Cresud Sociedad Anónima, Comercial, Inmobiliaria, Financiera y Agropecuaria

CRESY NASDAQ

Weekly Report

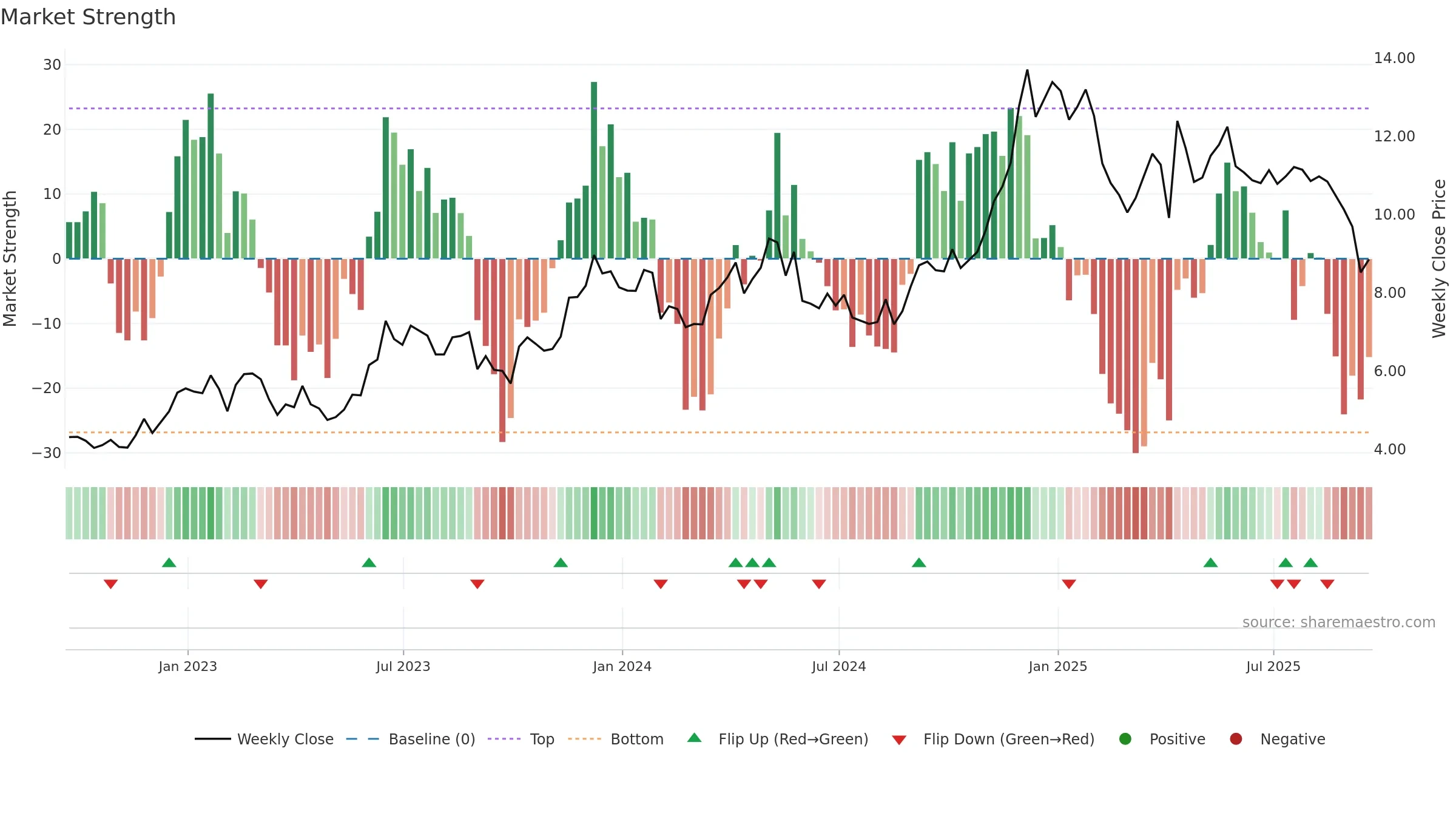

Cresud Sociedad Anónima, Comercial, Inmobiliaria, Financiera y Agropecuaria closed at 8.8500 (1.96% WoW) . Data window ends Fri, 19 Sep 2025.

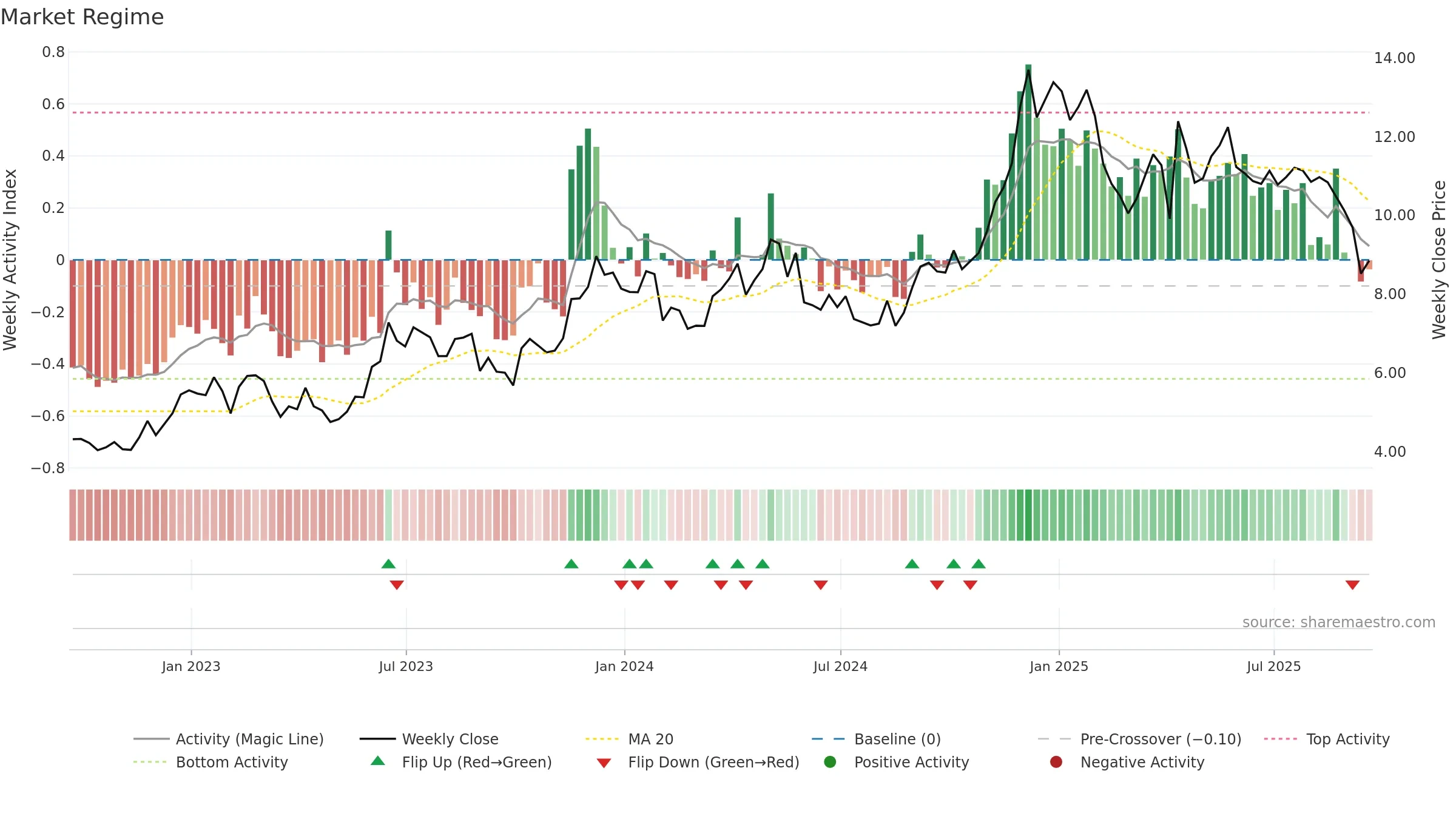

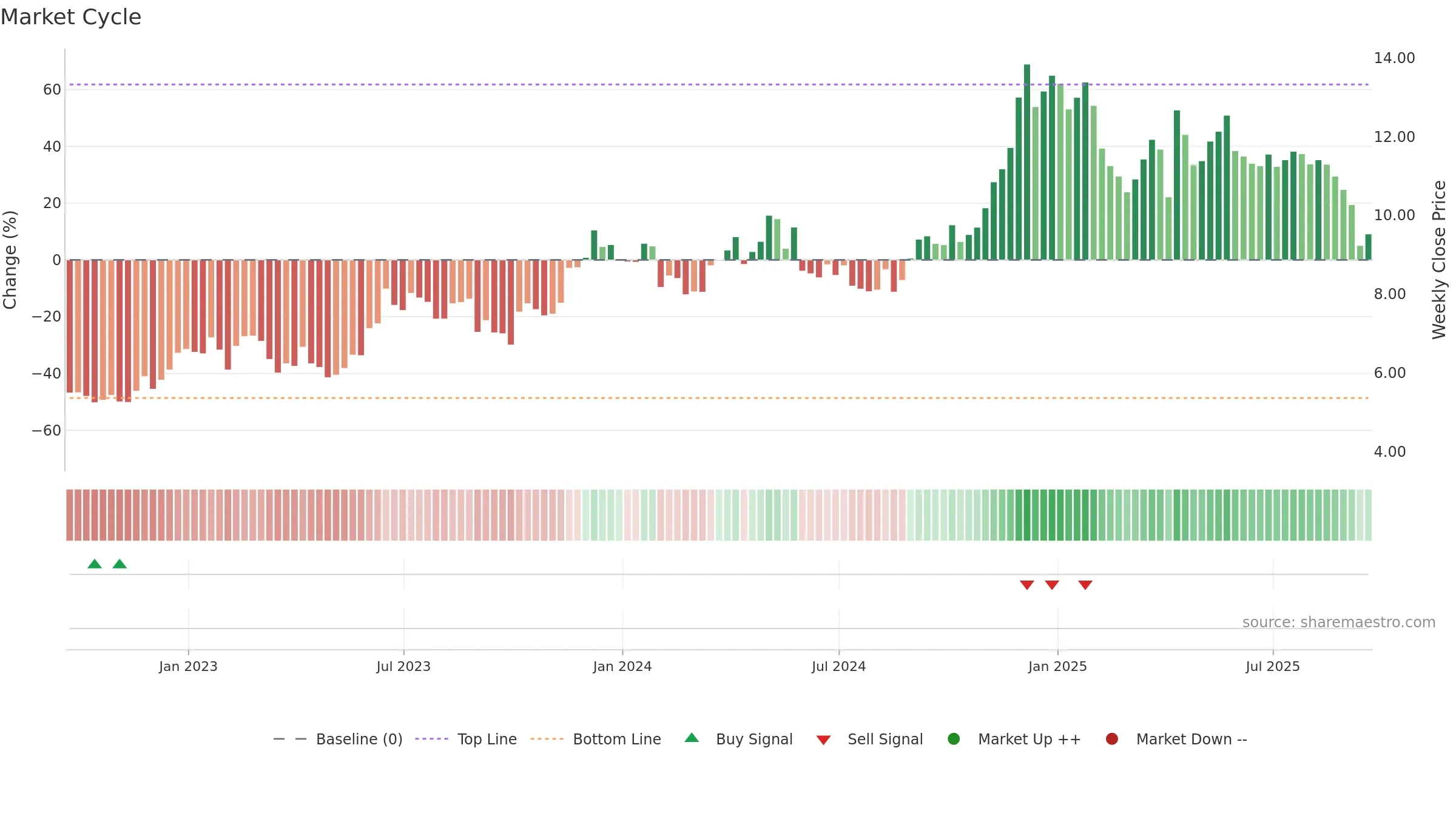

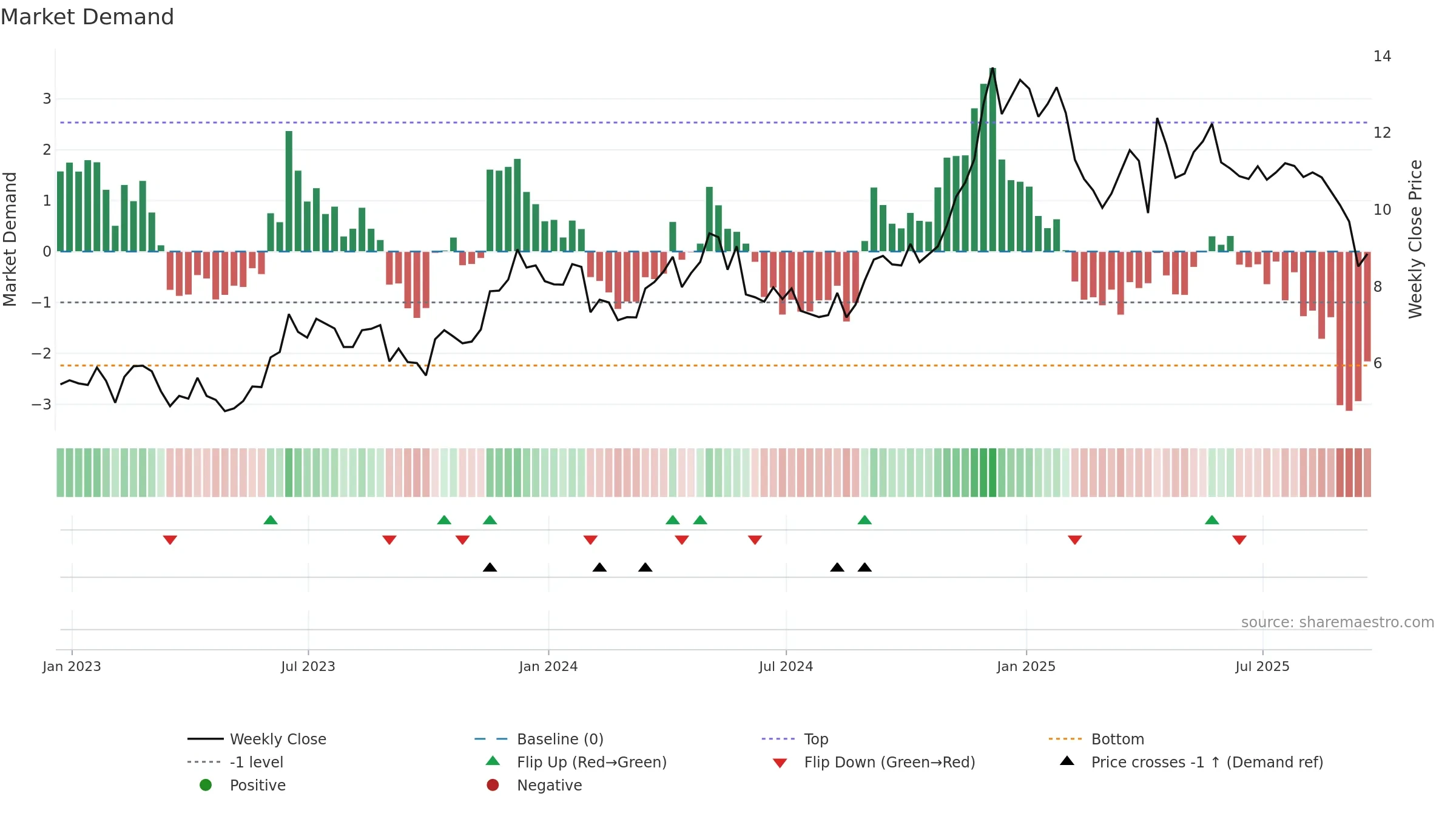

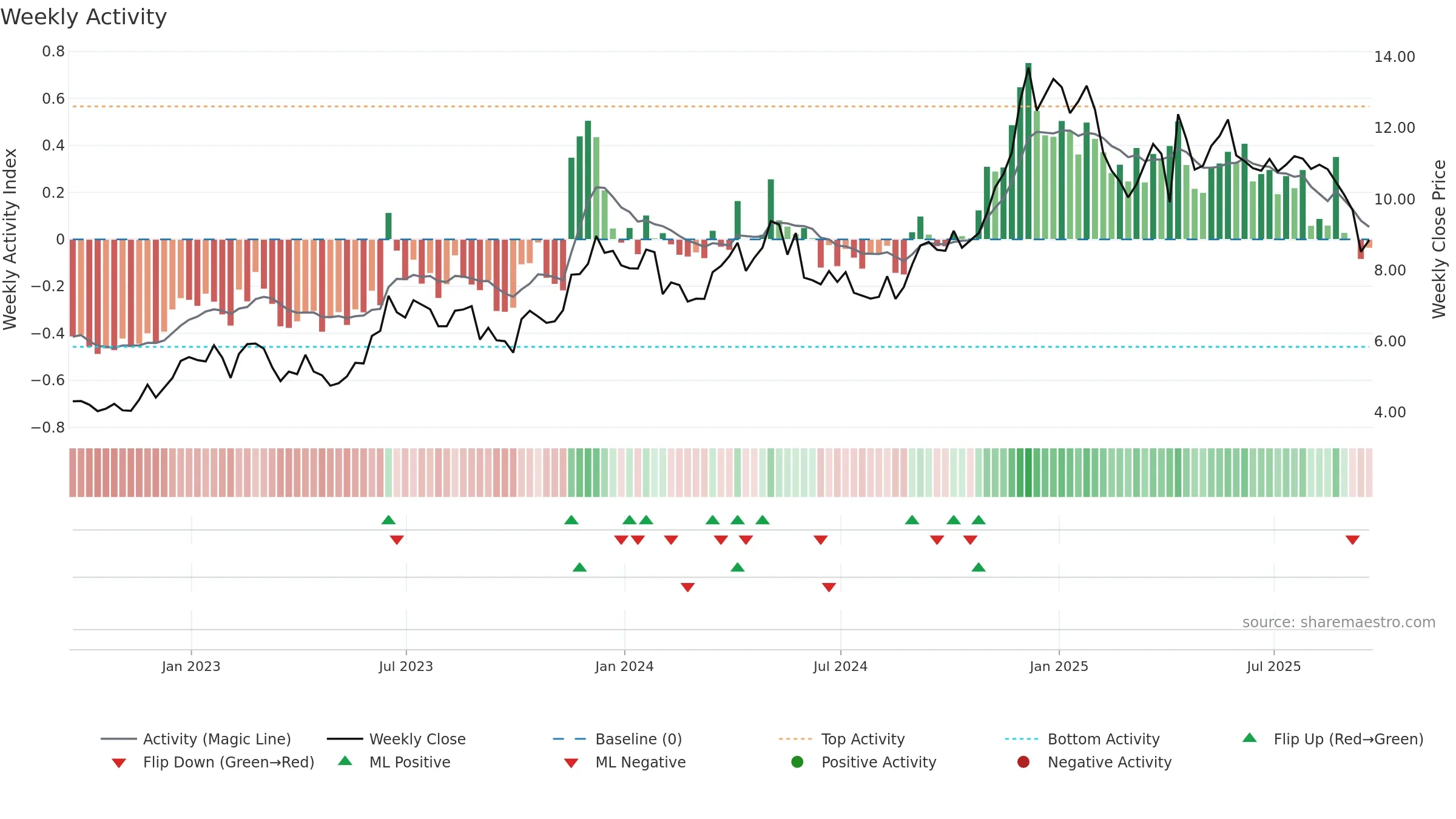

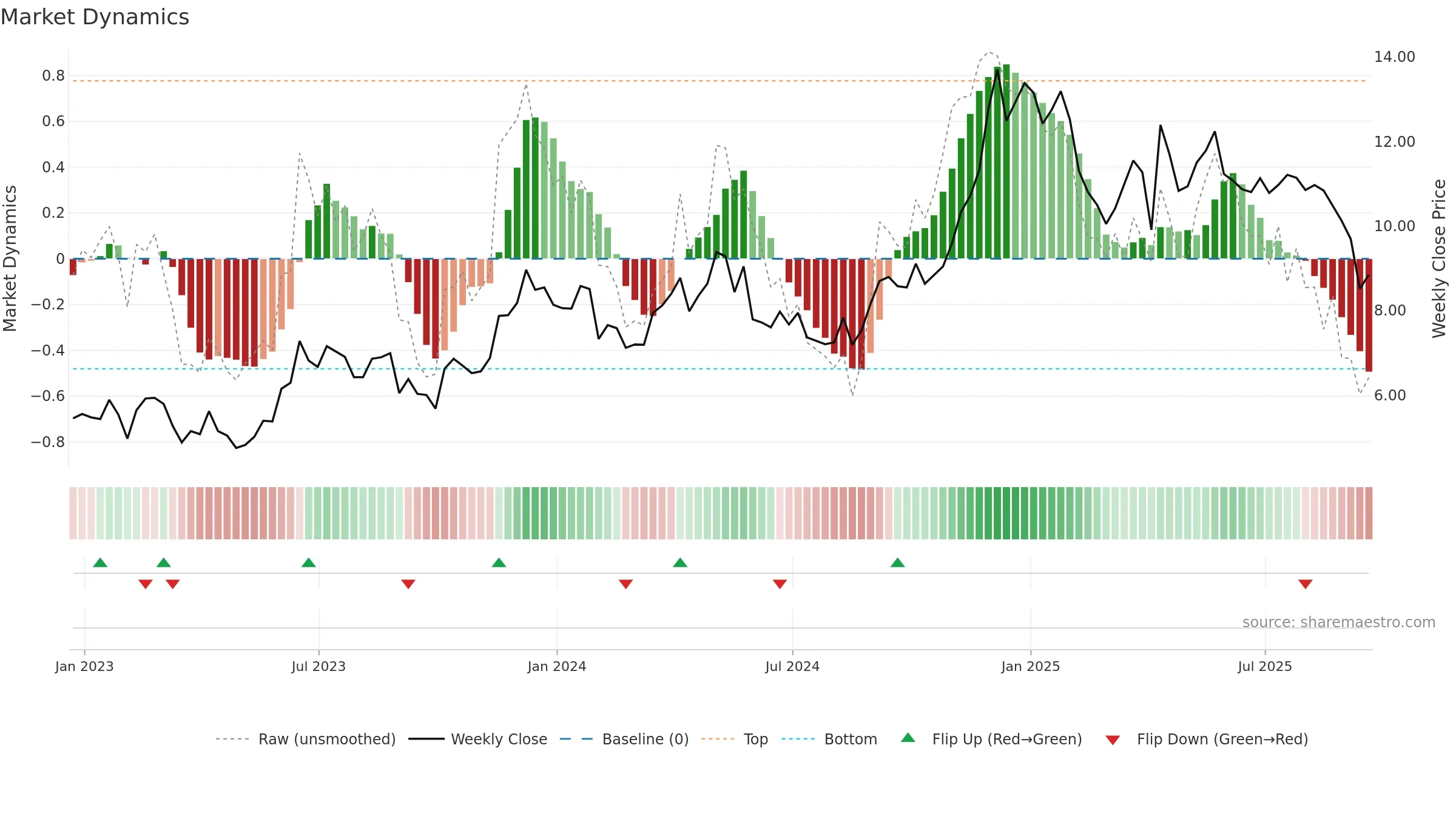

How to read this — Price slope is downward, indicating persistent supply pressure. Low weekly volatility favours steadier follow-through. Volume trend diverges from price — watch for fatigue or rotation. Returns are negatively correlated with volume — strength may come on lighter activity. Distance to baseline is narrowing — reverting closer to its fair-value track. Weak MA stack argues for caution; rallies can fail near the 8–13 week region. Price sits below key averages, keeping pressure on the tape.

Down-slope argues for patience; rallies can fade sooner unless participation improves. Because liquidity isn’t confirming, prefer evidence of fresh demand before chasing moves.

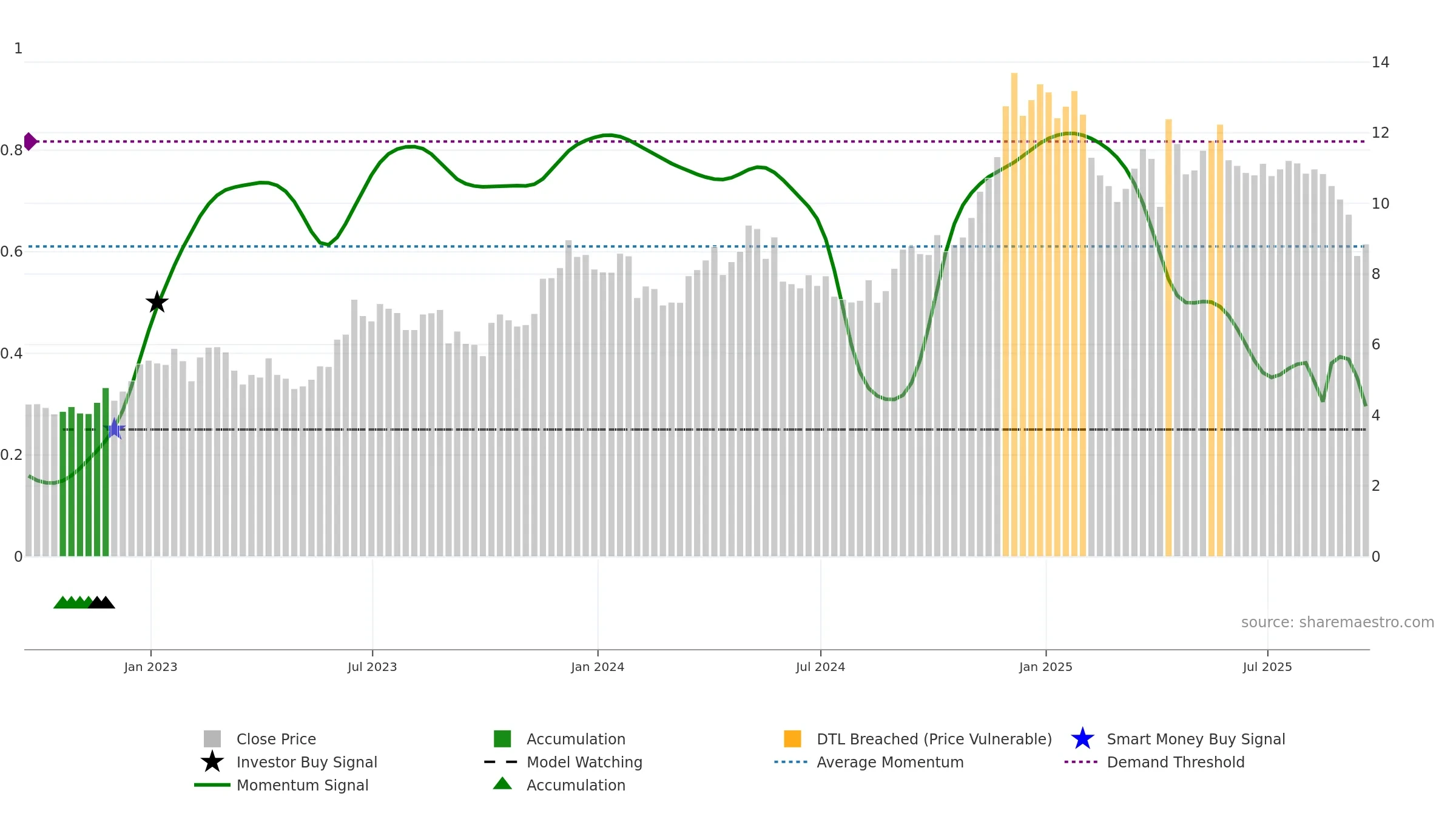

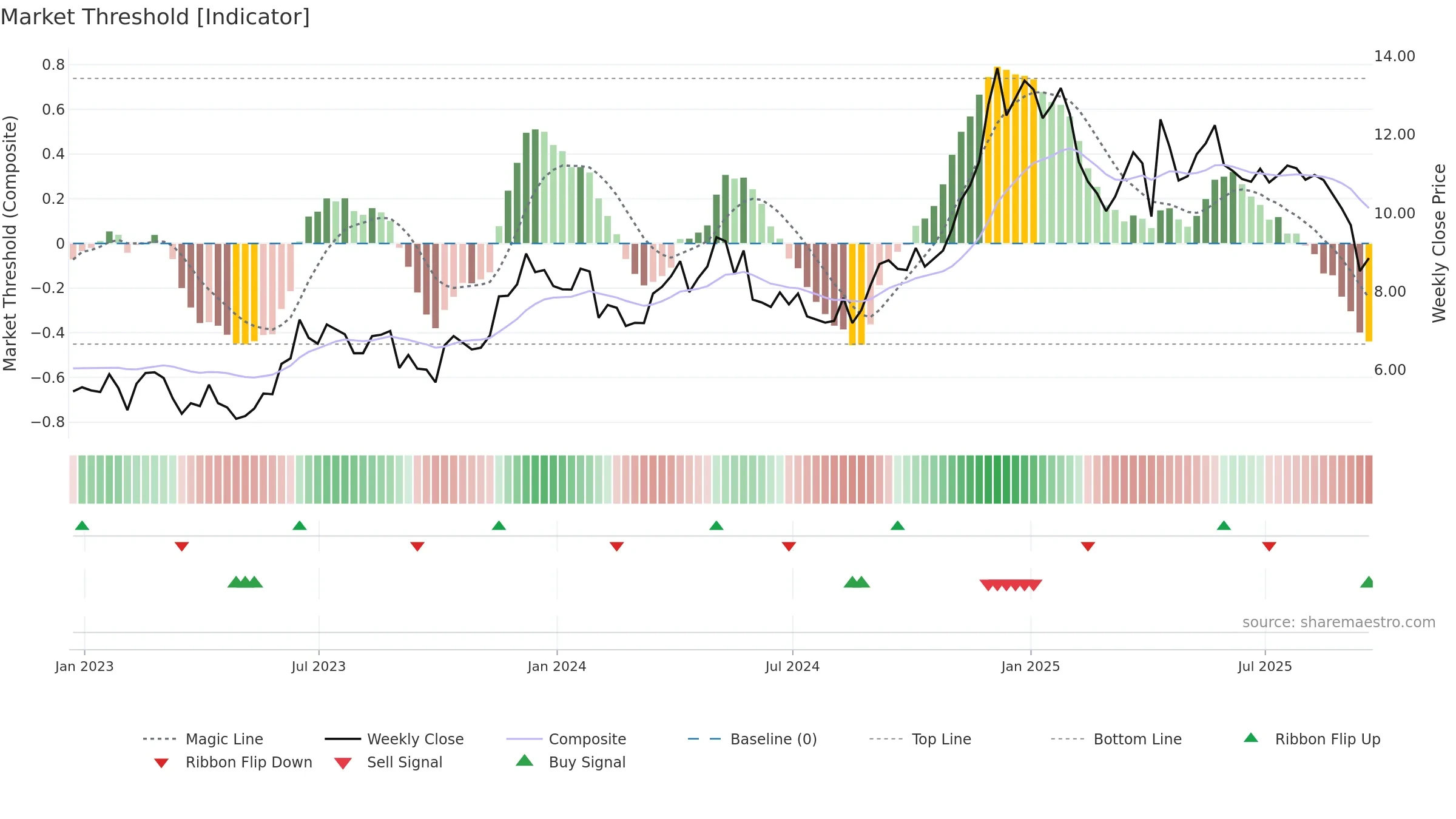

Gauge maps the trend signal to a 0–100 scale.

How to read this — Bearish zone with falling momentum — sellers in control.

Bias remains lower; rallies are suspect unless gauge reclaims 0.50/0.60.

The flag is positive: favourable upside skew with supportive conditions.

Conclusion

Negative setup. ★☆☆☆☆ confidence. Price window: -18. Trend: Downtrend Confirmed; gauge 29. In combination, liquidity diverges from price.

- Low return volatility supports durability

- Bearish control with falling momentum

- Momentum is weak/falling

- Price is not above key averages

- Weak moving-average stack

Why: Price window -18.43% over 8w. Close is -19.33% below the prior-window high. Return volatility 1.93%. Volume trend rising. Liquidity divergence with price. Trend state downtrend confirmed. MA stack weak. Momentum bearish and falling. Valuation stance positive.

Tip: Most metrics include a hover tooltip where they appear in the report.