QUALCOMM Incorporated

QCOM NASDAQ

Weekly Summary

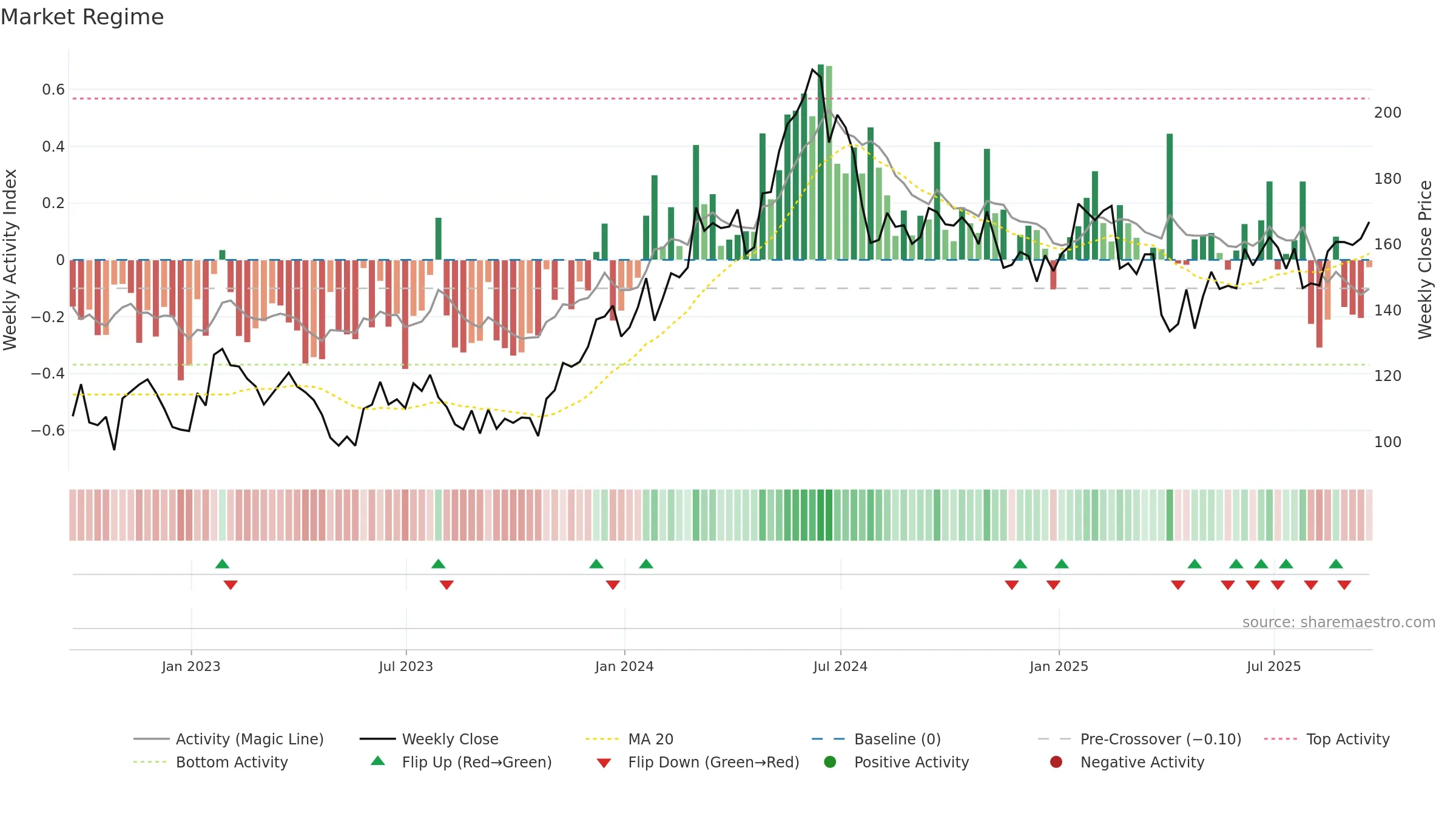

QUALCOMM Incorporated closed at 166.8500 (-1.37% WoW) . Data window ends Fri, 19 Sep 2025.

How to read this — Price slope is upward, indicating persistent buying over the window. Low weekly volatility favours steadier follow-through. Volume and price are moving in the same direction — a constructive confirmation. Returns are positively correlated with volume — strength tends to arrive on higher activity. Constructive MA stack supports the up-drift; pullbacks may find support at the 8–13 week region. Price holds above key averages, indicating constructive participation.

Up-slope supports buying interest; pullbacks may be contained if activity stays firm.

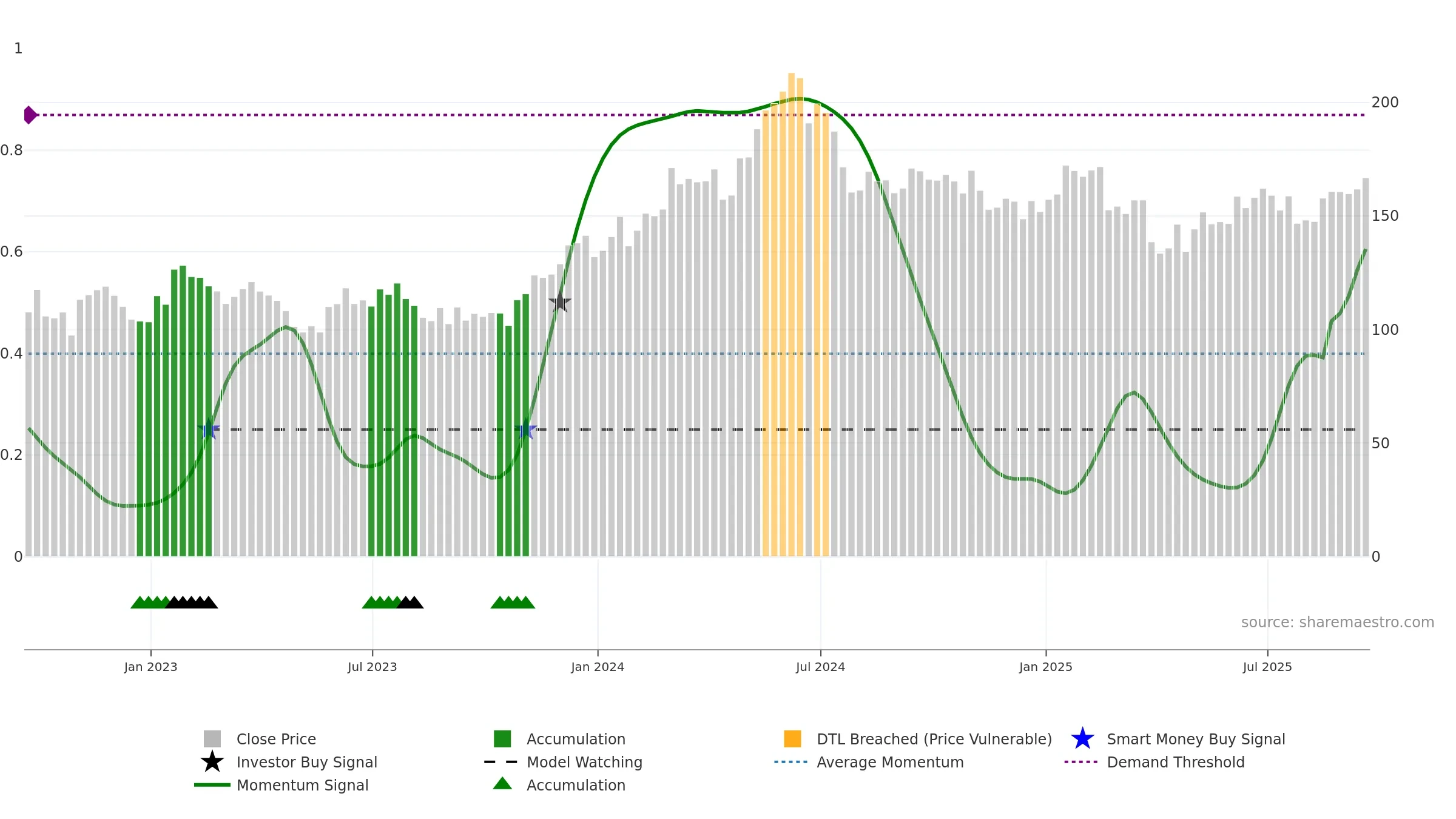

Gauge maps the trend signal to a 0–100 scale.

How to read this — High gauge and rising momentum — buyers in control.

Bias remains higher; pullbacks could be buyable if participation holds.

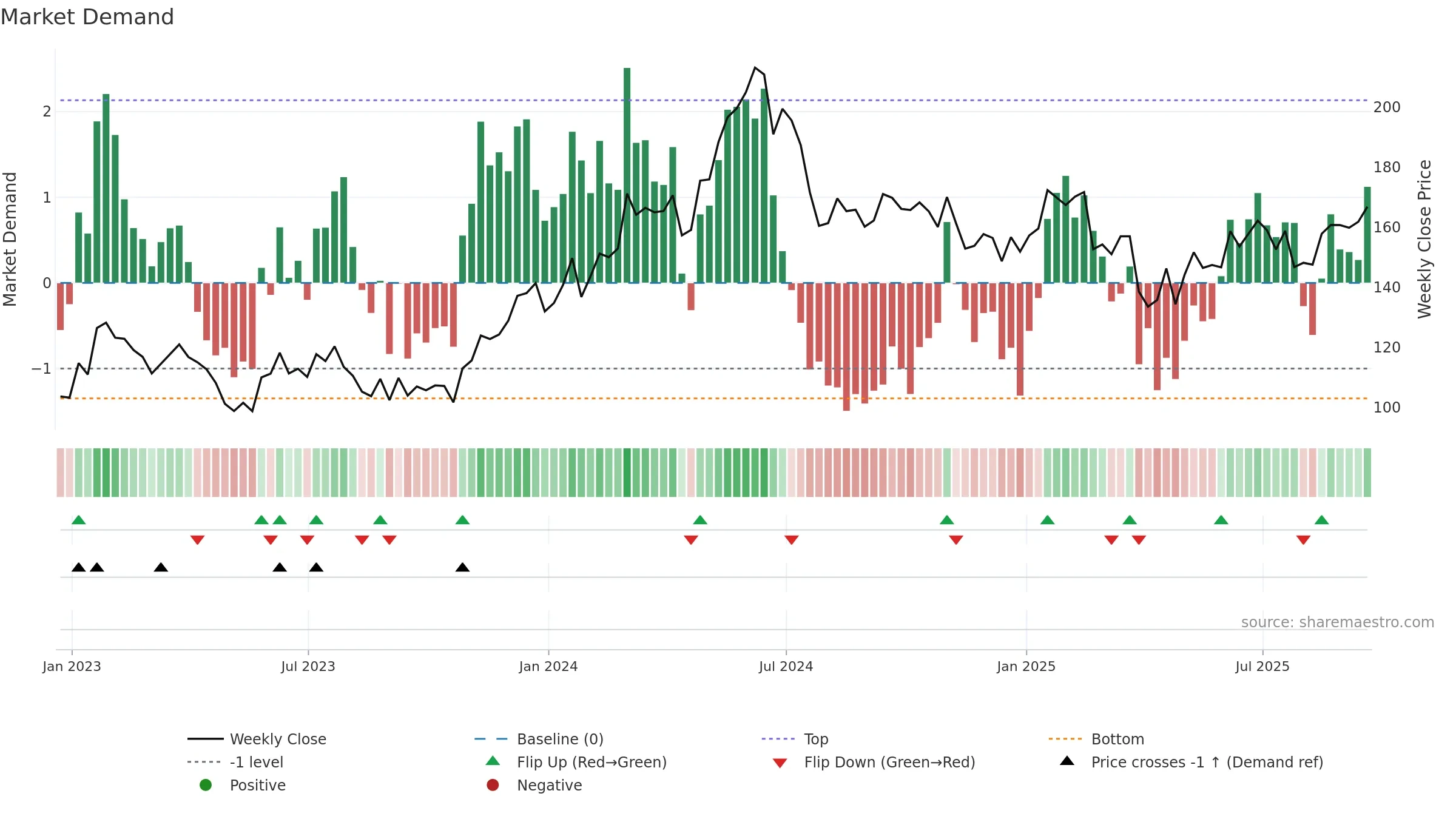

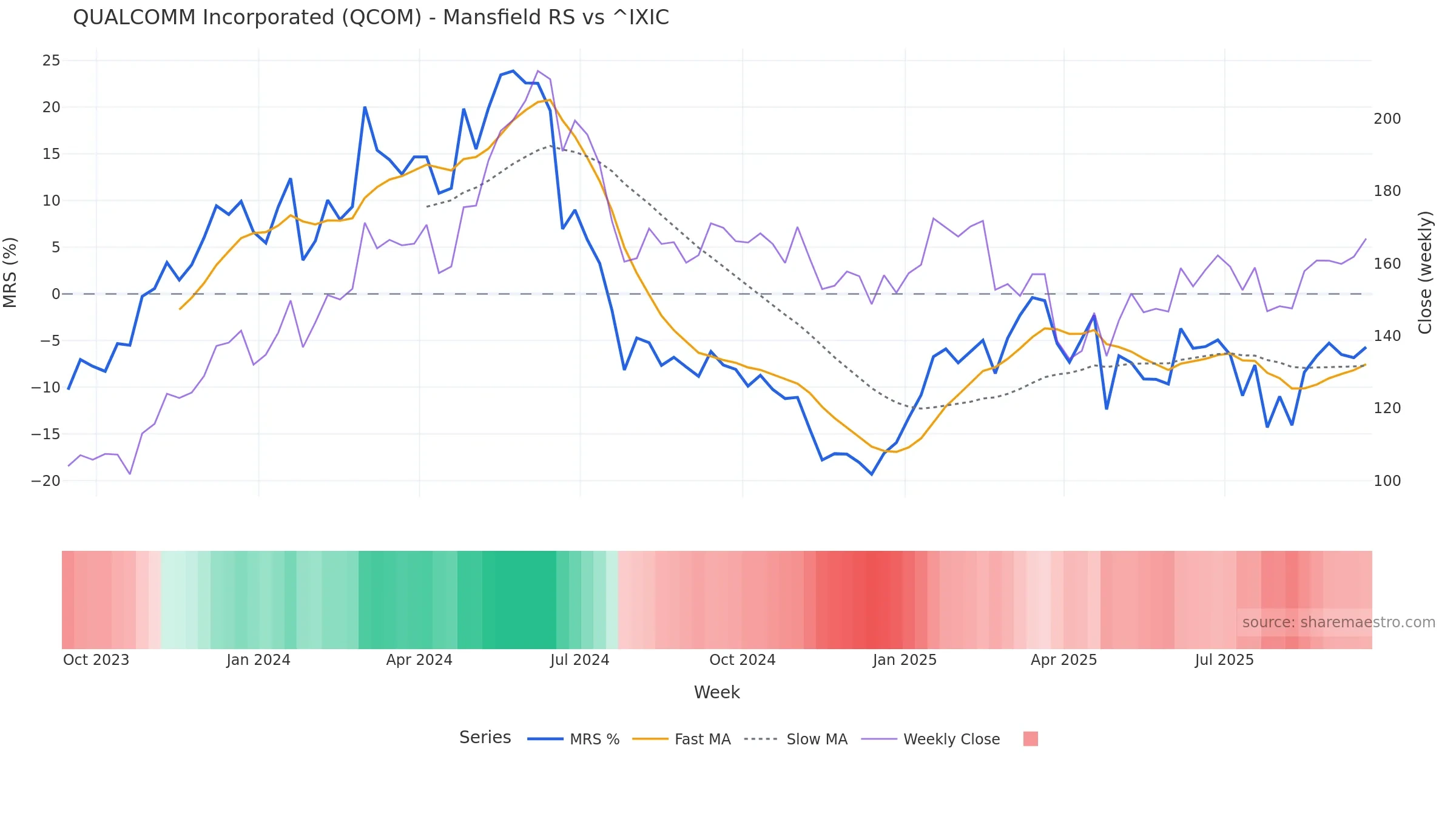

Relative strength is Negative

(< 0%, underperforming).

Latest MRS: -5.70% (week ending Fri, 19 Sep 2025).

Fast/slow crossover: Bullish.

Slope: Rising over 8w.

Notes:

- Fast/slow crossover turned bullish.

- Below zero line indicates relative weakness vs benchmark.

- MRS slope rising over ~8 weeks.

Conclusion

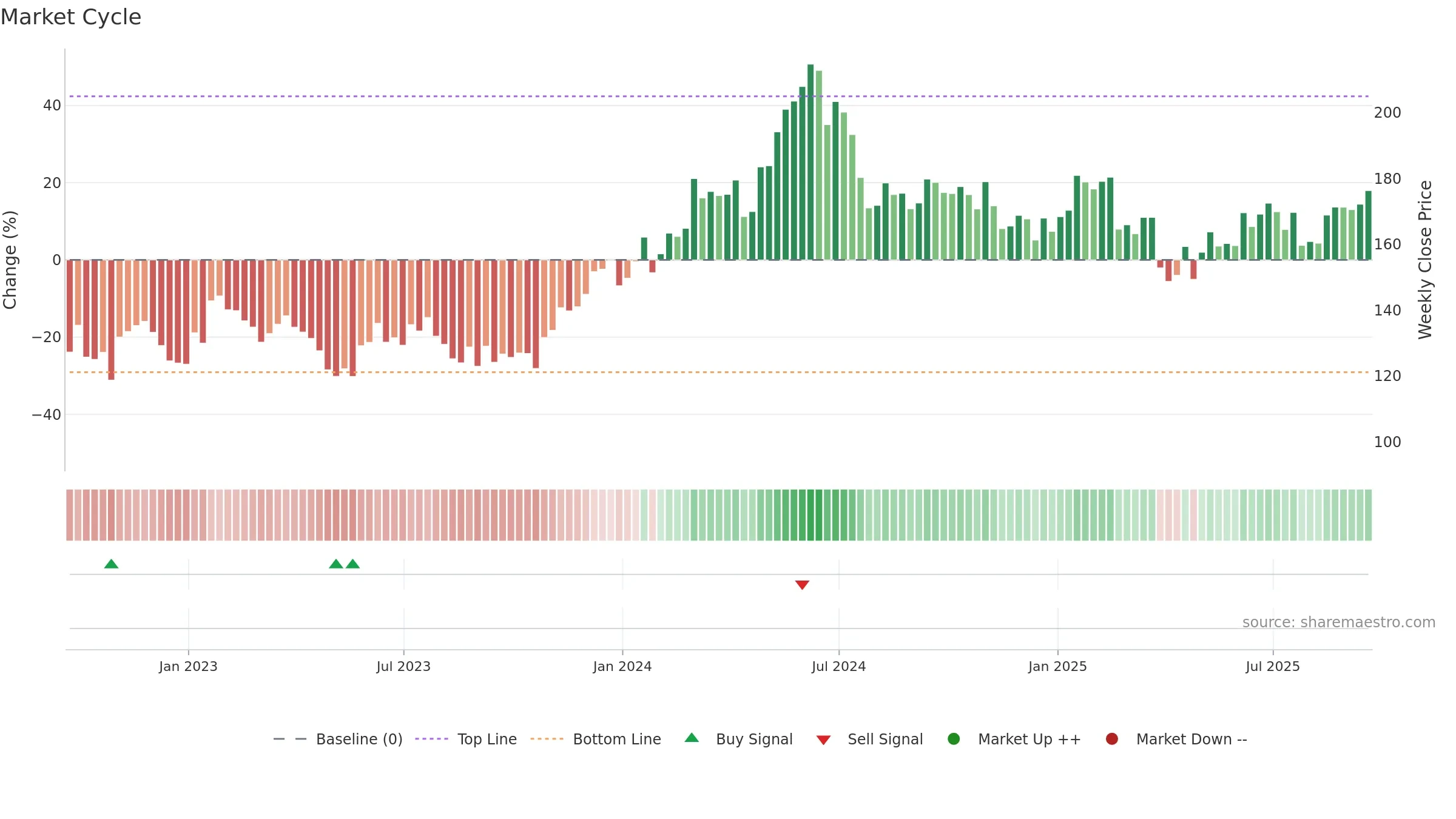

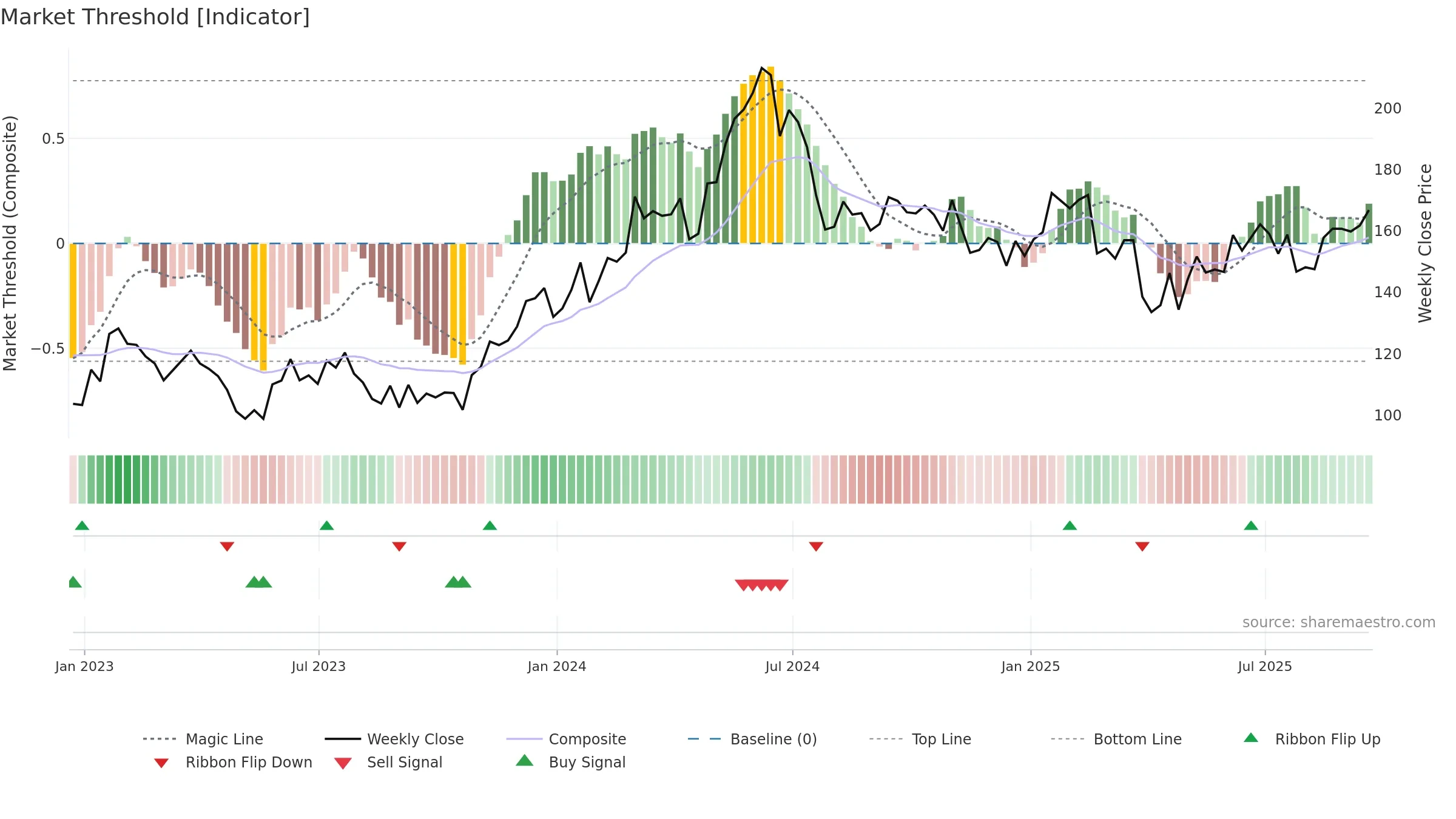

Positive setup. ★★★★★ confidence. Trend: Strong Uptrend · 12.59% over window · vol 1.42% · liquidity convergence · posture above · RS outperforming

- High gauge with rising momentum (strong uptrend)

- Momentum is bullish and rising

- Price holds above 8–26 week averages

- Constructive moving-average stack

Why: Price window 12.59% over w. Close is 3.10% above the prior-window high. Return volatility 1.42%. Volume trend rising. Liquidity convergence with price. Trend state strong uptrend. MA stack constructive. Momentum bullish and rising.

Tip: Most metrics include a hover tooltip where they appear in the report.