ITEQ Corporation

6213 TPE

Weekly Report

ITEQ Corporation closed at 111.0000 (-3.48% WoW) . Data window ends Mon, 15 Sep 2025.

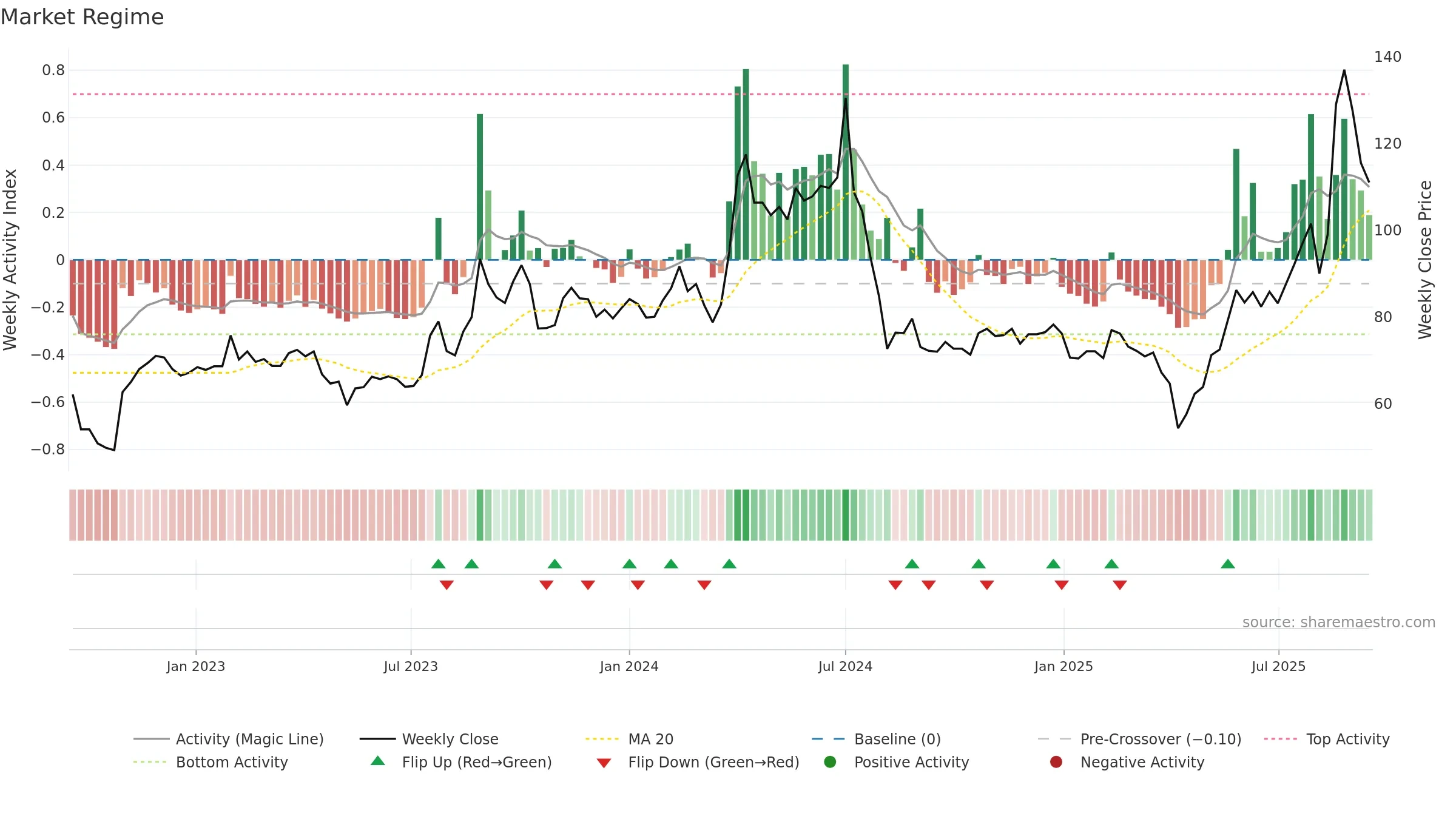

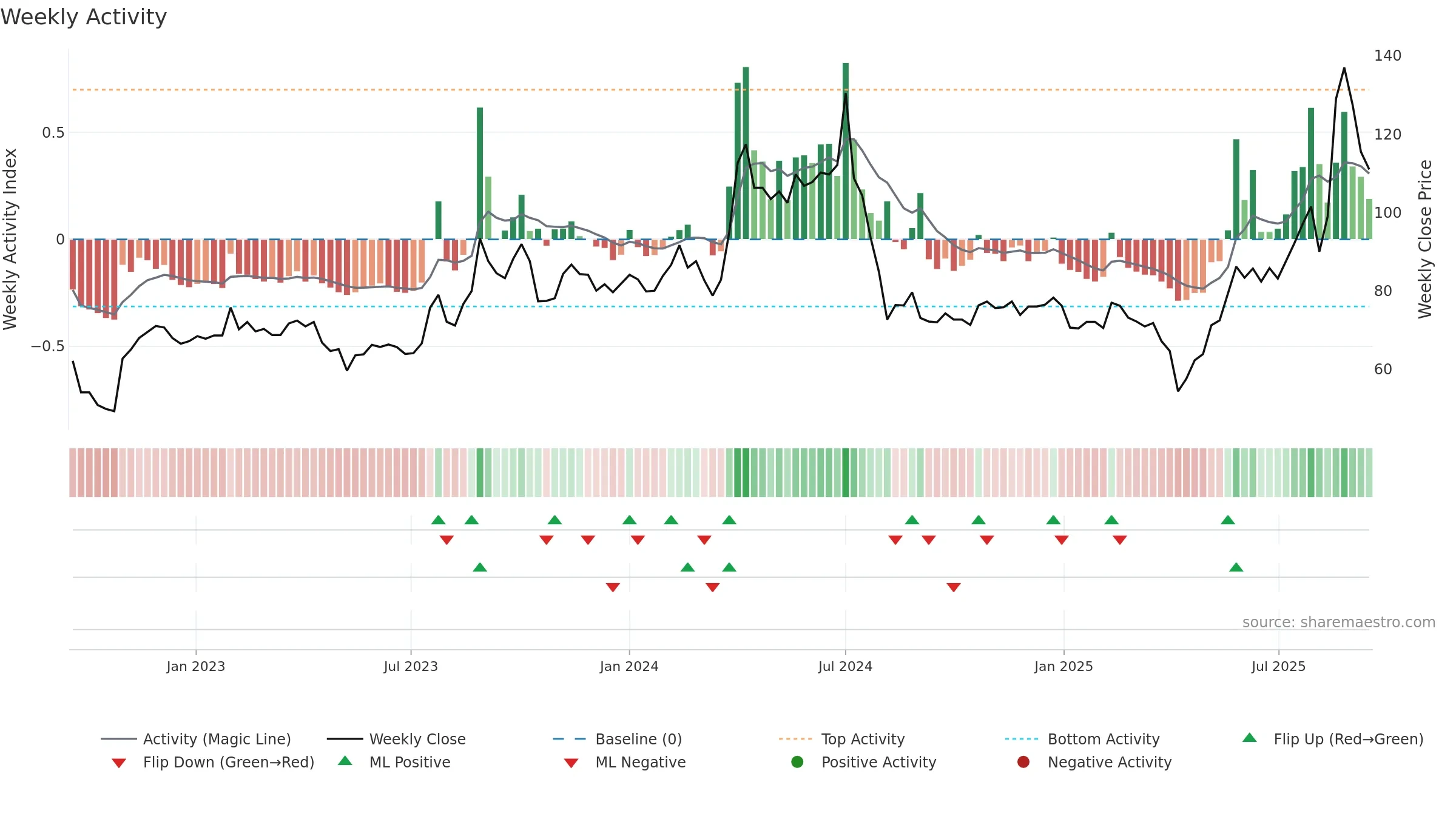

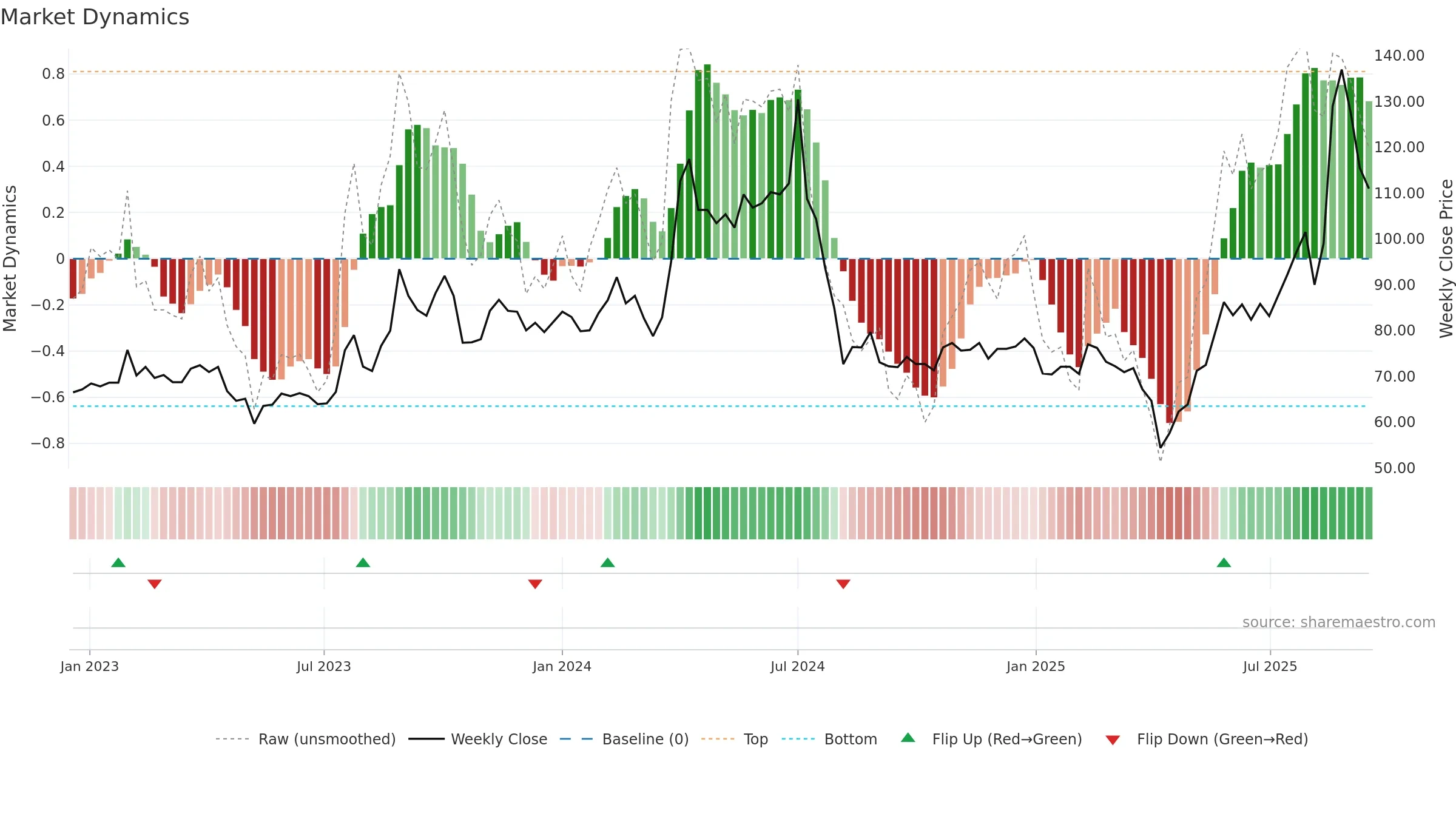

How to read this — Price slope is upward, indicating persistent buying over the window. Elevated weekly volatility increases whipsaw risk. Volume trend diverges from price — watch for fatigue or rotation. Constructive MA stack supports the up-drift; pullbacks may find support at the 8–13 week region.

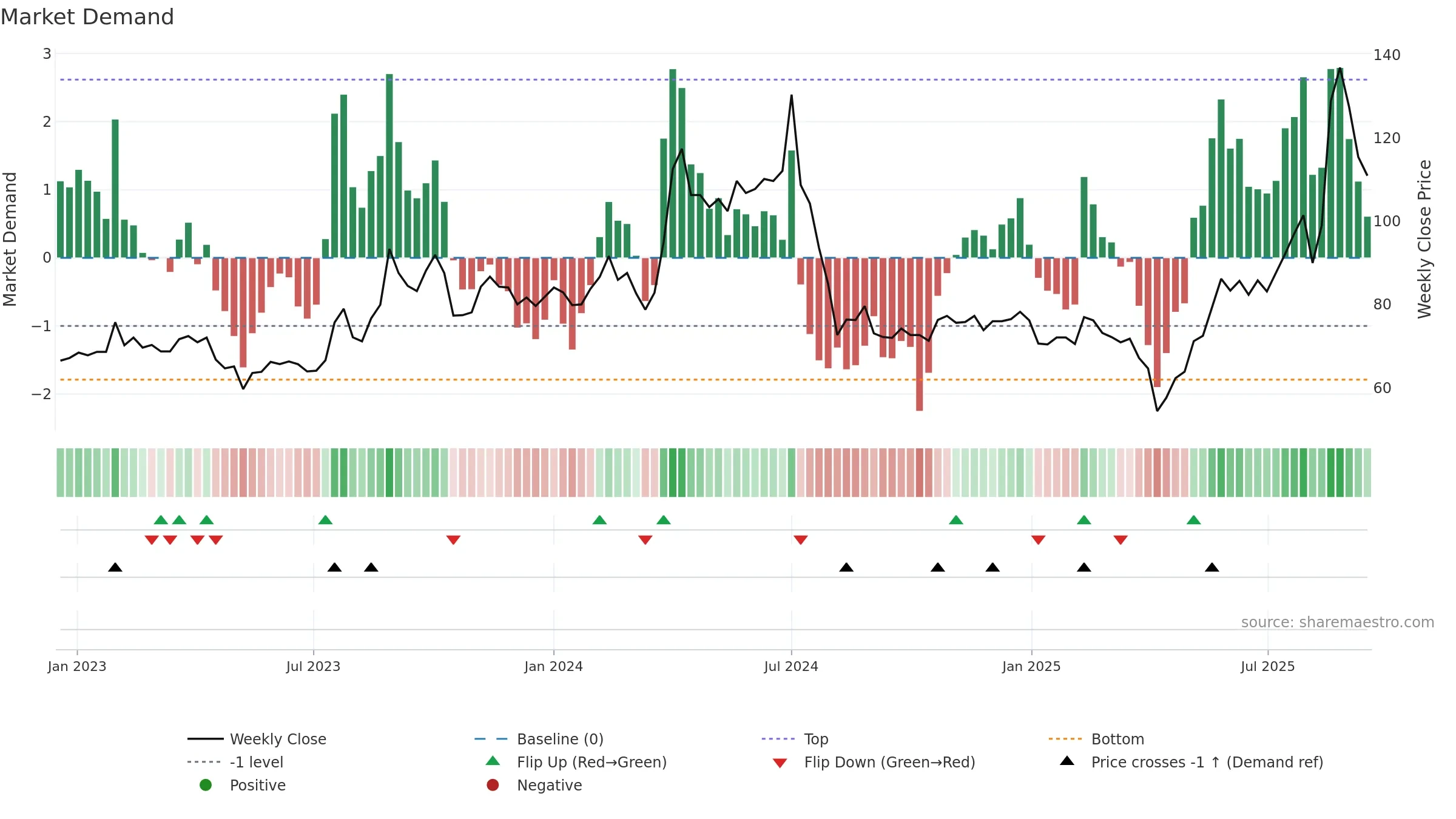

Up-slope supports buying interest; pullbacks may be contained if activity stays firm. Because liquidity isn’t confirming, prefer evidence of fresh demand before chasing moves.

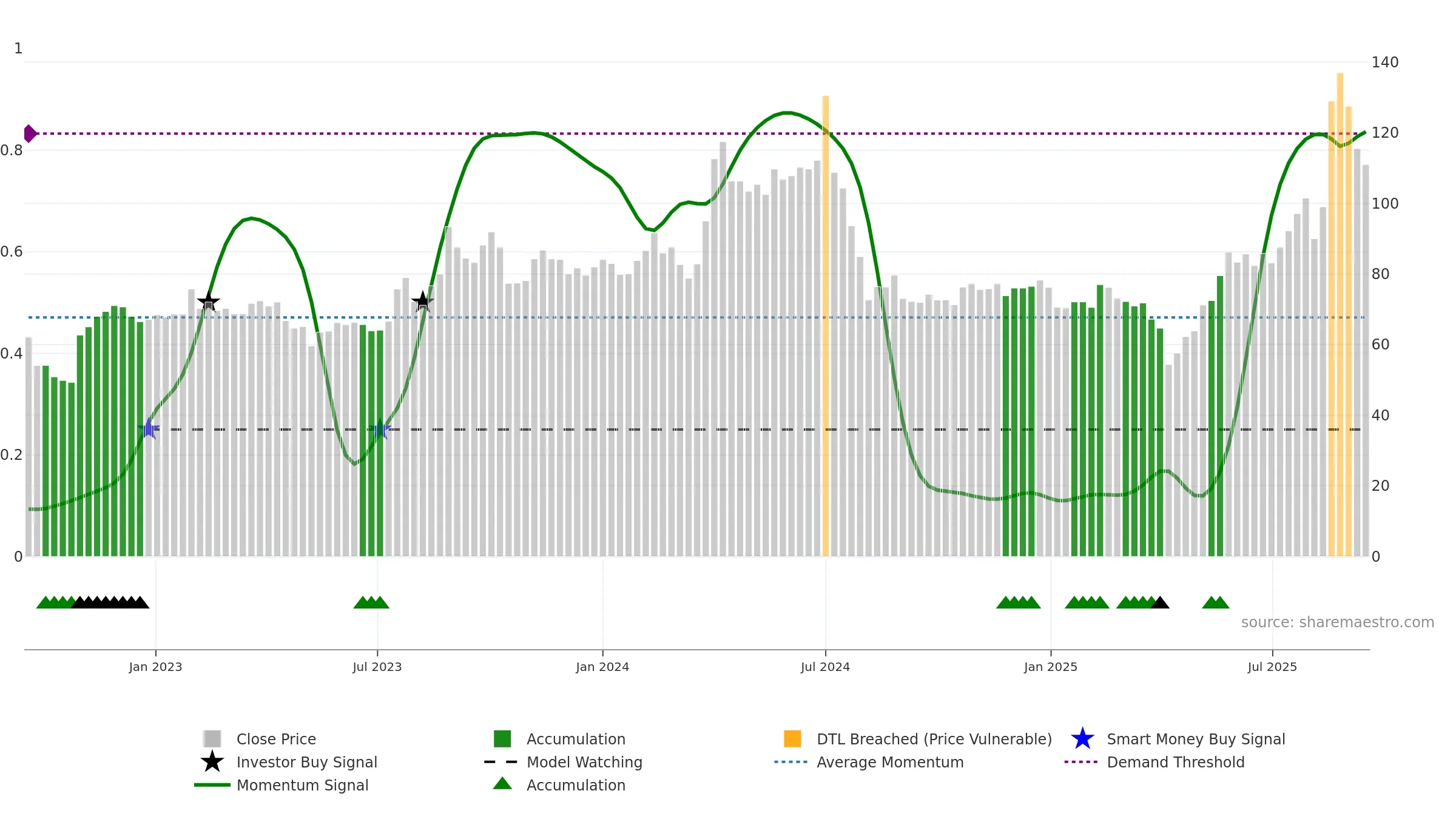

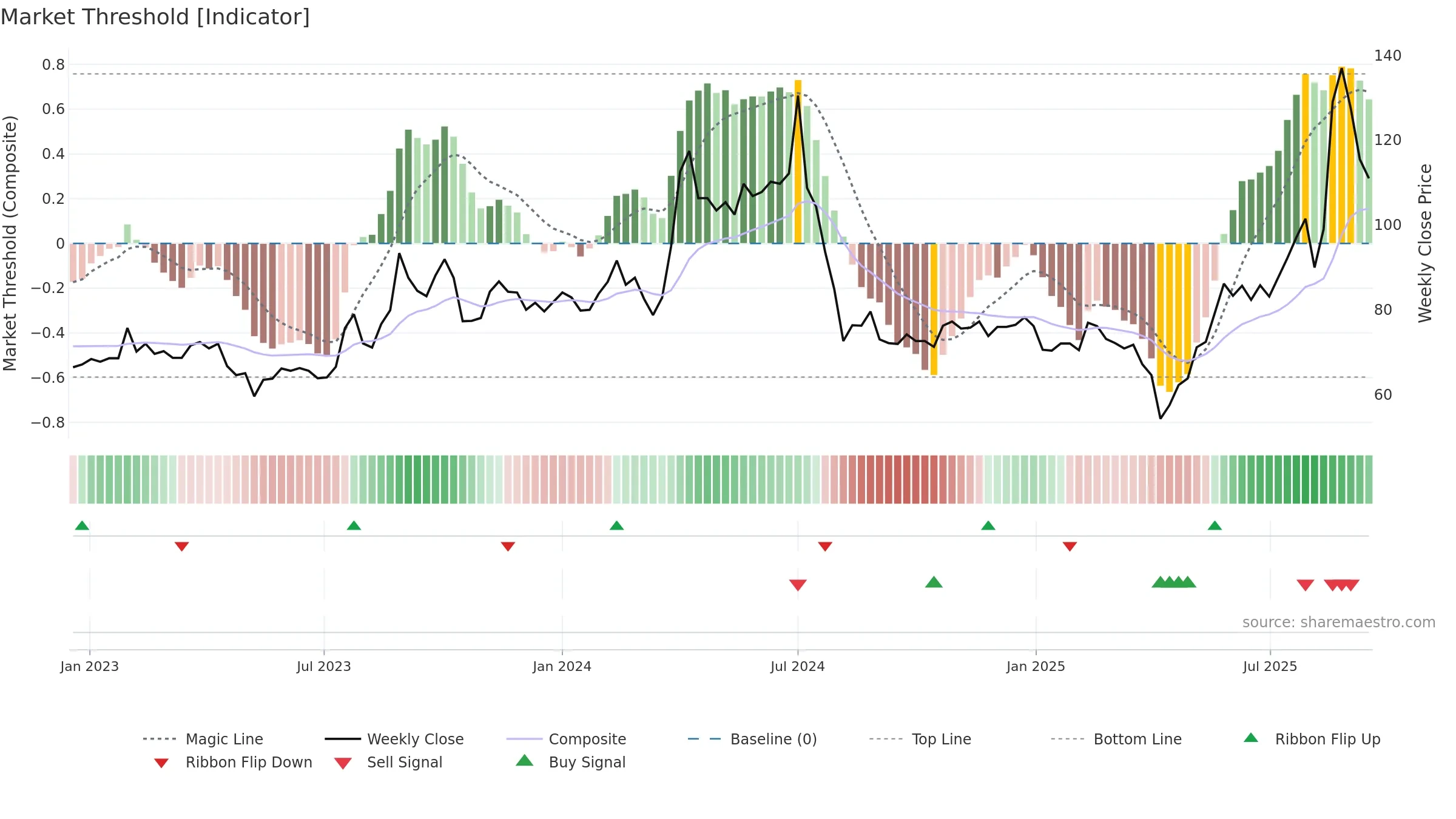

Gauge maps the trend signal to a 0–100 scale.

How to read this — Range-bound conditions; conviction is limited until a break or acceleration emerges.

Wait for a directional break or improving acceleration.

Price is above fair value; upside may be capped without catalysts.

Conclusion

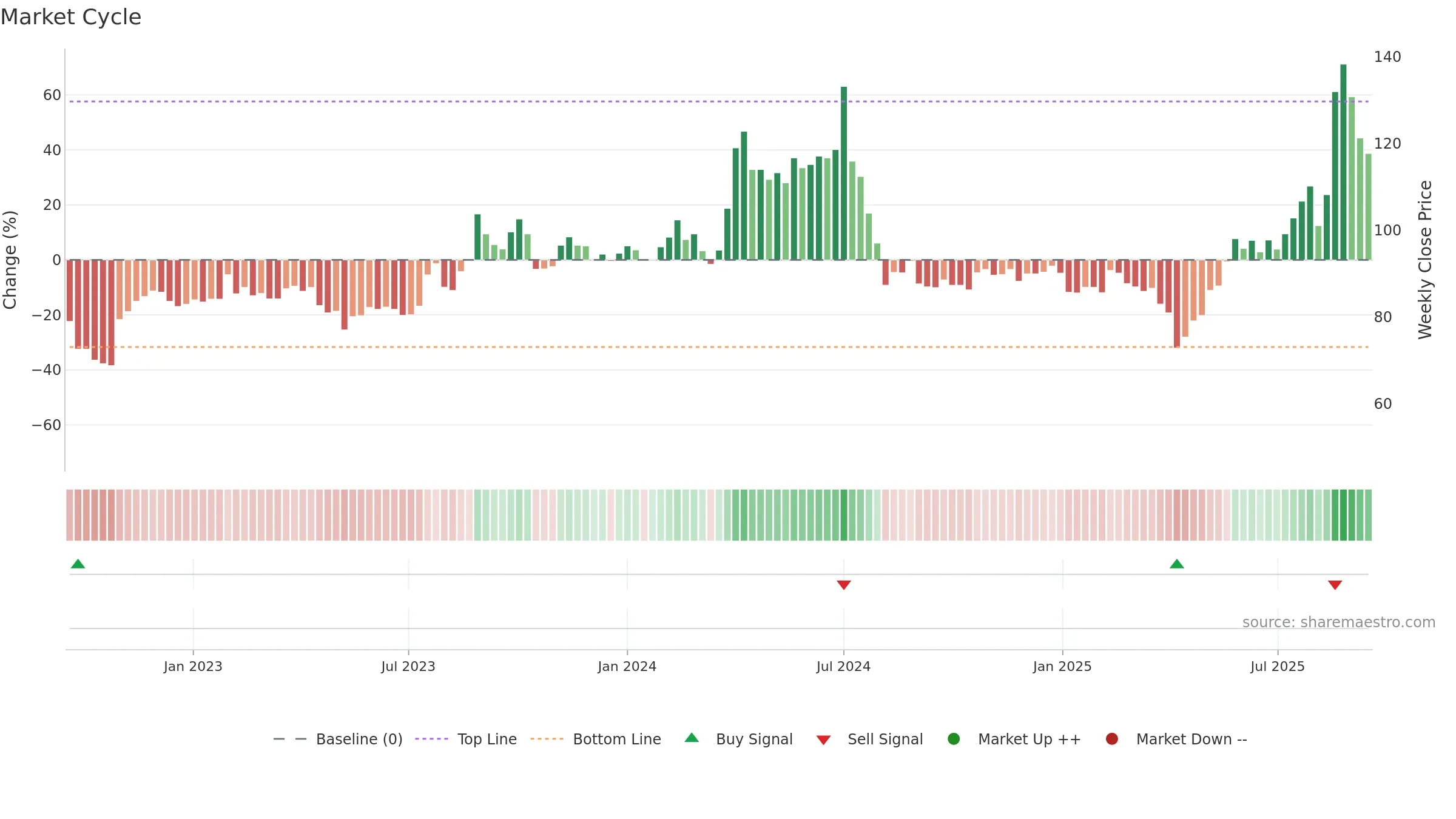

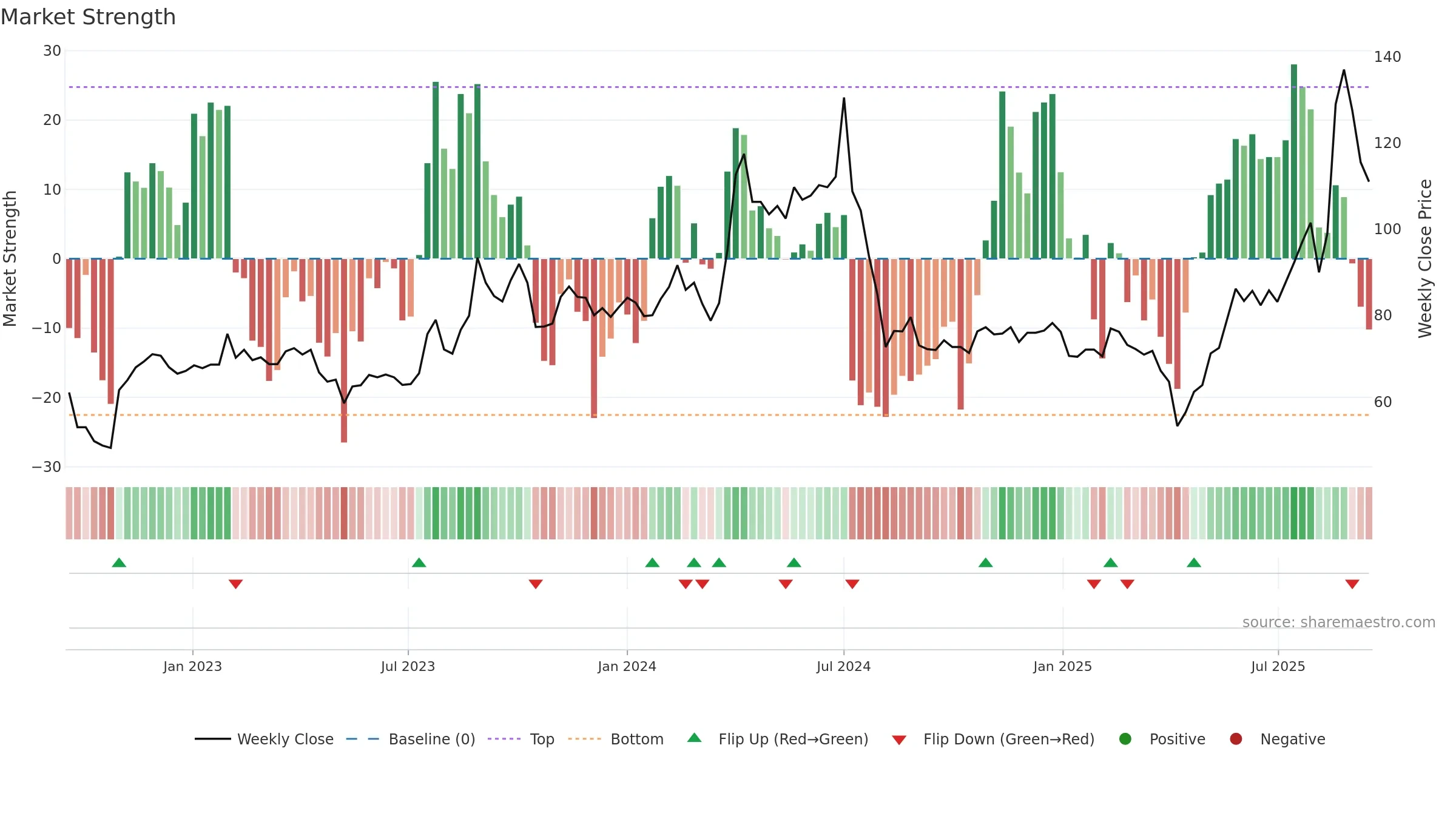

Negative setup. ★★☆☆☆ confidence. Price window: 9. Trend: Range / Neutral; gauge 83. In combination, liquidity diverges from price.

- Momentum is bullish and rising

- Constructive moving-average stack

- Price is not above key averages

- Liquidity diverges from price

- High return volatility raises whipsaw risk

Why: Price window 9.36% over 8w. Close is -18.98% below the prior-window high. Return volatility 5.90%. Volume trend falling. Liquidity divergence with price. Trend state range / neutral. High-regime (0.80–1.00) downticks 2/7 (29.0%) • Accumulating. MA stack constructive. Momentum bullish and rising. Valuation limited upside without catalysts.

Tip: Most metrics include a hover tooltip where they appear in the report.