PNC Infratech Limited

PNCINFRA NSE

Weekly Summary

PNC Infratech Limited closed at 307.2477 (-3.04% WoW) . Data window ends Mon, 22 Sep 2025.

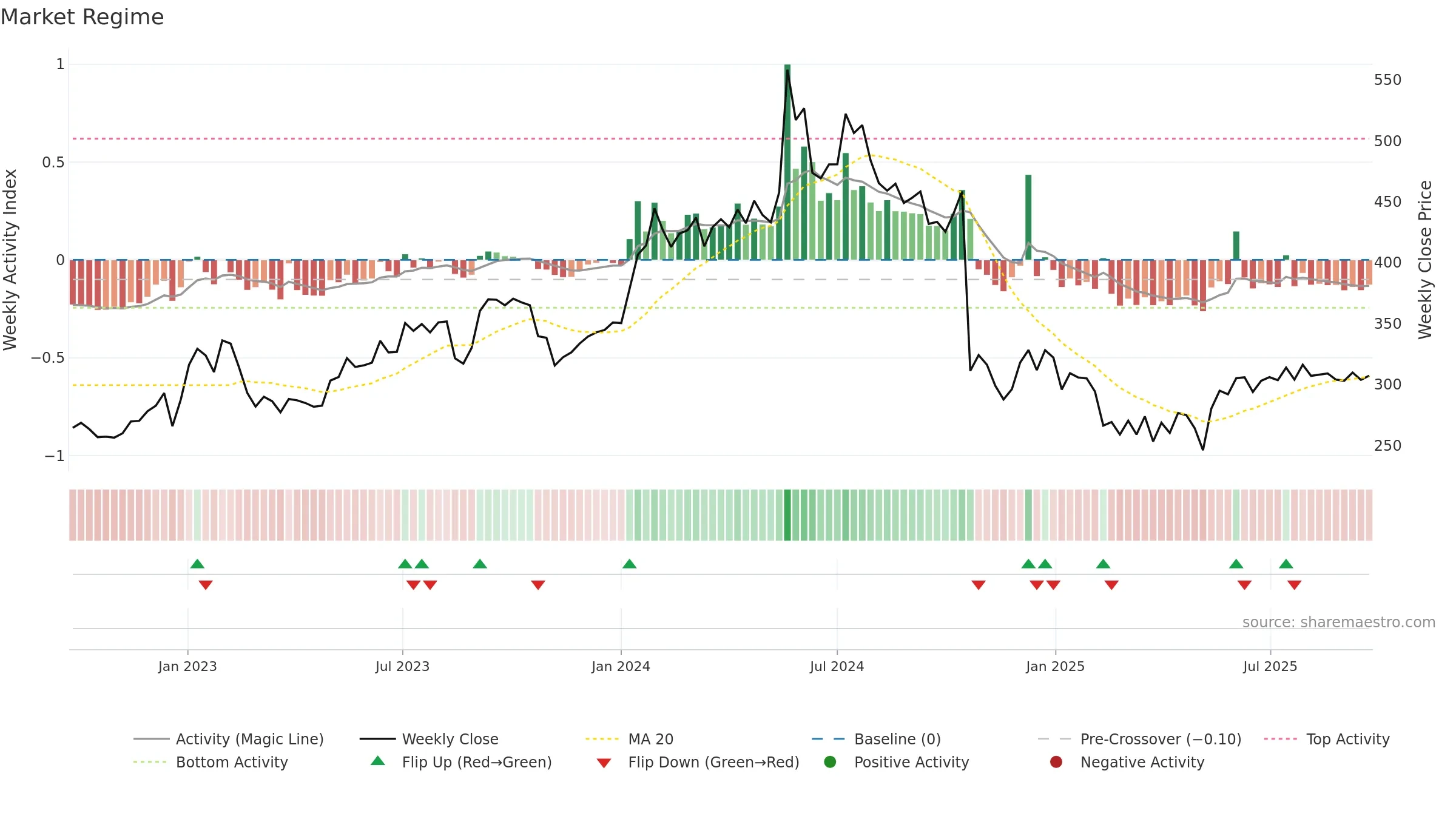

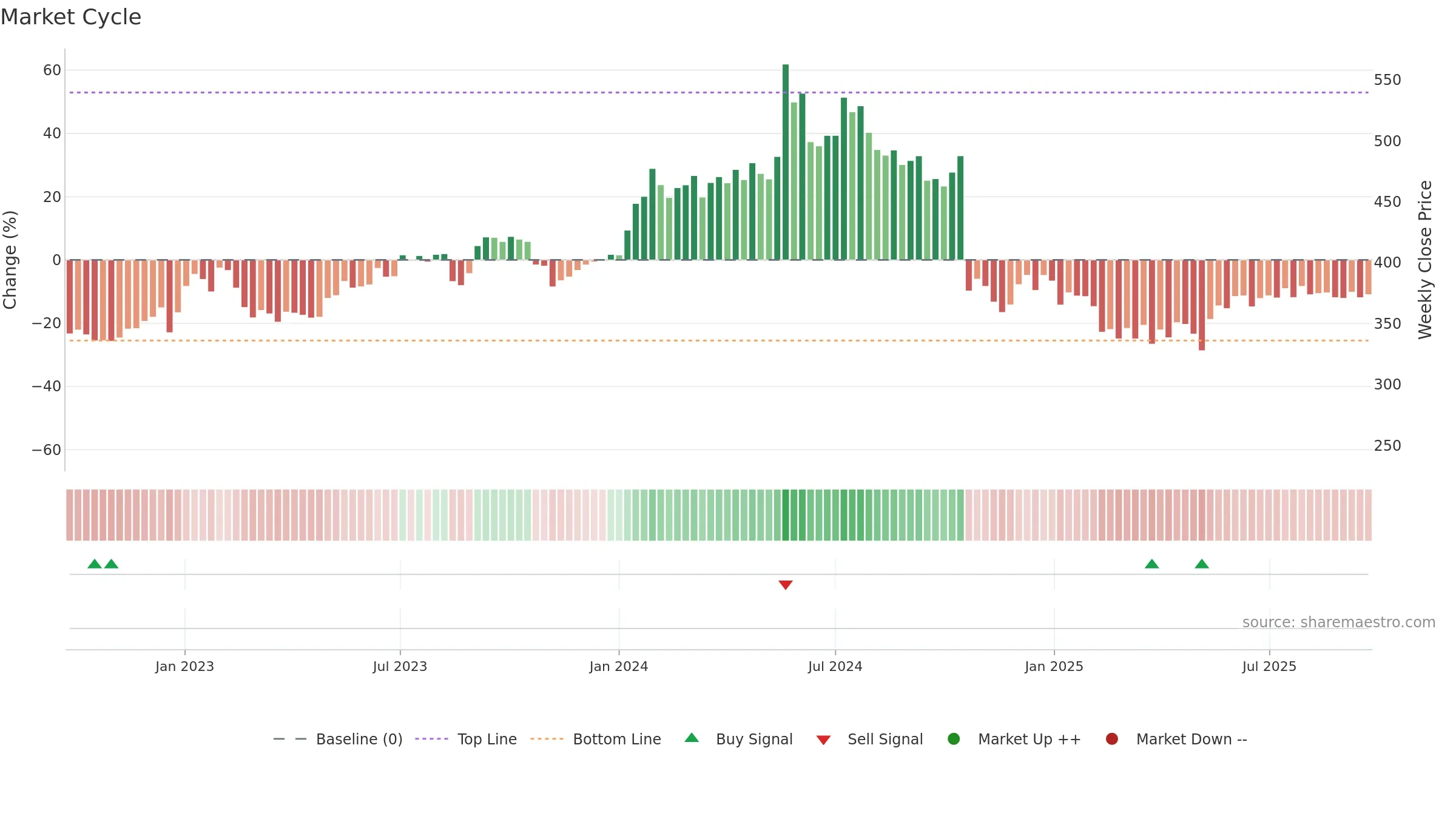

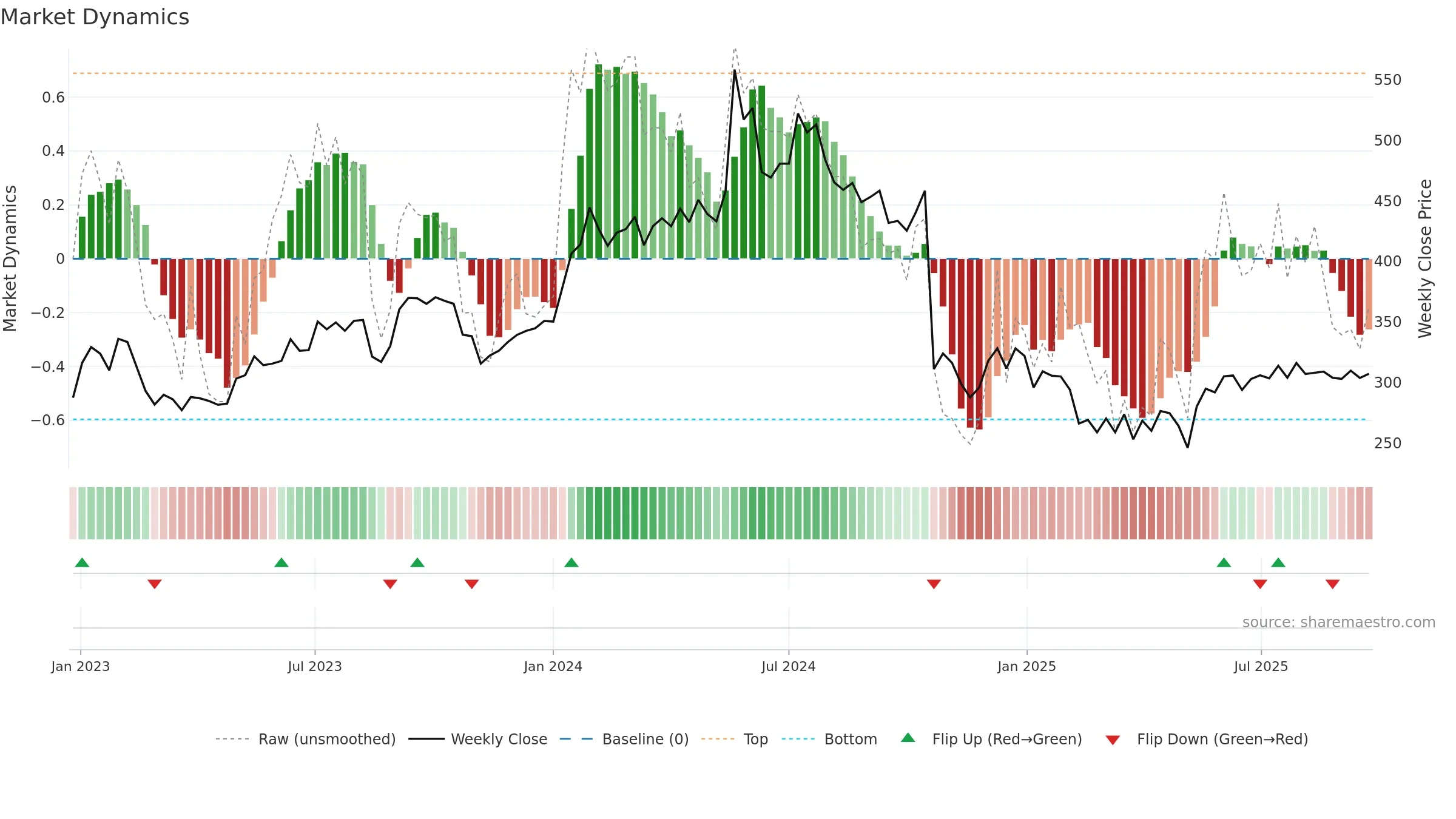

How to read this — Price slope is downward, indicating persistent supply pressure. Low weekly volatility favours steadier follow-through. Volume and price are moving in the same direction — a constructive confirmation. Returns are negatively correlated with volume — strength may come on lighter activity. Distance to baseline is narrowing — reverting closer to its fair-value track. Price holds above key averages, indicating constructive participation.

Down-slope argues for patience; rallies can fade sooner unless participation improves.

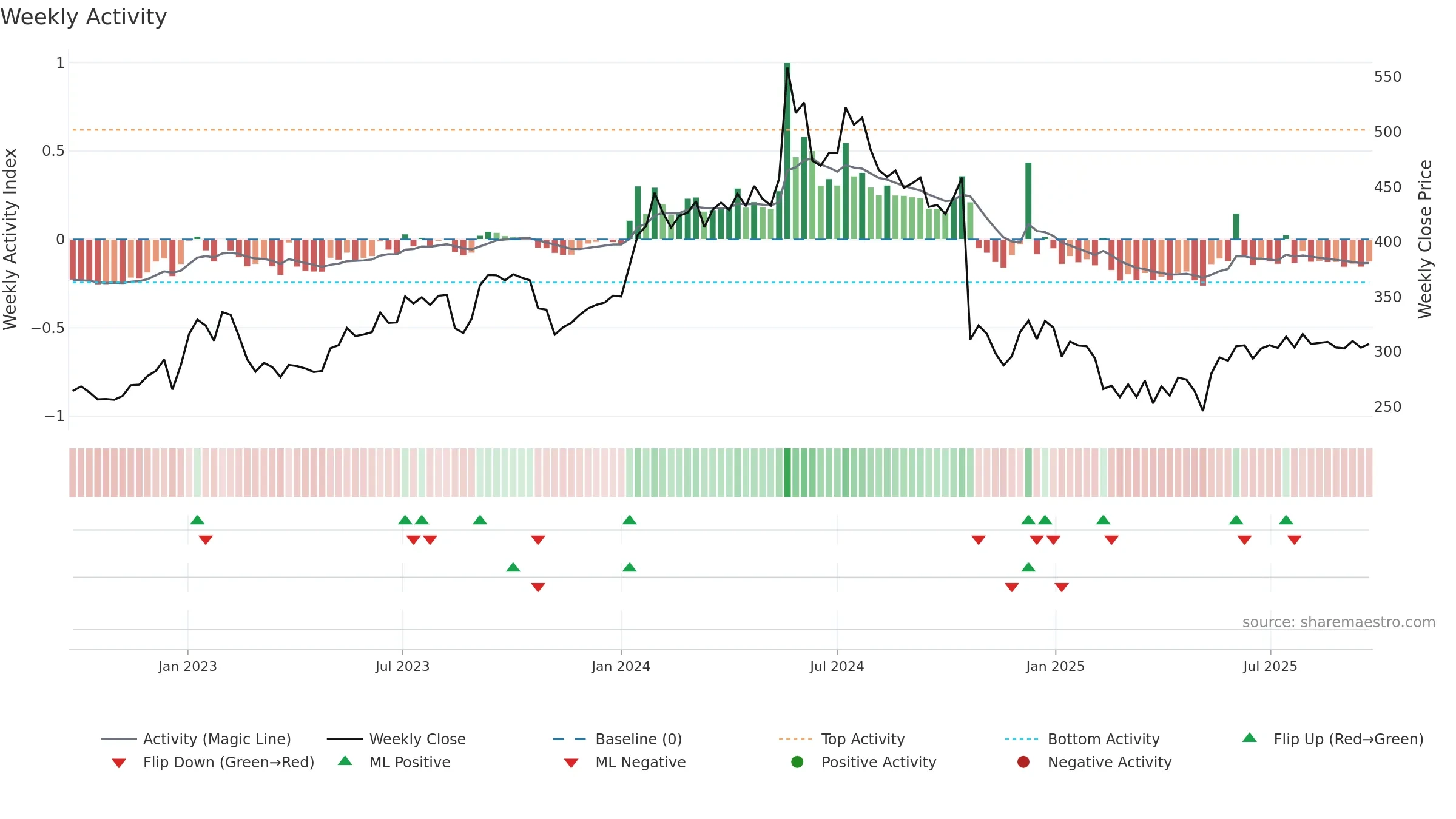

Gauge maps the trend signal to a 0–100 scale.

How to read this — Range-bound conditions; conviction is limited until a break or acceleration emerges.

Wait for a directional break or improving acceleration.

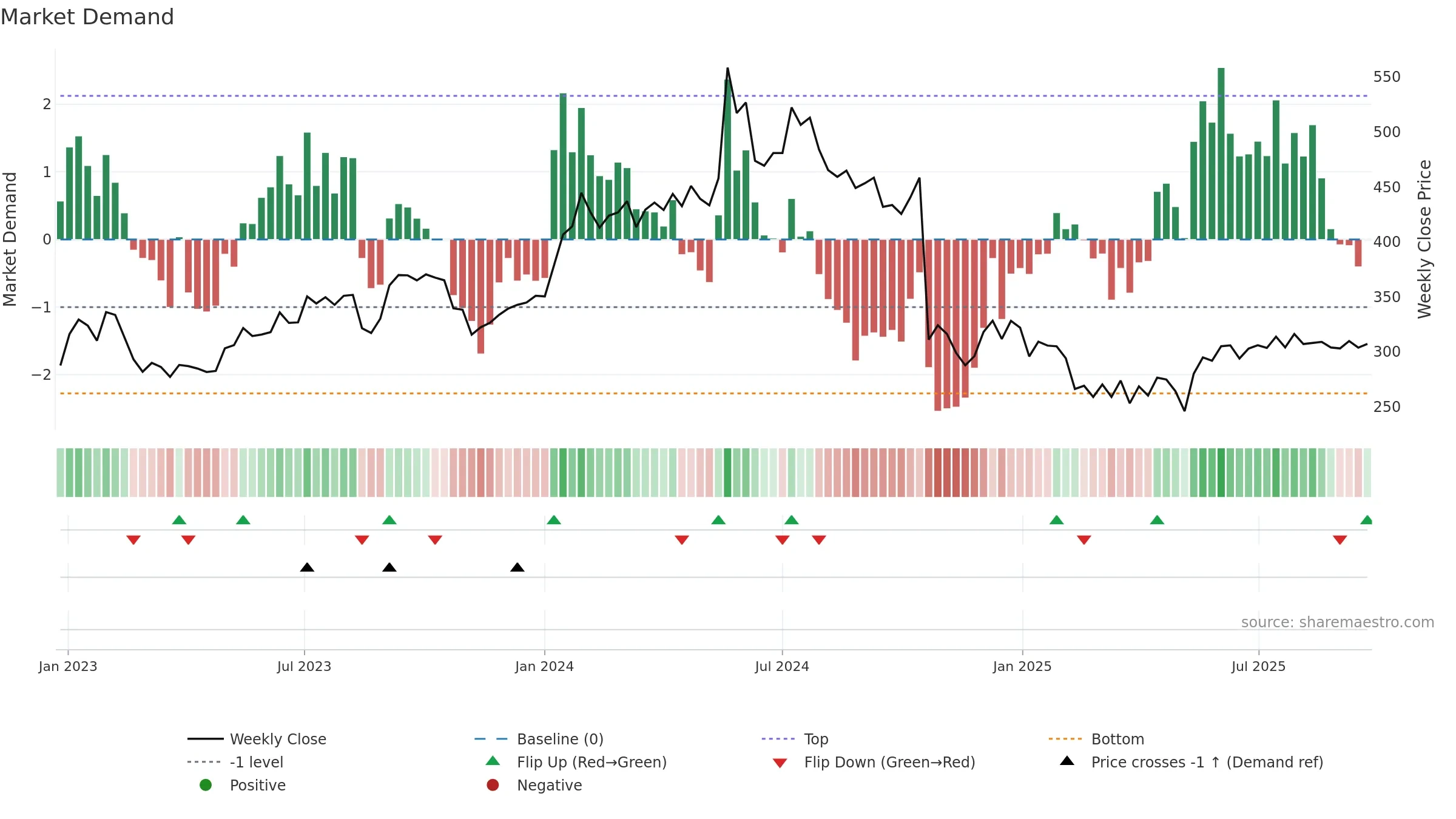

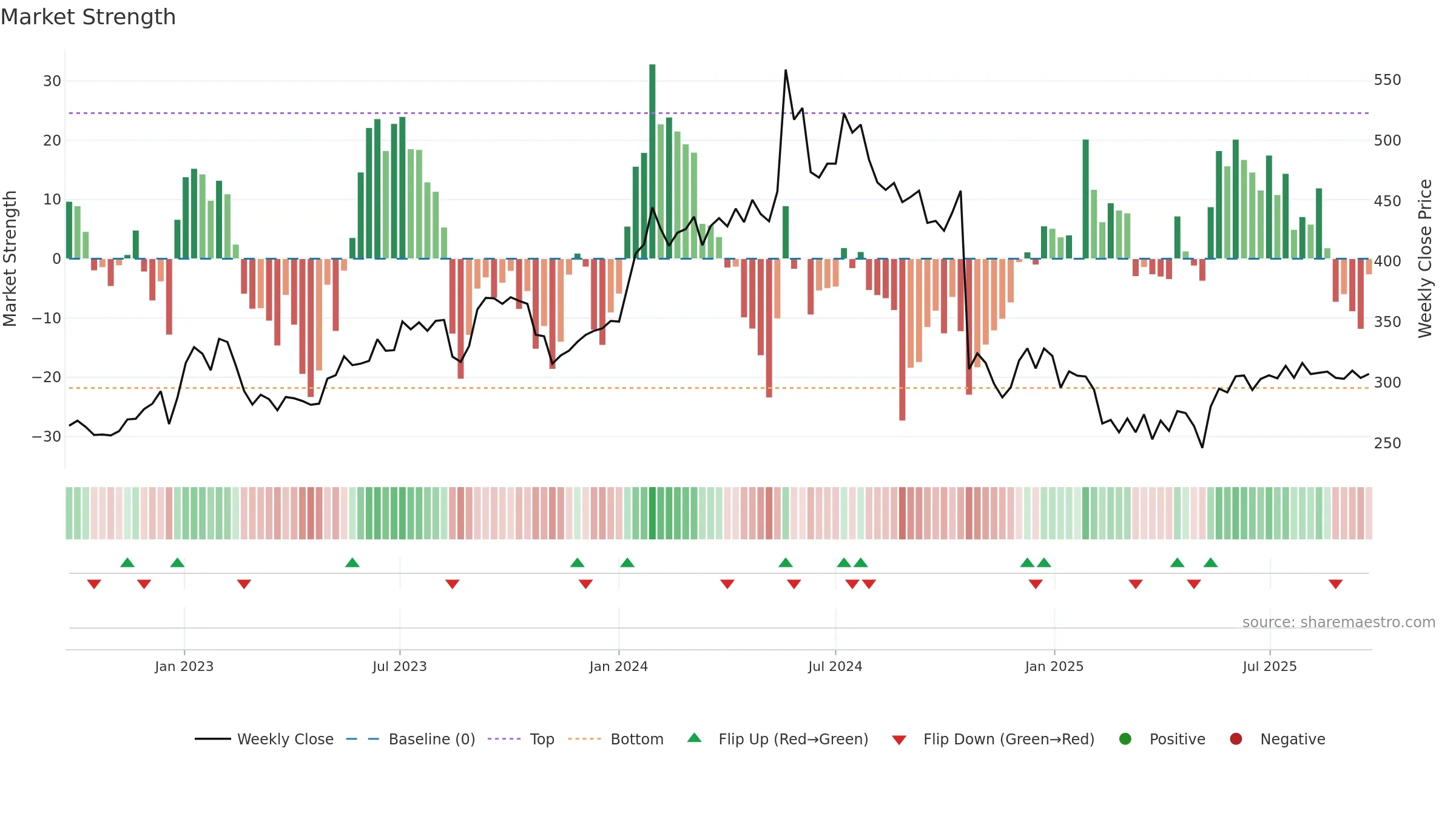

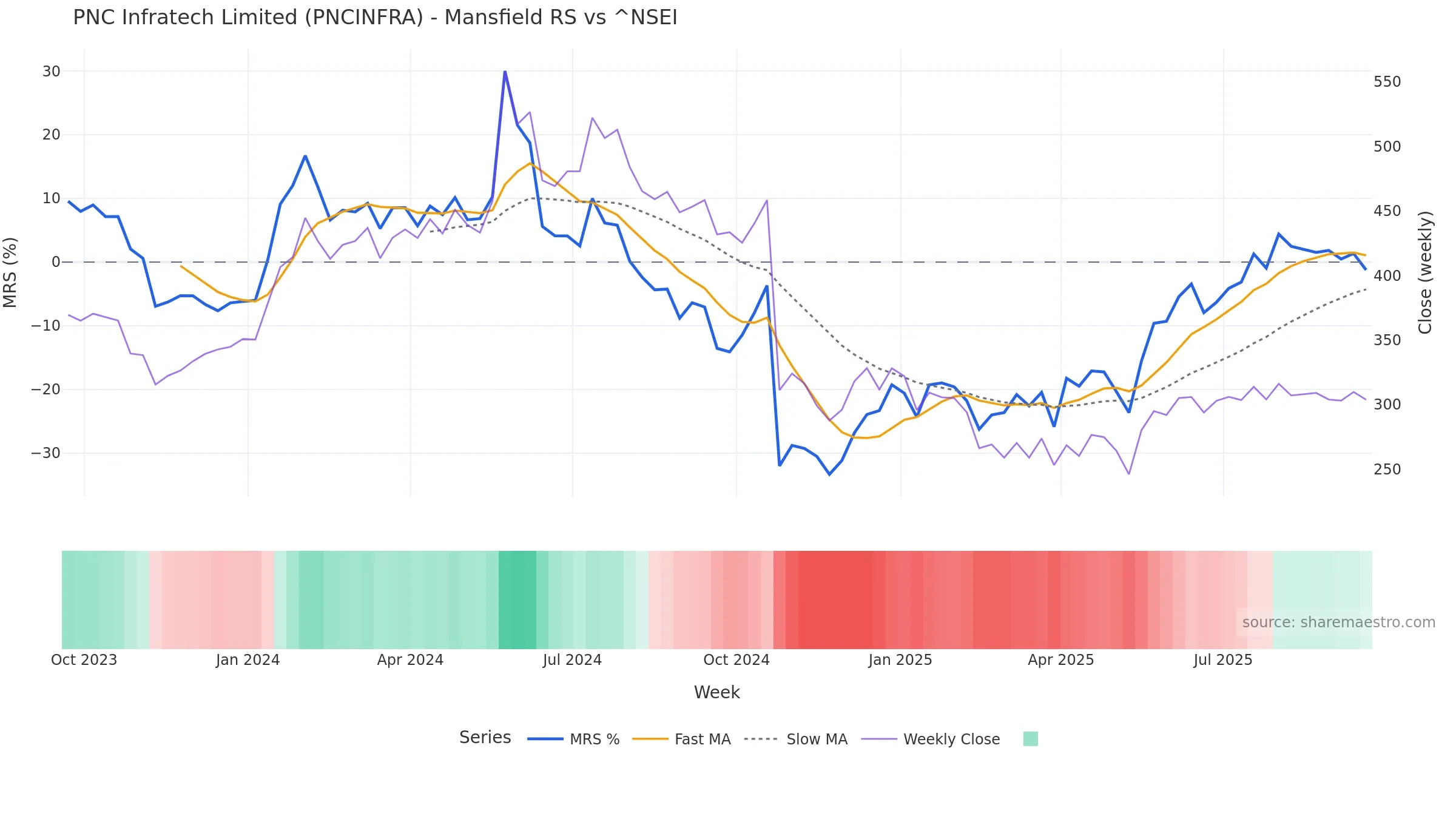

Relative strength is Negative

(< 0%, underperforming).

Latest MRS: -1.23% (week ending Fri, 19 Sep 2025).

Slope: Falling over 8w.

Notes:

- Below zero line indicates relative weakness vs benchmark.

- MRS slope falling over ~8 weeks.

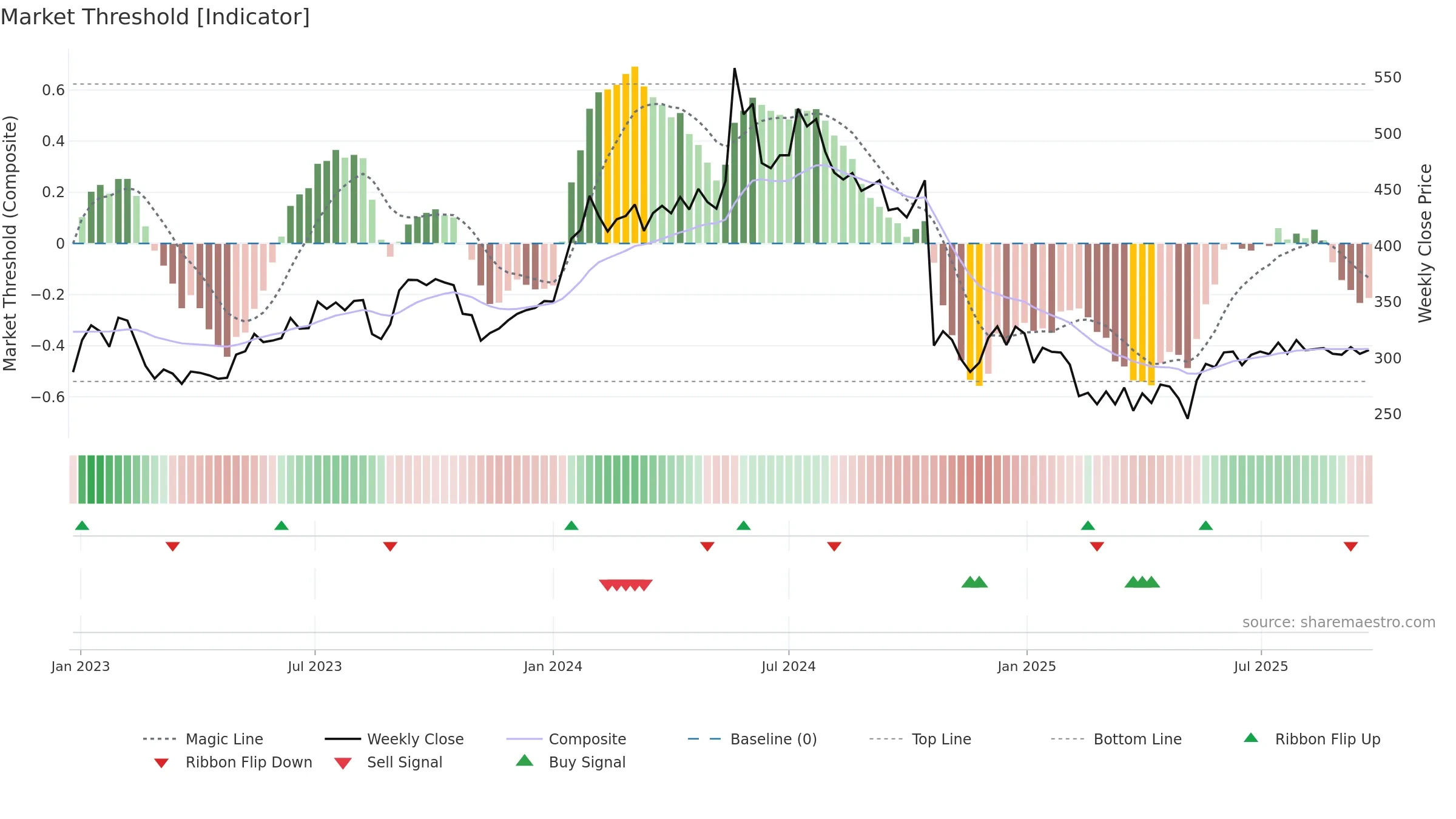

Price is below fair value; potential upside if momentum constructive.

Conclusion

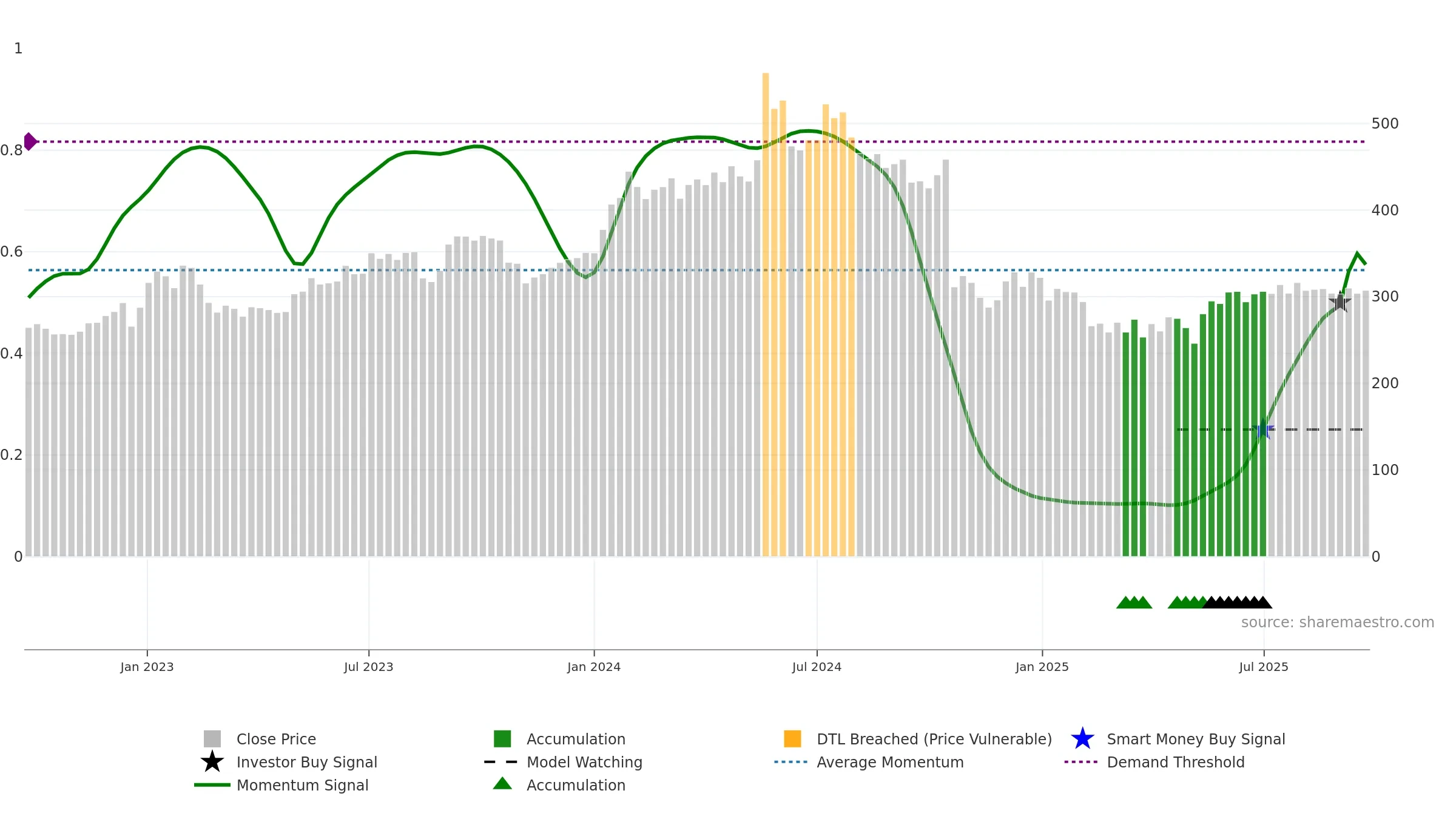

Positive setup. ★★★★★ confidence. Trend: Range / Neutral · 0.05% over window · vol 1.33% · liquidity convergence · posture above

- Price holds above 8–26 week averages

- Liquidity confirms the price trend

- Low return volatility supports durability

Why: Price window 0.05% over w. Close is -0.84% below the prior-window high. Return volatility 1.33%. Volume trend falling. Liquidity convergence with price. Trend state range / neutral. Momentum neutral and rising. Valuation supportive skew.

Tip: Most metrics include a hover tooltip where they appear in the report.