Sharda Motor Industries Limited

SHARDAMOTR NSE

Weekly Summary

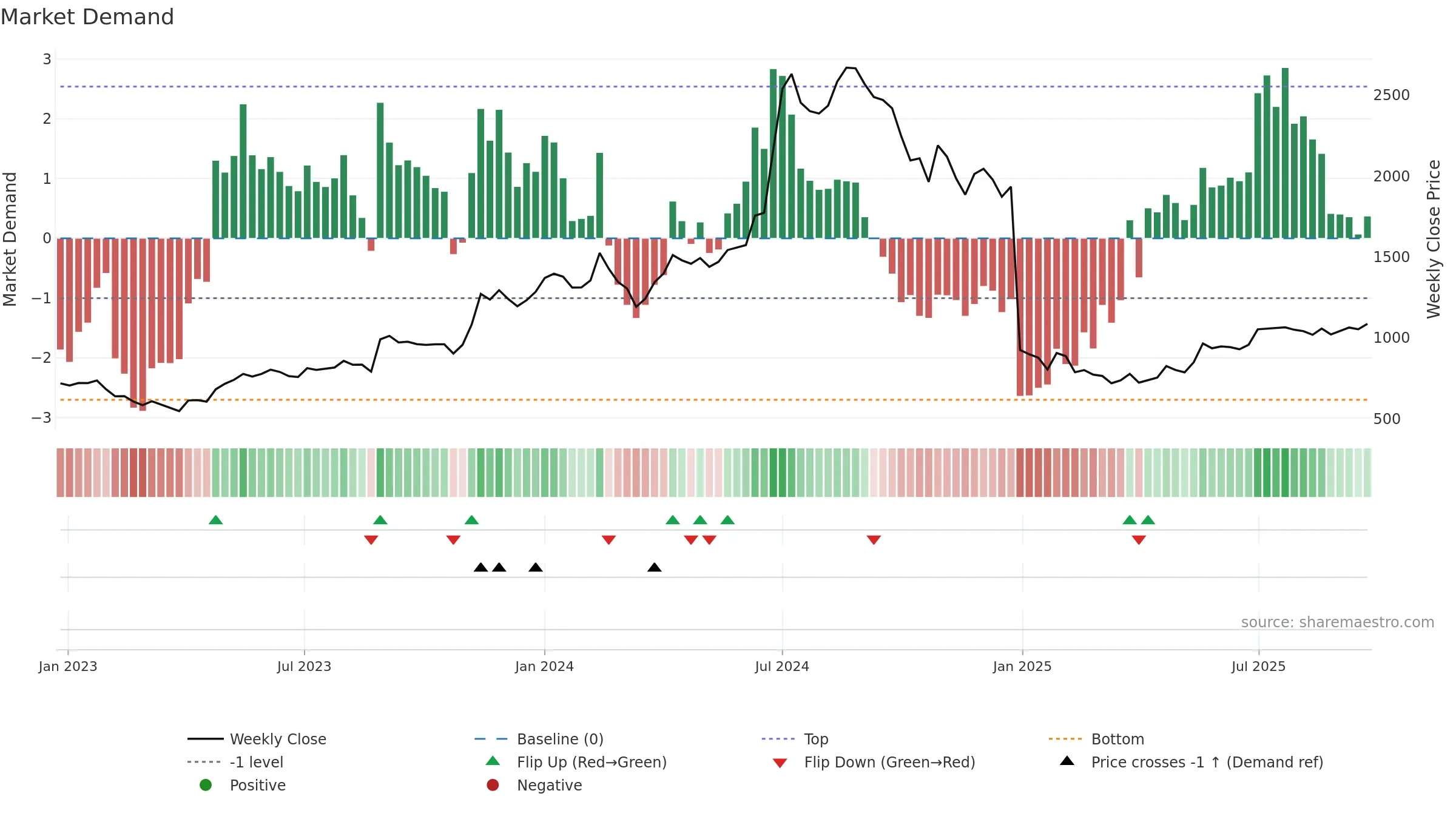

Sharda Motor Industries Limited closed at 1086.8000 (1.48% WoW) . Data window ends Mon, 22 Sep 2025.

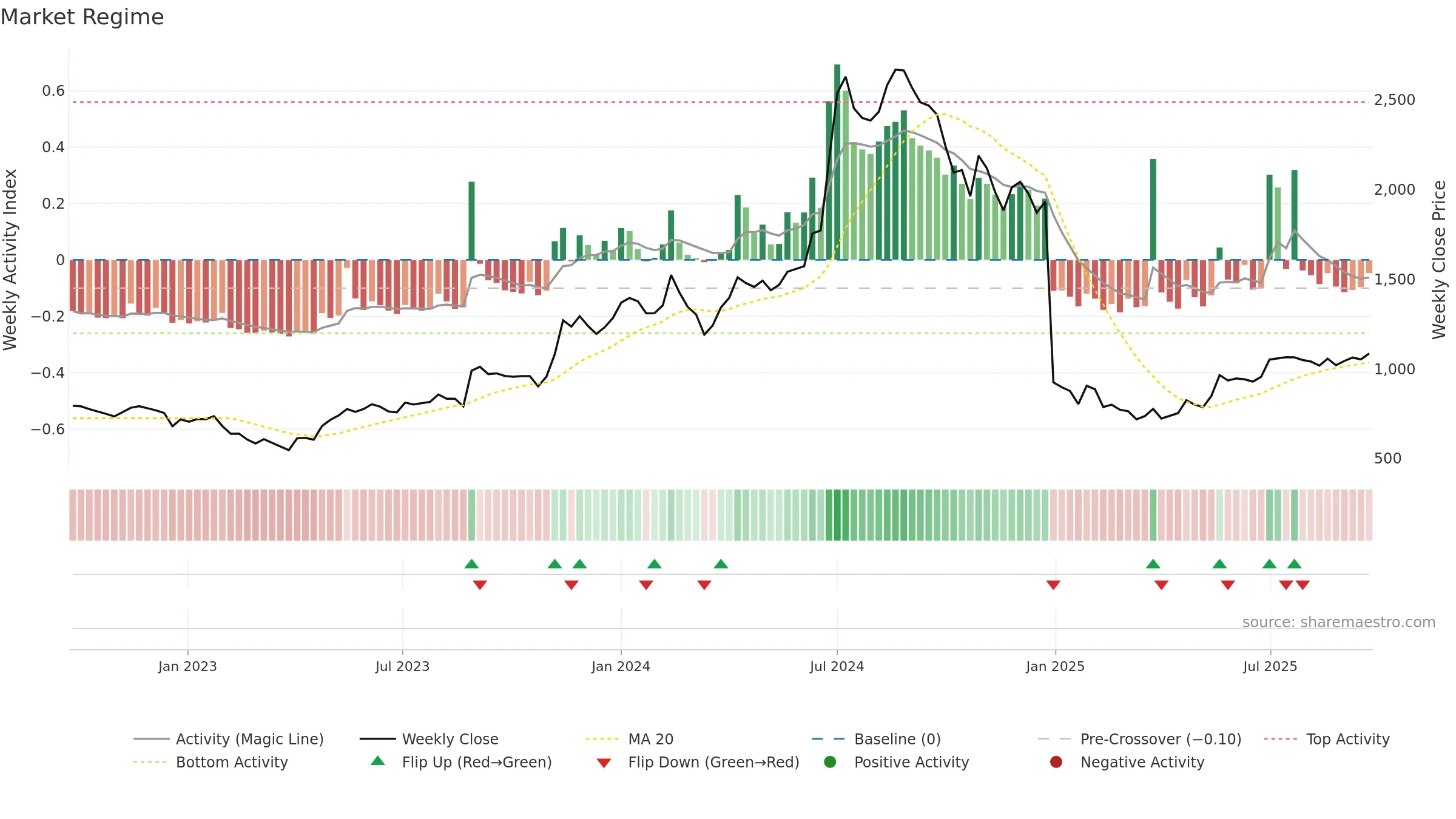

How to read this — Price slope is upward, indicating persistent buying over the window. Volume trend diverges from price — watch for fatigue or rotation. Price holds above key averages, indicating constructive participation.

Up-slope supports buying interest; pullbacks may be contained if activity stays firm. Because liquidity isn’t confirming, prefer evidence of fresh demand before chasing moves.

Gauge maps the trend signal to a 0–100 scale.

How to read this — Range-bound conditions; conviction is limited until a break or acceleration emerges.

Wait for a directional break or improving acceleration.

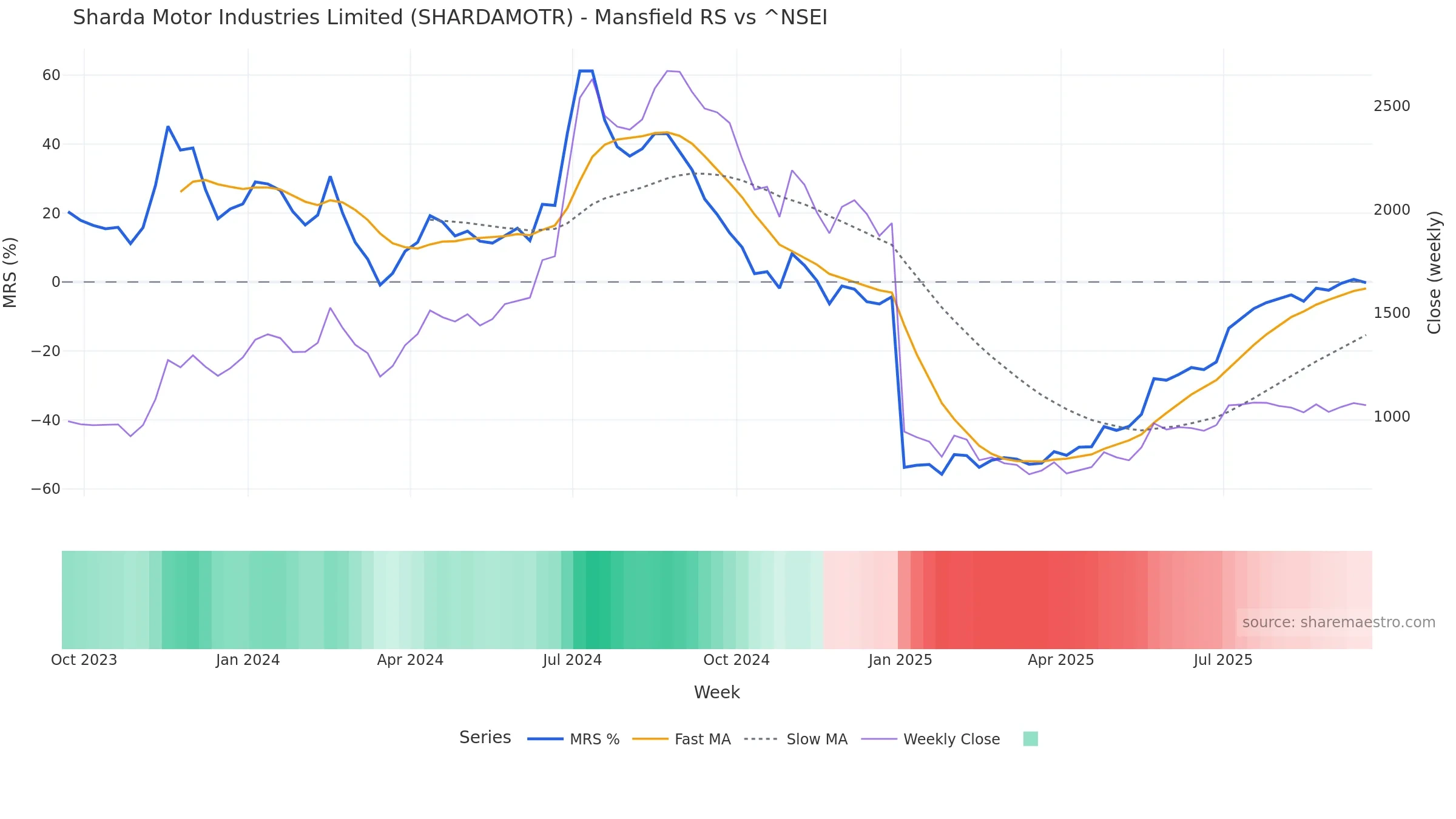

Relative strength is Negative

(< 0%, underperforming).

Latest MRS: -0.20% (week ending Fri, 19 Sep 2025).

Slope: Rising over 8w.

Notes:

- Below zero line indicates relative weakness vs benchmark.

- MRS slope rising over ~8 weeks.

Price is above fair value; upside may be capped without catalysts.

Conclusion

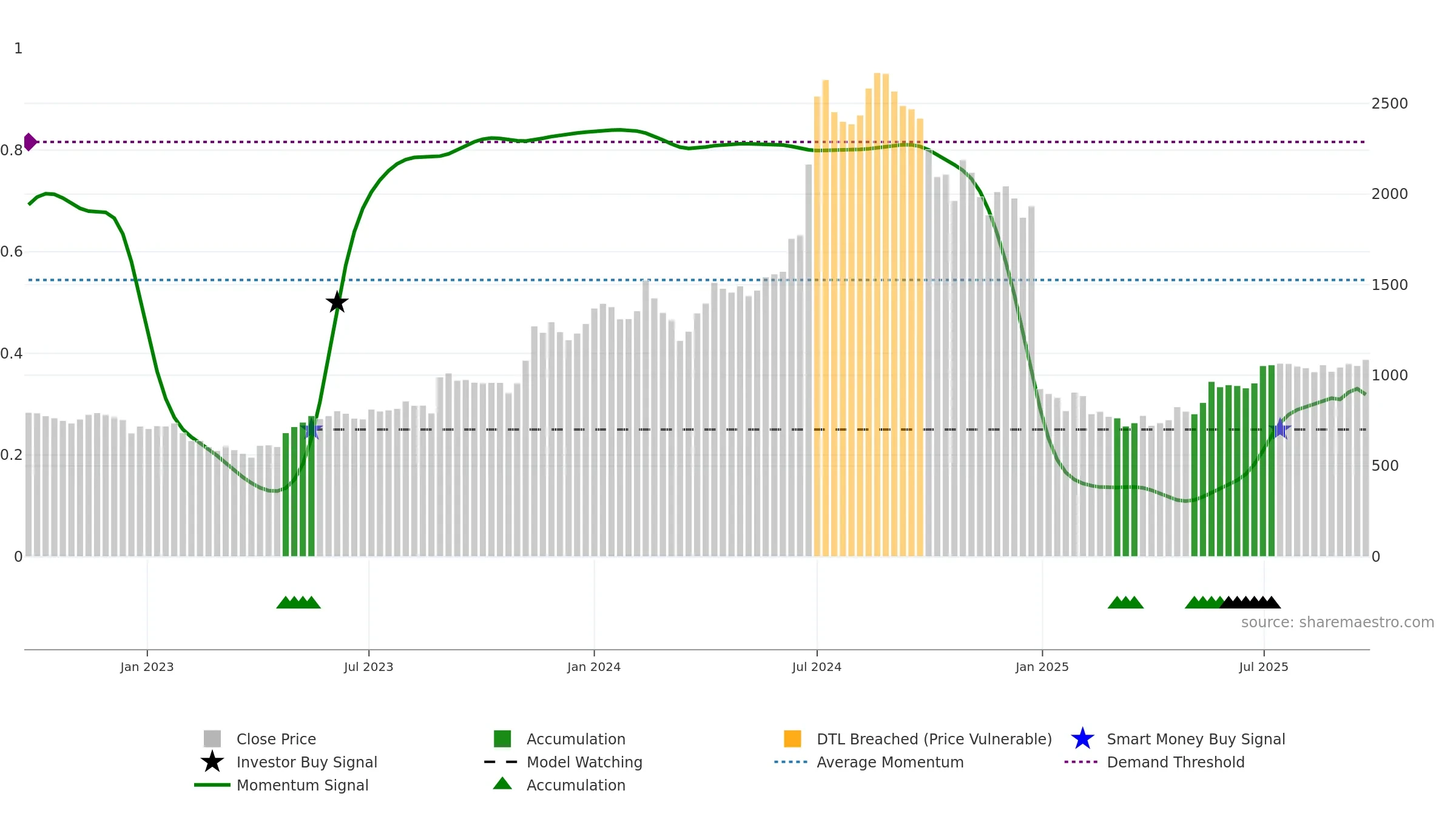

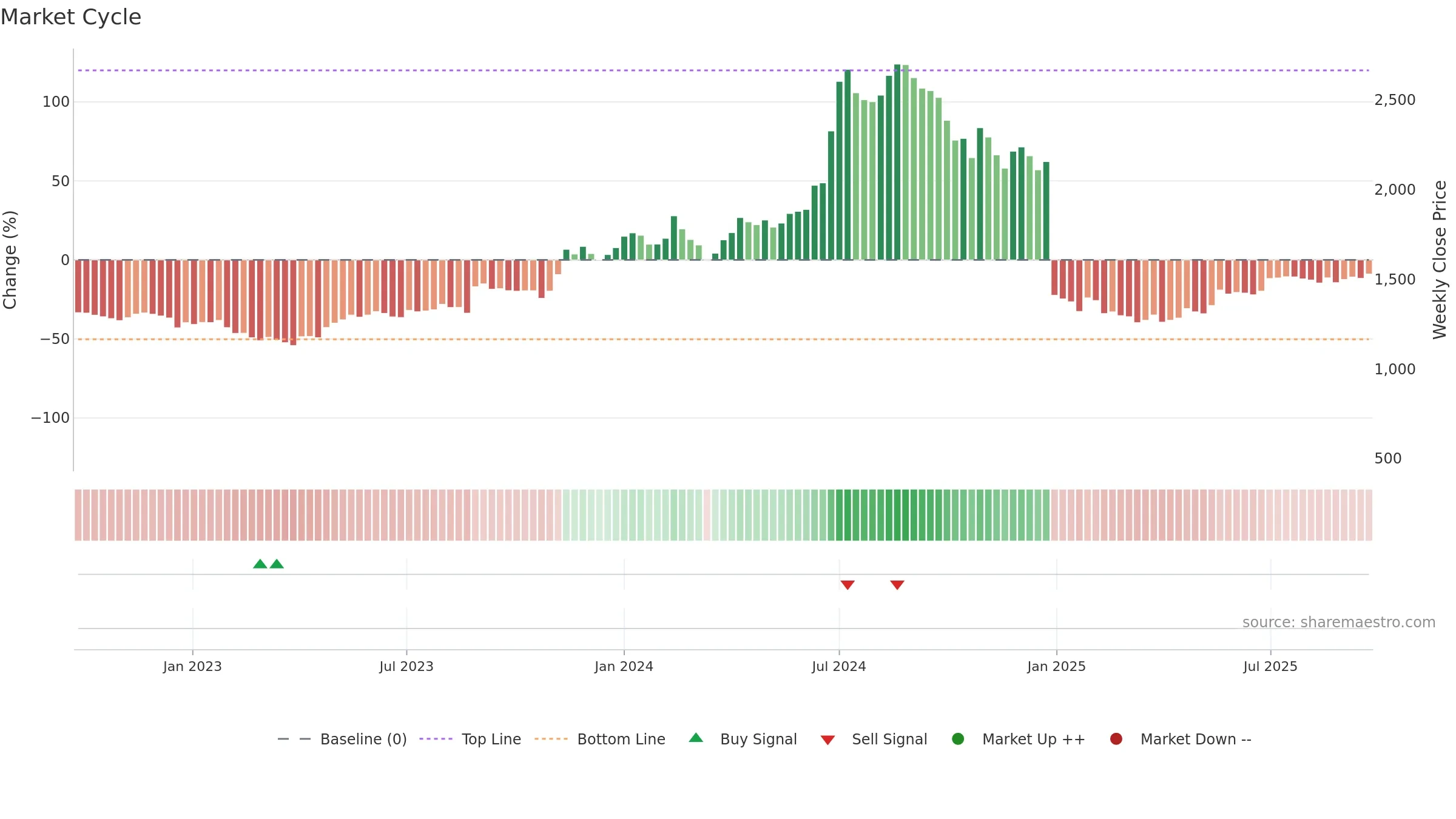

Neutral setup. ★★★☆☆ confidence. Trend: Range / Neutral · 4.35% over window · vol 2.75% · liquidity divergence · posture above

- Price holds above 8–26 week averages

- Momentum is weak/falling

- Liquidity diverges from price

Why: Price window 4.35% over w. Close is 2.17% above the prior-window high. Volume trend falling. Liquidity divergence with price. Trend state range / neutral. Momentum bearish and rising. Valuation limited upside without catalysts.

Tip: Most metrics include a hover tooltip where they appear in the report.