Sydbank A/S

SYDB CPH

Weekly Report

Sydbank A/S closed at 500.5000 (1.89% WoW) . Data window ends Mon, 15 Sep 2025.

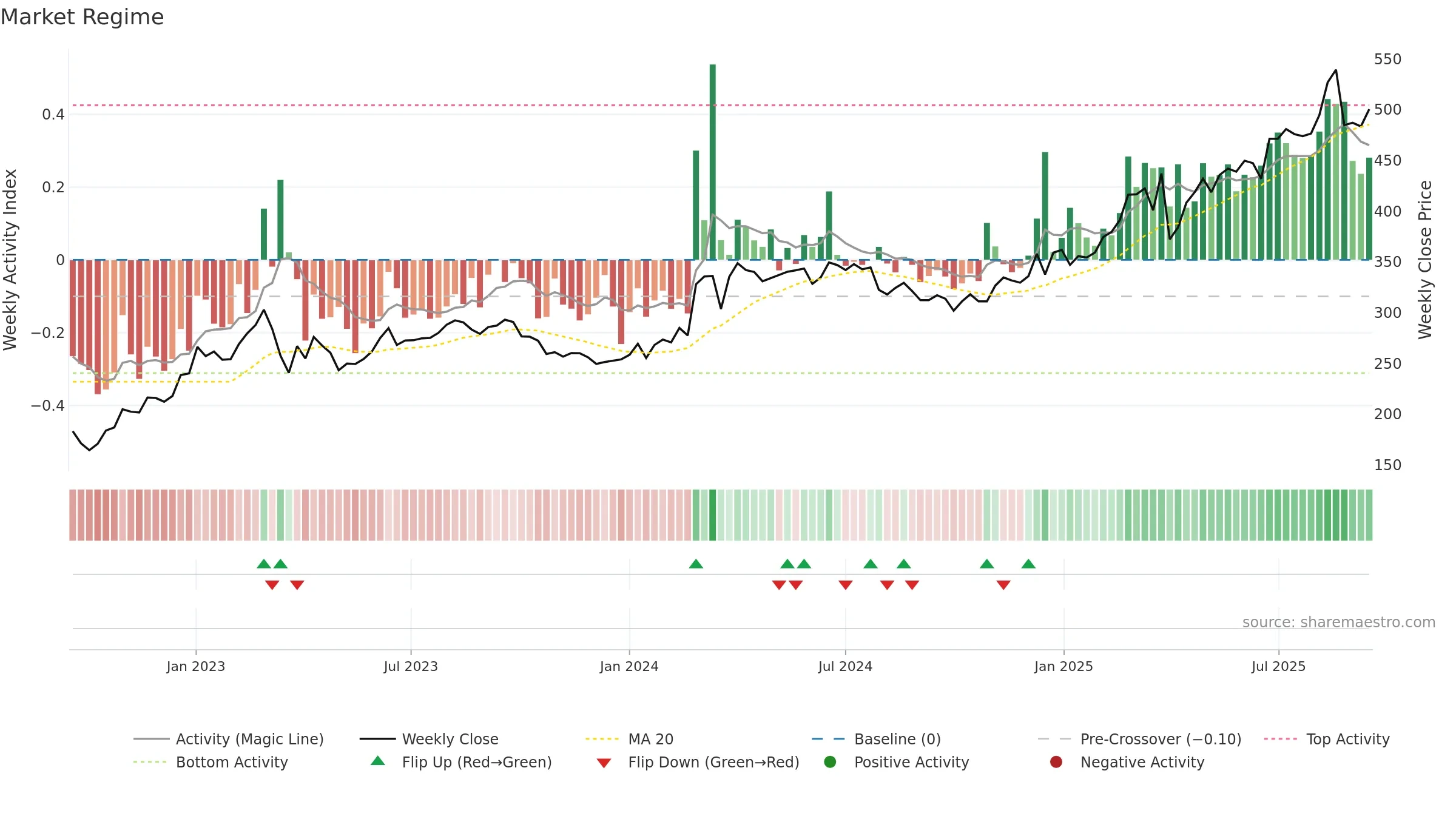

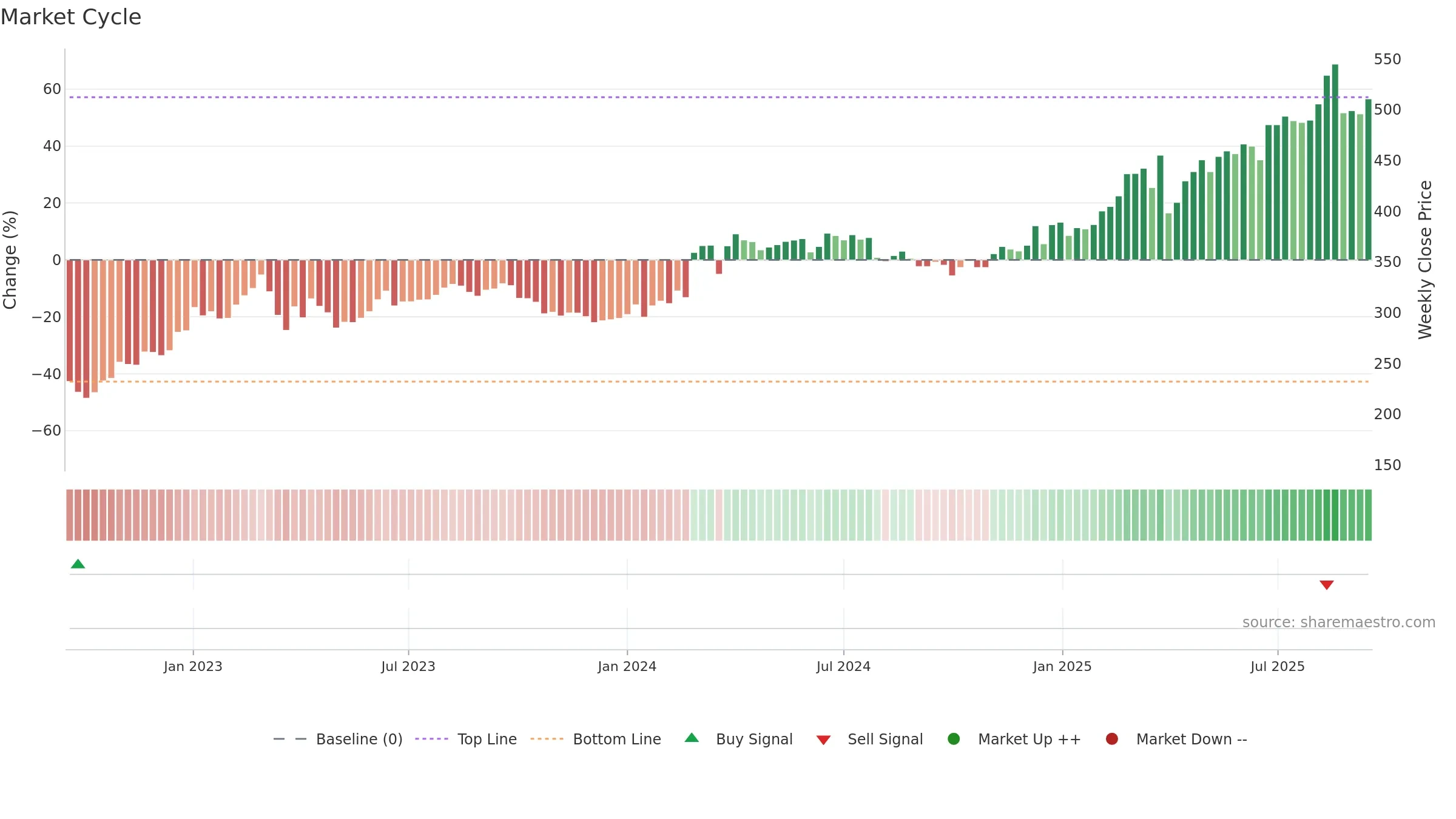

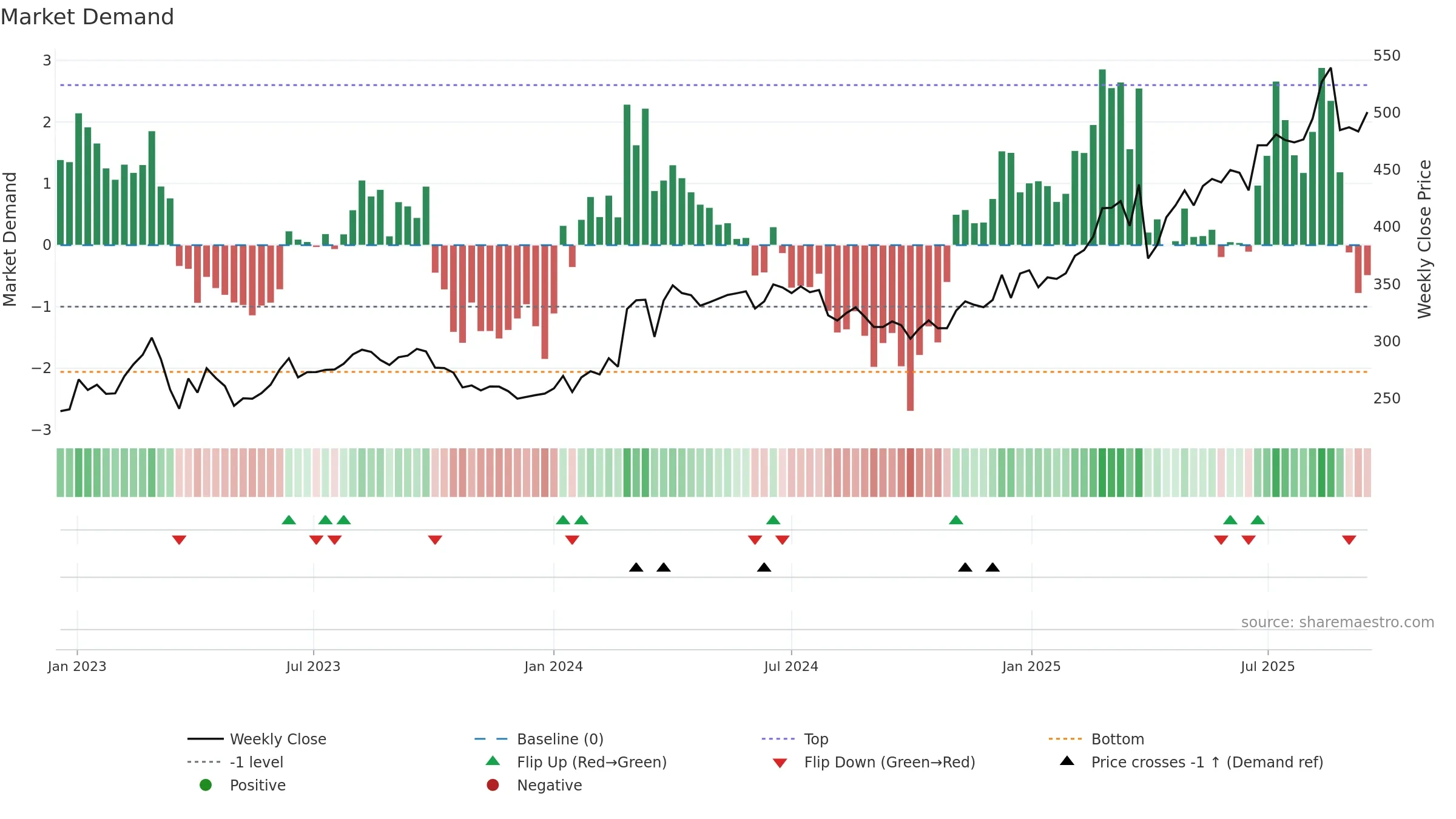

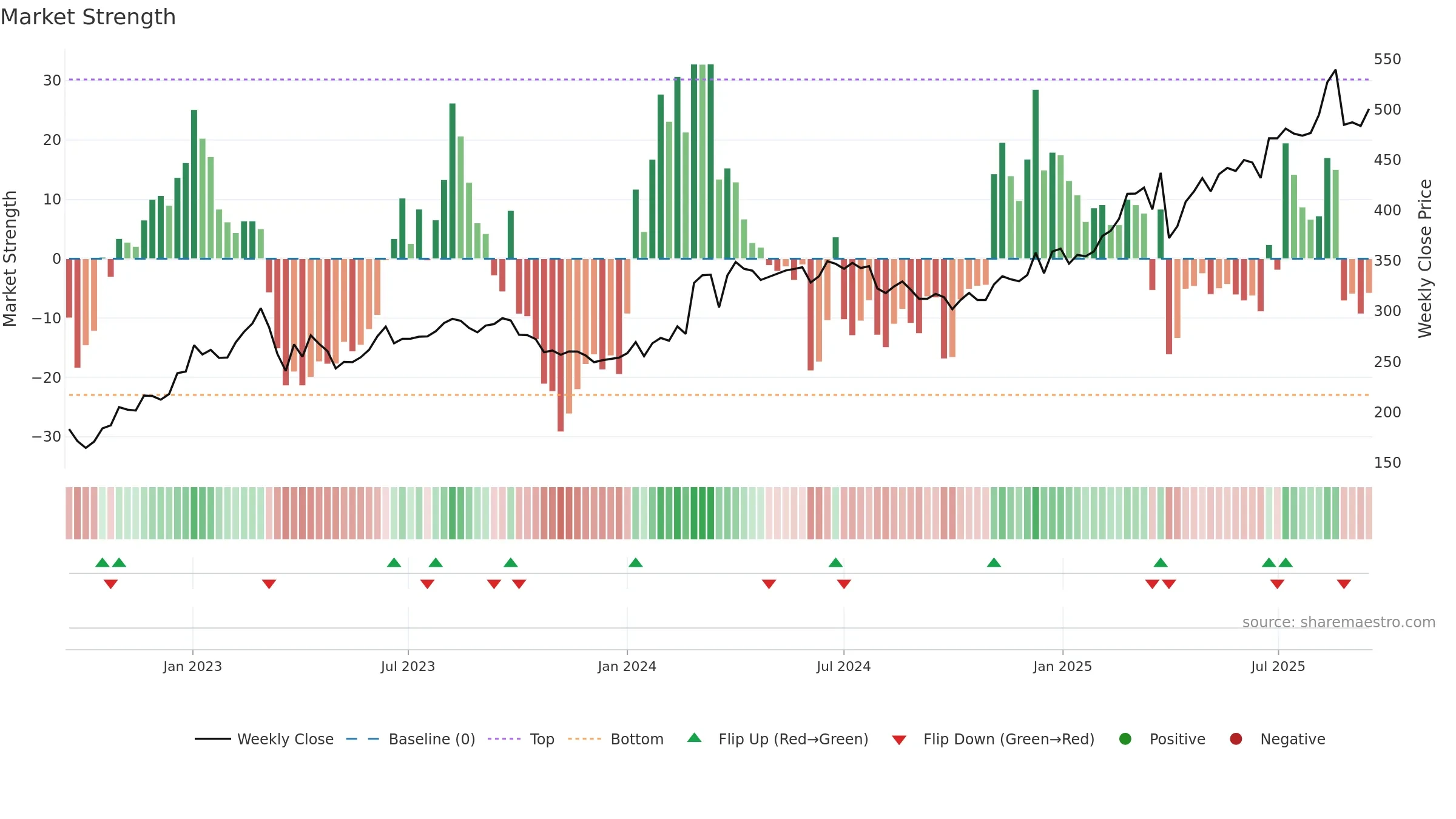

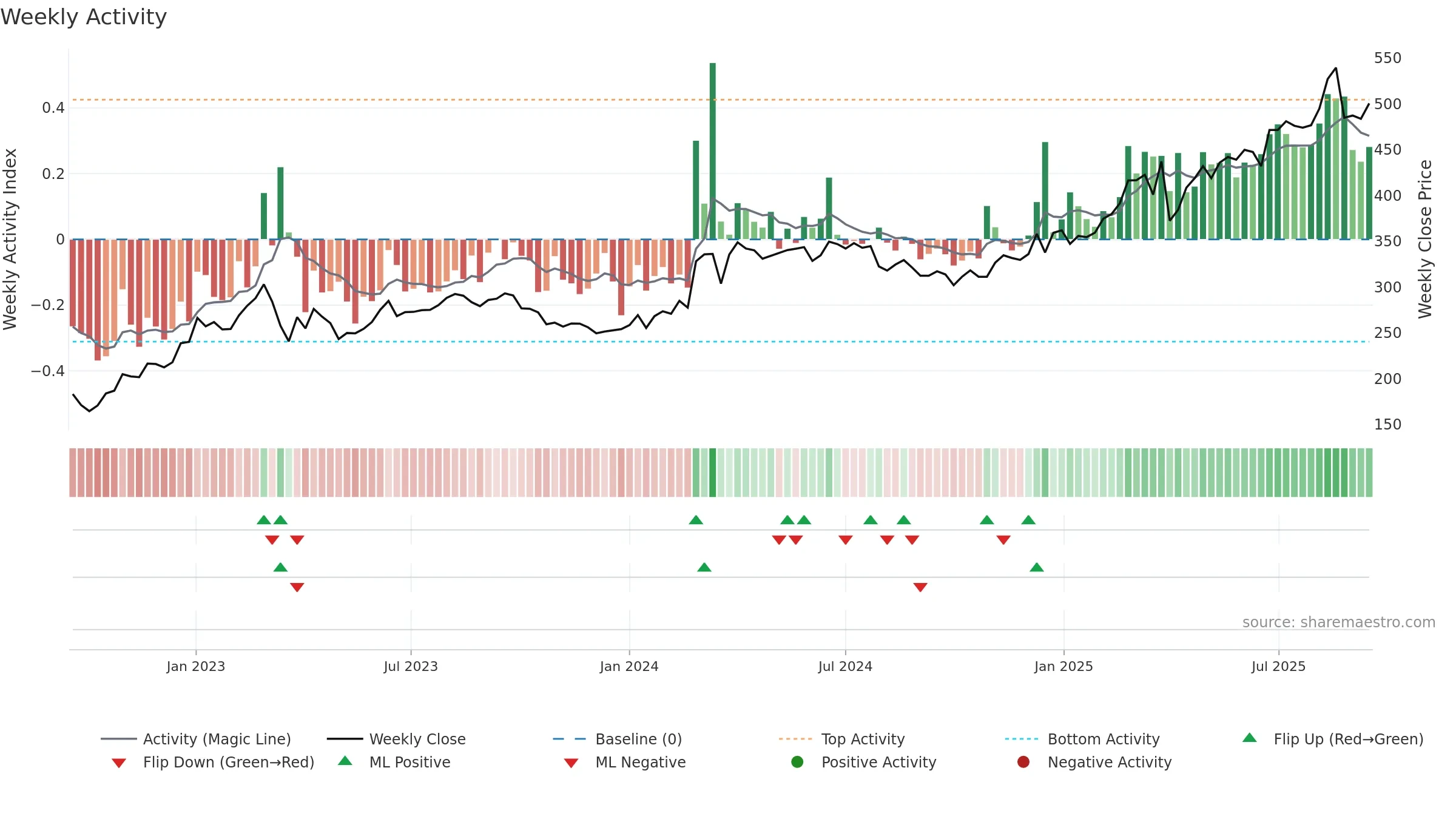

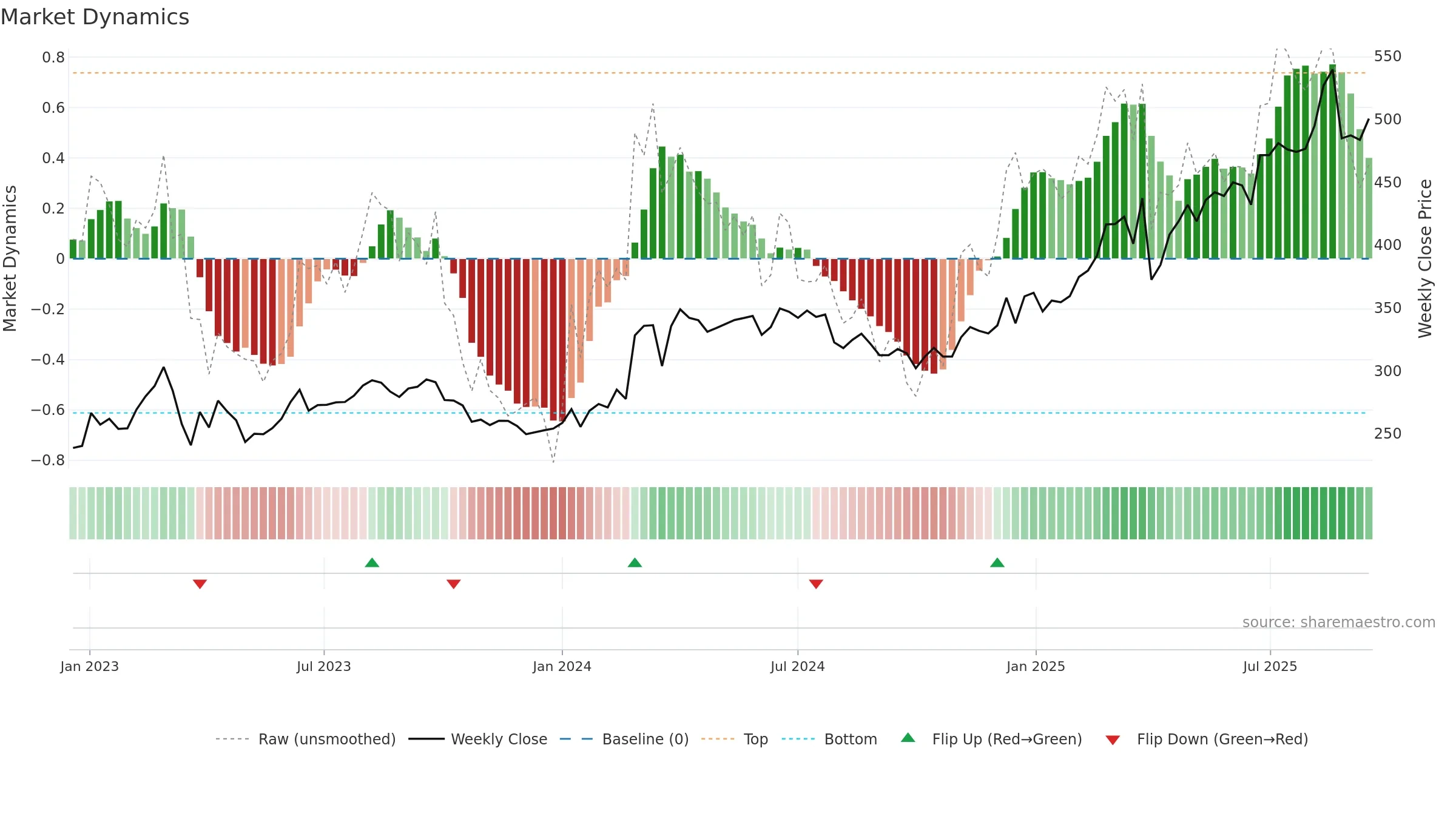

How to read this — Price slope is downward, indicating persistent supply pressure. Elevated weekly volatility increases whipsaw risk. Volume and price are moving in the same direction — a constructive confirmation. Returns are negatively correlated with volume — strength may come on lighter activity. Distance to baseline is narrowing — reverting closer to its fair-value track. Fresh short-term downside crossover weakens near-term tone. Price holds above key averages, indicating constructive participation.

Down-slope argues for patience; rallies can fade sooner unless participation improves.

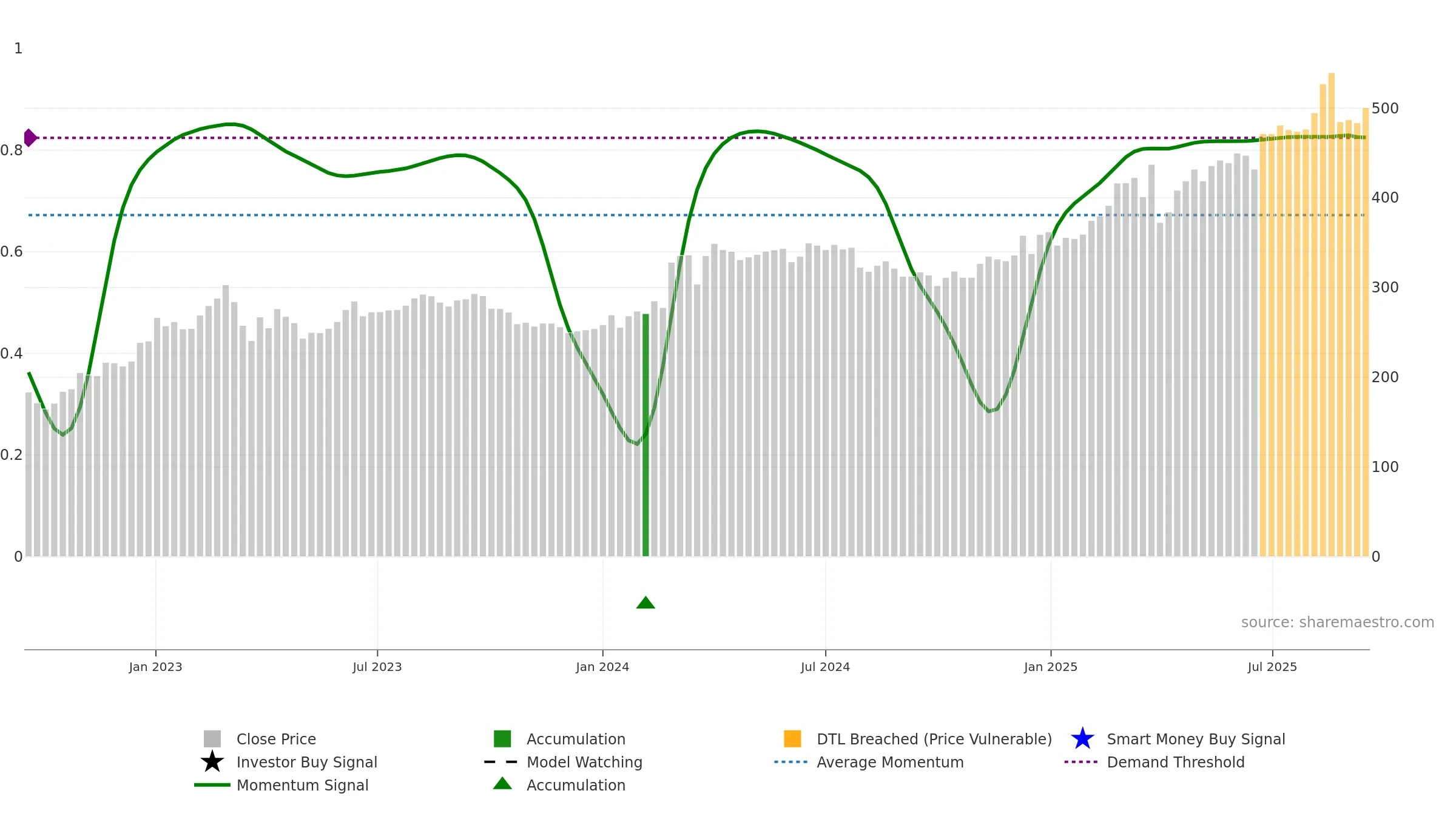

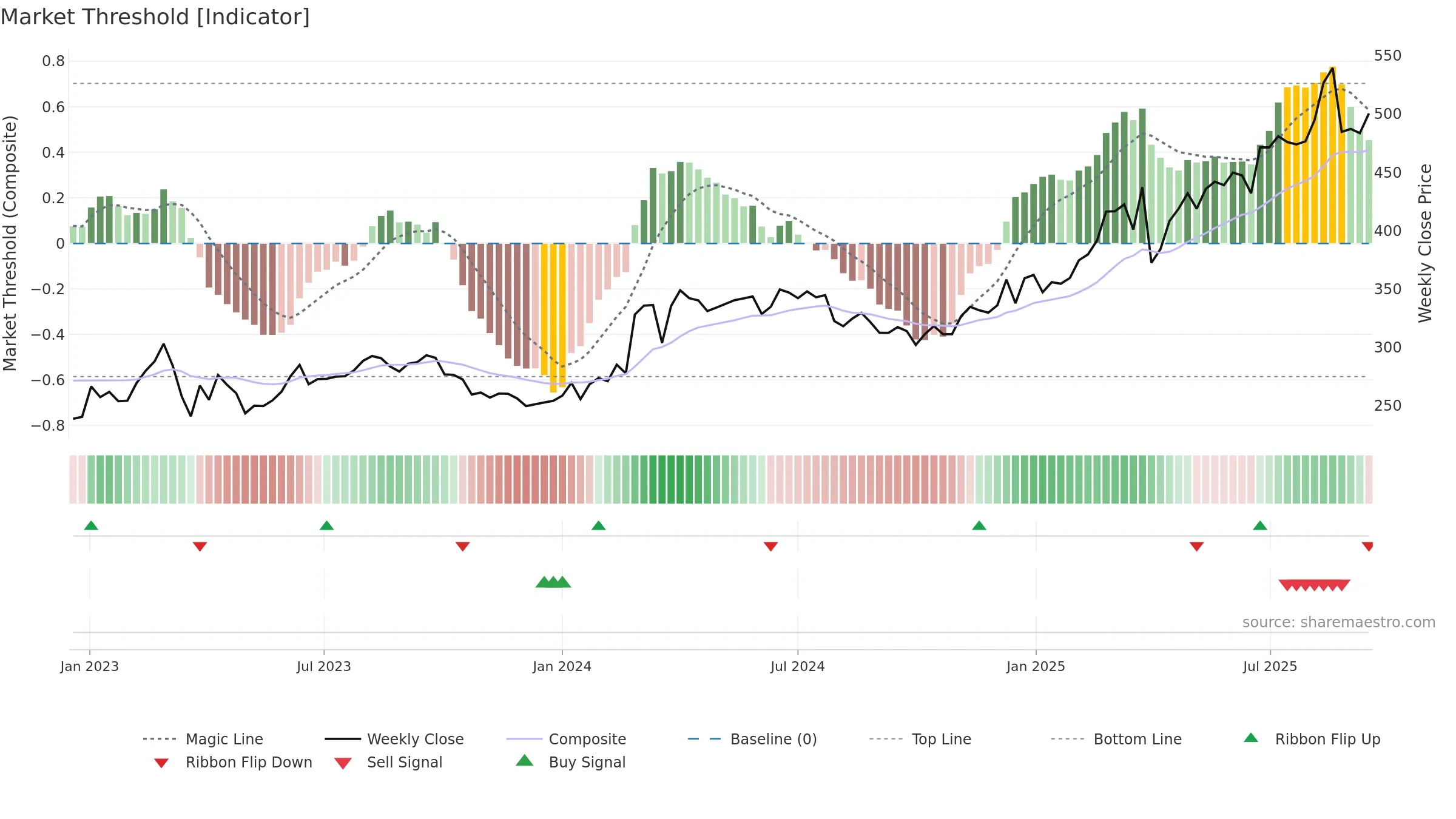

Gauge maps the trend signal to a 0–100 scale.

How to read this — Gauge is elevated but momentum is rolling over; topping risk is rising.

Stay alert: protect gains or seek confirmation before adding risk.

Conclusion

Negative setup. ★★☆☆☆ confidence. Price window: 5. Trend: Uptrend at Risk; gauge 82. In combination, liquidity confirms the move.

- Price holds above 8w & 26w averages

- Liquidity confirms the price trend

- High-level but rolling over (topping risk)

- High return volatility raises whipsaw risk

- Sellers active at elevated levels (distribution)

Why: Price window 5.01% over 8w. Close is -7.23% below the prior-window high. Return volatility 4.28%. Volume trend falling. Liquidity convergence with price. Trend state uptrend at risk. High-regime (0.80–1.00) downticks 4/7 (57.0%) • Distributing. 4–8w crossover bearish. Momentum neutral and rising.

Tip: Most metrics include a hover tooltip where they appear in the report.