PNB Housing Finance Limited

PNBHOUSING NSE

Weekly Report

PNB Housing Finance Limited closed at 835.3000 (0.11% WoW) . Data window ends Mon, 15 Sep 2025.

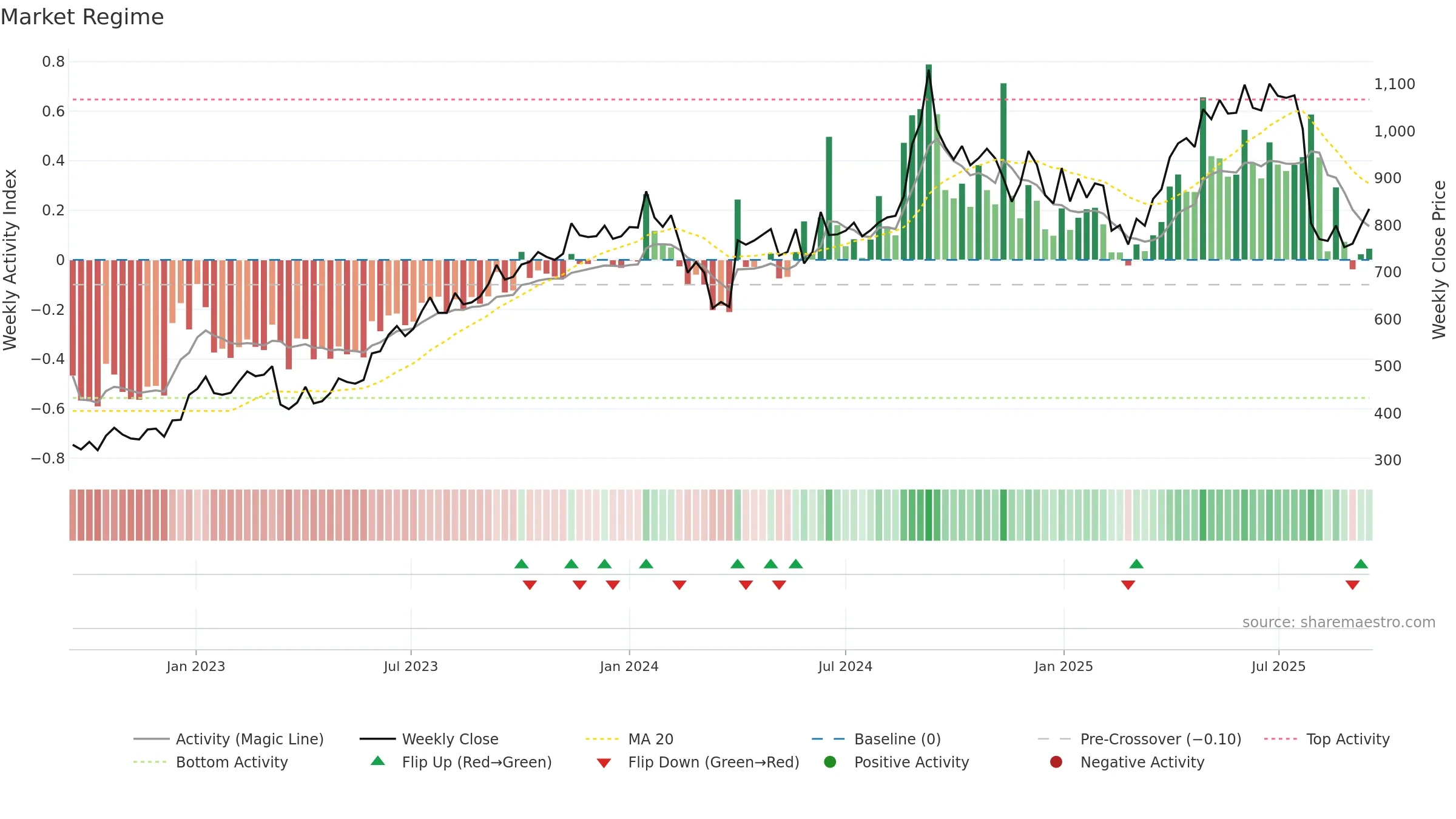

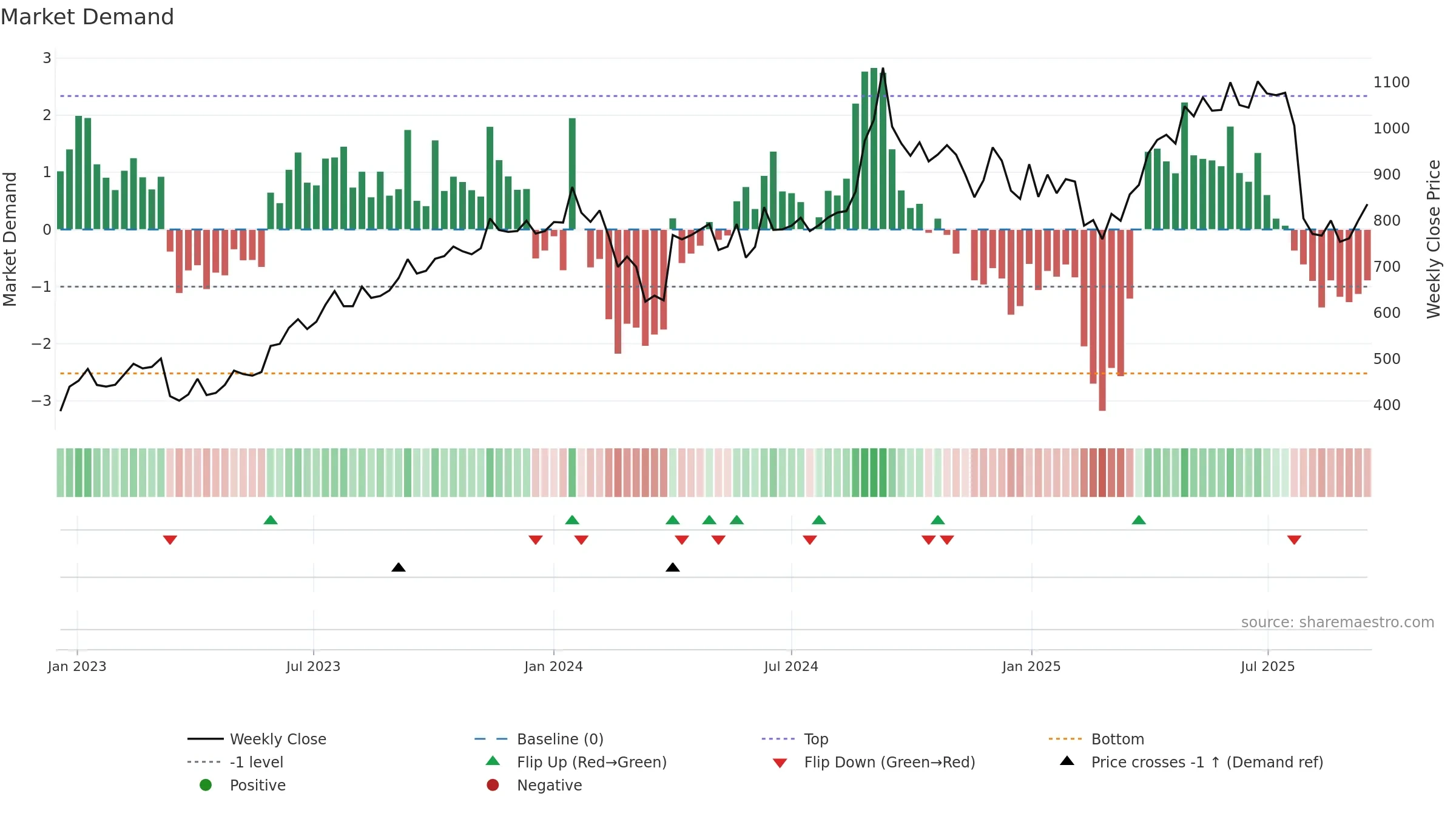

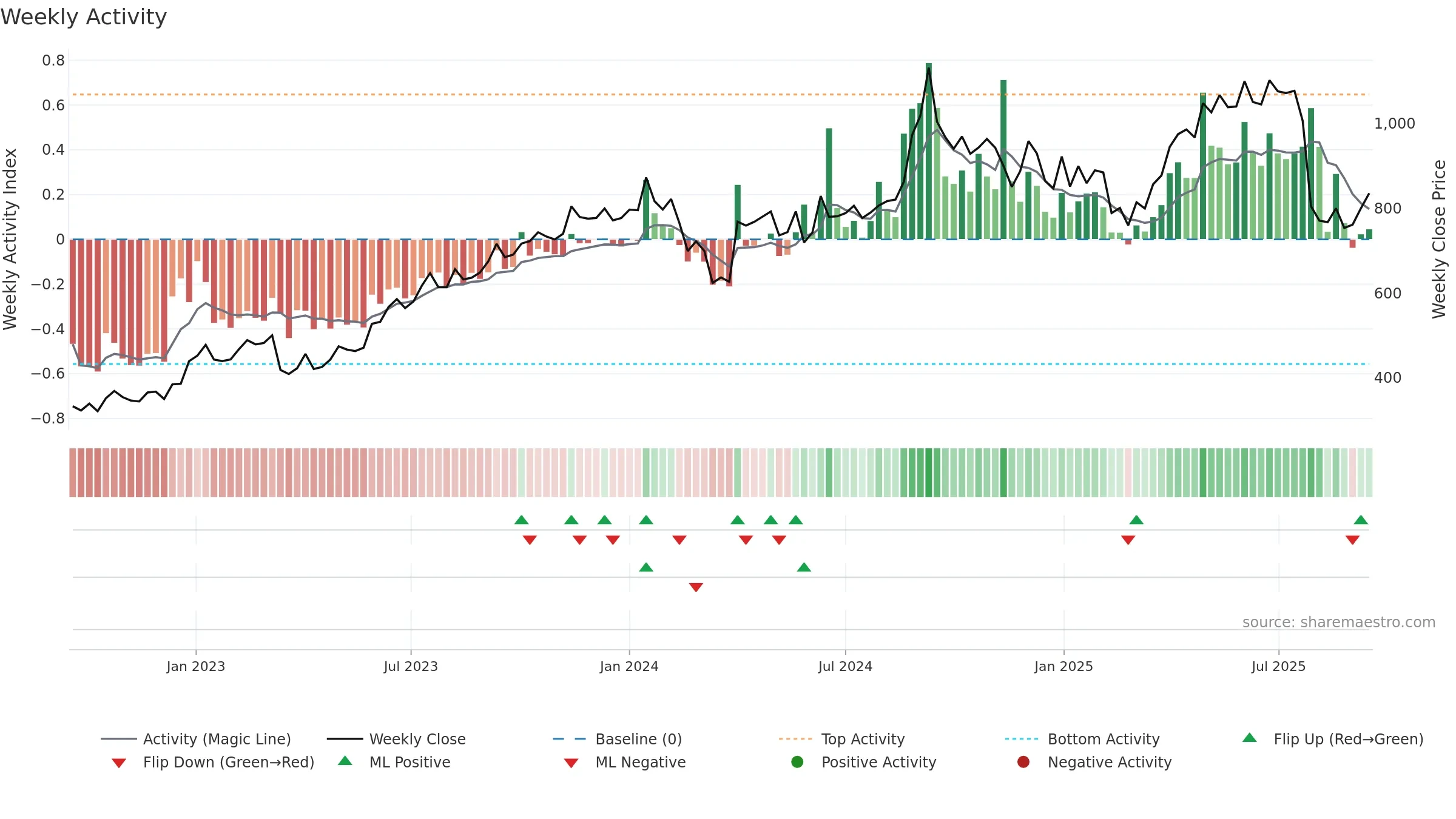

How to read this — Price slope is upward, indicating persistent buying over the window. Elevated weekly volatility increases whipsaw risk. Volume trend diverges from price — watch for fatigue or rotation. Returns are negatively correlated with volume — strength may come on lighter activity. Price is stretched above its baseline; consolidation risk rises if activity fades. Fresh short-term crossover improves near-term tone.

Up-slope supports buying interest; pullbacks may be contained if activity stays firm. Because liquidity isn’t confirming, prefer evidence of fresh demand before chasing moves.

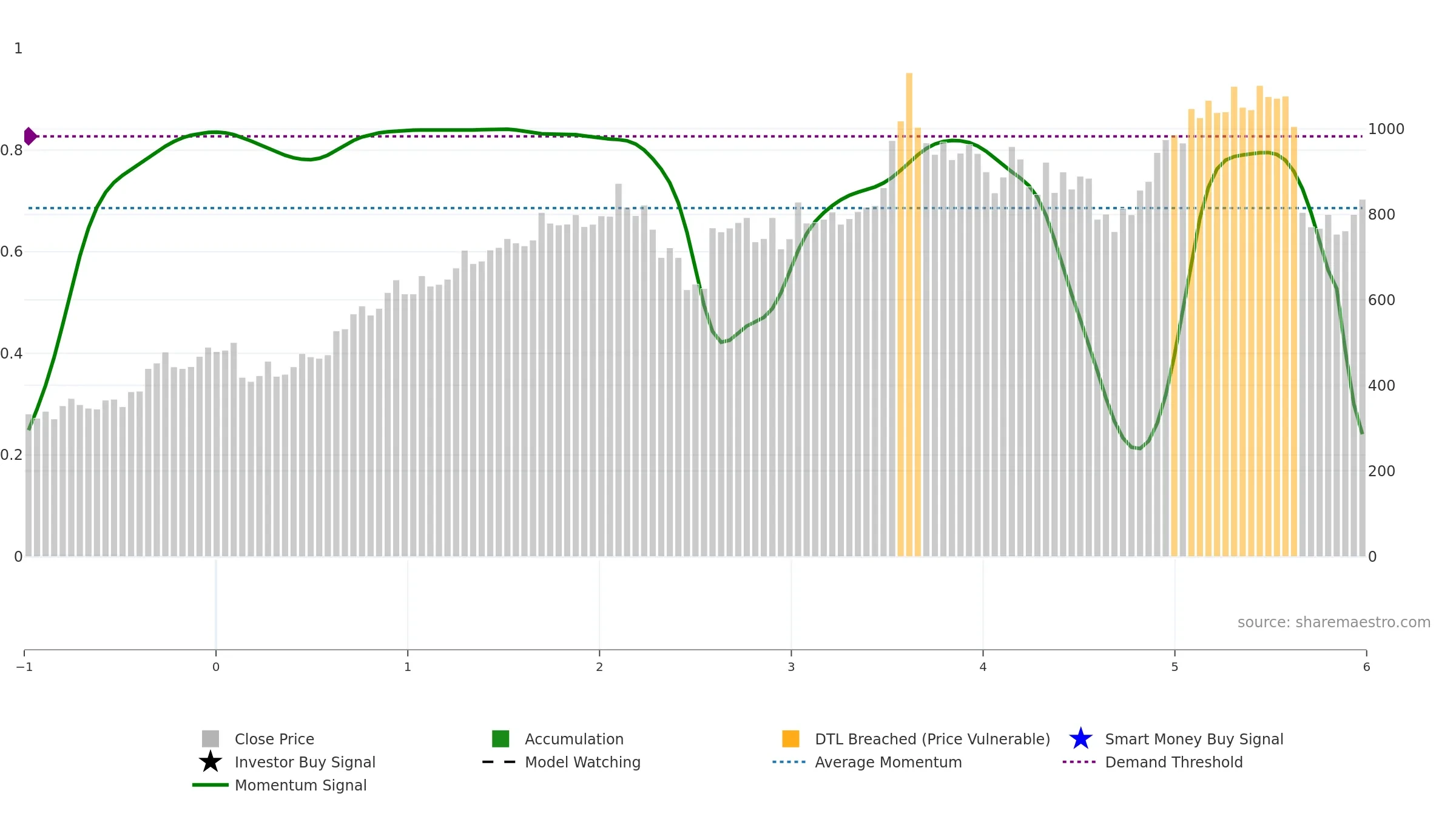

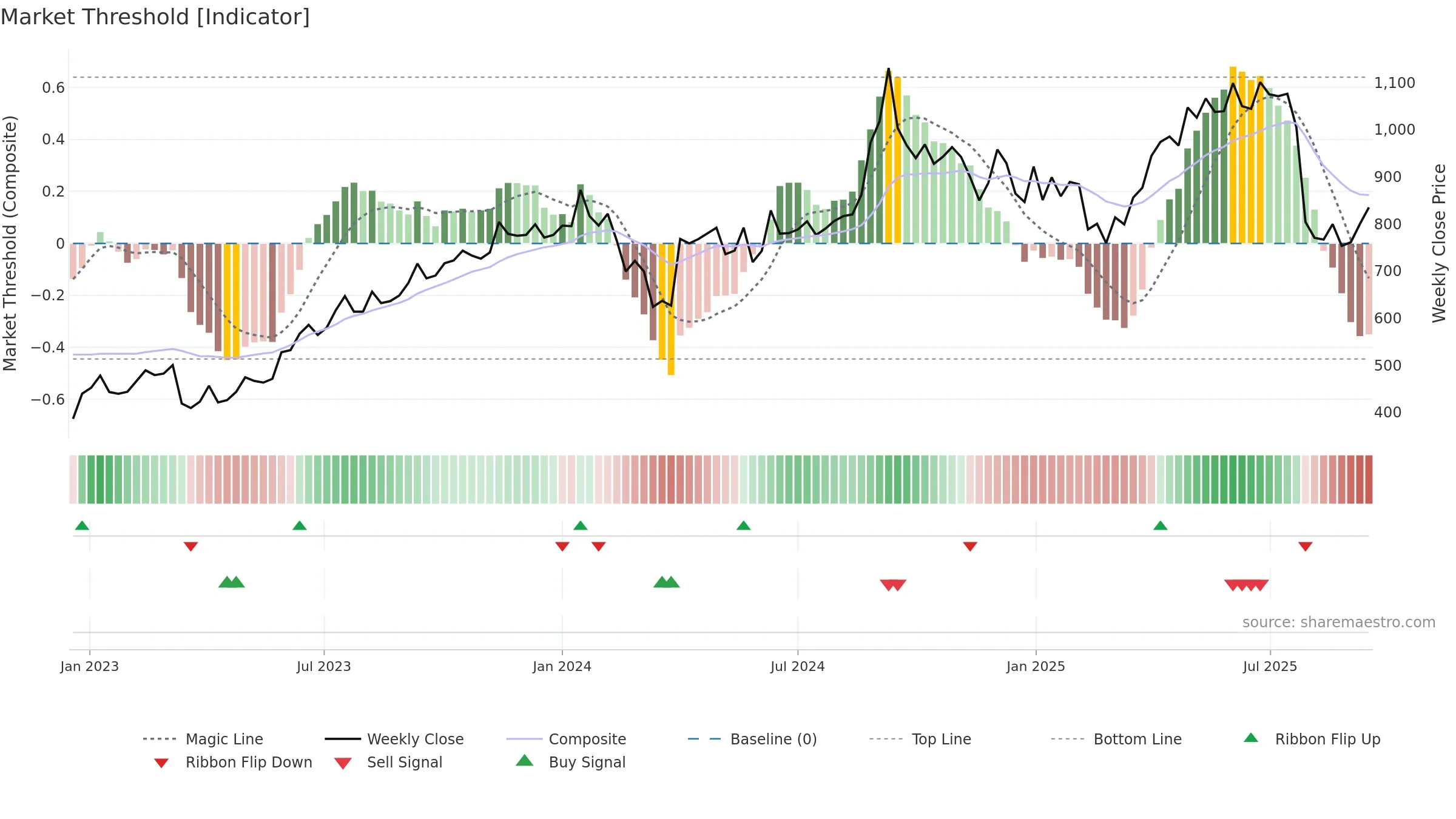

Gauge maps the trend signal to a 0–100 scale.

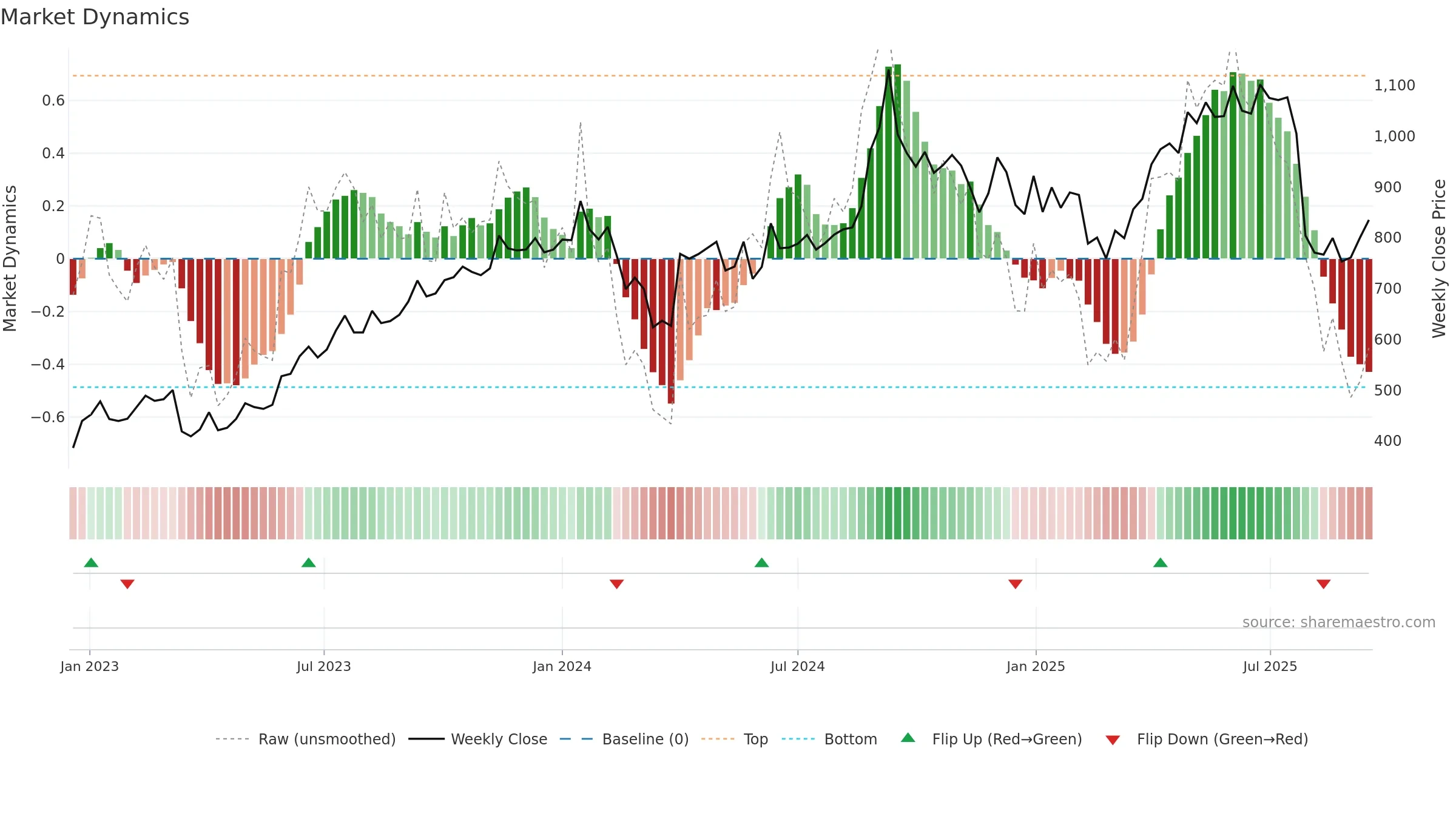

How to read this — Bearish zone with falling momentum — sellers in control. Loss of the ~0.50 midline after strength suggests regime shift. Sub-0.40 print confirms downside control.

Bias remains lower; rallies are suspect unless gauge reclaims 0.50/0.60.

Price is above fair value; upside may be capped without catalysts.

Conclusion

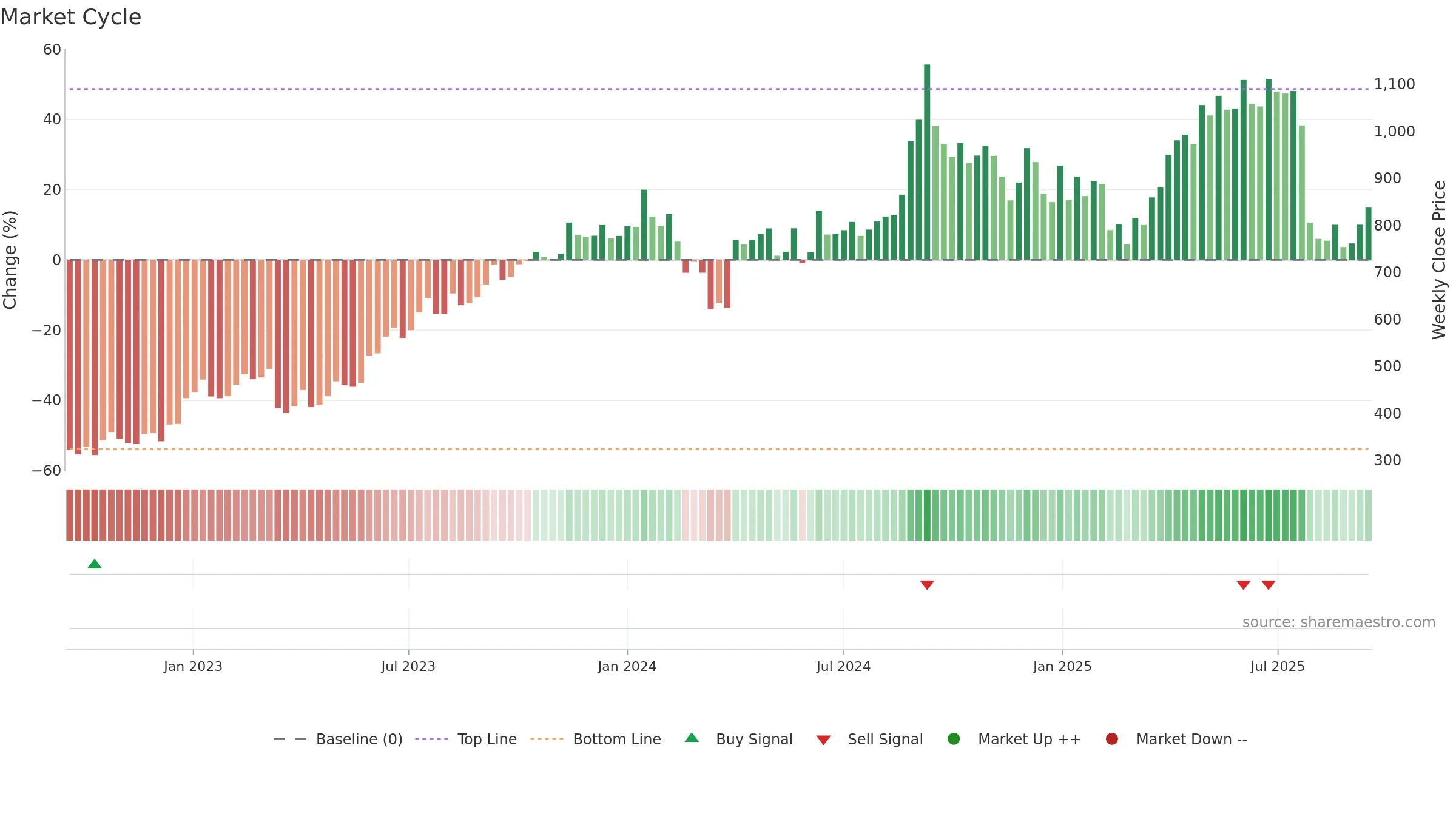

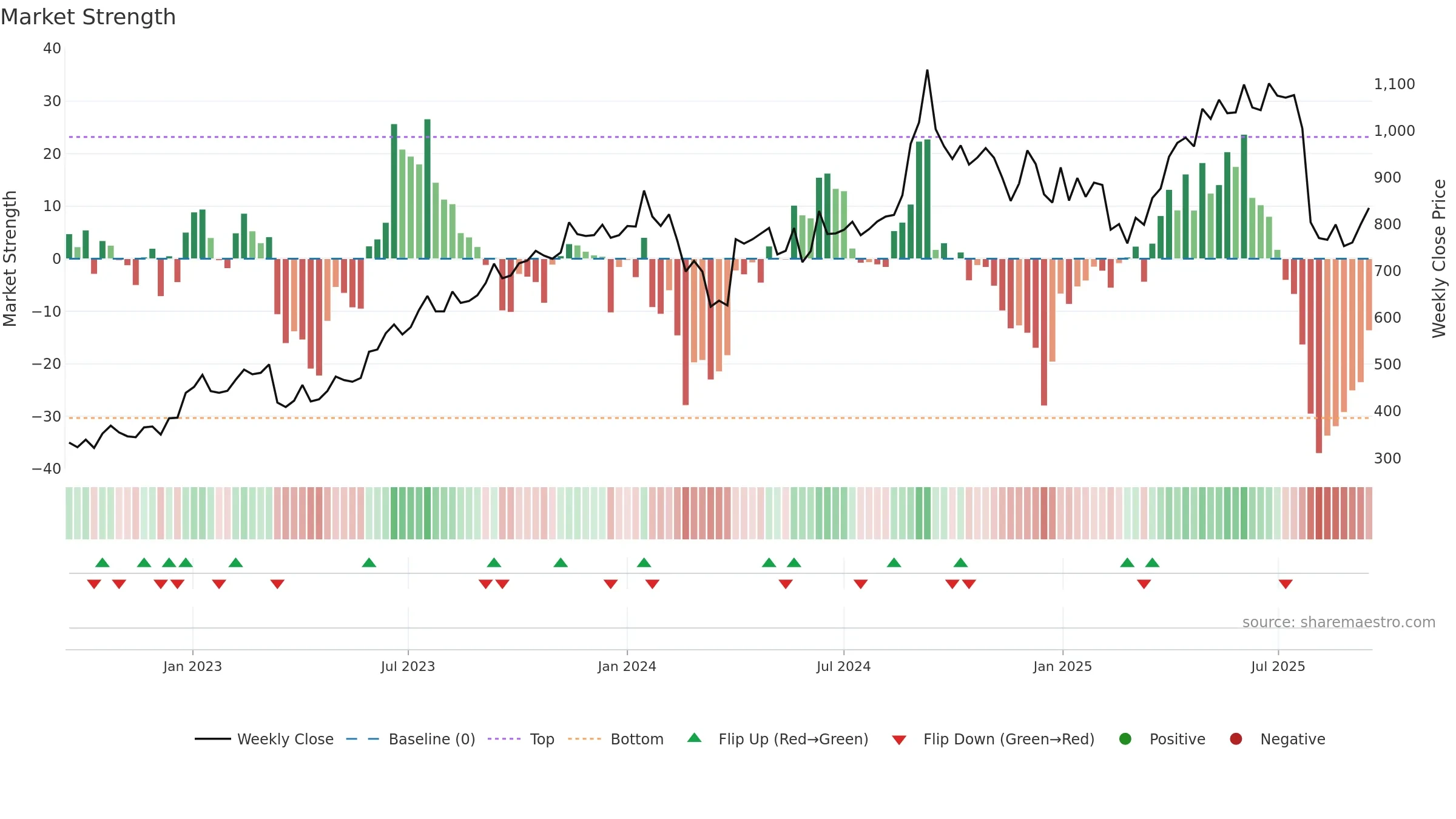

Negative setup. ★☆☆☆☆ confidence. Price window: 3. Trend: Downtrend Confirmed; gauge 24. In combination, liquidity diverges from price.

- Bearish control with falling momentum

- Momentum is weak/falling

- Price is not above key averages

- Liquidity diverges from price

Why: Price window 3.85% over 8w. Close is 3.85% above the prior-window high. Return volatility 6.85%. Volume trend falling. Liquidity divergence with price. Trend state downtrend confirmed. 4–8w crossover bullish. Momentum bearish and falling. Valuation limited upside without catalysts.

Tip: Most metrics include a hover tooltip where they appear in the report.