Jindal Worldwide Limited

JINDWORLD NSE

Weekly Report

Jindal Worldwide Limited closed at 38.2200 (5.17% WoW) . Data window ends Mon, 15 Sep 2025.

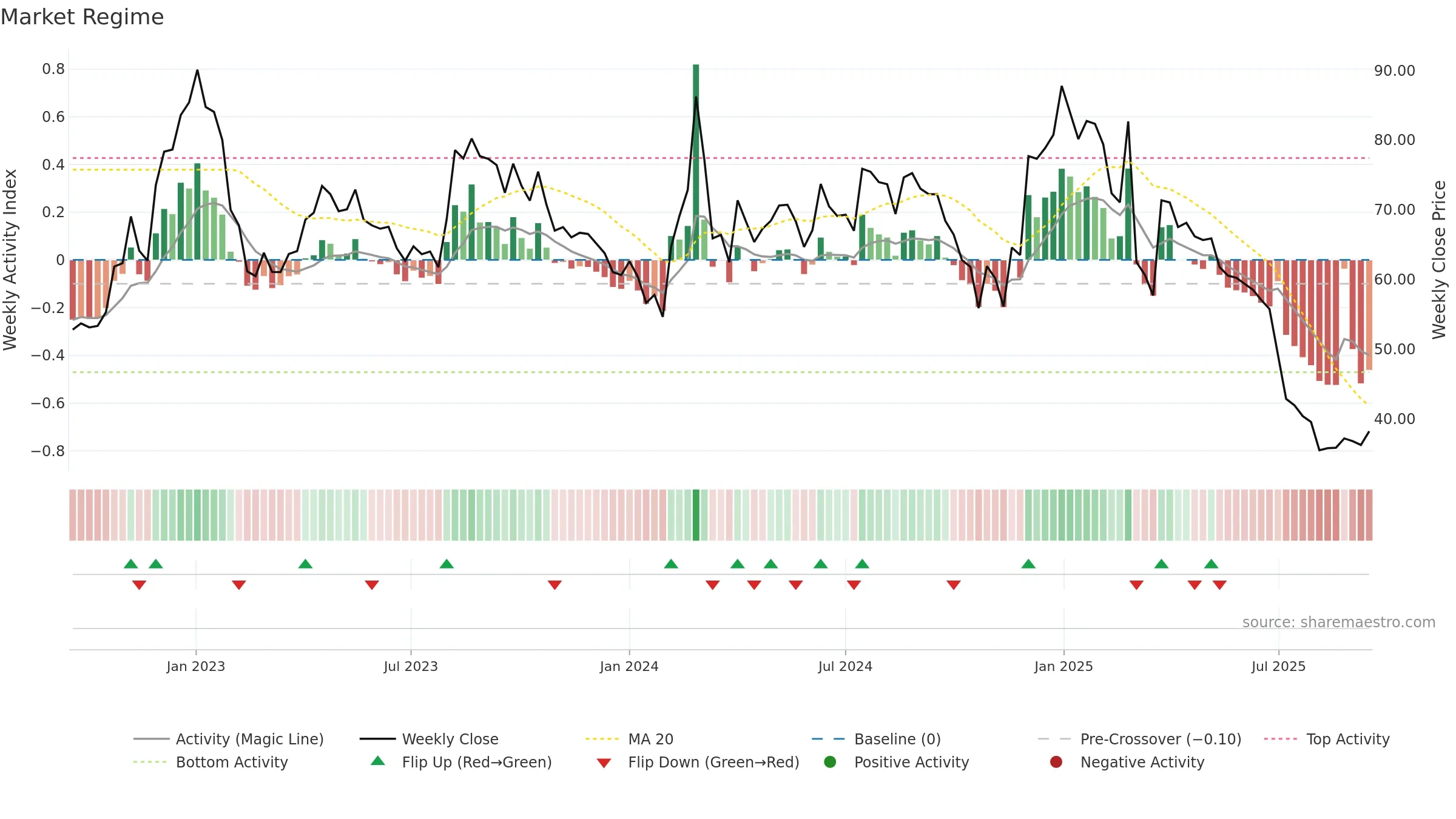

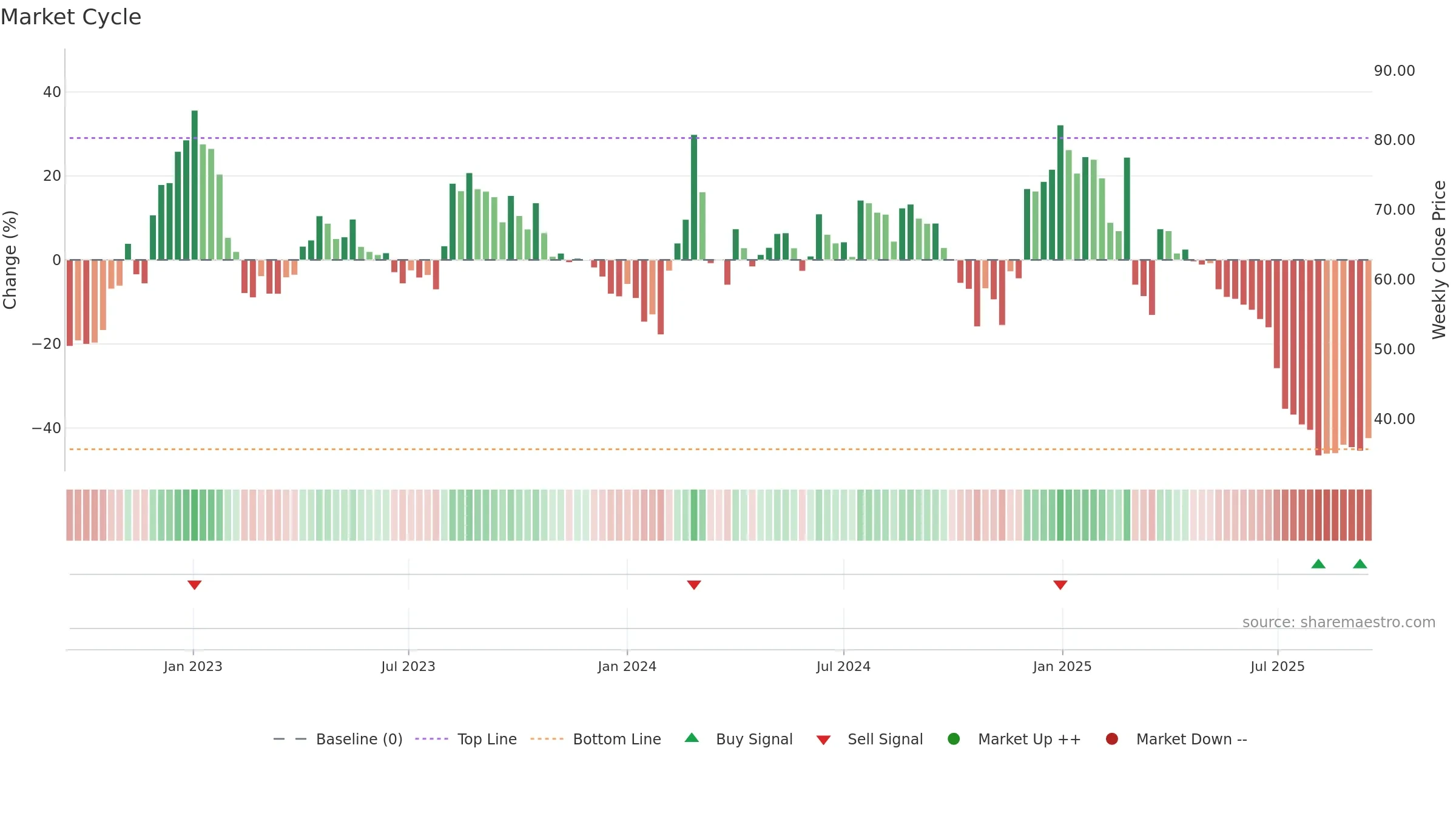

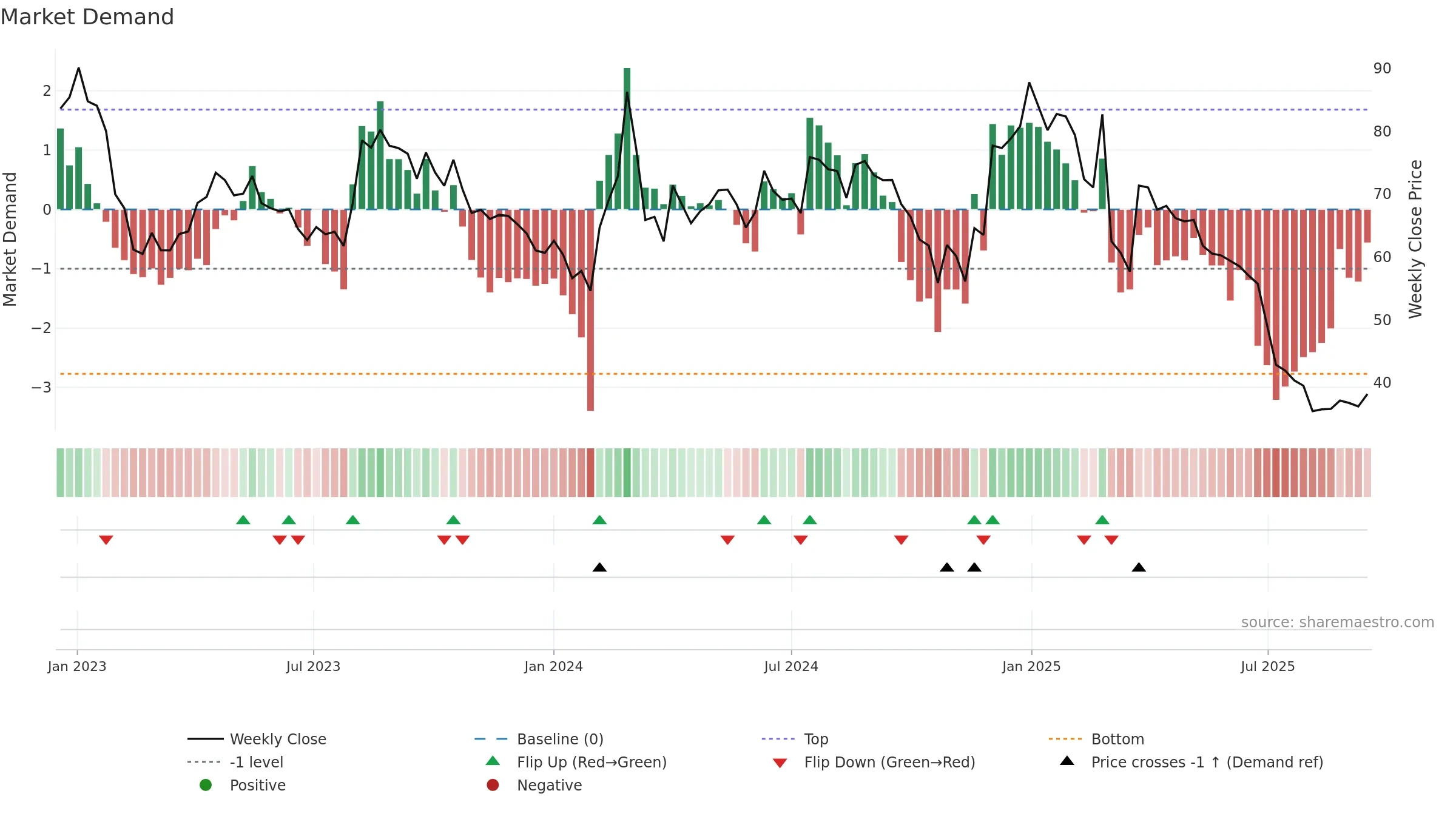

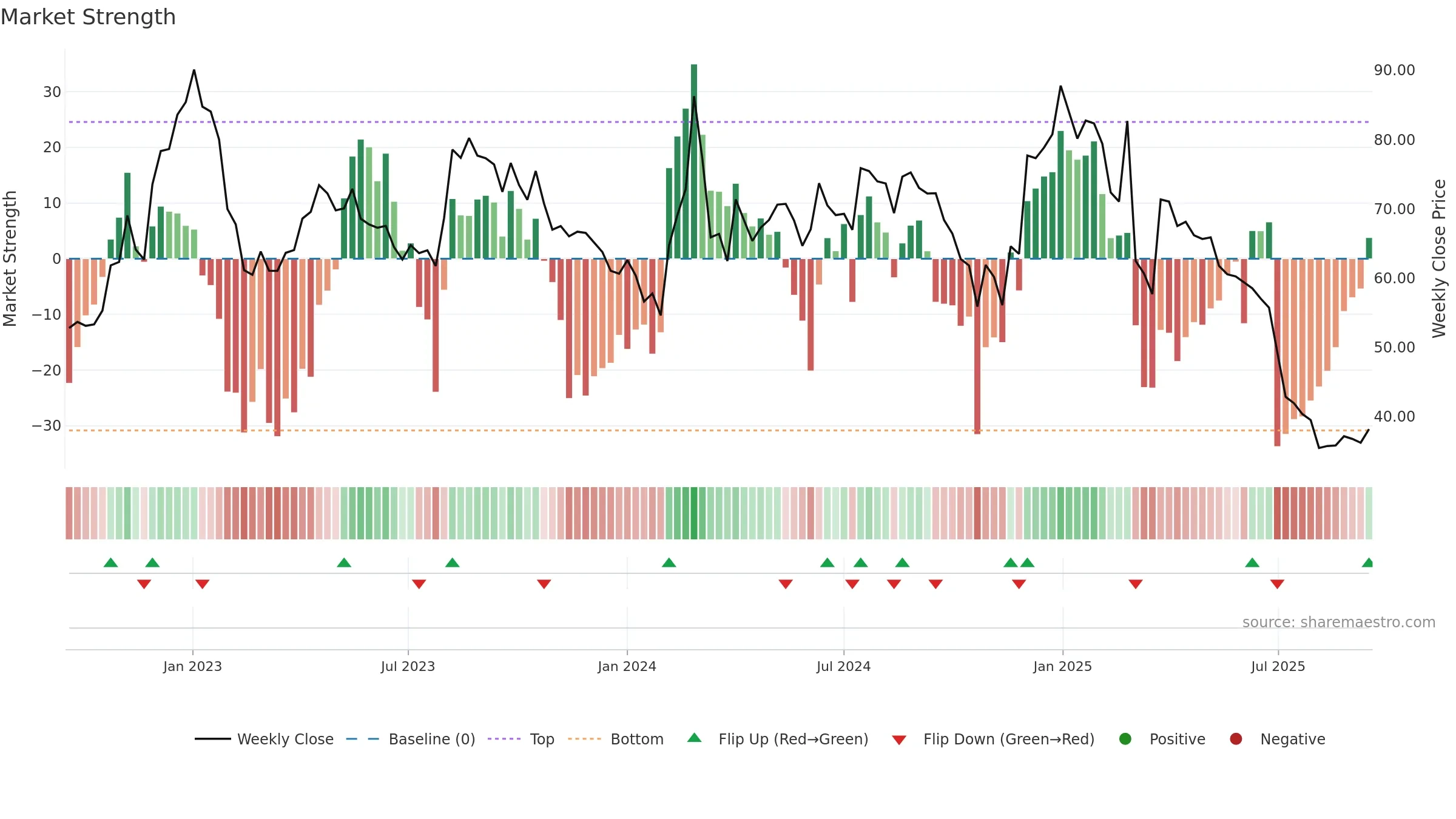

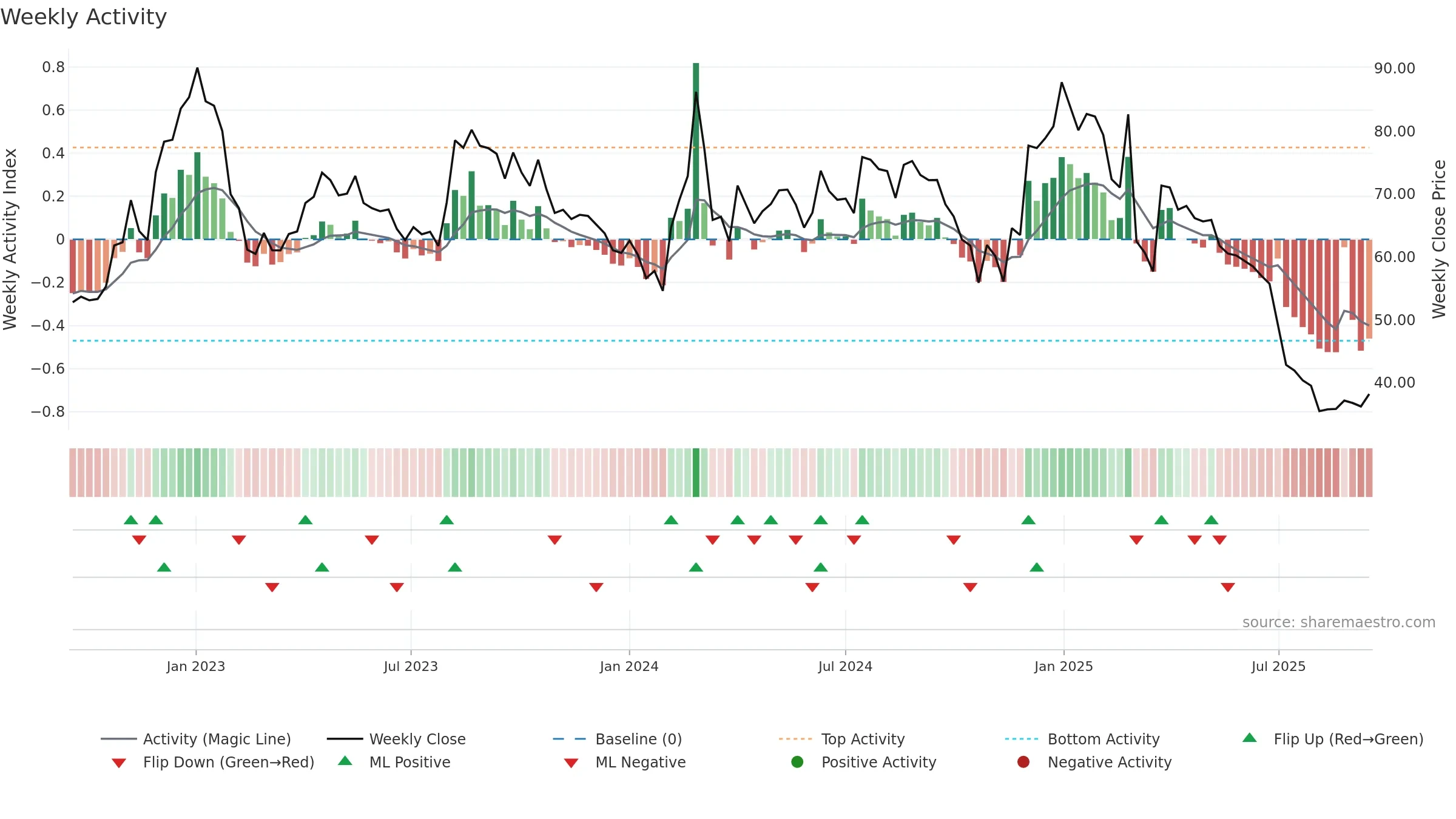

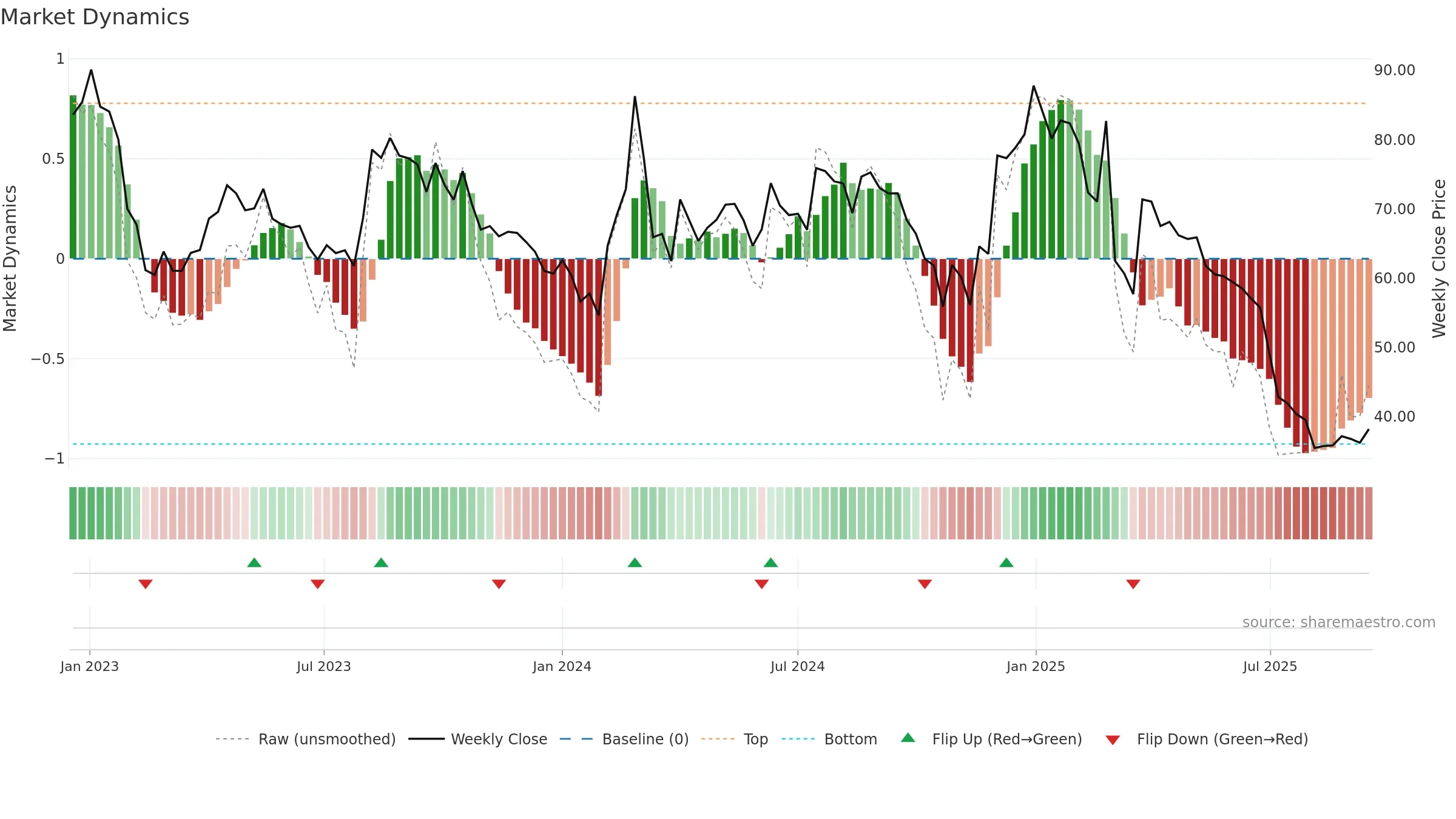

How to read this — Price slope is downward, indicating persistent supply pressure. Elevated weekly volatility increases whipsaw risk. Volume trend diverges from price — watch for fatigue or rotation. Distance to baseline is narrowing — reverting closer to its fair-value track. Fresh short-term crossover improves near-term tone.

Down-slope argues for patience; rallies can fade sooner unless participation improves. Because liquidity isn’t confirming, prefer evidence of fresh demand before chasing moves.

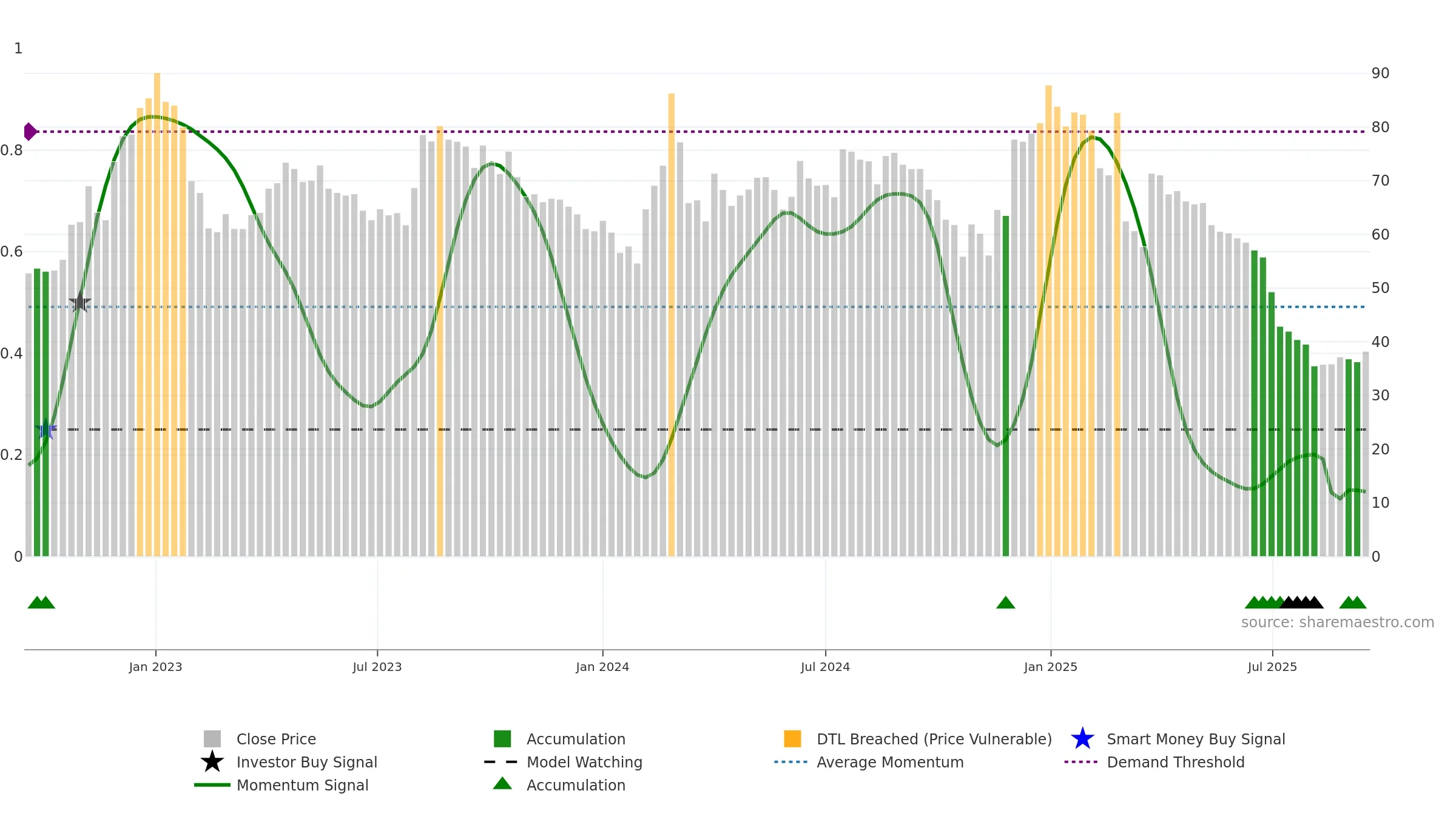

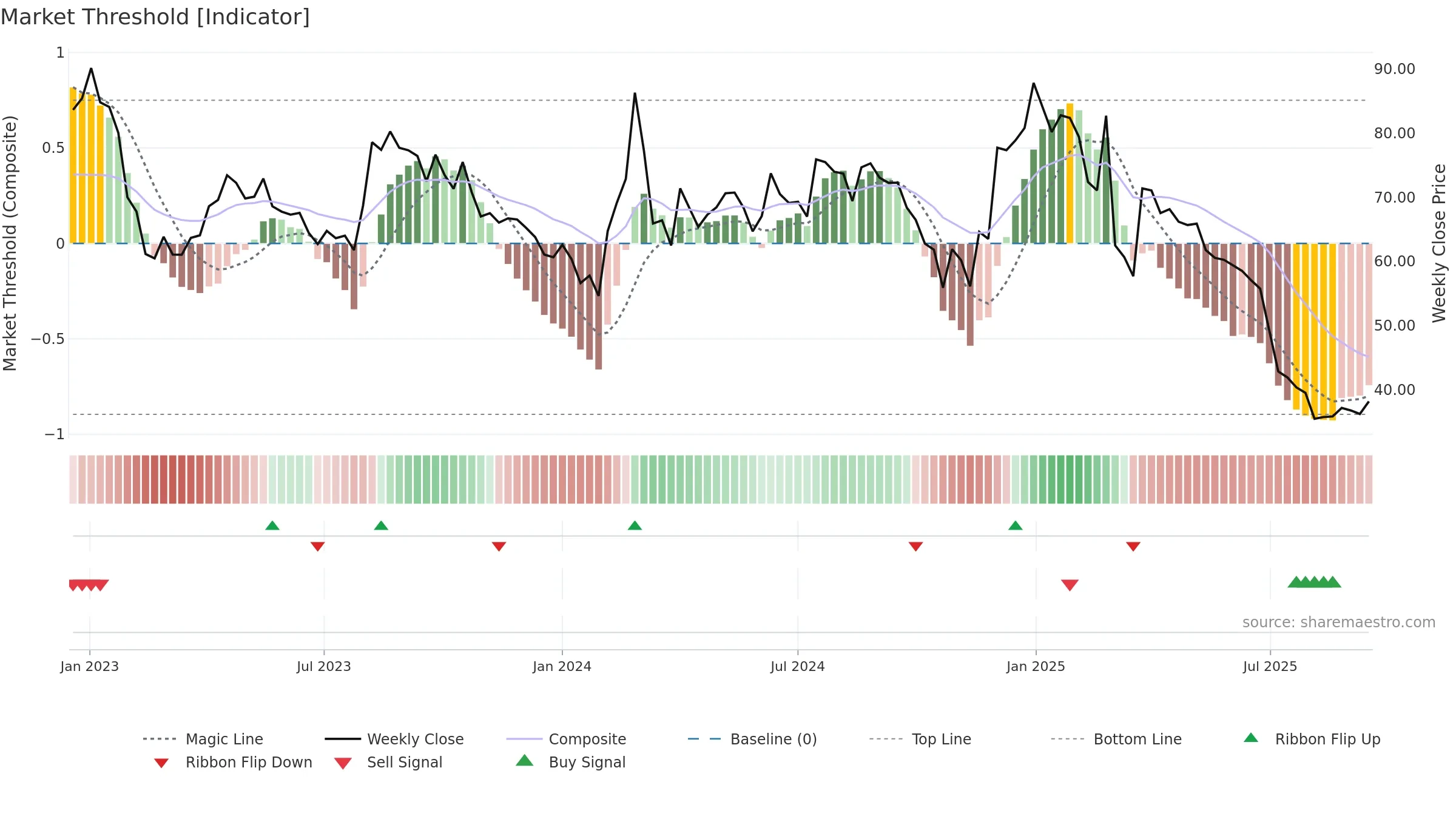

Gauge maps the trend signal to a 0–100 scale.

How to read this — Range-bound conditions; conviction is limited until a break or acceleration emerges.

Wait for a directional break or improving acceleration.

Price is above fair value; upside may be capped without catalysts.

Conclusion

Negative setup. ★☆☆☆☆ confidence. Price window: -3. Trend: Range / Neutral; gauge 12. In combination, liquidity diverges from price.

- Momentum is weak/falling

- Price is not above key averages

- Liquidity diverges from price

- High return volatility raises whipsaw risk

Why: Price window -3.34% over 8w. Close is -3.34% below the prior-window high. Return volatility 4.24%. Volume trend rising. Liquidity divergence with price. Trend state range / neutral. Low-regime (≤0.25) upticks 3/7 (43.0%) • Distributing. 4–8w crossover bullish. Momentum bearish and falling. Valuation limited upside without catalysts.

Tip: Most metrics include a hover tooltip where they appear in the report.