ADAMA Ltd.

000553 SHE

Weekly Summary

ADAMA Ltd. closed at 6.4600 (-2.42% WoW) . Data window ends Mon, 22 Sep 2025.

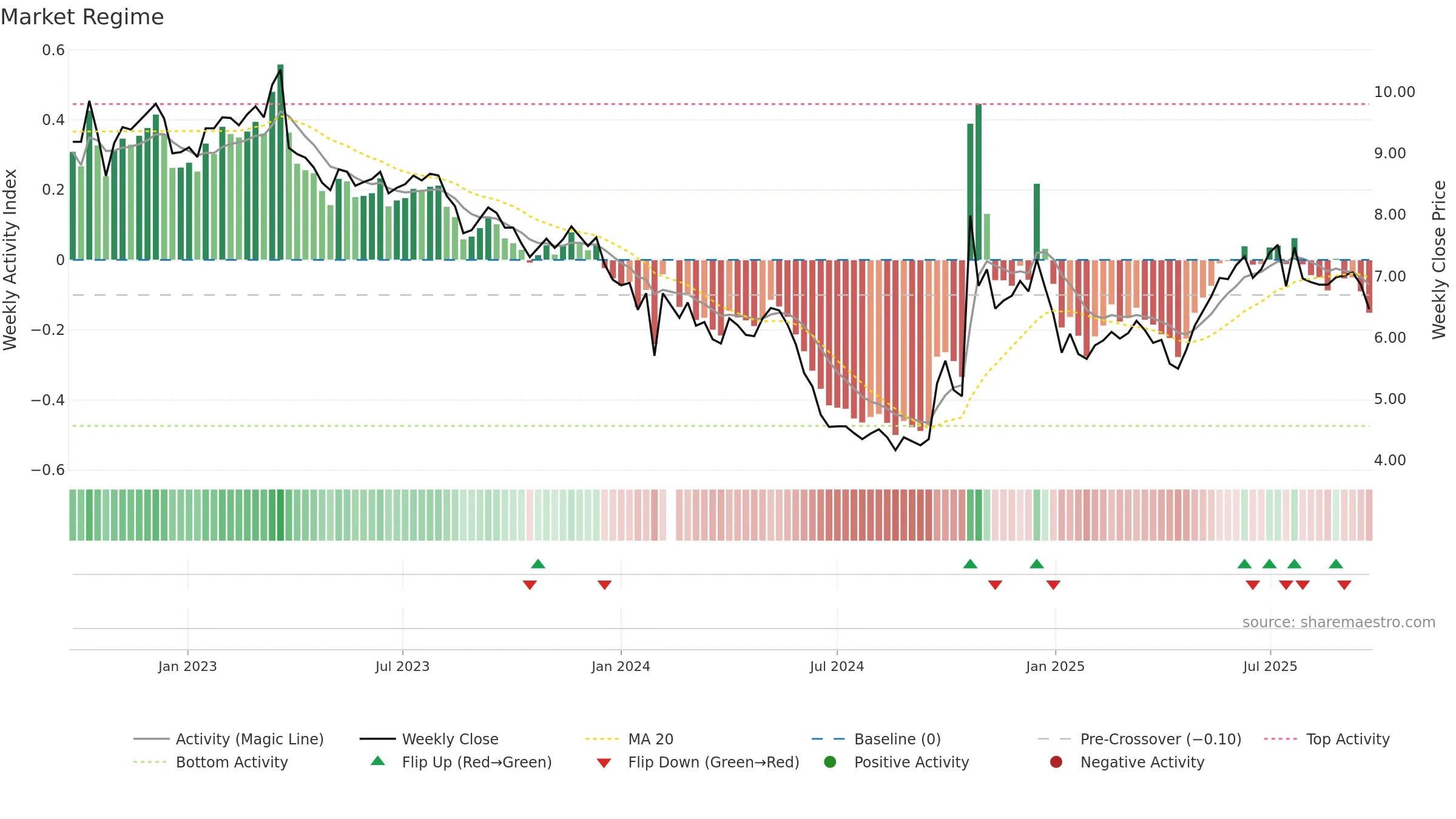

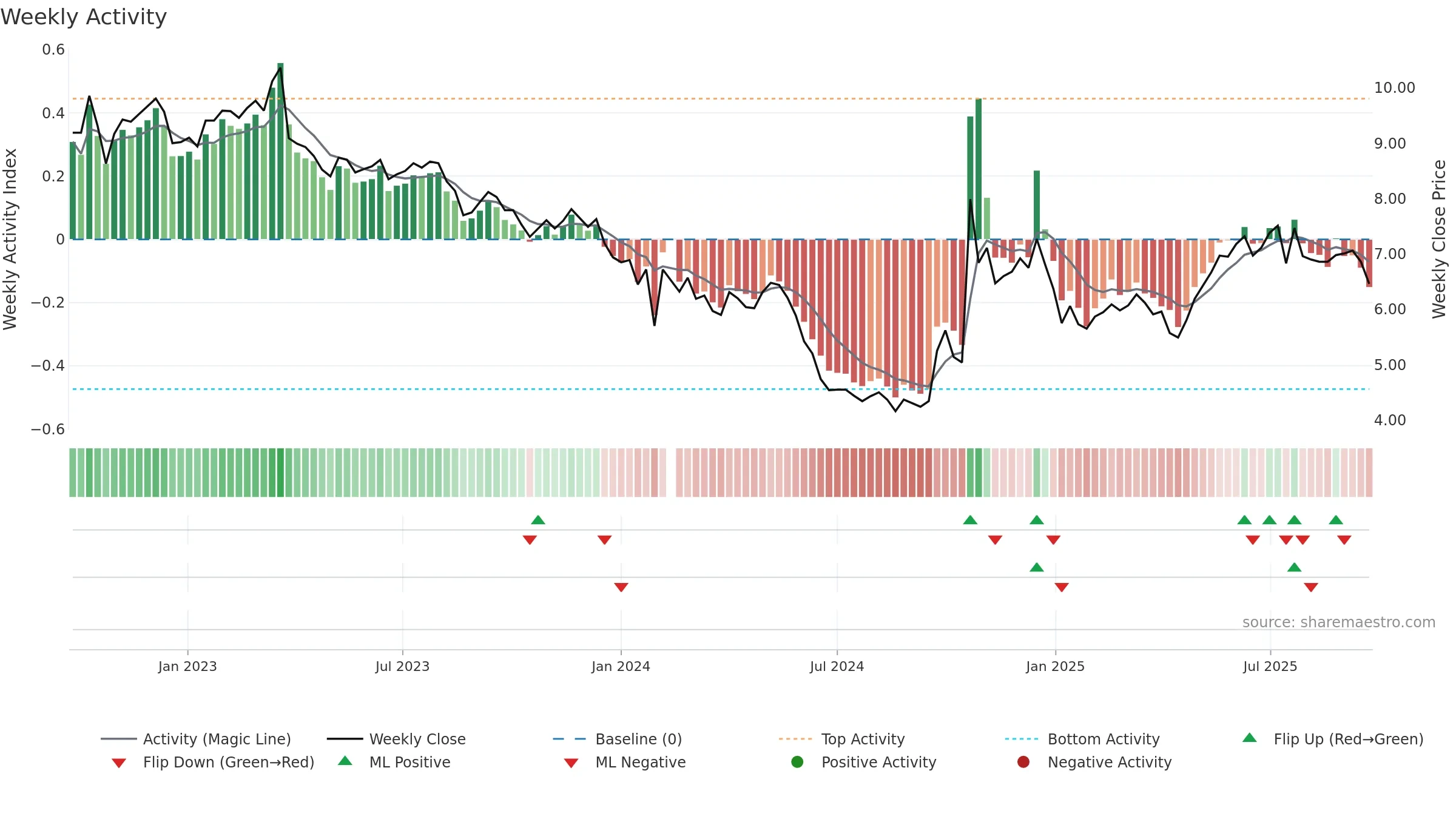

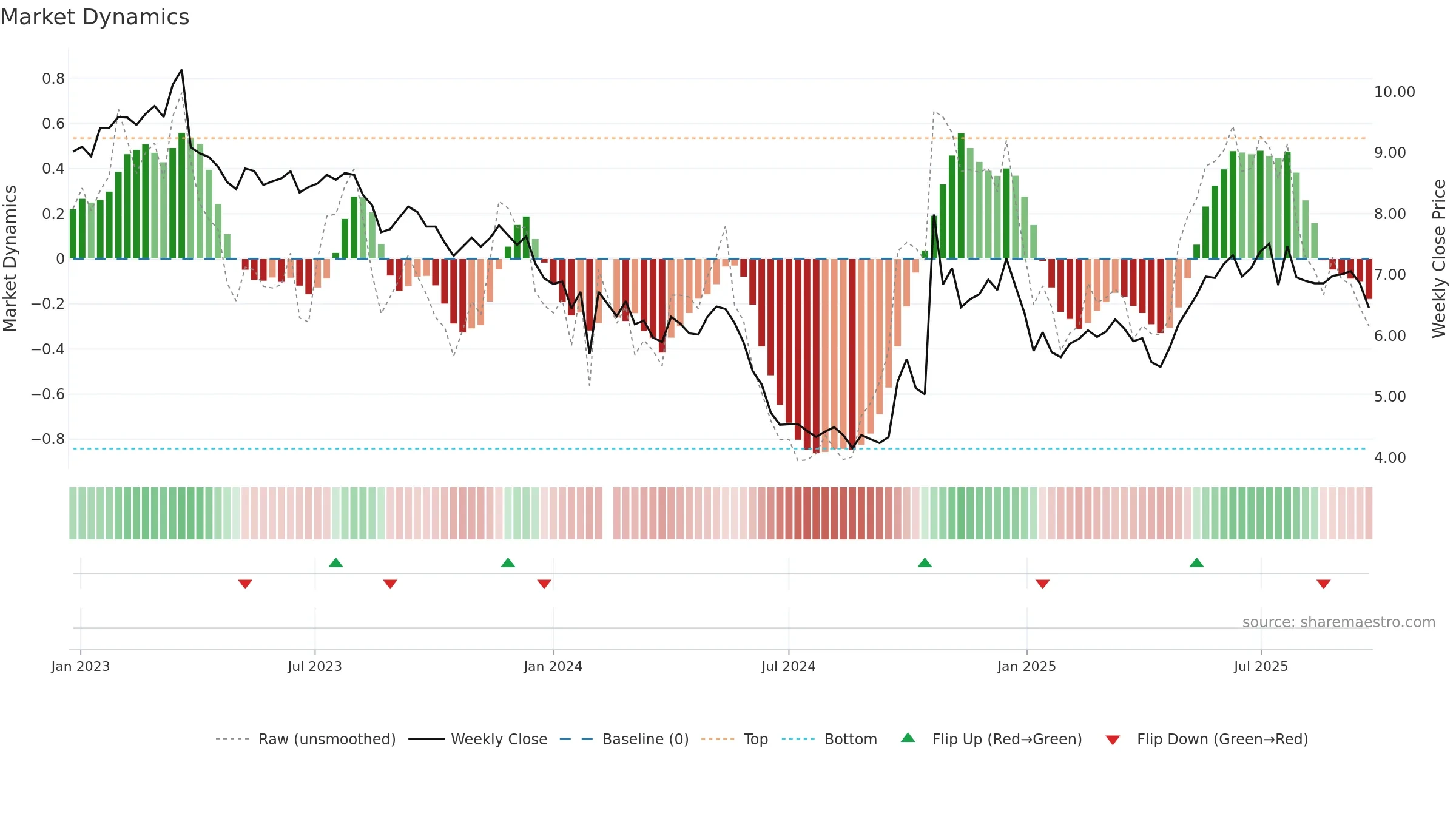

How to read this — Price slope is downward, indicating persistent supply pressure. Low weekly volatility favours steadier follow-through. Volume and price are moving in the same direction — a constructive confirmation. Fresh short-term downside crossover weakens near-term tone. Price sits below key averages, keeping pressure on the tape.

Down-slope argues for patience; rallies can fade sooner unless participation improves.

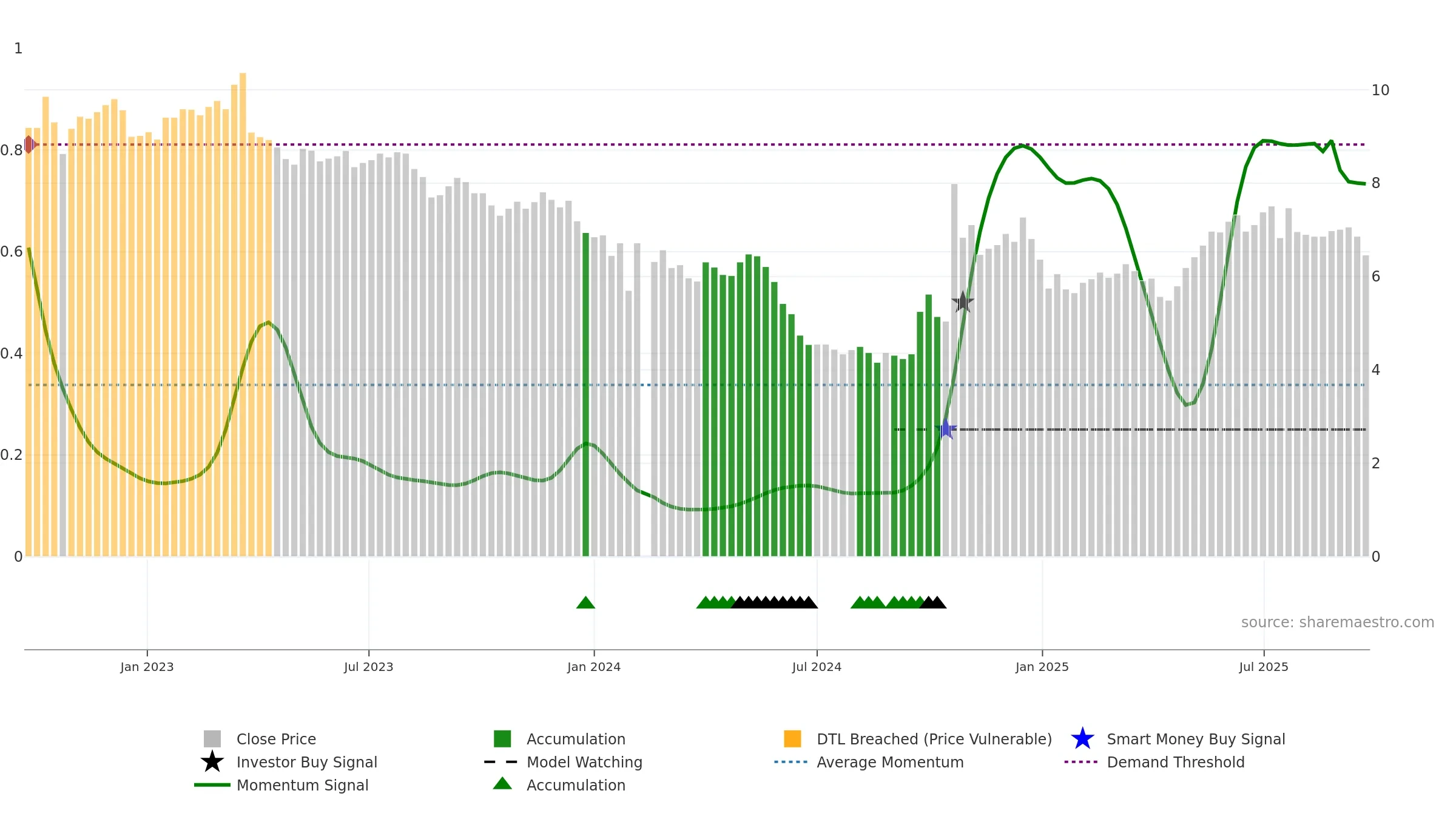

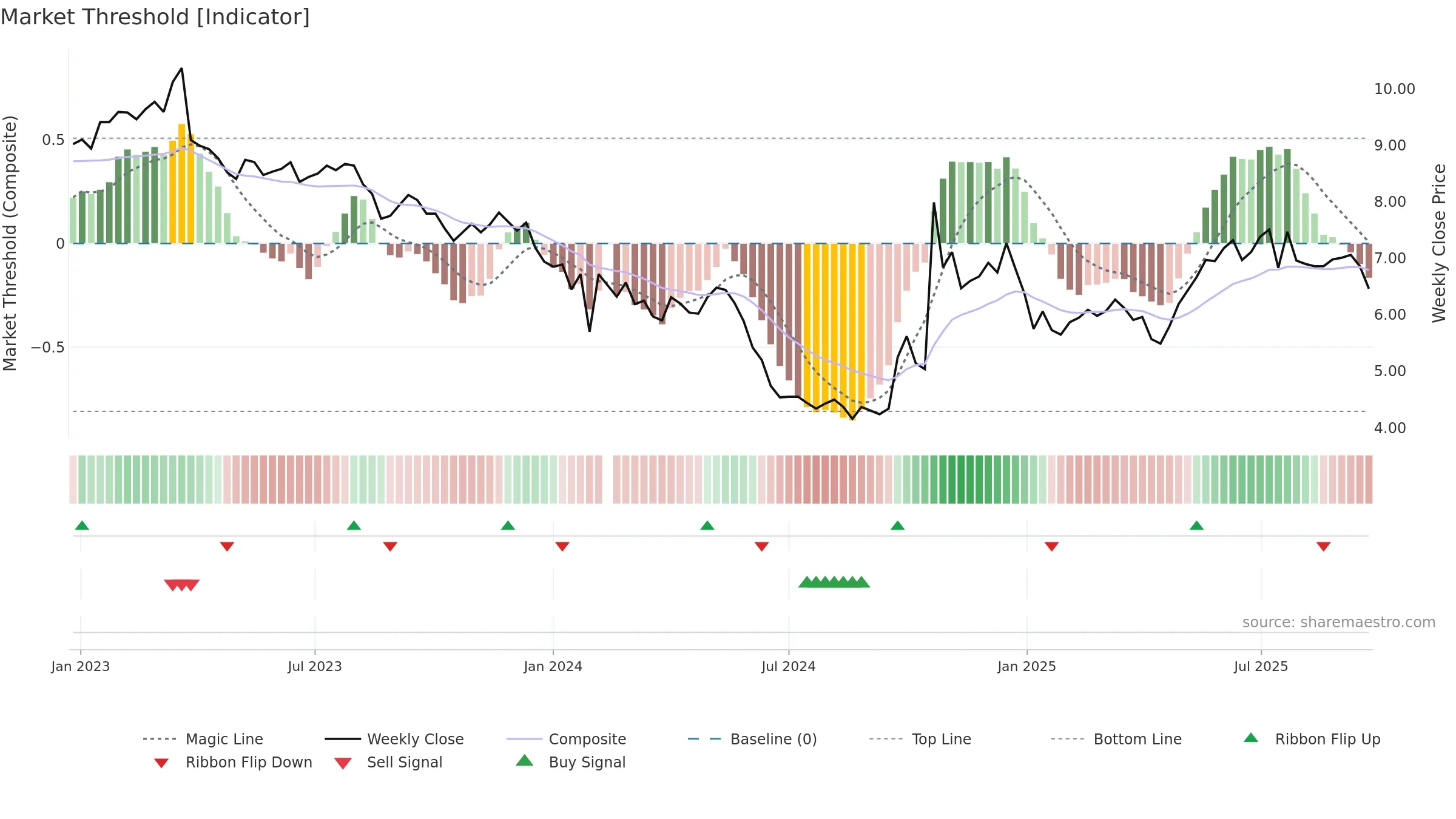

Gauge maps the trend signal to a 0–100 scale.

How to read this — Gauge is elevated but momentum is rolling over; topping risk is rising.

Stay alert: protect gains or seek confirmation before adding risk.

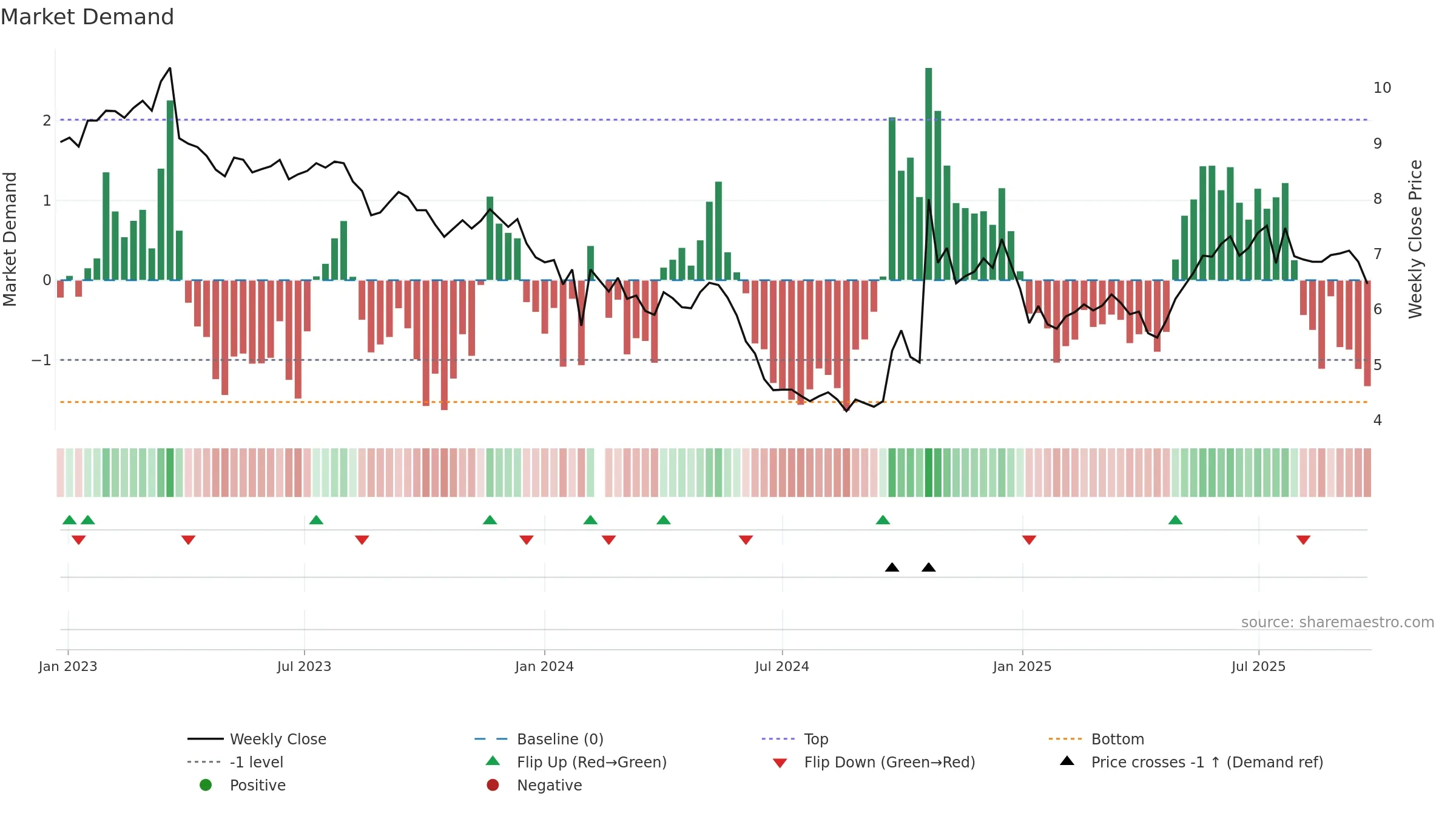

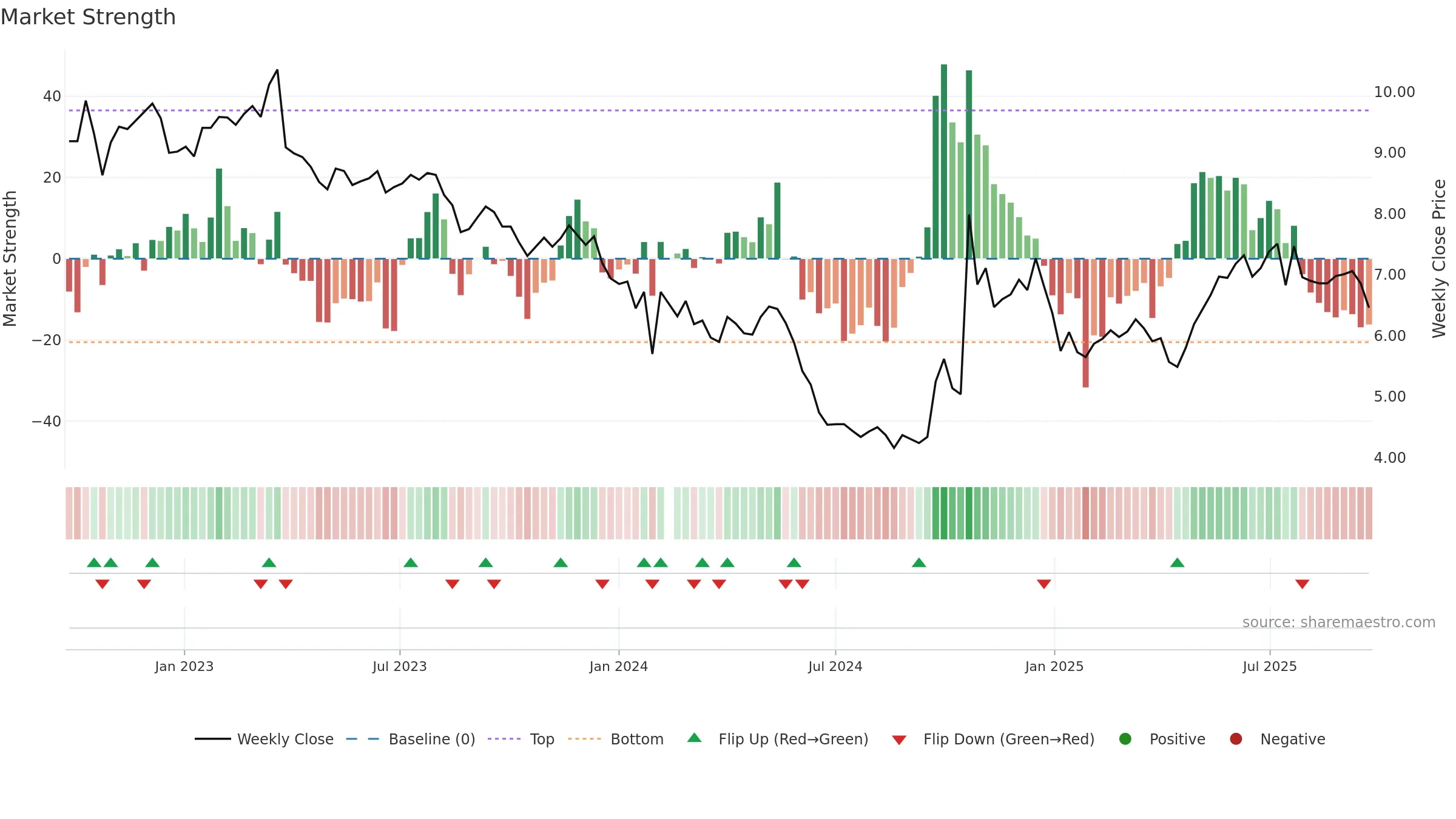

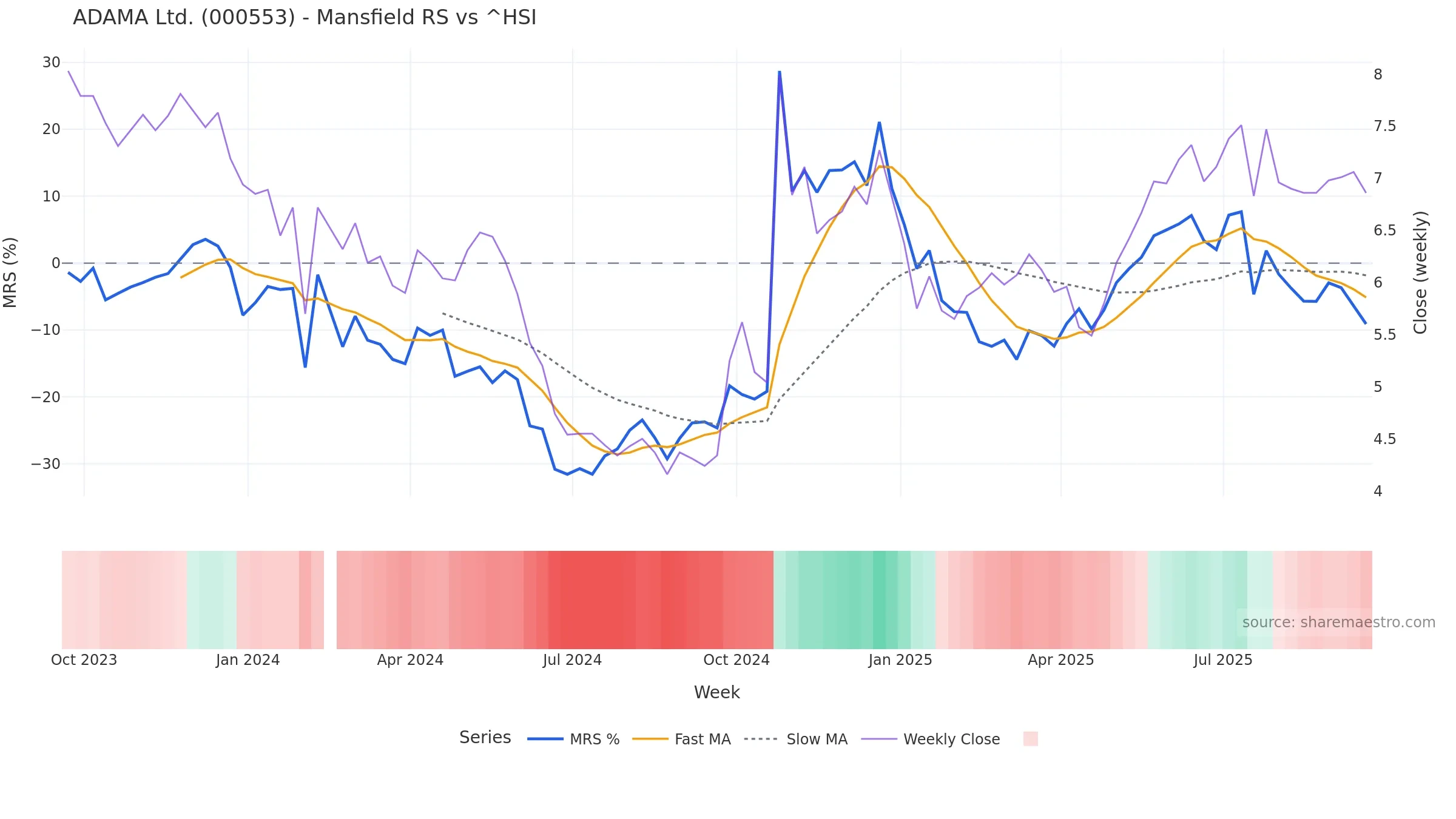

Relative strength is Negative

(< 0%, underperforming).

Latest MRS: -9.10% (week ending Fri, 19 Sep 2025).

Slope: Falling over 8w.

Notes:

- Below zero line indicates relative weakness vs benchmark.

- MRS slope falling over ~8 weeks.

Price is above fair value; upside may be capped without catalysts.

Conclusion

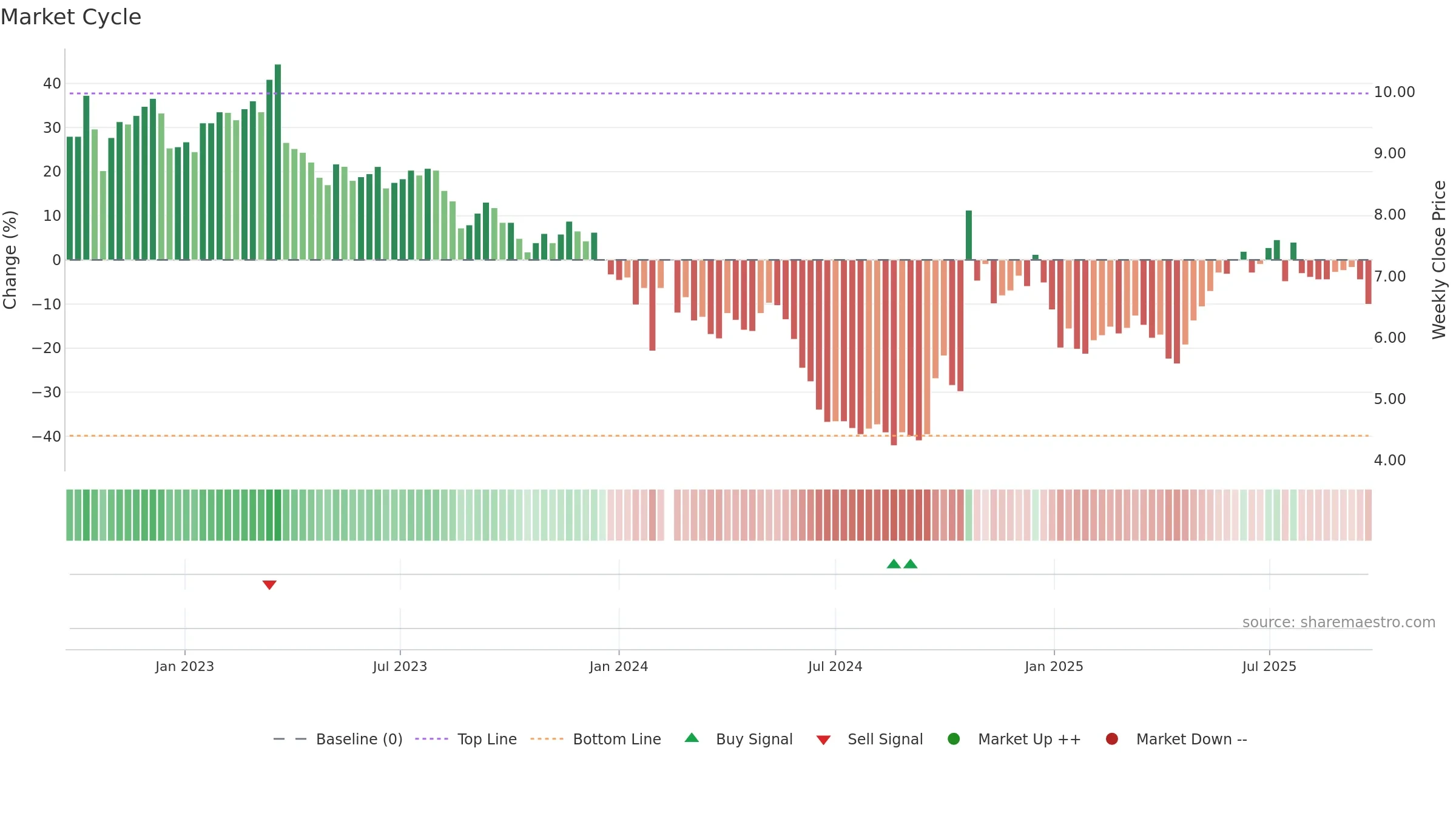

Negative setup. ★⯪☆☆☆ confidence. Trend: Uptrend at Risk · -6.38% over window · vol 1.56% · liquidity convergence · posture below · RS weak

- Liquidity confirms the price trend

- Low return volatility supports durability

- High level but momentum rolling over (topping risk)

- Momentum is weak/falling

- Price is not above key averages

- Negative multi-week performance

Why: Price window -6.38% over w. Close is -8.50% below the prior-window high. Return volatility 1.56%. Volume trend falling. Liquidity convergence with price. Trend state uptrend at risk. 4–8w crossover bearish. Momentum neutral and falling. Valuation limited upside without catalysts.

Tip: Most metrics include a hover tooltip where they appear in the report.