AppLovin Corporation

APP NASDAQ

Weekly Report

AppLovin Corporation closed at 649.5900 (12.28% WoW) . Data window ends Mon, 15 Sep 2025.

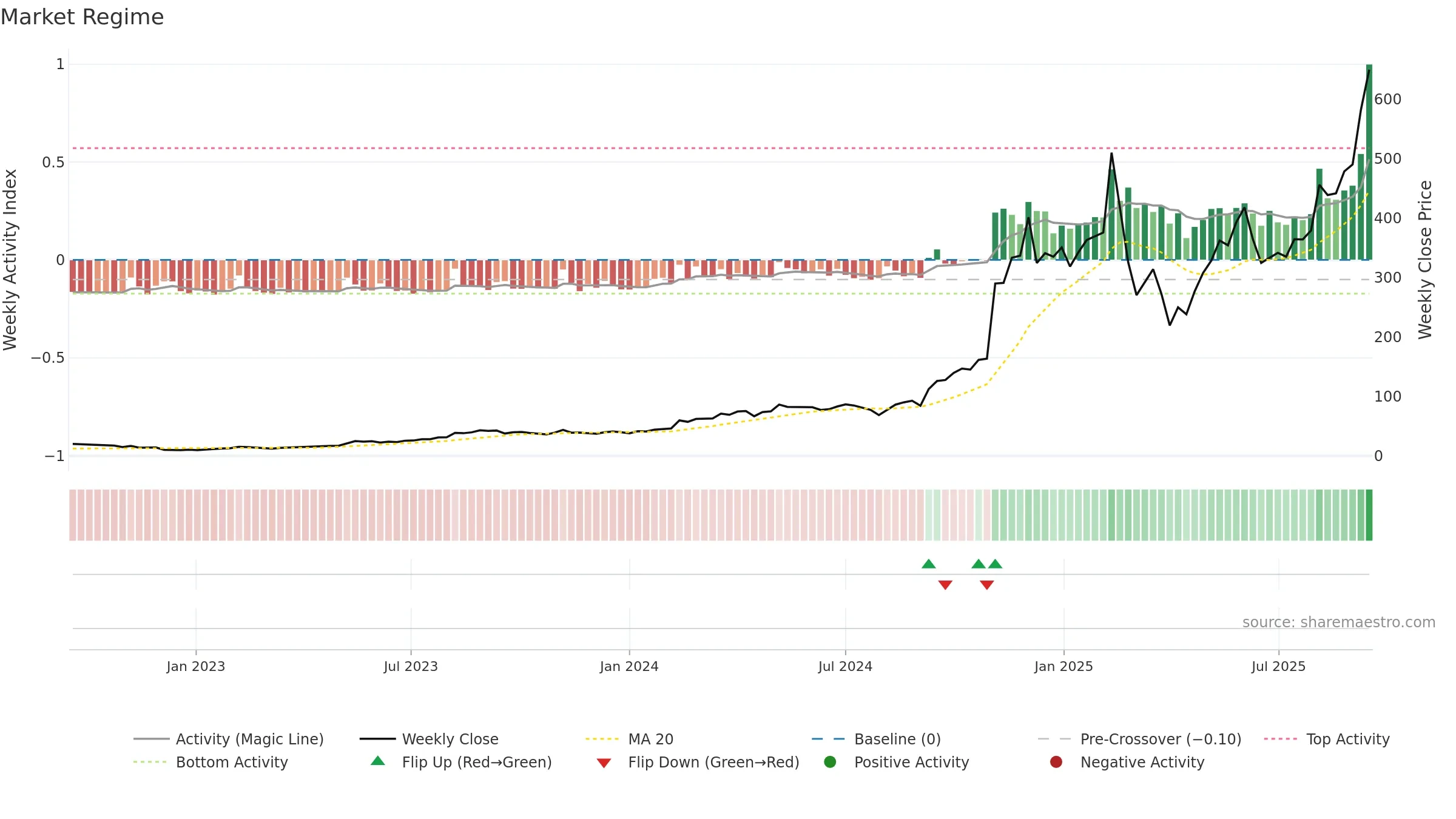

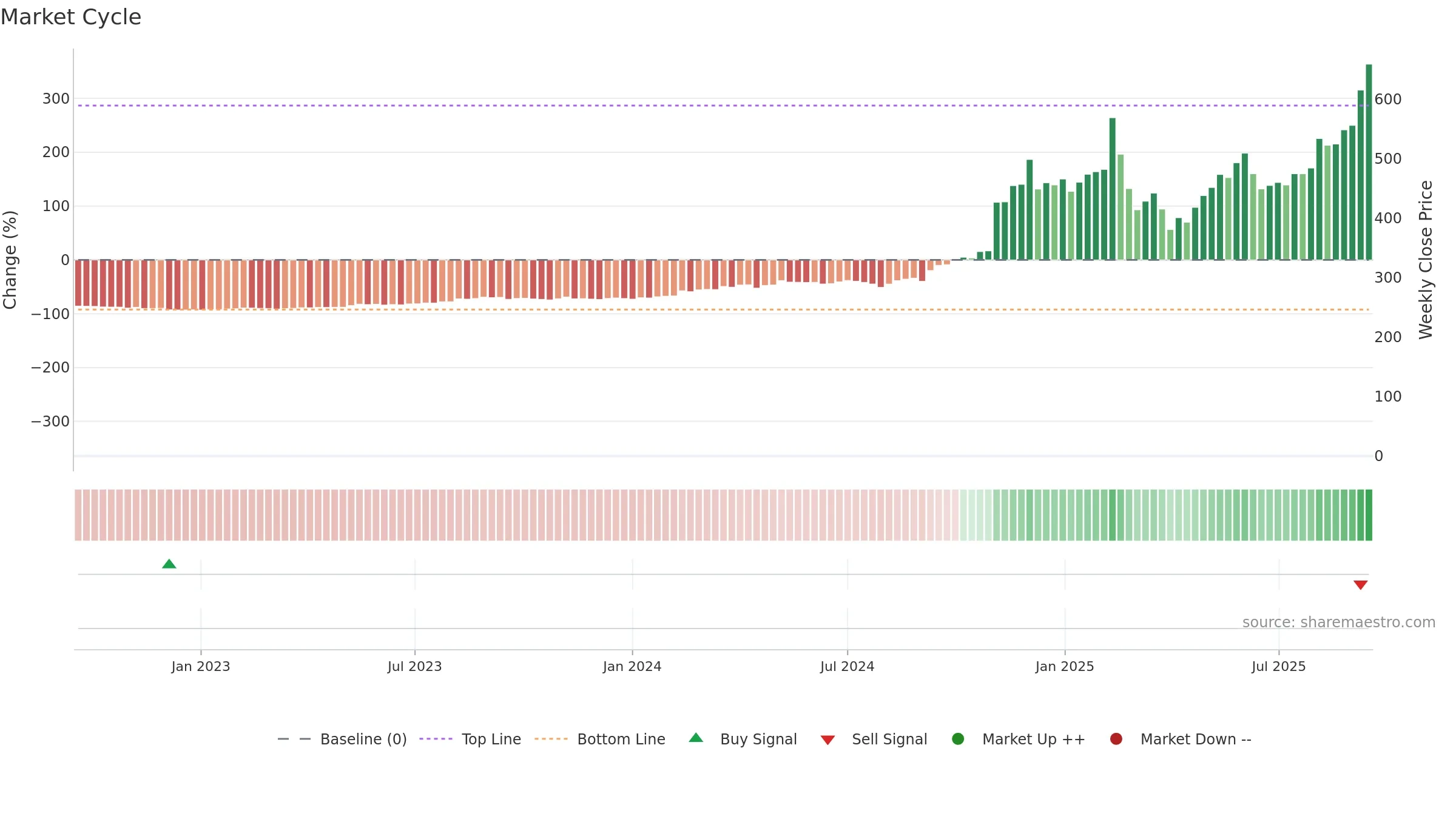

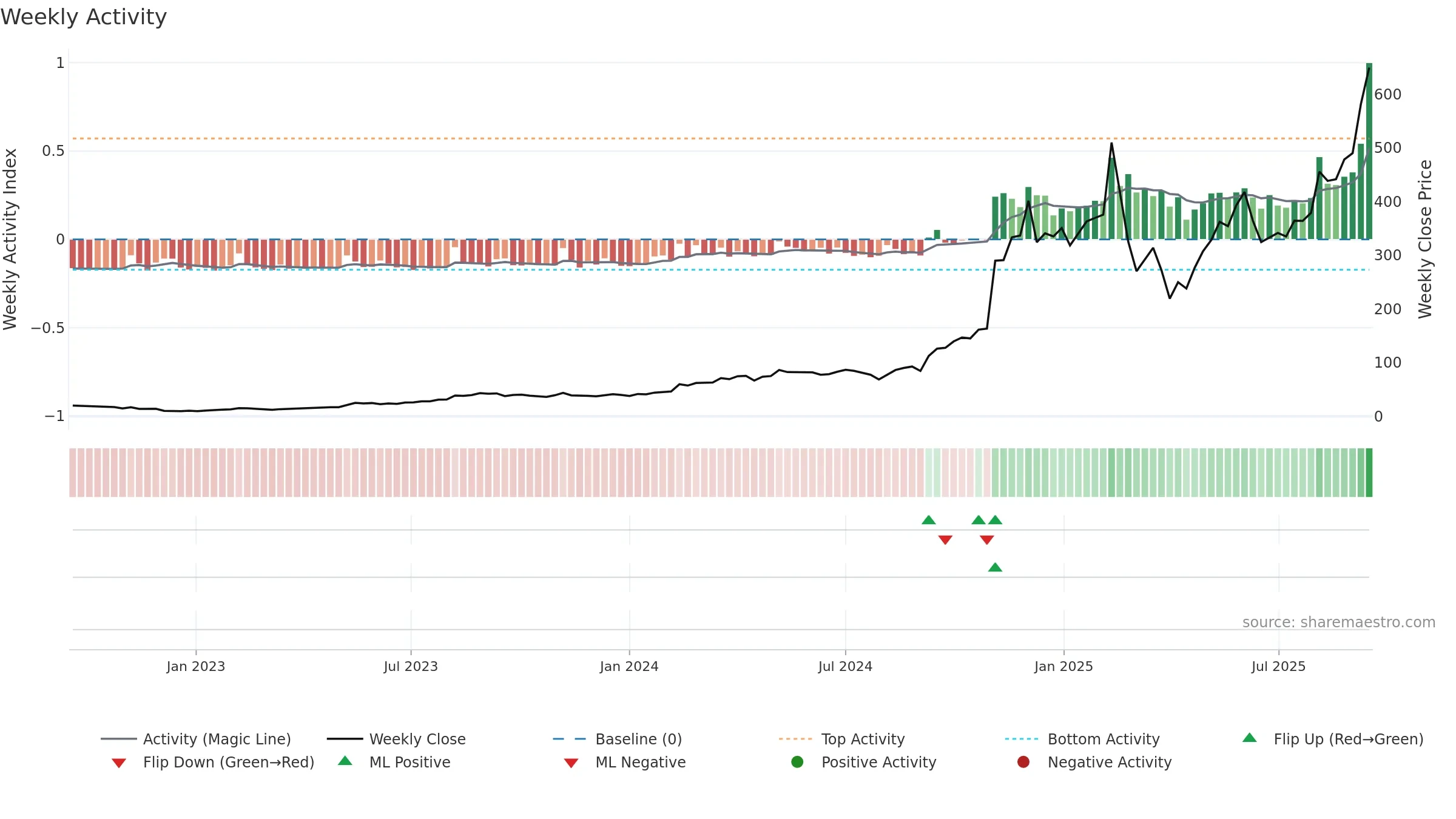

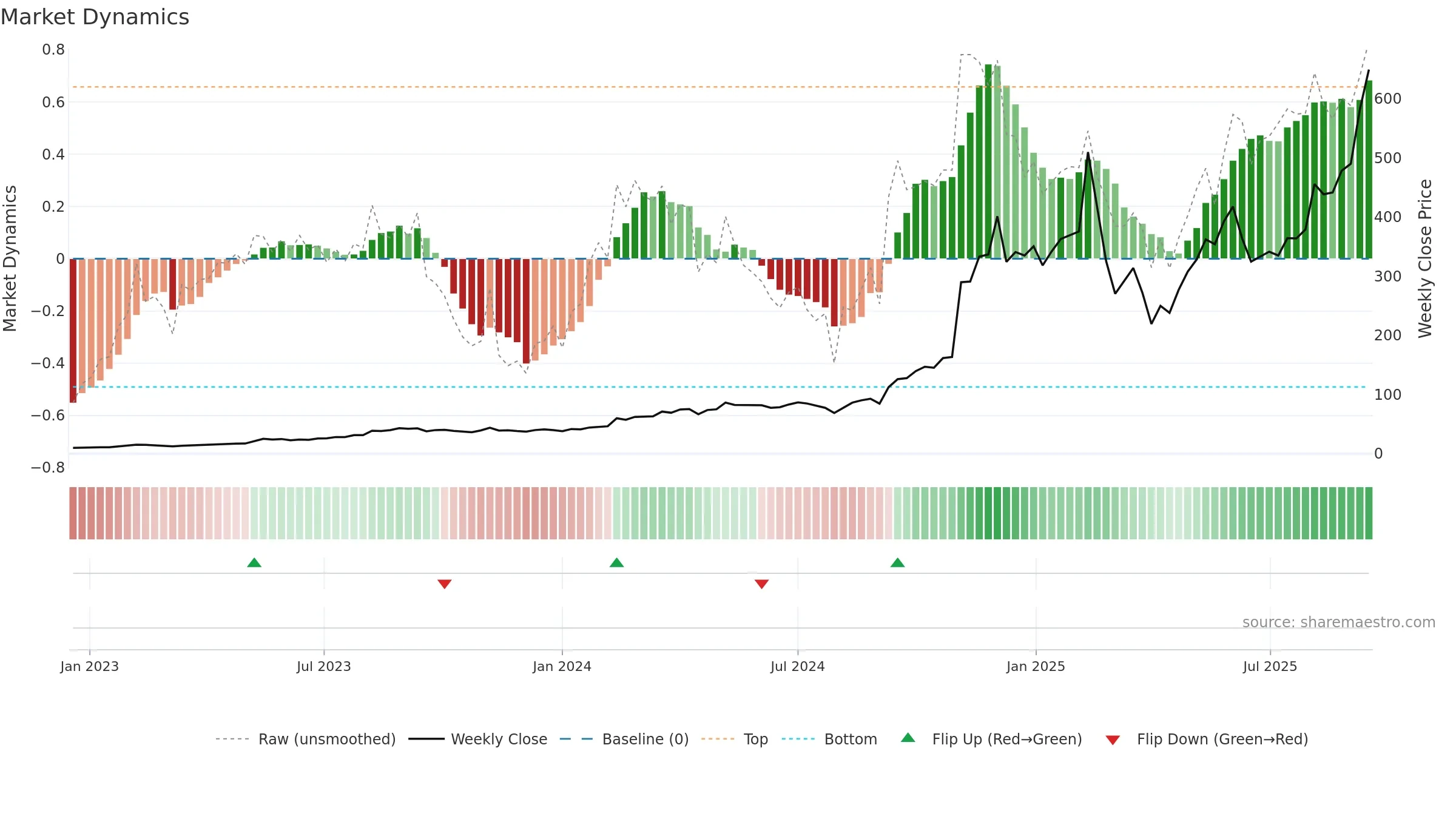

How to read this — Price slope is upward, indicating persistent buying over the window. Elevated weekly volatility increases whipsaw risk. Volume and price are moving in the same direction — a constructive confirmation. Returns are positively correlated with volume — strength tends to arrive on higher activity. Price is stretched above its baseline; consolidation risk rises if activity fades. Constructive MA stack supports the up-drift; pullbacks may find support at the 8–13 week region. Price holds above key averages, indicating constructive participation.

Up-slope supports buying interest; pullbacks may be contained if activity stays firm.

Gauge maps the trend signal to a 0–100 scale.

How to read this — Range-bound conditions; conviction is limited until a break or acceleration emerges.

Wait for a directional break or improving acceleration.

Conclusion

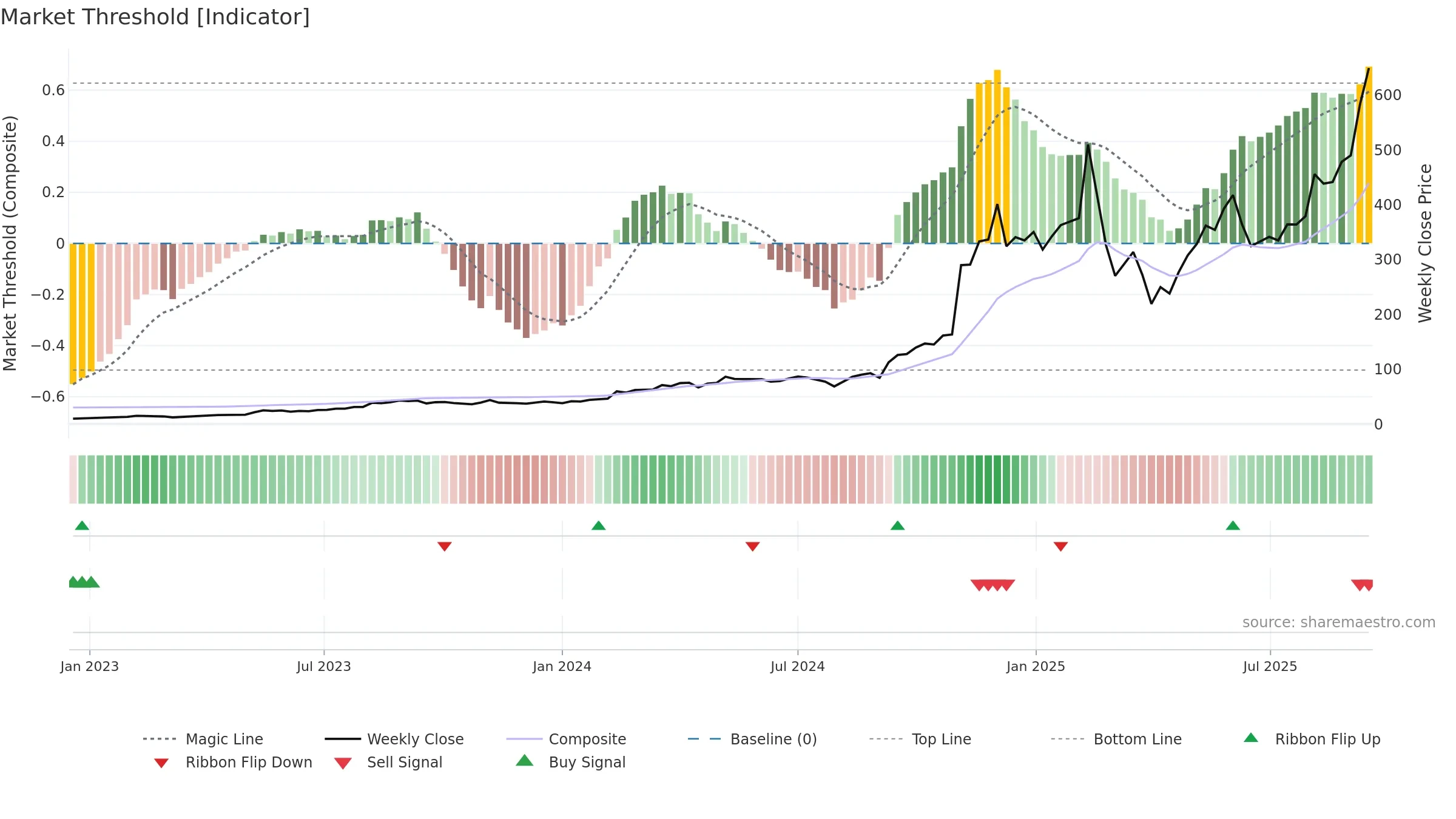

Negative setup. ★★☆☆☆ confidence. Price window: 71. Trend: Range / Neutral; gauge 82. In combination, liquidity confirms the move.

- Price holds above 8w & 26w averages

- Constructive moving-average stack

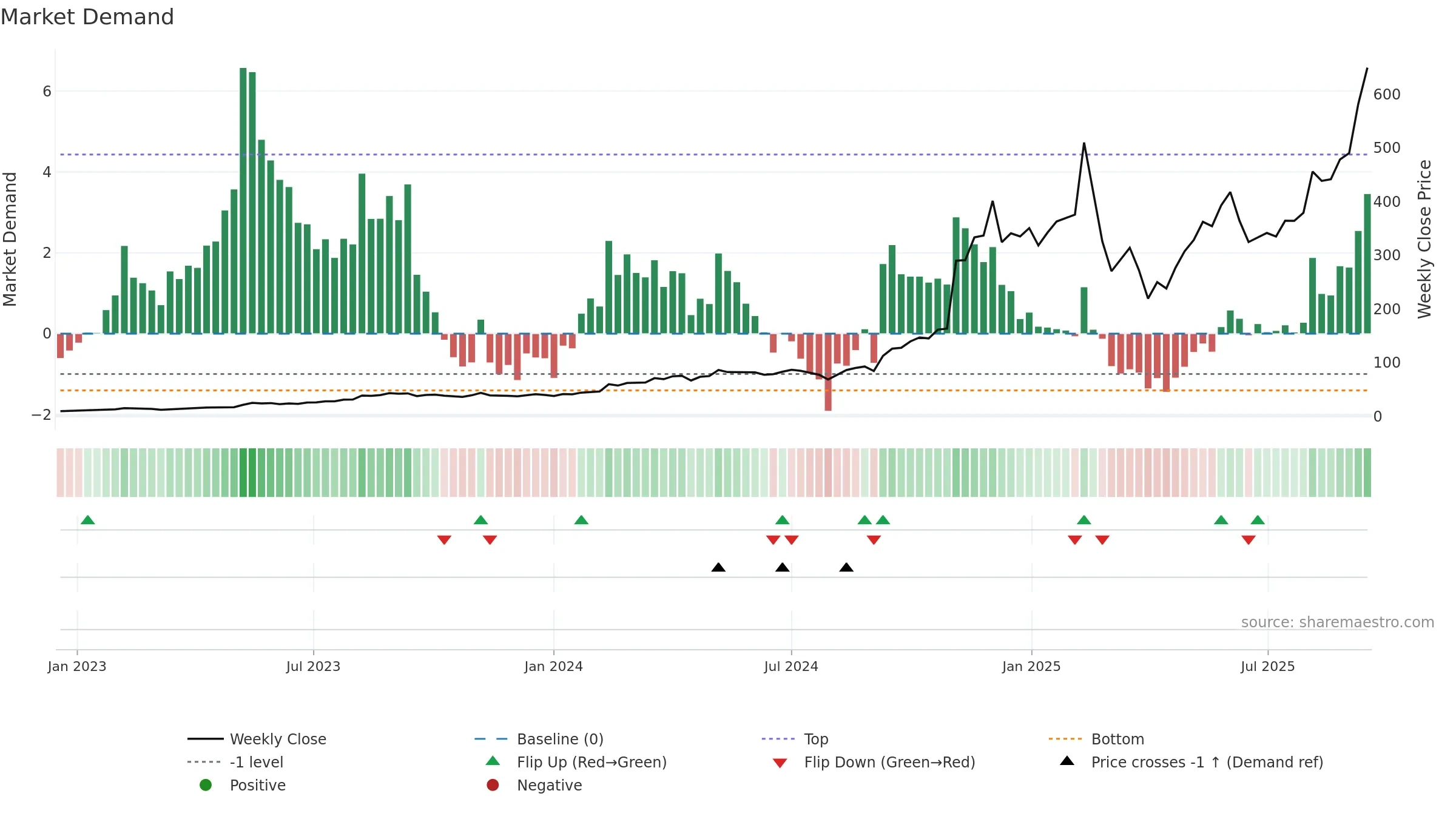

- Liquidity confirms the price trend

- Solid multi-week performance

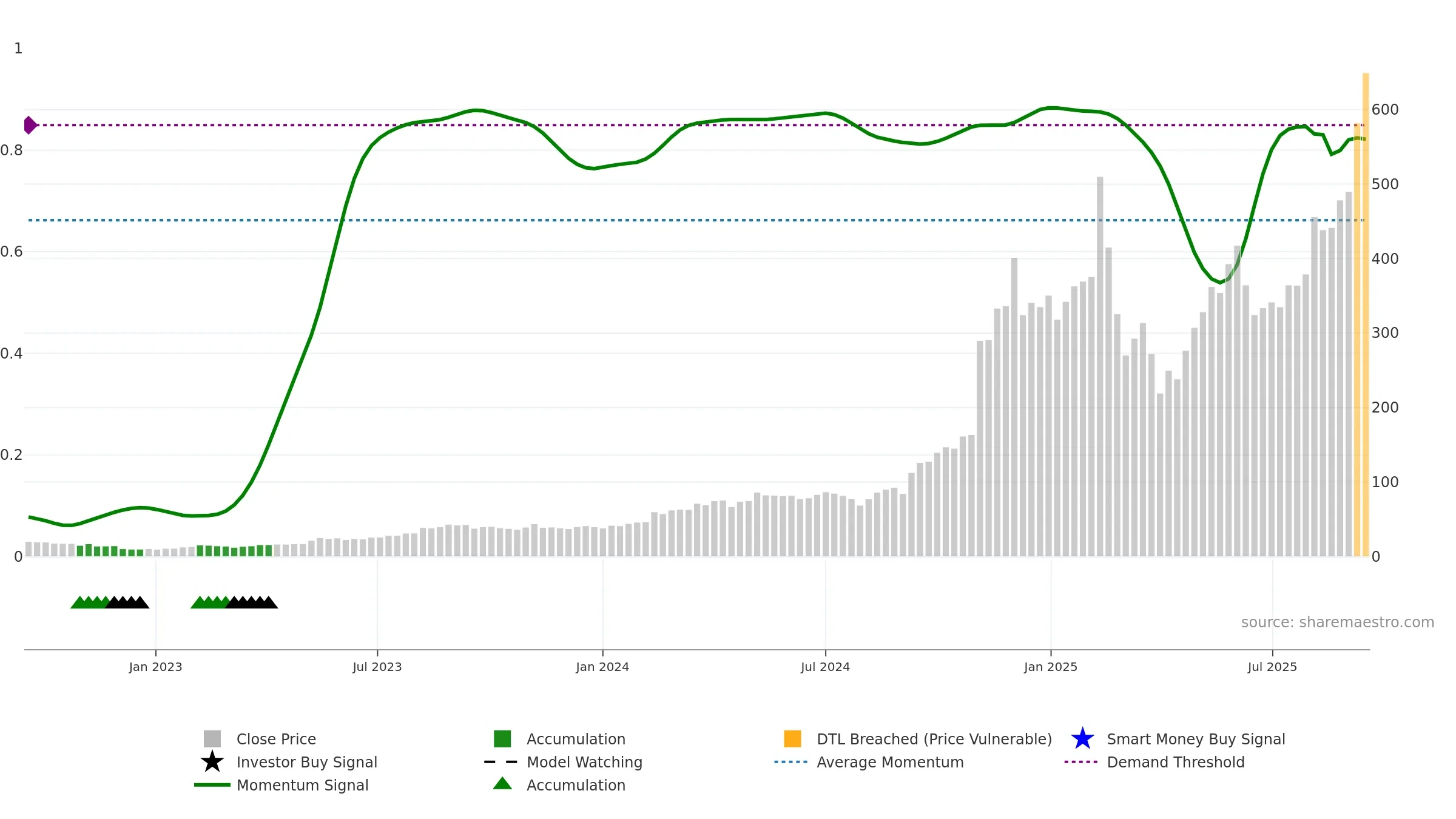

- Momentum is weak/falling

- High return volatility raises whipsaw risk

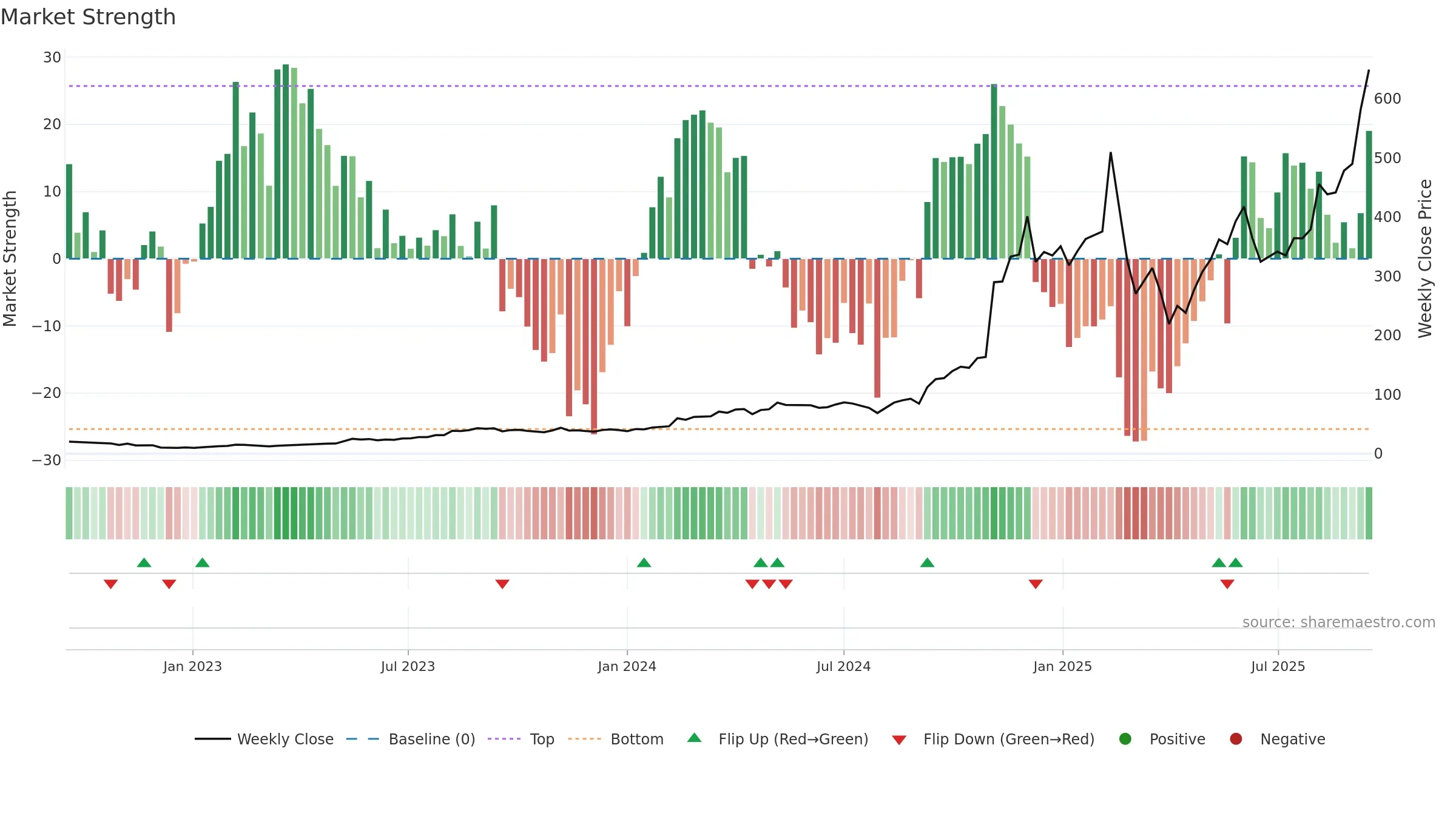

- Sellers active at elevated levels (distribution)

Why: Price window 71.32% over 8w. Close is 11.61% above the prior-window high. Return volatility 6.54%. Volume trend rising. Liquidity convergence with price. Trend state range / neutral. High-regime (0.80–1.00) downticks 4/5 (80.0%) • Distributing. MA stack constructive. Baseline deviation 3.59% (widening). Momentum neutral and falling.

Tip: Most metrics include a hover tooltip where they appear in the report.