Time Finance plc

TIME LSE

Weekly Report

Time Finance plc closed at 57.5000 (0.00% WoW) . Data window ends Fri, 19 Sep 2025.

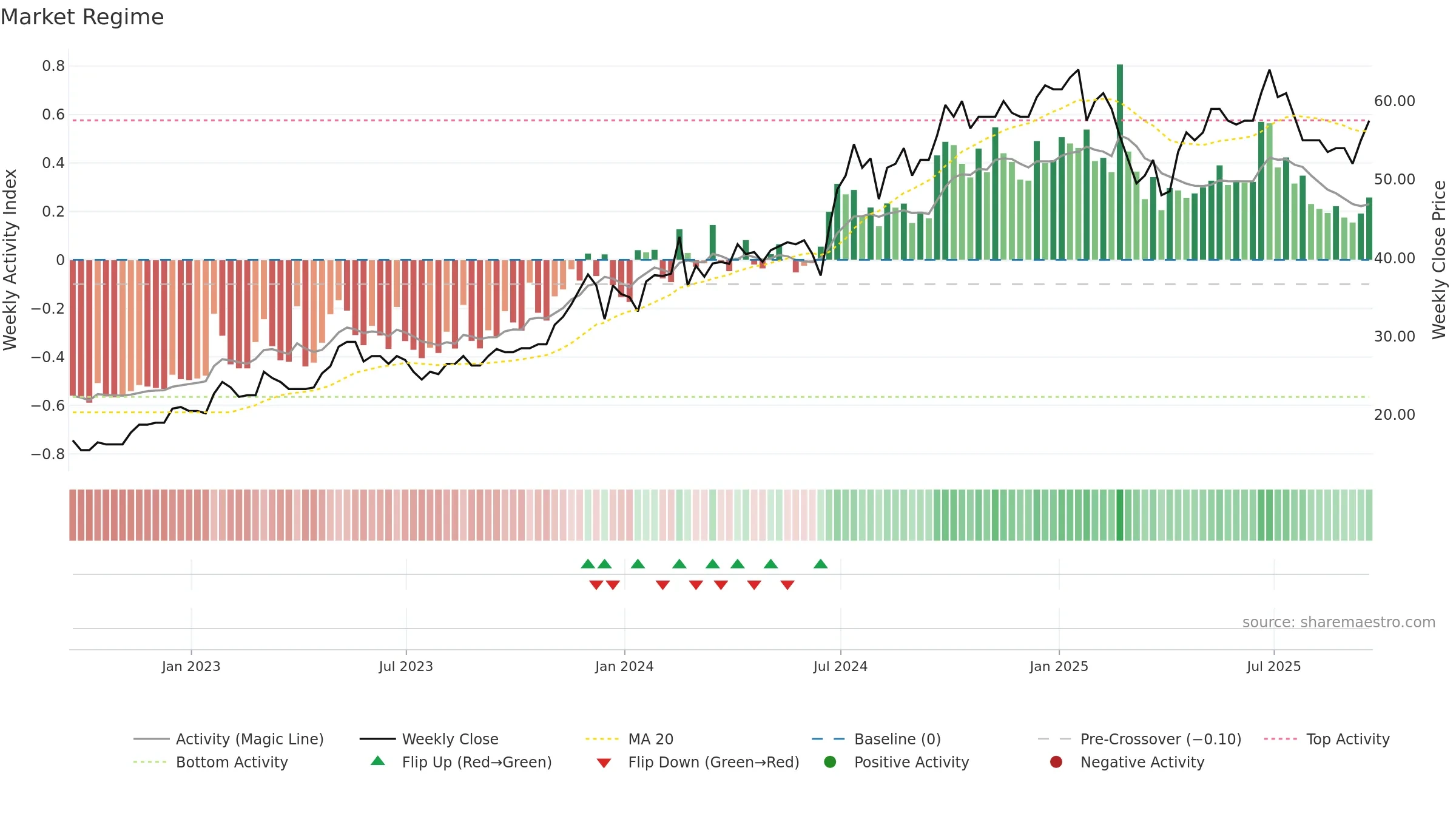

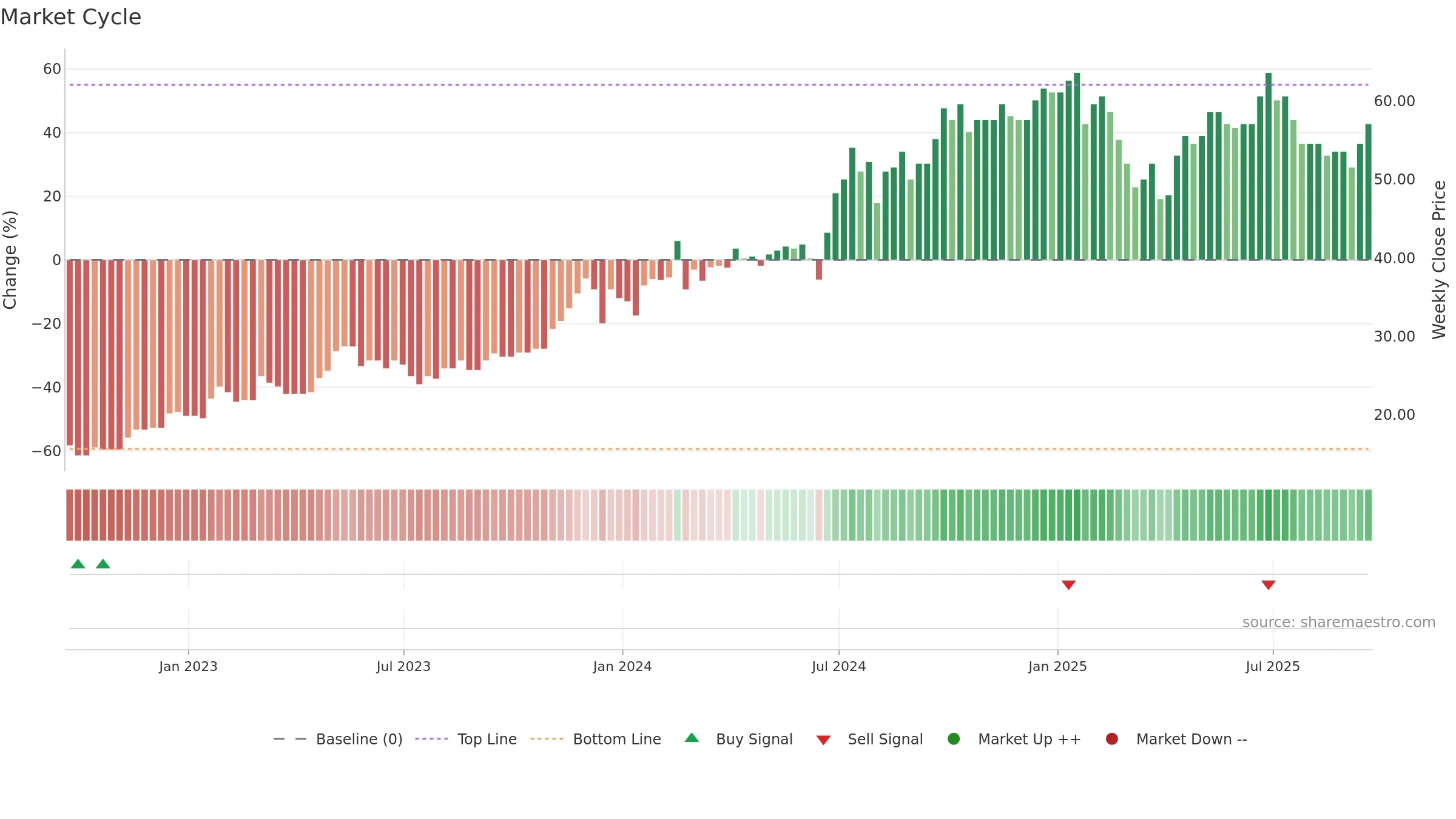

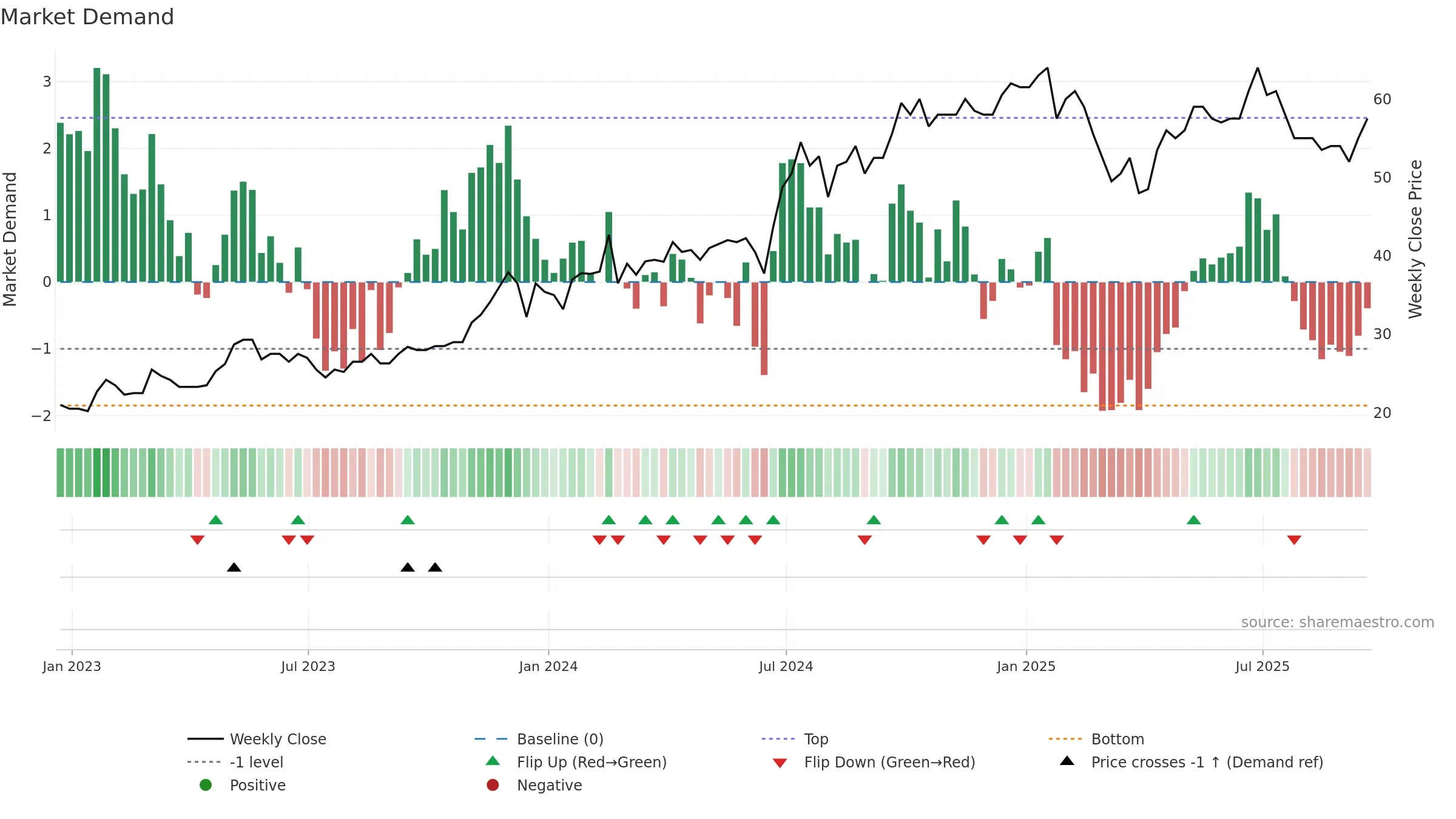

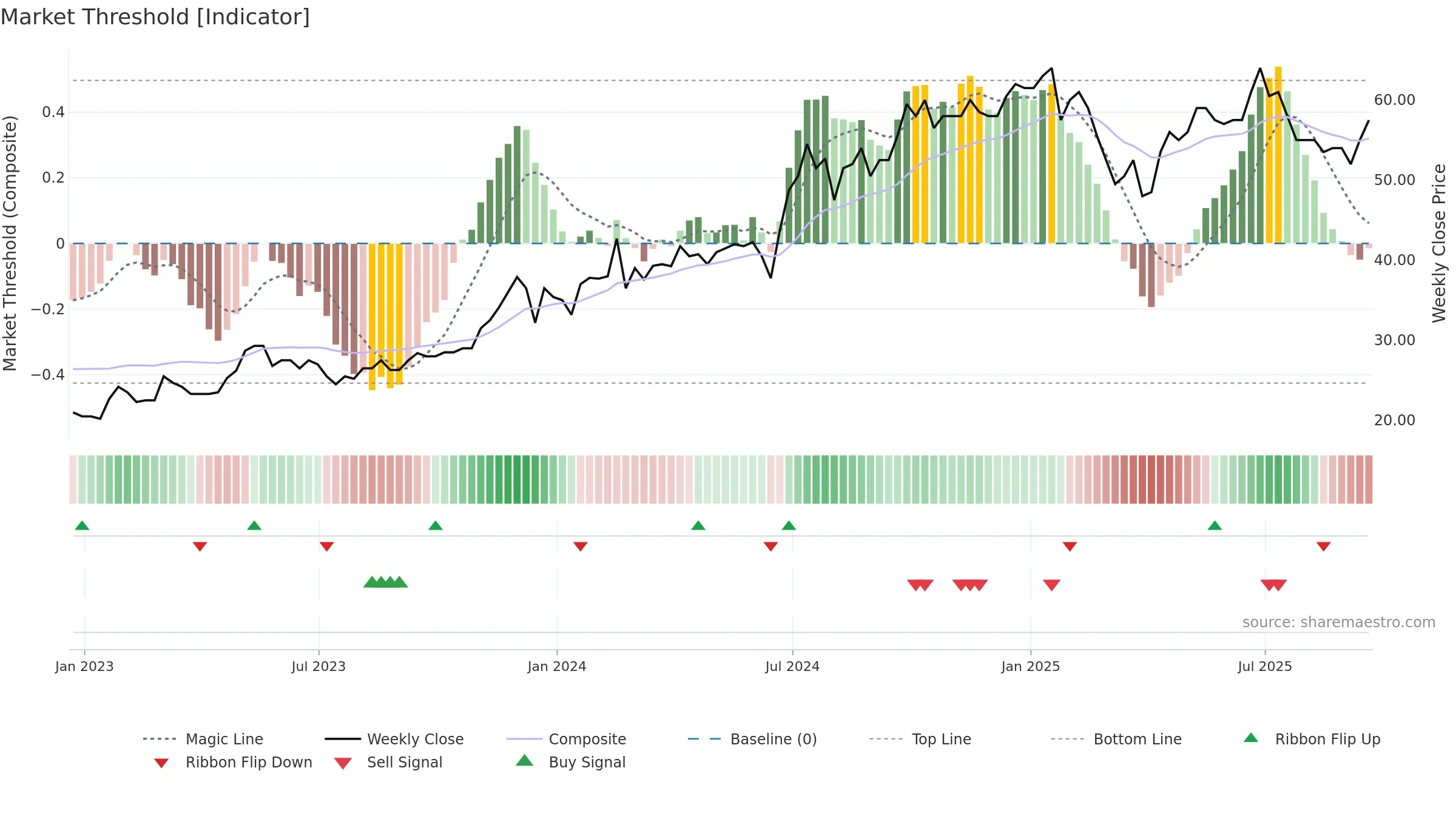

How to read this — Price slope is upward, indicating persistent buying over the window. Low weekly volatility favours steadier follow-through. Volume trend diverges from price — watch for fatigue or rotation. Returns are negatively correlated with volume — strength may come on lighter activity. Distance to baseline is narrowing — reverting closer to its fair-value track. Fresh short-term crossover improves near-term tone. Price holds above key averages, indicating constructive participation.

Up-slope supports buying interest; pullbacks may be contained if activity stays firm. Because liquidity isn’t confirming, prefer evidence of fresh demand before chasing moves.

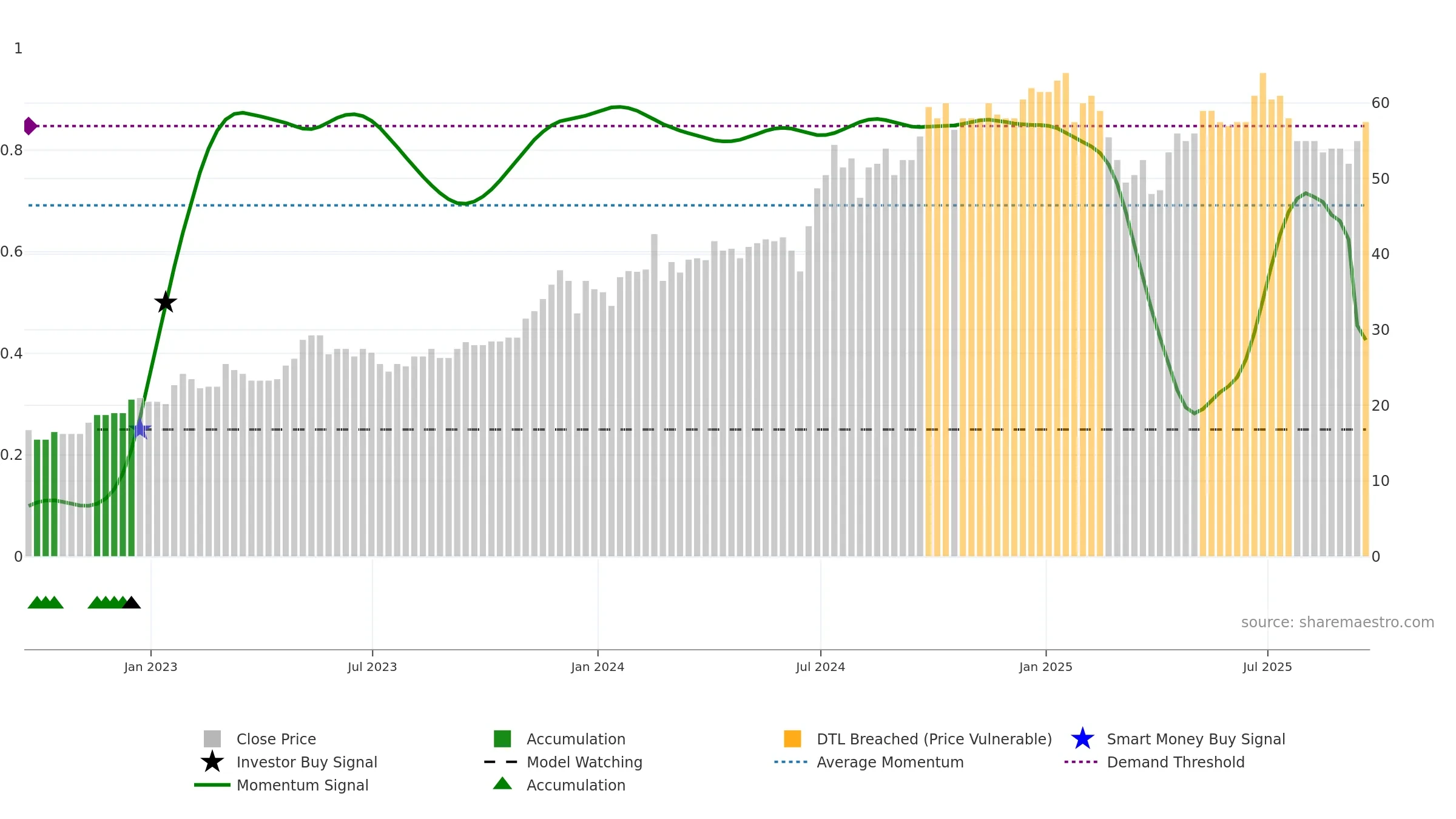

Gauge maps the trend signal to a 0–100 scale.

How to read this — Range-bound conditions; conviction is limited until a break or acceleration emerges. Loss of the ~0.50 midline after strength suggests regime shift.

Wait for a directional break or improving acceleration.

Conclusion

Neutral setup. ★★★☆☆ confidence. Price window: 4. Trend: Range / Neutral; gauge 42. In combination, liquidity diverges from price.

- Price holds above 8w & 26w averages

- Low return volatility supports durability

- Momentum is weak/falling

- Liquidity diverges from price

- Midline (~0.50) failure after strength

Why: Price window 4.55% over 8w. Close is 4.55% above the prior-window high. Return volatility 1.14%. Volume trend falling. Liquidity divergence with price. Trend state range / neutral. 4–8w crossover bullish. Momentum neutral and falling.

Tip: Most metrics include a hover tooltip where they appear in the report.