Diageo plc

DEO NYSE

Weekly Report

Diageo plc closed at 97.6400 (-0.61% WoW) . Data window ends Fri, 19 Sep 2025.

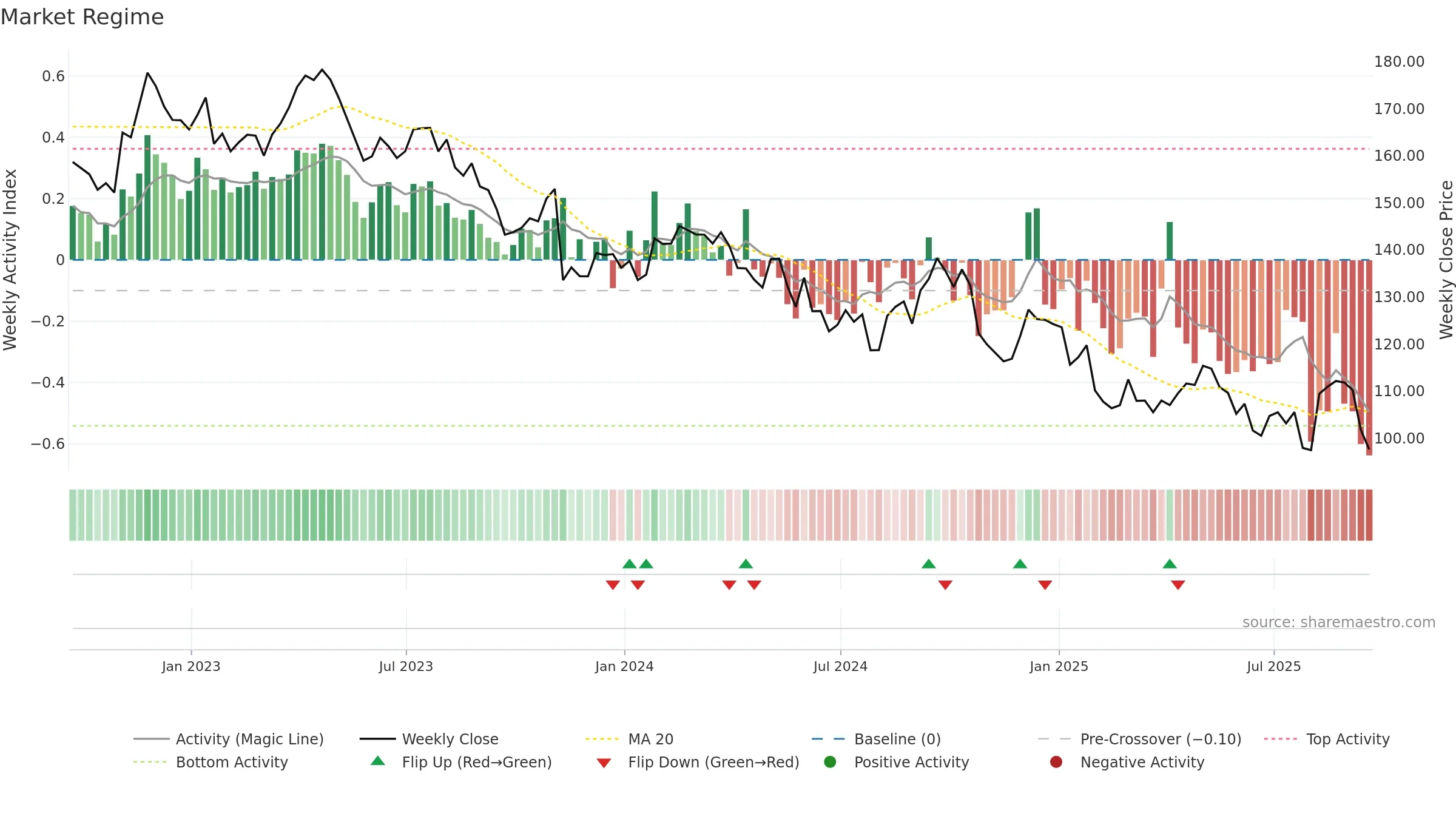

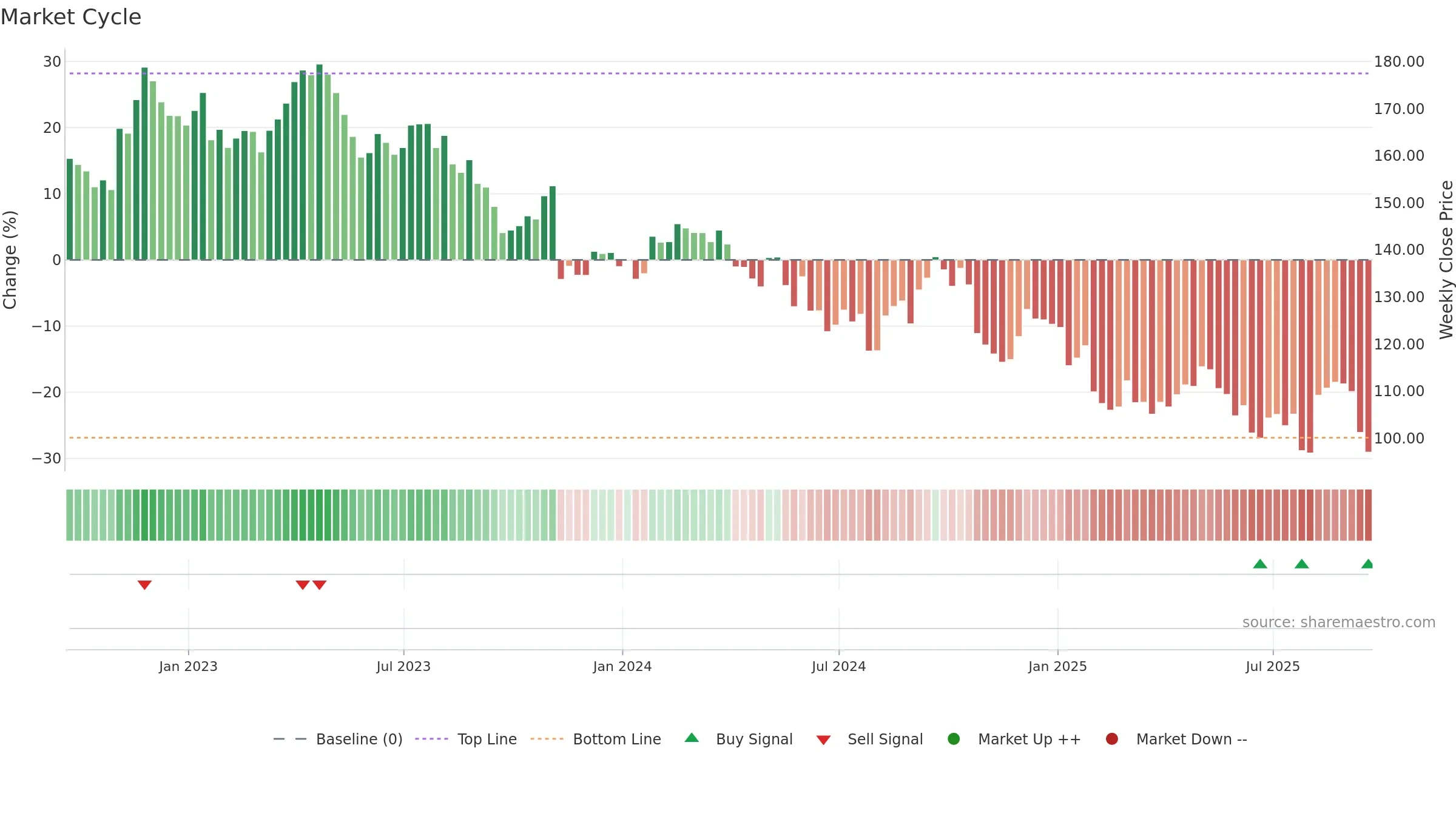

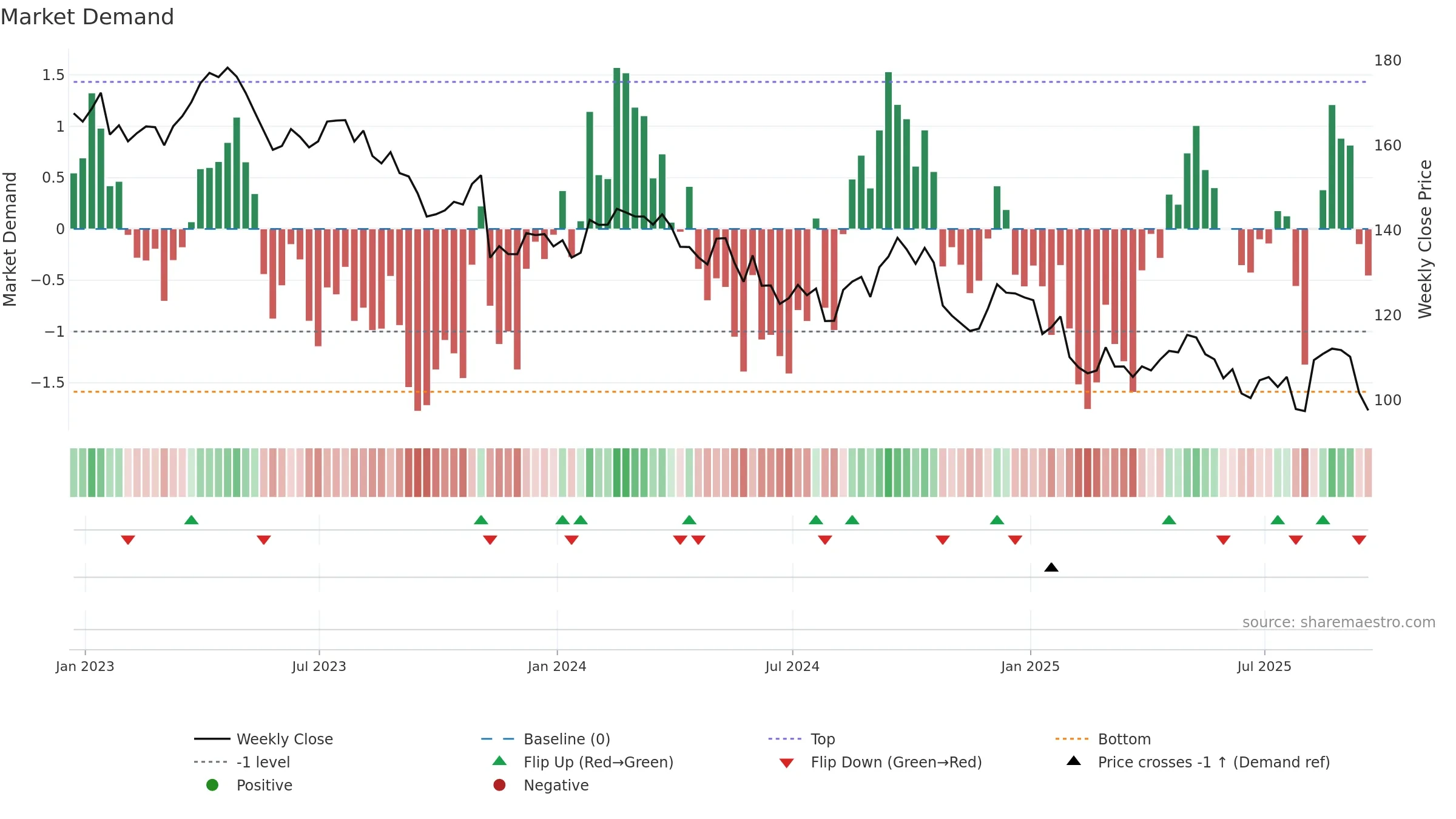

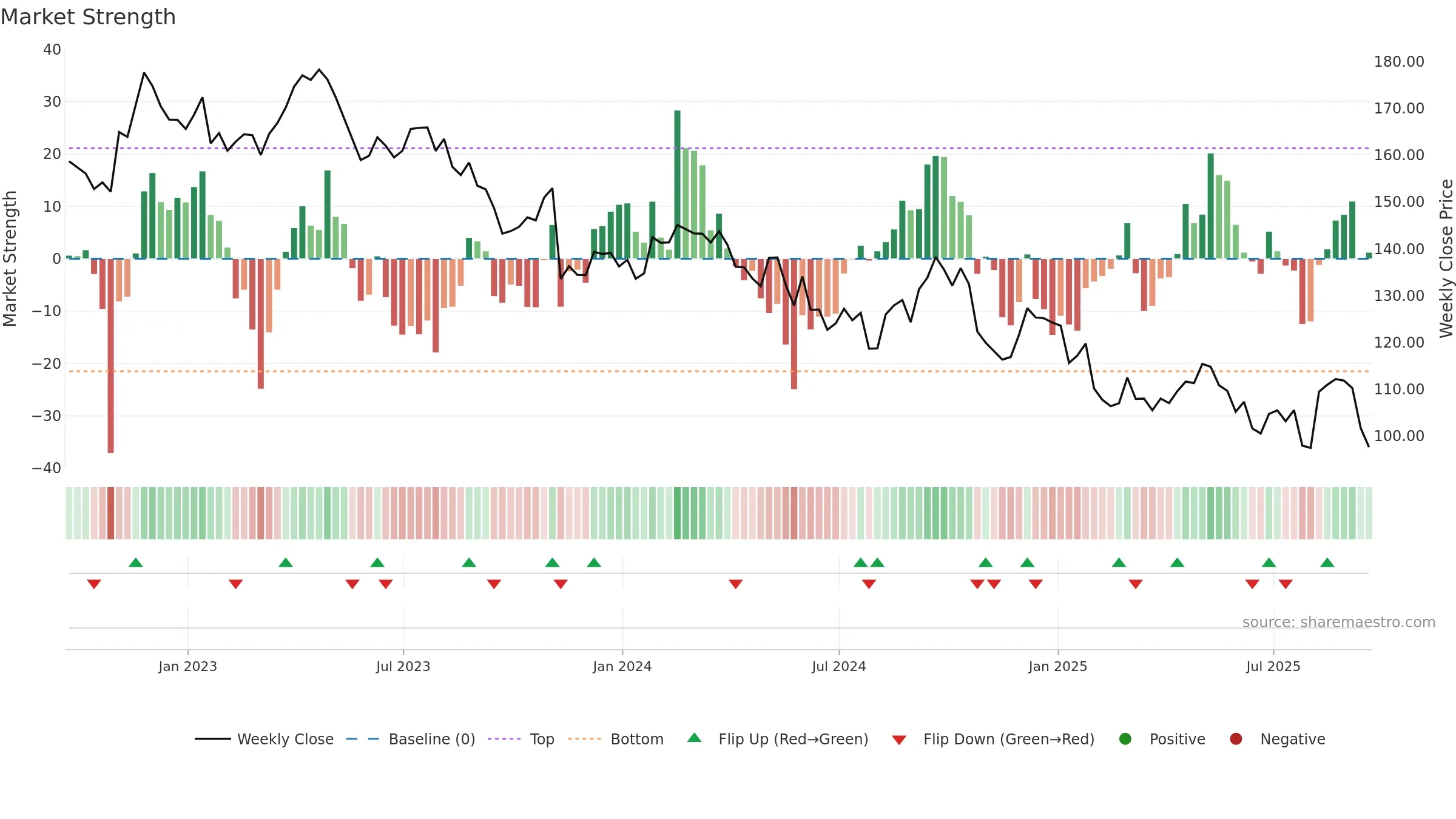

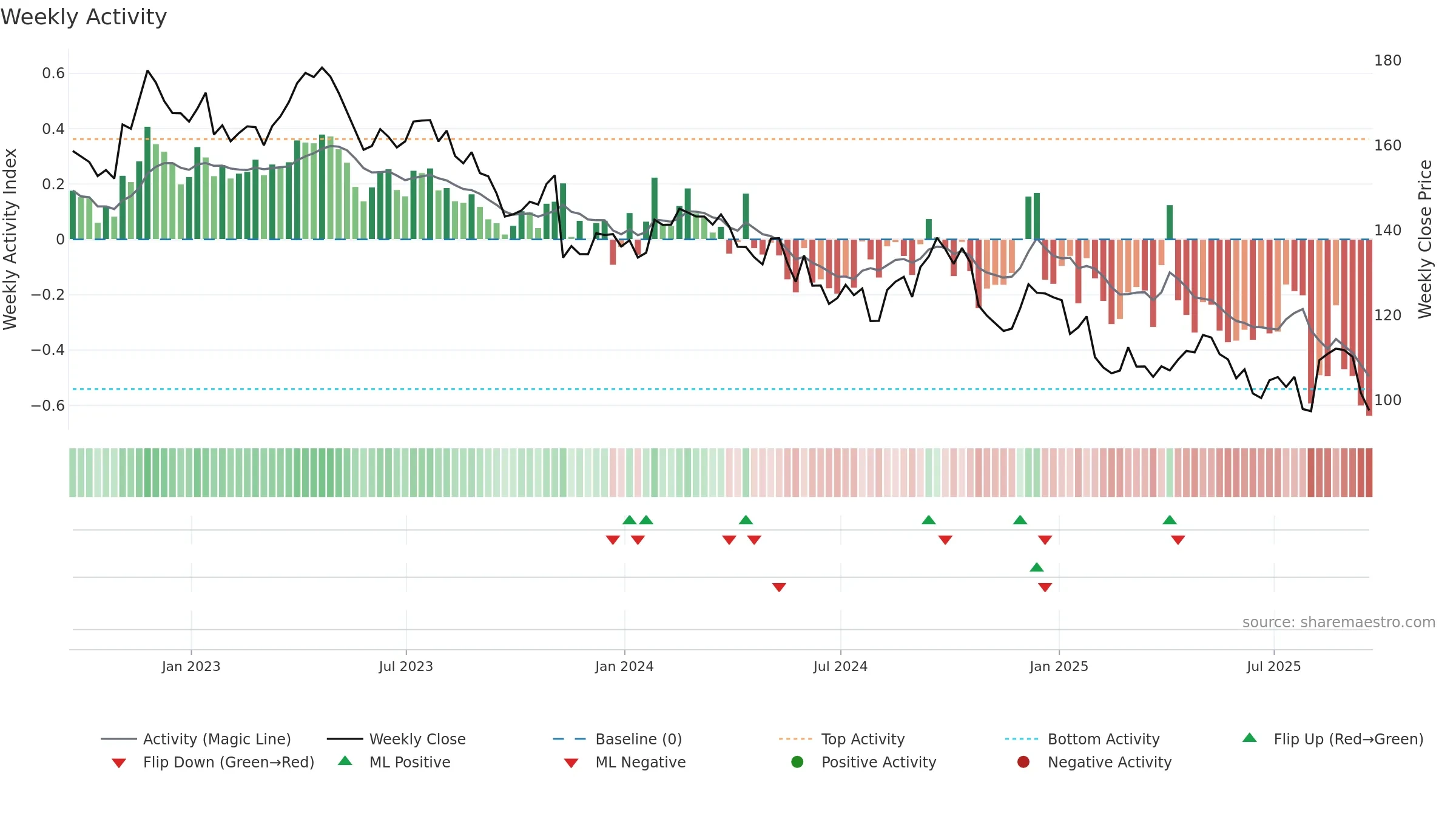

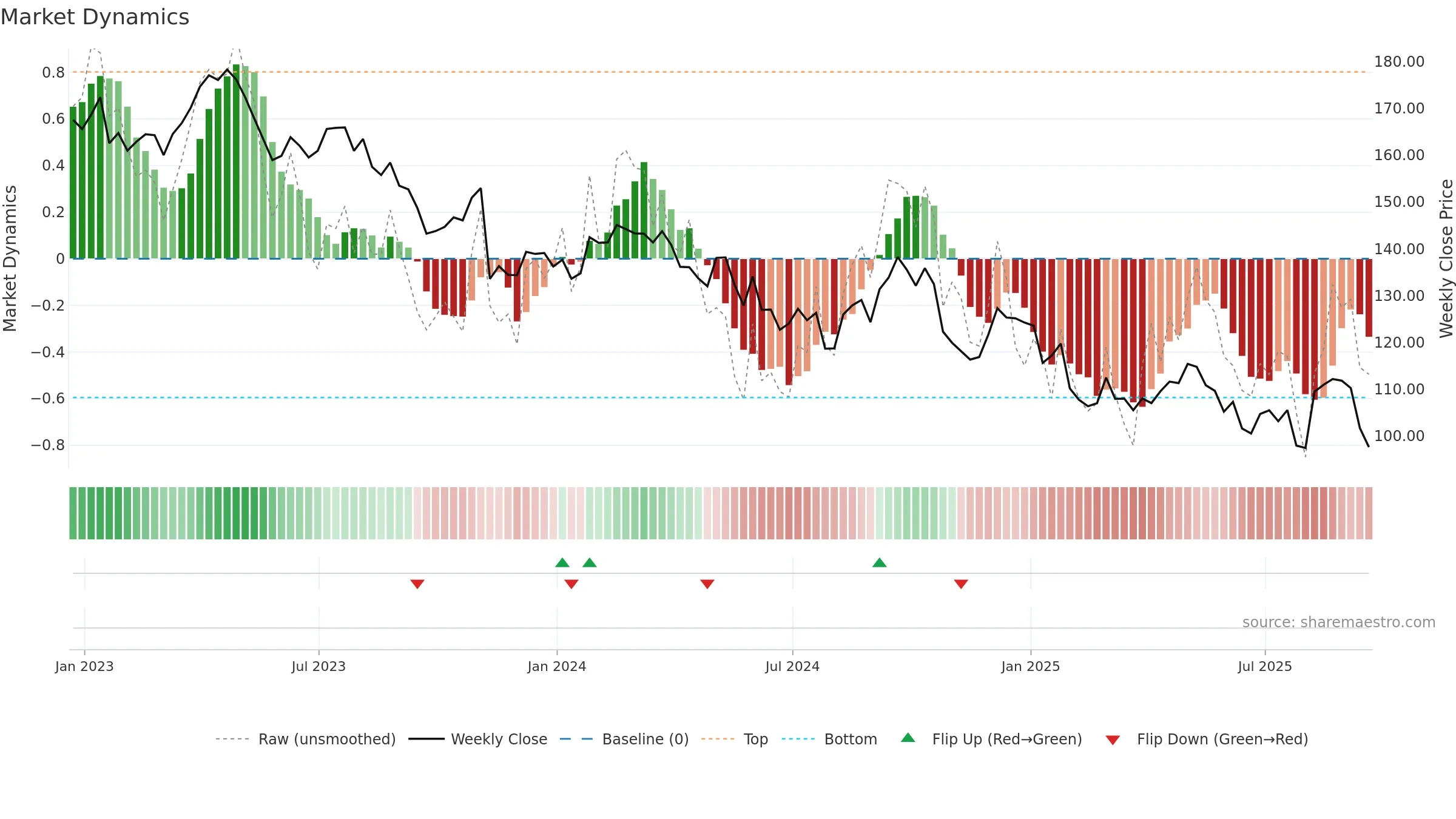

How to read this — Price slope is downward, indicating persistent supply pressure. Low weekly volatility favours steadier follow-through. Volume and price are moving in the same direction — a constructive confirmation. Returns are negatively correlated with volume — strength may come on lighter activity. Fresh short-term downside crossover weakens near-term tone. Price sits below key averages, keeping pressure on the tape.

Down-slope argues for patience; rallies can fade sooner unless participation improves.

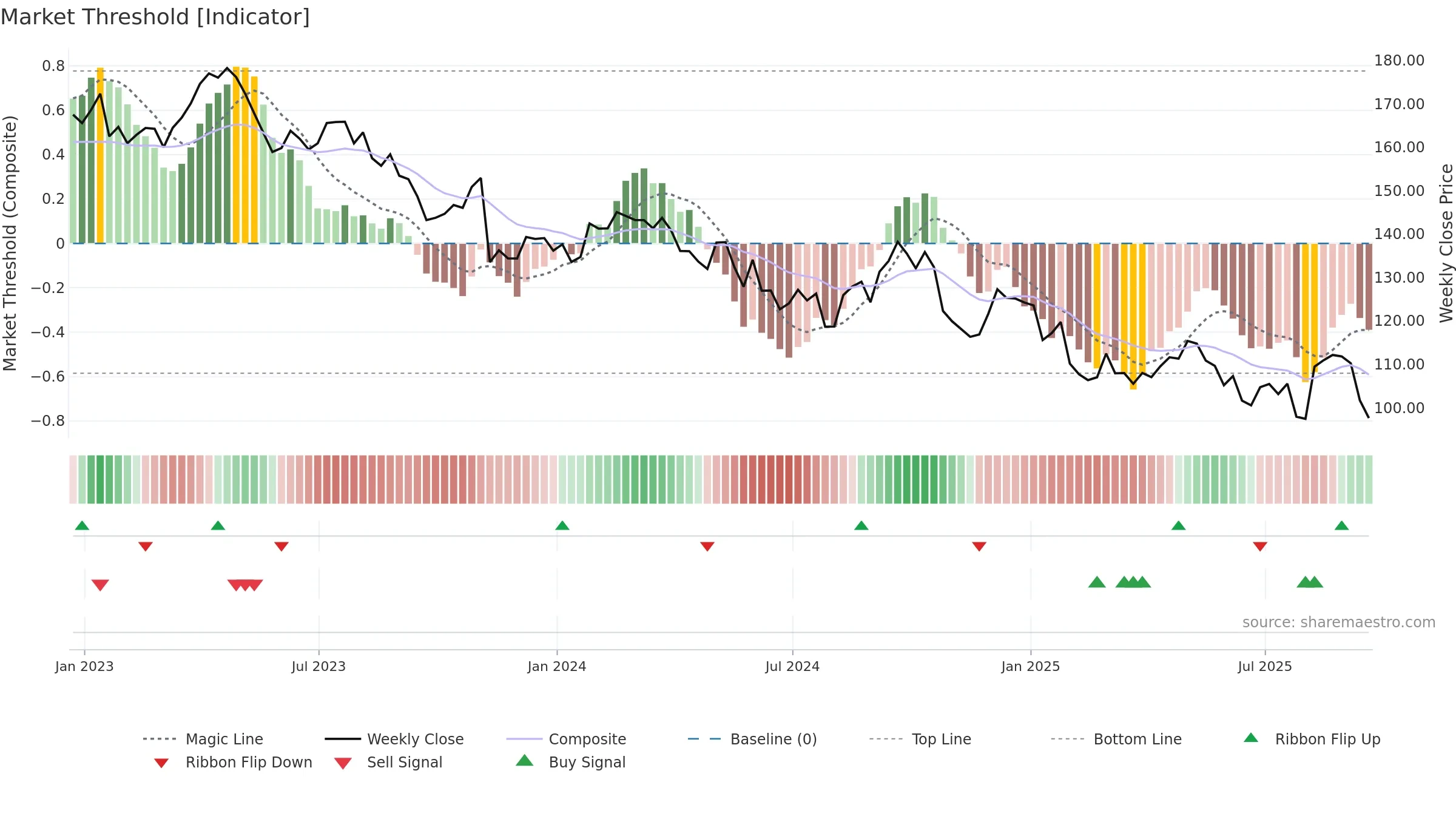

Gauge maps the trend signal to a 0–100 scale.

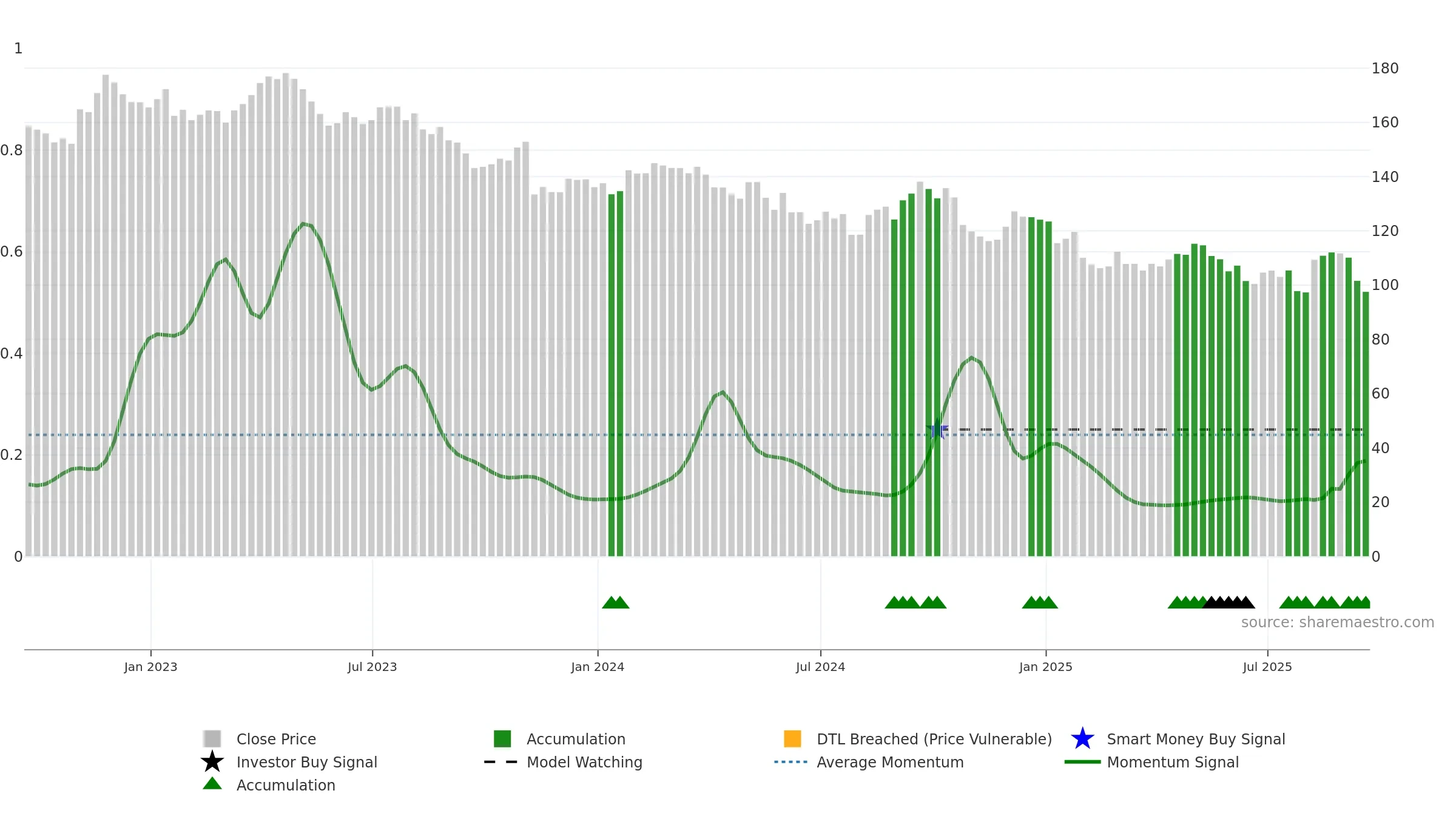

How to read this — Bearish backdrop but short-term momentum is improving; confirmation still needed.

Early improvement — look for a reclaim of 0.50→0.60 to validate.

Conclusion

Positive setup. ★★★★☆ confidence. Price window: 0. Trend: Bottoming Attempt; gauge 18. In combination, liquidity confirms the move.

- Early improvement from bearish zone (bottoming attempt)

- Liquidity confirms the price trend

- Low return volatility supports durability

- Buyers step in at depressed levels (accumulation)

- Price is not above key averages

Why: Price window 0.18% over 8w. Close is -12.95% below the prior-window high. Return volatility 0.94%. Volume trend falling. Liquidity convergence with price. Trend state bottoming attempt. Low-regime (≤0.25) upticks 5/7 (71.0%) • Accumulating. 4–8w crossover bearish. Momentum neutral and rising.

Tip: Most metrics include a hover tooltip where they appear in the report.