Price & Volume (8w)

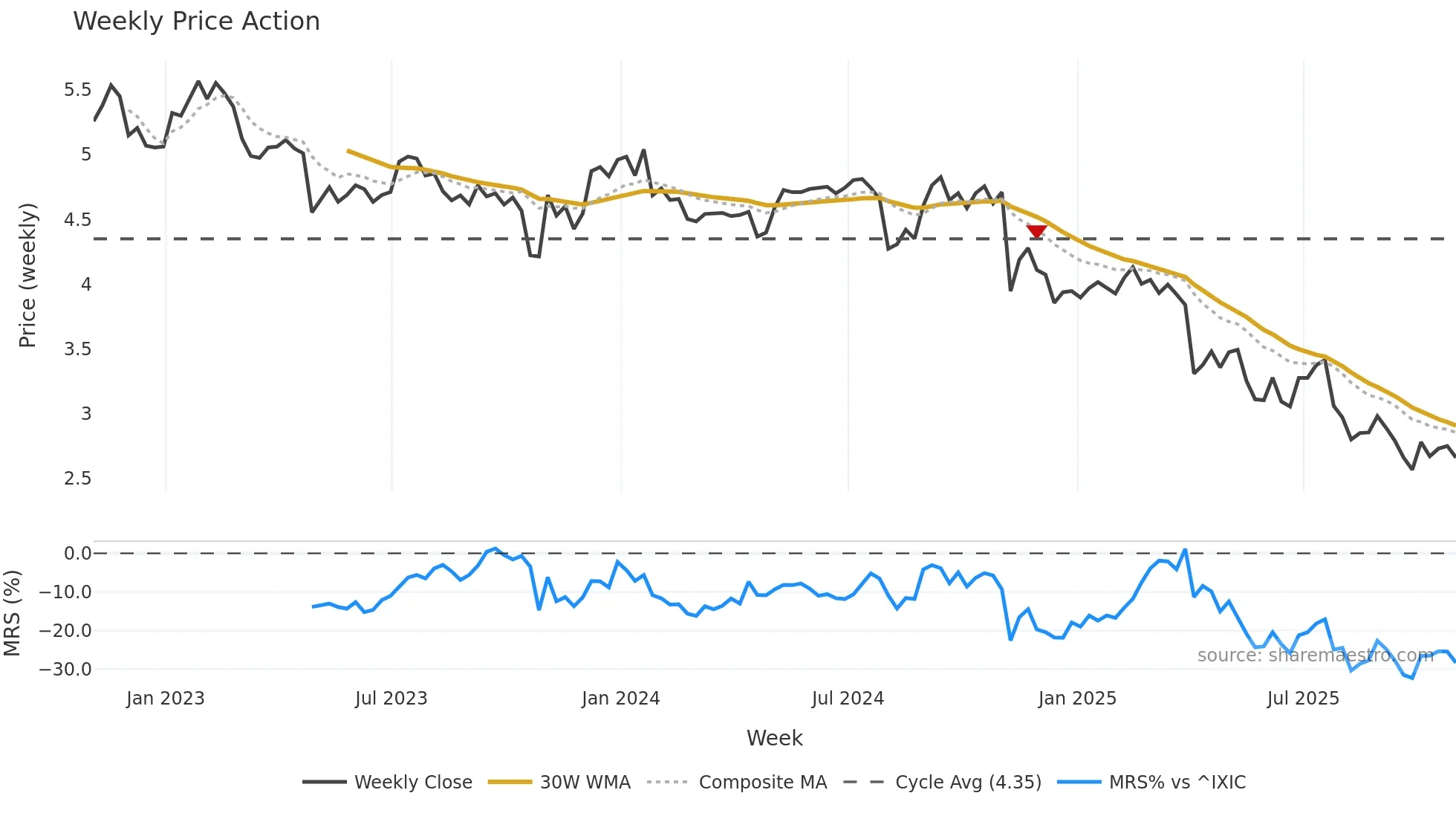

Last week closed up (1.14%), and over the last 8 weeks price is down (-4.66%) with a falling slope (-0.036%/w). Ranges are compressing (current 0.83× mean; 38th pct; realised vol ≈ 4.35%). Price spends time in the lower band (rising), participation is below typical with a selling-tilt bias (z -4.02), money flow is falling, and posture is below 30w & 50w (drawdown -4.66%). Pressure favours further decline unless momentum repairs.

Weekly Report (8w)

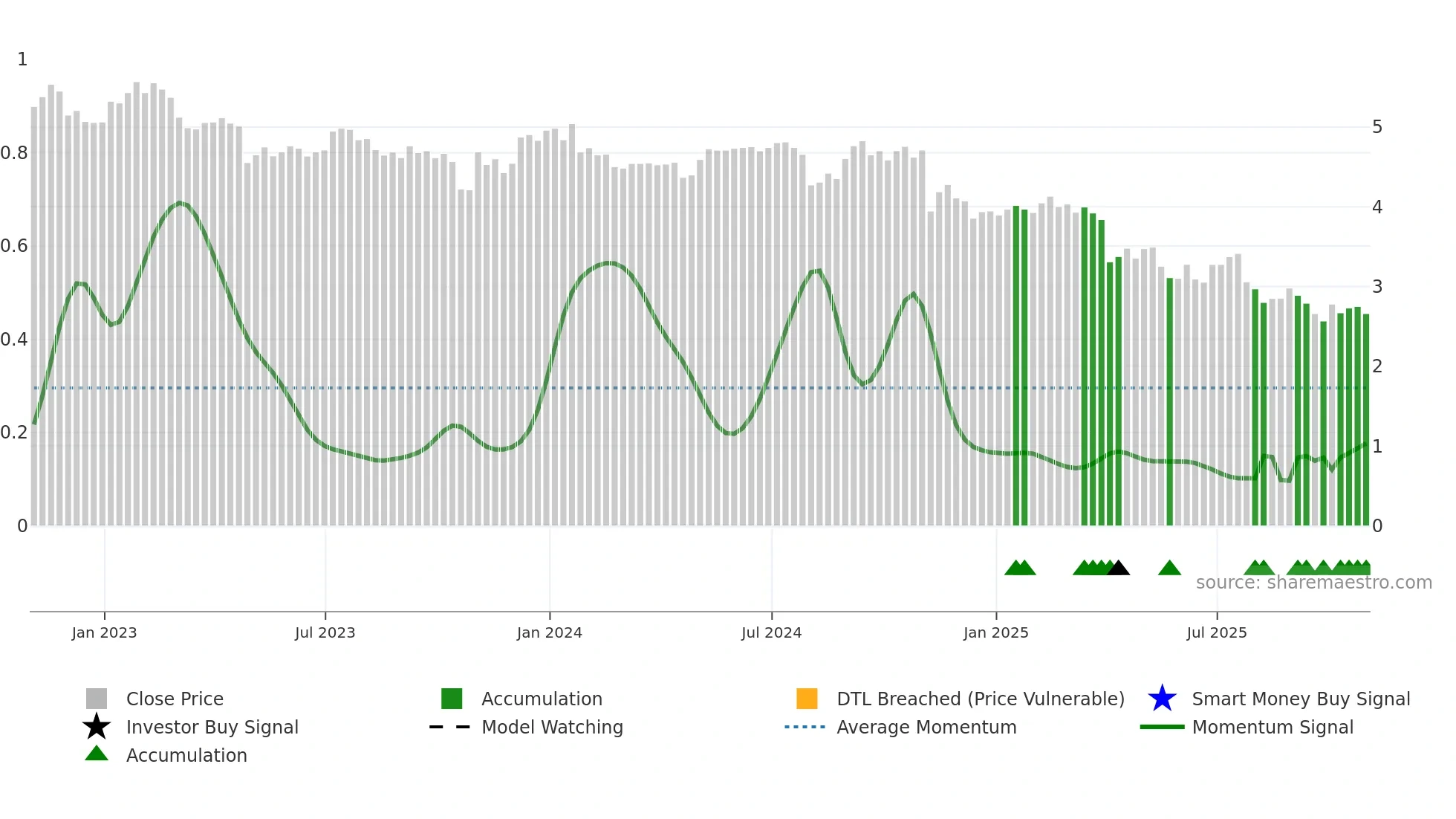

This week: Smart Money flow tilts to accumulation. In practical terms: backdrop is balanced; confirmation from breadth and closes is important; alignment between price and intent improves reliability of advances.

- Monitor participation on down-weeks—staying near typical or above supports continuation.

Market Regime (Activity)

Convergence / Divergence (SI vs Price)

(New − Old) / Old × 100.

Compression Ratio compares the latest range to the recent average (e.g., 0.72× means tighter than usual).

Range Percentile shows where the latest range sits within the recent distribution (e.g., 38th pct).

Realised Volatility is the standard deviation of week-to-week Close→Close % changes over the window (a volatility proxy).

0.0=lower band, 0.5=middle MA, 1.0=upper band.

Values >1 or <0 are outside the bands.

%B slope is the weekly drift of %B — rising means price is gravitating toward strength.

Band location (lower/middle/upper) and Band trend (rising/falling/flat)

summarise where price lives and whether that placement is improving.

Proprietary Analysis: All Sharemaestro charts, signals, and insights are unique to our platform. We do not follow conventional market models - this proprietary approach is what sets Sharemaestro apart.