SMC Global Securities Limited

SMCGLOBAL NSE

Weekly Summary

SMC Global Securities Limited closed at 140.4300 (-1.72% WoW) . Data window ends Mon, 22 Sep 2025.

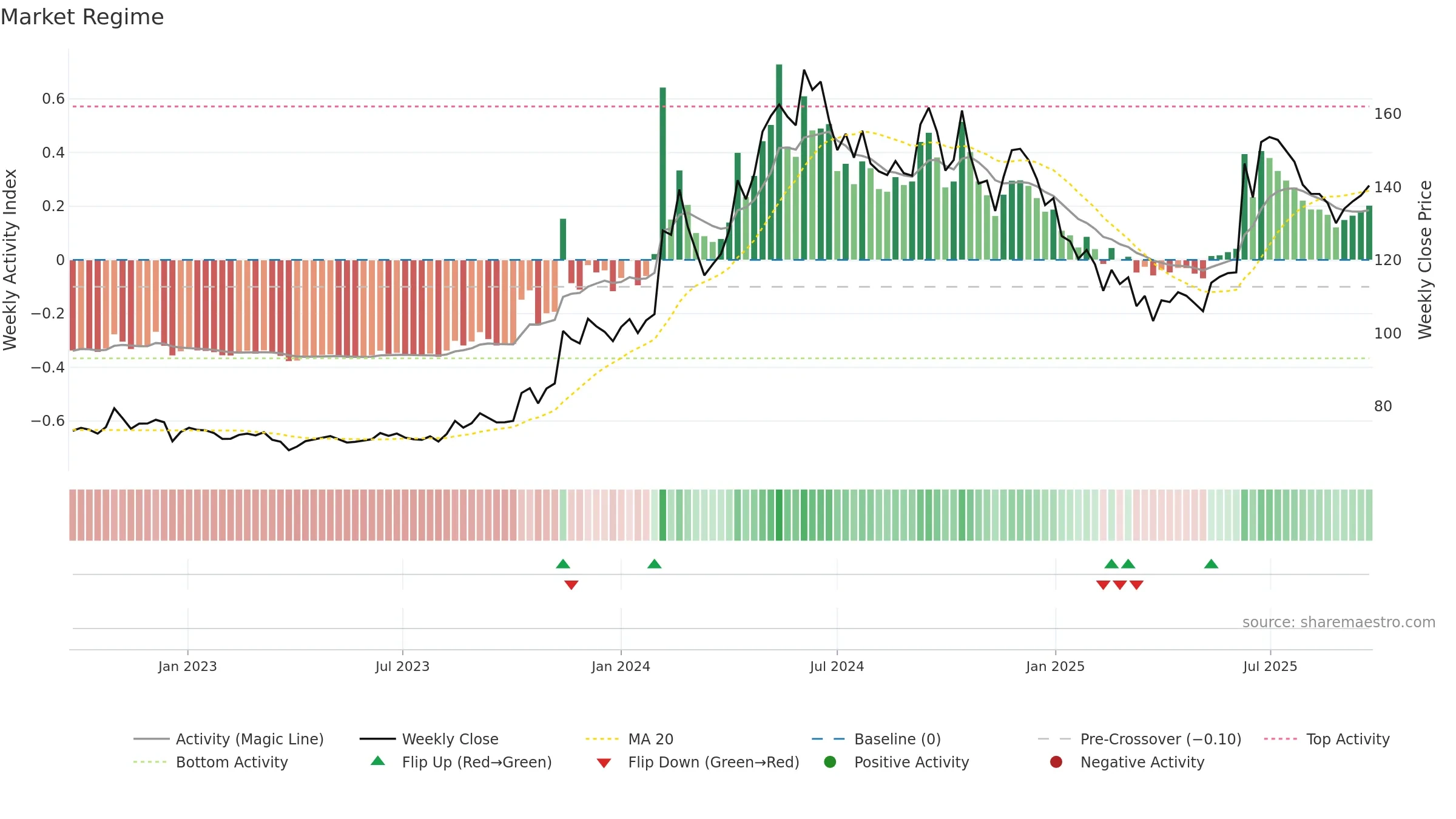

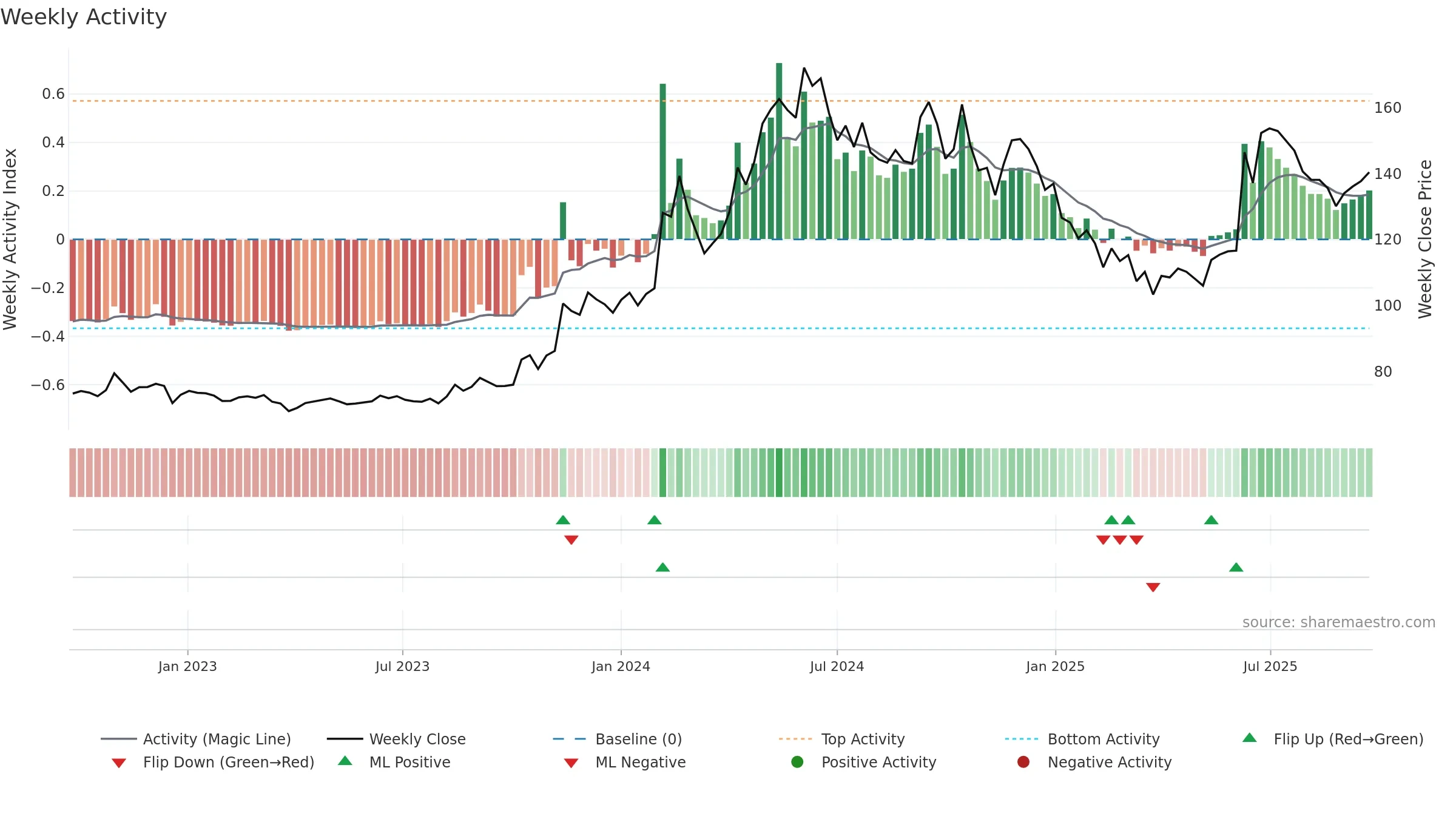

How to read this — Price slope is upward, indicating persistent buying over the window. Volume trend diverges from price — watch for fatigue or rotation. Returns are negatively correlated with volume — strength may come on lighter activity. Distance to baseline is narrowing — reverting closer to its fair-value track. Fresh short-term crossover improves near-term tone. Price holds above key averages, indicating constructive participation.

Up-slope supports buying interest; pullbacks may be contained if activity stays firm. Because liquidity isn’t confirming, prefer evidence of fresh demand before chasing moves.

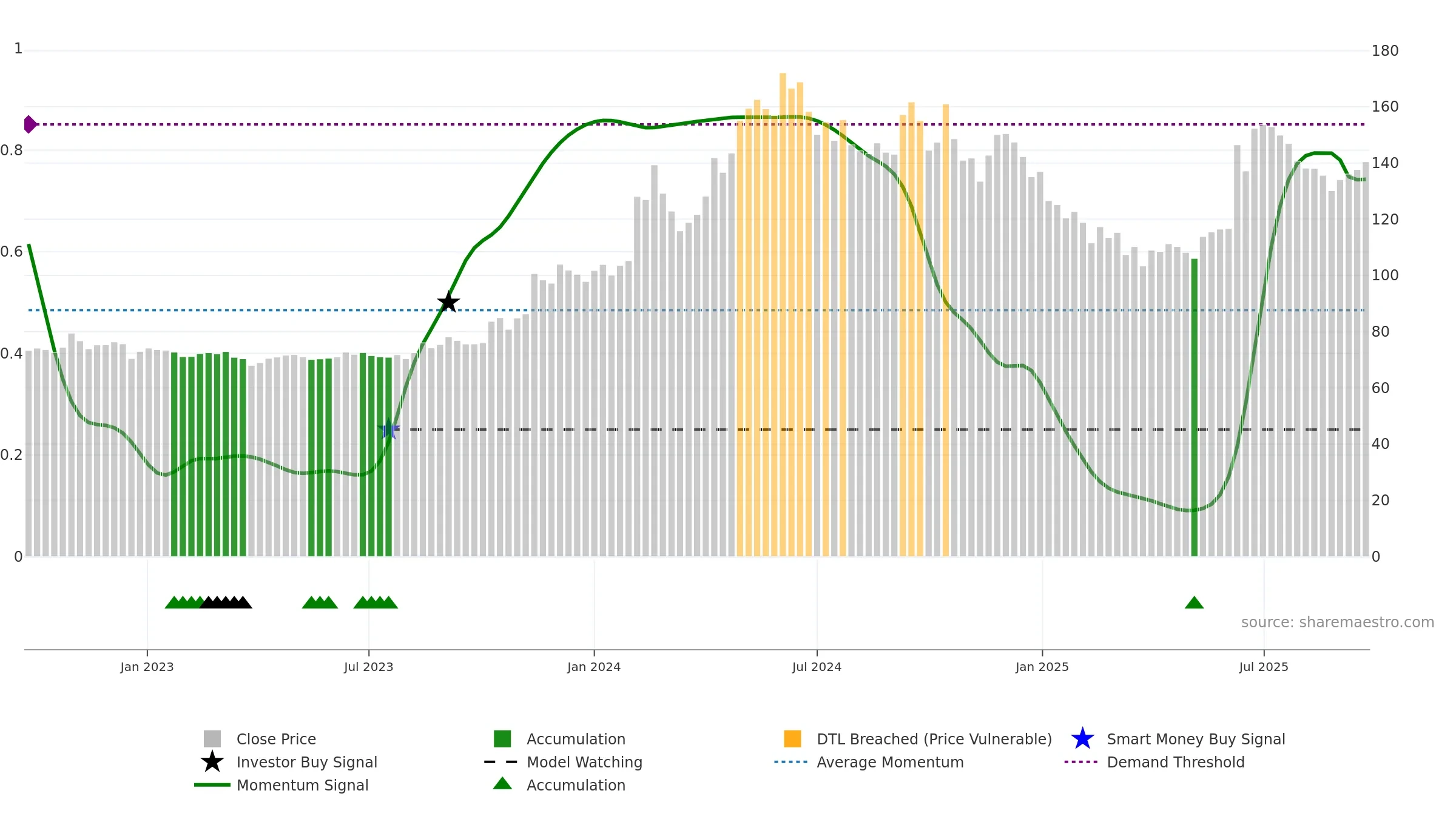

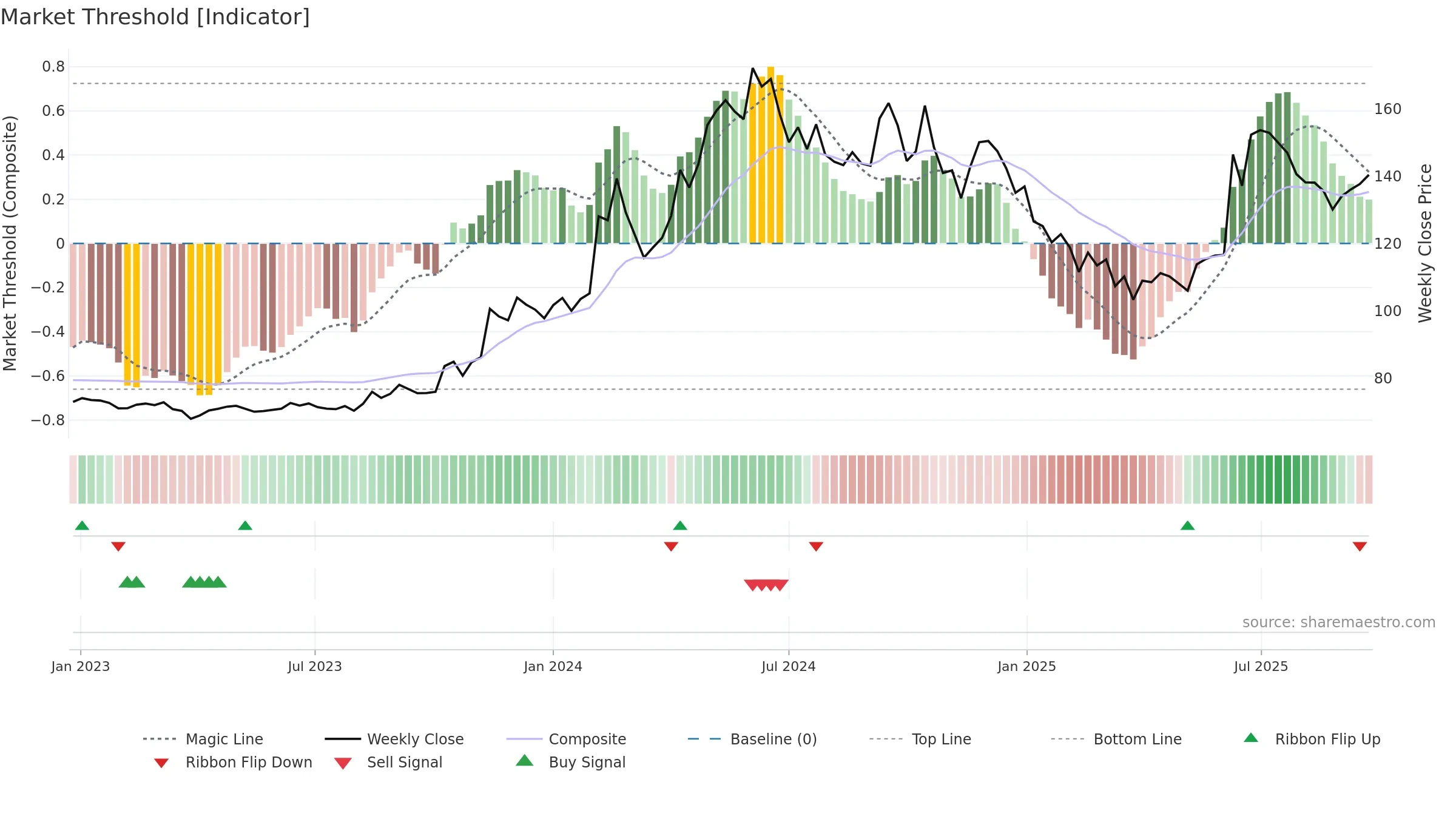

Gauge maps the trend signal to a 0–100 scale.

How to read this — Gauge is elevated but momentum is rolling over; topping risk is rising.

Stay alert: protect gains or seek confirmation before adding risk.

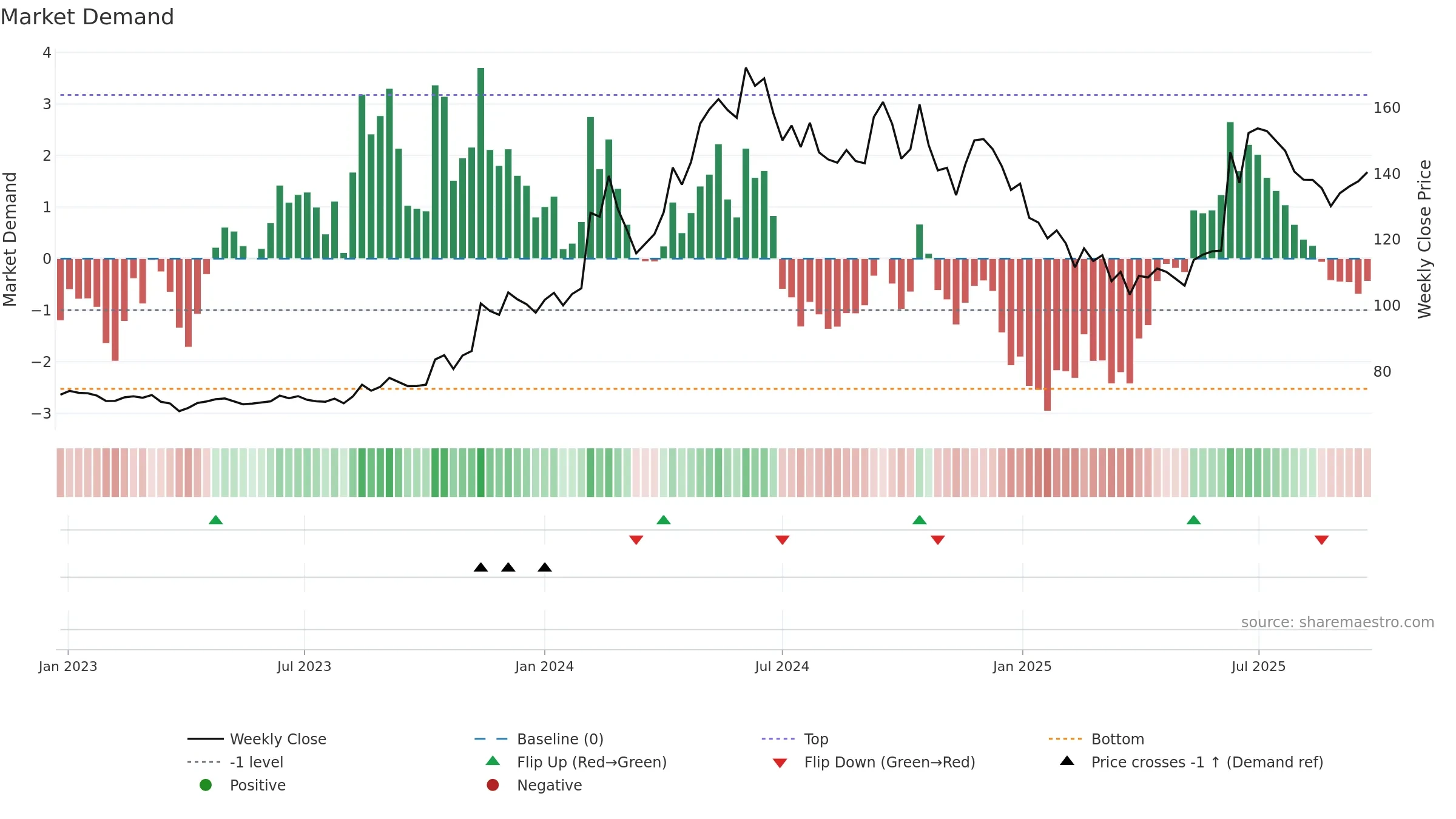

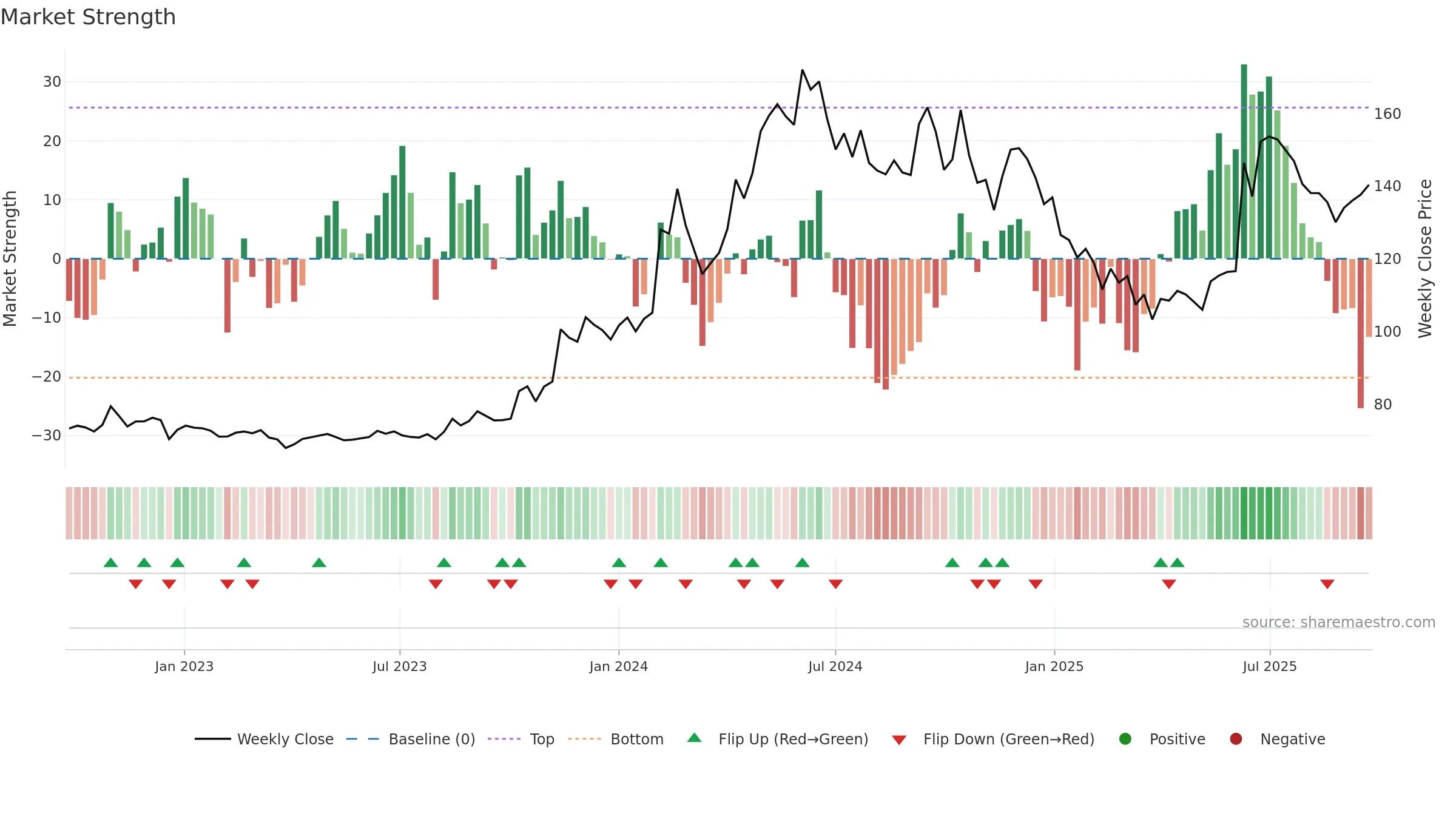

Relative strength is Positive

(> 0%, outperforming).

Latest MRS: 2.16% (week ending Fri, 19 Sep 2025).

Slope: Falling over 8w.

Notes:

- Holding above the zero line indicates relative bid.

- MRS slope falling over ~8 weeks.

The flag is positive: favourable upside skew with supportive conditions.

Conclusion

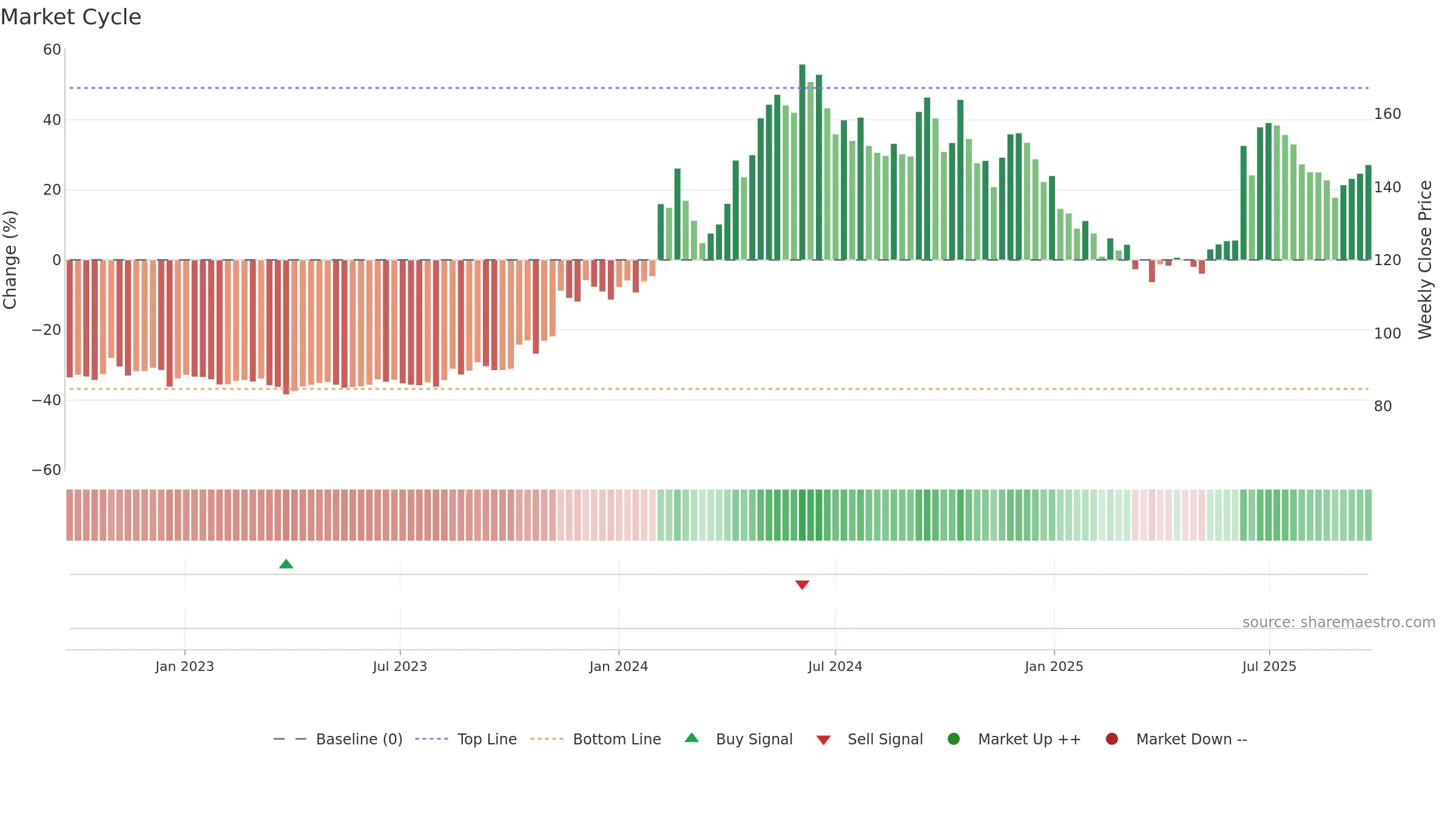

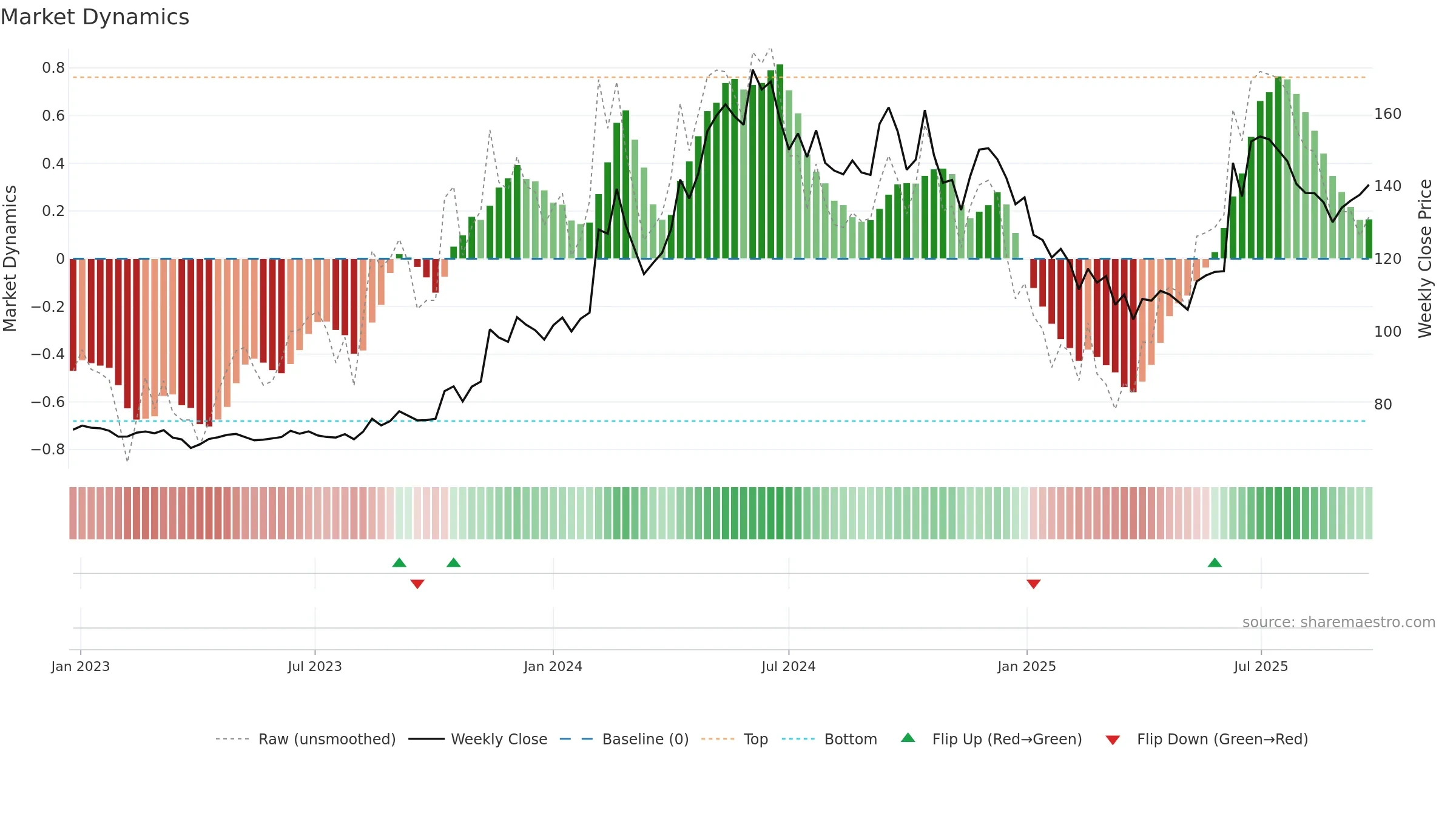

Neutral setup. ★★★☆☆ confidence. Trend: Uptrend at Risk · 1.63% over window · vol 2.76% · liquidity divergence · posture above · RS outperforming

- Price holds above 8–26 week averages

- Mansfield RS: outperforming & rising

- High level but momentum rolling over (topping risk)

- Momentum is weak/falling

- Liquidity diverges from price

Why: Price window 1.63% over w. Close is 1.63% above the prior-window high. Volume trend falling. Liquidity divergence with price. Trend state uptrend at risk. 4–8w crossover bullish. Momentum neutral and falling. Valuation stance positive.

Tip: Most metrics include a hover tooltip where they appear in the report.