Weekly Report

Avantis US Small Cap Equity ETF closed at 57.7000 (0.54% WoW) . Data window ends Mon, 15 Sep 2025.

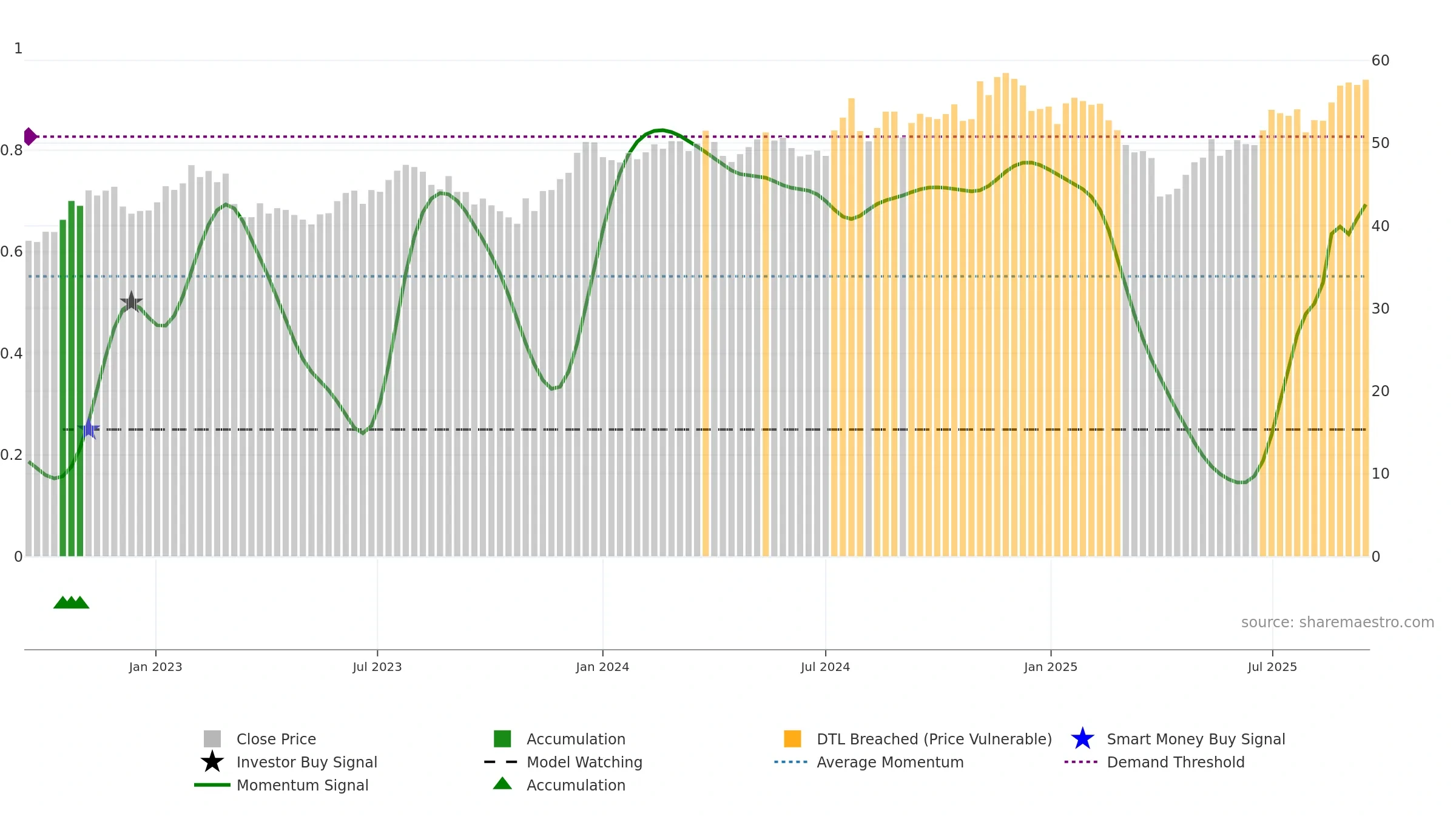

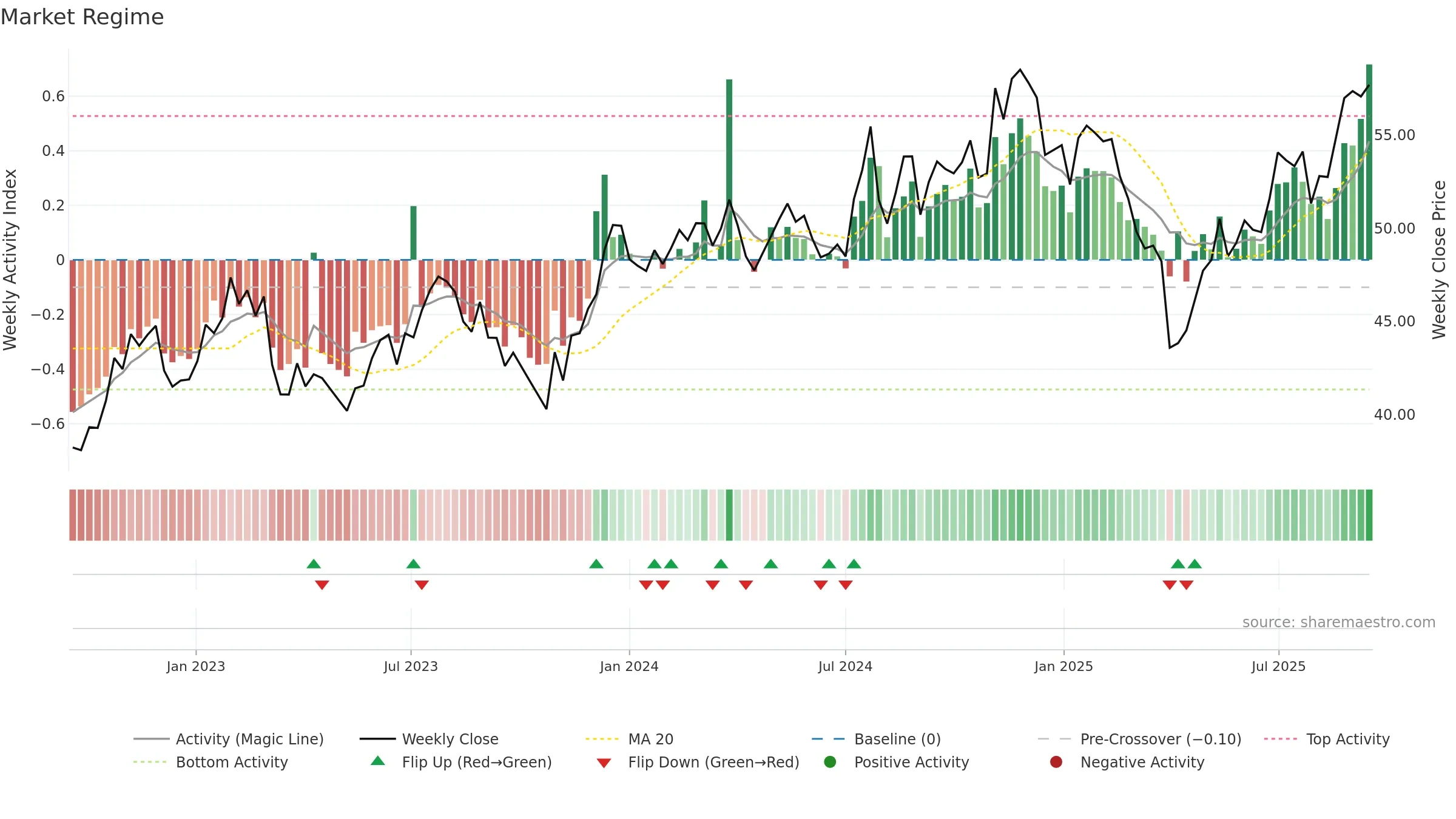

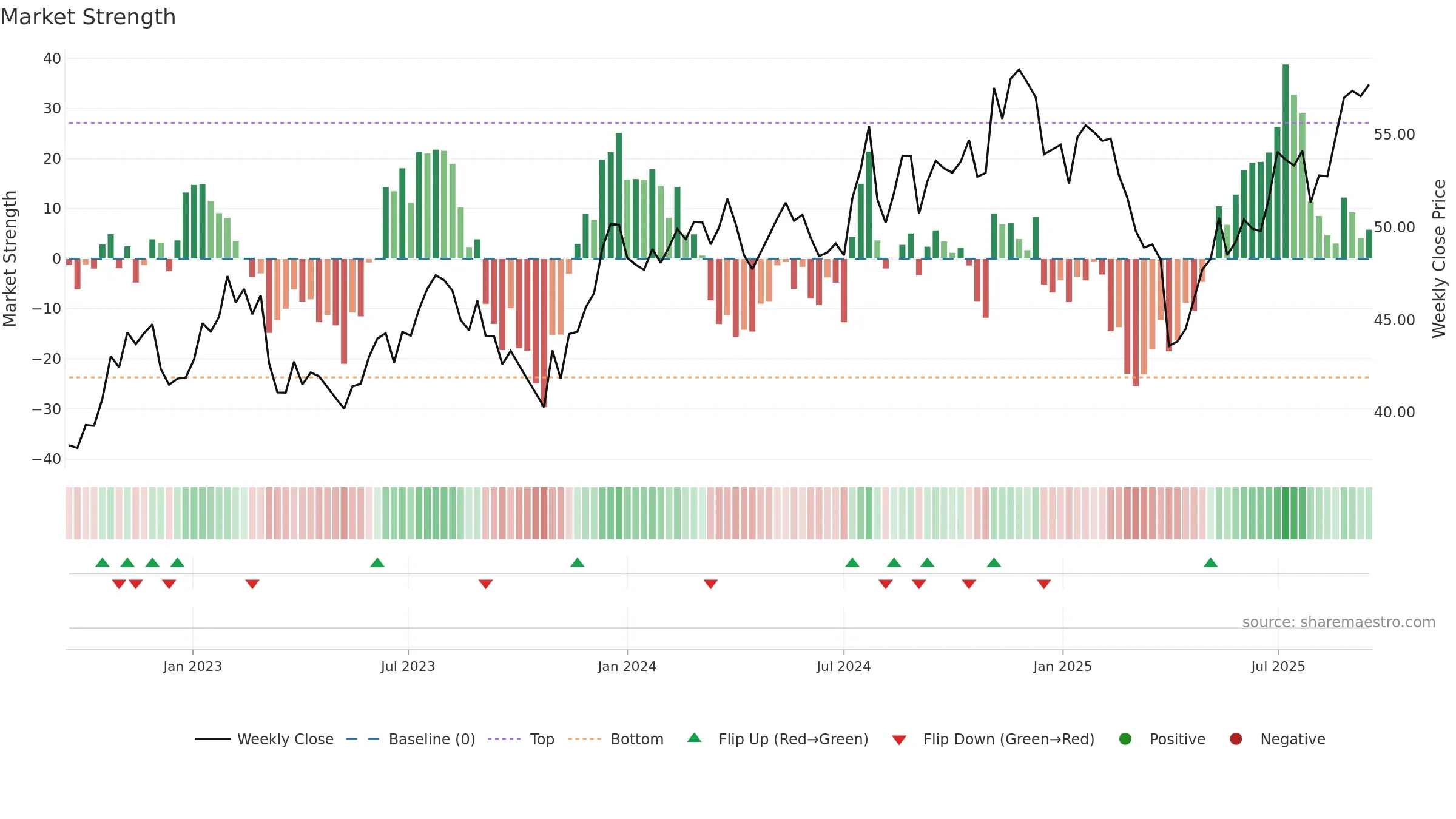

How to read this — Price slope is upward, indicating persistent buying over the window. Volume and price are moving in the same direction — a constructive confirmation. Accumulation weeks: 3; distribution weeks: 1. Constructive MA stack supports the up-drift; pullbacks may find support at the 8–13 week region. Price holds above key averages, indicating constructive participation.

Up-slope supports buying interest; pullbacks may be contained if activity stays firm.

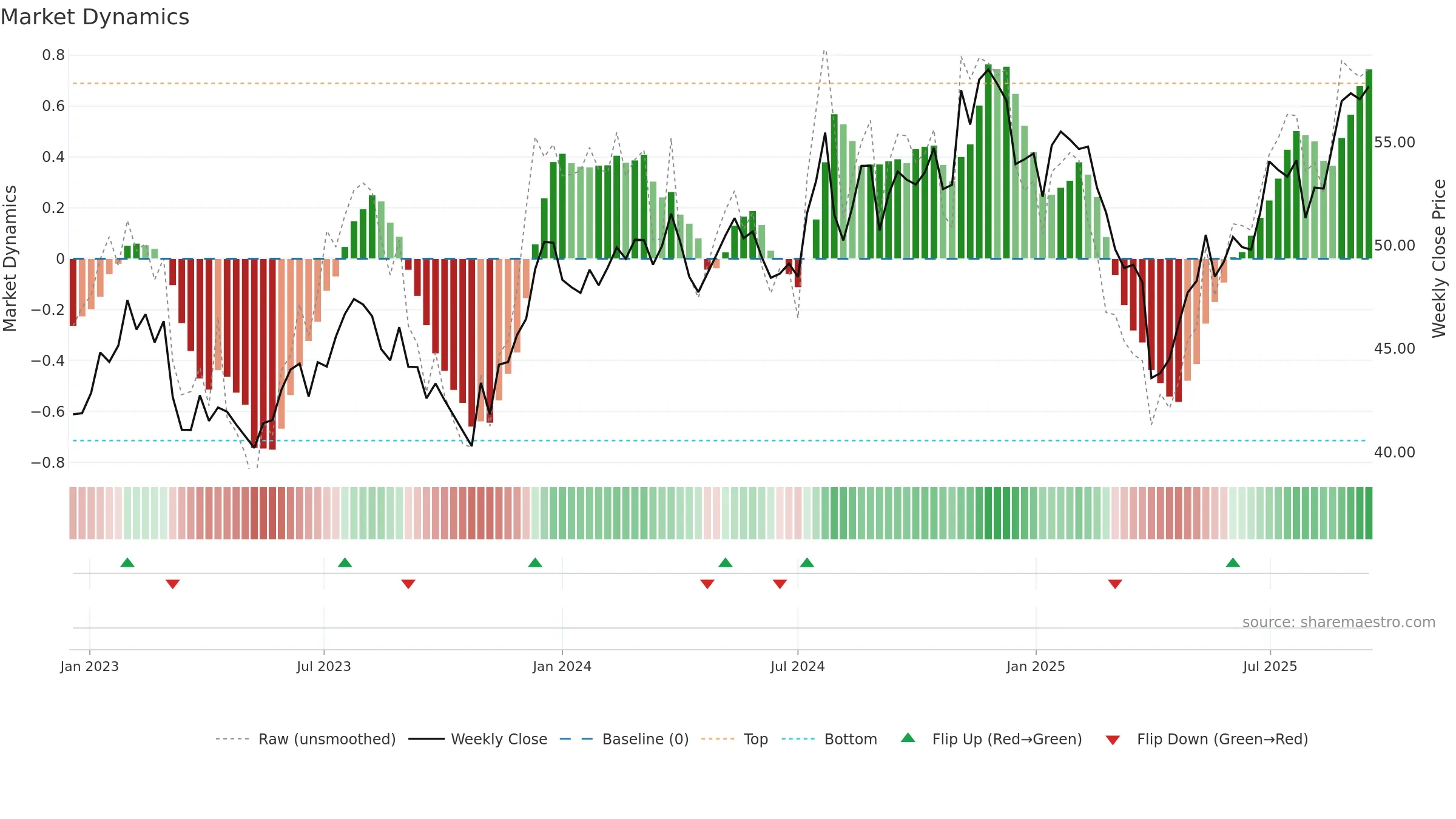

Gauge maps the trend signal to a 0–100 scale.

How to read this — Bullish gauge levels imply persistent upside pressure. A rising gauge shows momentum building rather than fading. Deceleration reduces the odds of persistence.

Constructive backdrop; dips are more likely to find support while the gauge stays high.

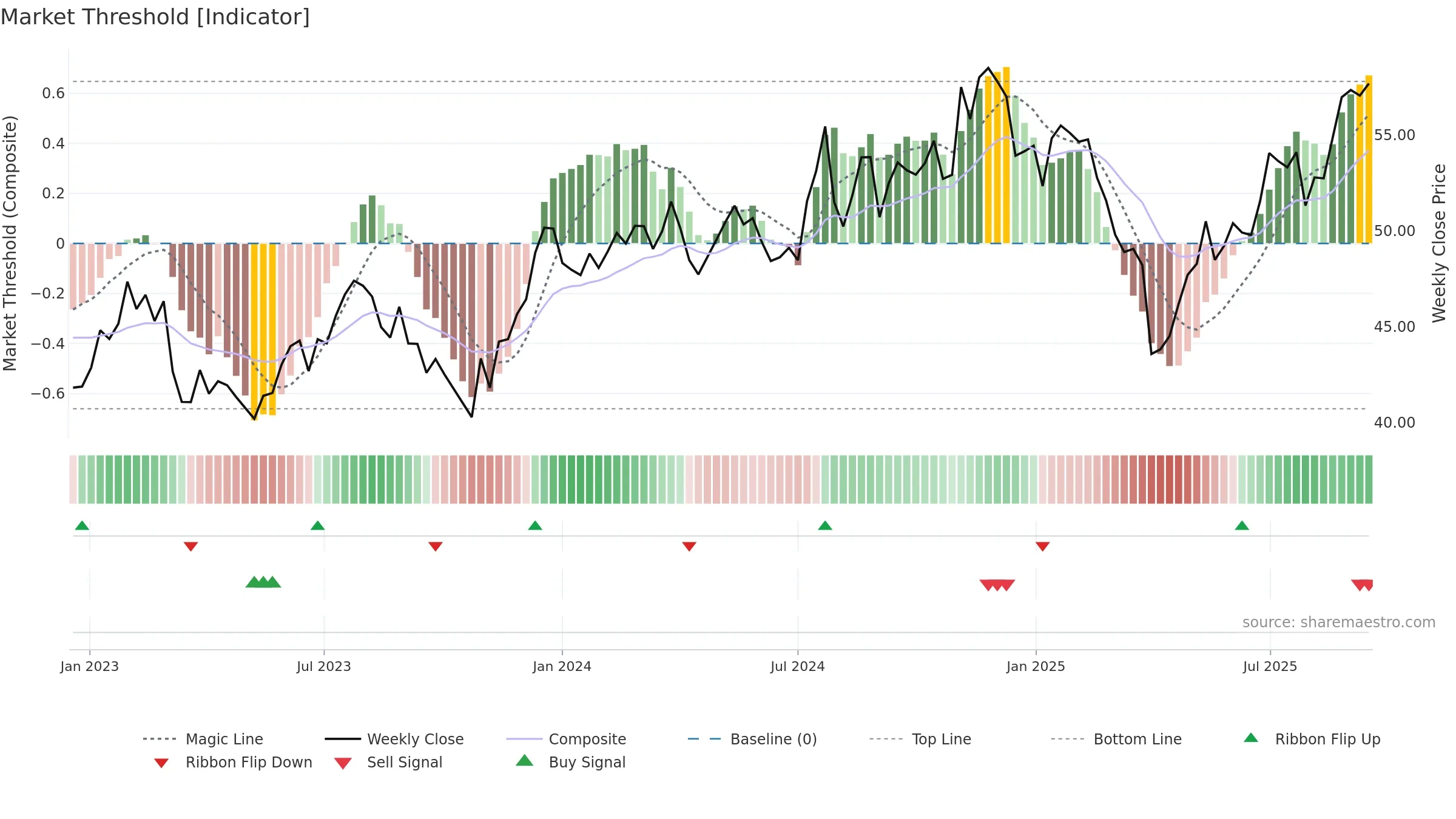

Conclusion

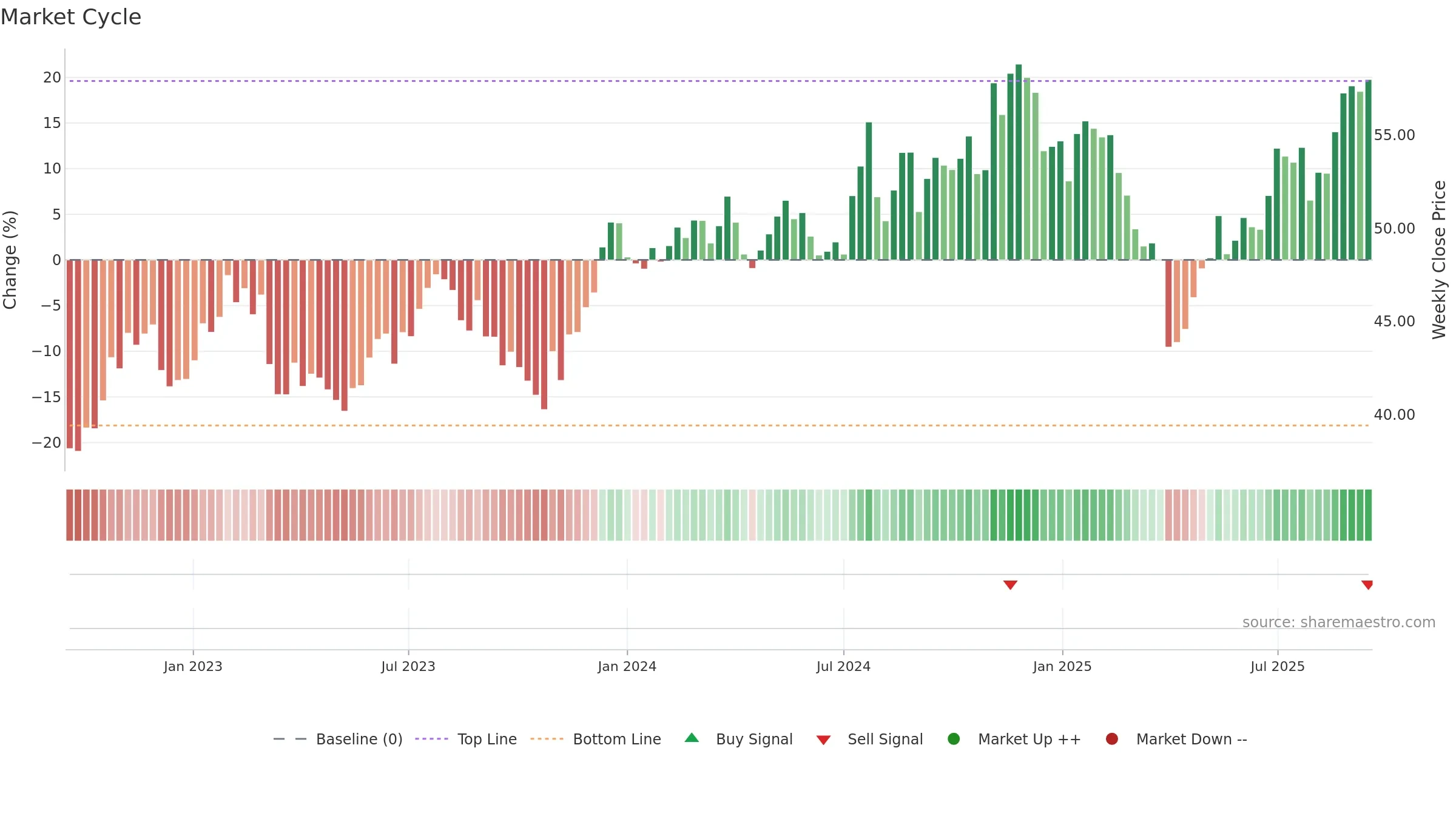

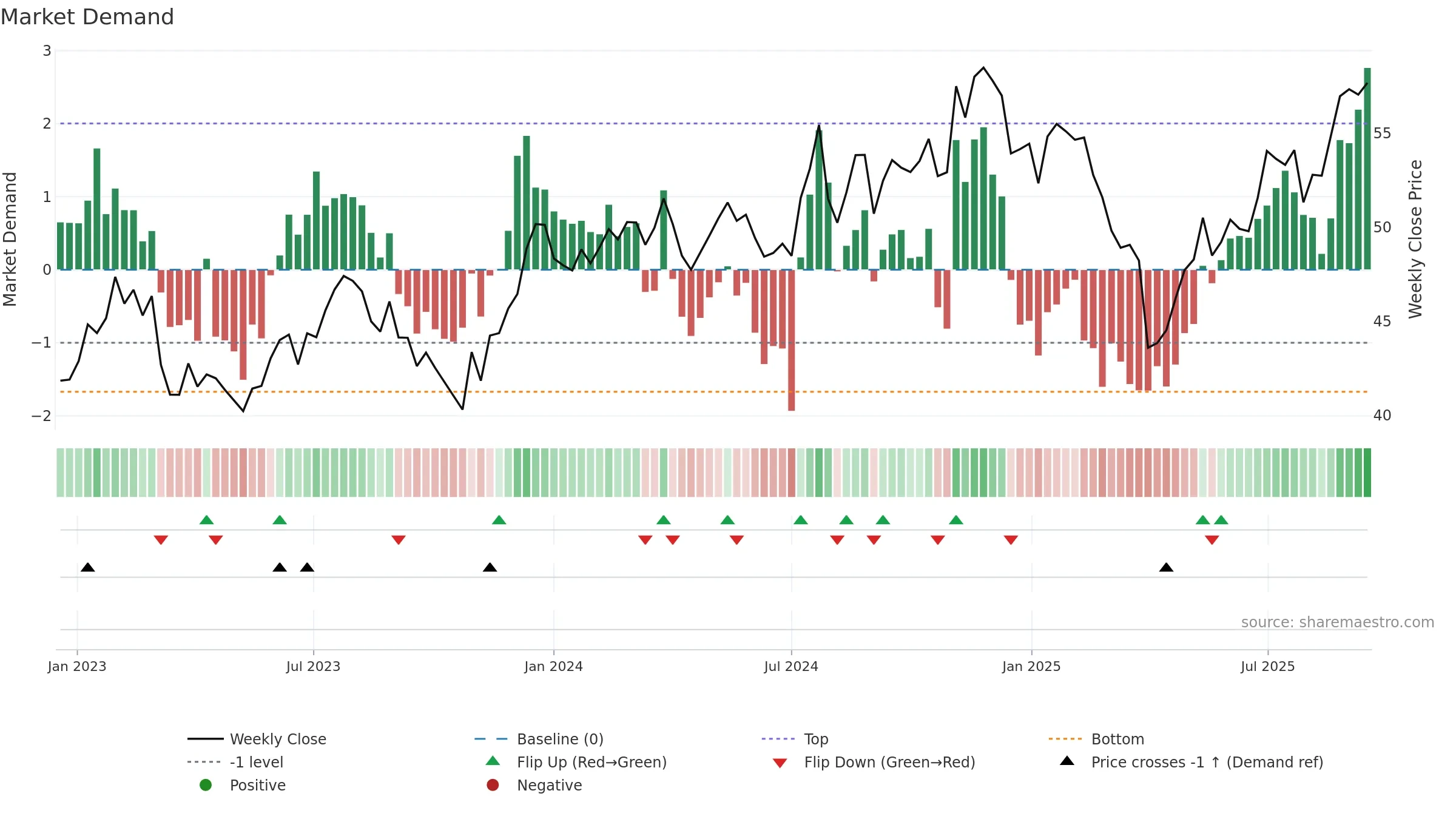

Positive setup. ★★★★★ confidence. Price window: 12. Trend: Bullish @ 84. In combination, liquidity confirms the move.

Why: Price window 12.41% over 8w. Close is 0.00% above the window high. Return volatility 2.25%. Volume trend rising. Liquidity convergence with price. Accumulation 3; distribution 1. MA stack constructive. Baseline deviation 0.19% (widening). Momentum bullish and rising. Acceleration decelerating. Gauge volatility normal.

Tip: Most metrics also include a hover tooltip where they appear in the report.