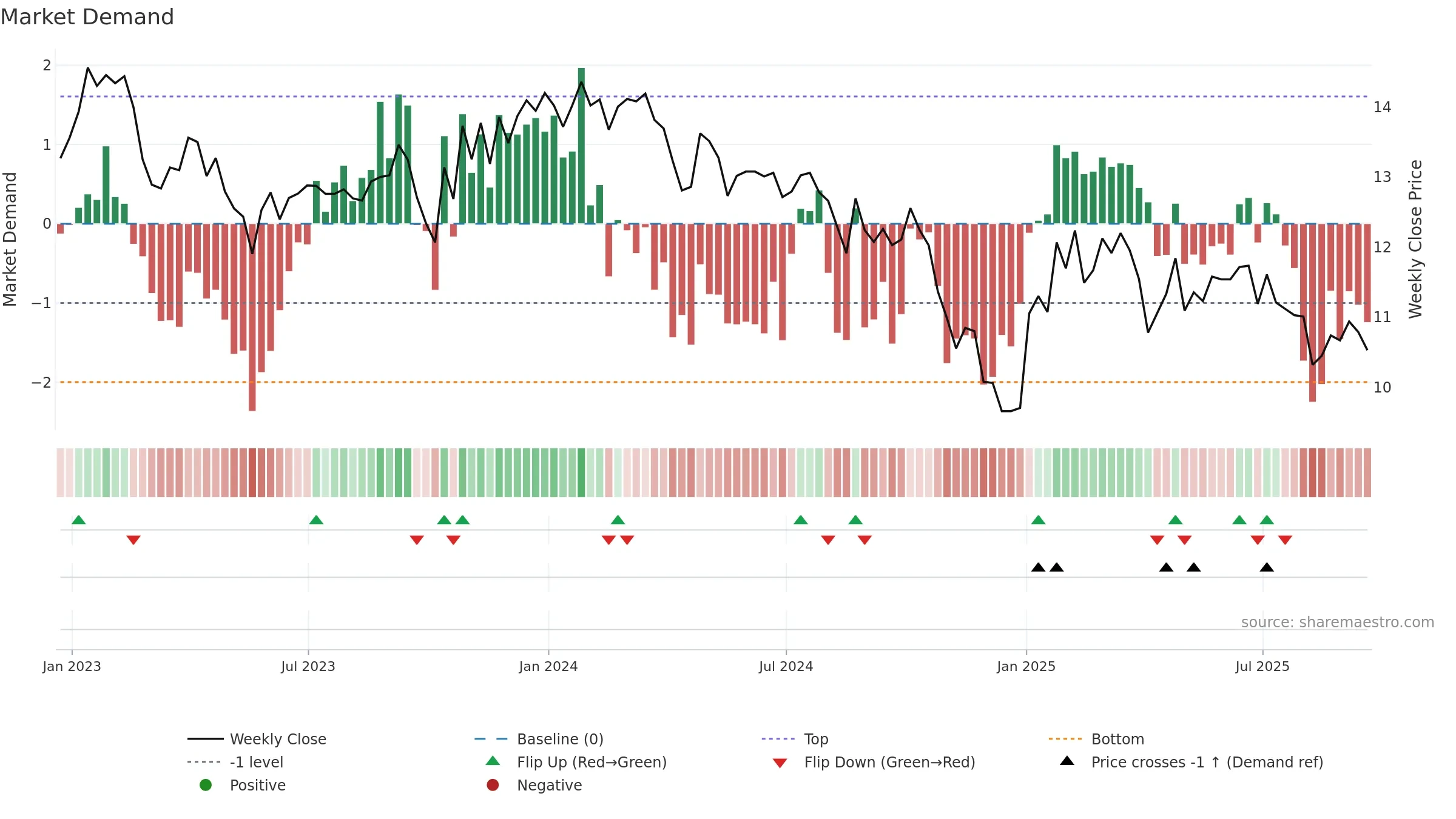

- Liquidity confirms the price trend

- Low return volatility supports durability

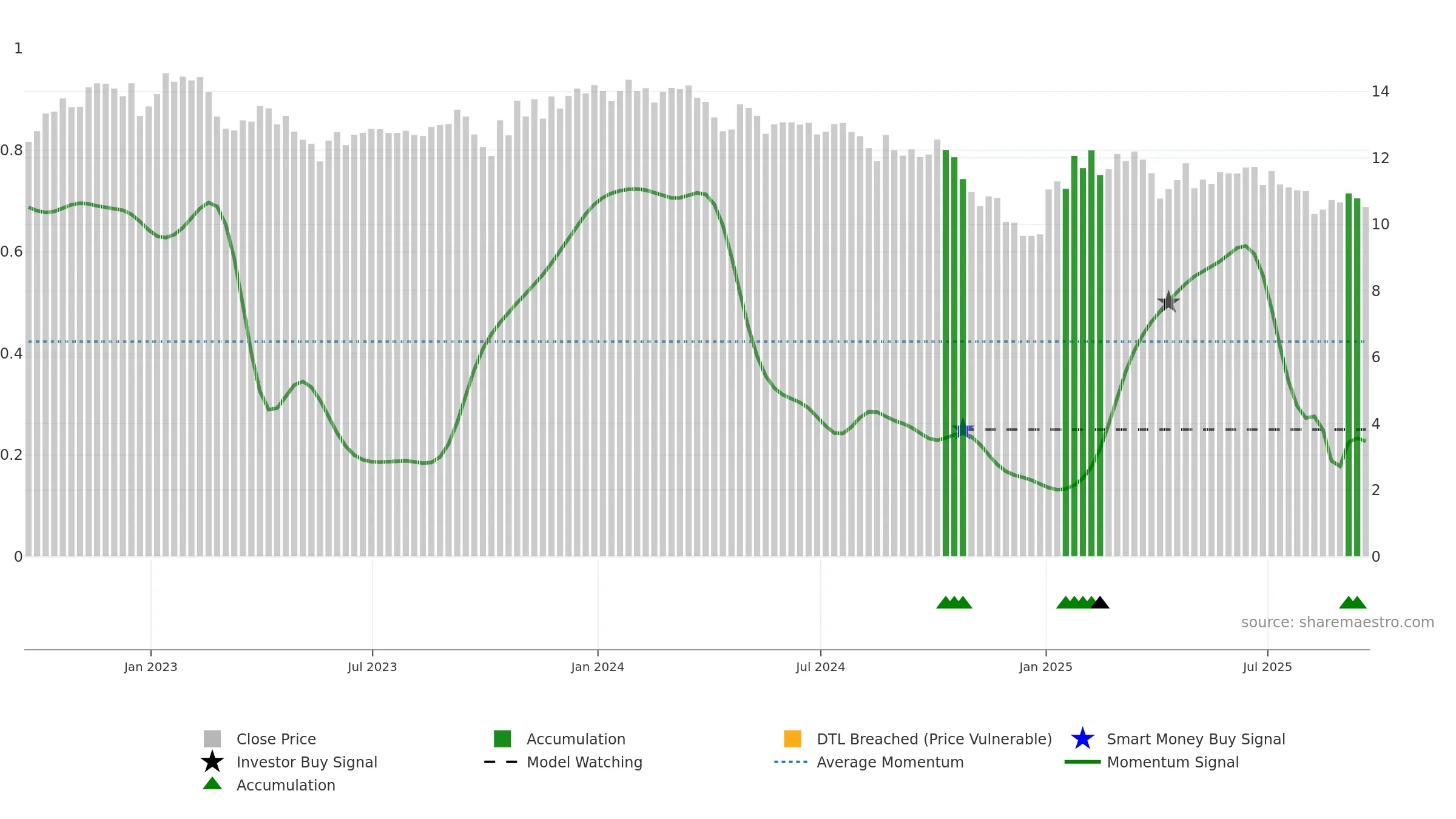

- Momentum is weak/falling

- Price is not above key averages

- Negative multi-week performance

Why: Price window -4.36% over 8w. Close is -4.36% below the prior-window high. Return volatility 0.85%. Volume trend rising. Liquidity convergence with price. Trend state range / neutral. Low-regime (≤0.25) upticks 2/5 (40.0%) • Distributing. Momentum bearish and falling.

Tip: Most metrics include a hover tooltip where they appear in the report.