Tribune Resources Limited

TBR ASX

Weekly Report

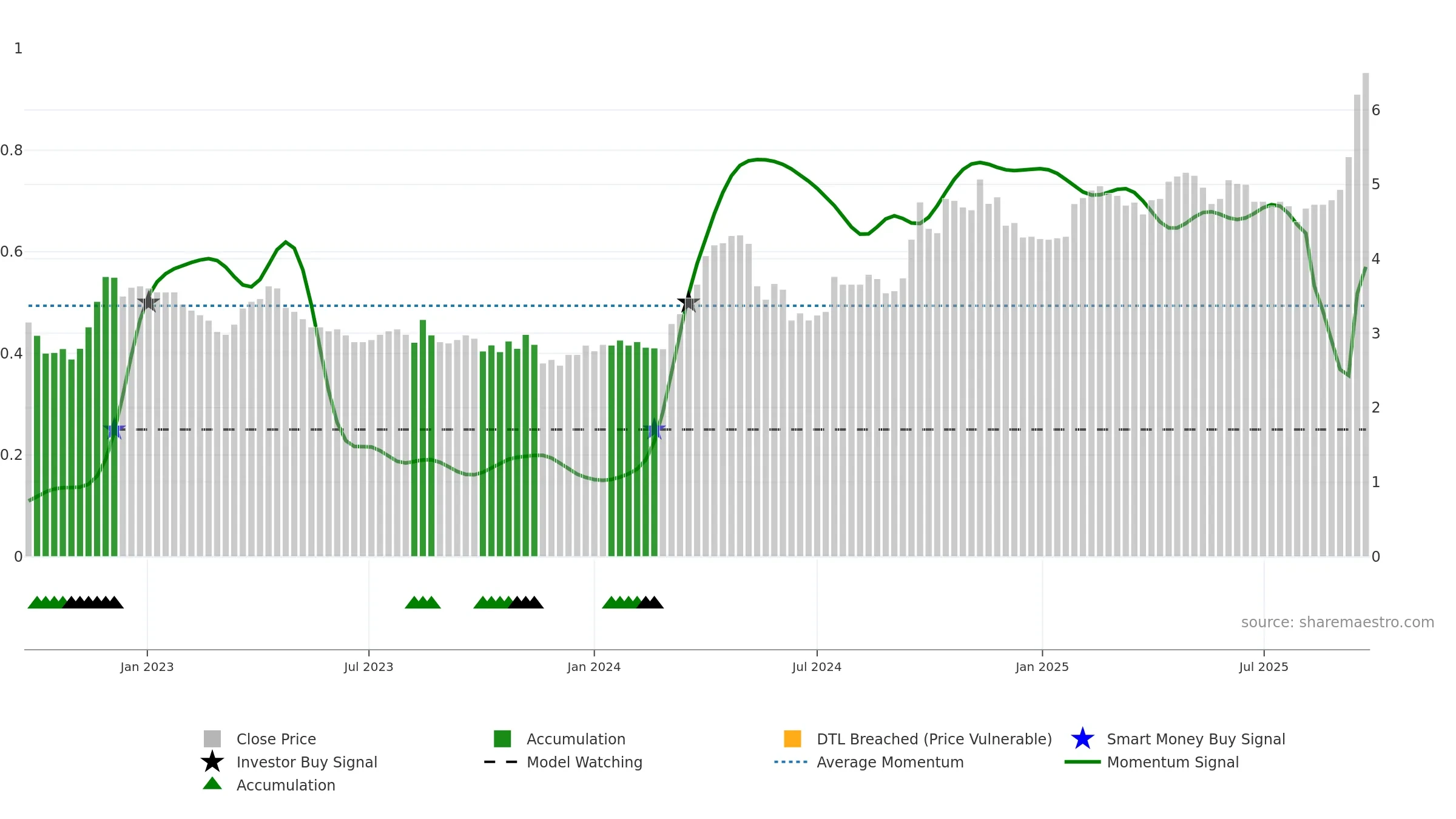

Tribune Resources Limited closed at 6.2100 (3.33% WoW) . Data window ends Mon, 15 Sep 2025.

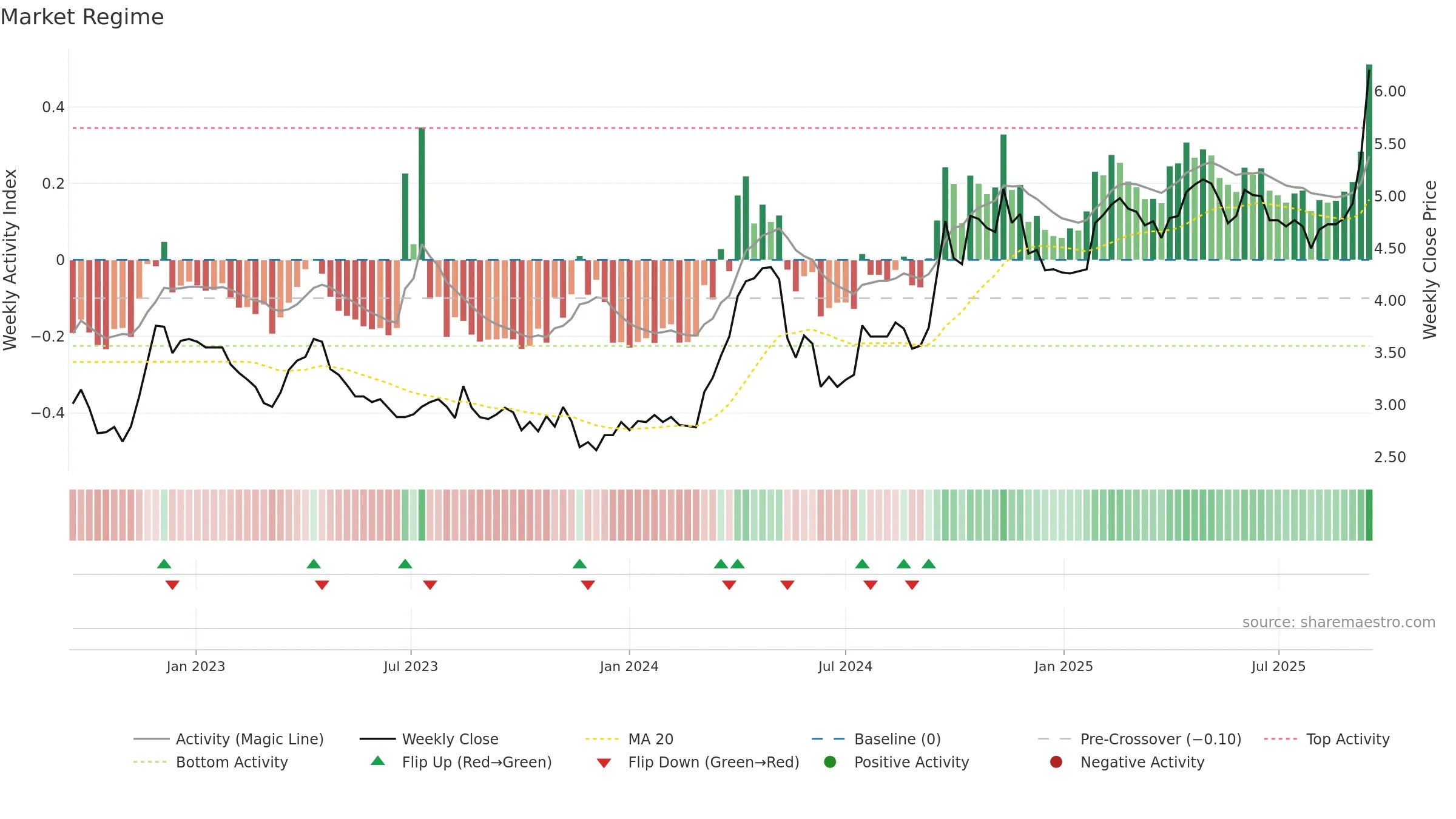

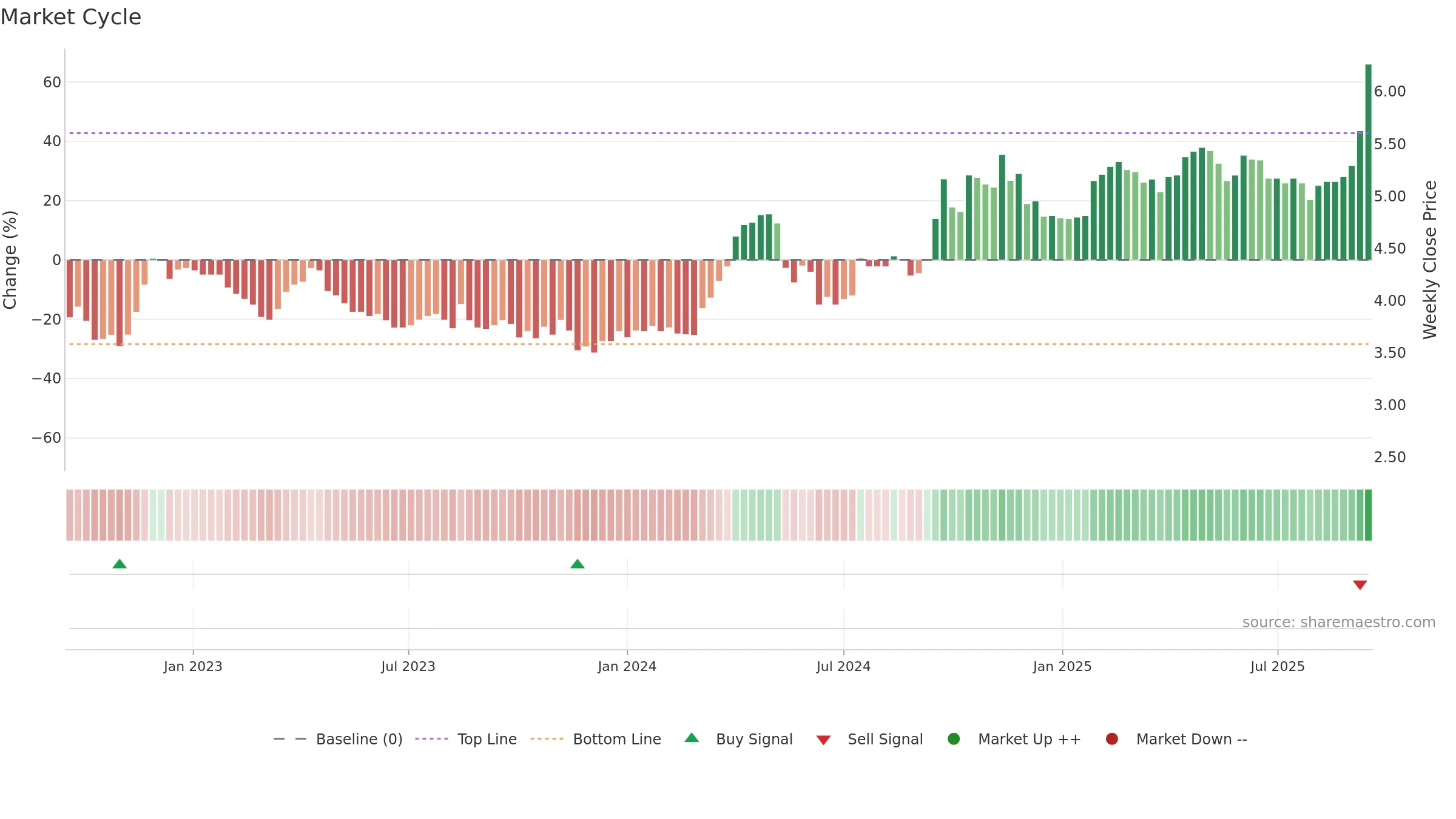

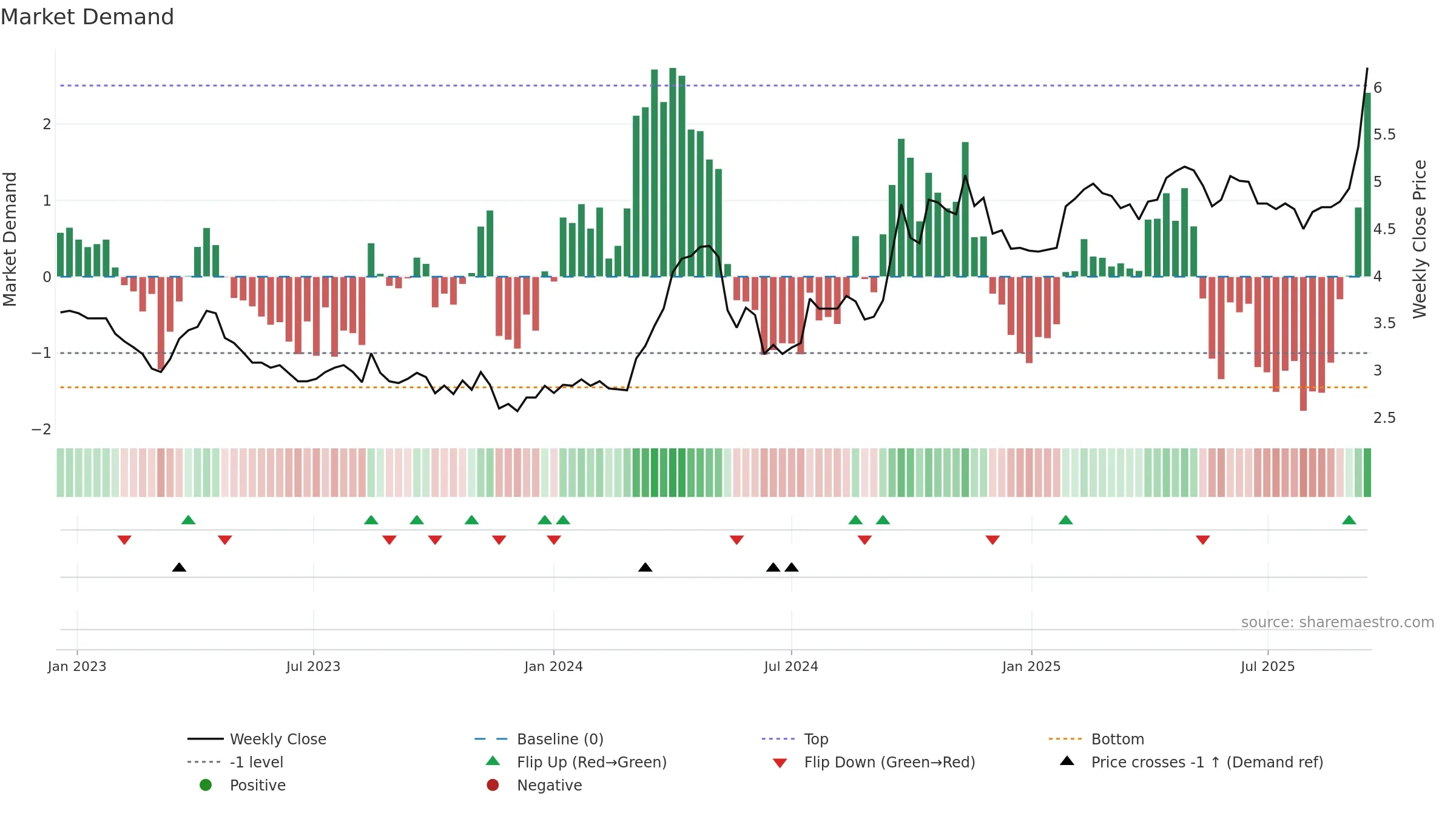

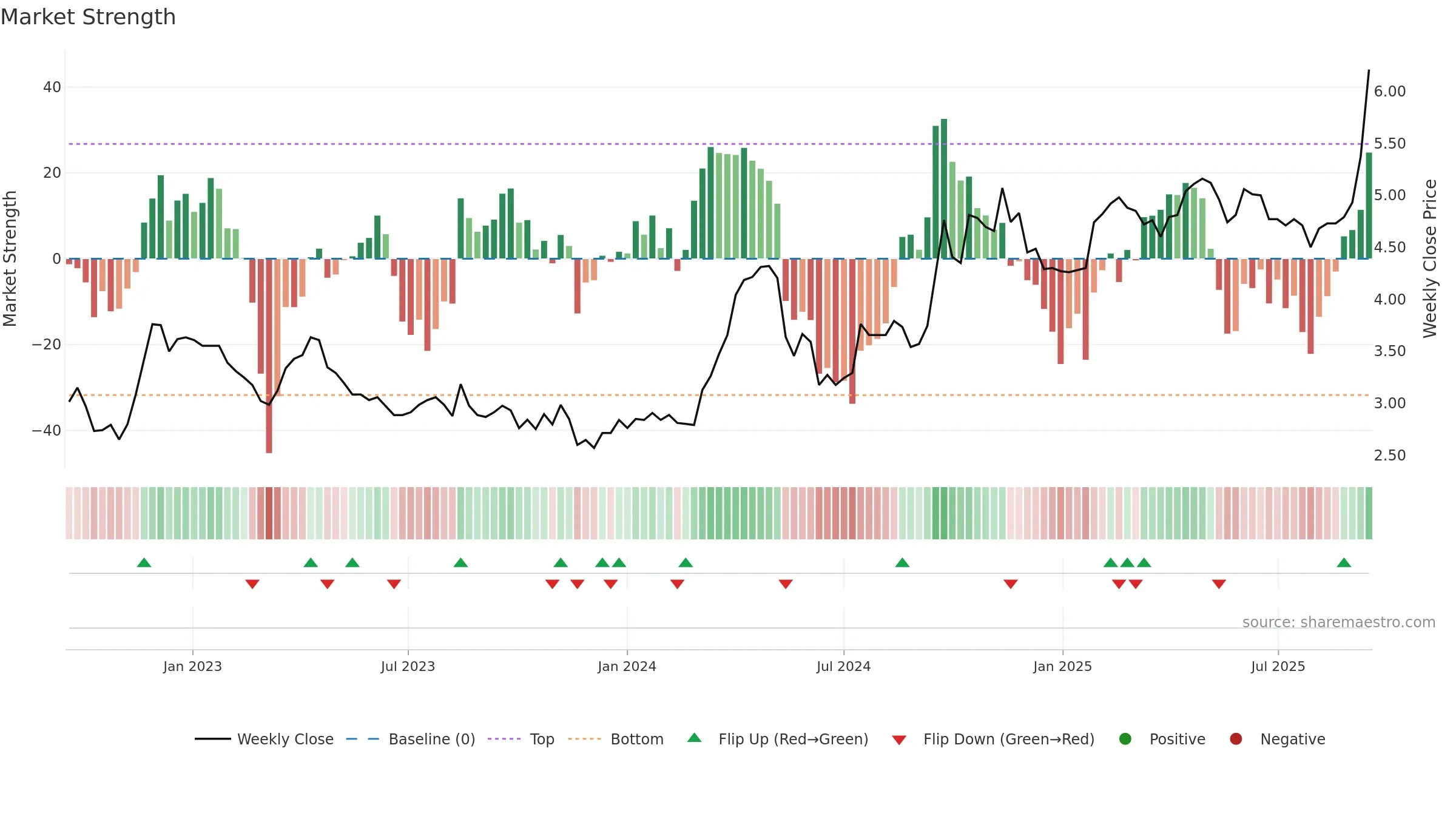

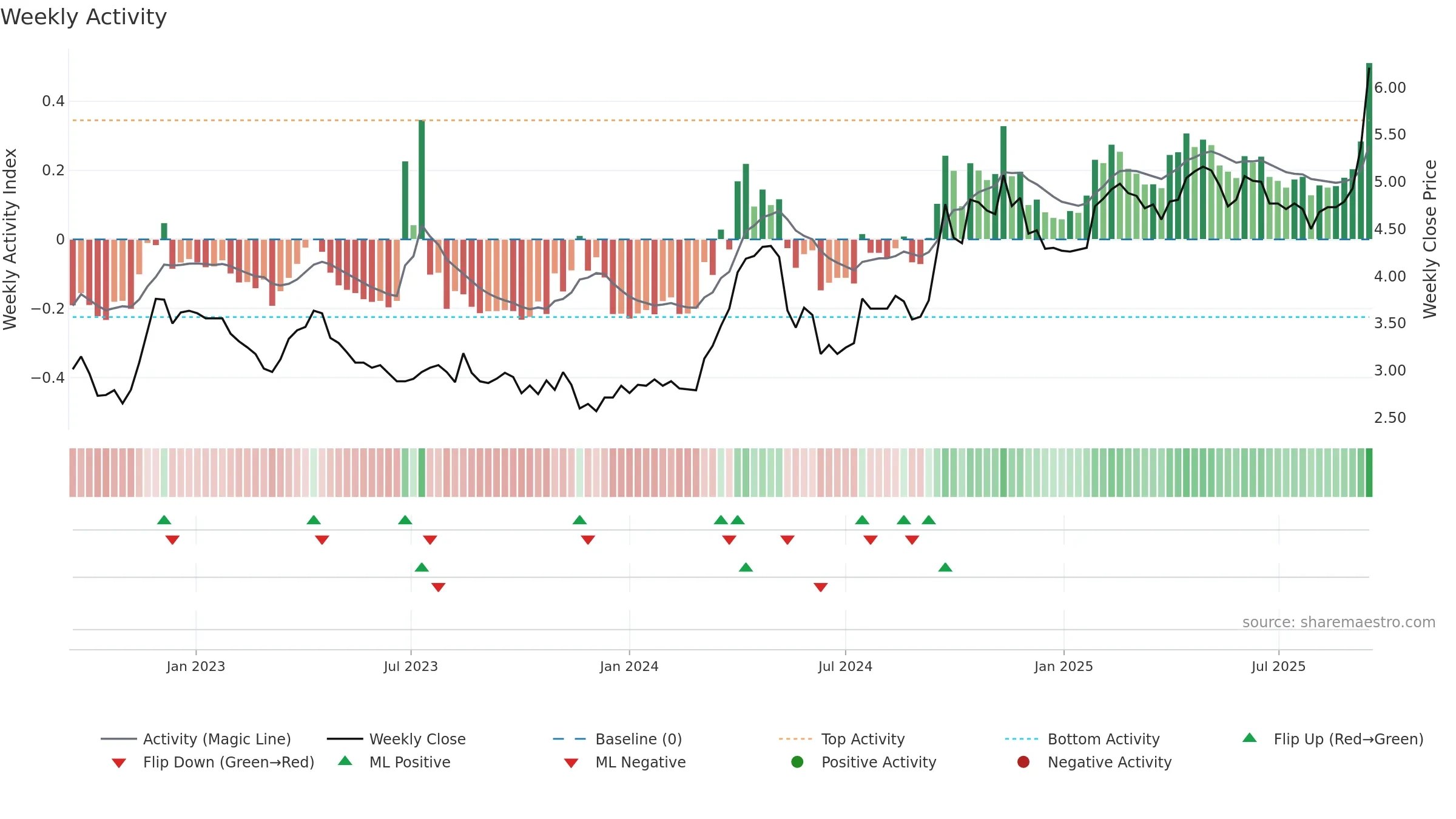

How to read this — Price slope is upward, indicating persistent buying over the window. Volume and price are moving in the same direction — a constructive confirmation. Returns are positively correlated with volume — strength tends to arrive on higher activity. Price is stretched above its baseline; consolidation risk rises if activity fades. Price holds above key averages, indicating constructive participation.

Up-slope supports buying interest; pullbacks may be contained if activity stays firm.

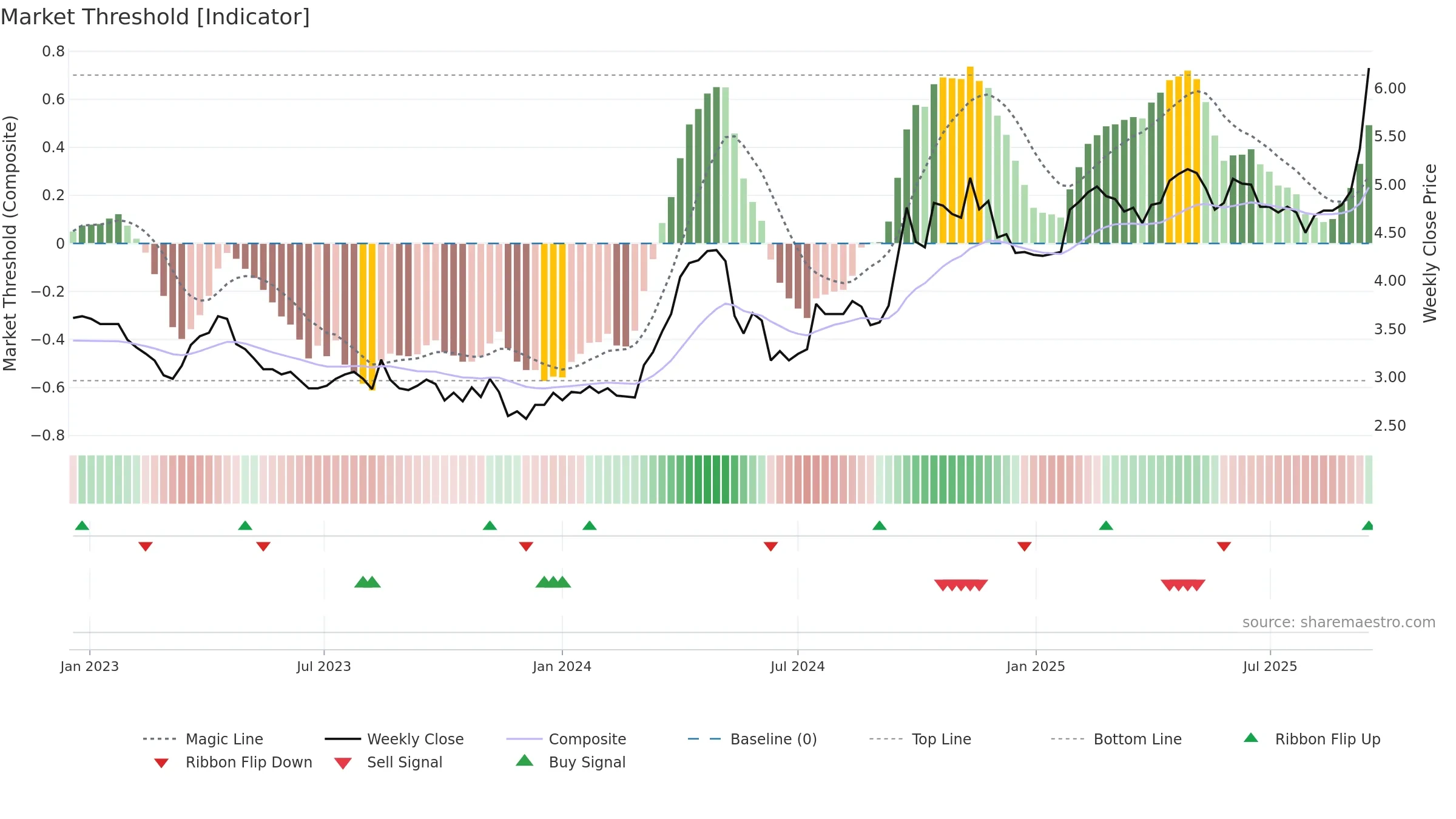

Gauge maps the trend signal to a 0–100 scale.

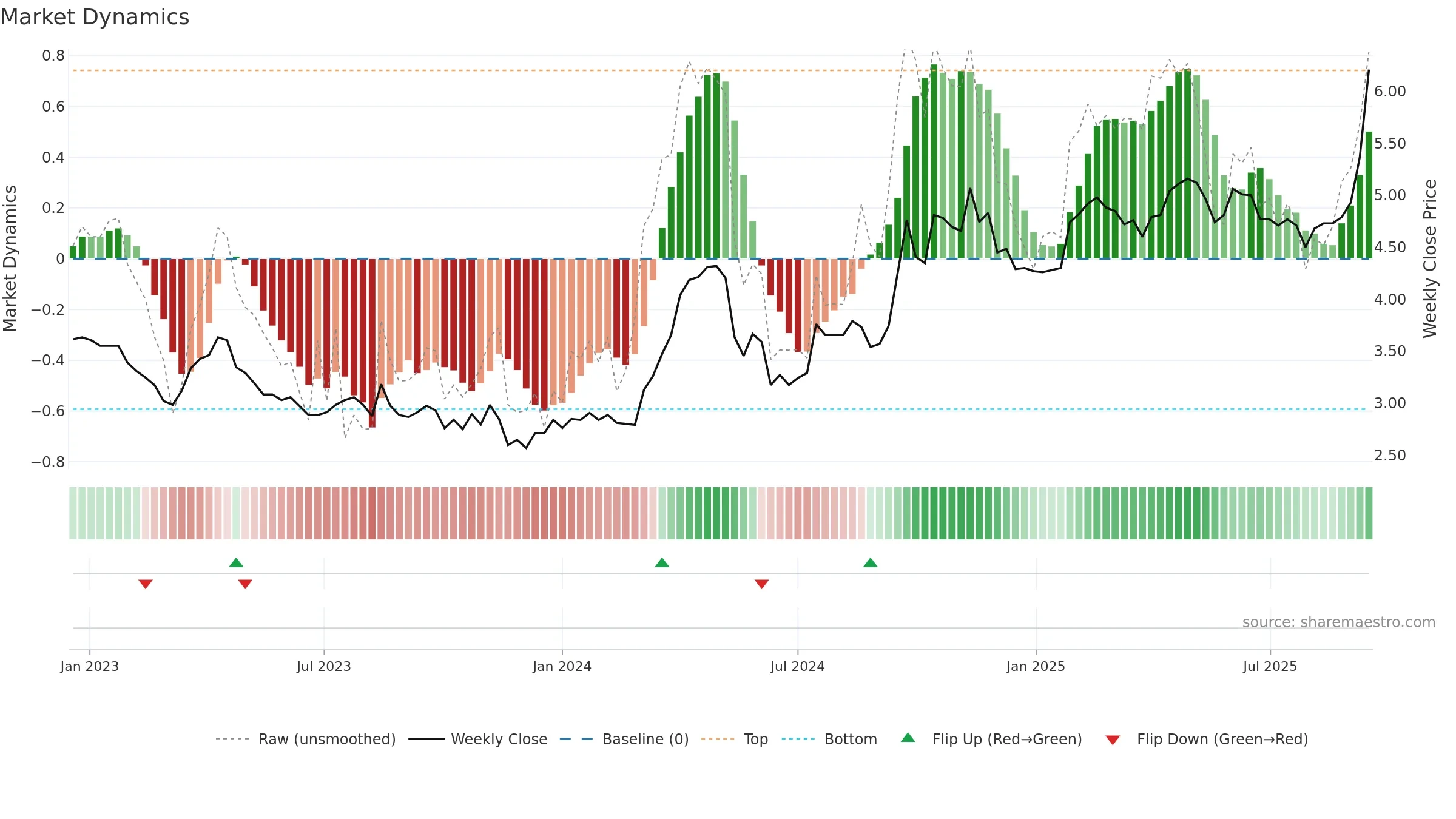

How to read this — Range-bound conditions; conviction is limited until a break or acceleration emerges. Sub-0.40 print confirms downside control.

Wait for a directional break or improving acceleration.

The flag is positive: favourable upside skew with supportive conditions.

Conclusion

Neutral setup. ★★★☆☆ confidence. Price window: 38. Trend: Range / Neutral; gauge 51. In combination, liquidity confirms the move.

- Price holds above 8w & 26w averages

- Liquidity confirms the price trend

- Solid multi-week performance

- Momentum is weak/falling

- Sub-0.40 print confirms bear control

Why: Price window 38.00% over 8w. Close is 15.64% above the prior-window high. Volume trend rising. Liquidity convergence with price. Trend state range / neutral. Momentum neutral and falling. Valuation stance positive.

Tip: Most metrics include a hover tooltip where they appear in the report.