Micronics Japan Co., Ltd.

6871 TYO

Weekly Summary

Micronics Japan Co., Ltd. closed at 6320.0000 (6.22% WoW) . Data window ends Mon, 22 Sep 2025.

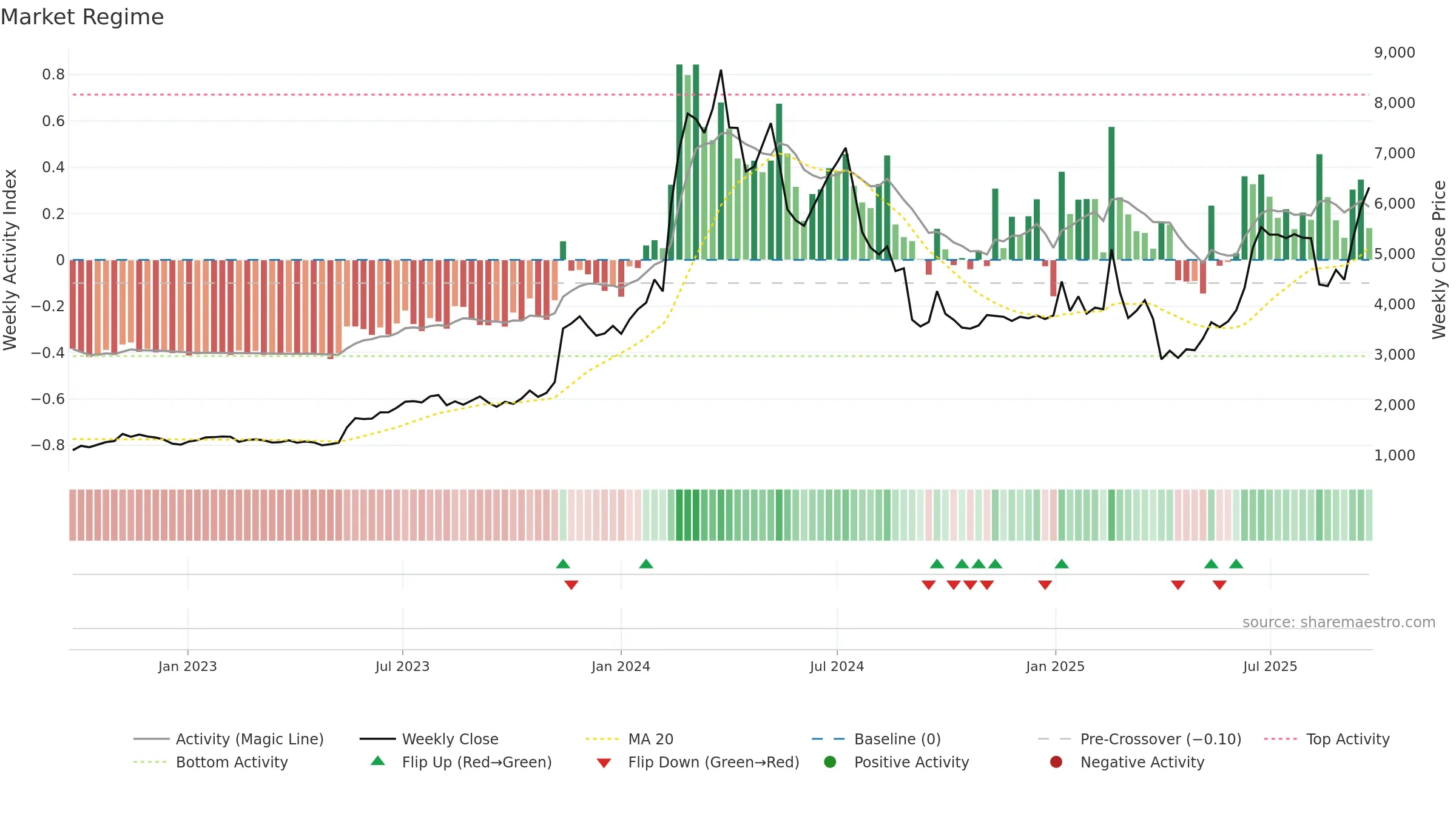

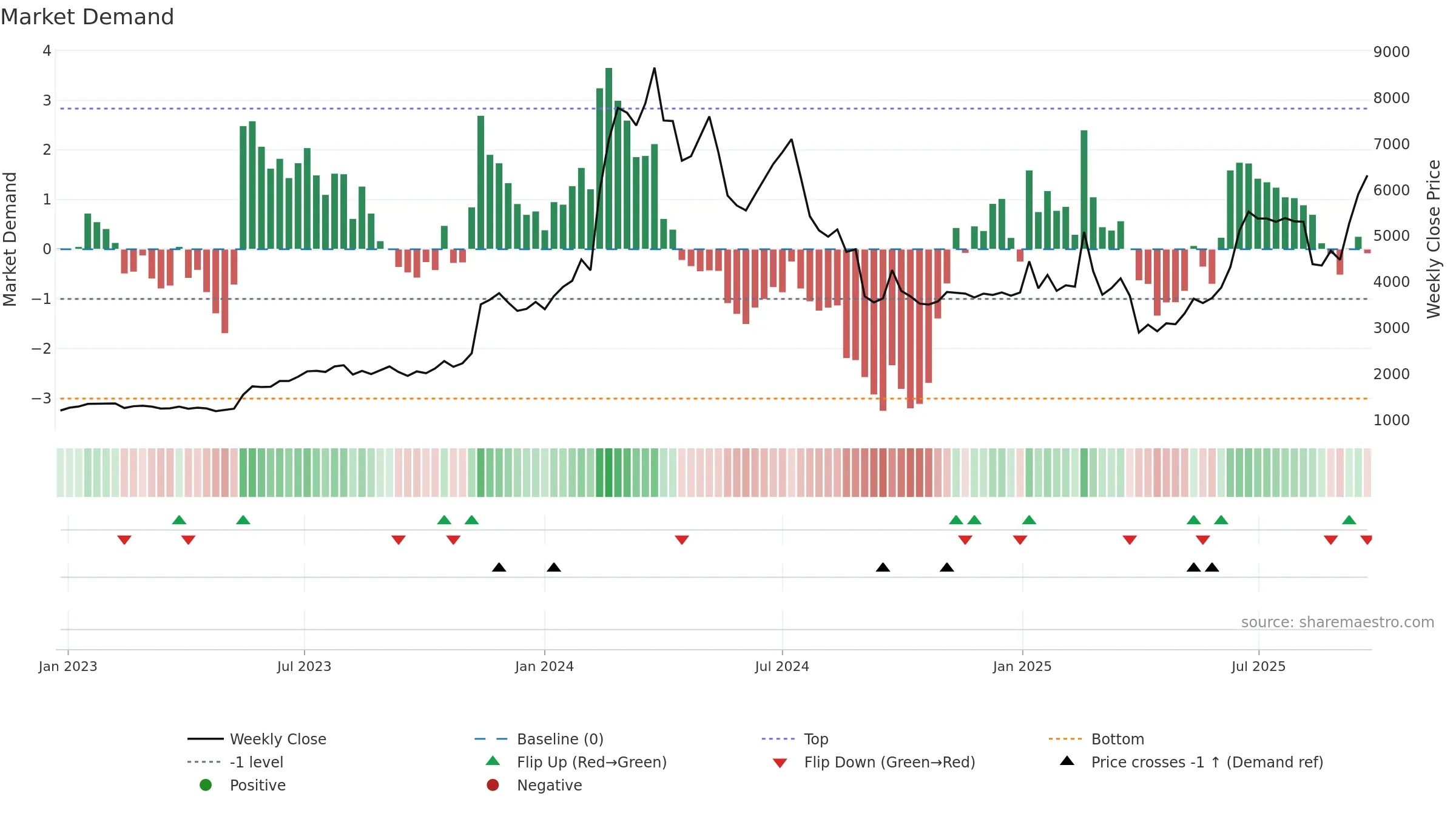

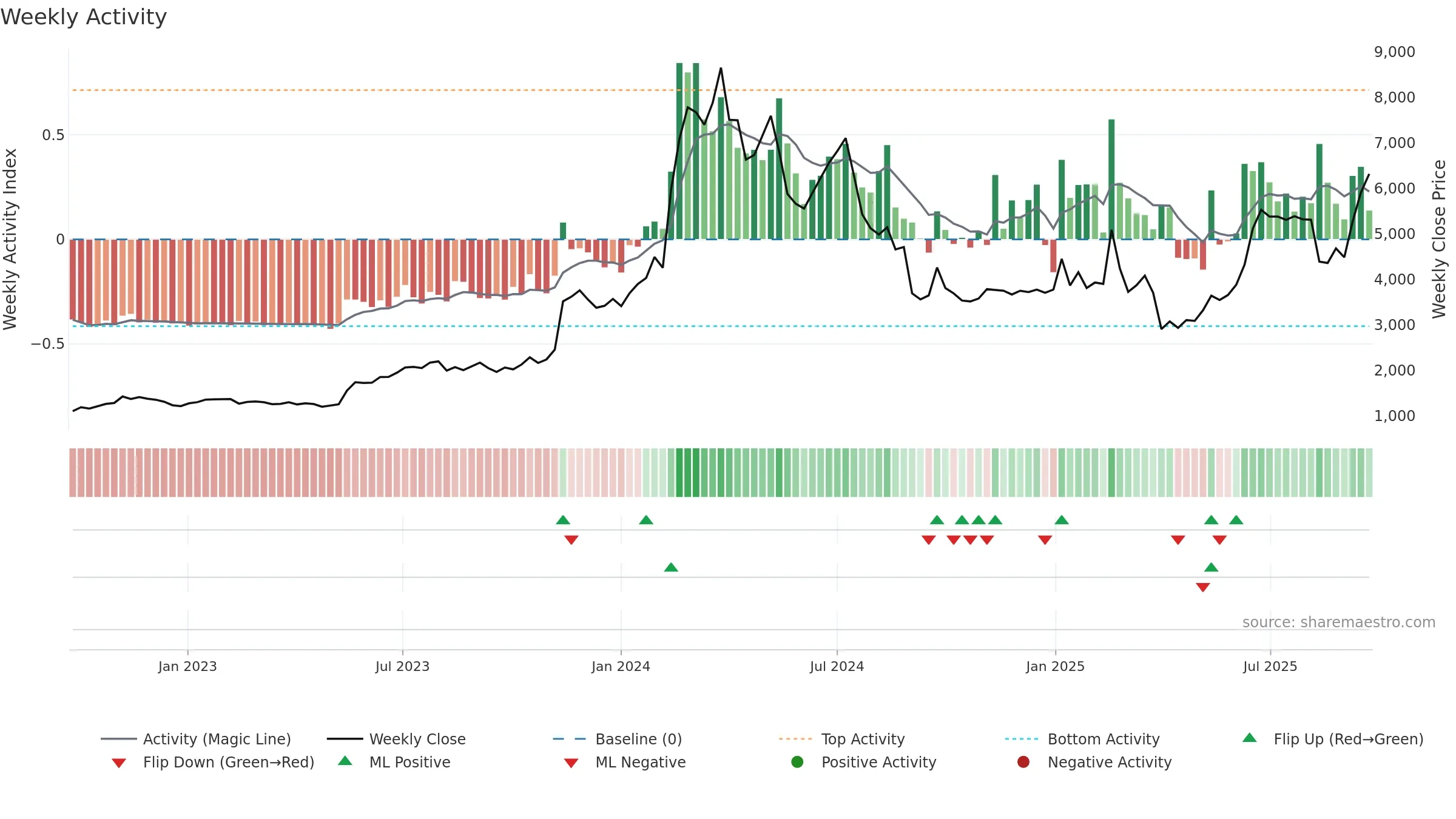

How to read this — Price slope is upward, indicating persistent buying over the window. Elevated weekly volatility increases whipsaw risk. Volume trend diverges from price — watch for fatigue or rotation. Returns are negatively correlated with volume — strength may come on lighter activity. Price is stretched above its baseline; consolidation risk rises if activity fades. Price holds above key averages, indicating constructive participation.

Up-slope supports buying interest; pullbacks may be contained if activity stays firm. Because liquidity isn’t confirming, prefer evidence of fresh demand before chasing moves.

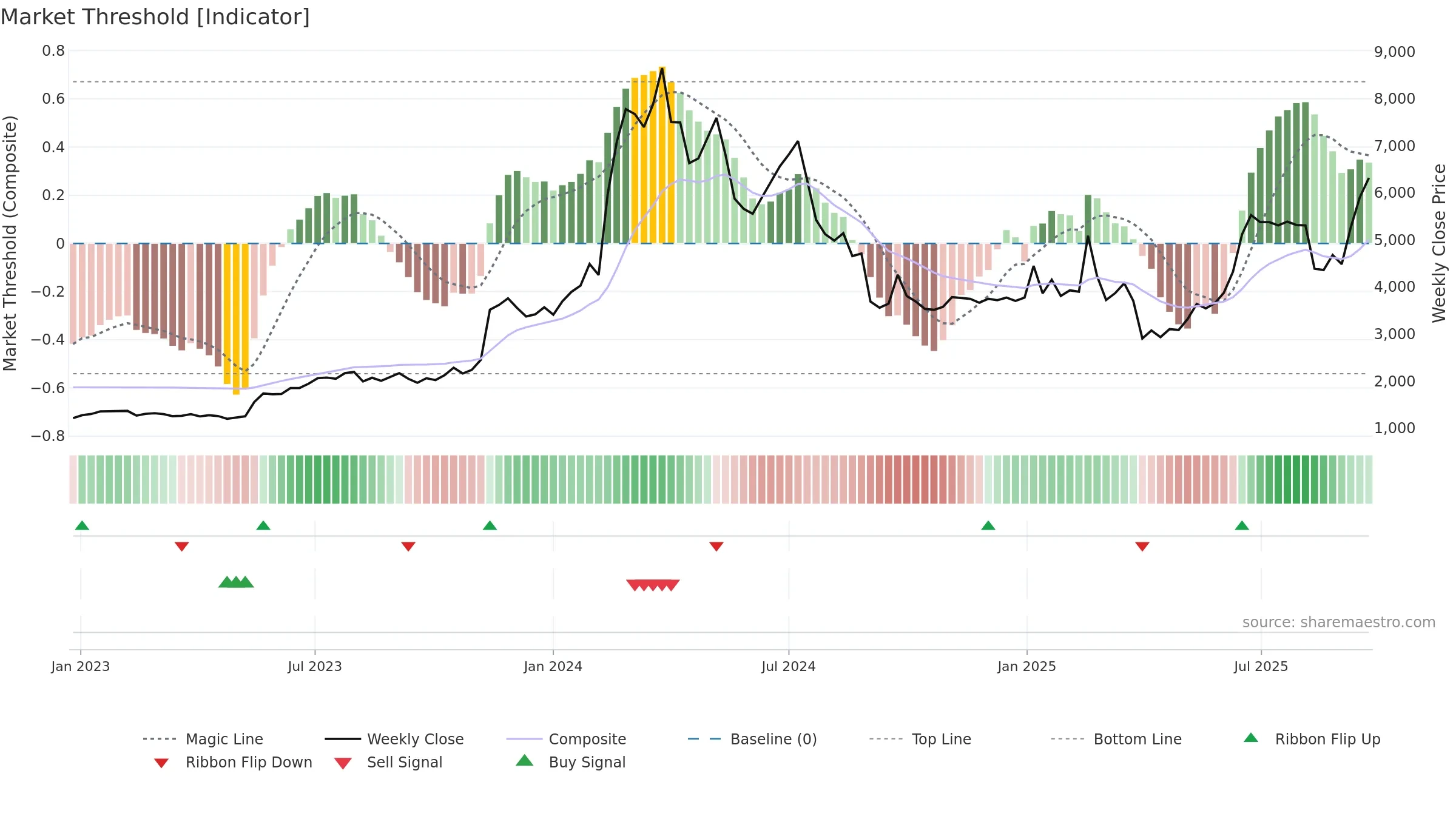

Gauge maps the trend signal to a 0–100 scale.

How to read this — Range-bound conditions; conviction is limited until a break or acceleration emerges.

Wait for a directional break or improving acceleration.

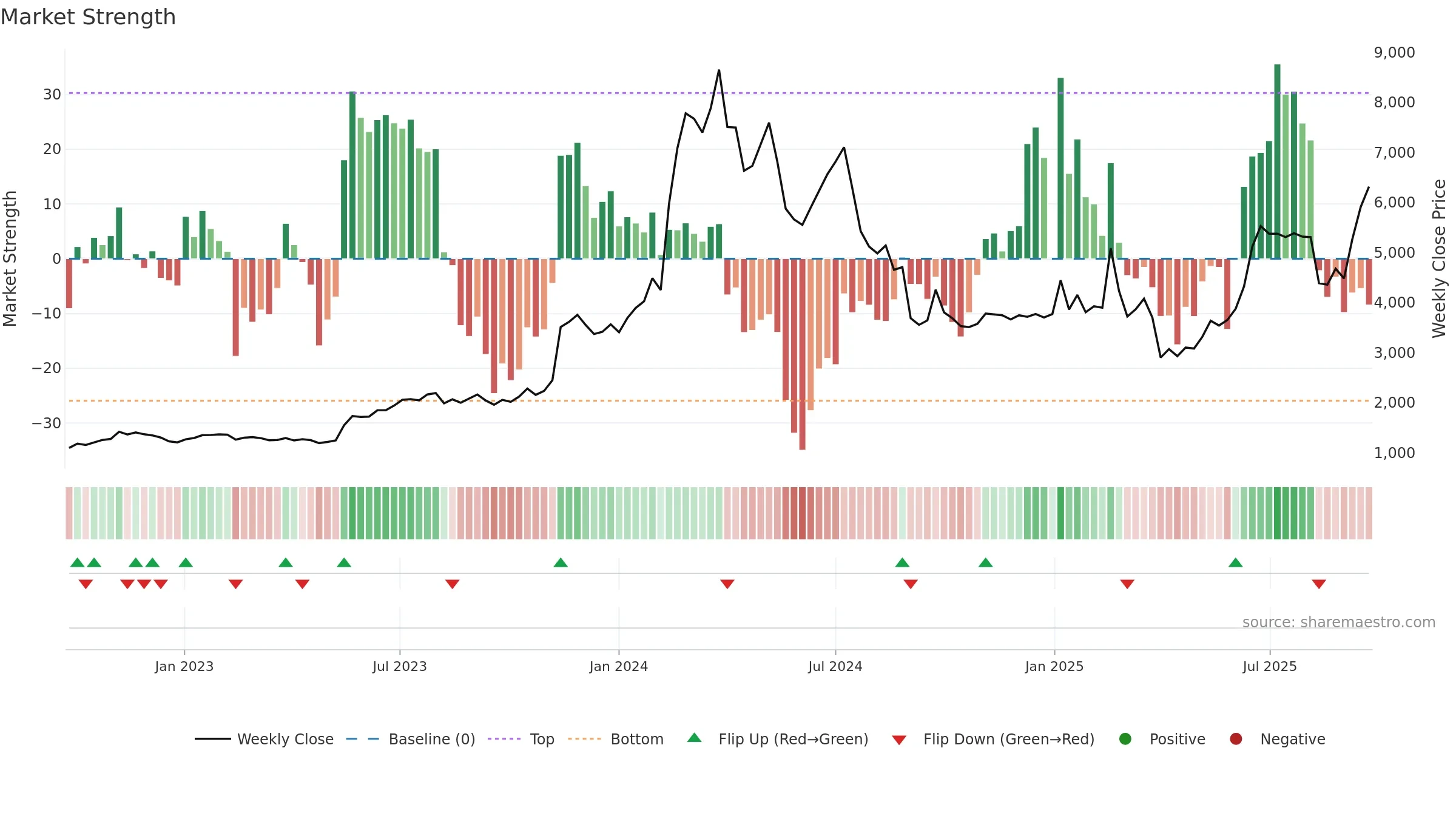

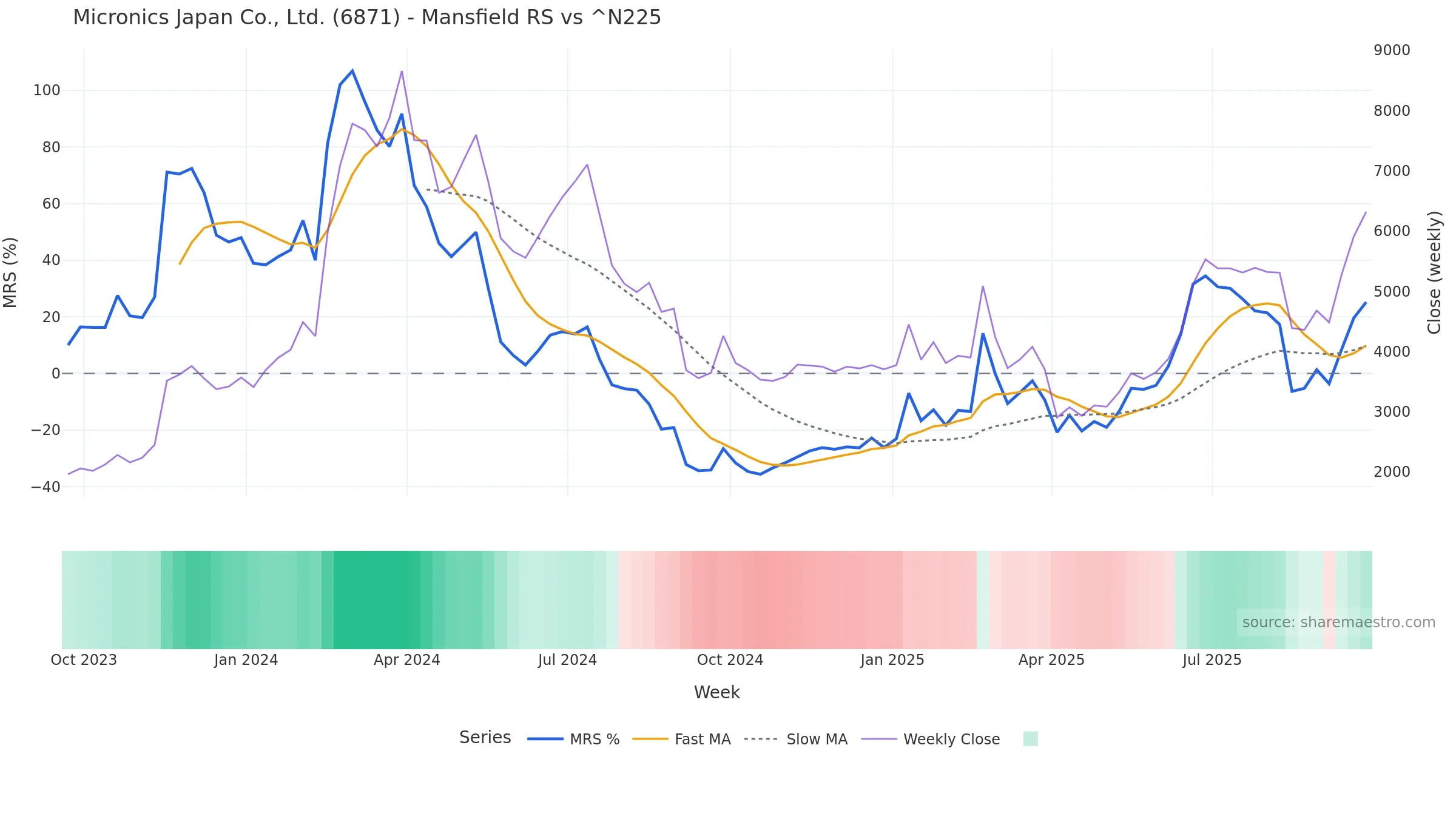

Relative strength is Positive

(> 0%, outperforming).

Latest MRS: 25.20% (week ending Fri, 26 Sep 2025).

Fast/slow crossover: Bullish.

Slope: Rising over 8w.

Notes:

- Fast/slow crossover turned bullish.

- Holding above the zero line indicates relative bid.

- MRS slope rising over ~8 weeks.

Conclusion

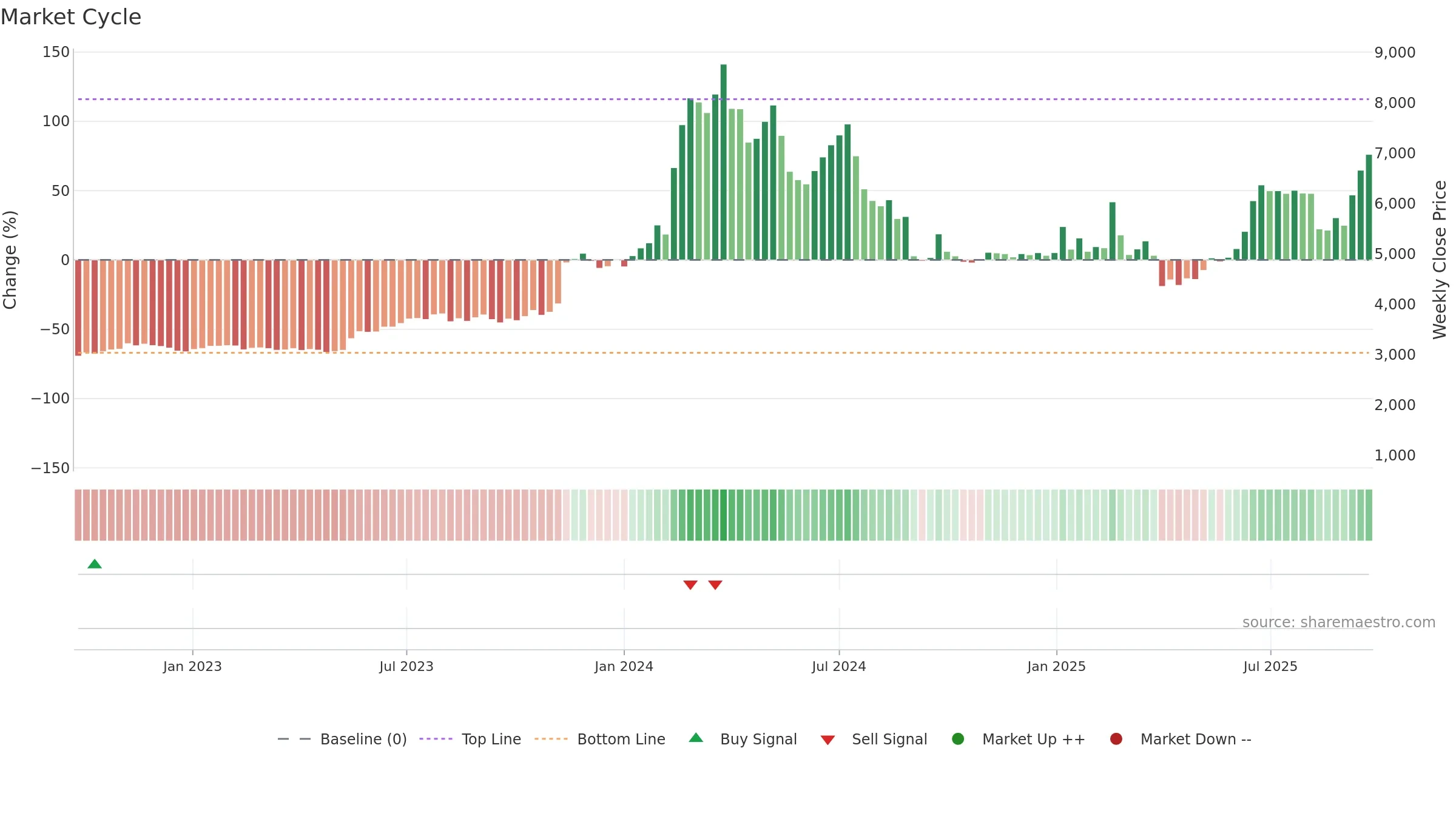

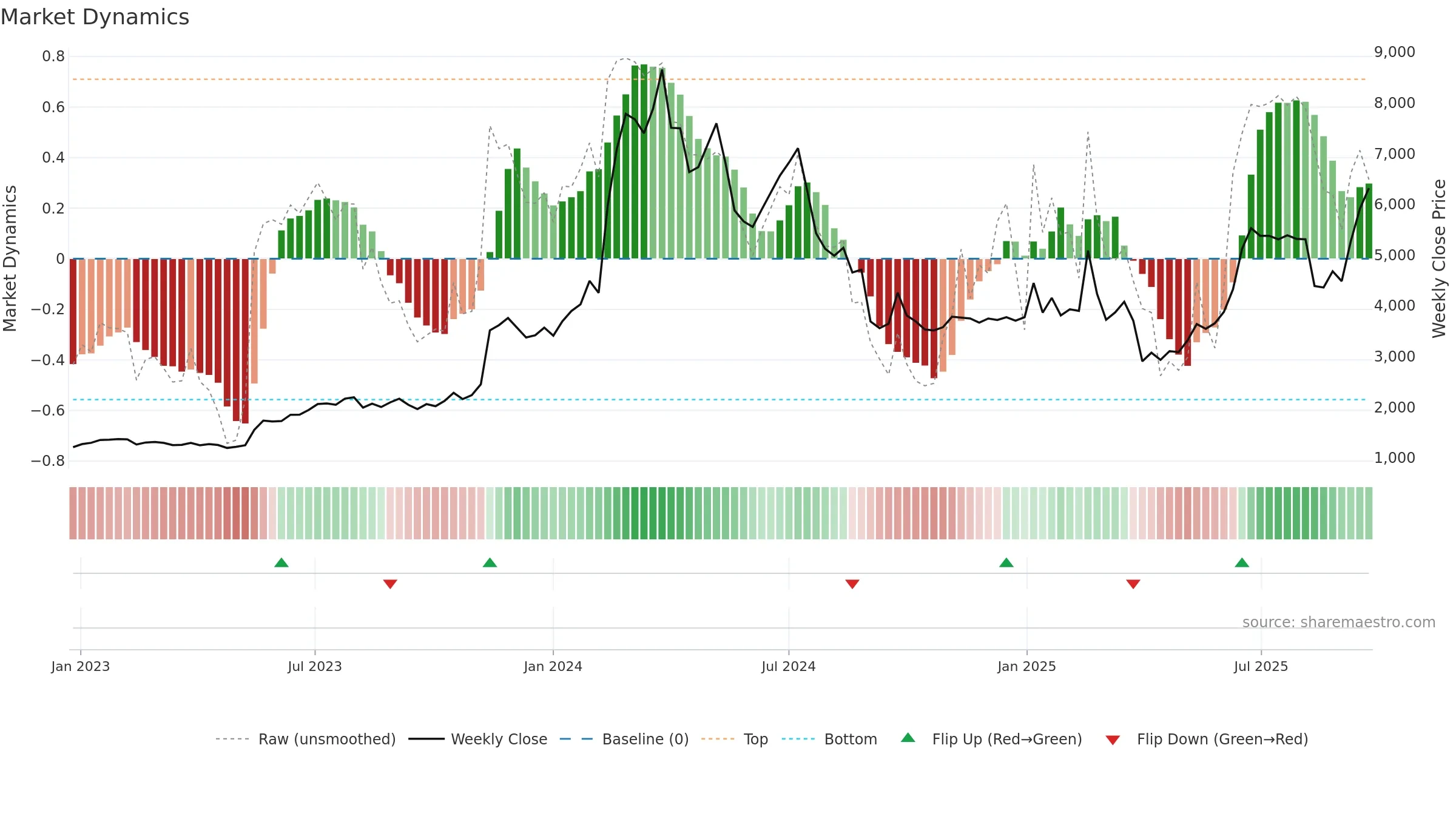

Negative setup. ★★⯪☆☆ confidence. Trend: Range / Neutral · 19.02% over window · vol 9.16% · liquidity divergence · posture above · RS outperforming · leaning negative

- Price holds above 8–26 week averages

- Solid multi-week performance

- Mansfield RS: outperforming & rising

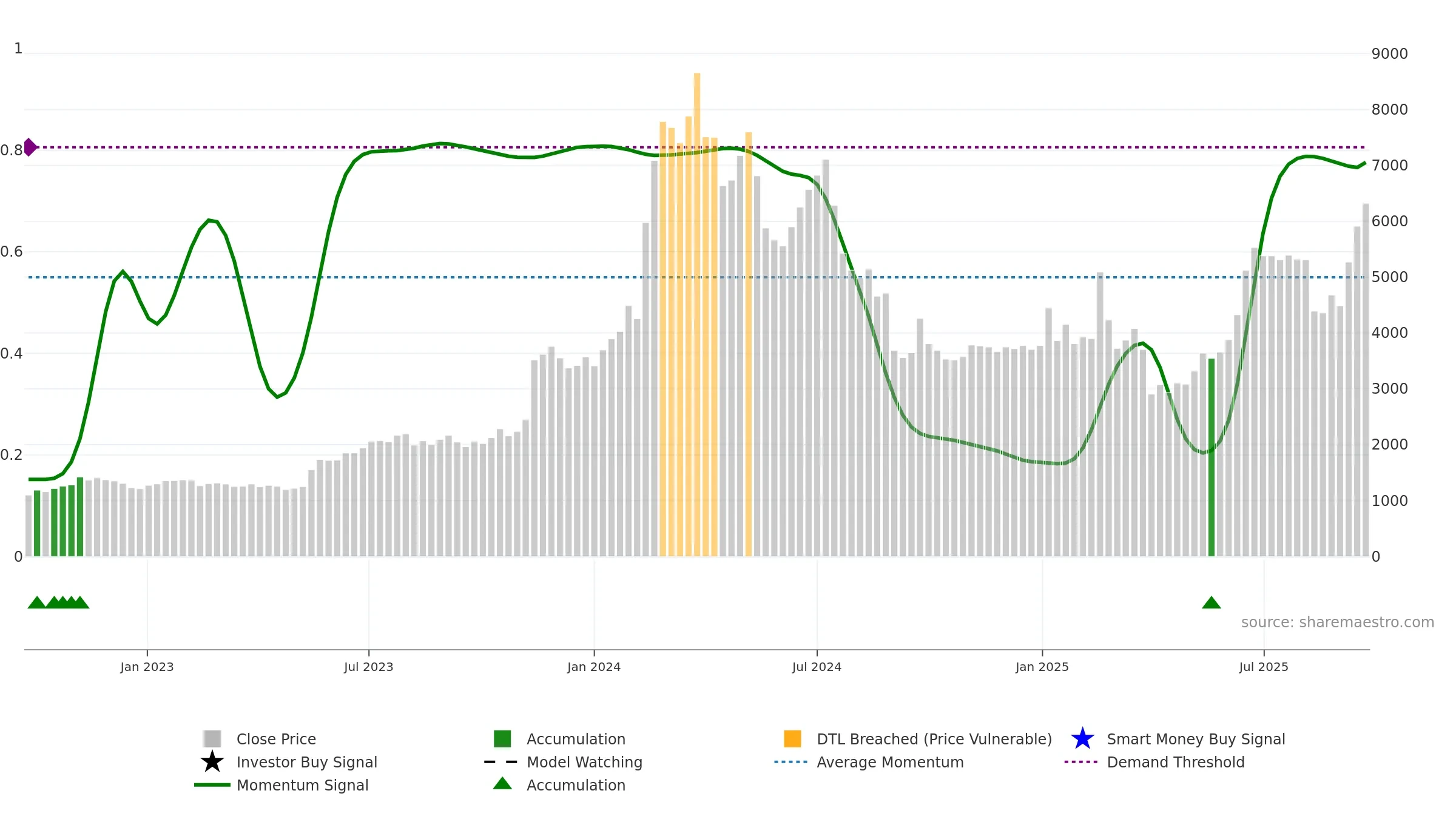

- Momentum is weak/falling

- Liquidity diverges from price

- High return volatility raises whipsaw risk

Why: Price window 19.02% over w. Close is 6.94% above the prior-window high. Return volatility 9.16%. Volume trend falling. Liquidity divergence with price. Trend state range / neutral. Momentum bullish and falling.

Tip: Most metrics include a hover tooltip where they appear in the report.