Sphere Entertainment Co.

SPHR NYSE

Weekly Report

Sphere Entertainment Co. closed at 59.7100 (-1.44% WoW) . Data window ends Fri, 19 Sep 2025.

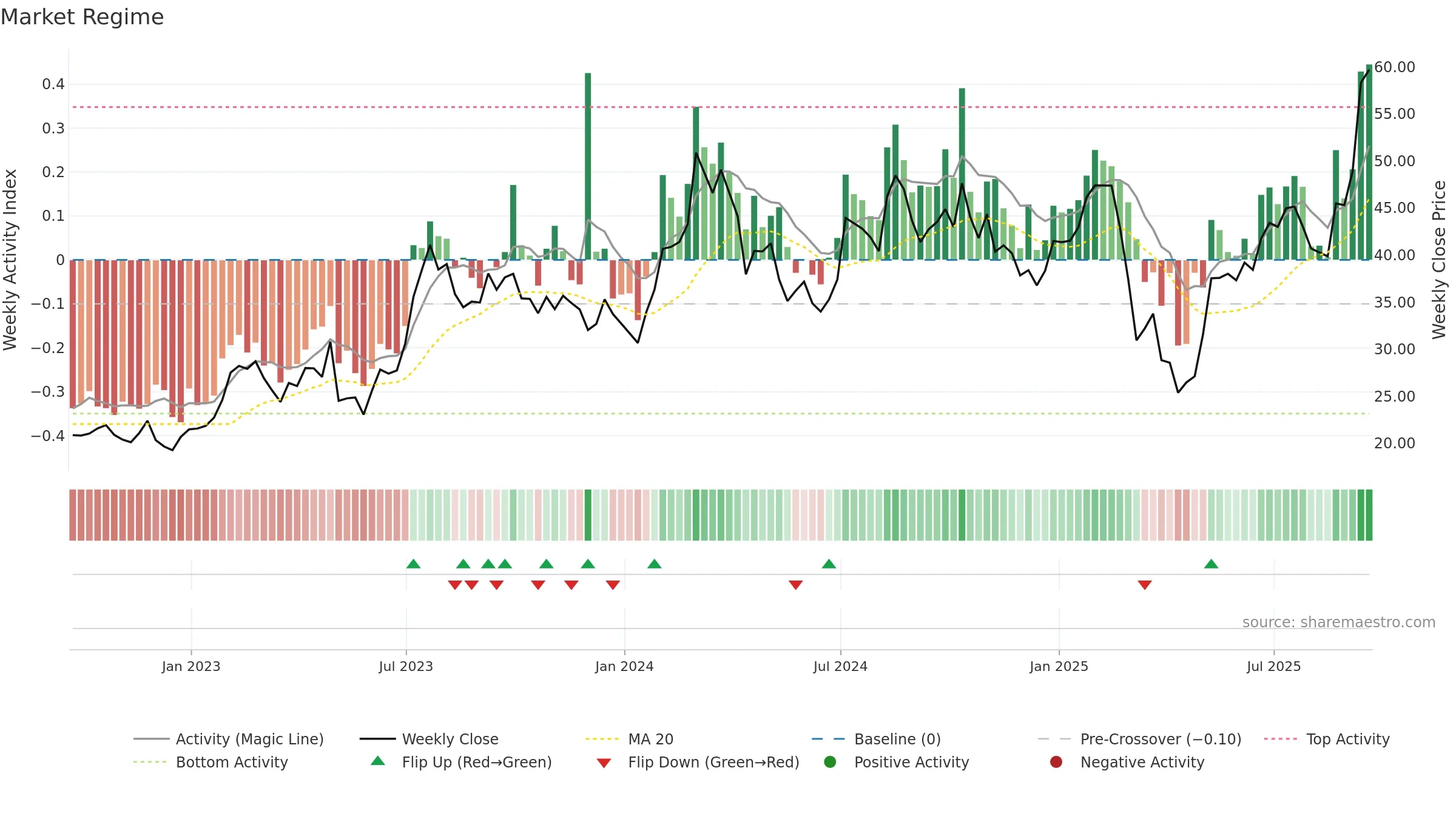

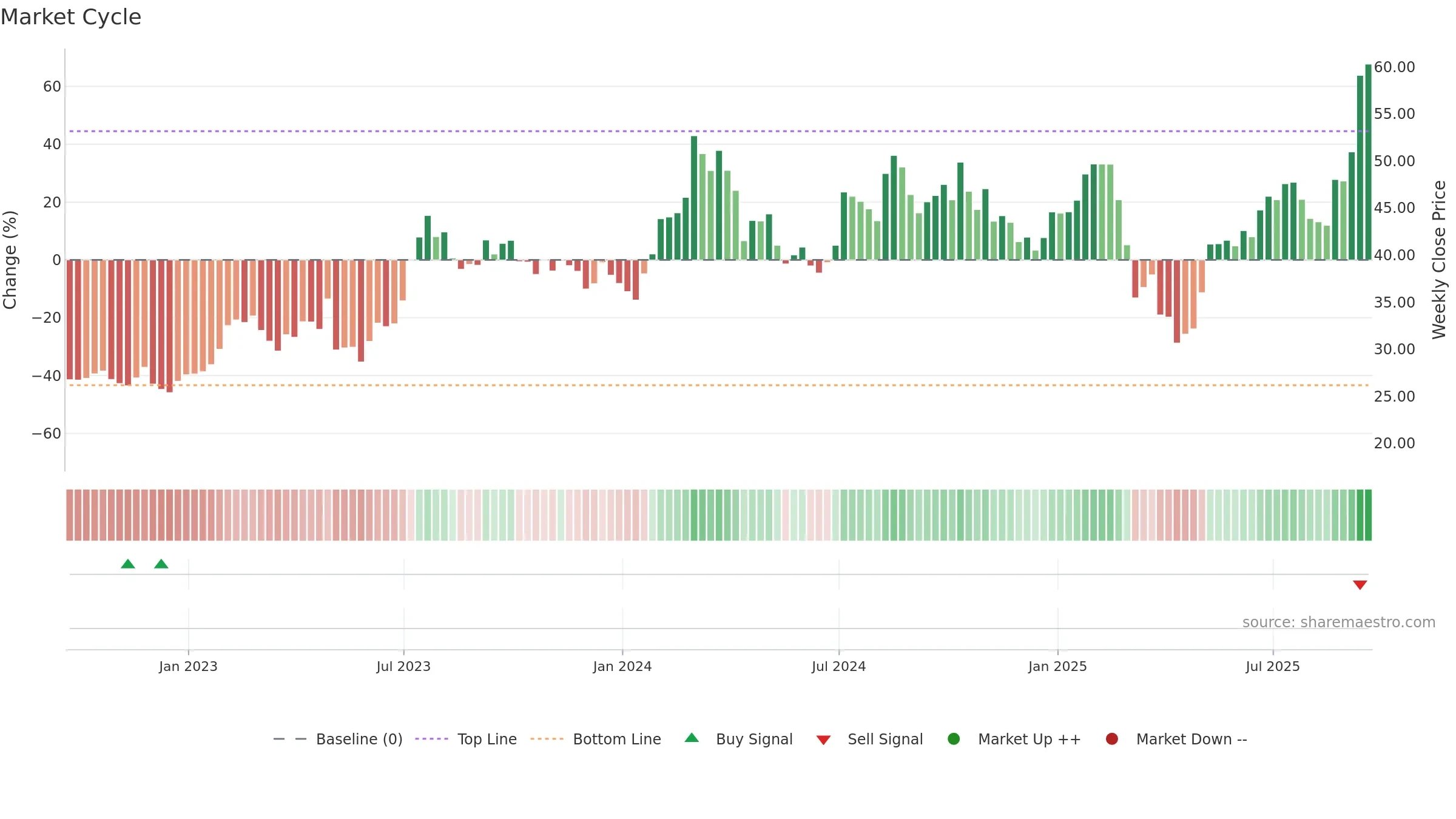

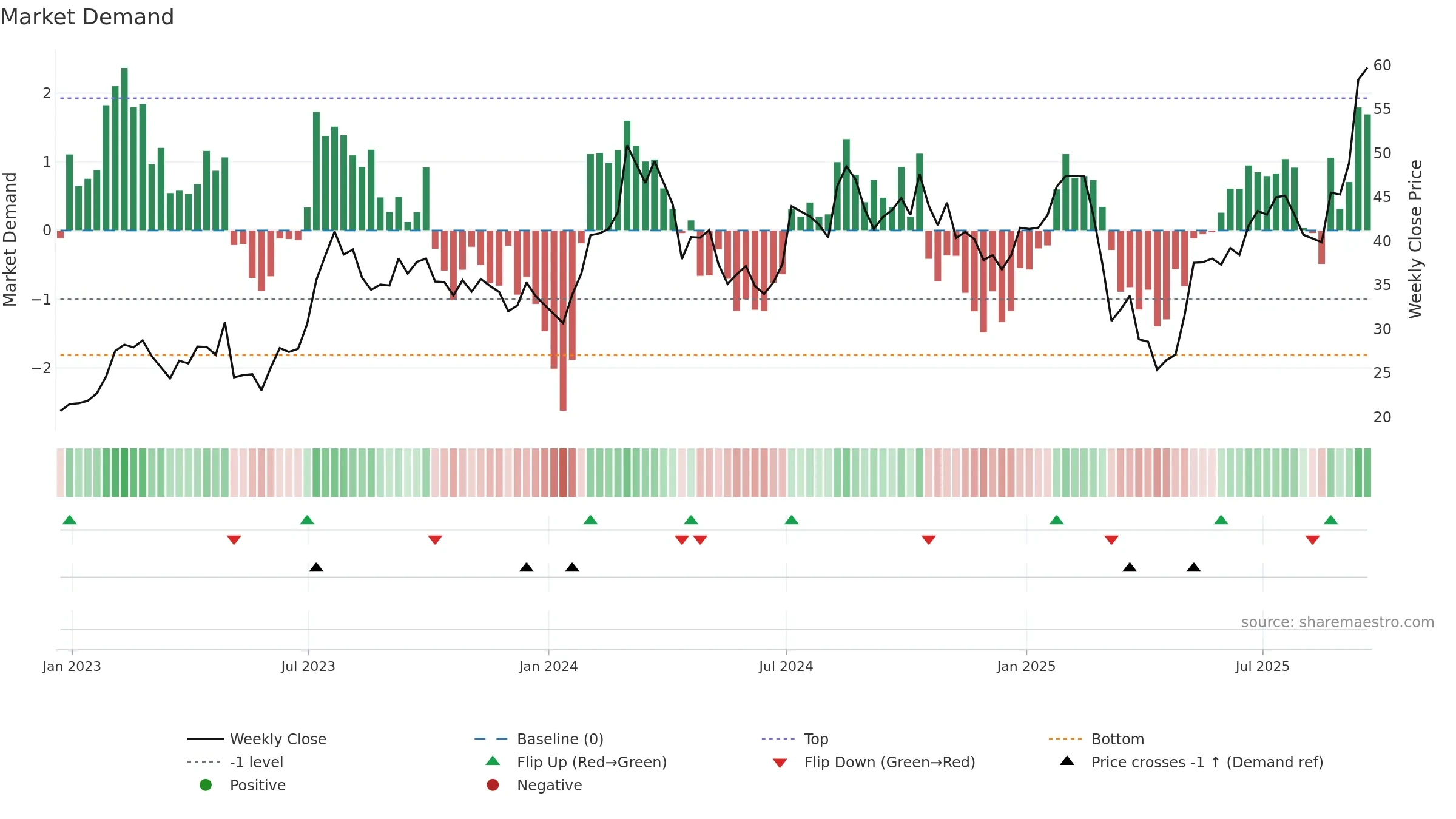

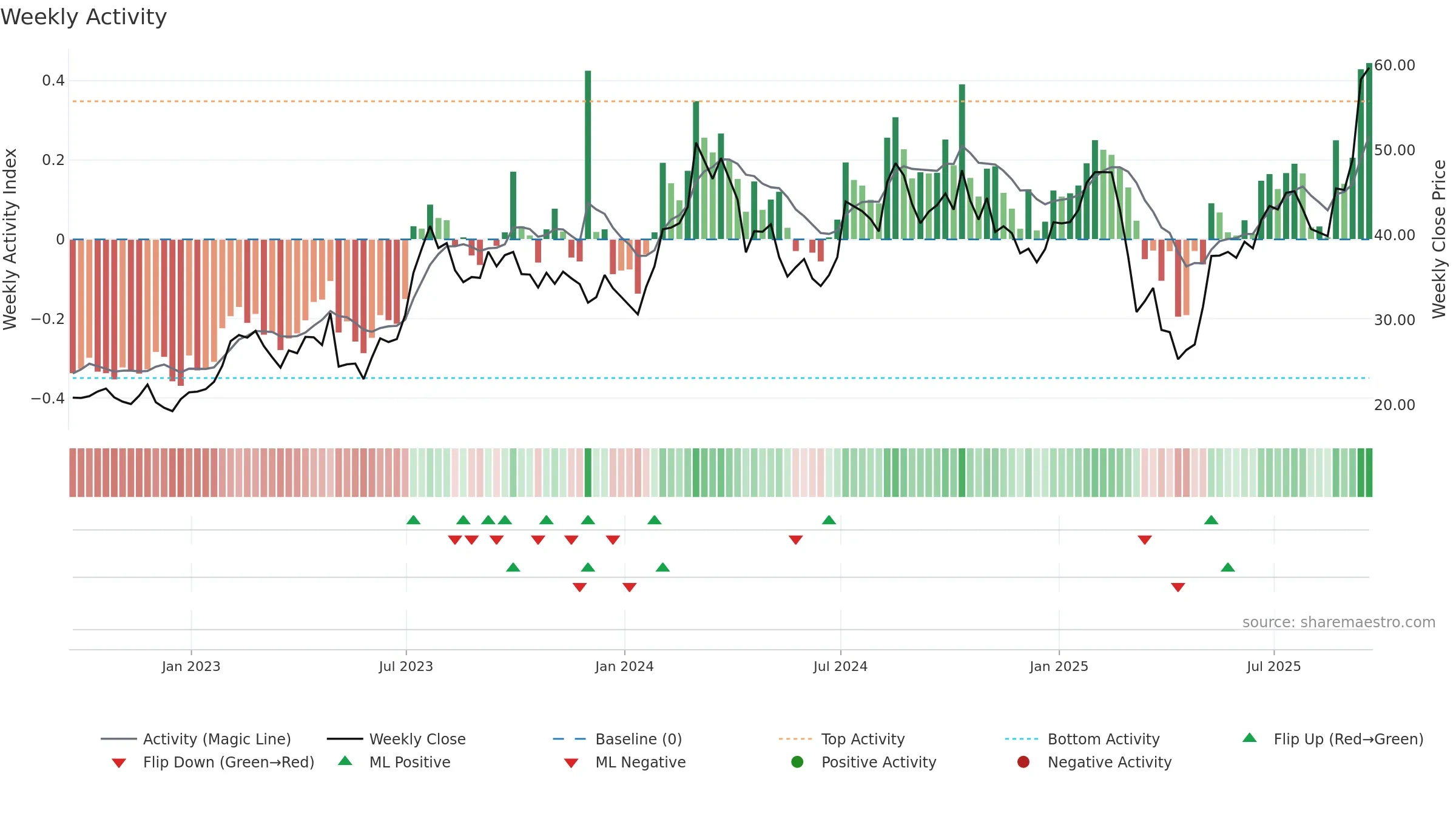

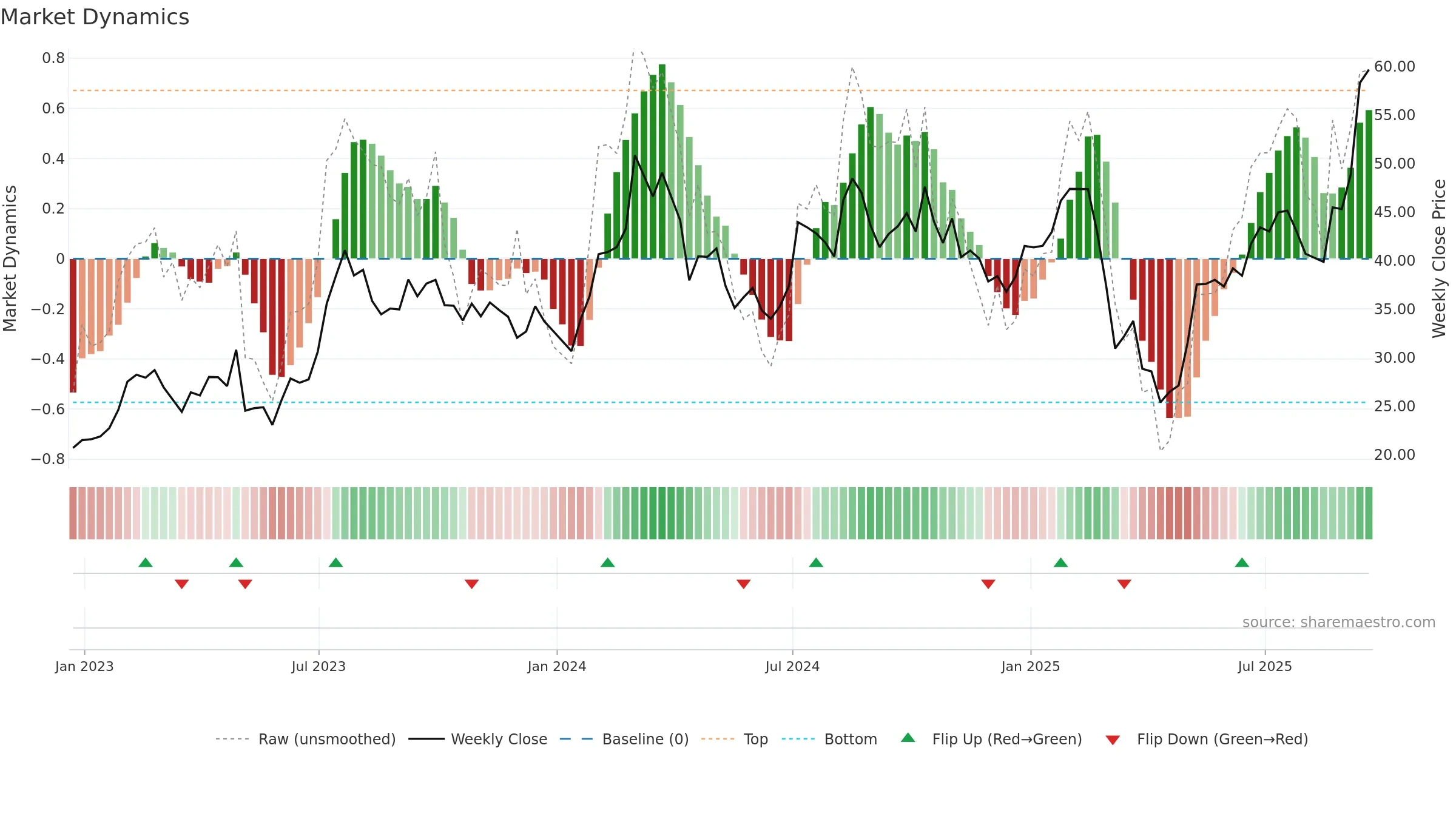

How to read this — Price slope is upward, indicating persistent buying over the window. Elevated weekly volatility increases whipsaw risk. Volume and price are moving in the same direction — a constructive confirmation. Returns are positively correlated with volume — strength tends to arrive on higher activity. Price is stretched above its baseline; consolidation risk rises if activity fades. Constructive MA stack supports the up-drift; pullbacks may find support at the 8–13 week region. Price holds above key averages, indicating constructive participation.

Up-slope supports buying interest; pullbacks may be contained if activity stays firm.

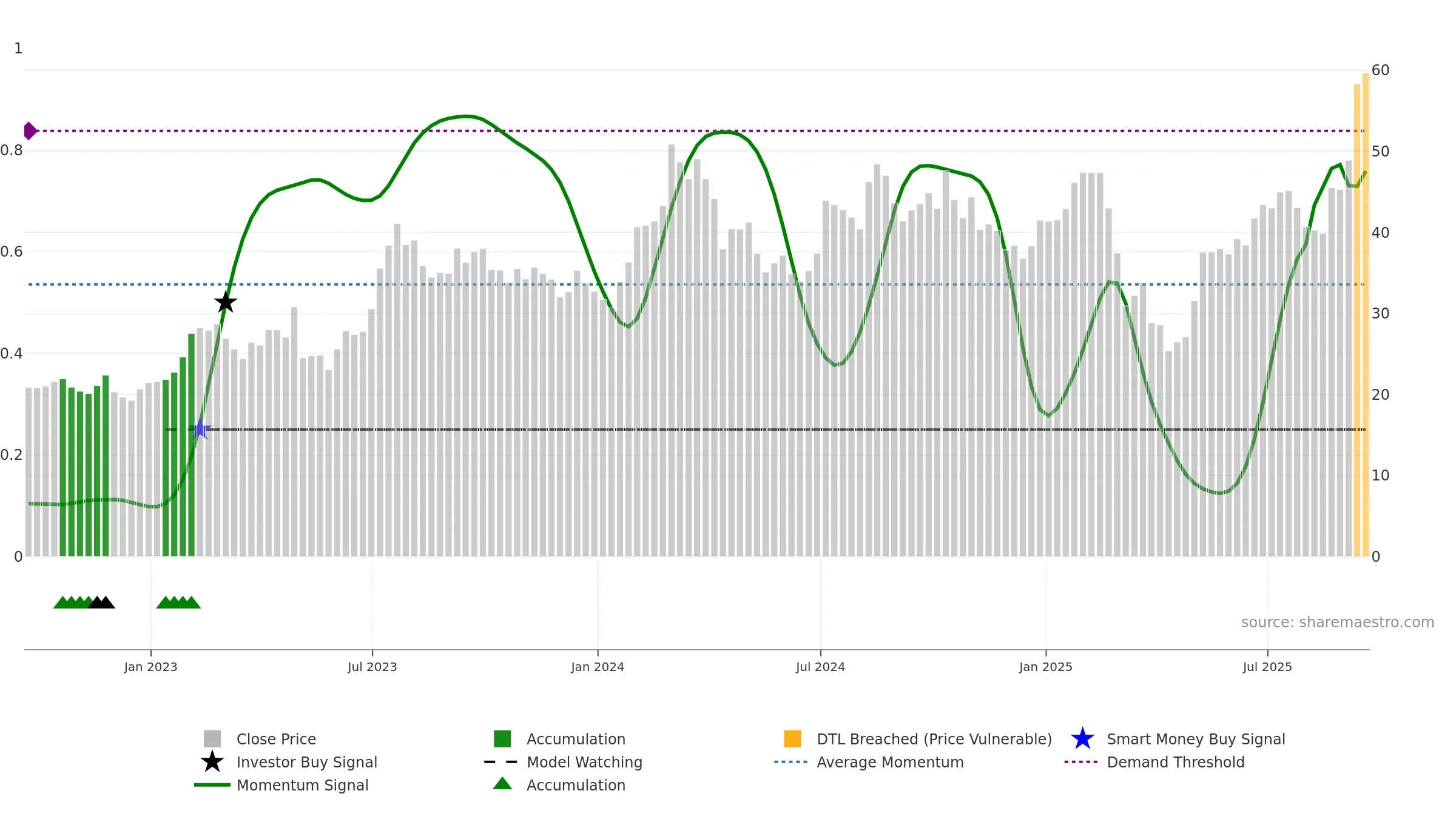

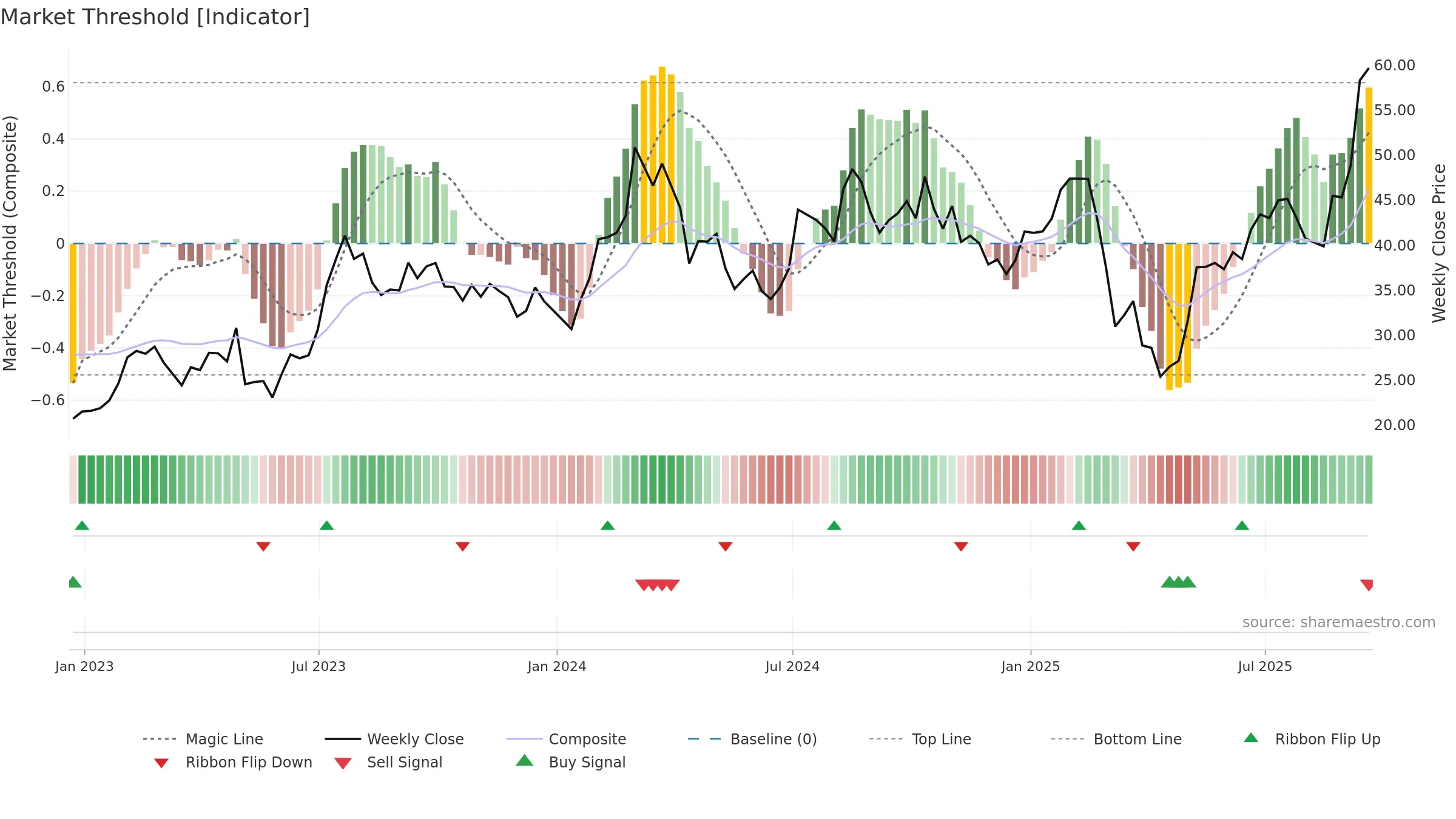

Gauge maps the trend signal to a 0–100 scale.

How to read this — Gauge is elevated but momentum is rolling over; topping risk is rising.

Stay alert: protect gains or seek confirmation before adding risk.

Conclusion

Neutral setup. ★★★☆☆ confidence. Price window: 46. Trend: Uptrend at Risk; gauge 75. In combination, liquidity confirms the move.

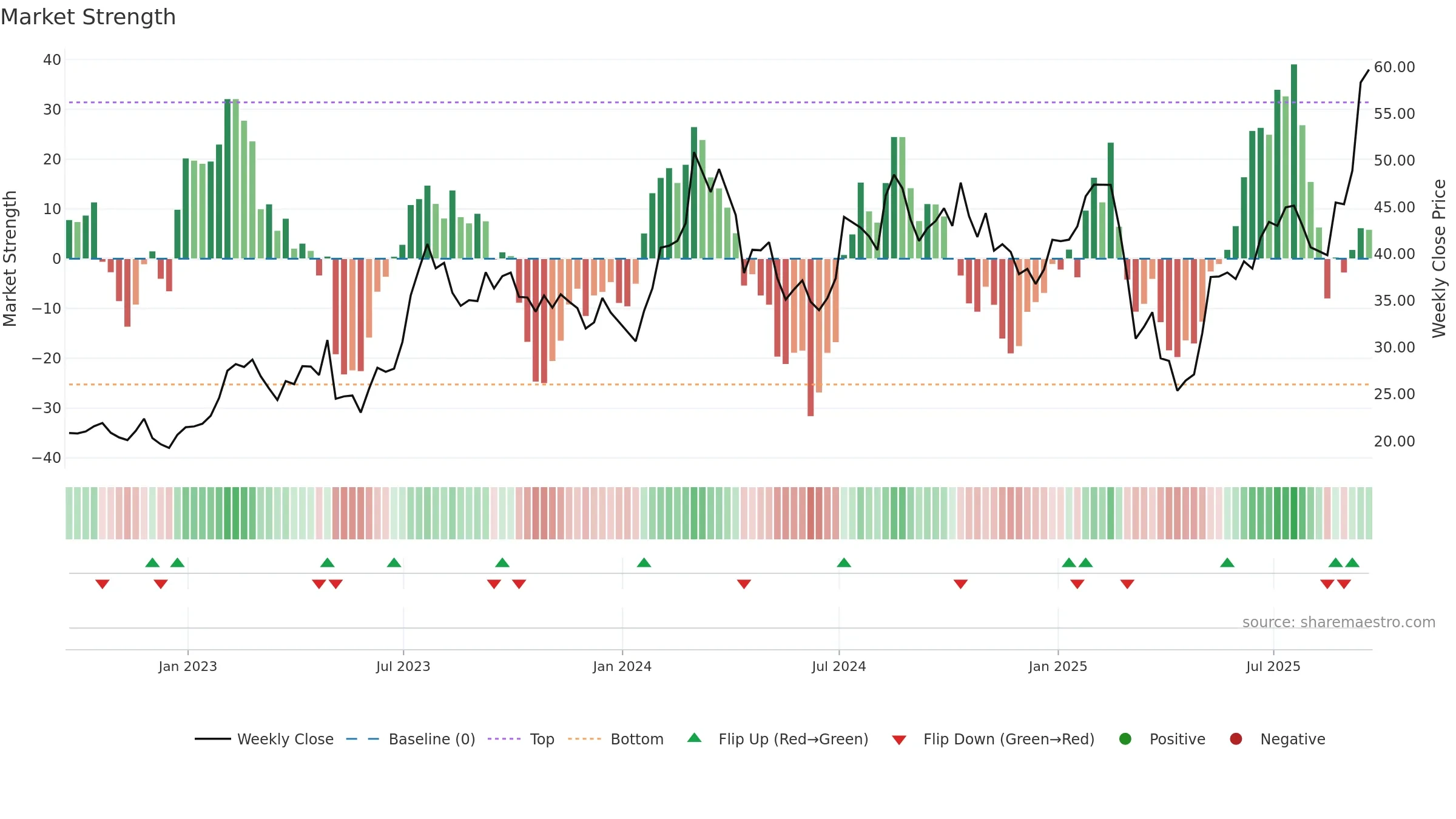

- Momentum is bullish and rising

- Price holds above 8w & 26w averages

- Constructive moving-average stack

- Liquidity confirms the price trend

- High-level but rolling over (topping risk)

- High return volatility raises whipsaw risk

Why: Price window 46.67% over 8w. Close is 2.37% above the prior-window high. Return volatility 4.43%. Volume trend rising. Liquidity convergence with price. Trend state uptrend at risk. MA stack constructive. Momentum bullish and rising.

Tip: Most metrics include a hover tooltip where they appear in the report.