SPS Commerce, Inc.

SPSC NASDAQ

Weekly Report

SPS Commerce, Inc. closed at 107.1900 (-1.48% WoW) . Data window ends Fri, 19 Sep 2025.

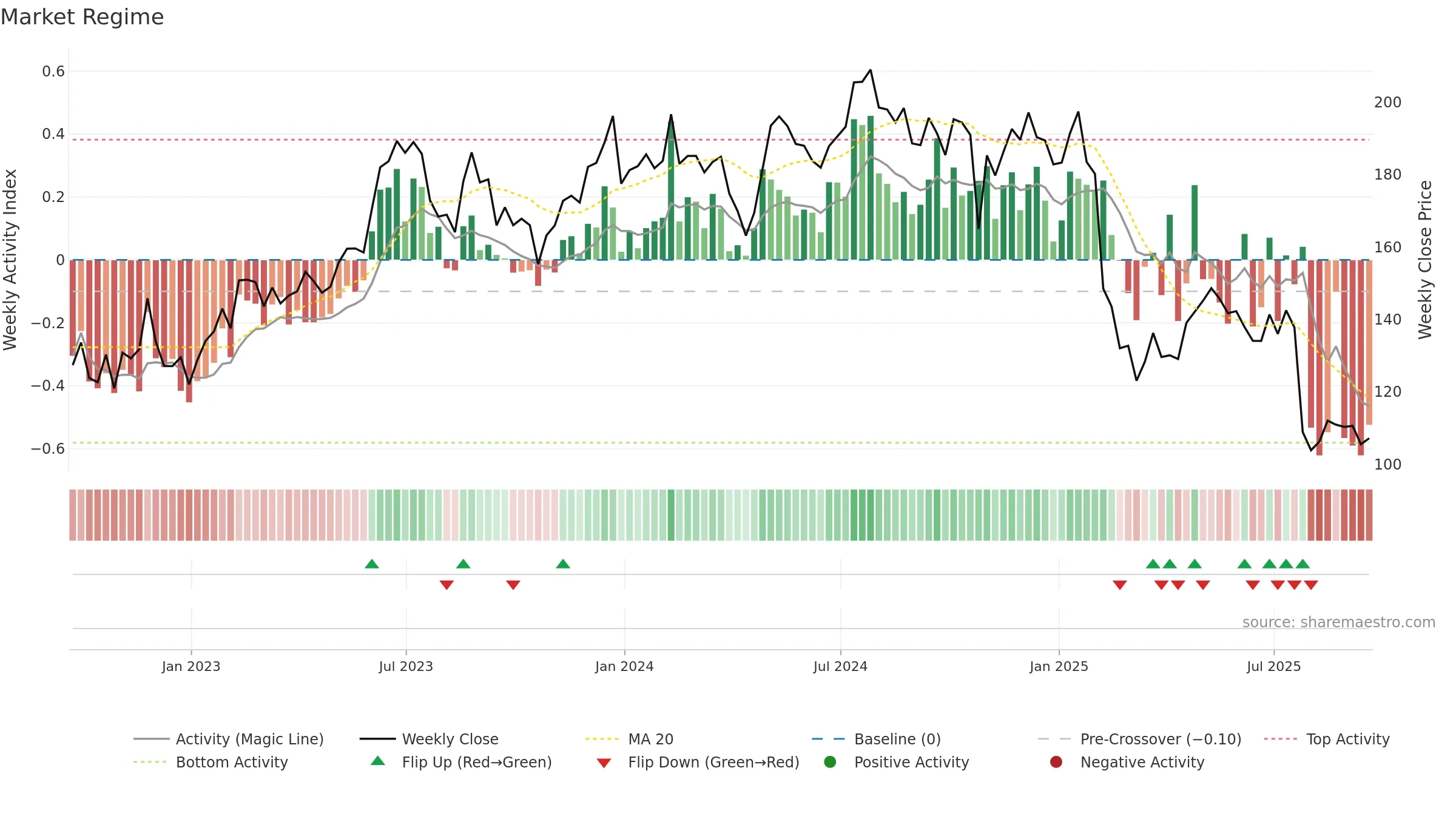

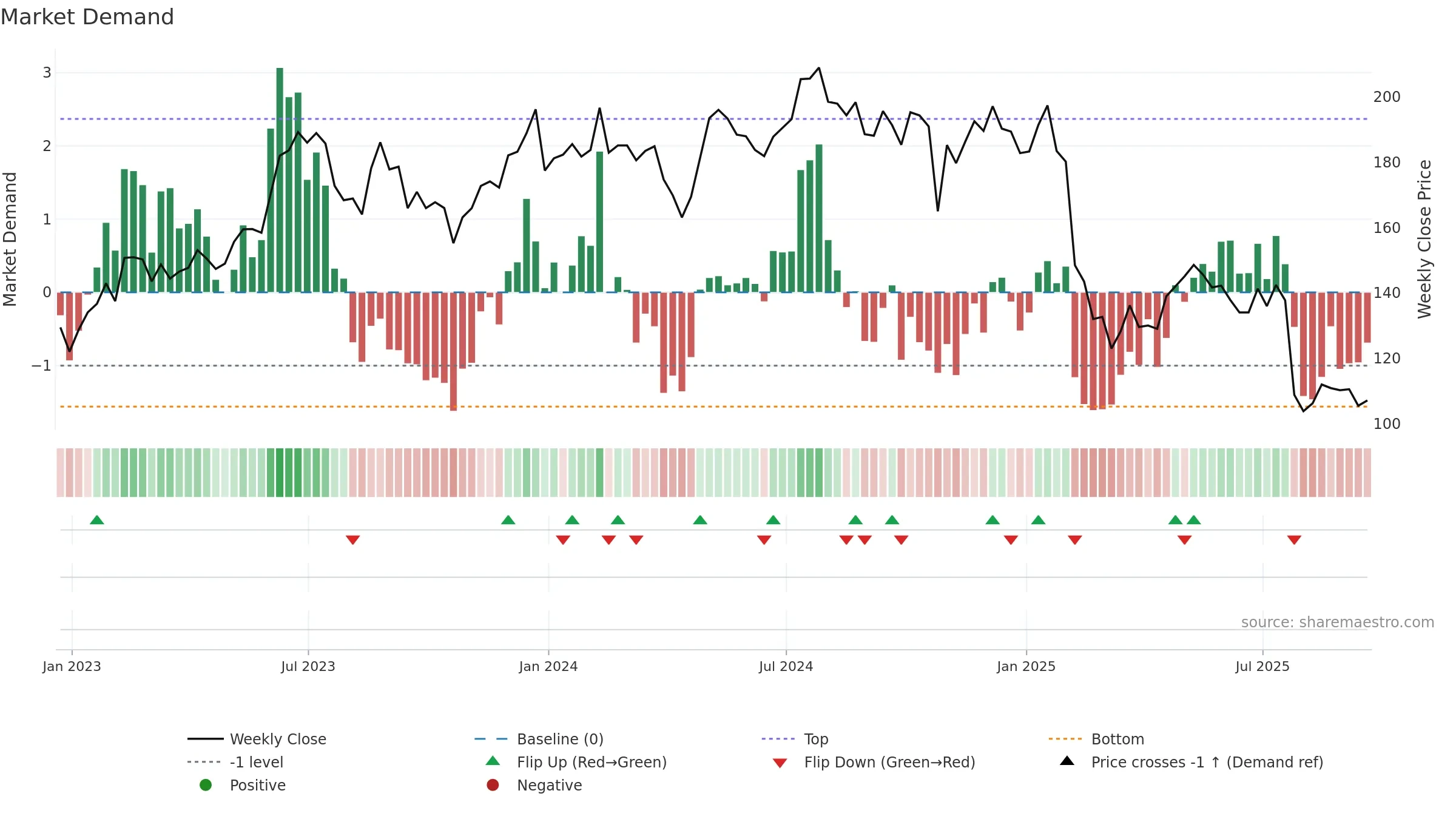

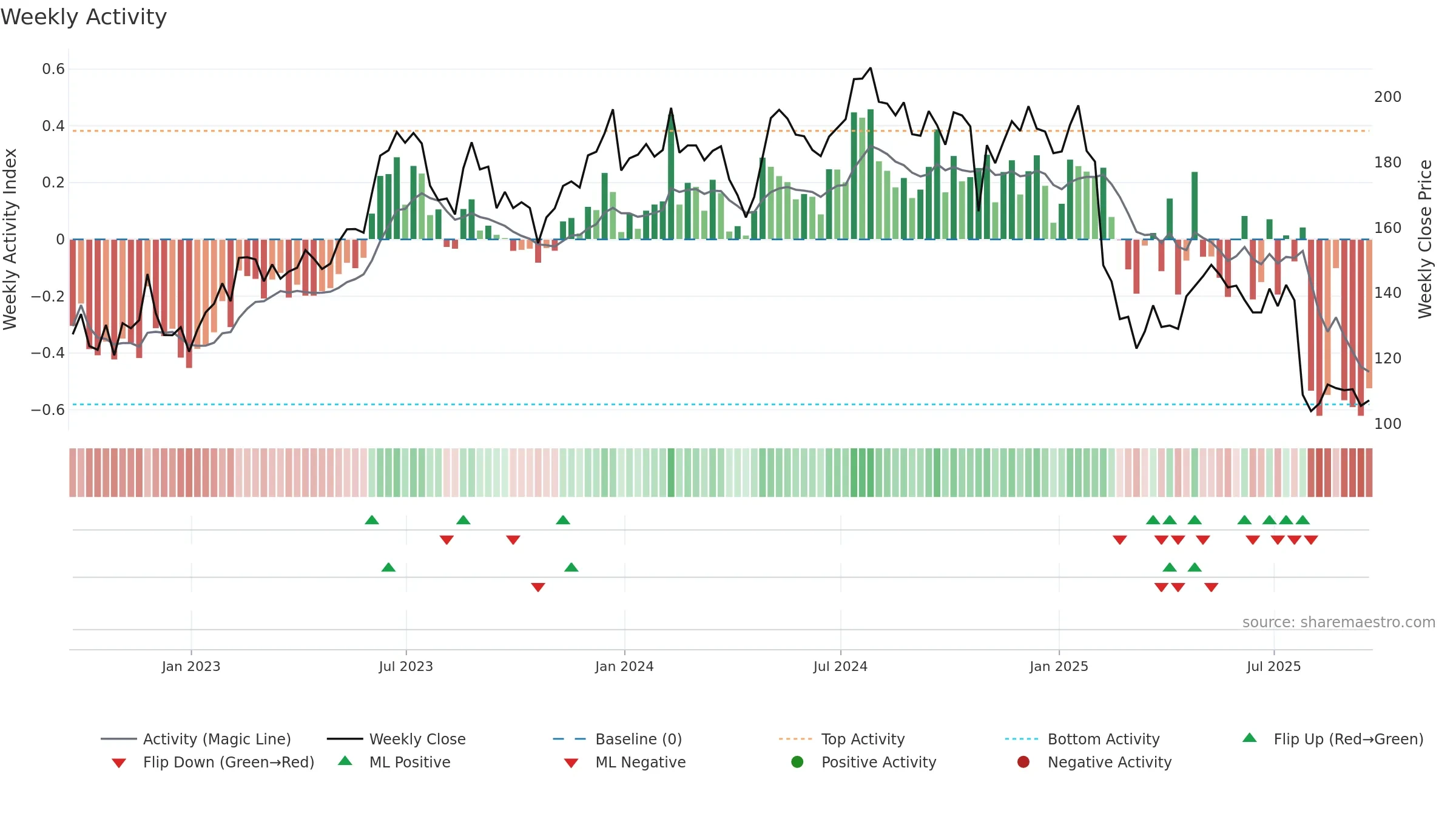

How to read this — Price slope is upward, indicating persistent buying over the window. Low weekly volatility favours steadier follow-through. Volume trend diverges from price — watch for fatigue or rotation. Distance to baseline is narrowing — reverting closer to its fair-value track. Price sits below key averages, keeping pressure on the tape.

Up-slope supports buying interest; pullbacks may be contained if activity stays firm. Because liquidity isn’t confirming, prefer evidence of fresh demand before chasing moves.

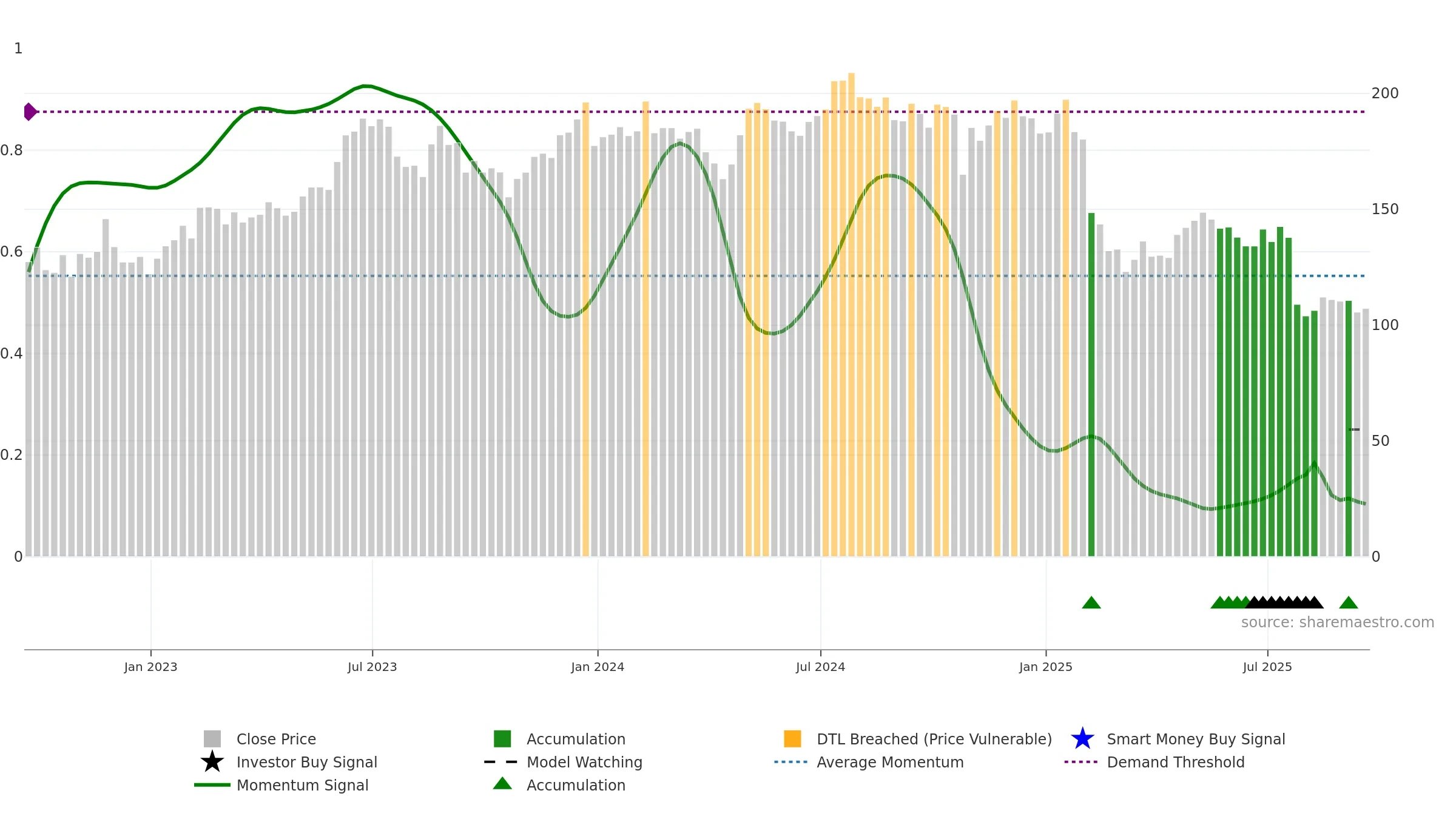

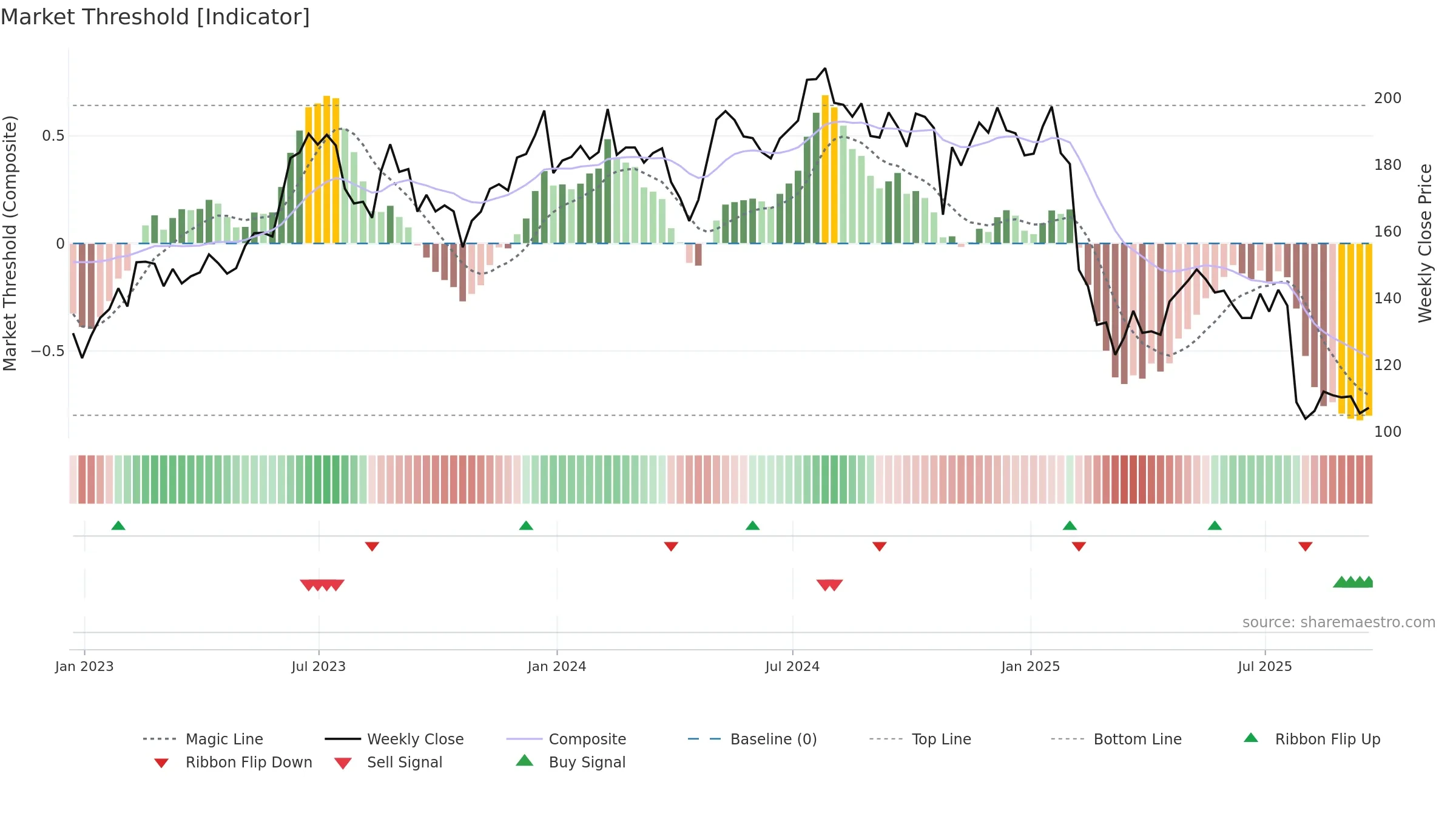

Gauge maps the trend signal to a 0–100 scale.

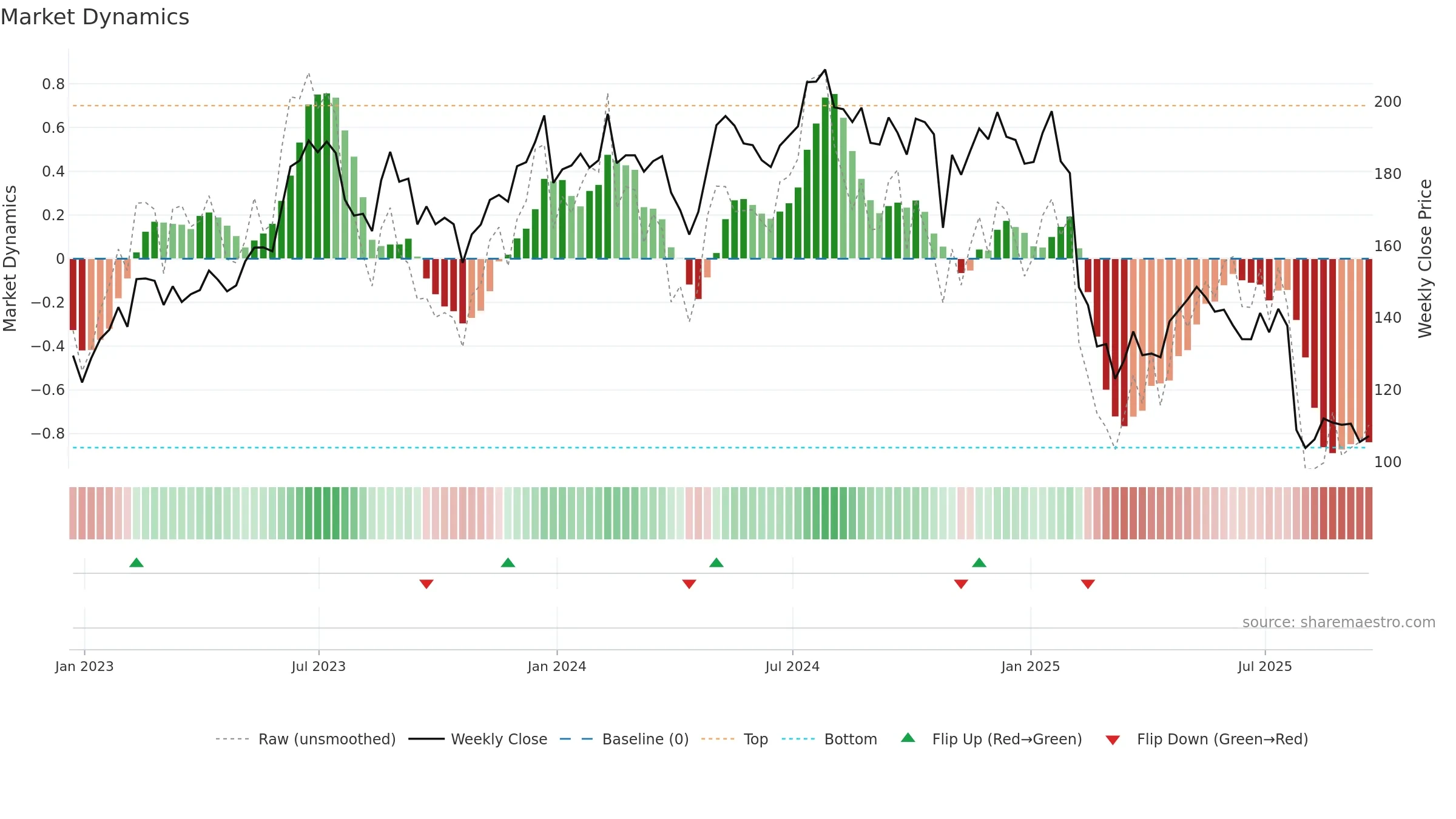

How to read this — Bearish zone with falling momentum — sellers in control.

Bias remains lower; rallies are suspect unless gauge reclaims 0.50/0.60.

Price is above fair value; upside may be capped without catalysts.

Conclusion

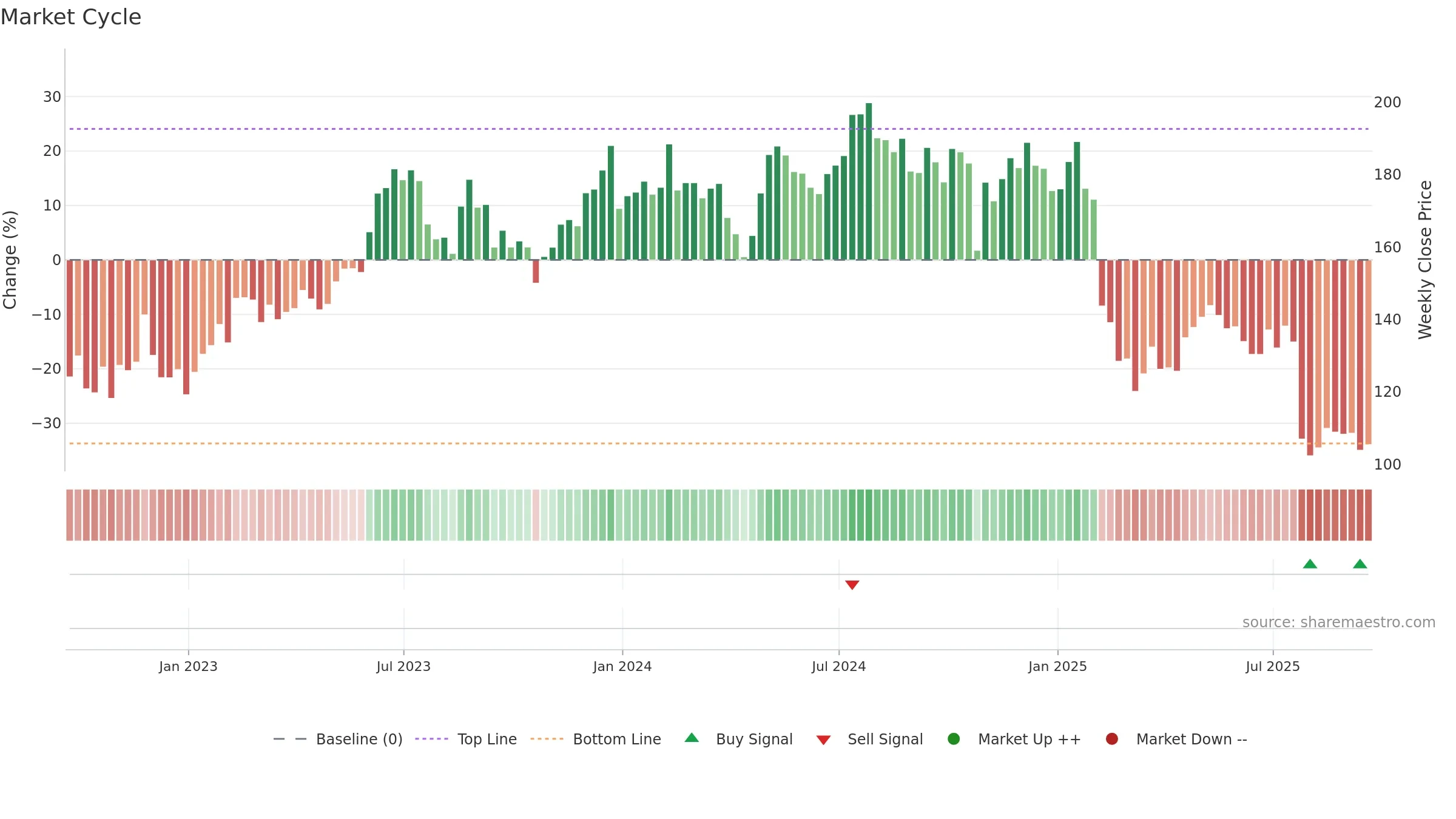

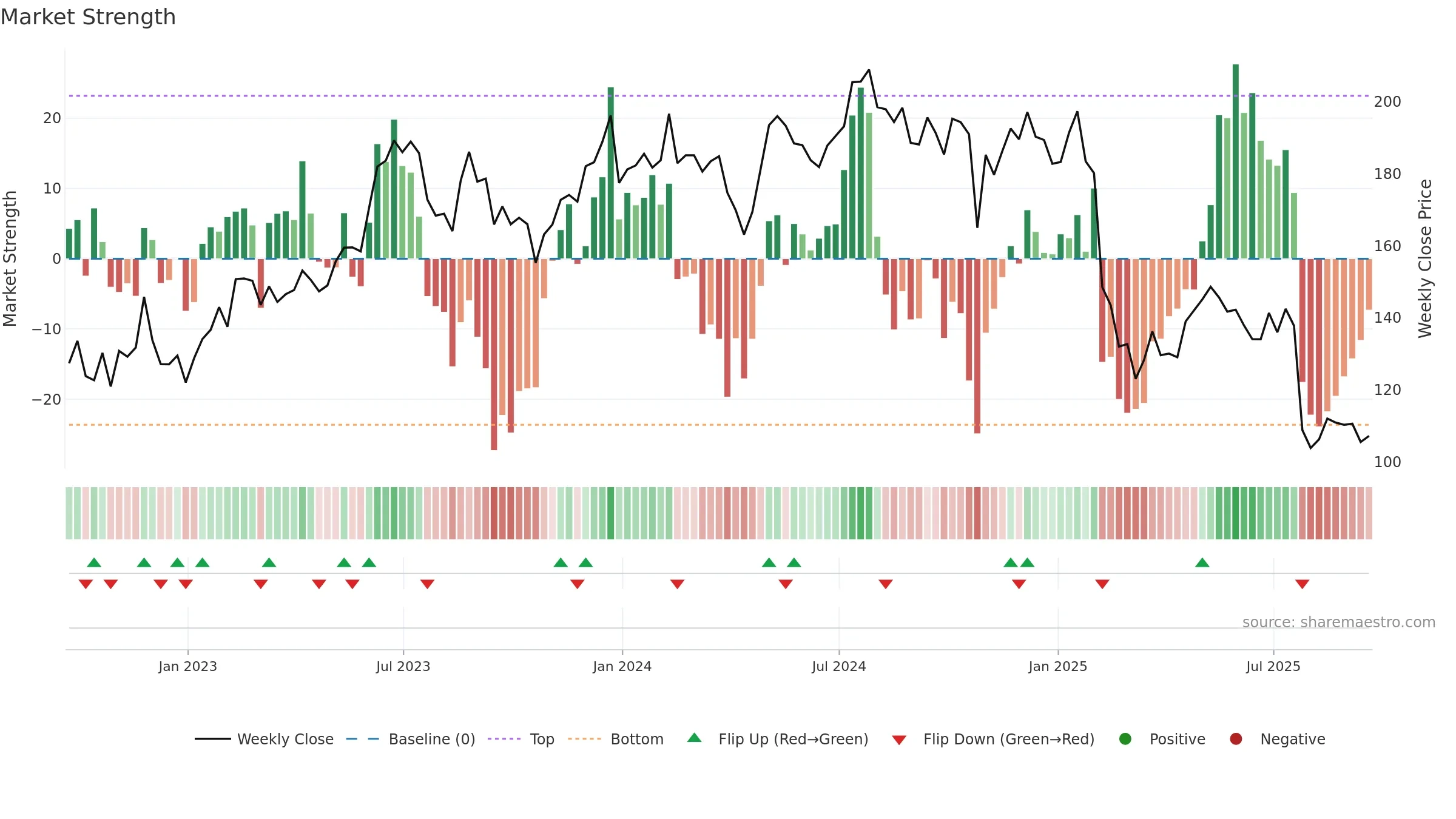

Negative setup. ★★☆☆☆ confidence. Price window: 3. Trend: Downtrend Confirmed; gauge 10. In combination, liquidity diverges from price.

- Low return volatility supports durability

- Bearish control with falling momentum

- Momentum is weak/falling

- Price is not above key averages

- Liquidity diverges from price

Why: Price window 3.19% over 8w. Close is -4.33% below the prior-window high. Return volatility 1.77%. Volume trend falling. Liquidity divergence with price. Trend state downtrend confirmed. Low-regime (≤0.25) upticks 2/7 (29.0%) • Distributing. Momentum bearish and falling. Valuation limited upside without catalysts.

Tip: Most metrics include a hover tooltip where they appear in the report.