Weekly Report

Invesco S&P 500 Low Volatility ETF closed at 72.2500 (-0.33% WoW) . Data window ends Fri, 19 Sep 2025.

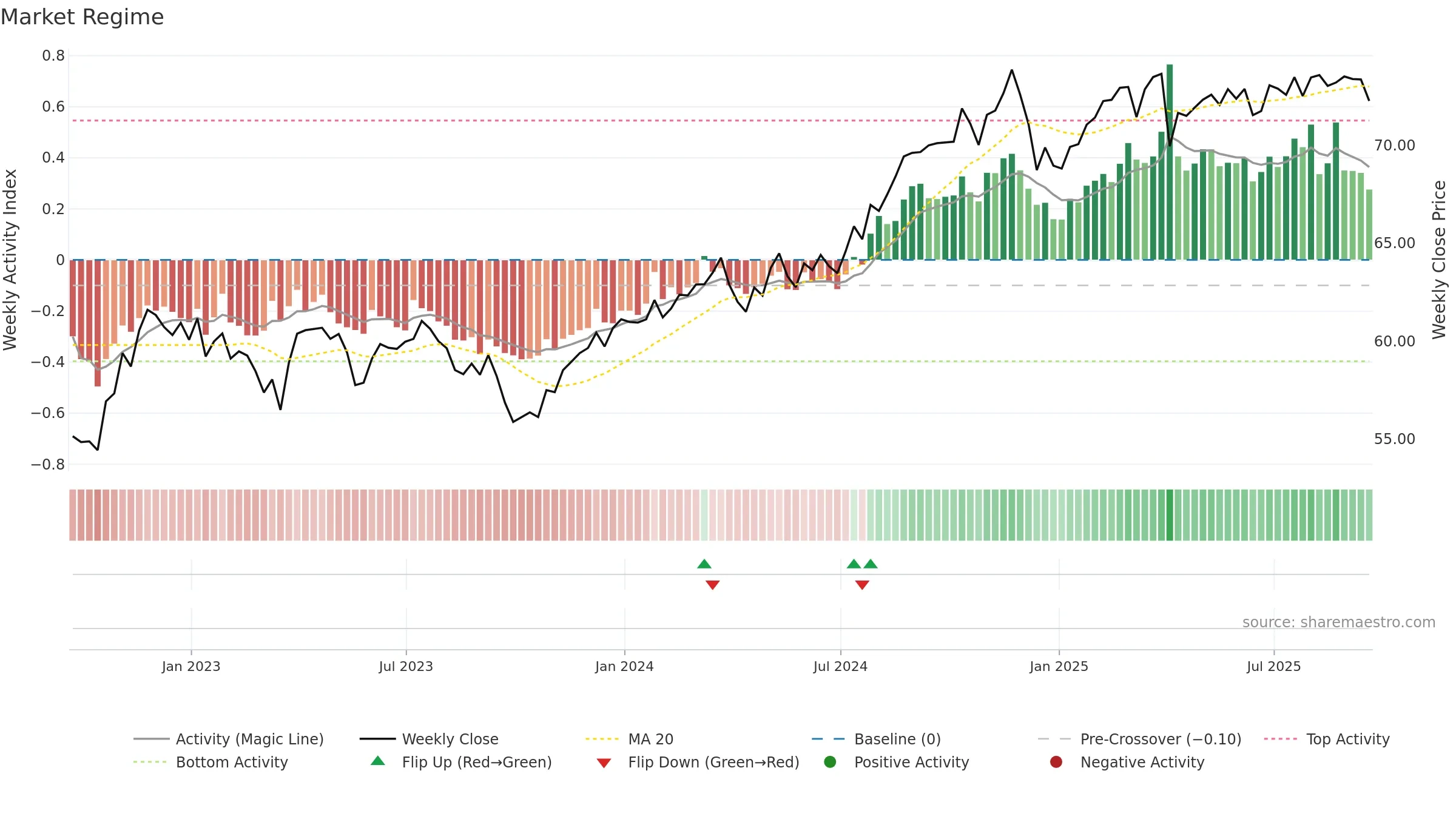

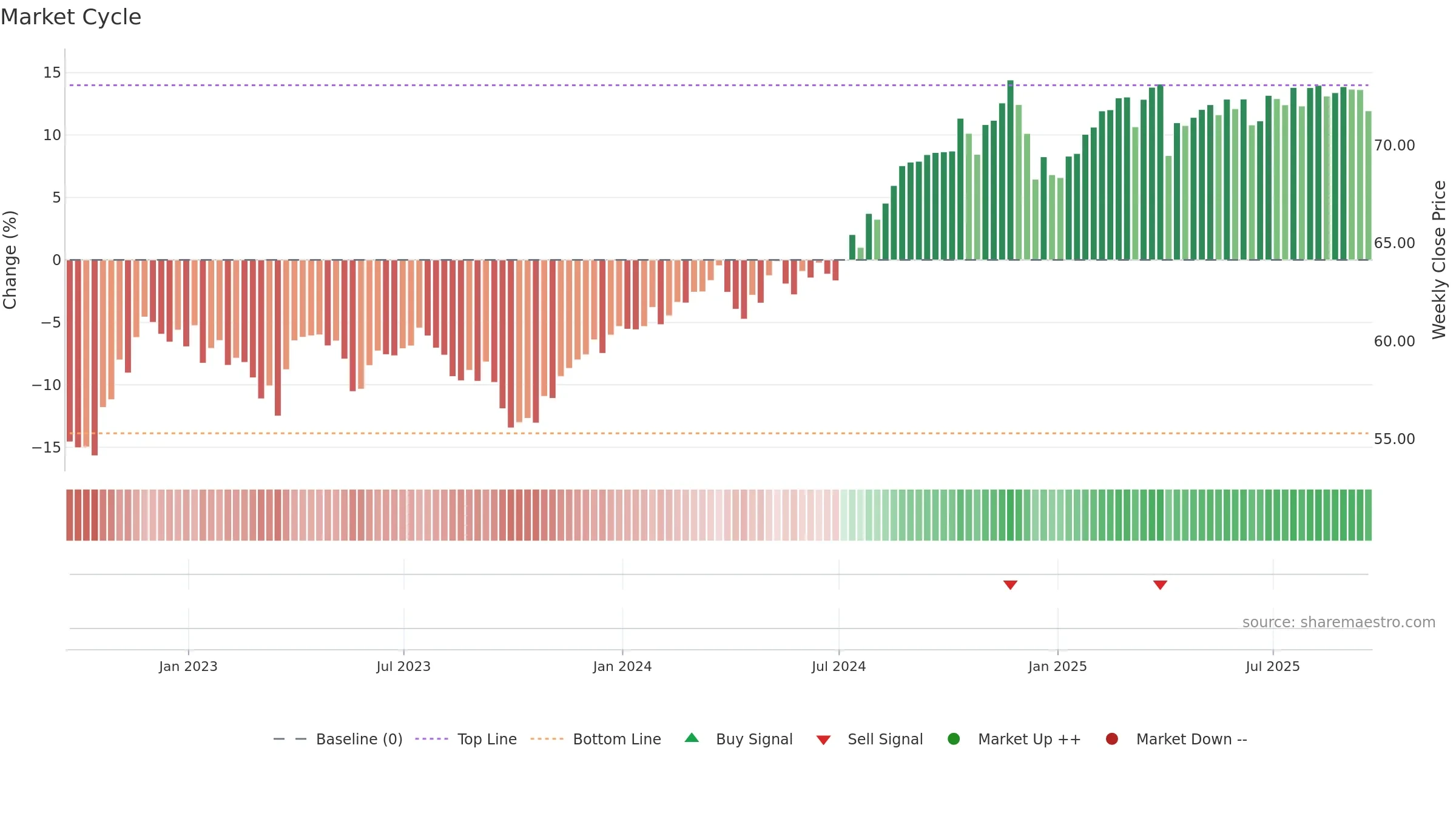

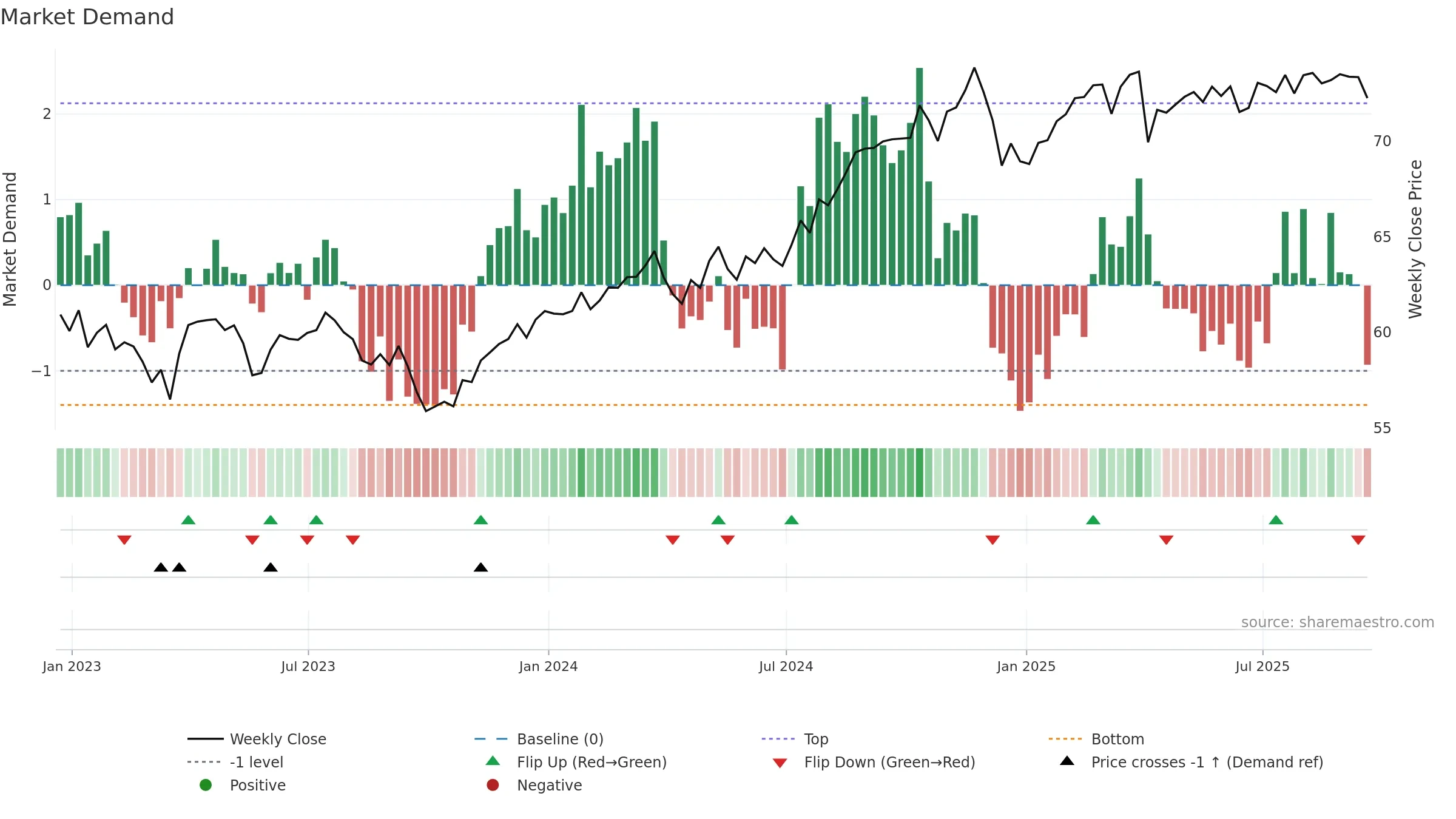

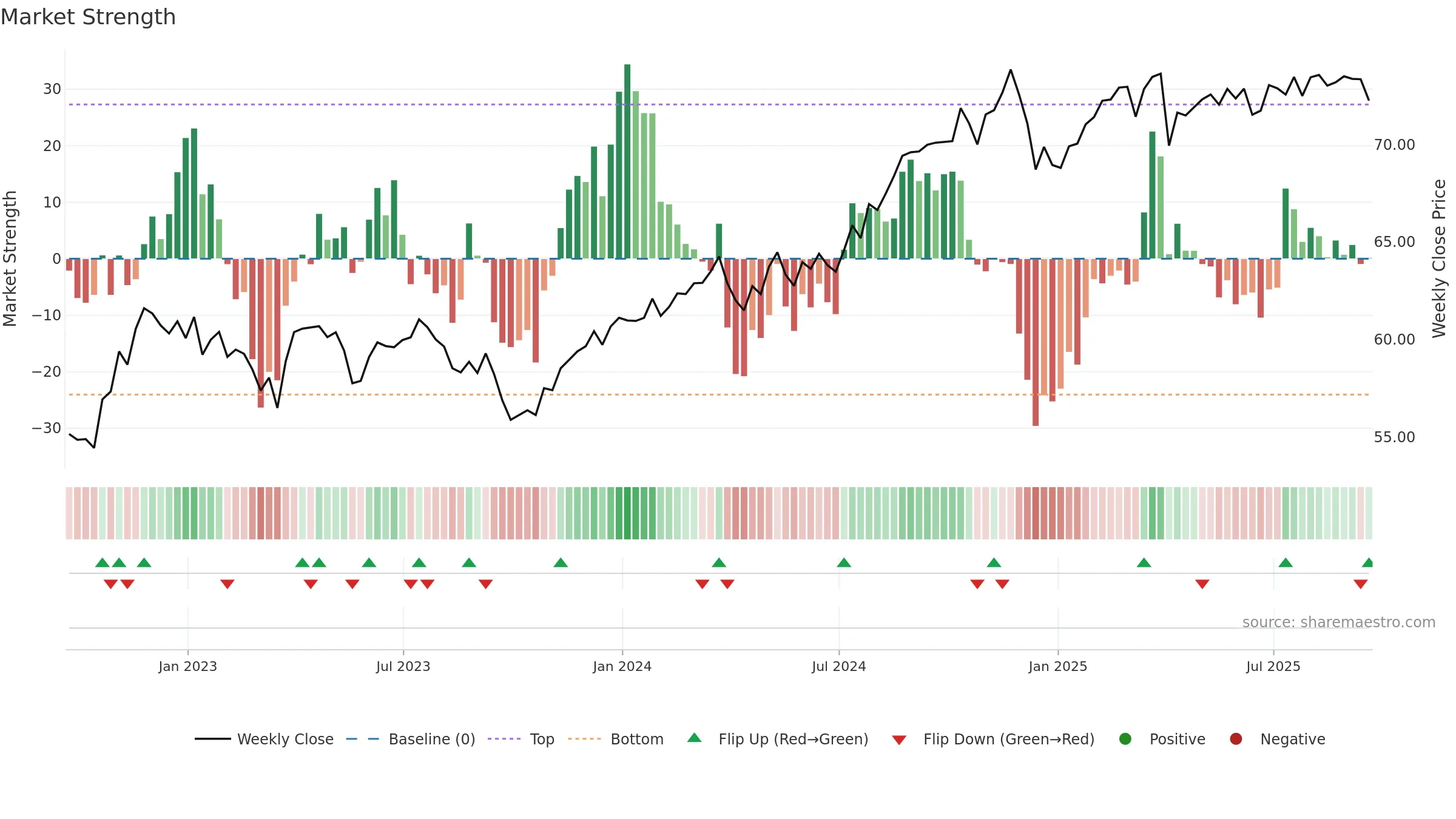

How to read this — Price slope is downward, indicating persistent supply pressure. Low weekly volatility favours steadier follow-through. Volume and price are moving in the same direction — a constructive confirmation. Accumulation weeks: 0; distribution weeks: 3. Distance to baseline is narrowing — reverting closer to its fair-value track. Fresh short-term downside crossover weakens near-term tone. Price sits below key averages, keeping pressure on the tape.

Down-slope argues for patience; rallies can fade sooner unless participation improves.

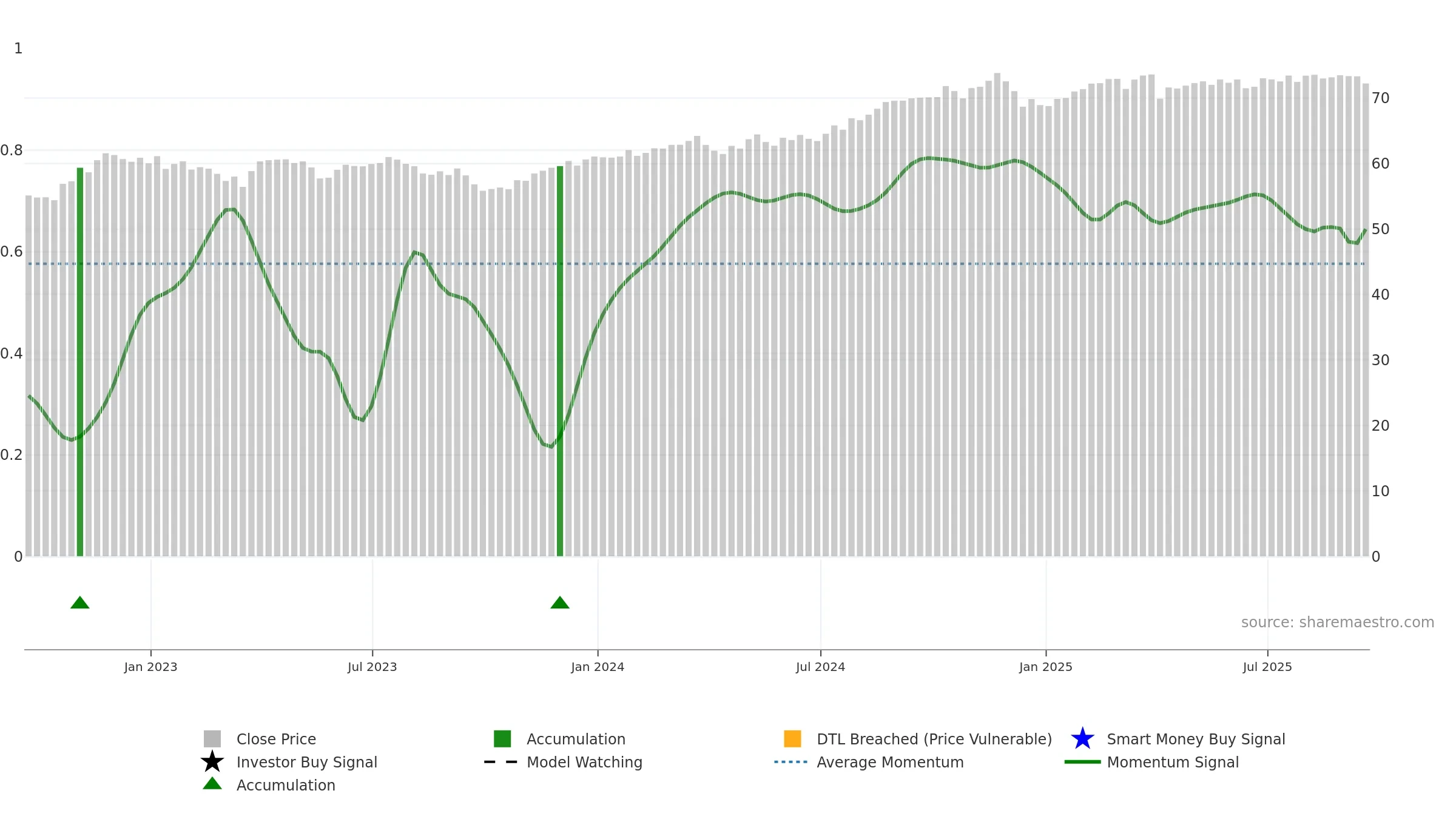

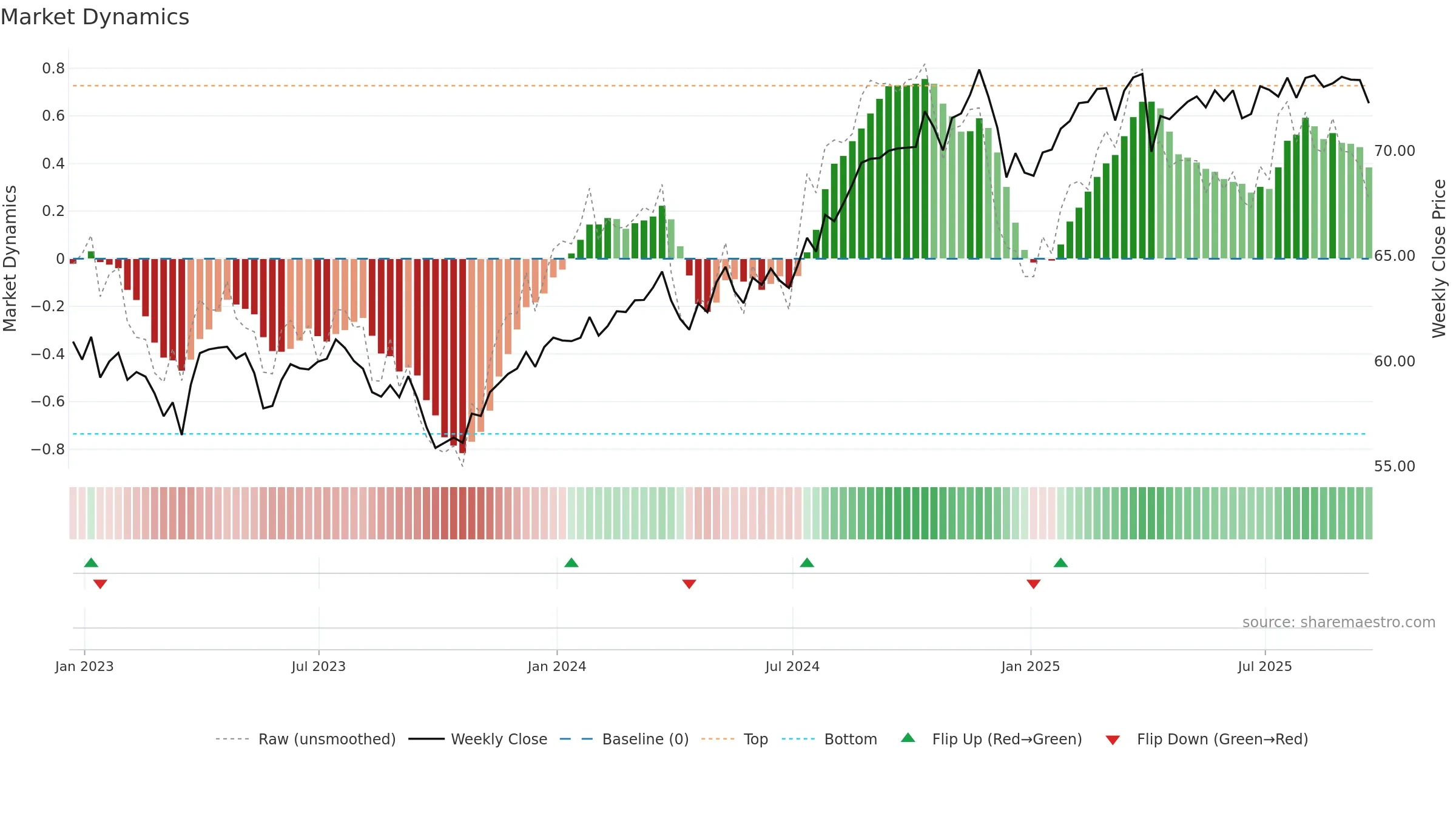

Gauge maps the trend signal to a 0–100 scale.

How to read this — Bullish gauge levels imply persistent upside pressure. A falling gauge warns of momentum fatigue. Acceleration increases the odds of follow-through from week to week.

Constructive backdrop; dips are more likely to find support while the gauge stays high.

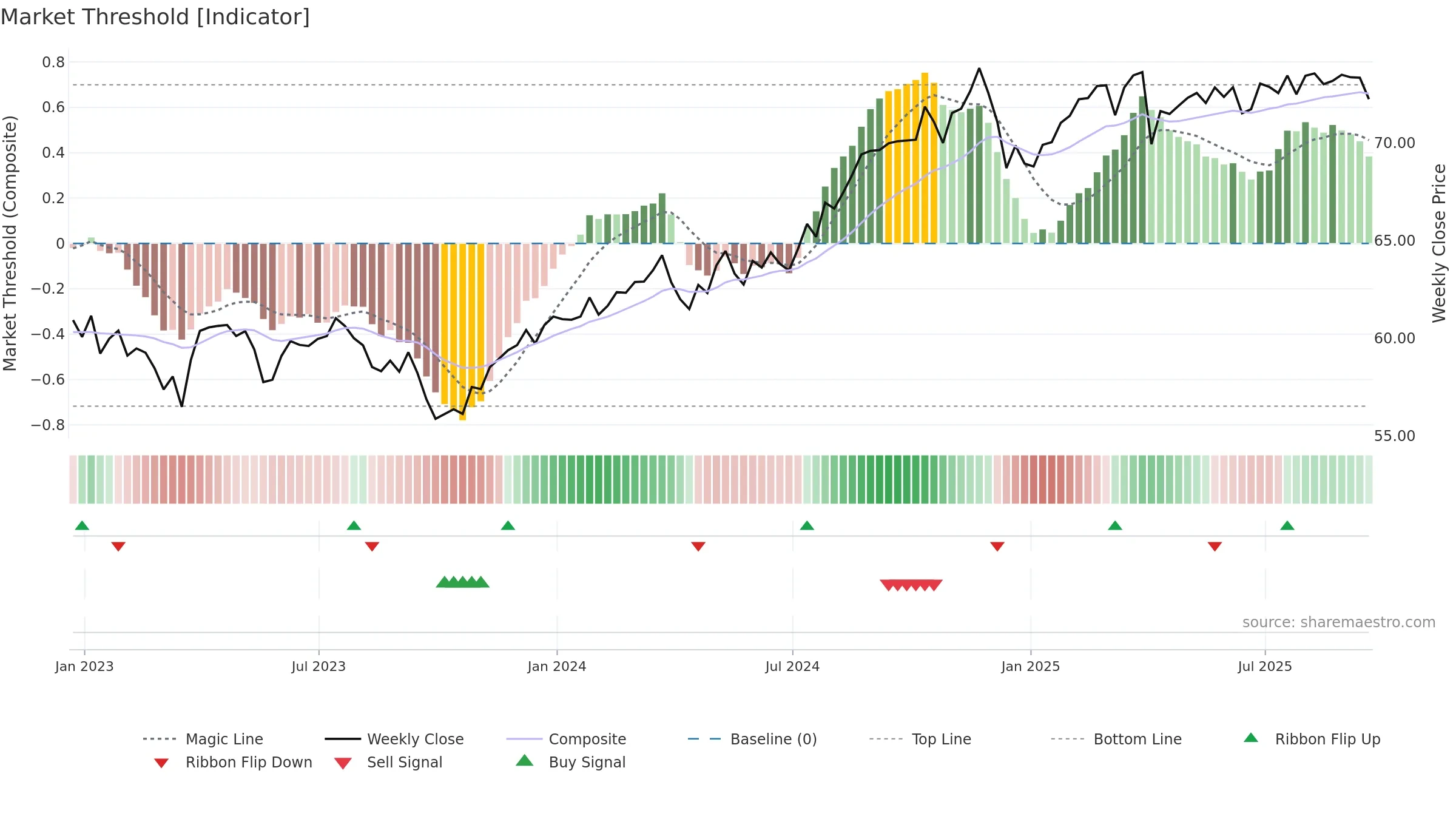

Conclusion

Neutral setup. ★★★☆☆ confidence. Price window: -1. Trend: Bullish @ 82. In combination, liquidity confirms the move.

Why: Price window -1.63% over 8w. Close is -1.79% below the window high. Return volatility 0.76%. Volume trend falling. Liquidity convergence with price. Accumulation 0; distribution 3. MA stack mixed. 4–8w crossover bearish. Baseline deviation 0.12% (narrowing). Momentum bullish and falling. Acceleration accelerating. Gauge volatility low.

Tip: Most metrics also include a hover tooltip where they appear in the report.