Botnia Gold AB (publ)

BOTX STO

Weekly Report

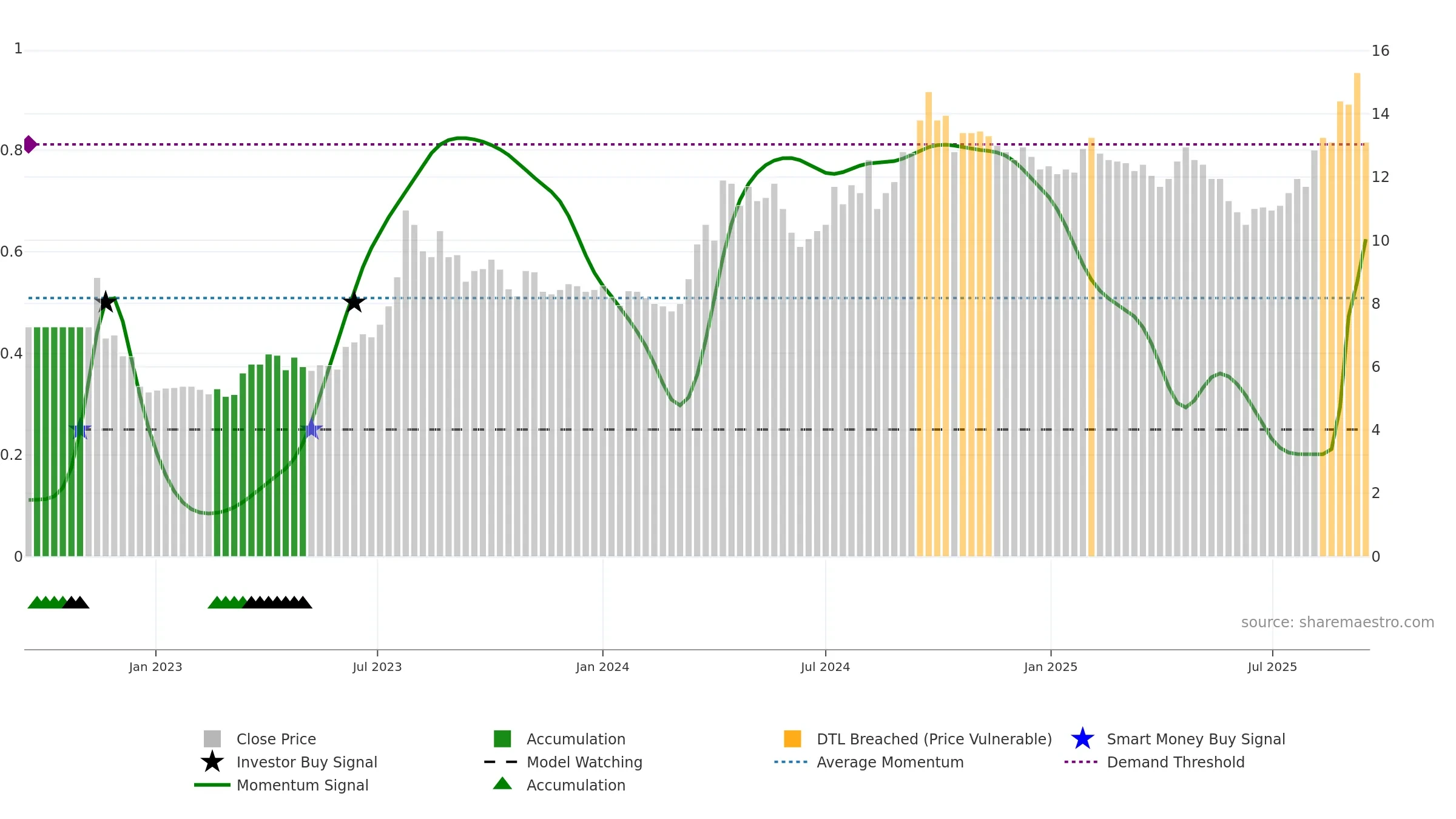

Botnia Gold AB (publ) closed at 13.1000 (-4.38% WoW) . Data window ends Mon, 15 Sep 2025.

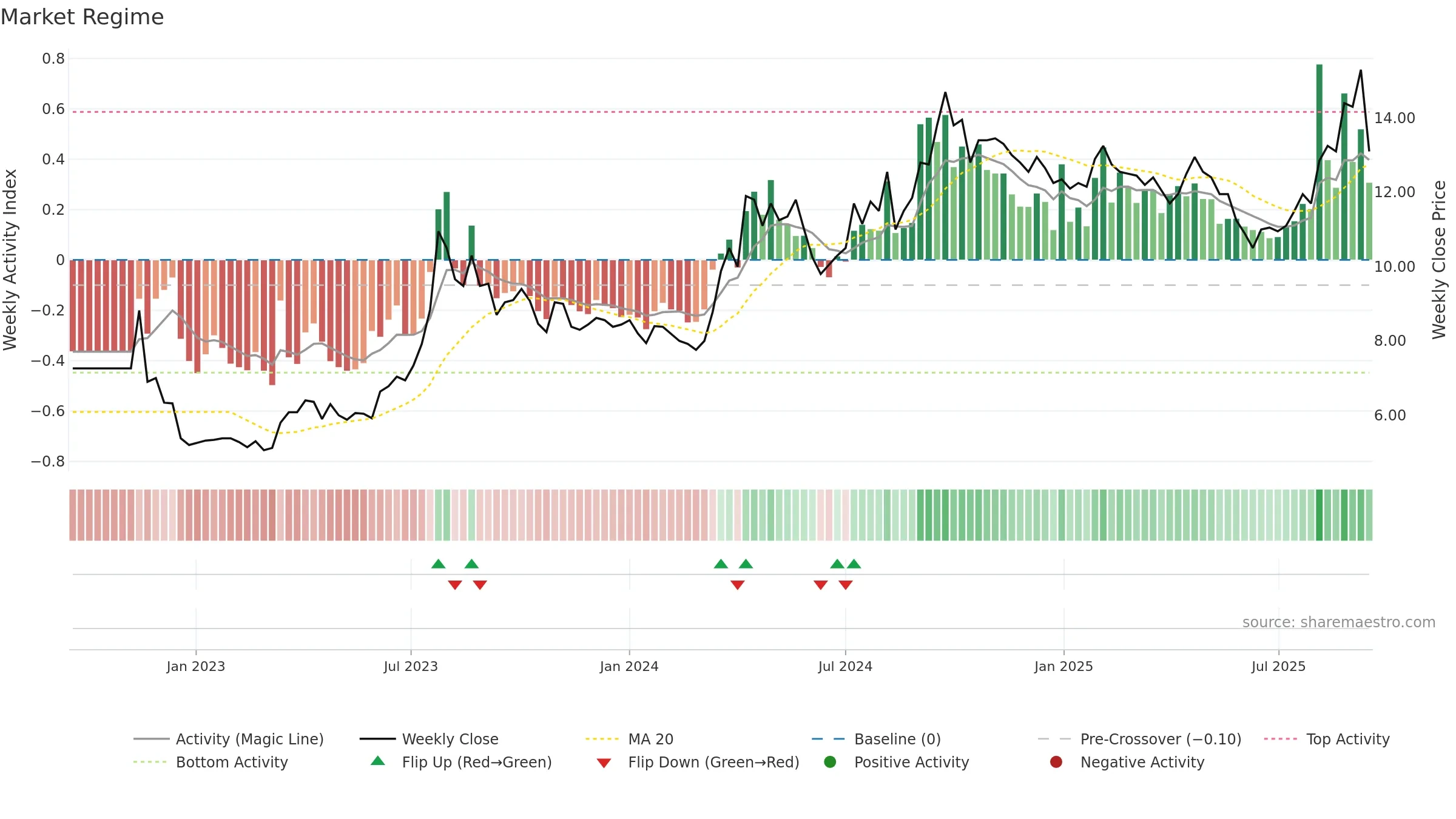

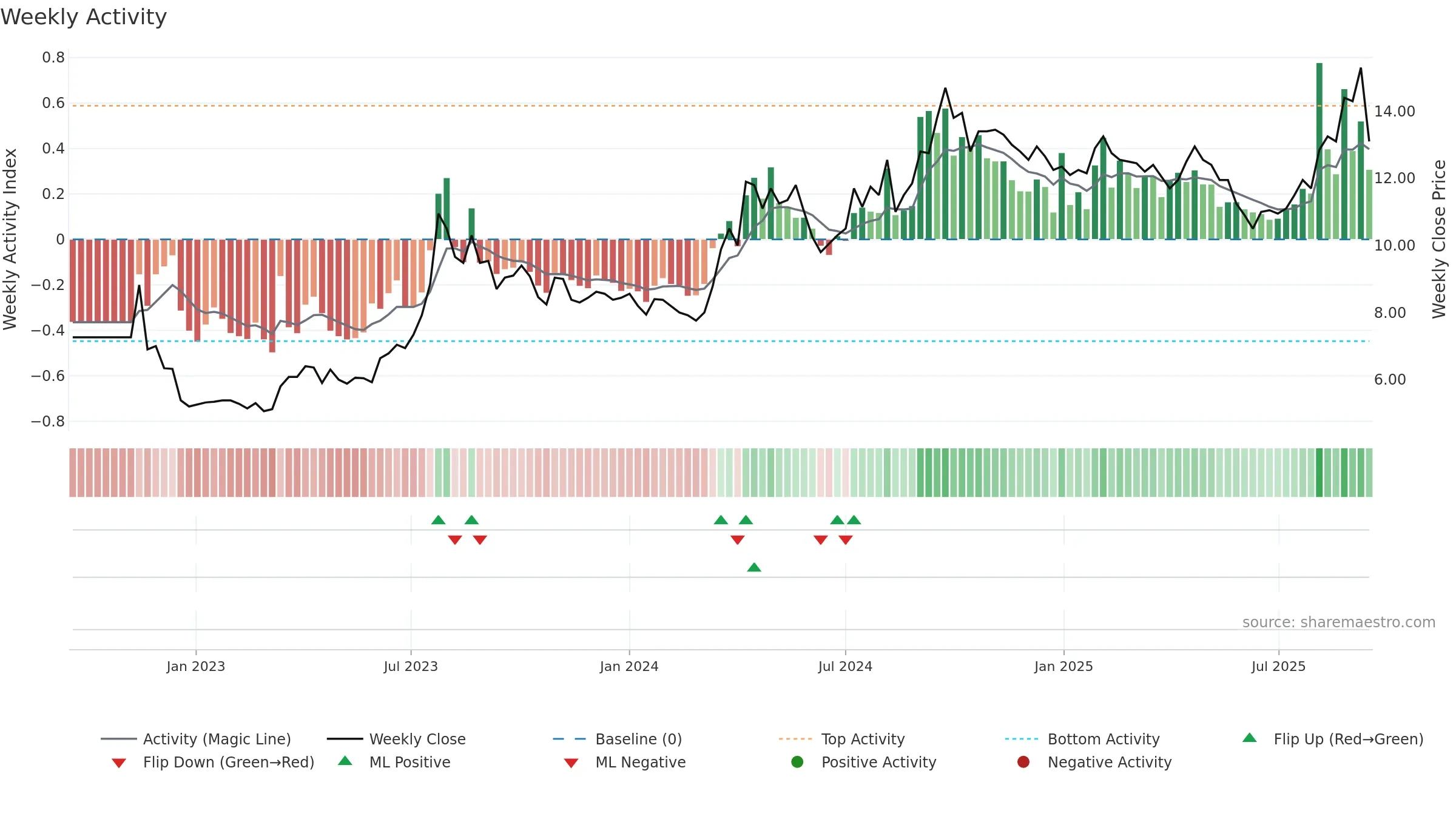

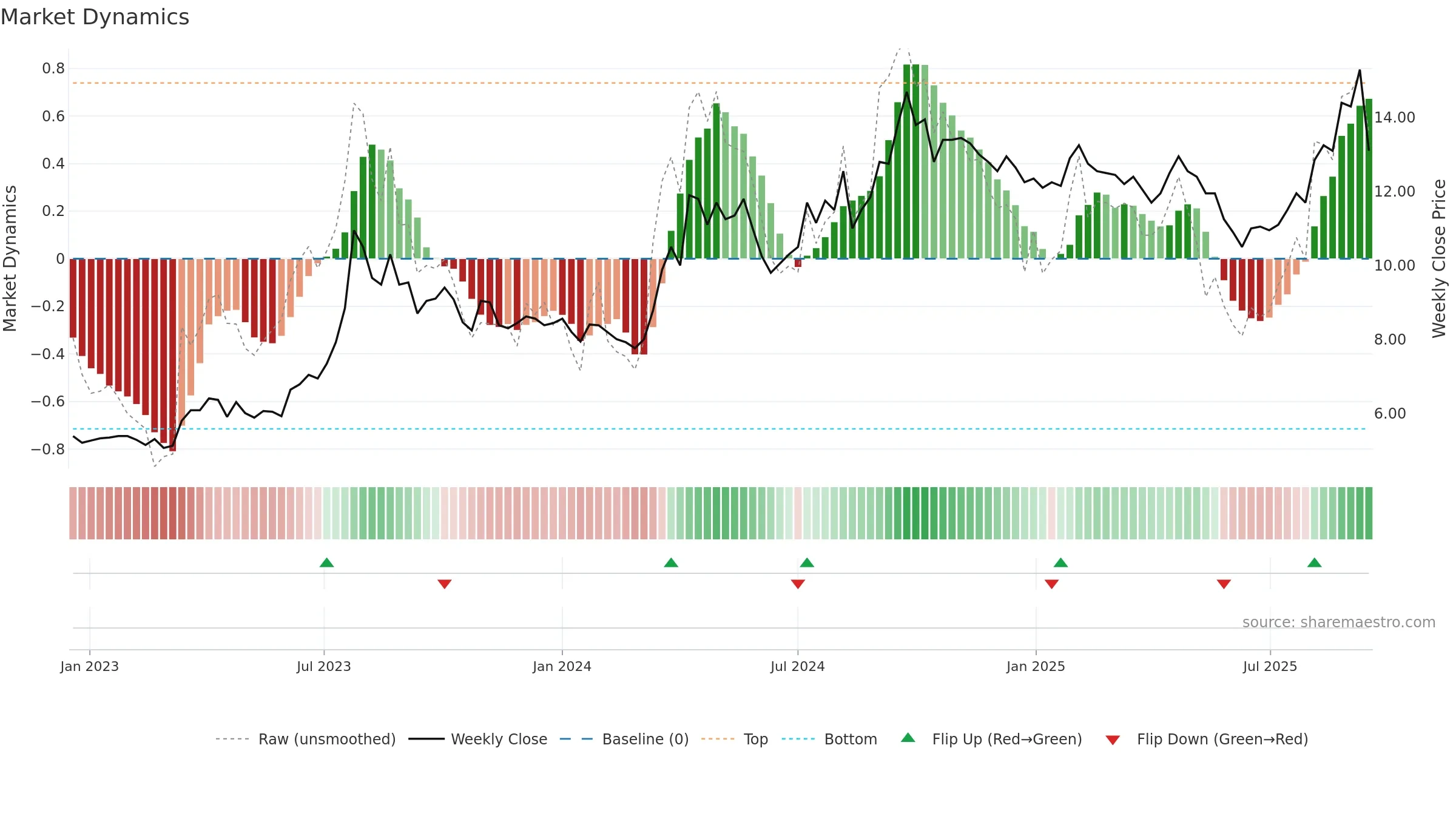

How to read this — Price slope is upward, indicating persistent buying over the window. Volume trend diverges from price — watch for fatigue or rotation. Returns are positively correlated with volume — strength tends to arrive on higher activity. Constructive MA stack supports the up-drift; pullbacks may find support at the 8–13 week region.

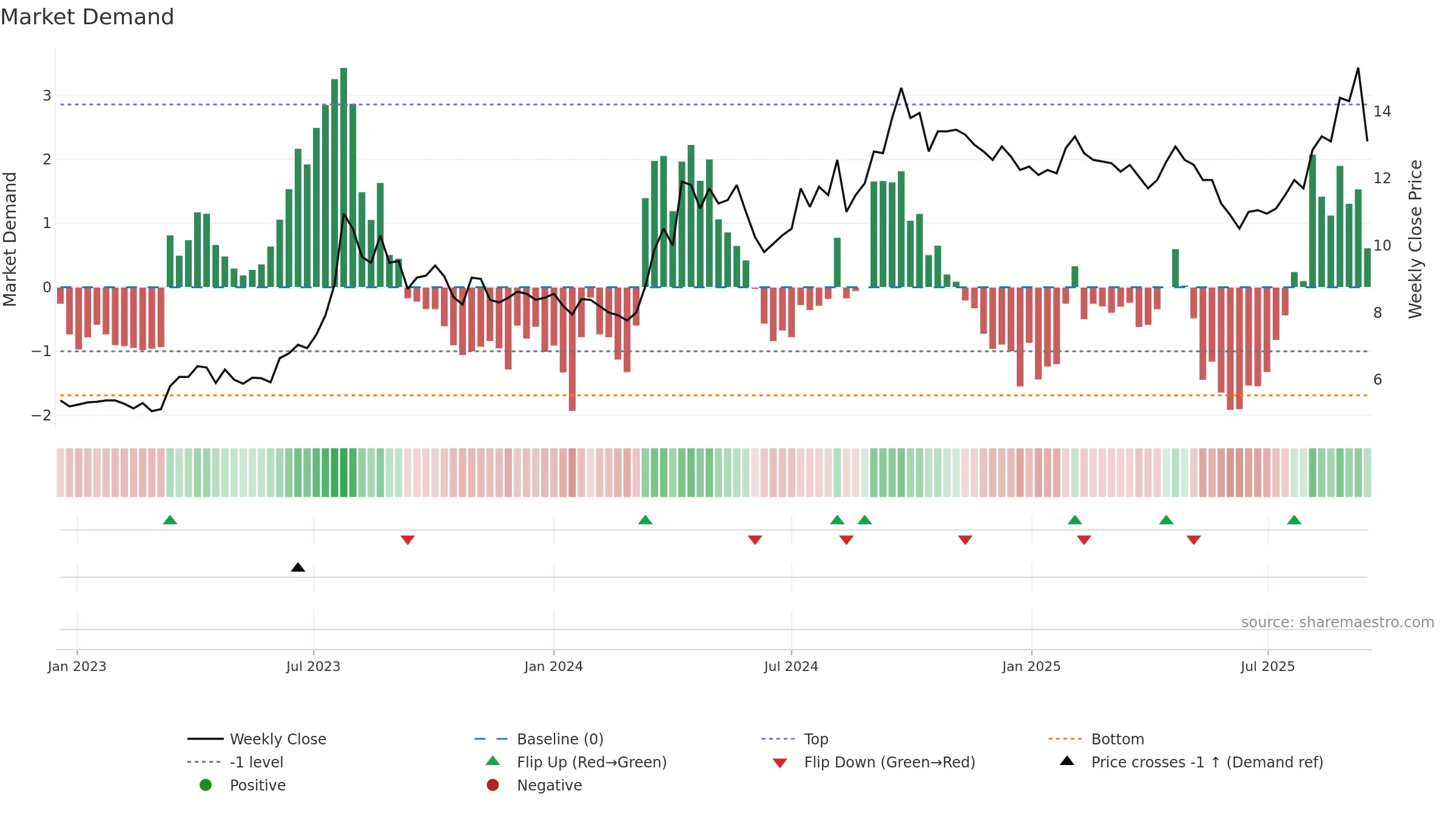

Up-slope supports buying interest; pullbacks may be contained if activity stays firm. Because liquidity isn’t confirming, prefer evidence of fresh demand before chasing moves.

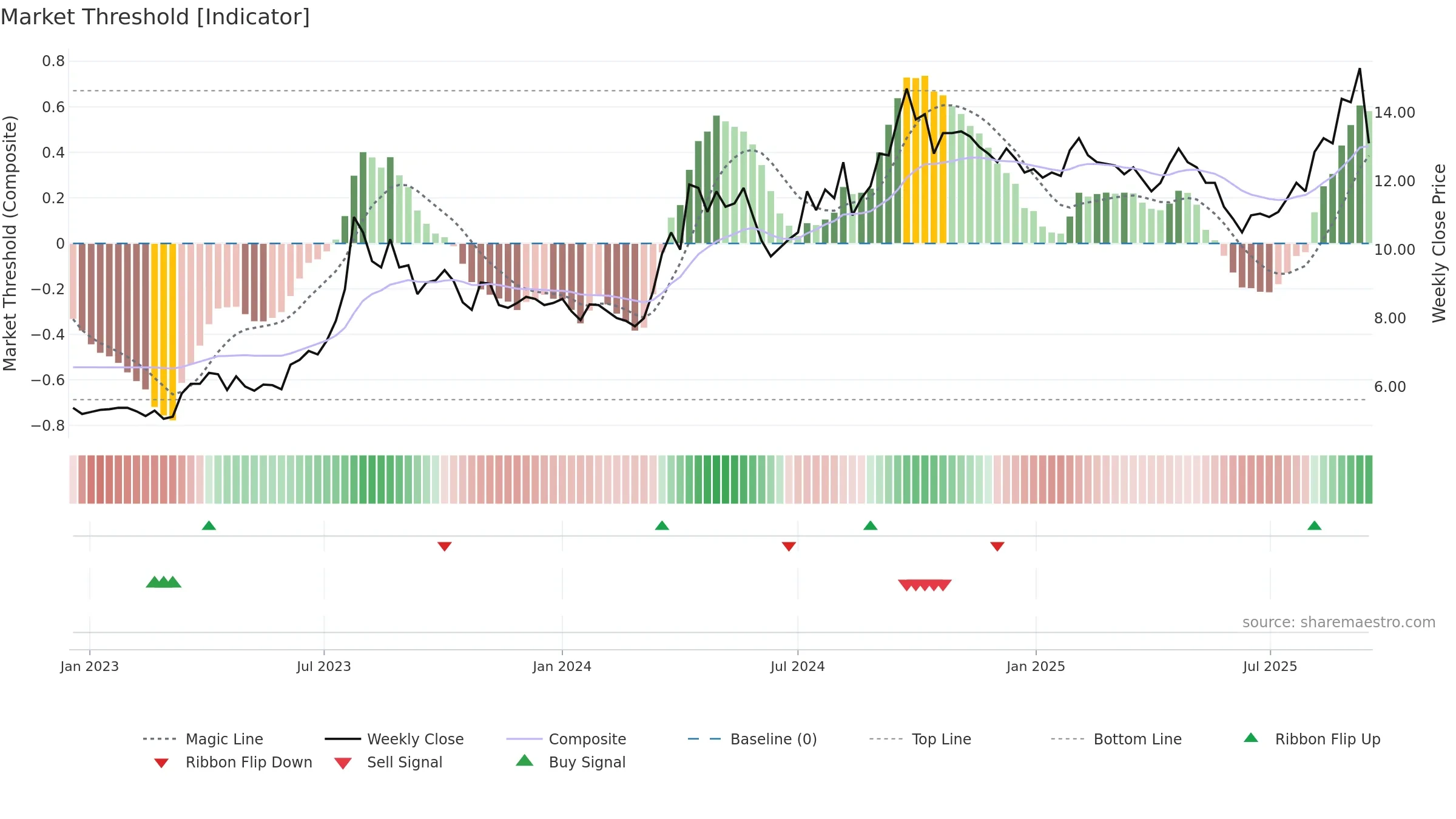

Gauge maps the trend signal to a 0–100 scale.

How to read this — High gauge and rising momentum — buyers in control.

Bias remains higher; pullbacks could be buyable if participation holds.

The flag is positive: favourable upside skew with supportive conditions.

Conclusion

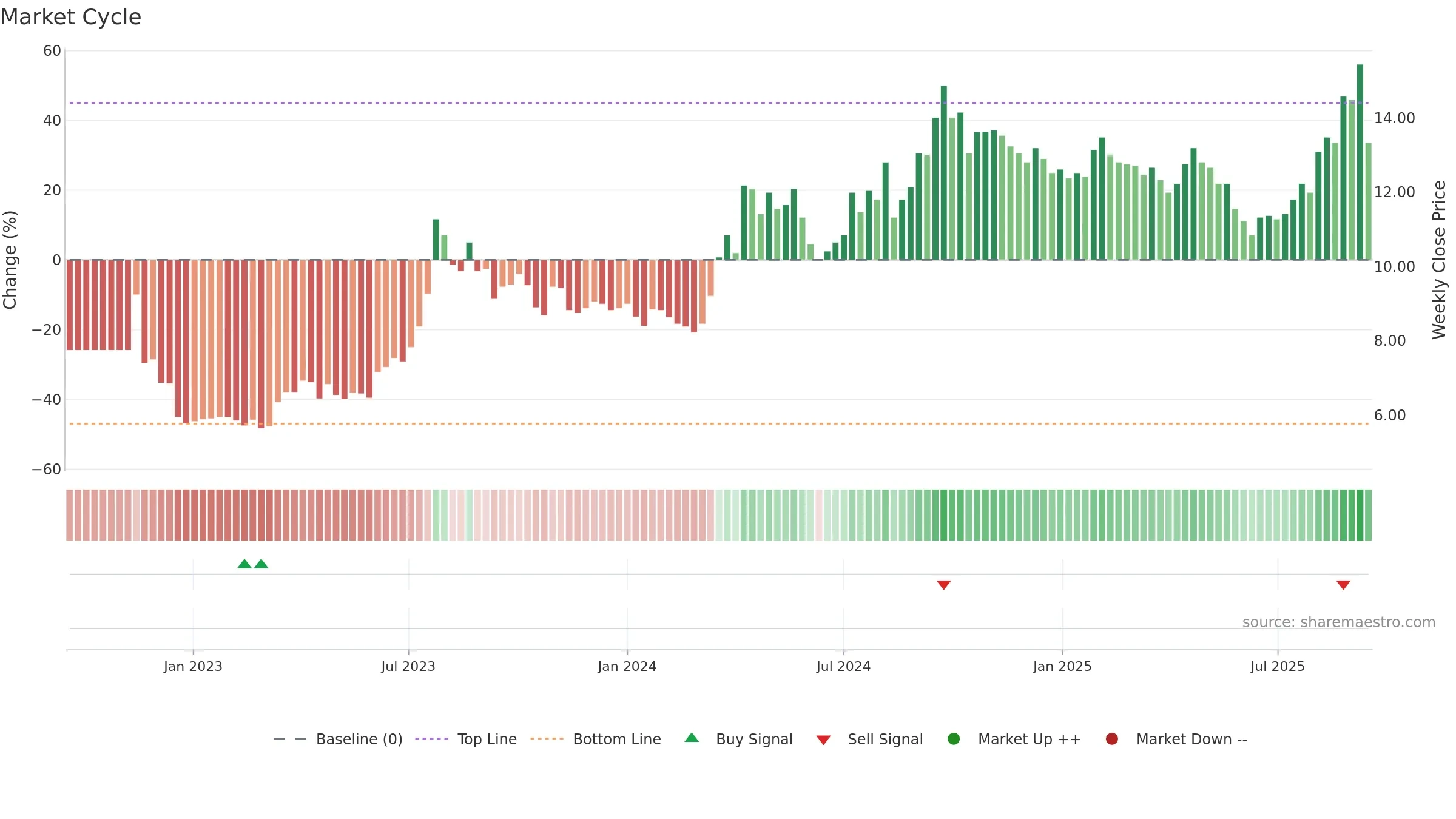

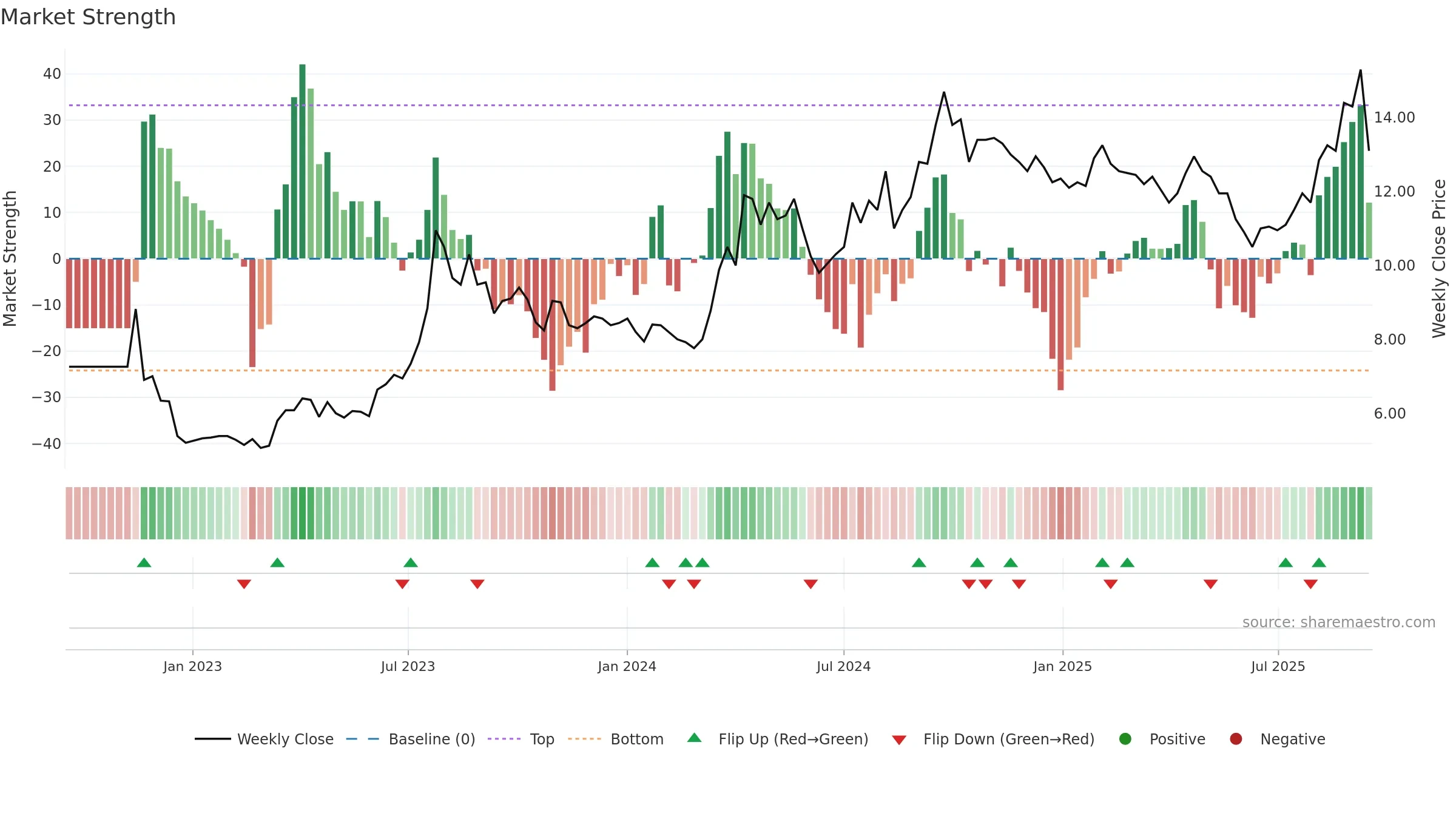

Neutral setup. ★★★☆☆ confidence. Price window: 11. Trend: Strong Uptrend; gauge 62. In combination, liquidity diverges from price.

- High gauge with rising momentum (strong uptrend)

- Momentum is bullish and rising

- Constructive moving-average stack

- Solid multi-week performance

- Price is not above key averages

- Liquidity diverges from price

Why: Price window 11.97% over 8w. Close is -14.38% below the prior-window high. Volume trend falling. Liquidity divergence with price. Trend state strong uptrend. Low-regime (≤0.25) upticks 3/4 (75.0%) • Accumulating. MA stack constructive. Momentum bullish and rising. Valuation stance positive.

Tip: Most metrics include a hover tooltip where they appear in the report.