Taylor Wimpey plc

TW LSE

Weekly Report

Taylor Wimpey plc closed at 98.7000 (-0.84% WoW) . Data window ends Fri, 19 Sep 2025.

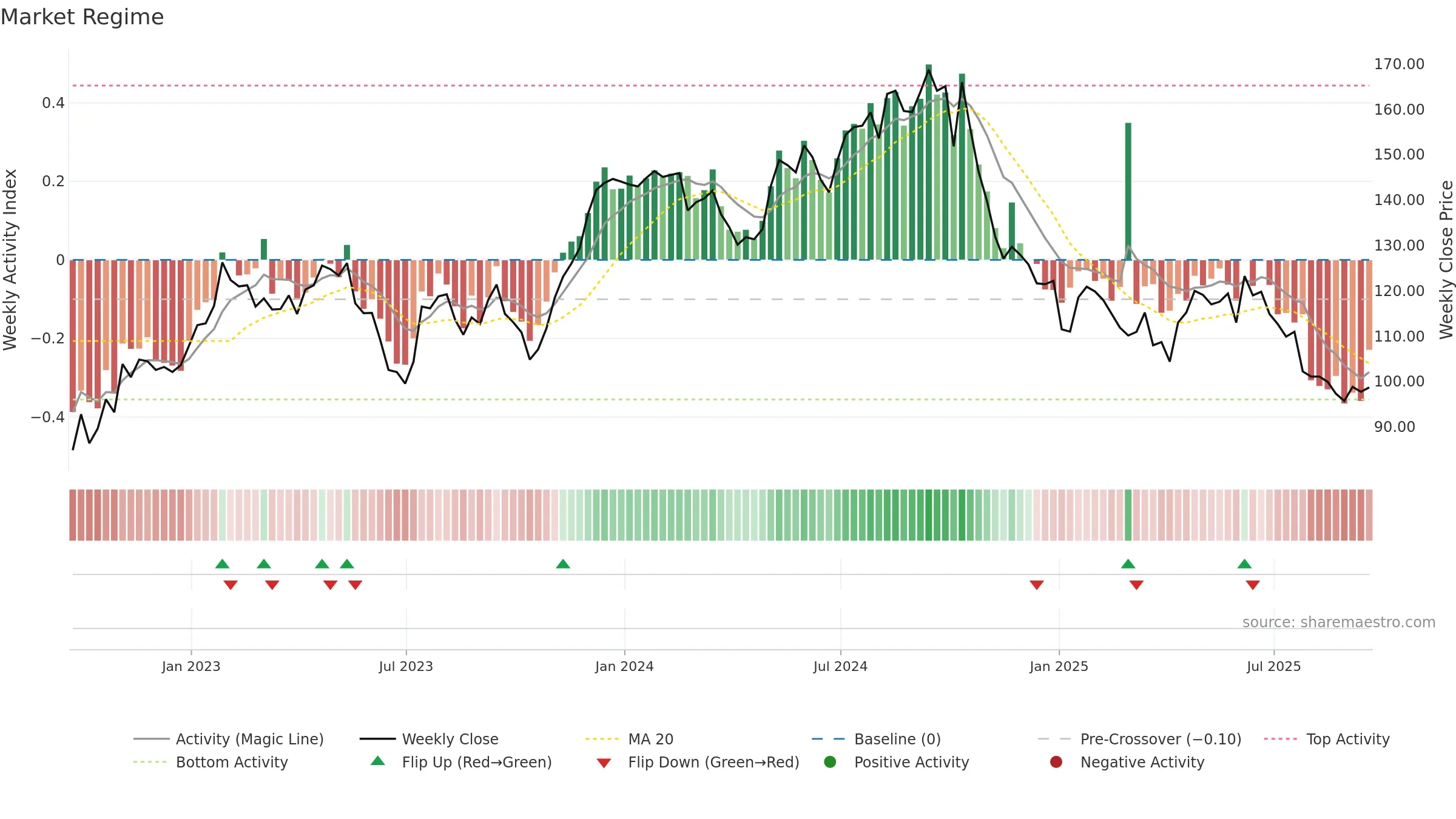

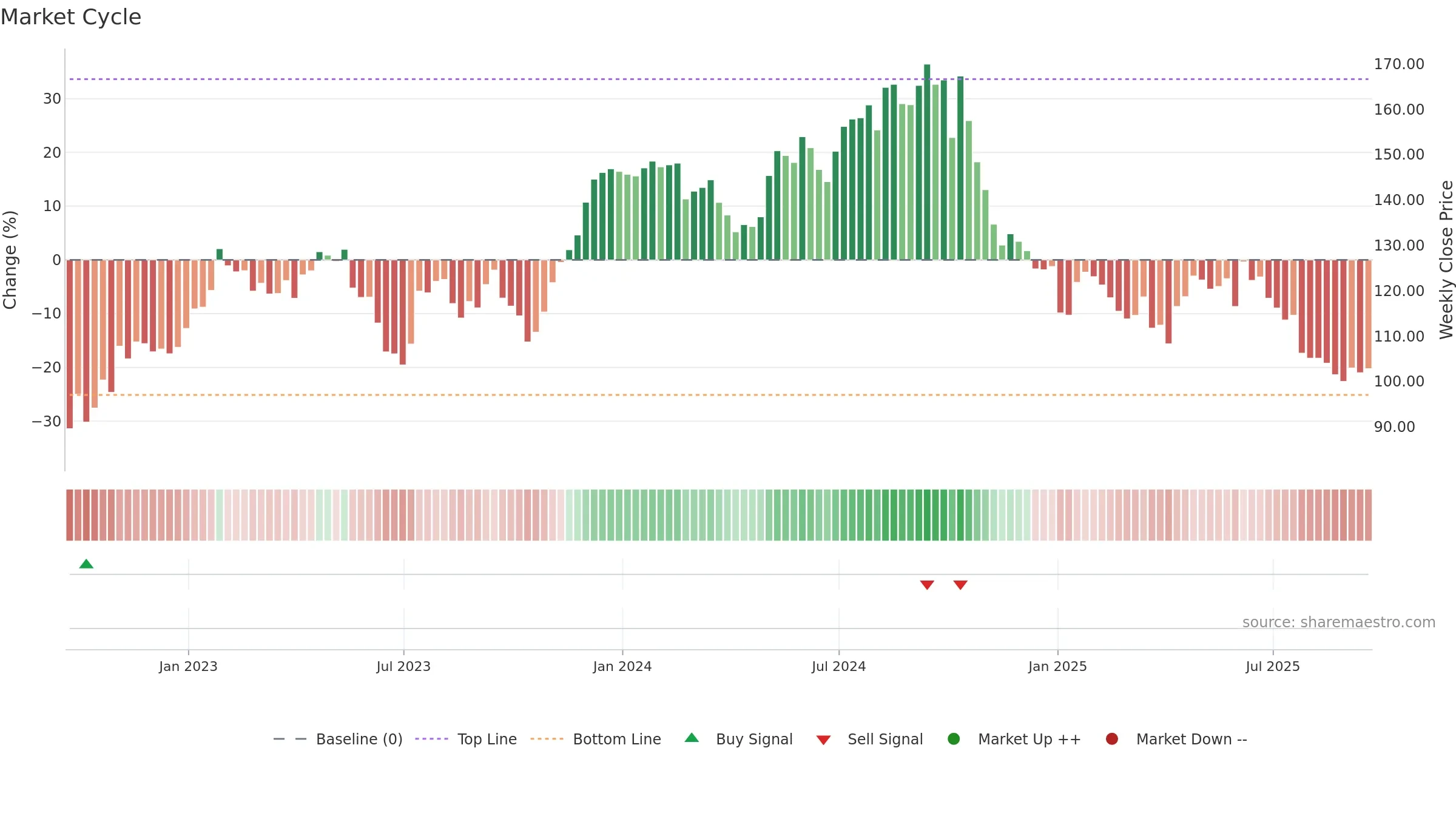

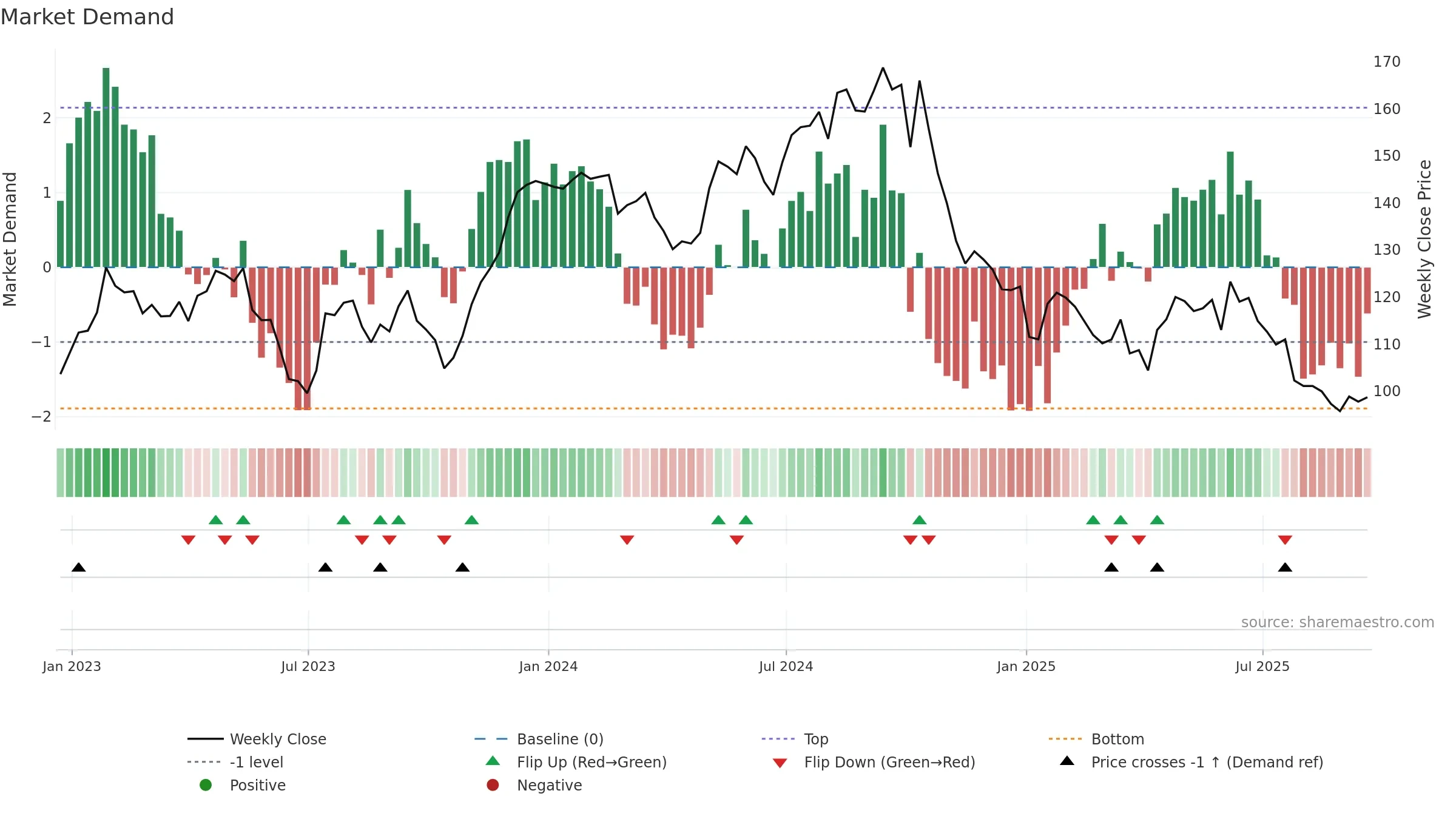

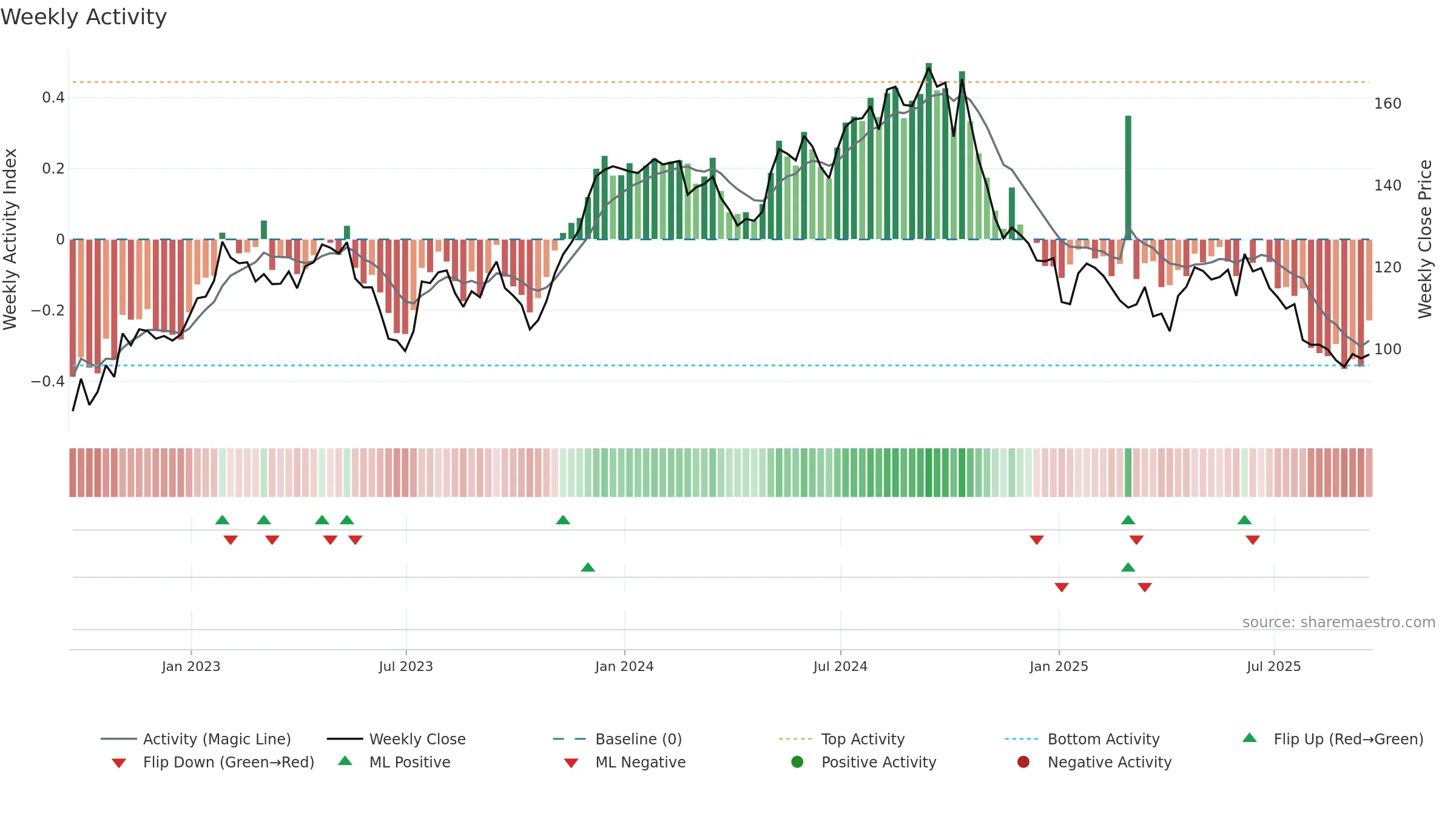

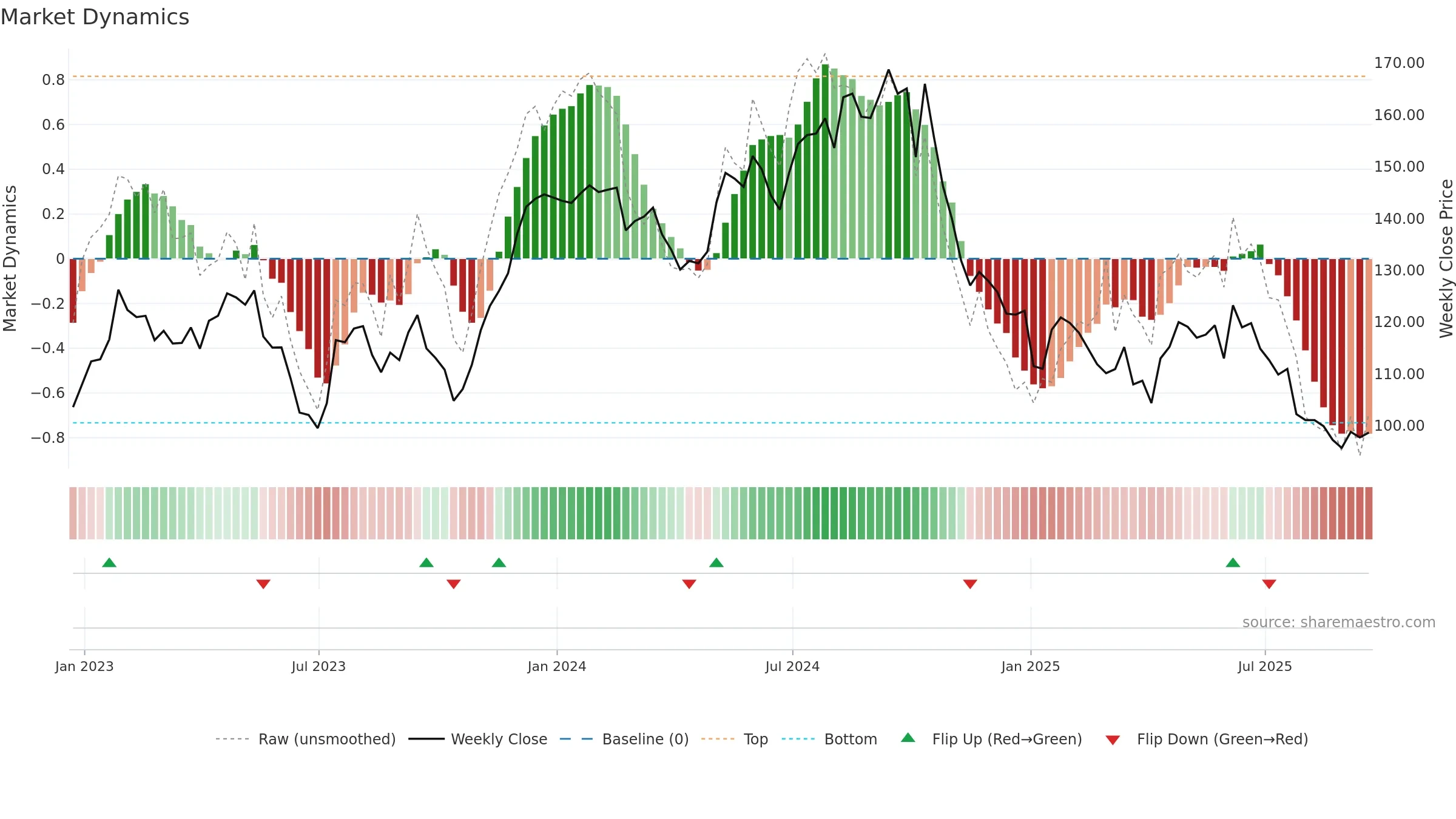

How to read this — Price slope is downward, indicating persistent supply pressure. Low weekly volatility favours steadier follow-through. Volume trend diverges from price — watch for fatigue or rotation. Weak MA stack argues for caution; rallies can fail near the 8–13 week region. Price sits below key averages, keeping pressure on the tape.

Down-slope argues for patience; rallies can fade sooner unless participation improves. Because liquidity isn’t confirming, prefer evidence of fresh demand before chasing moves.

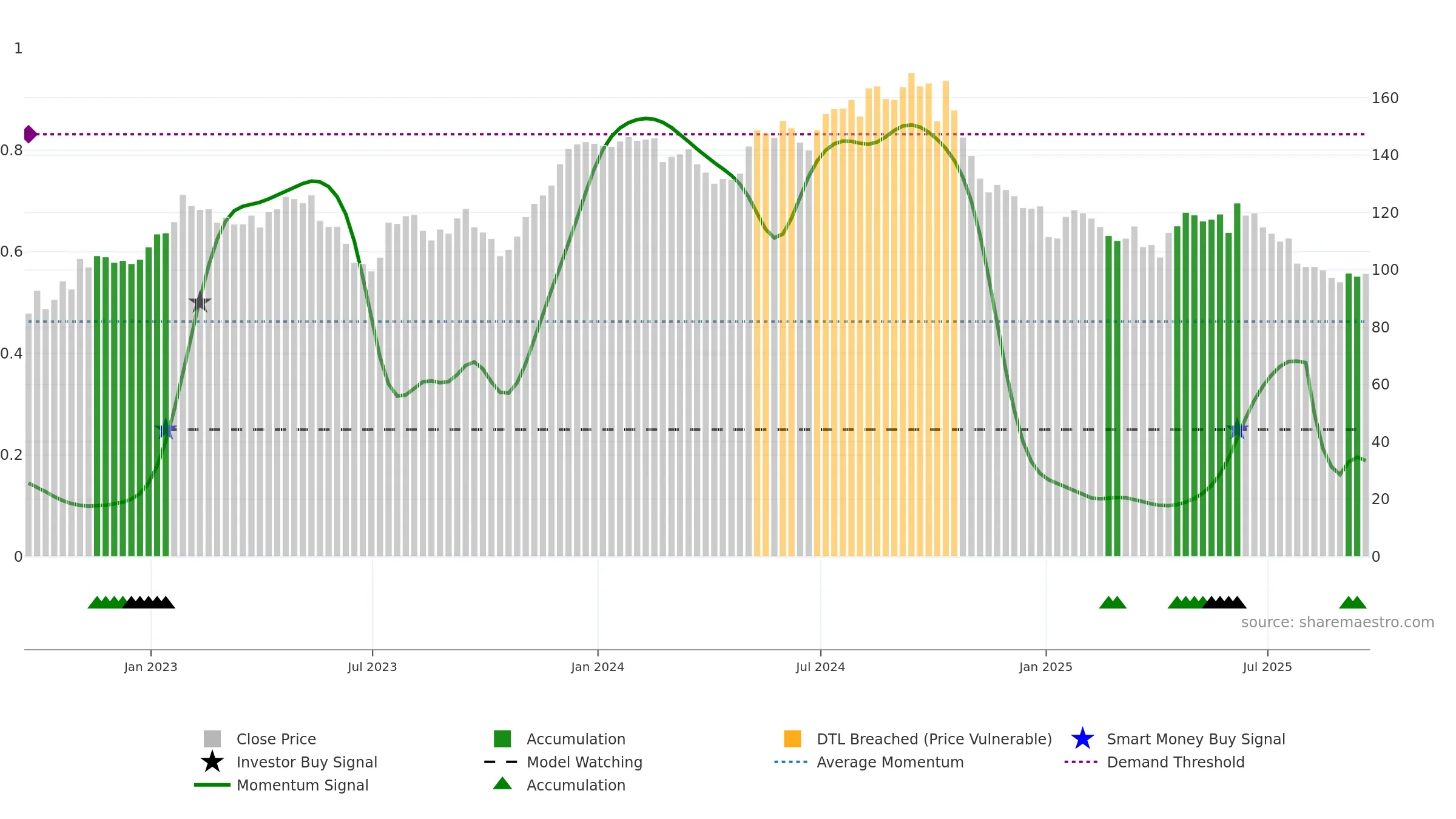

Gauge maps the trend signal to a 0–100 scale.

How to read this — Range-bound conditions; conviction is limited until a break or acceleration emerges.

Wait for a directional break or improving acceleration.

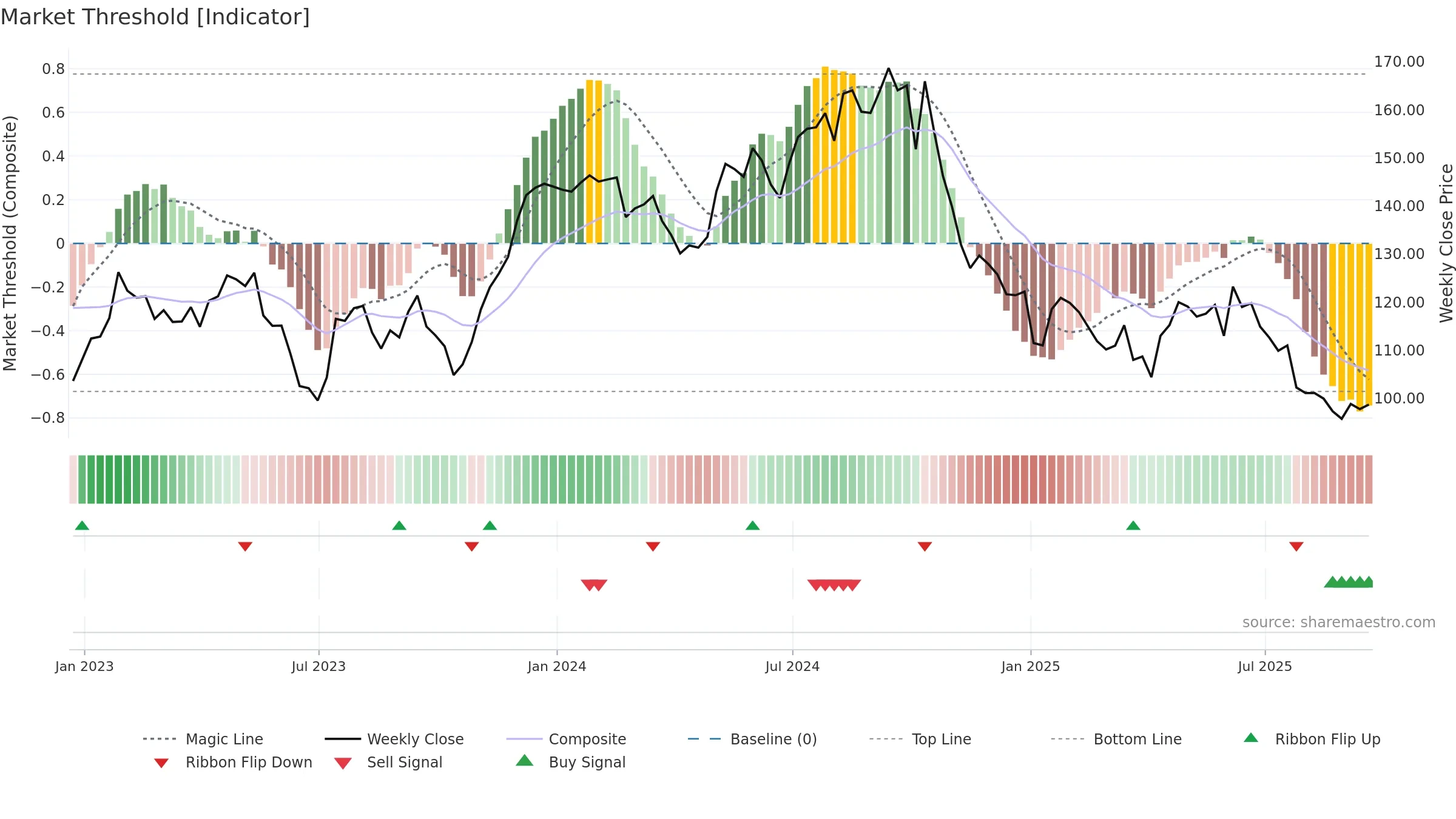

The flag is positive: favourable upside skew with supportive conditions.

Conclusion

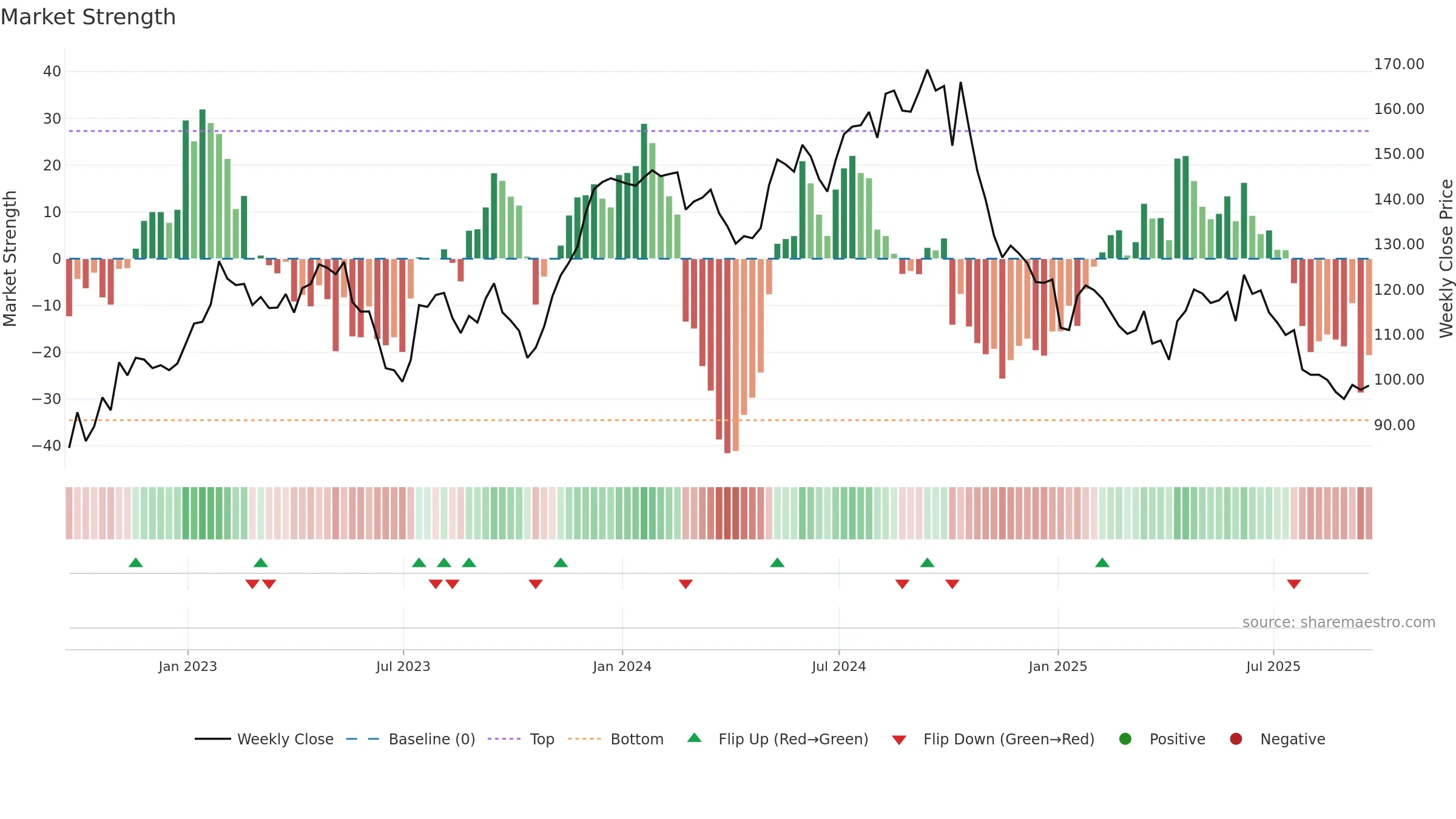

Negative setup. ★☆☆☆☆ confidence. Price window: -2. Trend: Range / Neutral; gauge 18. In combination, liquidity diverges from price.

- Low return volatility supports durability

- Momentum is weak/falling

- Price is not above key averages

- Weak moving-average stack

- Liquidity diverges from price

Why: Price window -2.37% over 8w. Close is -2.37% below the prior-window high. Return volatility 1.20%. Volume trend rising. Liquidity divergence with price. Trend state range / neutral. Low-regime (≤0.25) upticks 2/5 (40.0%) • Distributing. MA stack weak. Momentum bearish and falling. Valuation stance positive.

Tip: Most metrics include a hover tooltip where they appear in the report.