Mirza International Limited

MIRZAINT NSE

Weekly Report

Mirza International Limited closed at 41.2400 (-3.71% WoW) . Data window ends Mon, 22 Sep 2025.

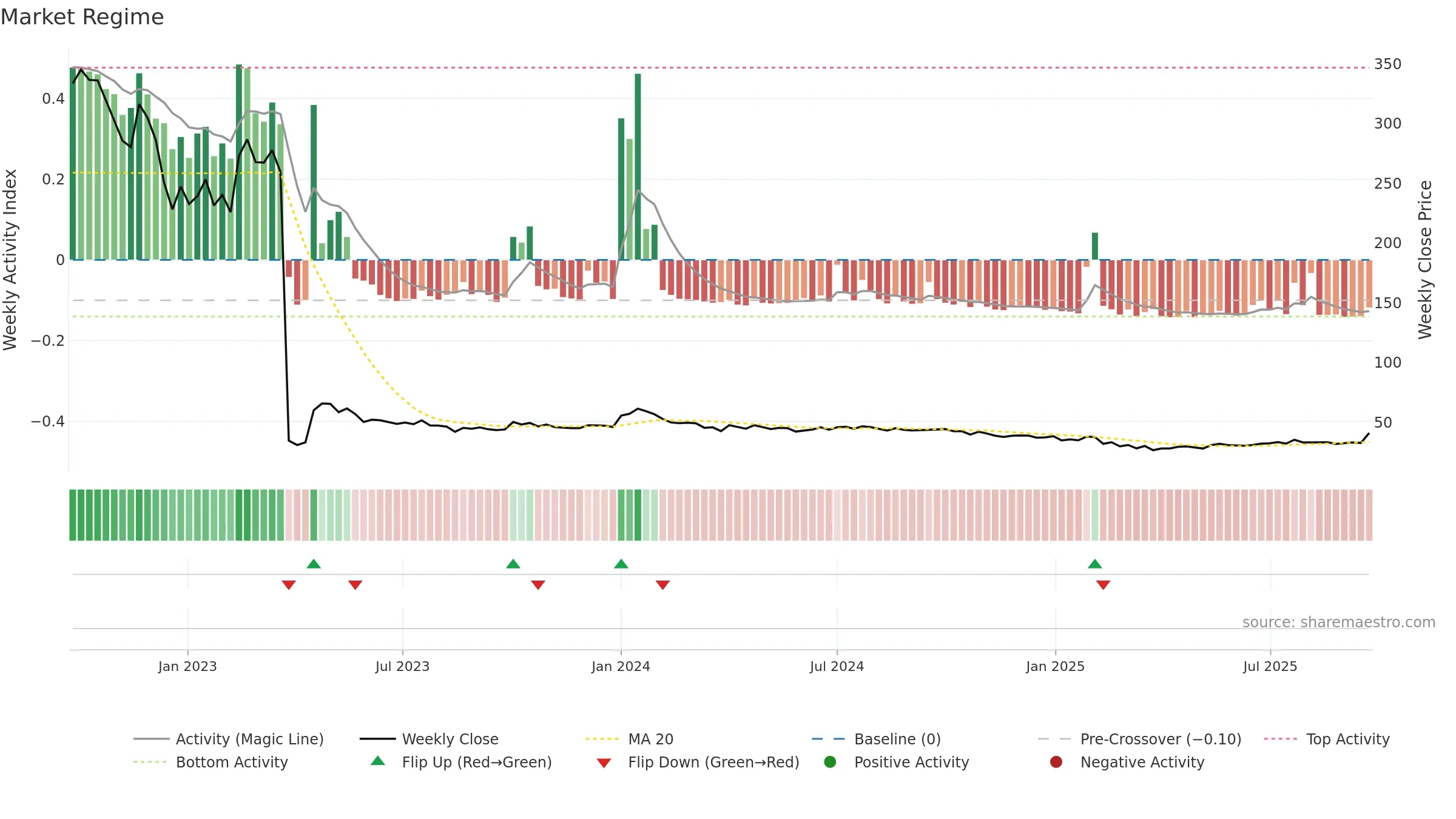

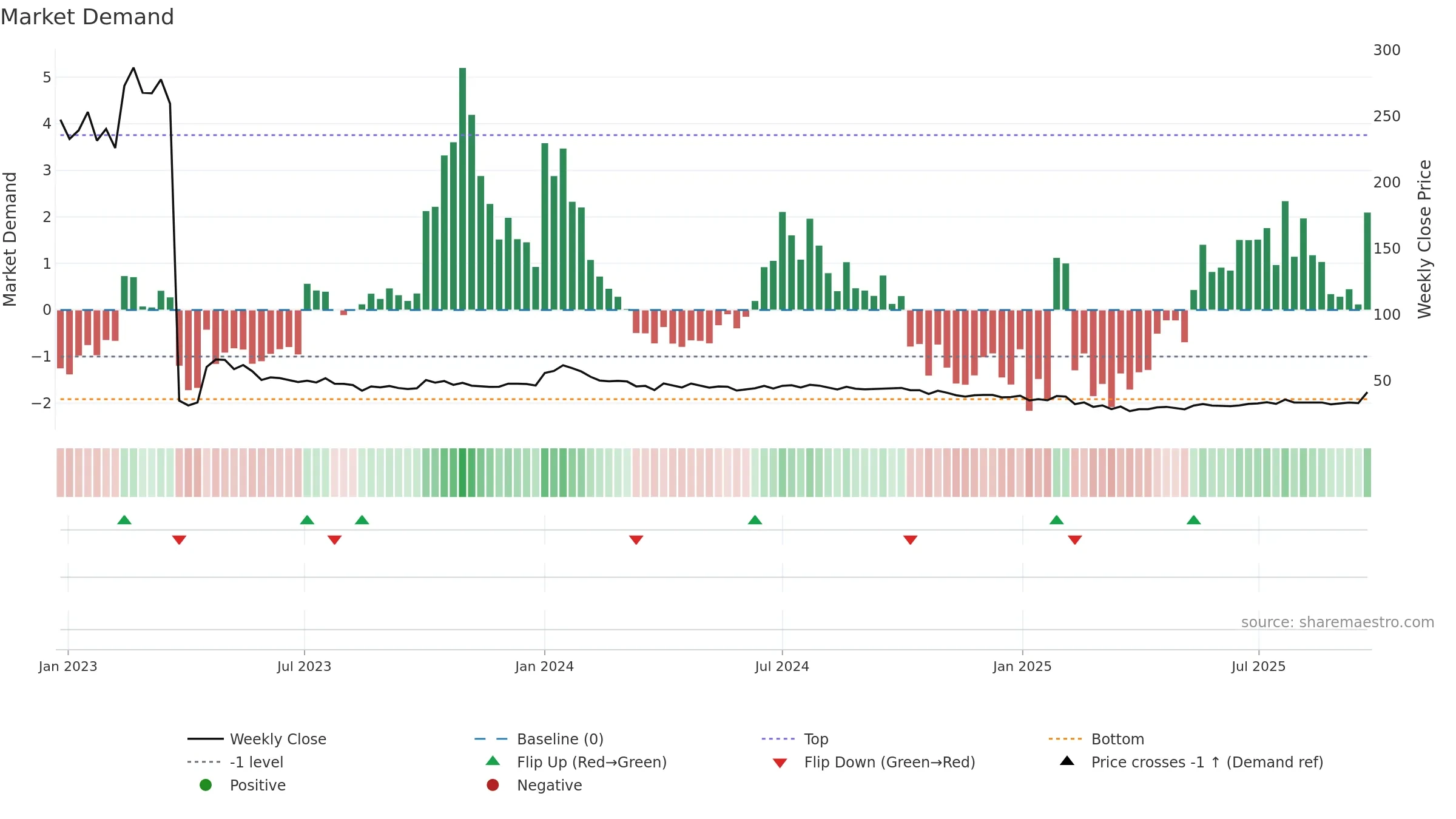

How to read this — Price slope is upward, indicating persistent buying over the window. Volume trend diverges from price — watch for fatigue or rotation. Returns are negatively correlated with volume — strength may come on lighter activity. Constructive MA stack supports the up-drift; pullbacks may find support at the 8–13 week region. Fresh short-term crossover improves near-term tone. Price holds above key averages, indicating constructive participation.

Up-slope supports buying interest; pullbacks may be contained if activity stays firm. Because liquidity isn’t confirming, prefer evidence of fresh demand before chasing moves.

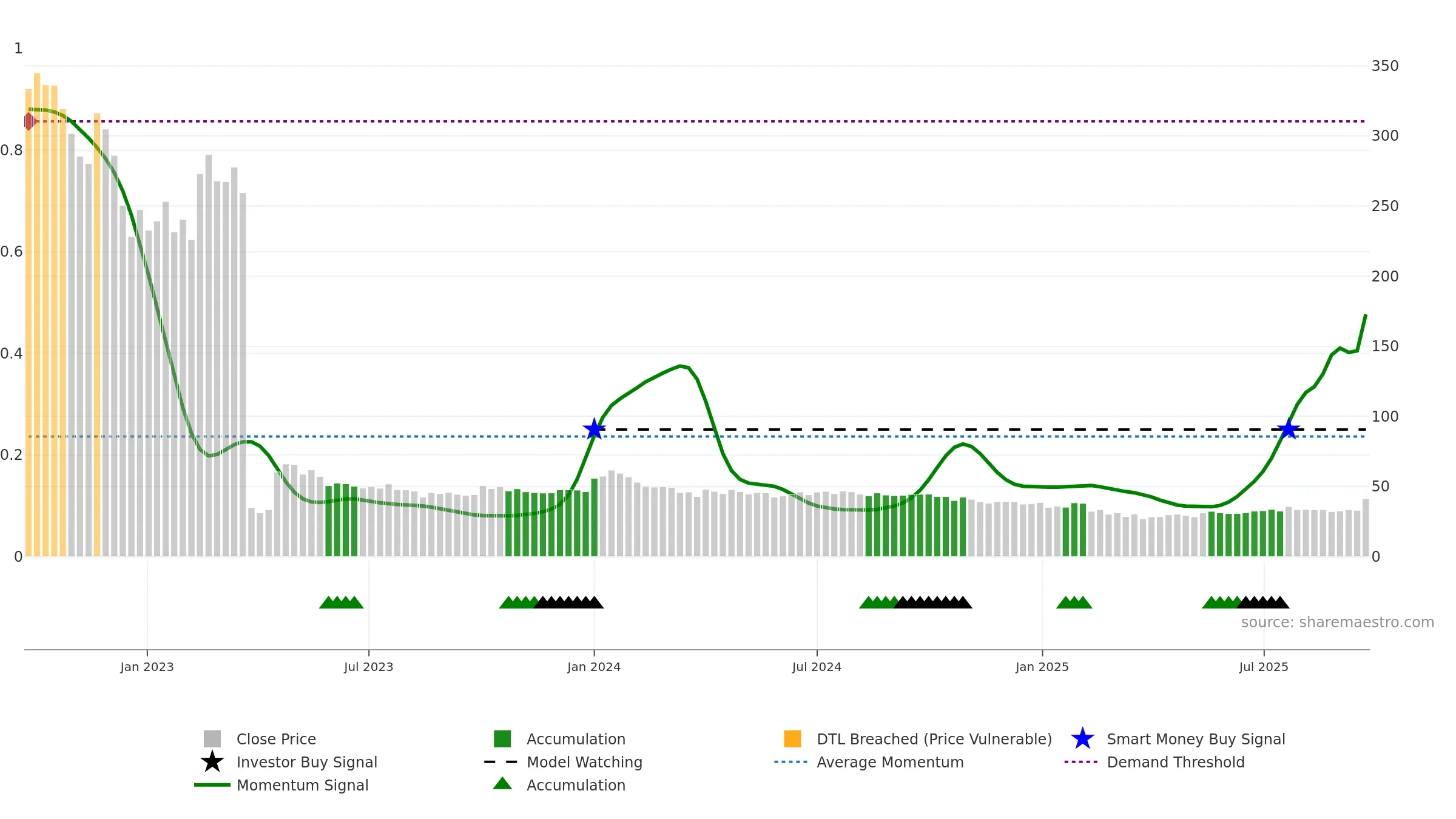

Gauge maps the trend signal to a 0–100 scale.

How to read this — Range-bound conditions; conviction is limited until a break or acceleration emerges.

Wait for a directional break or improving acceleration.

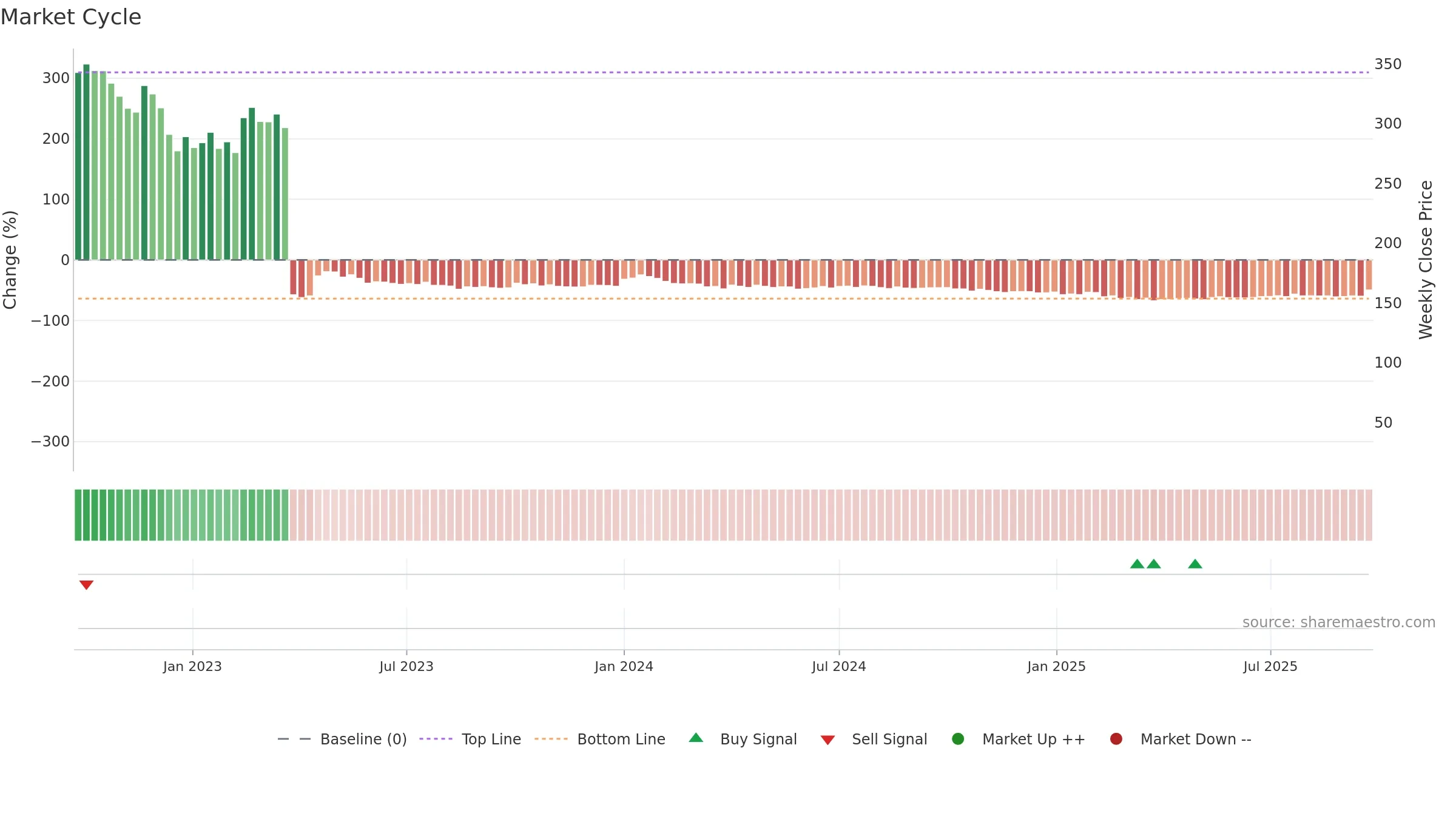

The flag is positive: favourable upside skew with supportive conditions.

Conclusion

Positive setup. ★★★★☆ confidence. Price window: 22. Trend: Range / Neutral; gauge 47. In combination, liquidity diverges from price.

- Price holds above 8w & 26w averages

- Constructive moving-average stack

- Solid multi-week performance

- Liquidity diverges from price

Why: Price window 22.96% over 8w. Close is 22.96% above the prior-window high. Volume trend falling. Liquidity divergence with price. Trend state range / neutral. MA stack constructive. 4–8w crossover bullish. Momentum neutral and rising. Valuation stance positive.

Tip: Most metrics include a hover tooltip where they appear in the report.