None

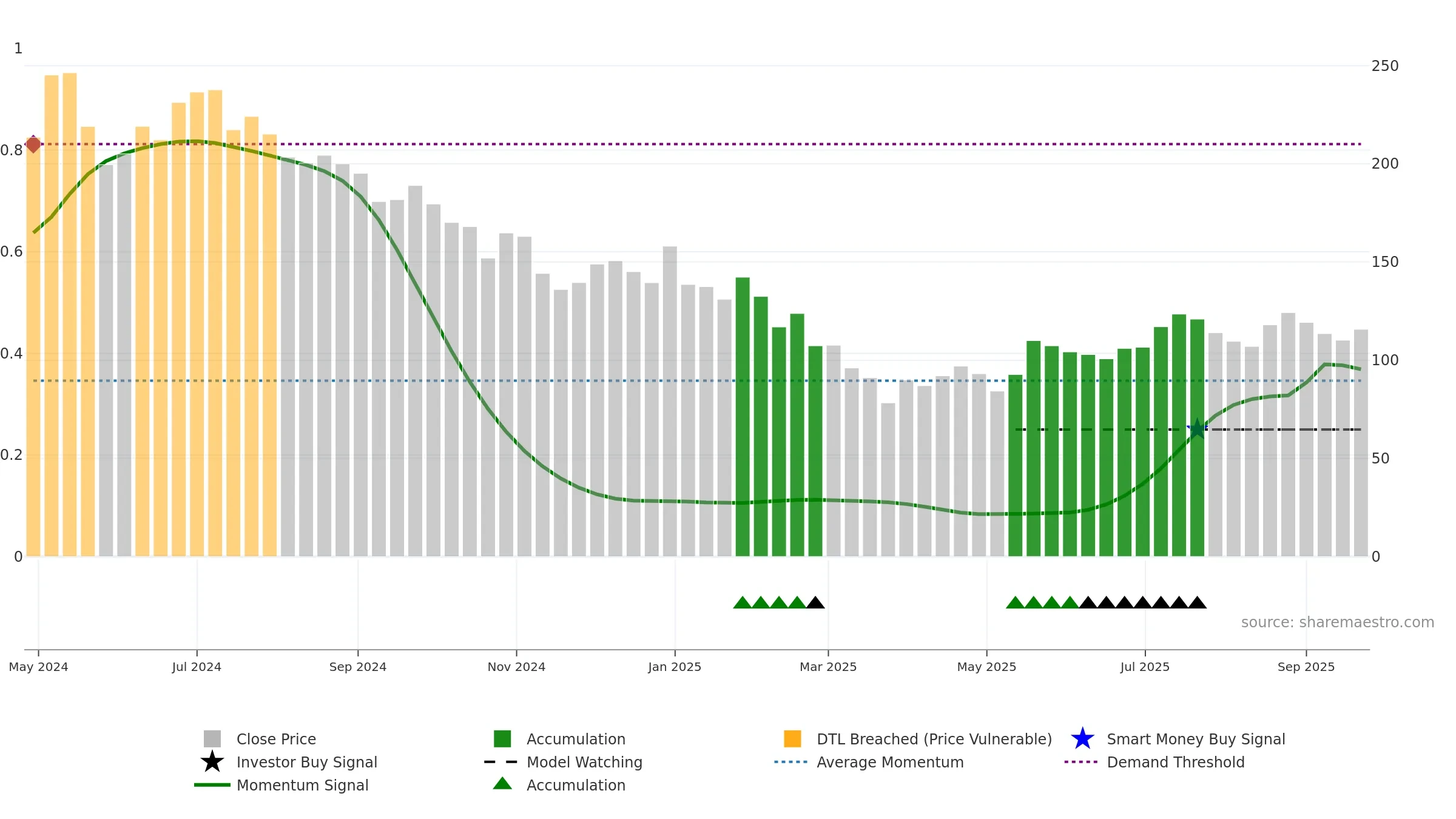

SADHAV NSE

Weekly Report

None closed at 115.7000 (2.71% WoW) . Data window ends Mon, 22 Sep 2025.

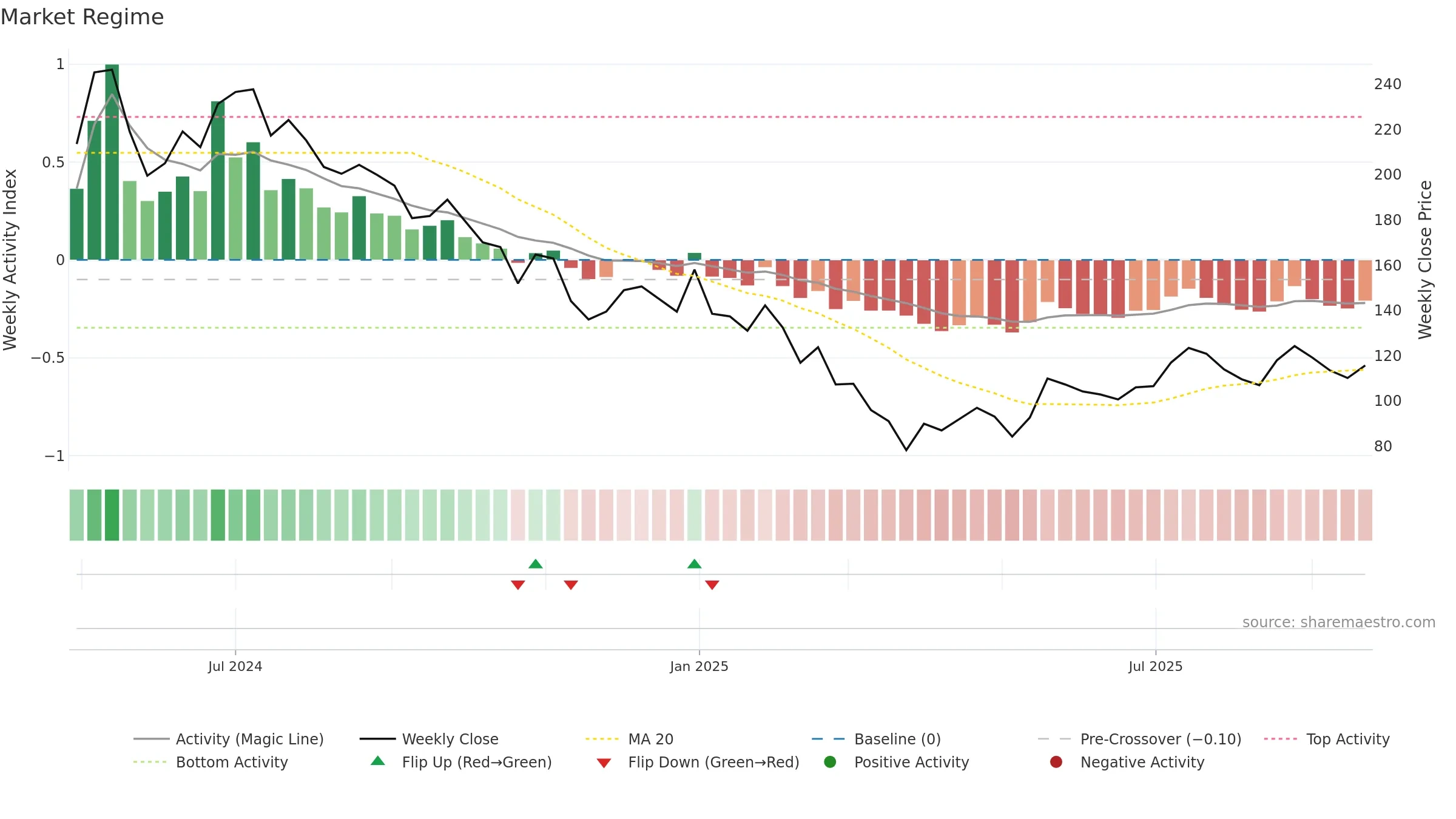

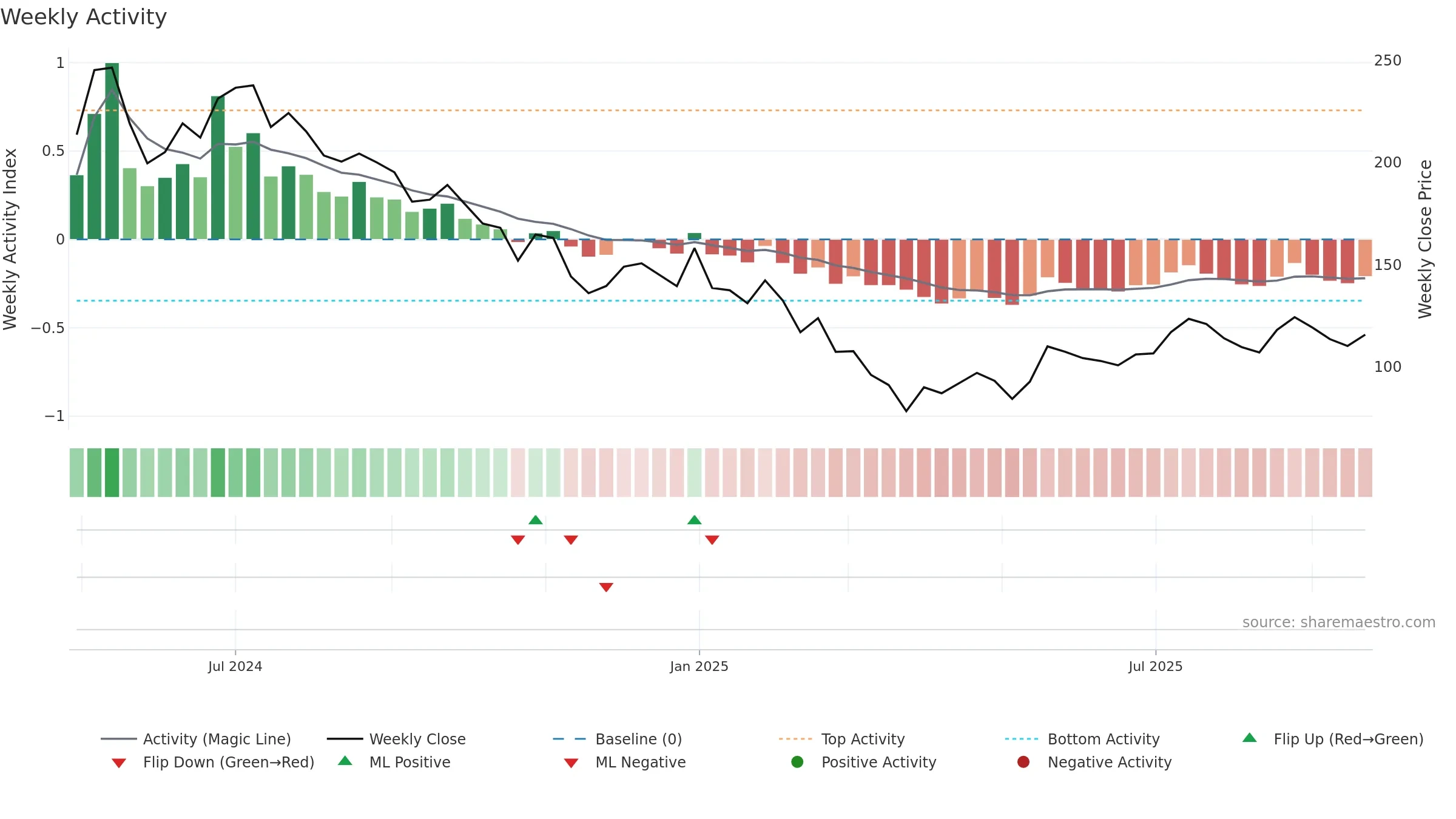

How to read this — Price slope is upward, indicating persistent buying over the window. Elevated weekly volatility increases whipsaw risk. Volume and price are moving in the same direction — a constructive confirmation. Fresh short-term downside crossover weakens near-term tone. Price holds above key averages, indicating constructive participation.

Up-slope supports buying interest; pullbacks may be contained if activity stays firm.

Gauge maps the trend signal to a 0–100 scale.

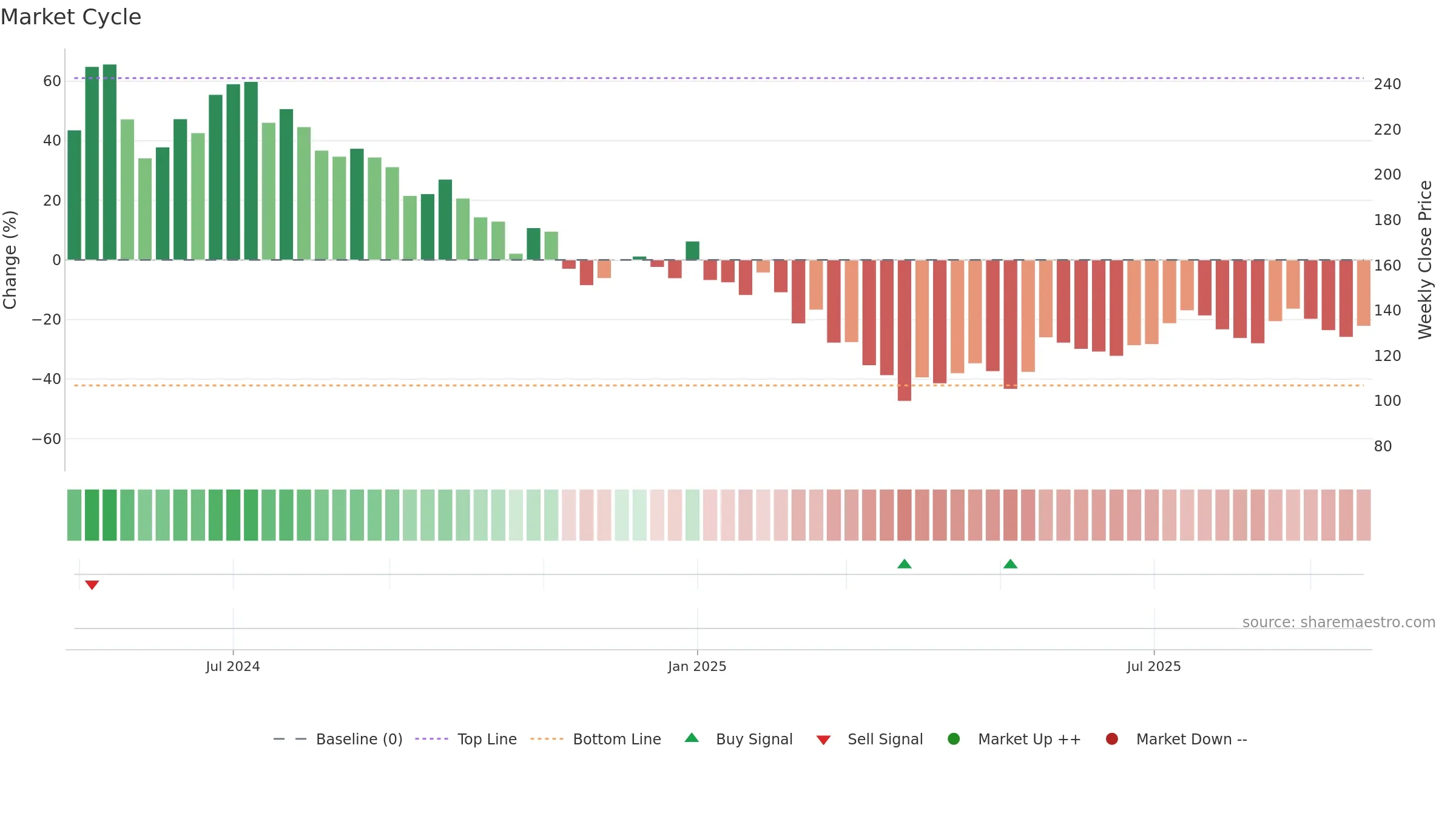

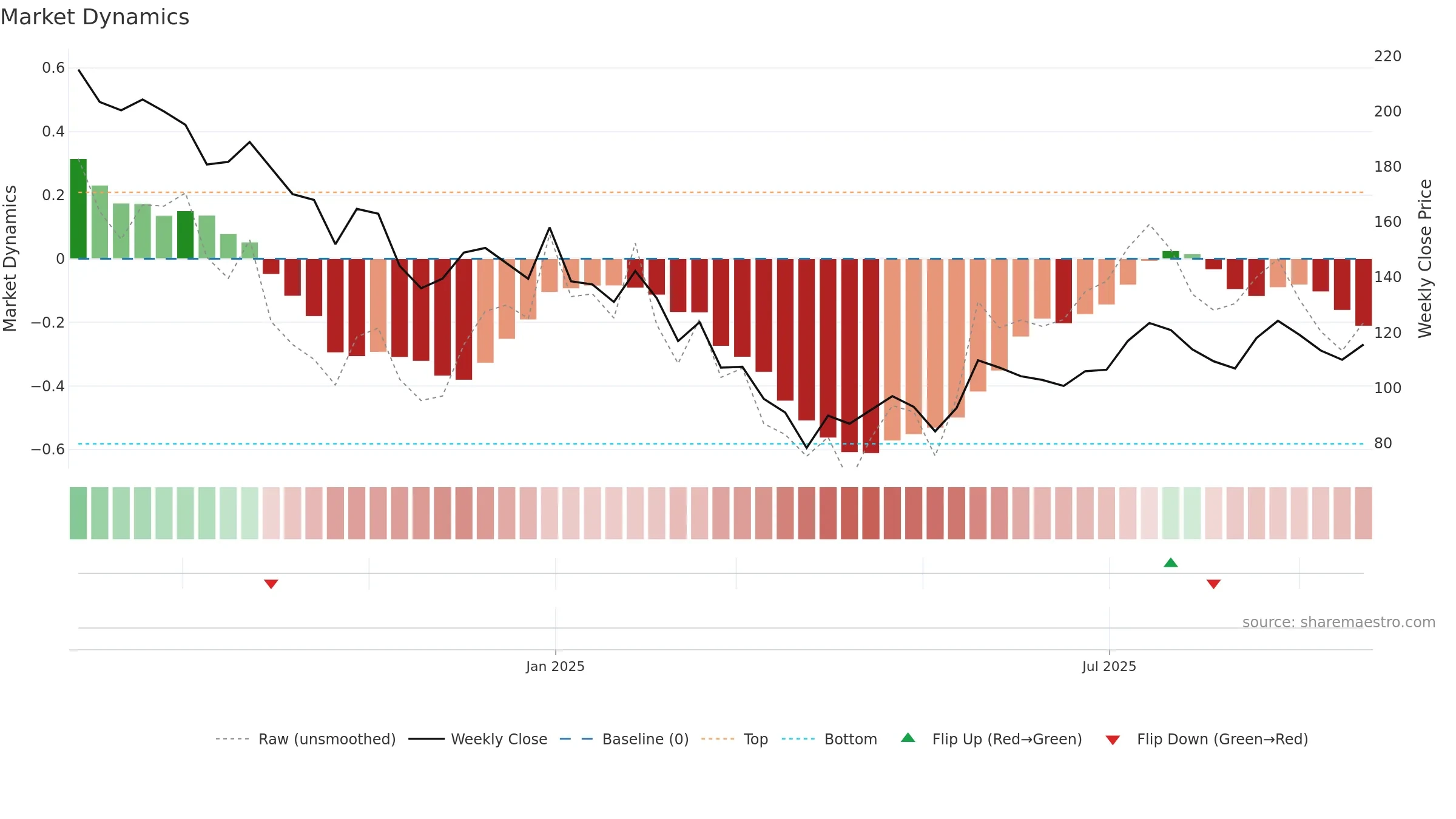

How to read this — Range-bound conditions; conviction is limited until a break or acceleration emerges.

Wait for a directional break or improving acceleration.

Conclusion

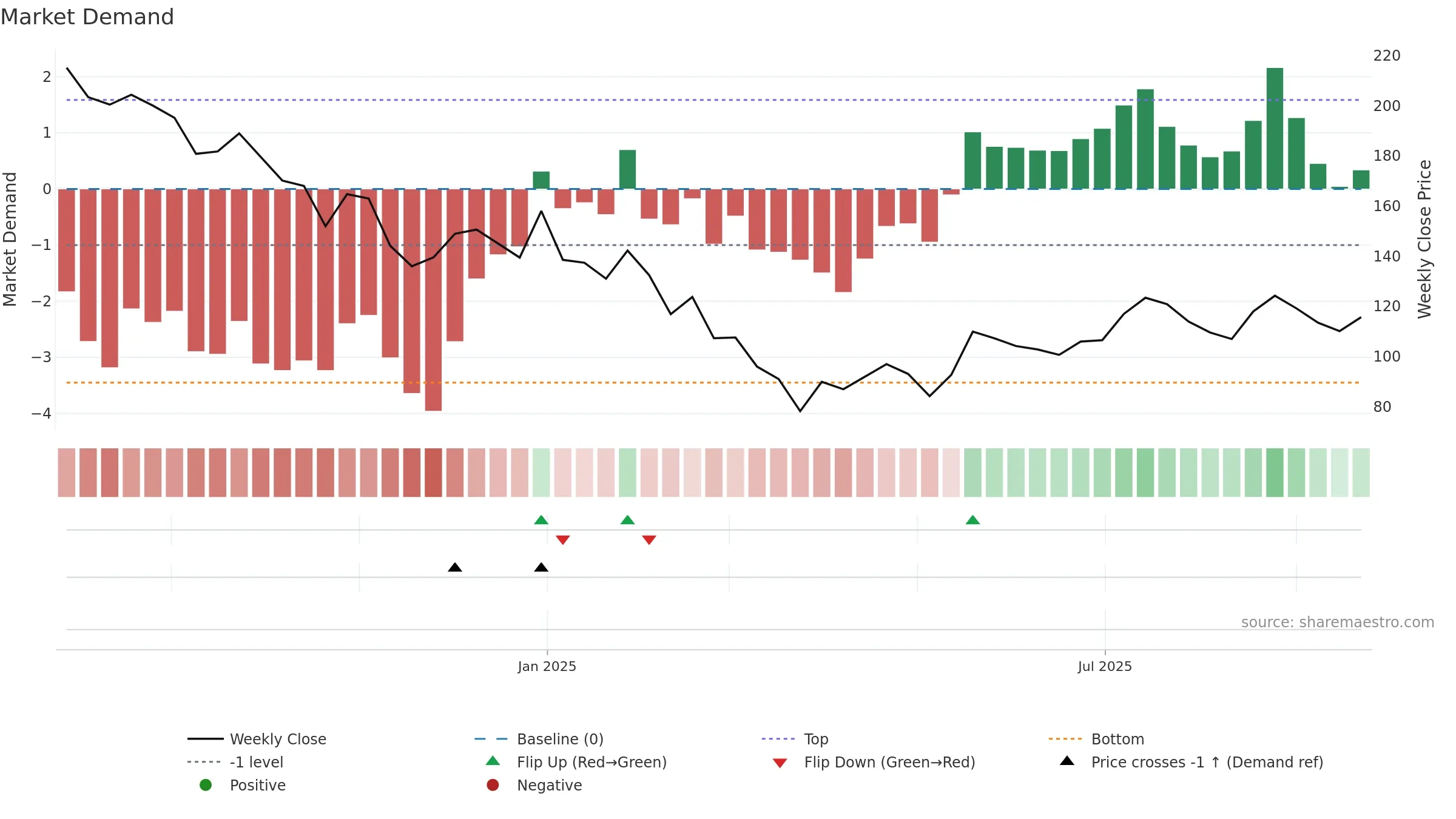

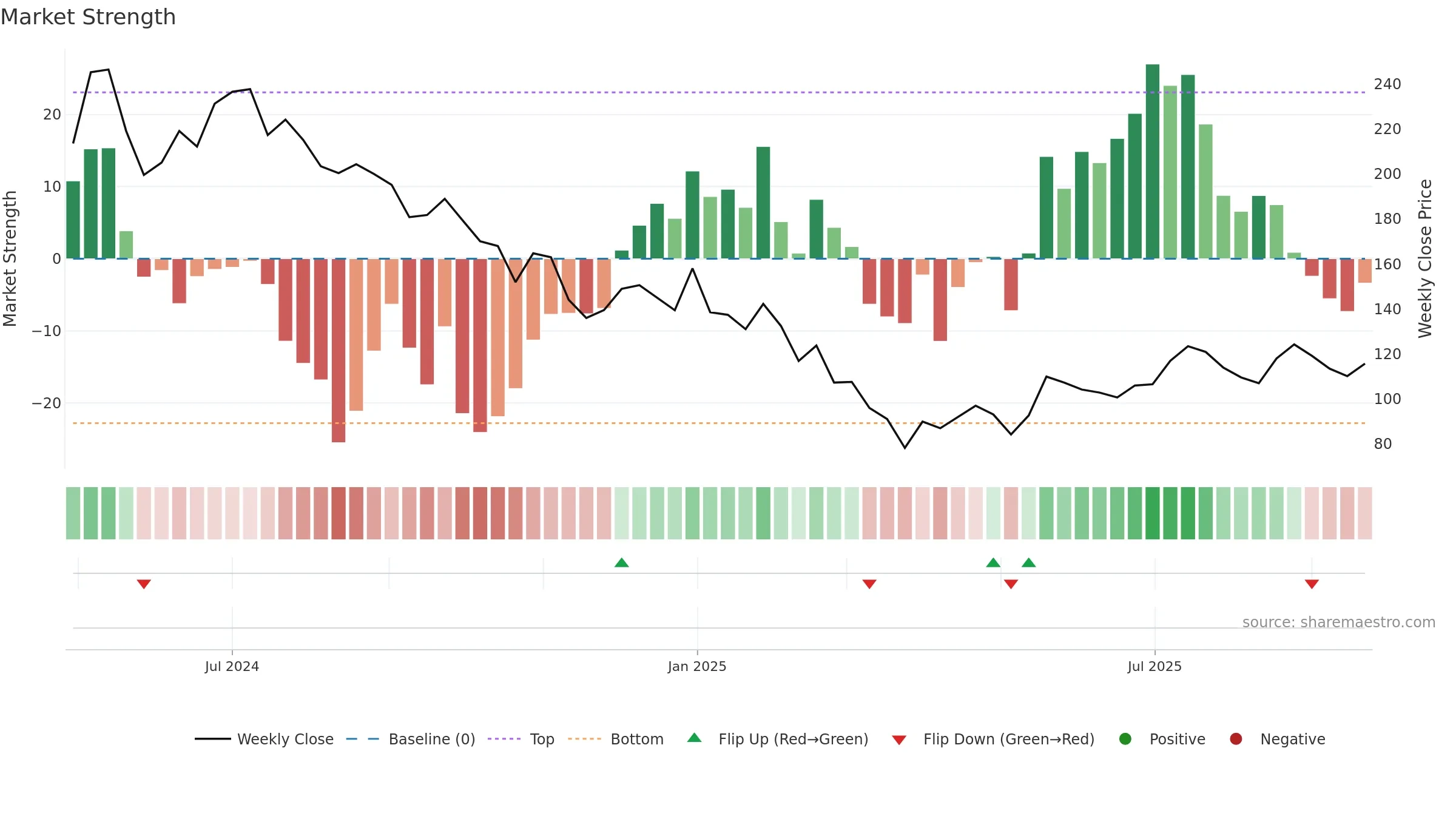

Neutral setup. ★★★☆☆ confidence. Price window: 5. Trend: Range / Neutral; gauge 36. In combination, liquidity confirms the move.

- Price holds above 8w & 26w averages

- Liquidity confirms the price trend

- Momentum is weak/falling

- High return volatility raises whipsaw risk

Why: Price window 5.57% over 8w. Close is -6.88% below the prior-window high. Return volatility 4.49%. Volume trend rising. Liquidity convergence with price. Trend state range / neutral. 4–8w crossover bearish. Momentum bearish and rising.

Tip: Most metrics include a hover tooltip where they appear in the report.