Crocs, Inc.

CROX NASDAQ

Weekly Summary

Crocs, Inc. closed at 80.3200 (-0.64% WoW) . Data window ends Fri, 19 Sep 2025.

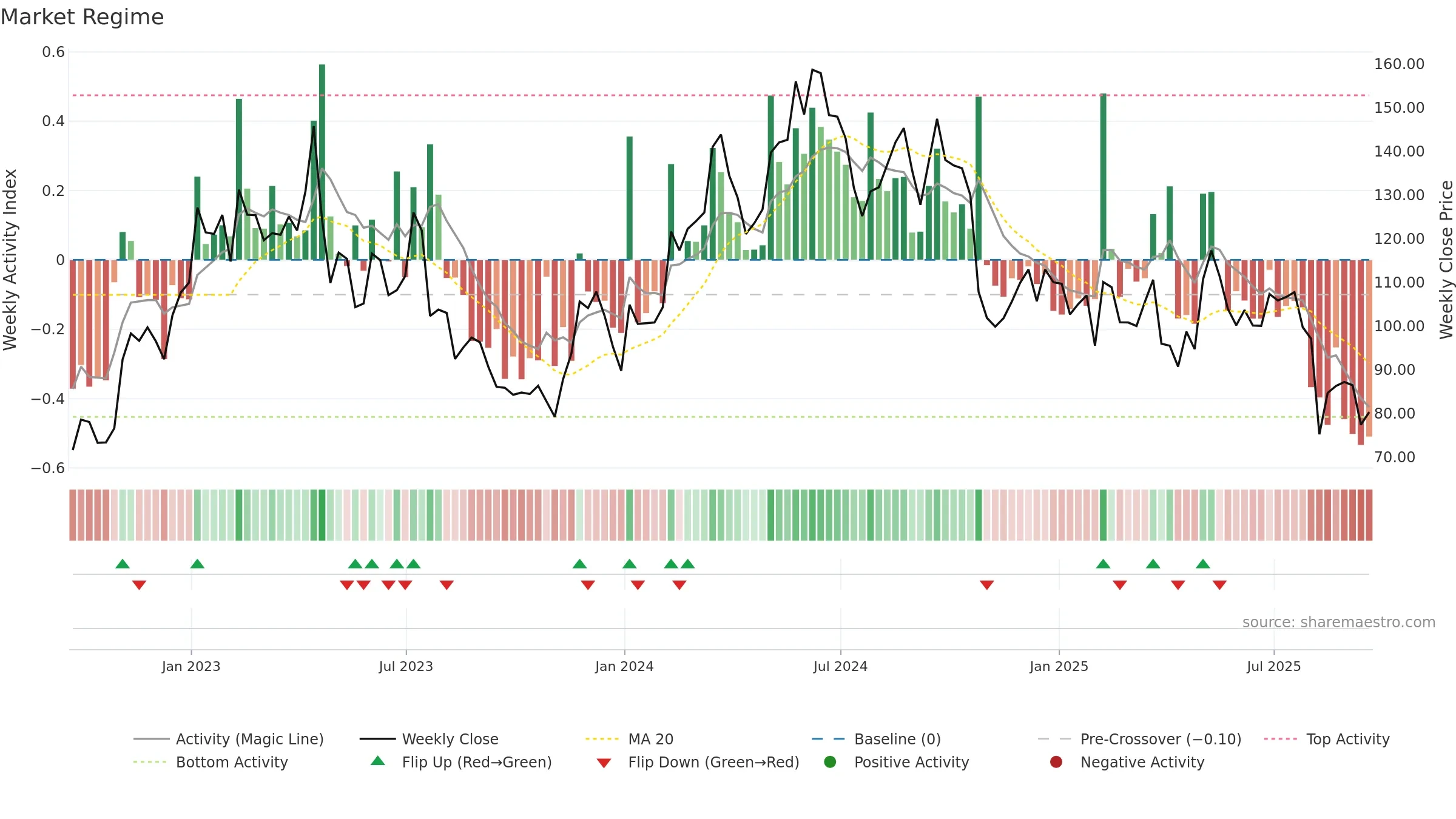

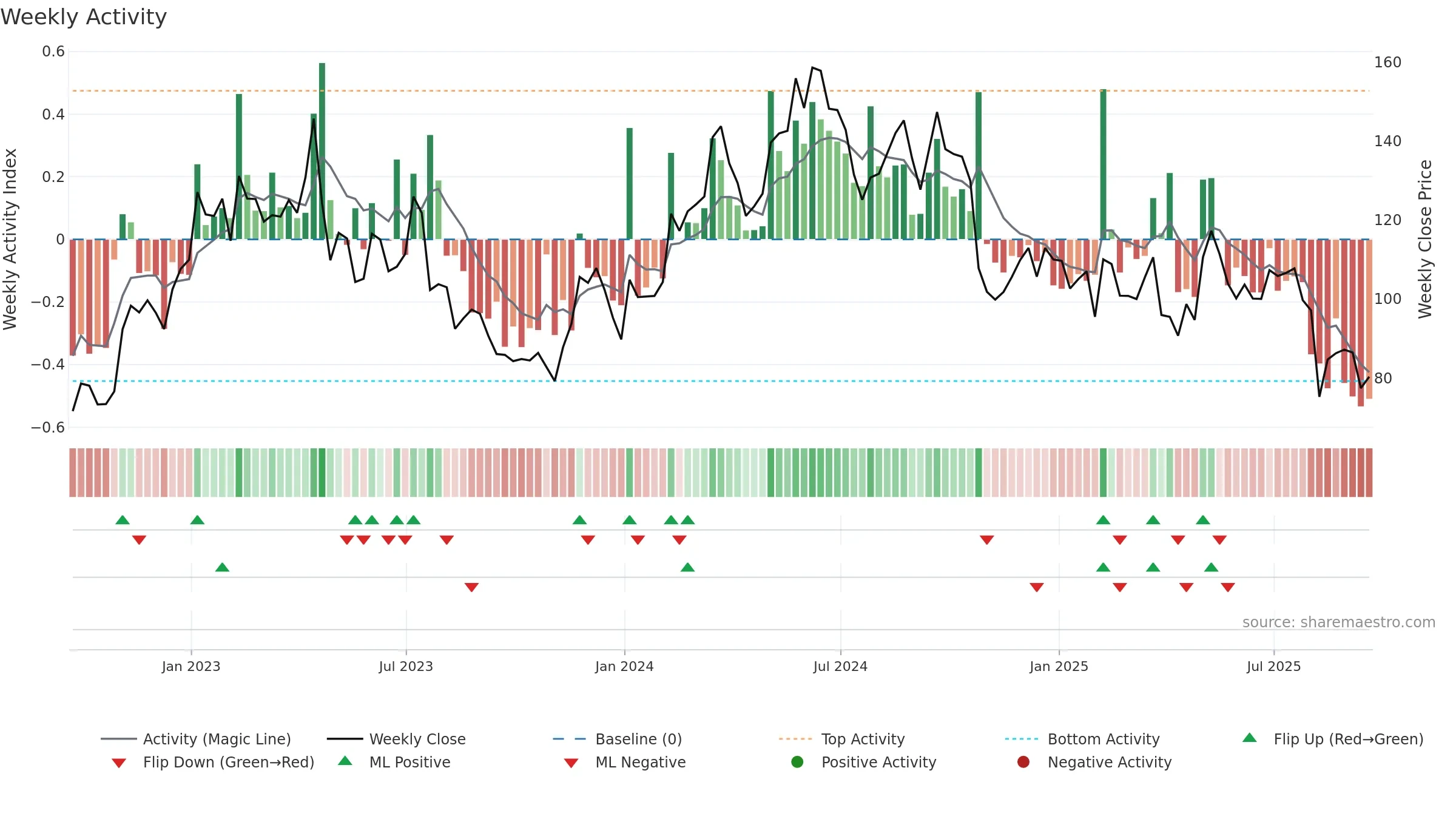

How to read this — Price slope is downward, indicating persistent supply pressure. Low weekly volatility favours steadier follow-through. Volume and price are moving in the same direction — a constructive confirmation. Returns are positively correlated with volume — strength tends to arrive on higher activity. Distance to baseline is narrowing — reverting closer to its fair-value track. Weak MA stack argues for caution; rallies can fail near the 8–13 week region. Price sits below key averages, keeping pressure on the tape.

Down-slope argues for patience; rallies can fade sooner unless participation improves.

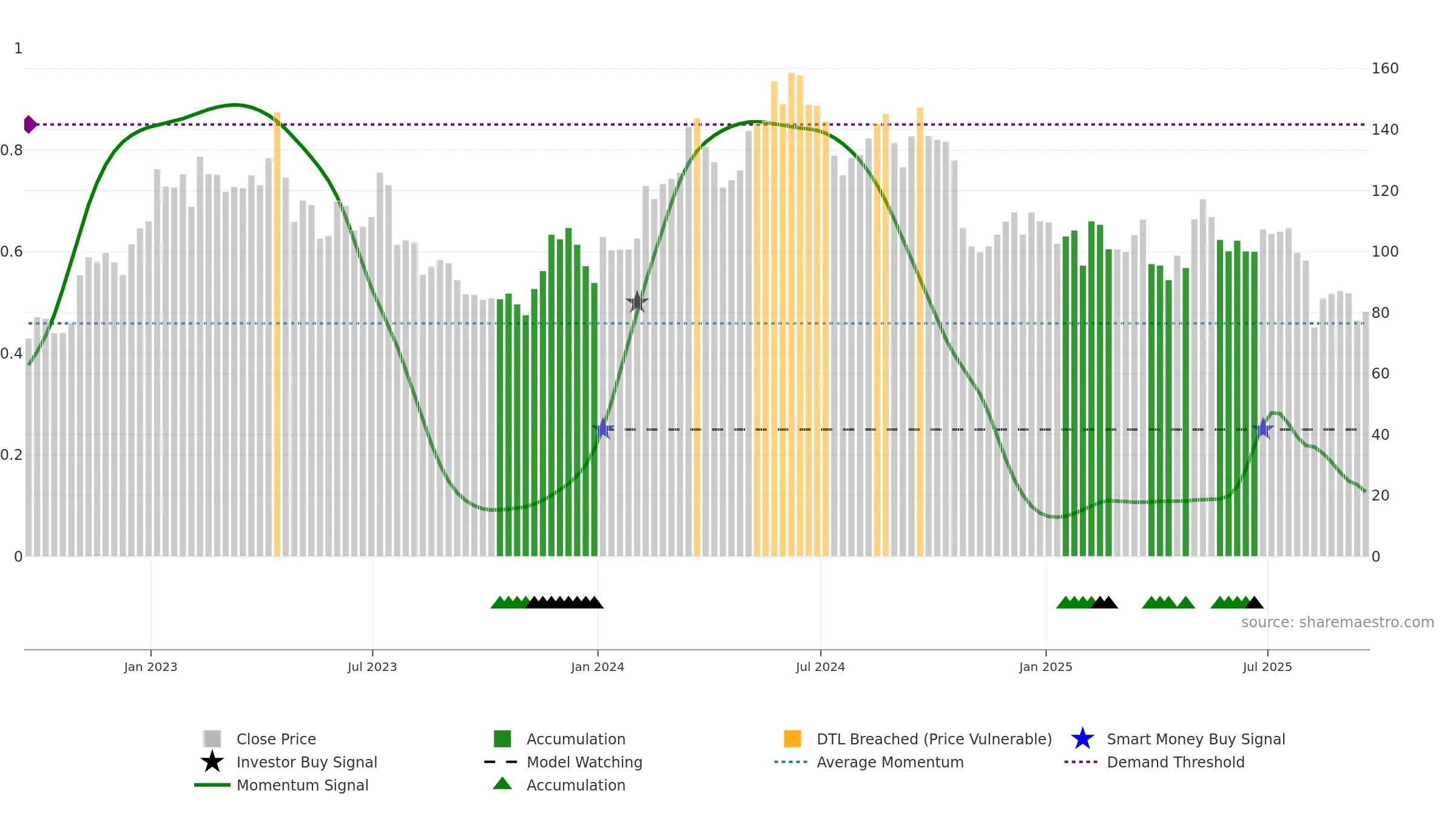

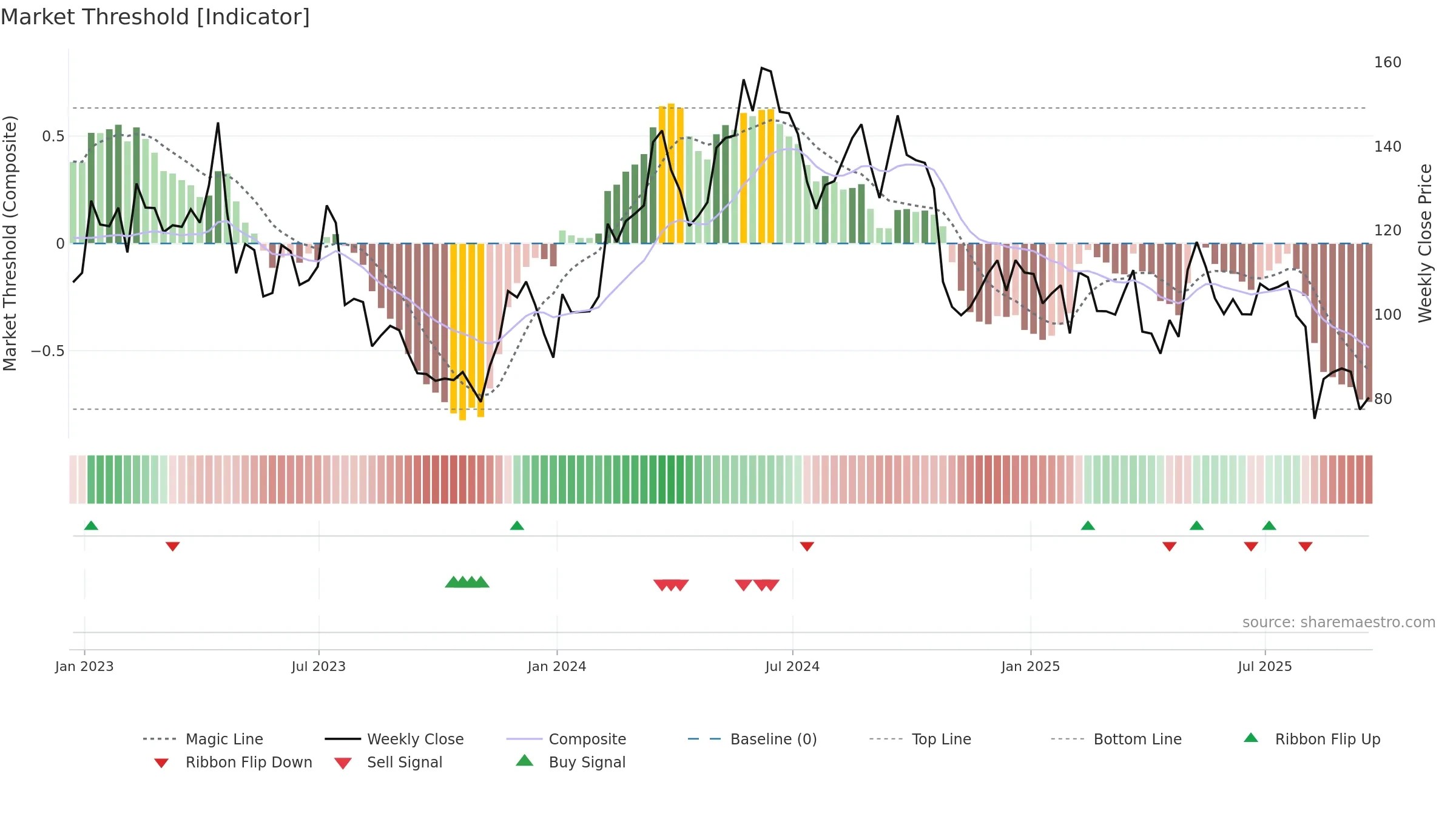

Gauge maps the trend signal to a 0–100 scale.

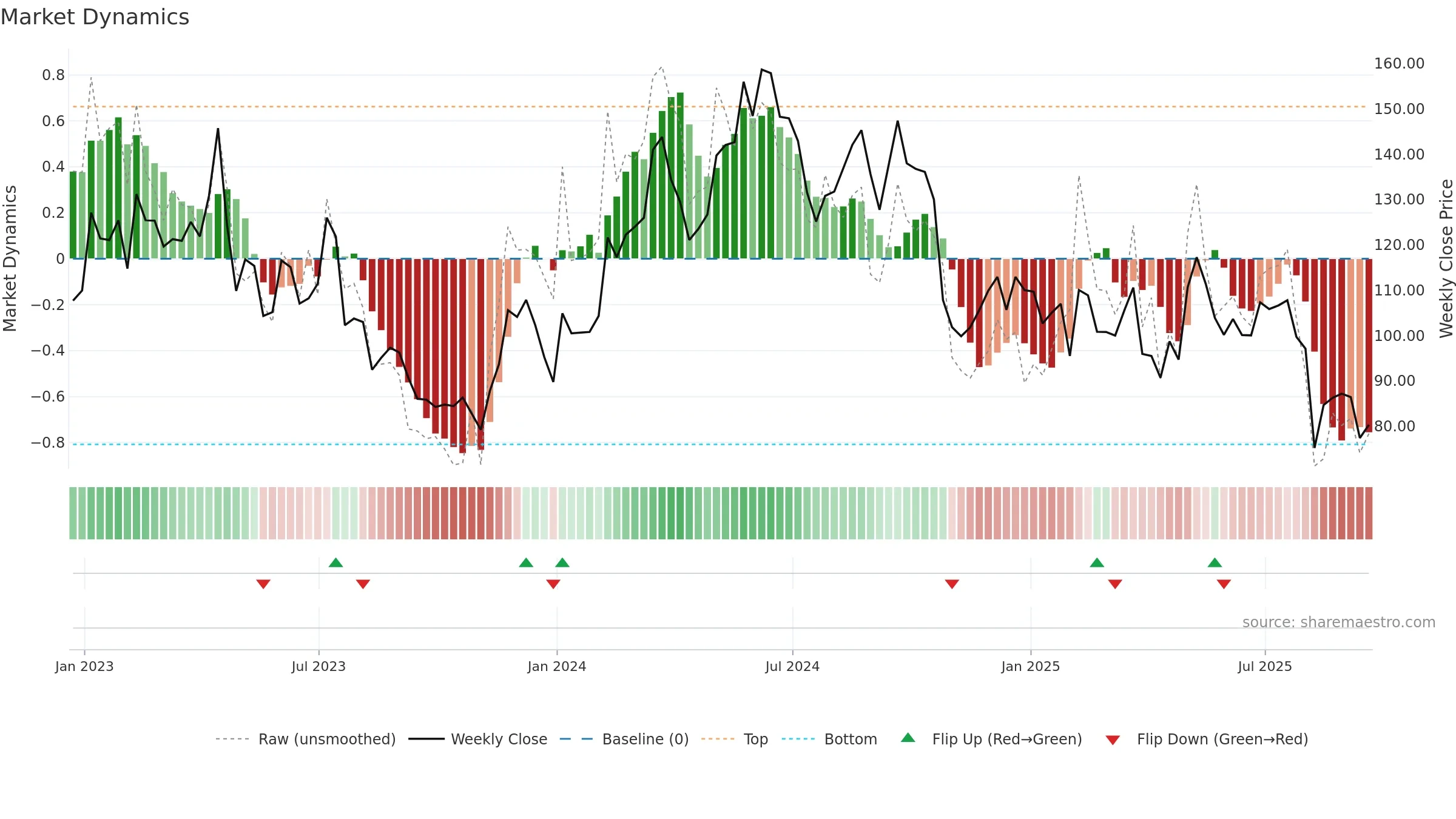

How to read this — Bearish zone with falling momentum — sellers in control.

Bias remains lower; rallies are suspect unless gauge reclaims 0.50/0.60.

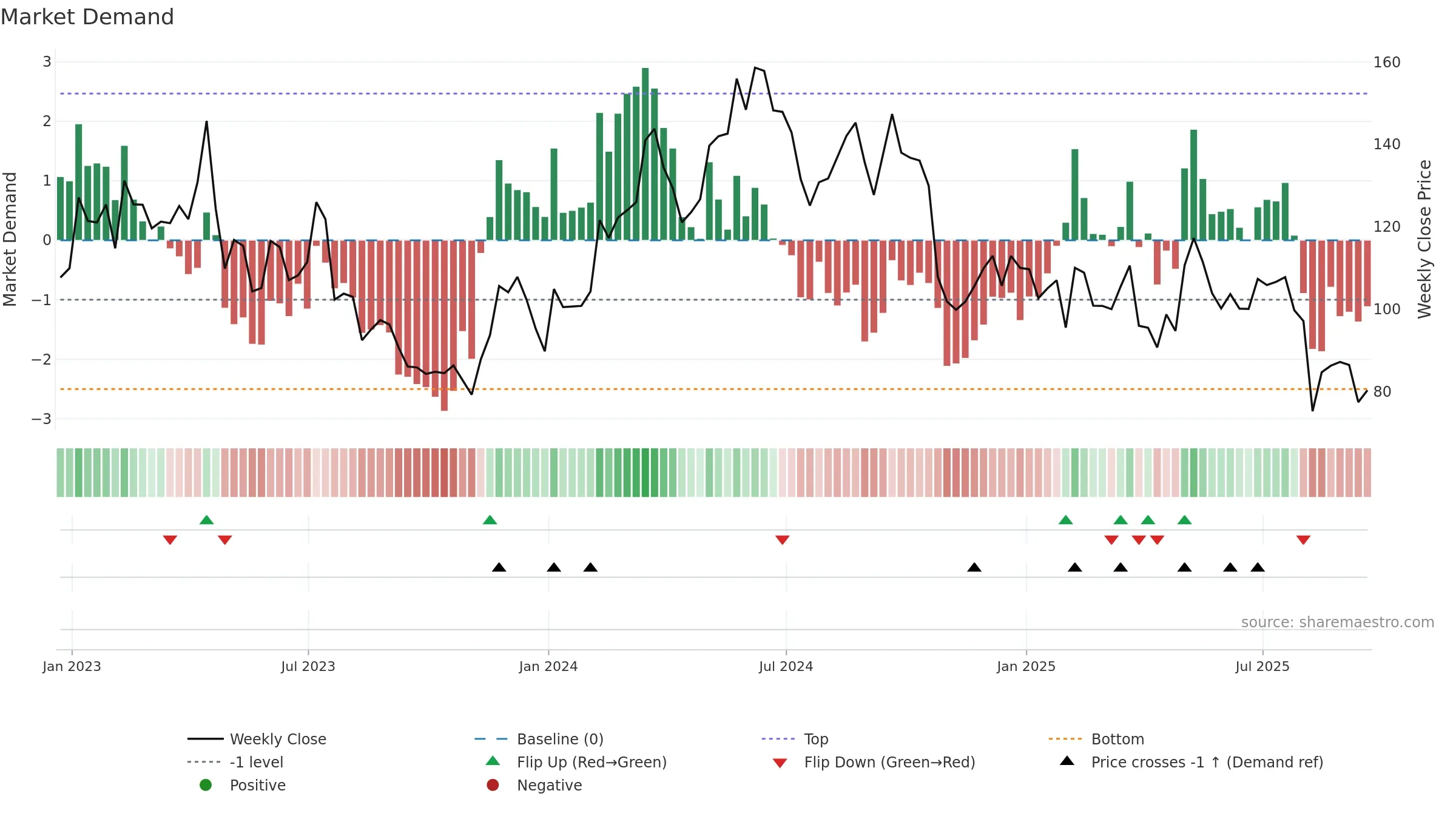

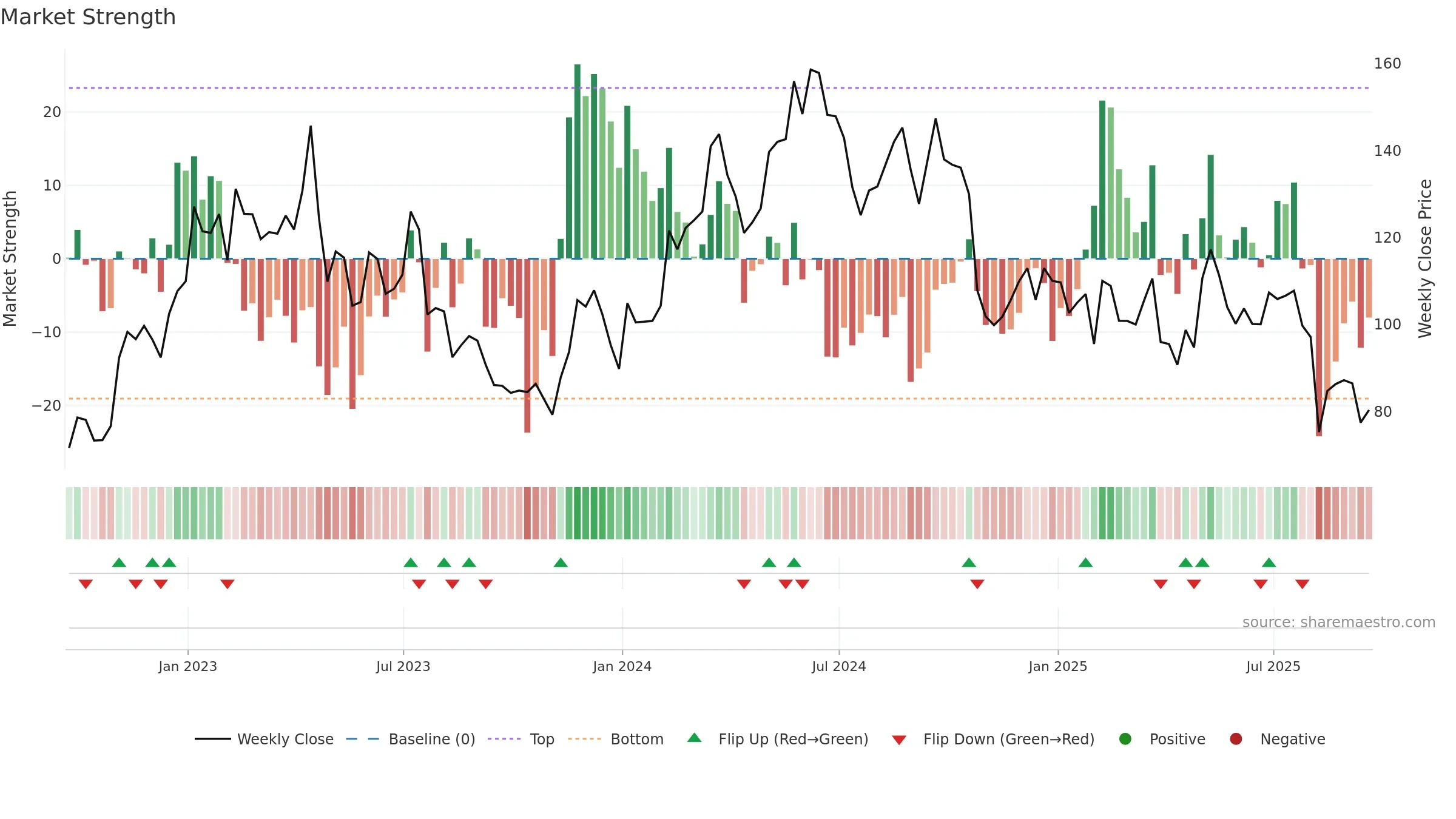

Relative strength is Negative

(< 0%, underperforming).

Latest MRS: -29.33% (week ending Fri, 19 Sep 2025).

Slope: Falling over 8w.

Notes:

- Below zero line indicates relative weakness vs benchmark.

- MRS slope falling over ~8 weeks.

The flag is positive: favourable upside skew with supportive conditions.

Conclusion

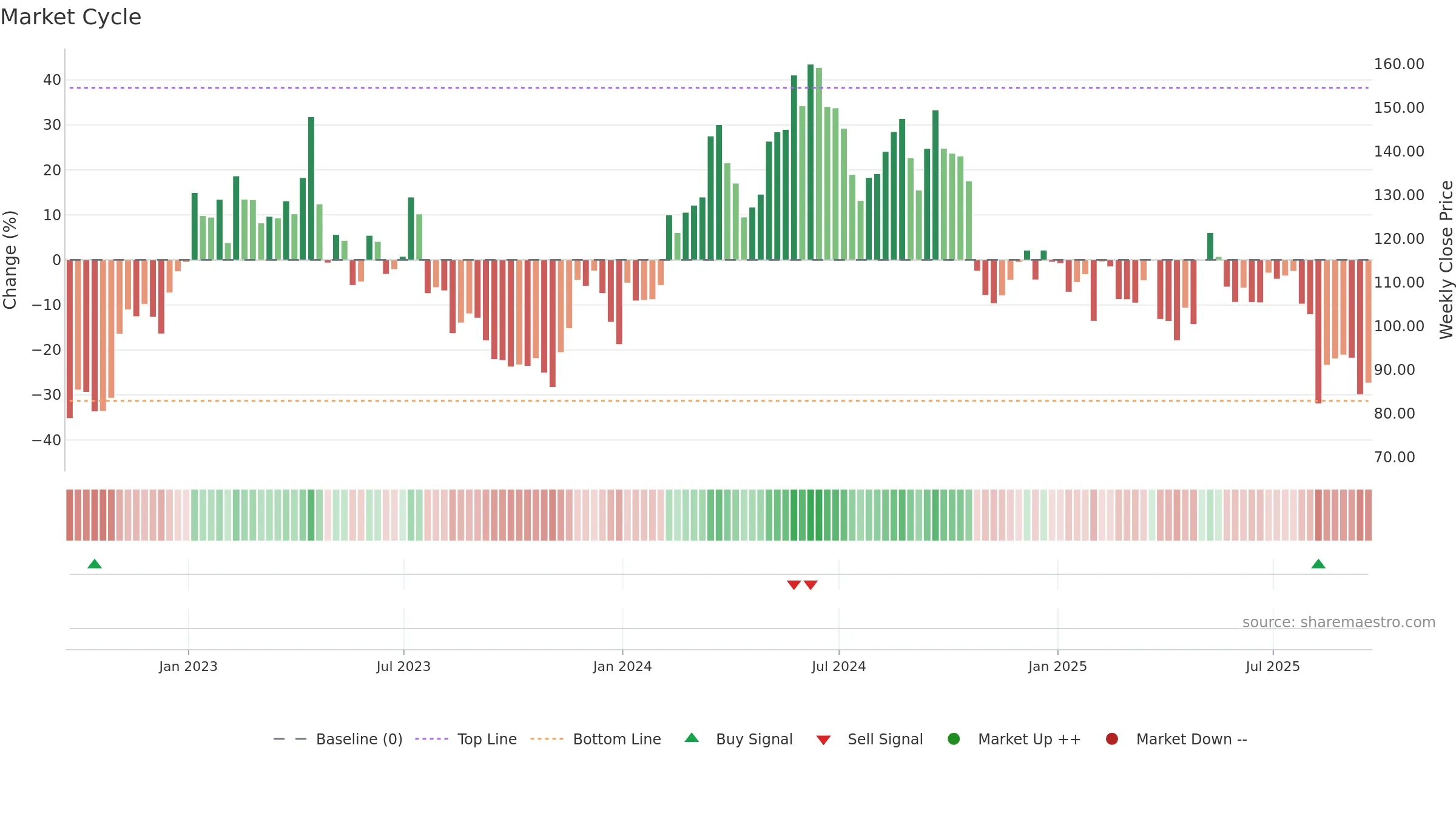

Negative setup. ★☆☆☆☆ confidence. Trend: Downtrend Confirmed · -17.31% over window · vol 1.99% · liquidity convergence · posture below · RS weak

- Liquidity confirms the price trend

- Low return volatility supports durability

- Bearish control with falling momentum

- Momentum is weak/falling

- Price is not above key averages

- Weak moving-average stack

Why: Price window -17.31% over w. Close is -17.31% below the prior-window high. Return volatility 1.99%. Volume trend falling. Liquidity convergence with price. Trend state downtrend confirmed. MA stack weak. Momentum bearish and falling. Valuation stance positive.

Tip: Most metrics include a hover tooltip where they appear in the report.