Scorpio Tankers Inc.

STNG NYSE

Weekly Summary

Scorpio Tankers Inc. closed at 58.8100 (-1.01% WoW) . Data window ends Fri, 19 Sep 2025.

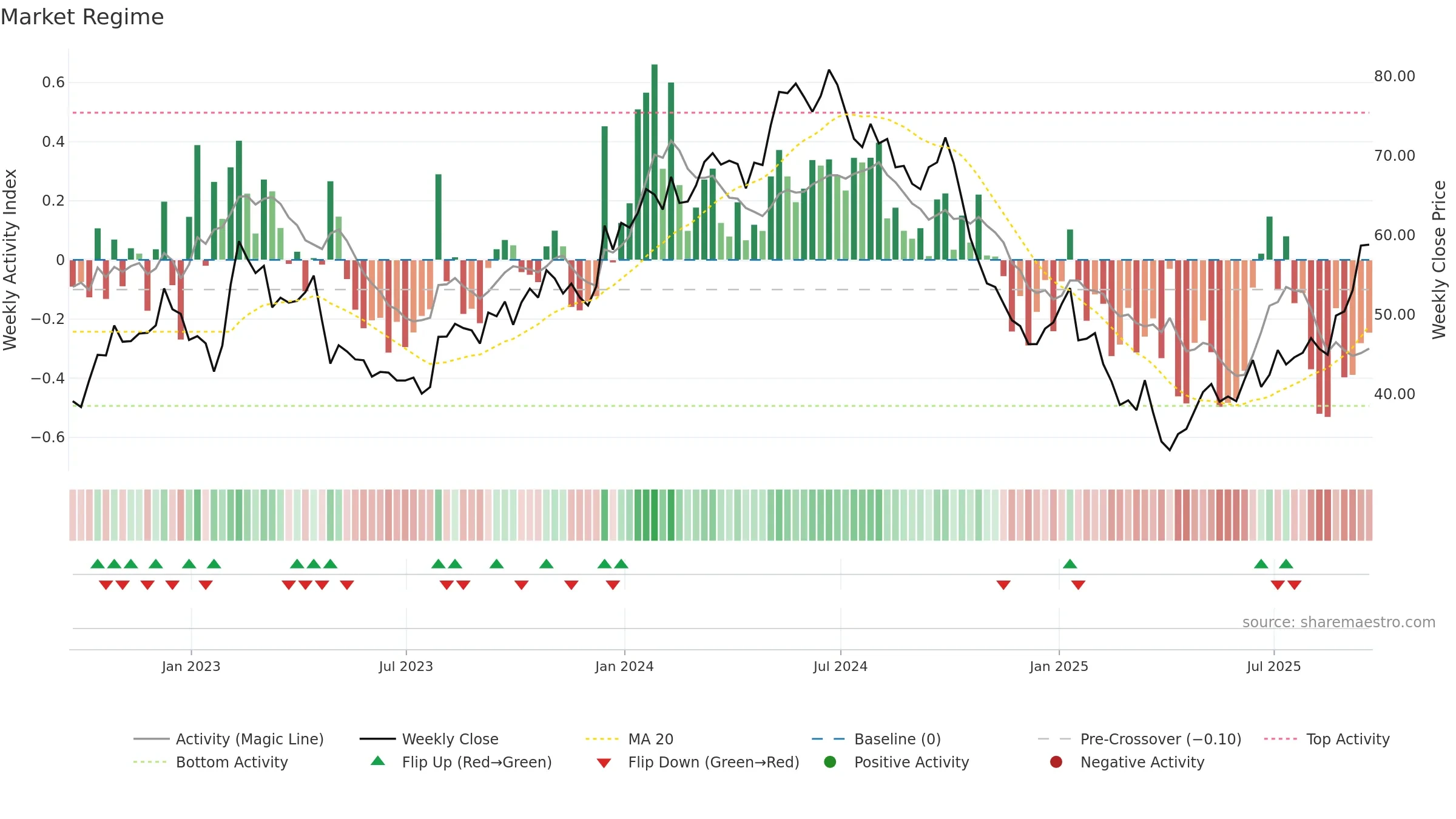

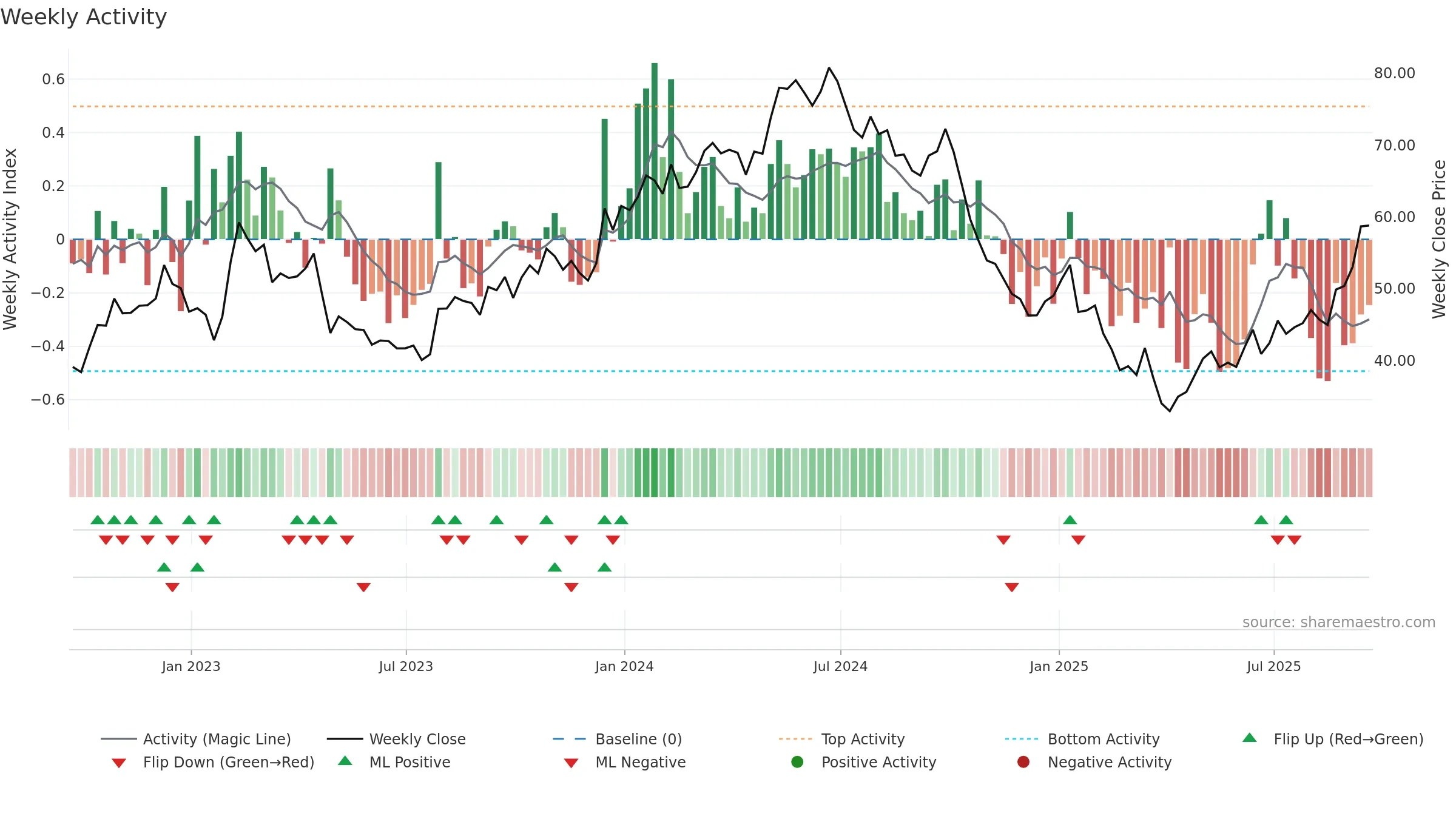

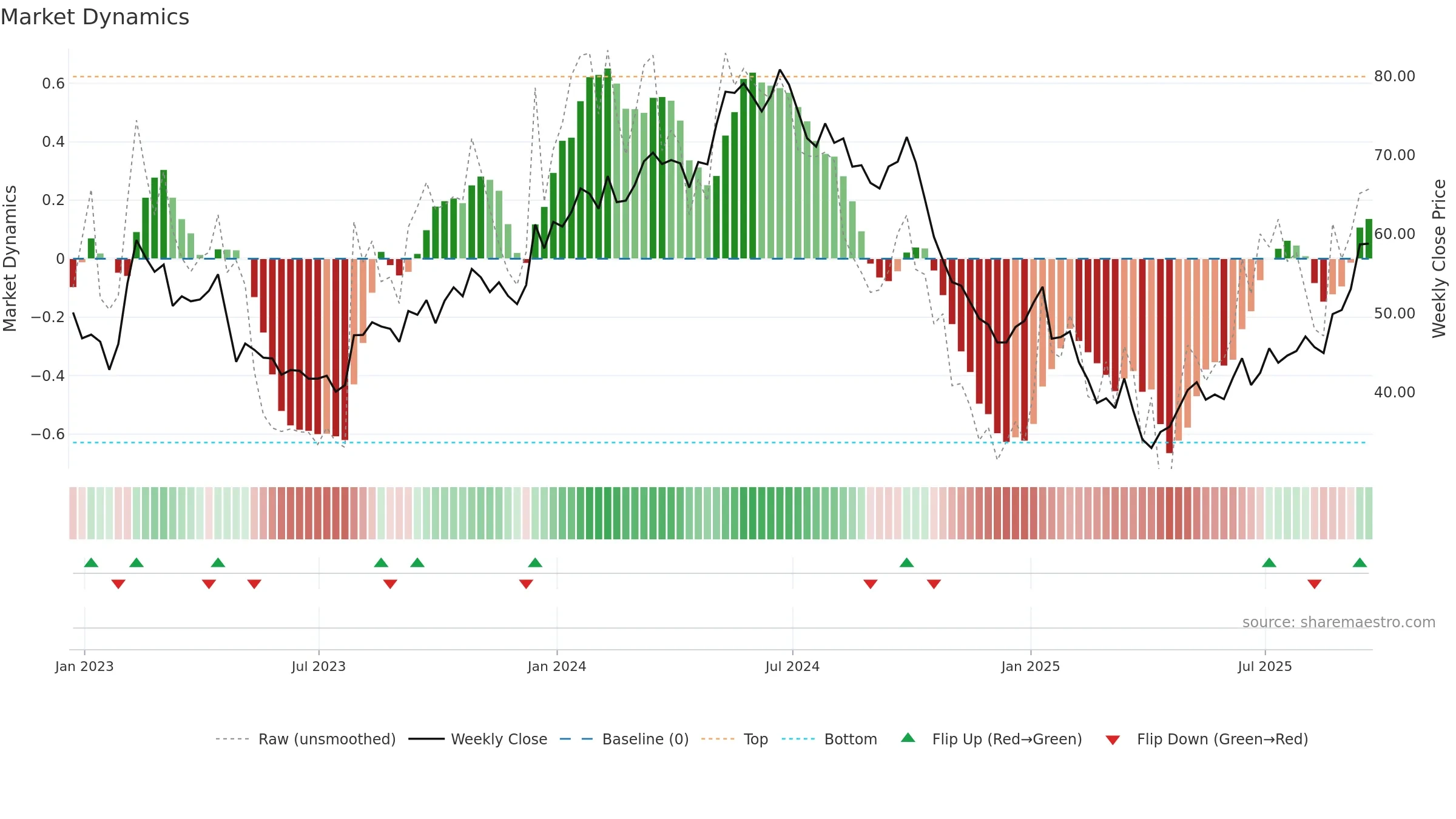

How to read this — Price slope is upward, indicating persistent buying over the window. Volume trend diverges from price — watch for fatigue or rotation. Returns are positively correlated with volume — strength tends to arrive on higher activity. Distance to baseline is narrowing — reverting closer to its fair-value track. Constructive MA stack supports the up-drift; pullbacks may find support at the 8–13 week region. Price holds above key averages, indicating constructive participation.

Up-slope supports buying interest; pullbacks may be contained if activity stays firm. Because liquidity isn’t confirming, prefer evidence of fresh demand before chasing moves.

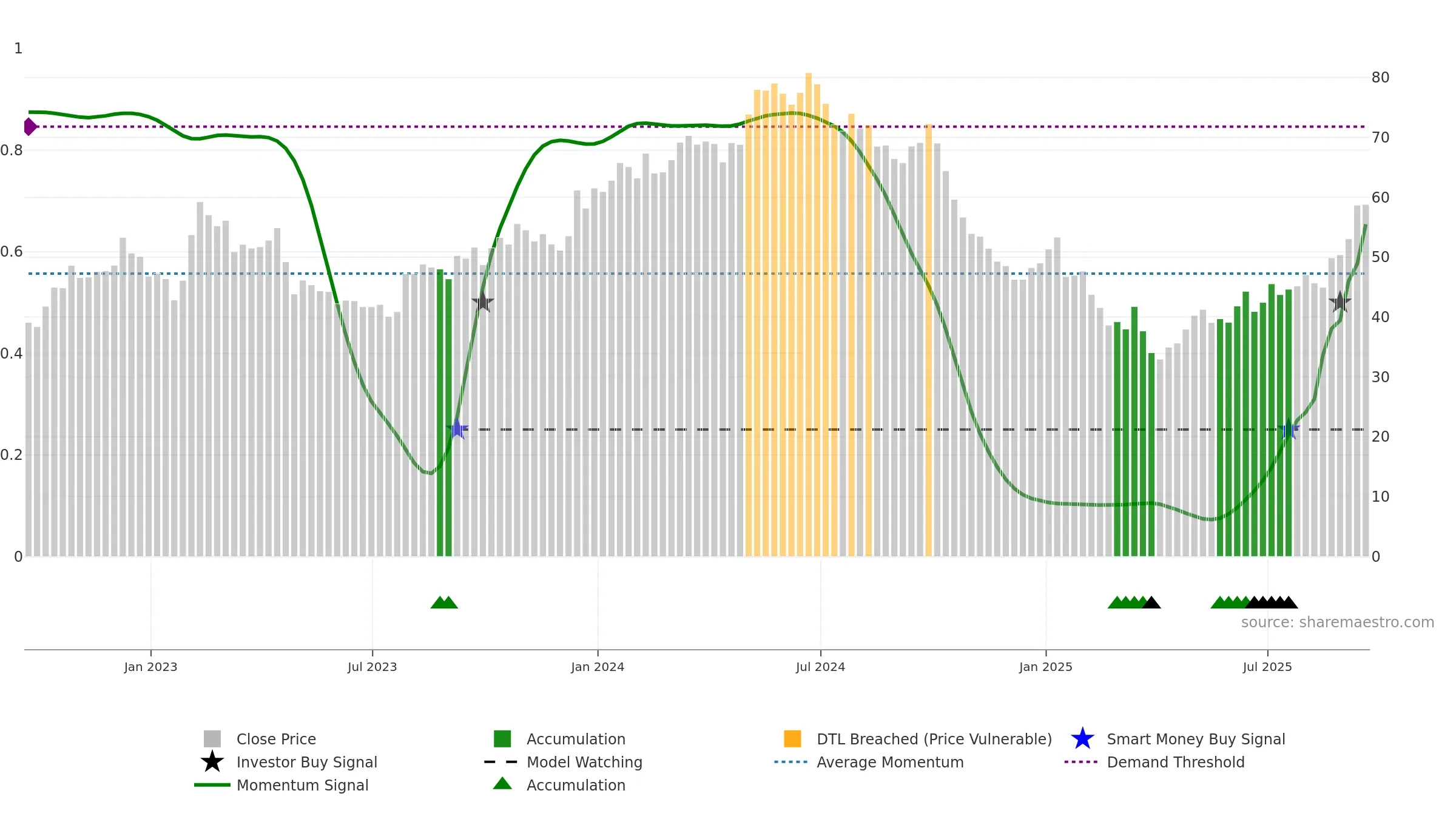

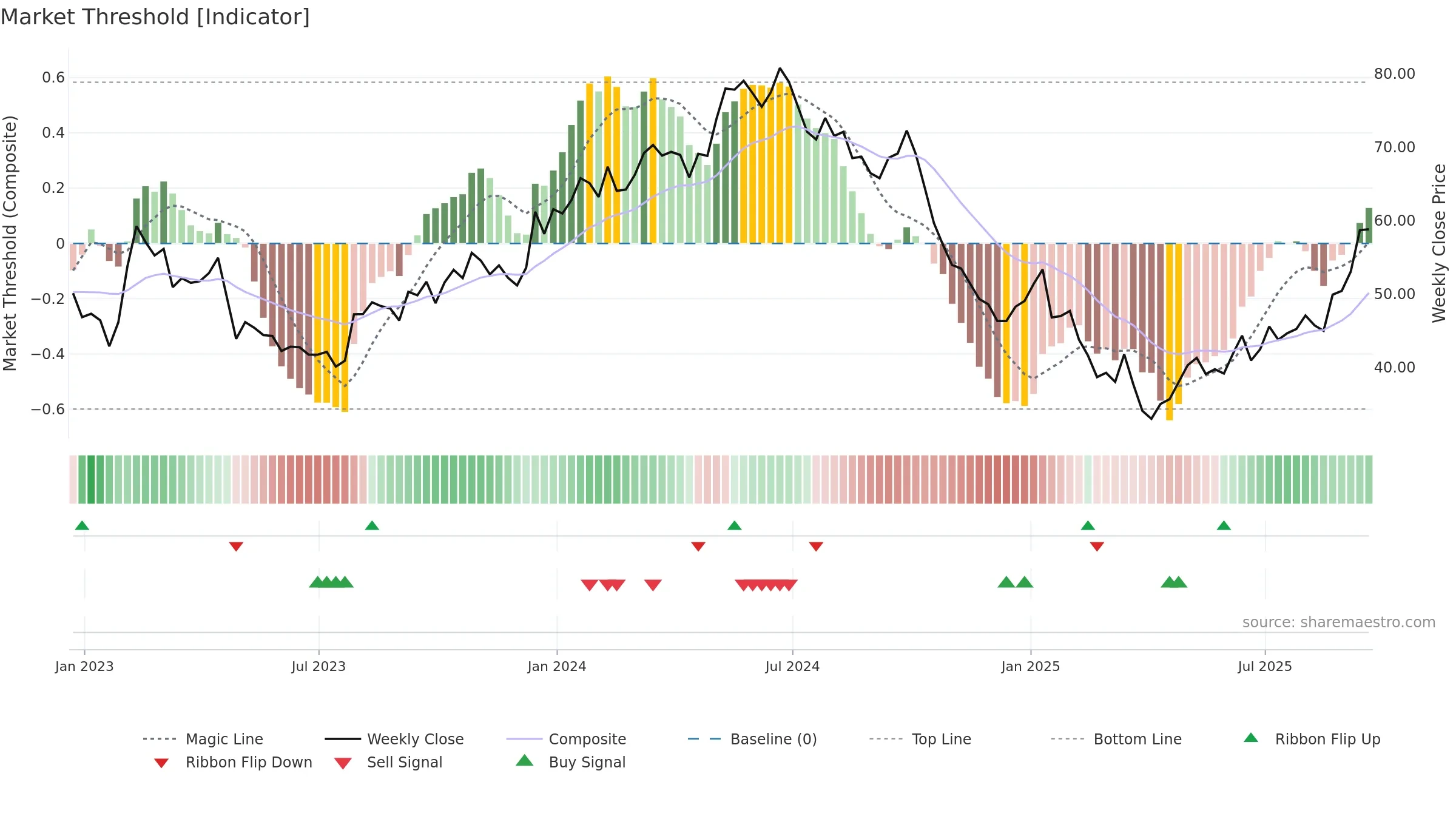

Gauge maps the trend signal to a 0–100 scale.

How to read this — High gauge and rising momentum — buyers in control.

Bias remains higher; pullbacks could be buyable if participation holds.

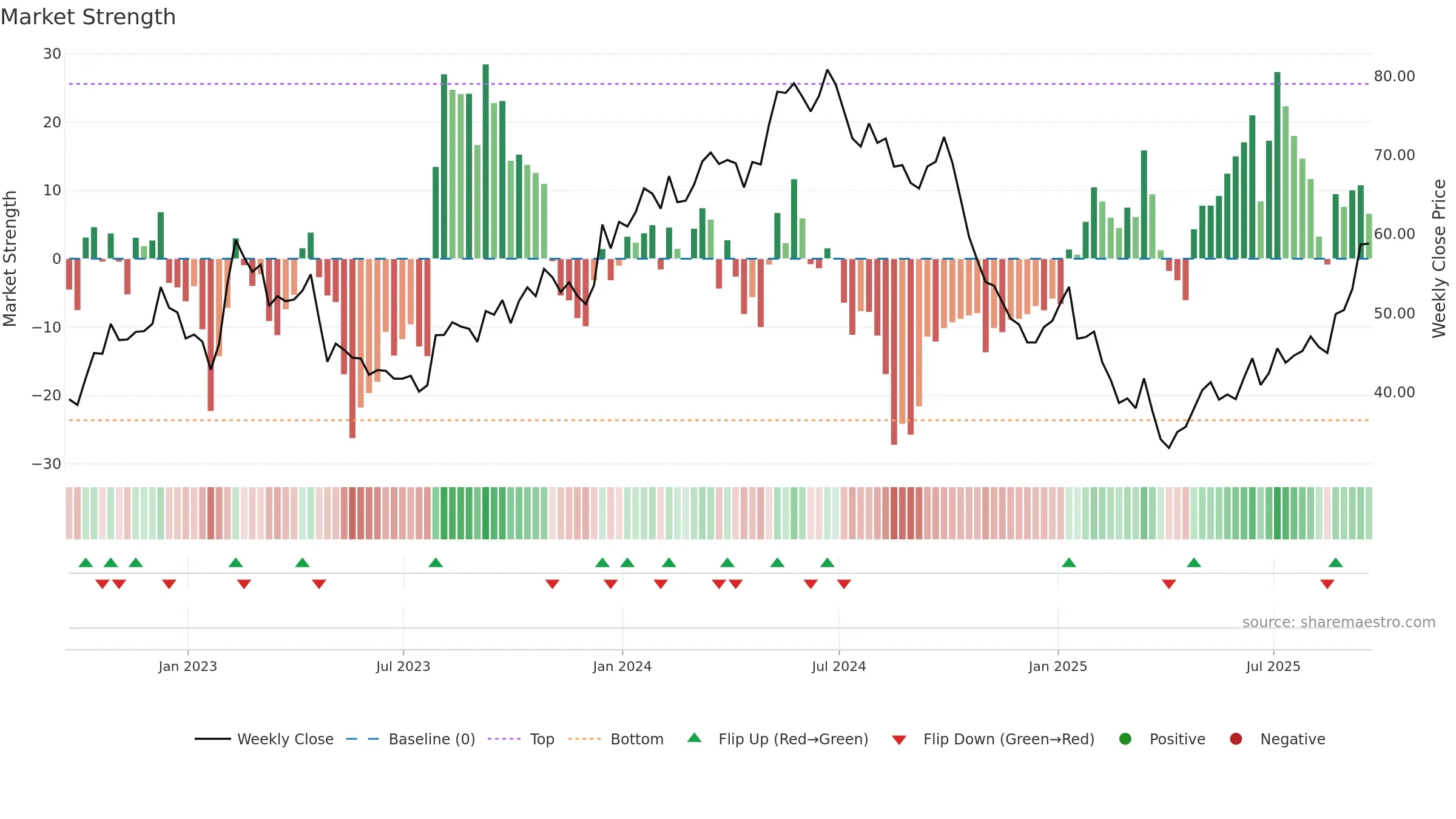

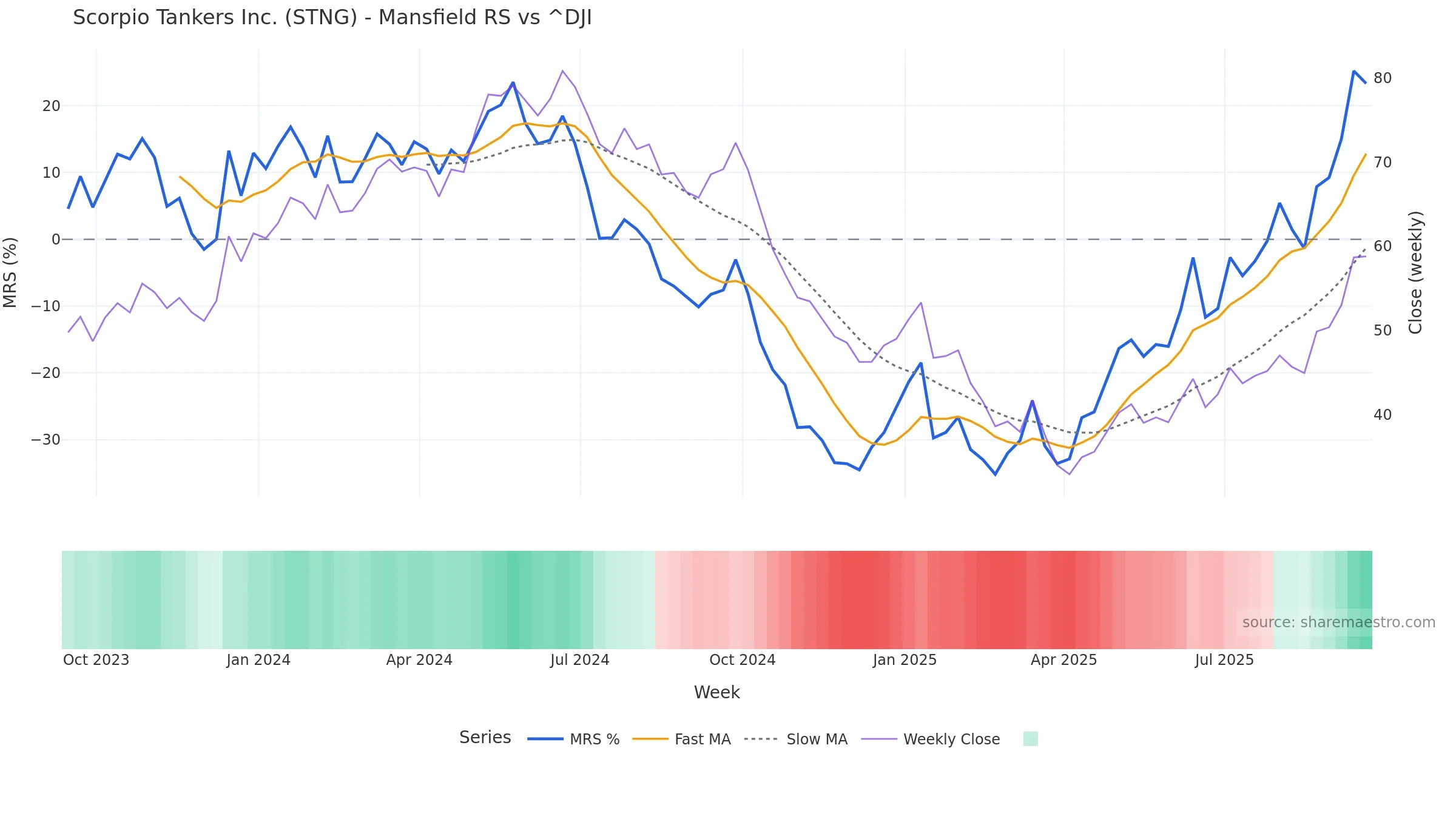

Relative strength is Positive

(> 0%, outperforming).

Latest MRS: 23.33% (week ending Fri, 19 Sep 2025).

Slope: Rising over 8w.

Notes:

- Holding above the zero line indicates relative bid.

- MRS slope rising over ~8 weeks.

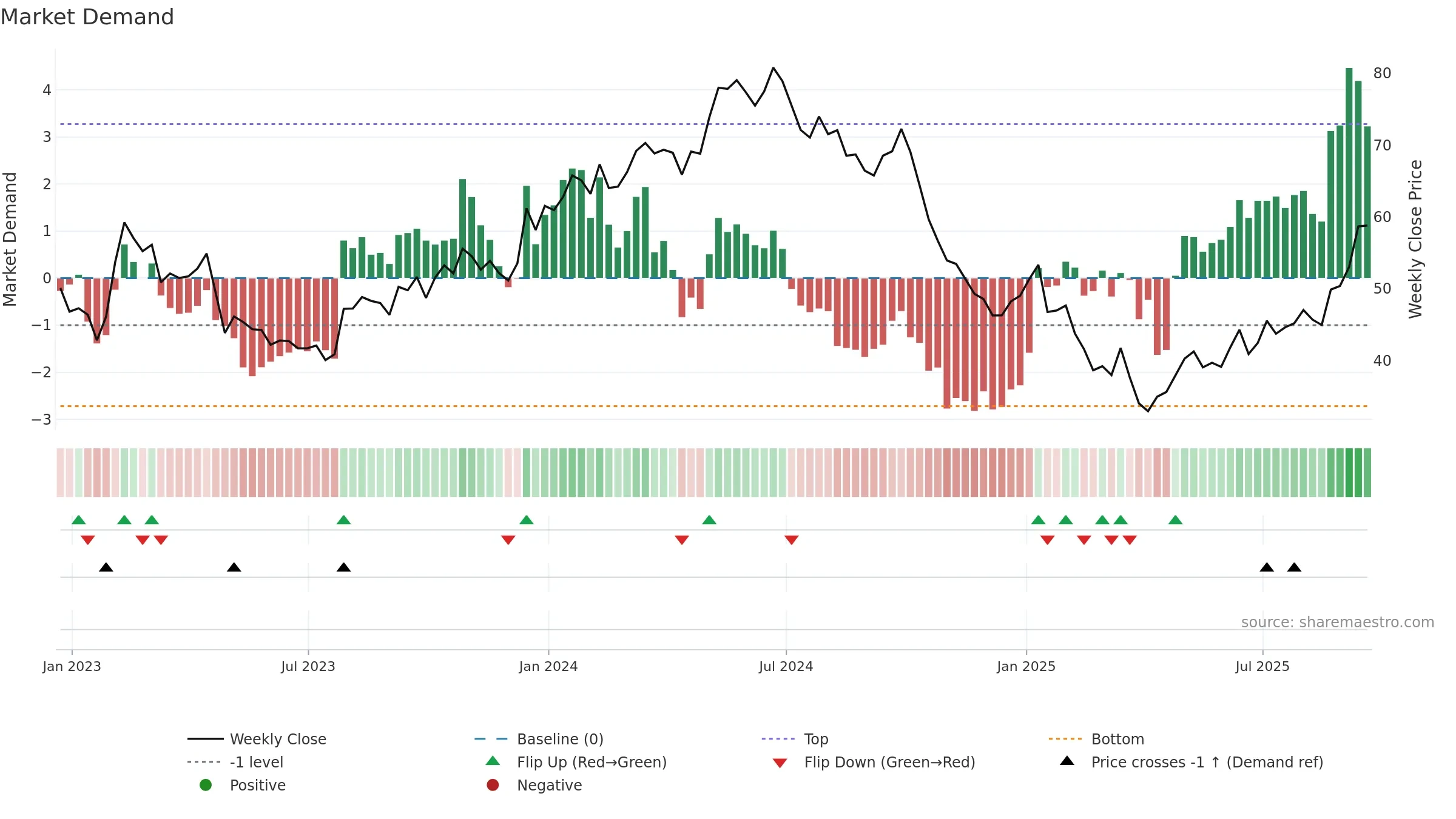

Price is below fair value; potential upside if momentum constructive.

Conclusion

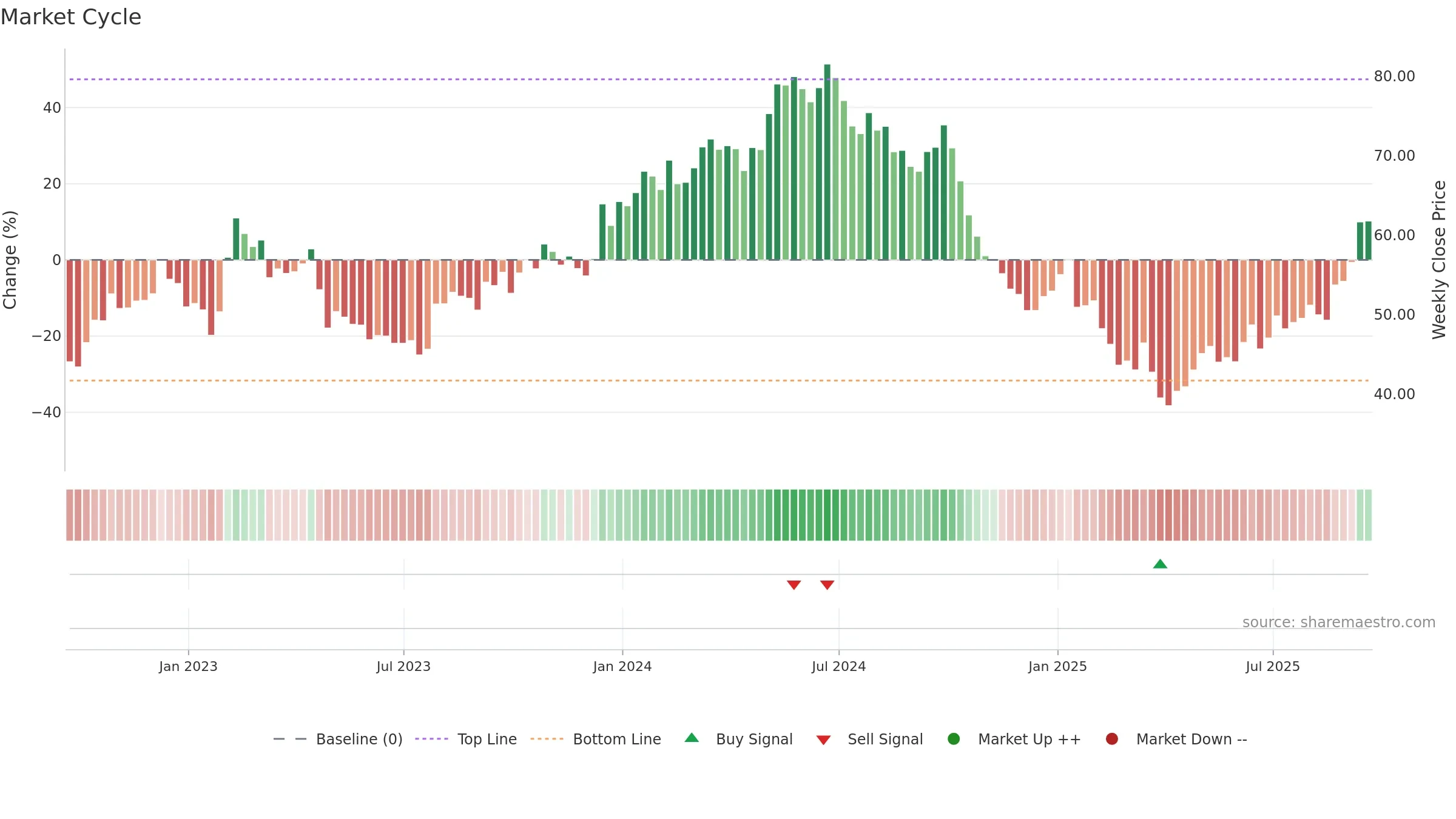

Positive setup. ★★★★⯪ confidence. Trend: Strong Uptrend · 24.99% over window · vol 2.33% · liquidity divergence · posture above · RS outperforming

- High gauge with rising momentum (strong uptrend)

- Momentum is bullish and rising

- Price holds above 8–26 week averages

- Constructive moving-average stack

- Liquidity diverges from price

Why: Price window 24.99% over w. Return volatility 2.33%. Volume trend falling. Liquidity divergence with price. Trend state strong uptrend. MA stack constructive. Momentum bullish and rising. Valuation supportive skew.

Tip: Most metrics include a hover tooltip where they appear in the report.