Icahn Enterprises L.P.

IEP NASDAQ

Weekly Report

Icahn Enterprises L.P. closed at 8.1900 (-0.73% WoW) . Data window ends Fri, 19 Sep 2025.

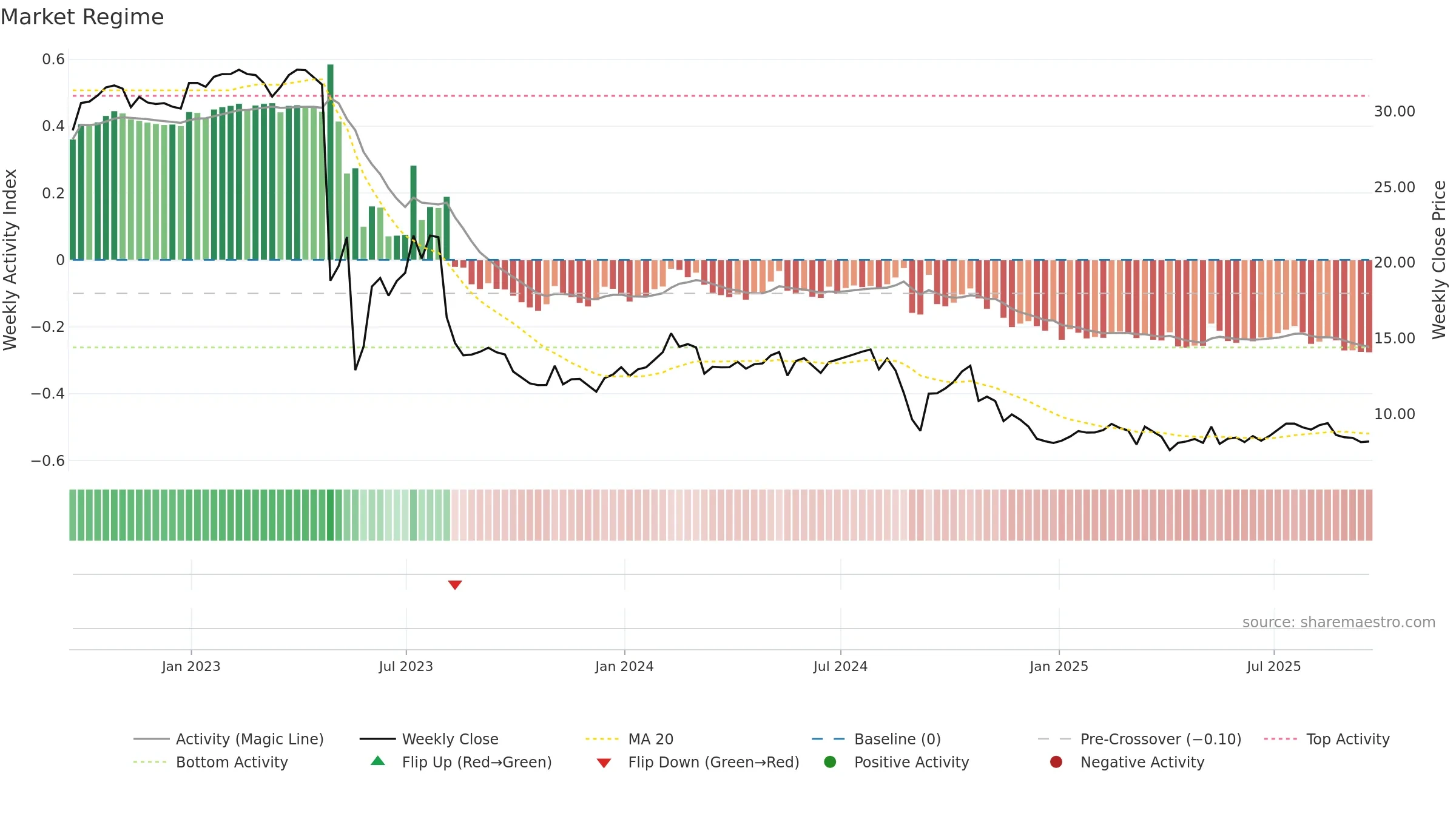

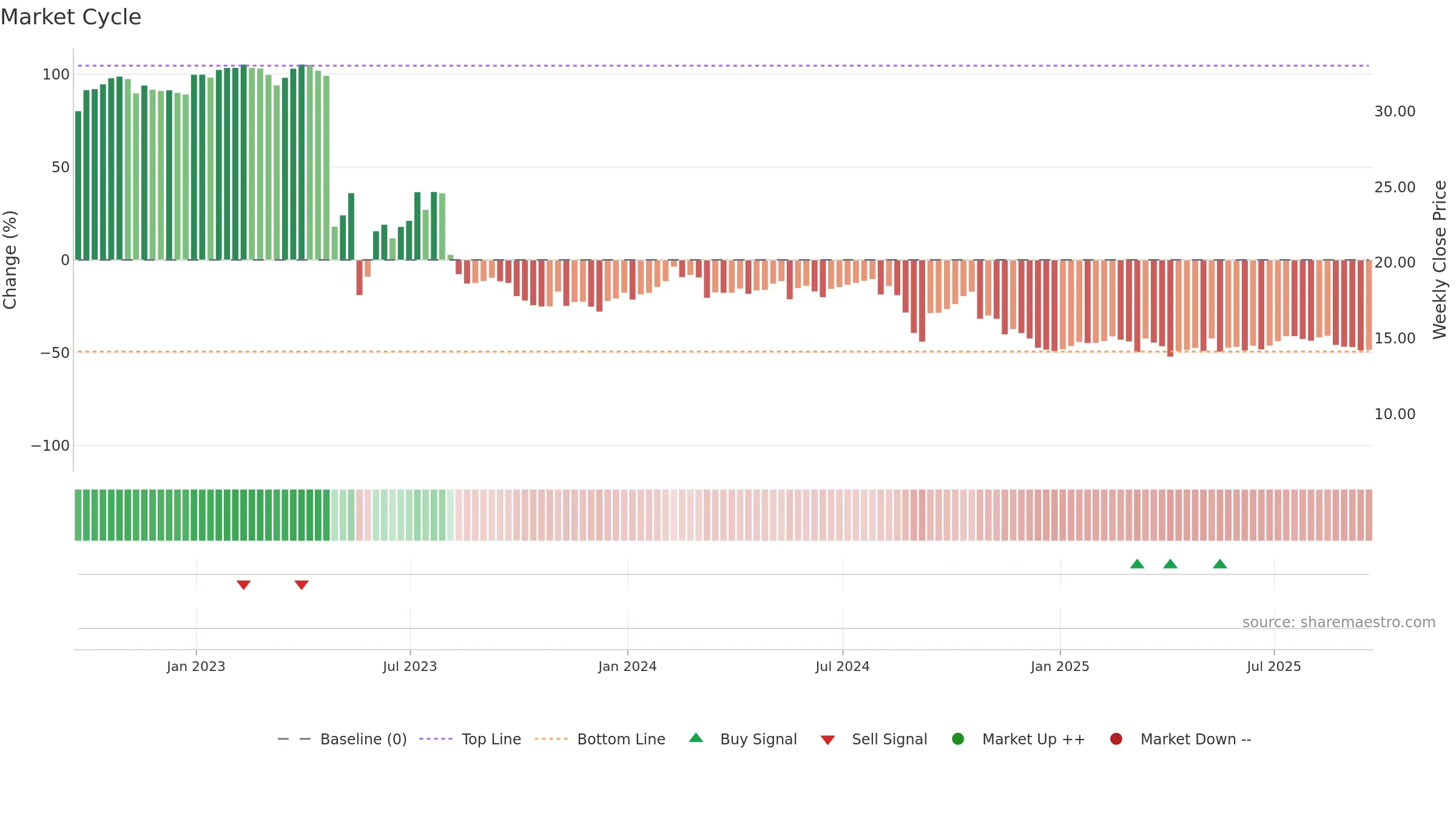

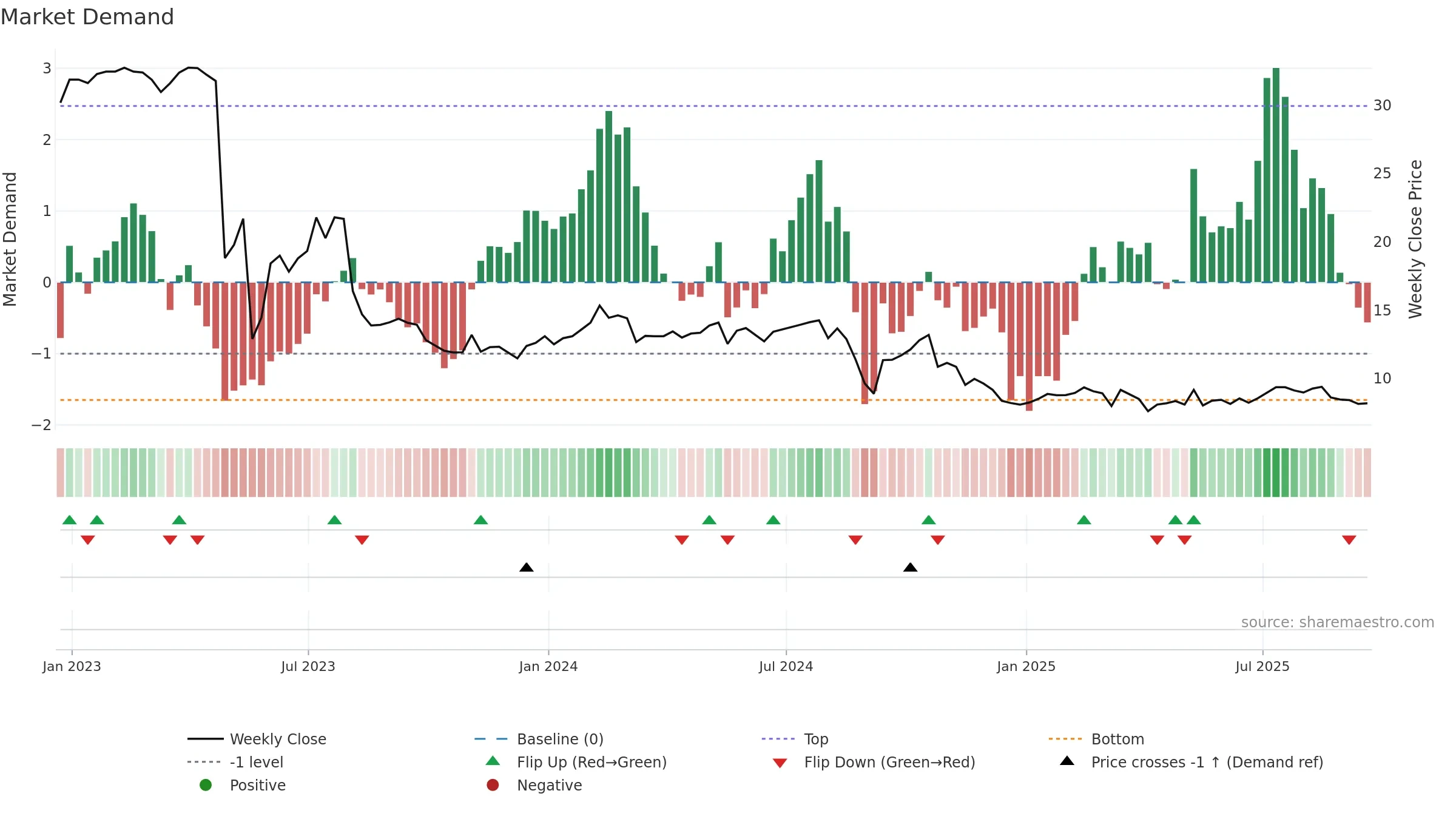

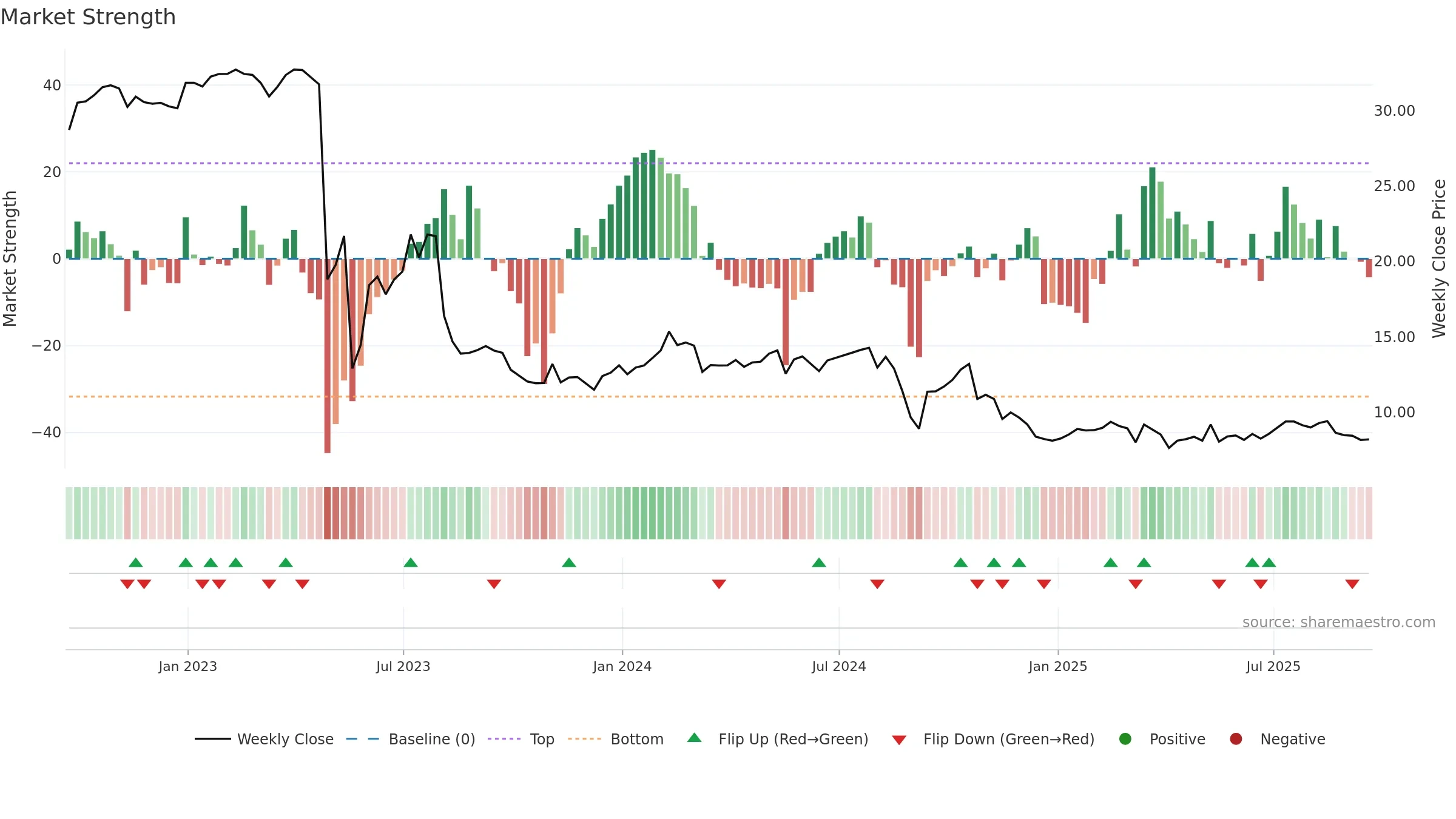

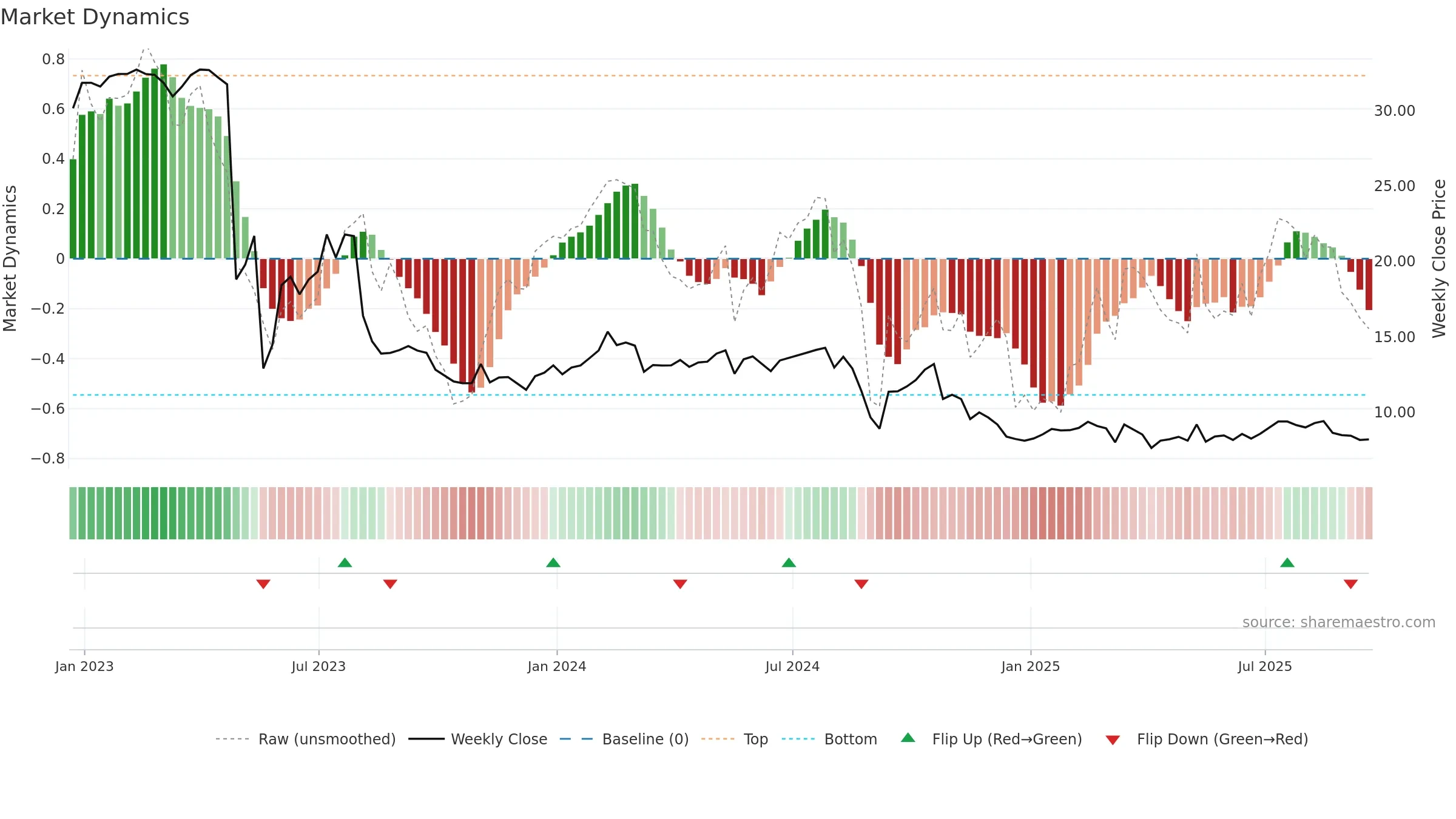

How to read this — Price slope is downward, indicating persistent supply pressure. Low weekly volatility favours steadier follow-through. Volume and price are moving in the same direction — a constructive confirmation. Returns are positively correlated with volume — strength tends to arrive on higher activity. Price sits below key averages, keeping pressure on the tape.

Down-slope argues for patience; rallies can fade sooner unless participation improves.

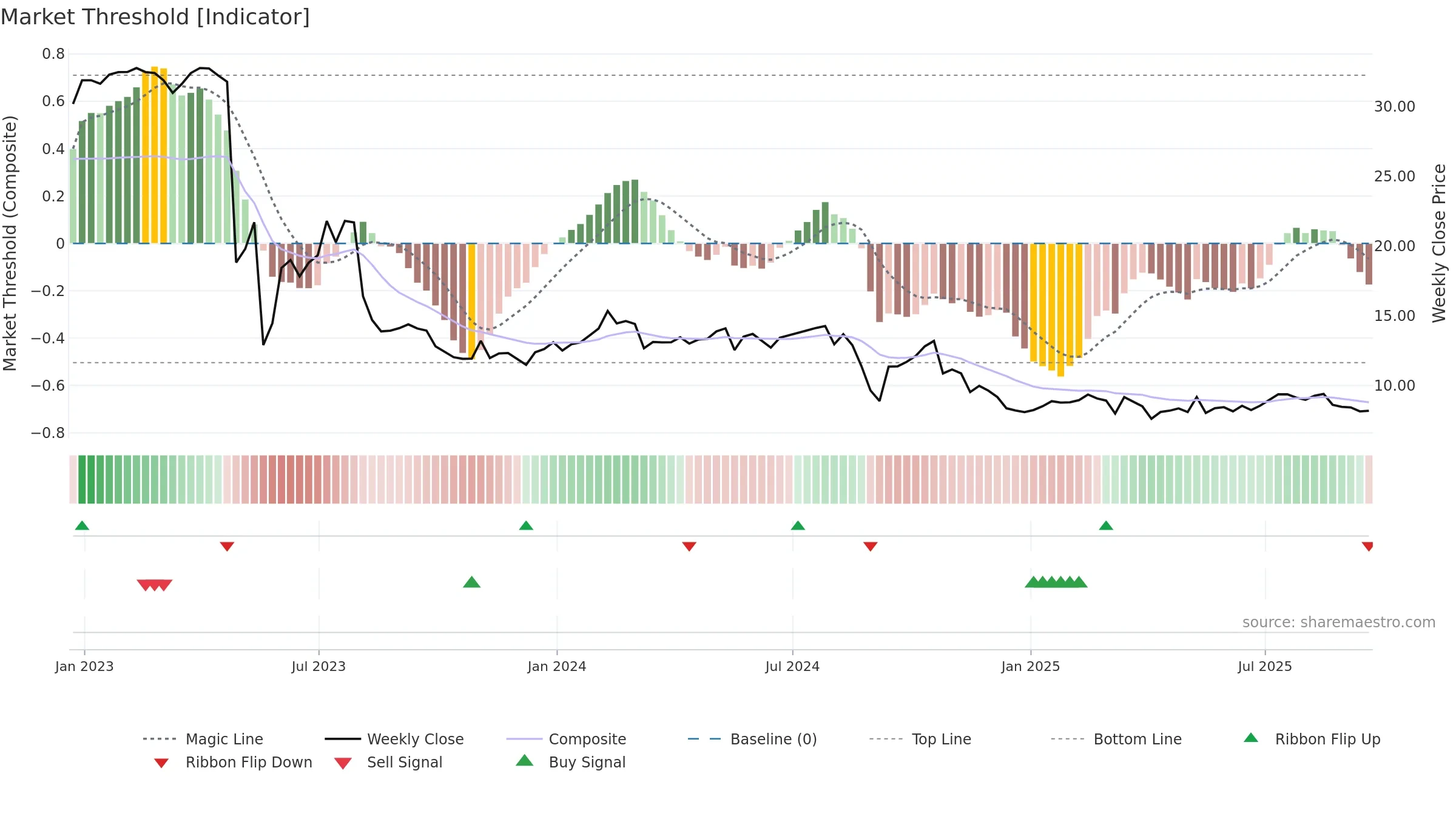

Gauge maps the trend signal to a 0–100 scale.

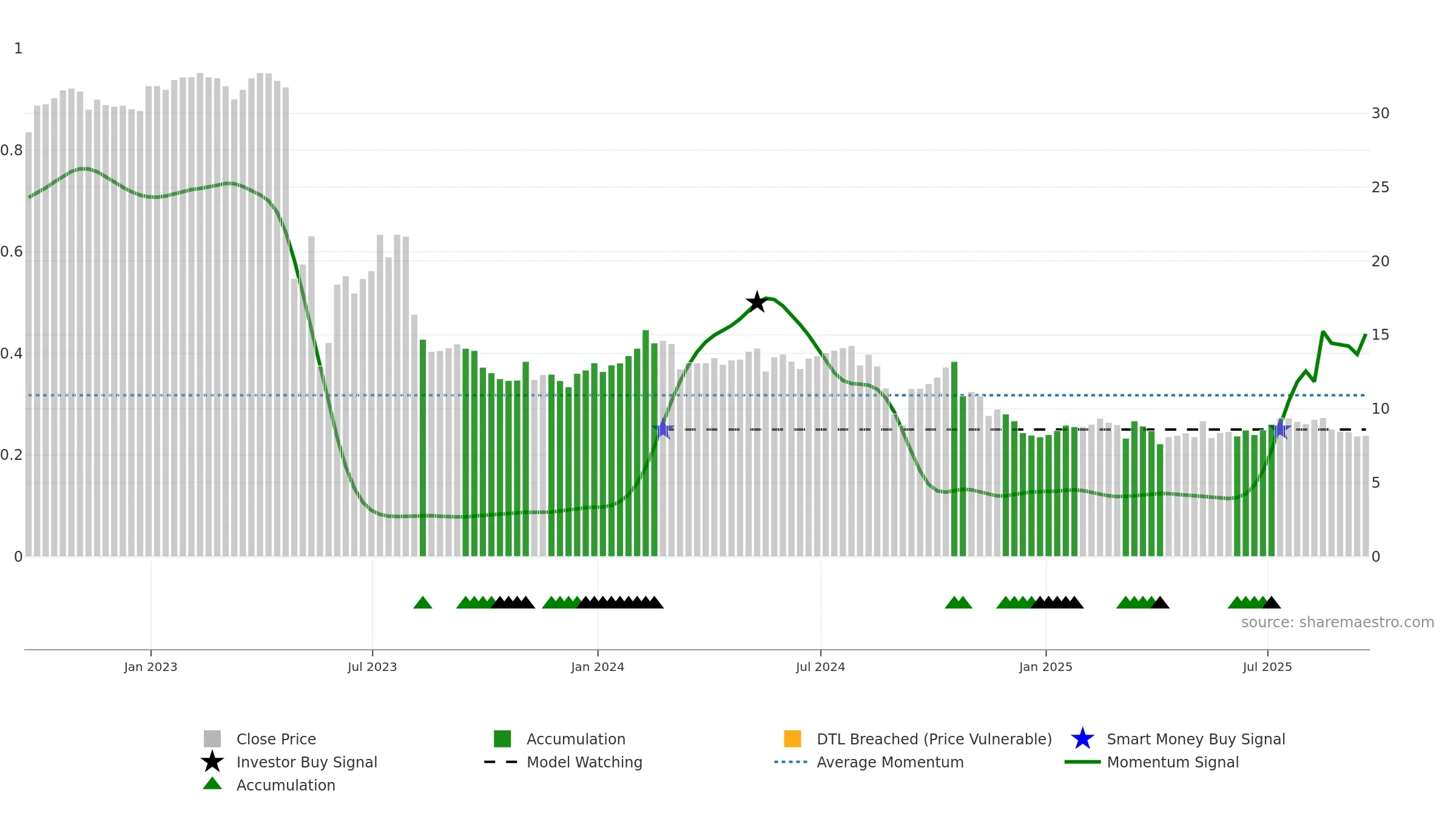

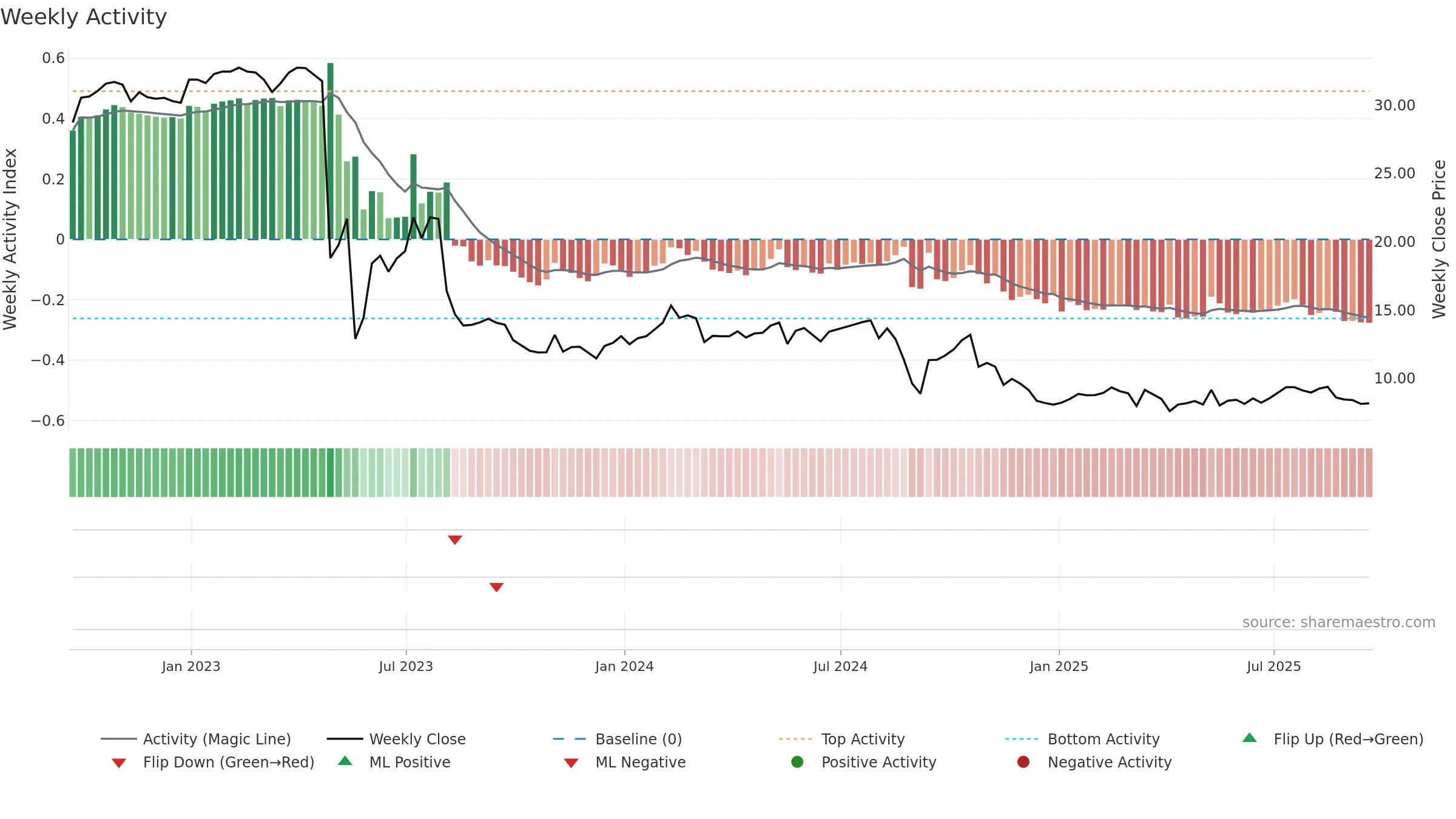

How to read this — Range-bound conditions; conviction is limited until a break or acceleration emerges. Sub-0.40 print confirms downside control.

Wait for a directional break or improving acceleration.

The flag is positive: favourable upside skew with supportive conditions.

Conclusion

Neutral setup. ★★★☆☆ confidence. Price window: -8. Trend: Range / Neutral; gauge 43. In combination, liquidity confirms the move.

- Liquidity confirms the price trend

- Low return volatility supports durability

- Price is not above key averages

- Negative multi-week performance

- Sub-0.40 print confirms bear control

Why: Price window -8.80% over 8w. Close is -12.87% below the prior-window high. Return volatility 1.40%. Volume trend falling. Liquidity convergence with price. Trend state range / neutral. Momentum neutral and rising. Valuation stance positive.

Tip: Most metrics include a hover tooltip where they appear in the report.