Alok Industries Limited

ALOKINDS NSE

Weekly Report

Alok Industries Limited closed at 18.7100 (0.86% WoW) . Data window ends Mon, 15 Sep 2025.

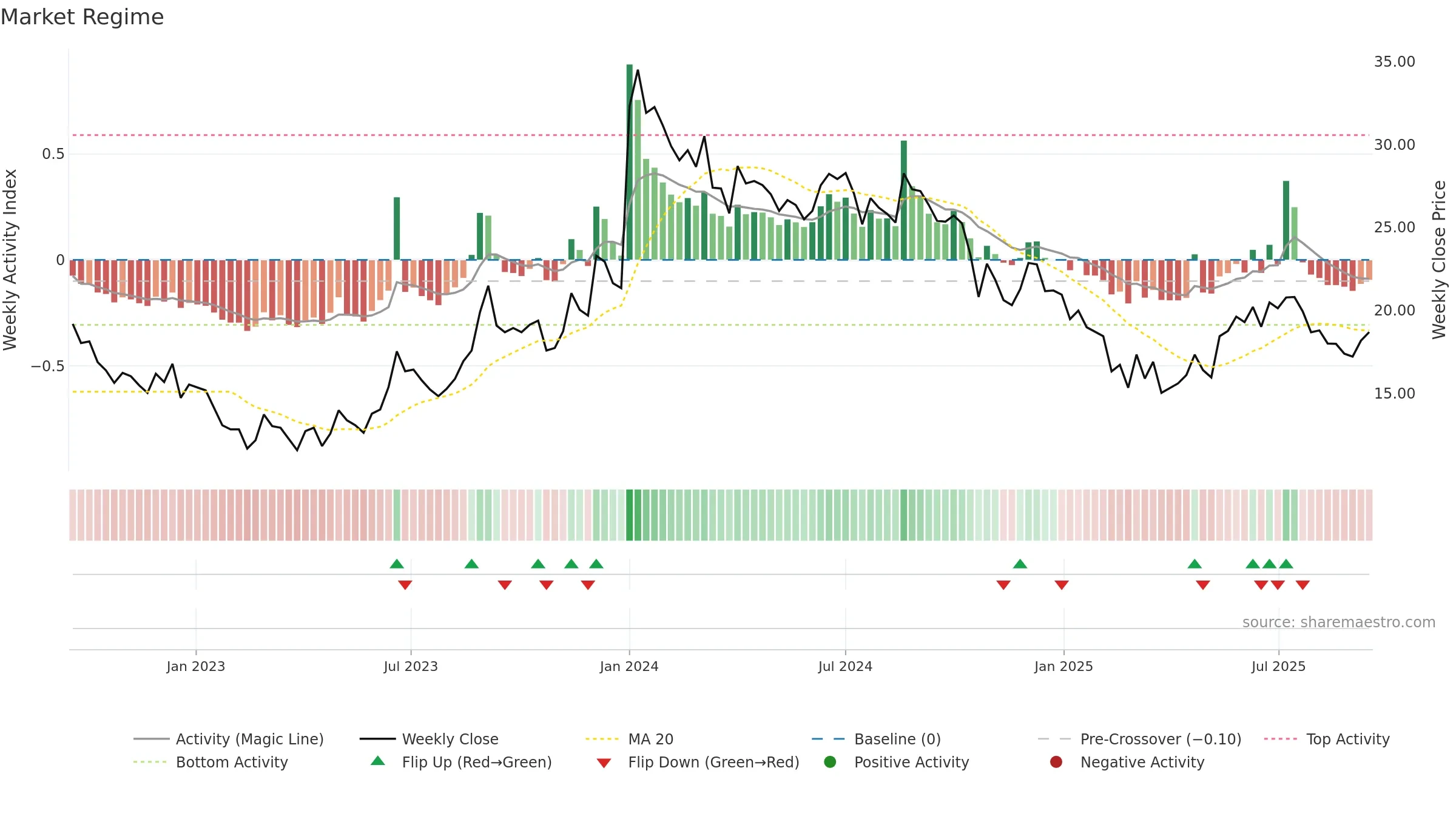

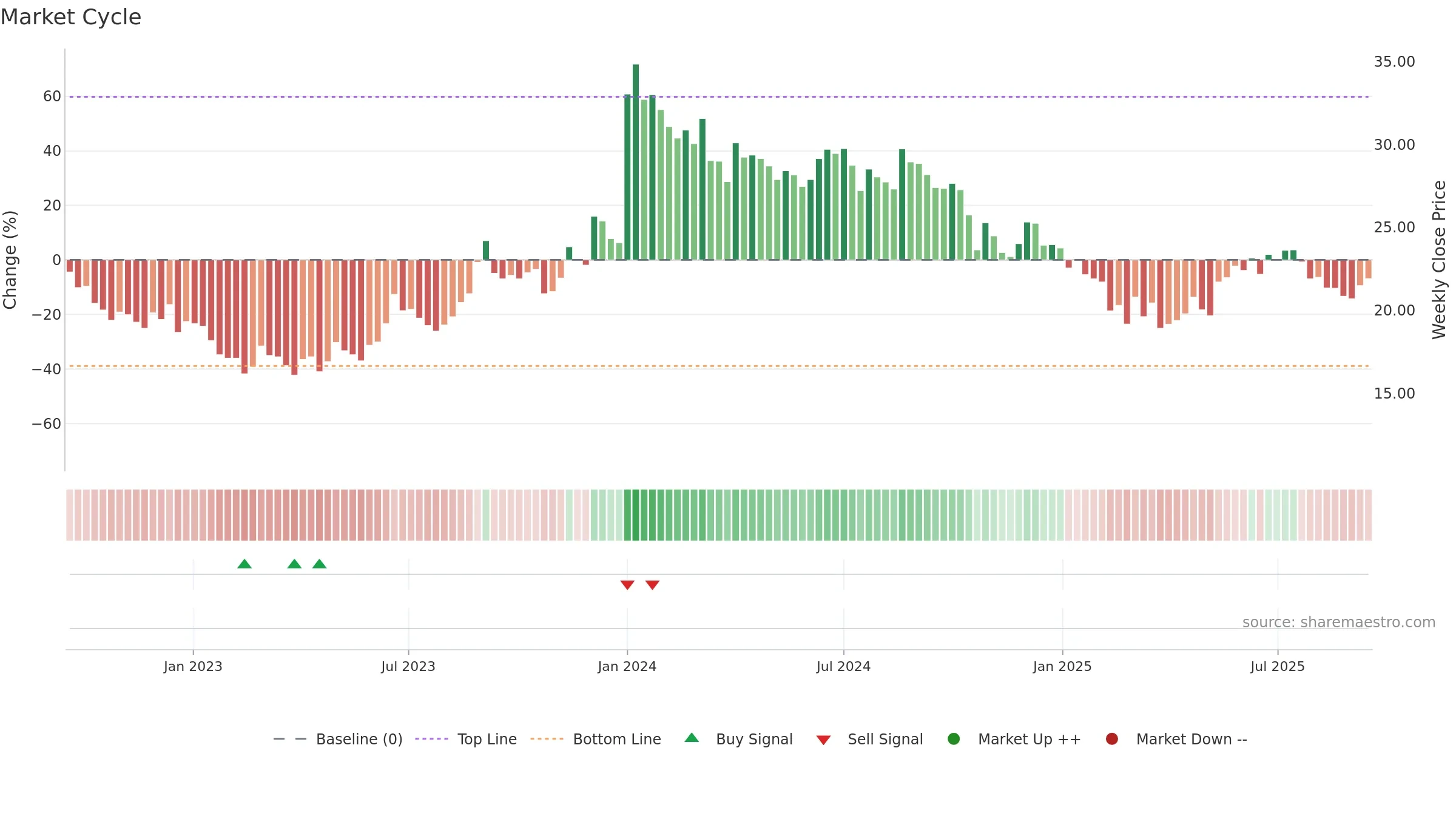

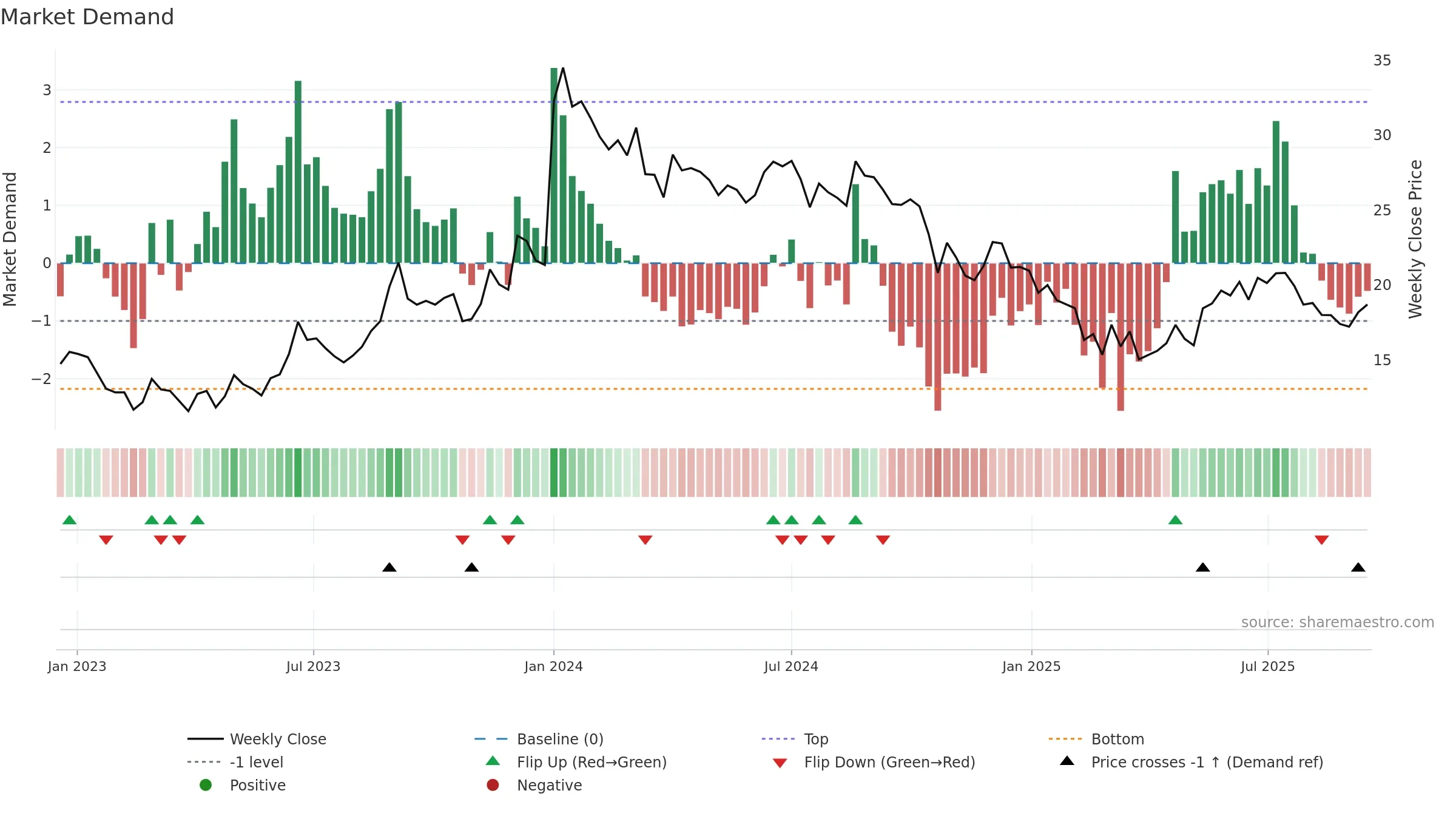

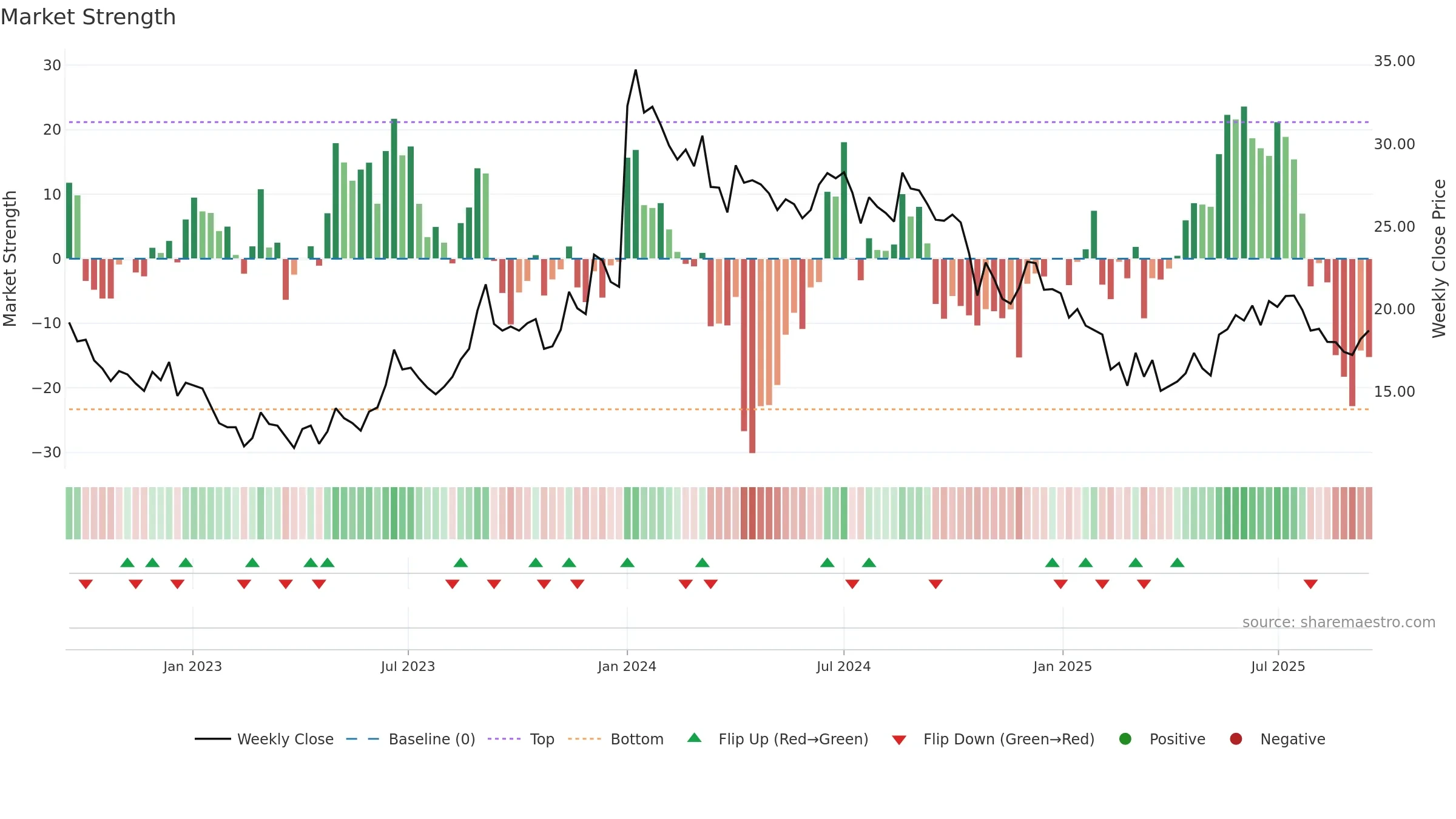

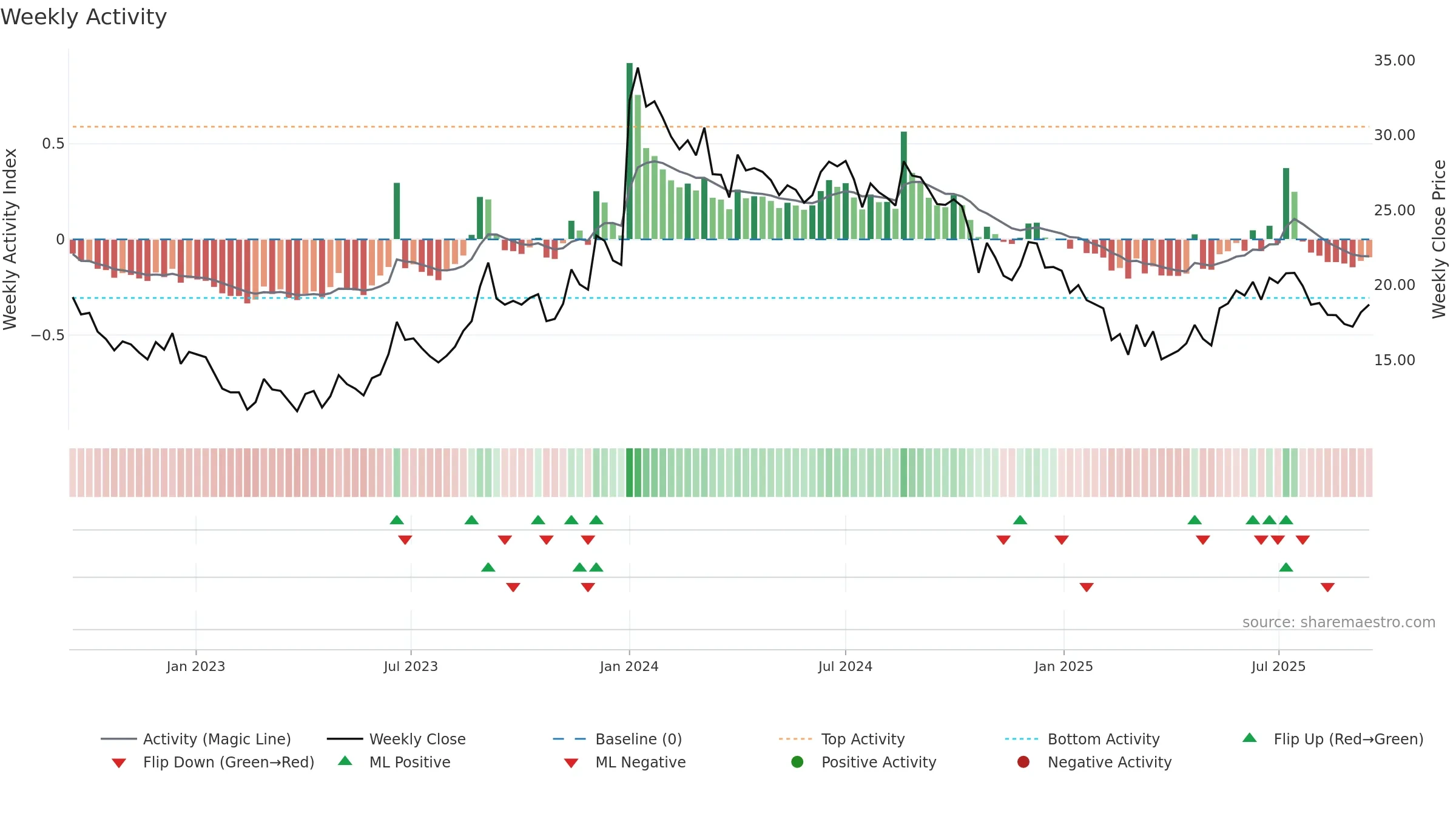

How to read this — Price slope is downward, indicating persistent supply pressure. Volume and price are moving in the same direction — a constructive confirmation. Returns are negatively correlated with volume — strength may come on lighter activity. Price holds above key averages, indicating constructive participation.

Down-slope argues for patience; rallies can fade sooner unless participation improves.

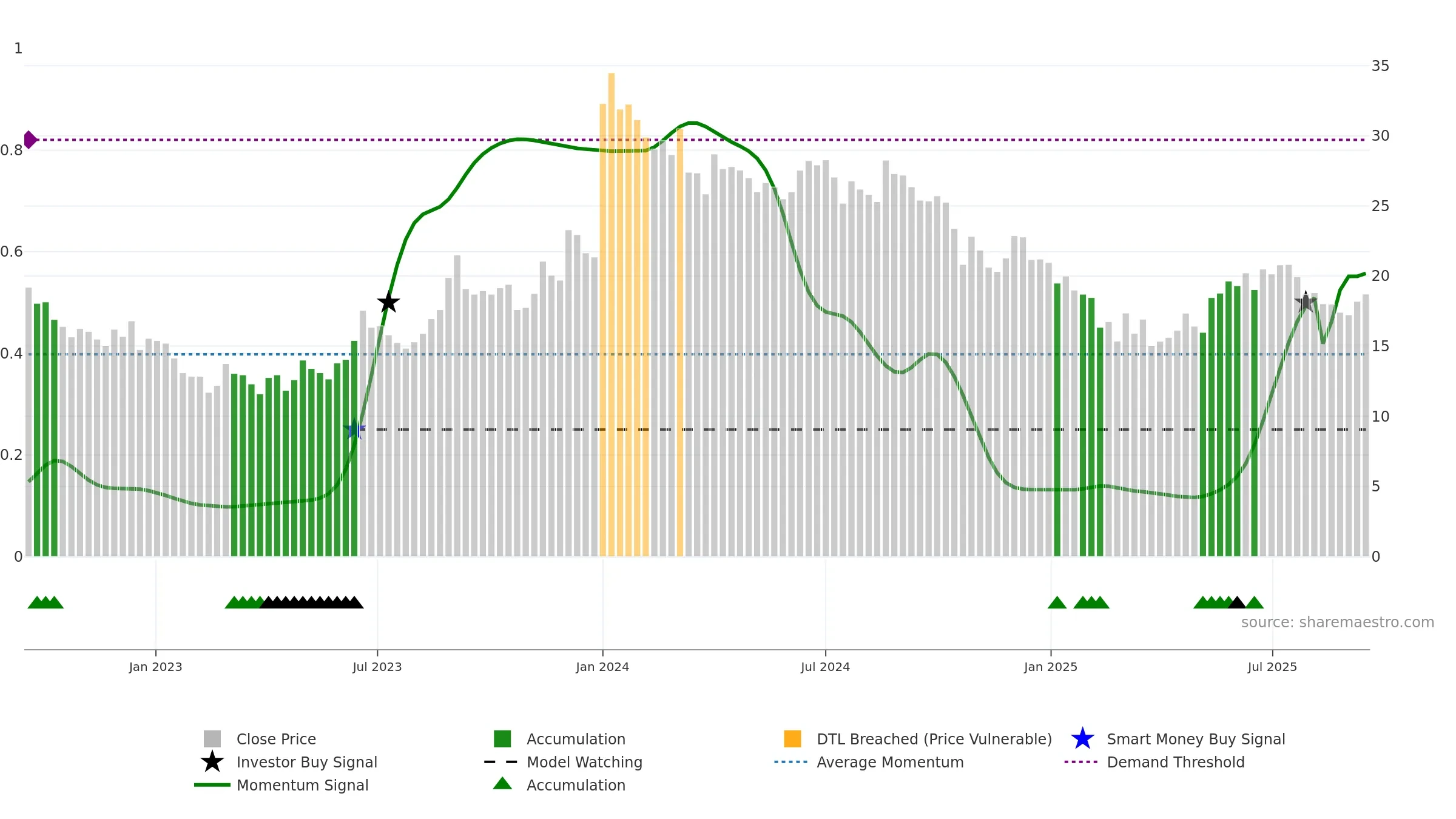

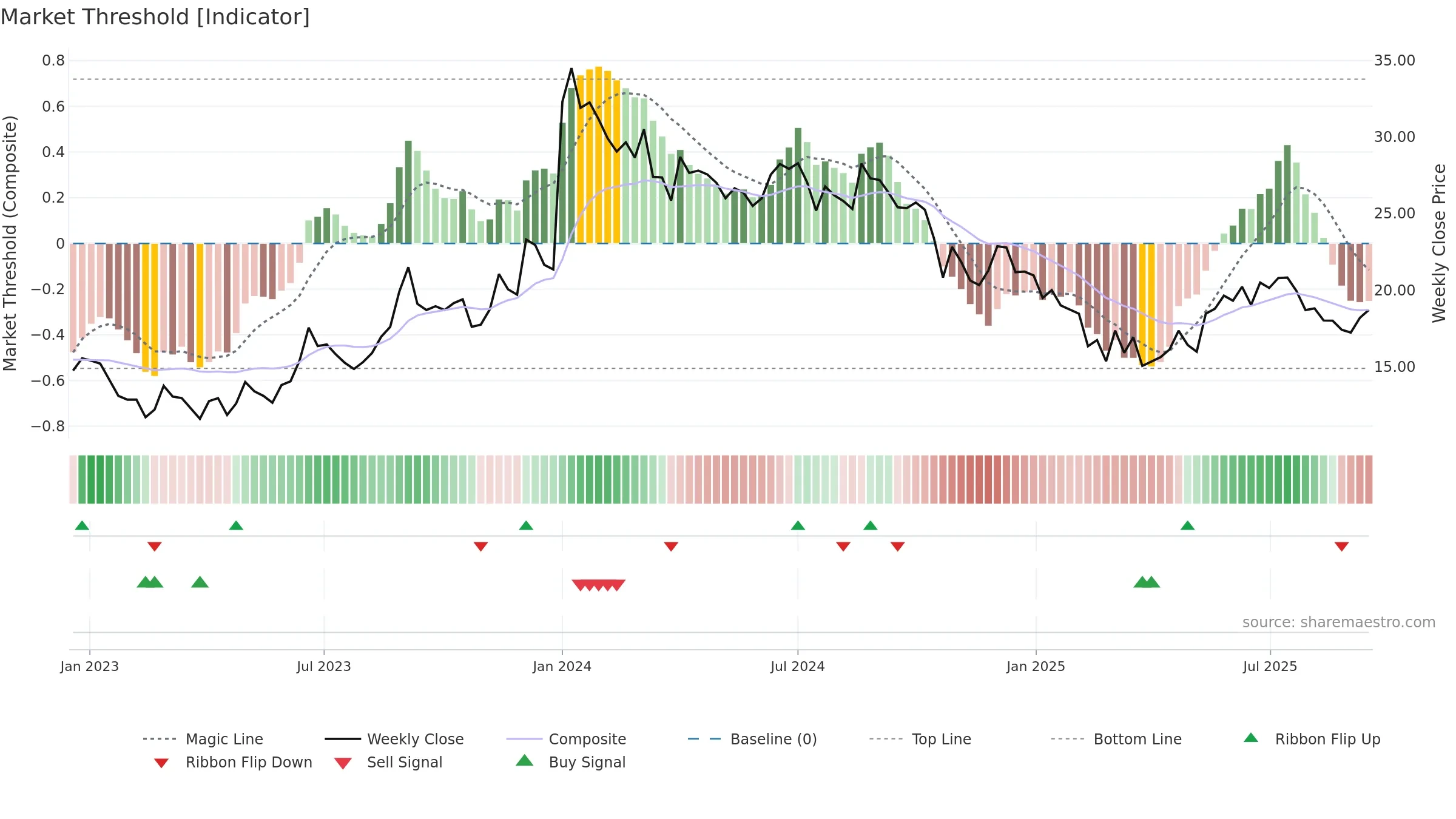

Gauge maps the trend signal to a 0–100 scale.

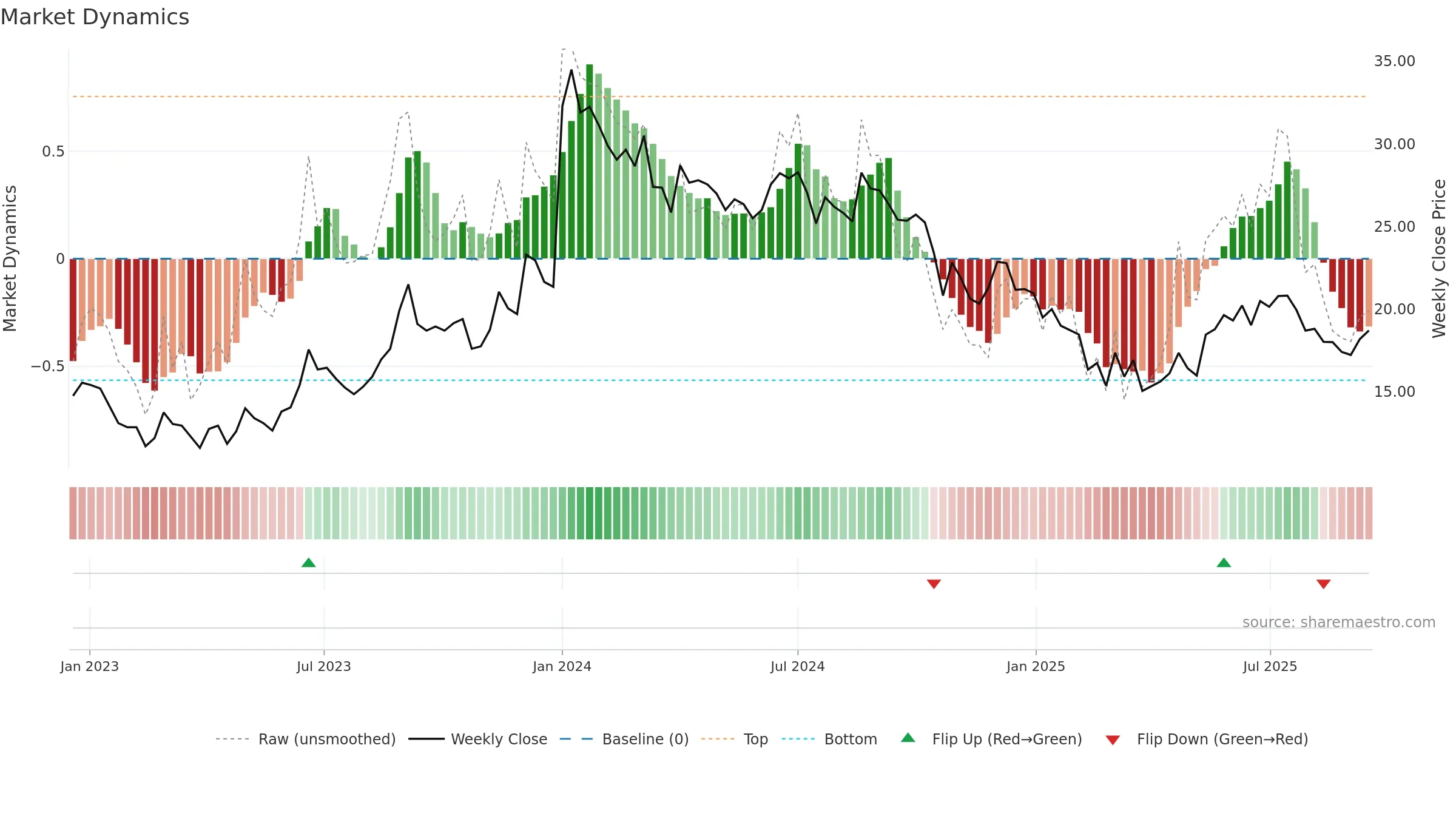

How to read this — Range-bound conditions; conviction is limited until a break or acceleration emerges.

Wait for a directional break or improving acceleration.

Conclusion

Positive setup. ★★★★☆ confidence. Price window: 0. Trend: Range / Neutral; gauge 55. In combination, liquidity confirms the move.

- Price holds above 8w & 26w averages

- Liquidity confirms the price trend

Why: Price window 0.05% over 8w. Close is -0.53% below the prior-window high. Return volatility 2.30%. Volume trend falling. Liquidity convergence with price. Trend state range / neutral. Momentum neutral and rising.

Tip: Most metrics include a hover tooltip where they appear in the report.