Sierra Bancorp

BSRR NASDAQ

Weekly Report

Sierra Bancorp closed at 30.2800 (-2.35% WoW) . Data window ends Fri, 19 Sep 2025.

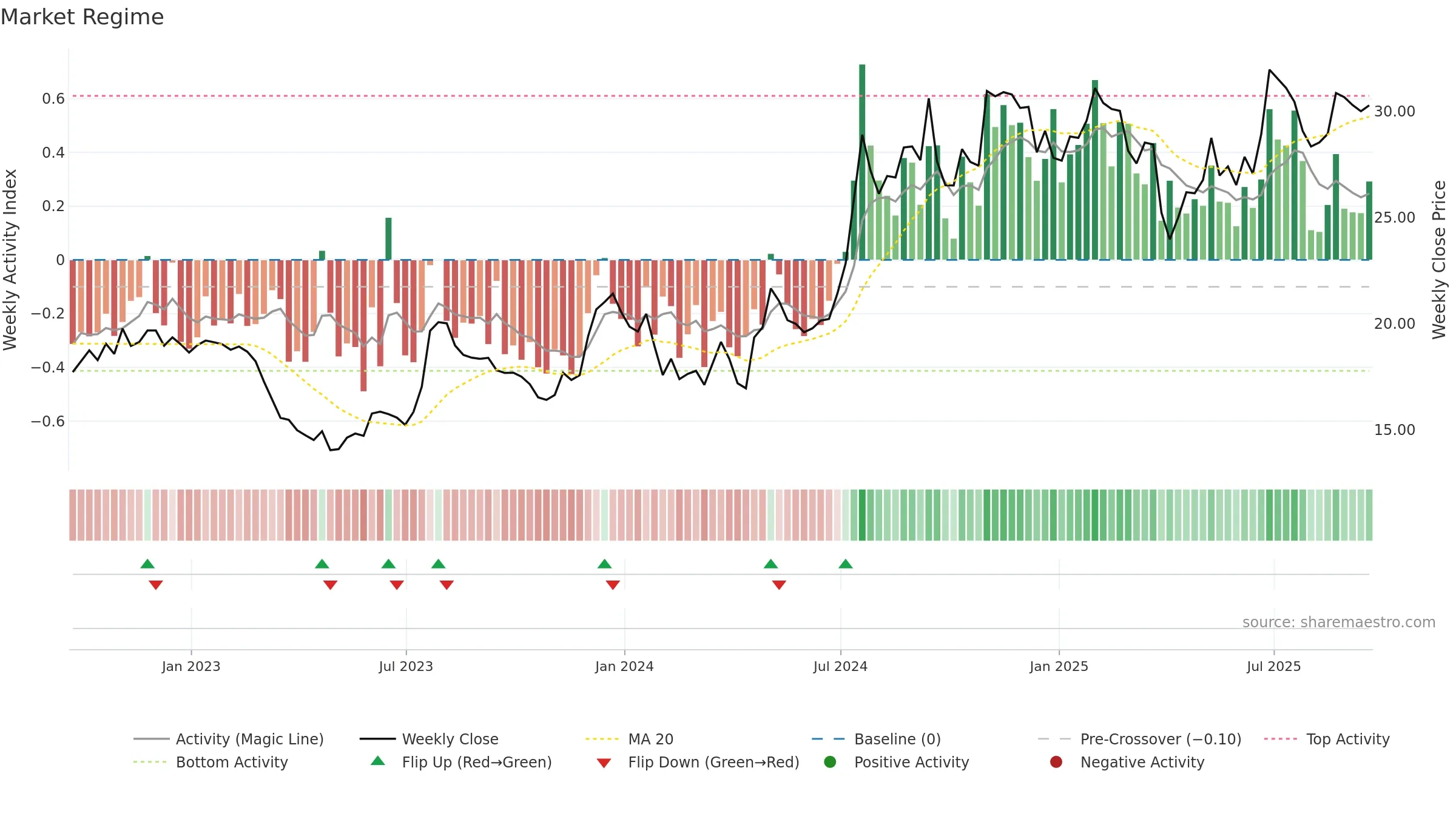

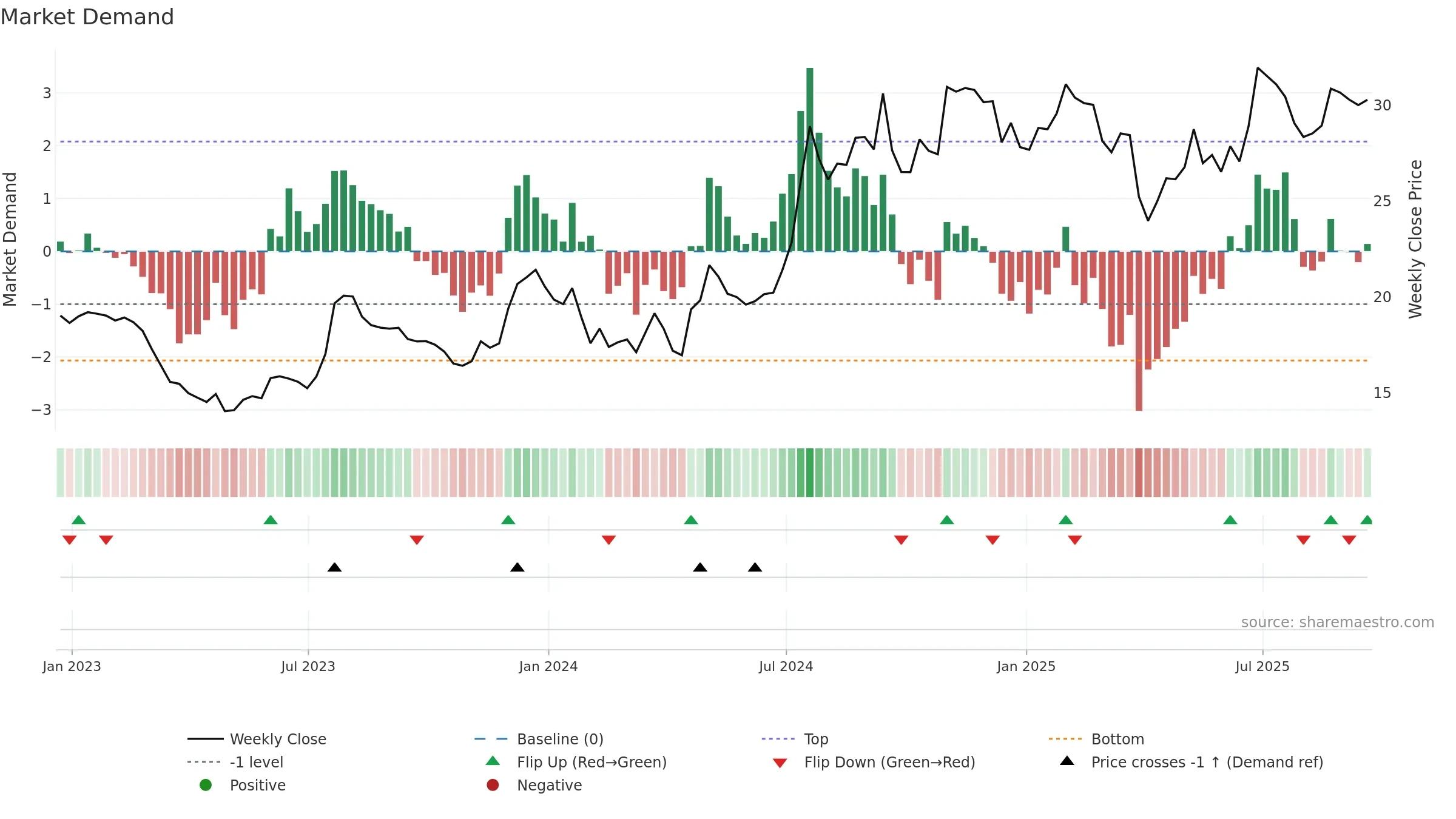

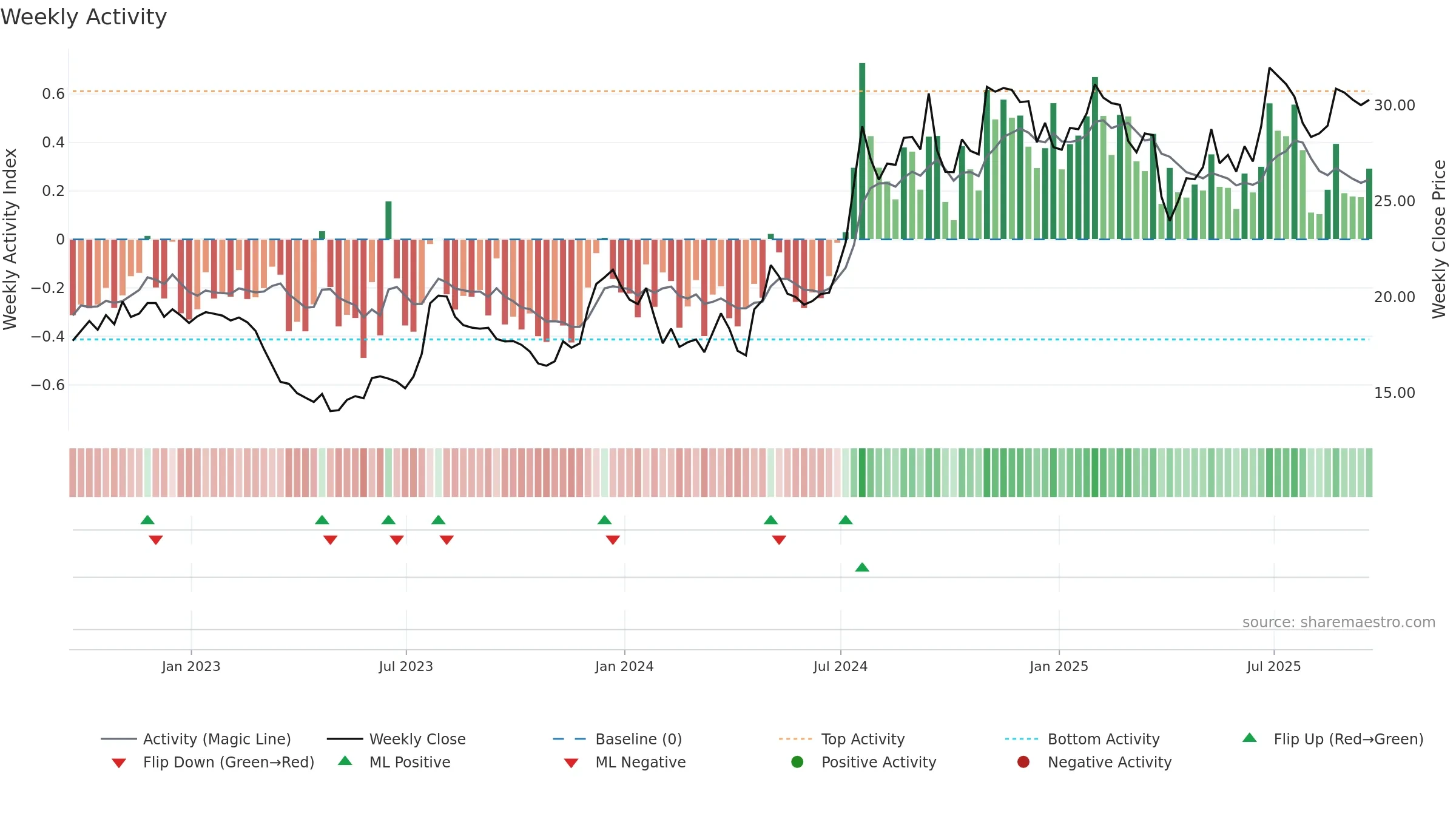

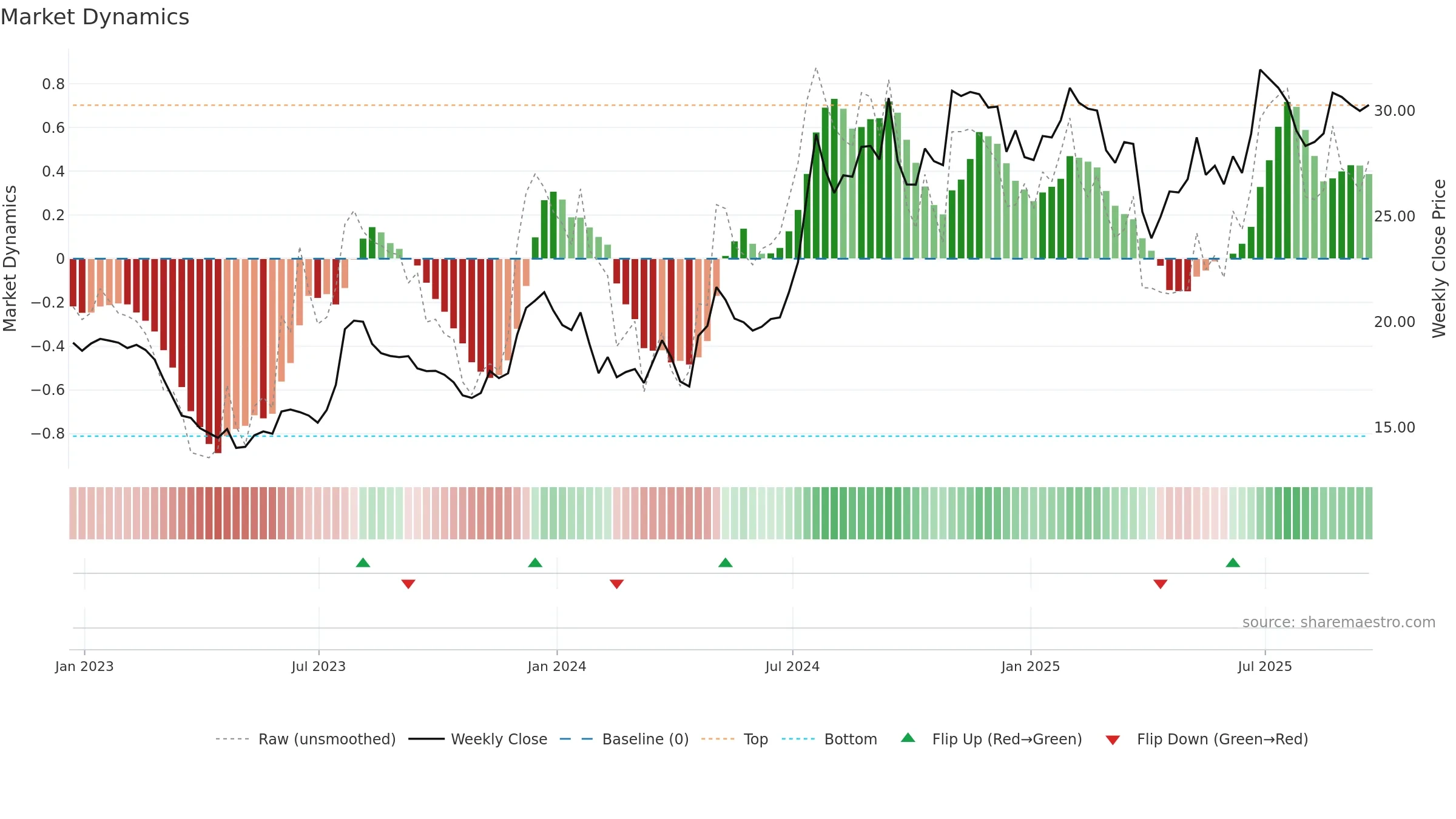

How to read this — Price slope is upward, indicating persistent buying over the window. Volume and price are moving in the same direction — a constructive confirmation. Returns are positively correlated with volume — strength tends to arrive on higher activity. Price holds above key averages, indicating constructive participation.

Up-slope supports buying interest; pullbacks may be contained if activity stays firm.

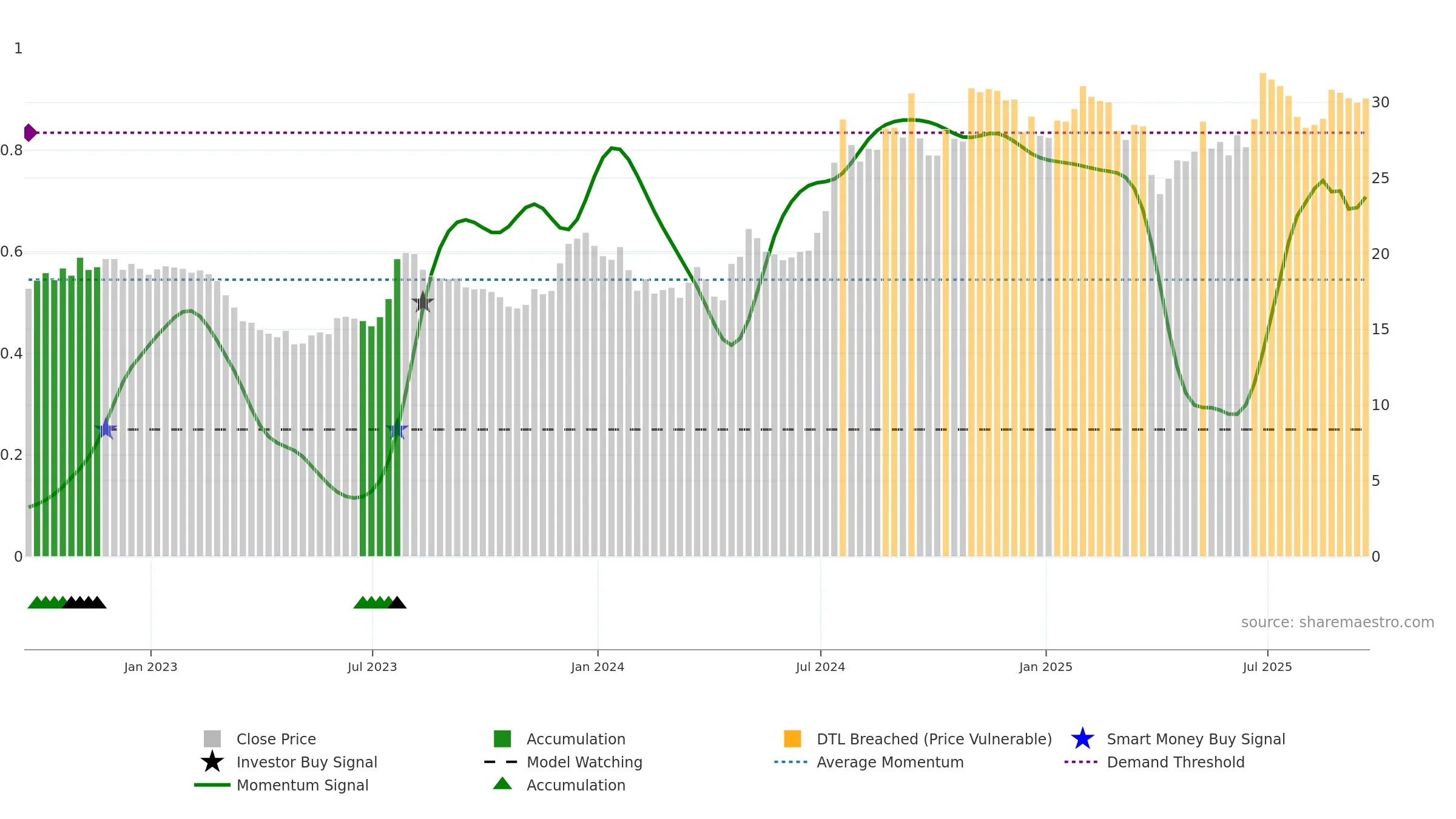

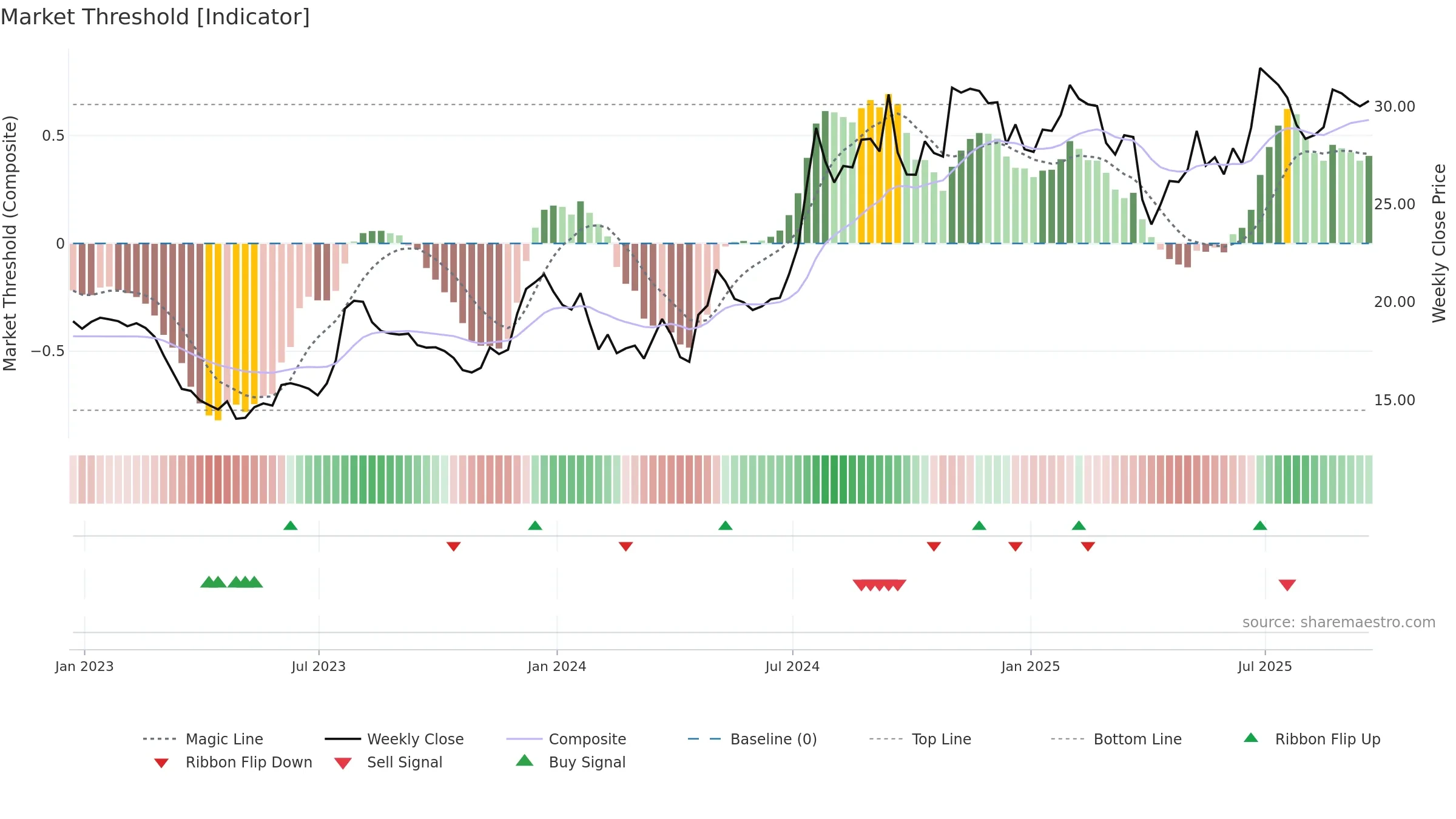

Gauge maps the trend signal to a 0–100 scale.

How to read this — Gauge is elevated but momentum is rolling over; topping risk is rising.

Stay alert: protect gains or seek confirmation before adding risk.

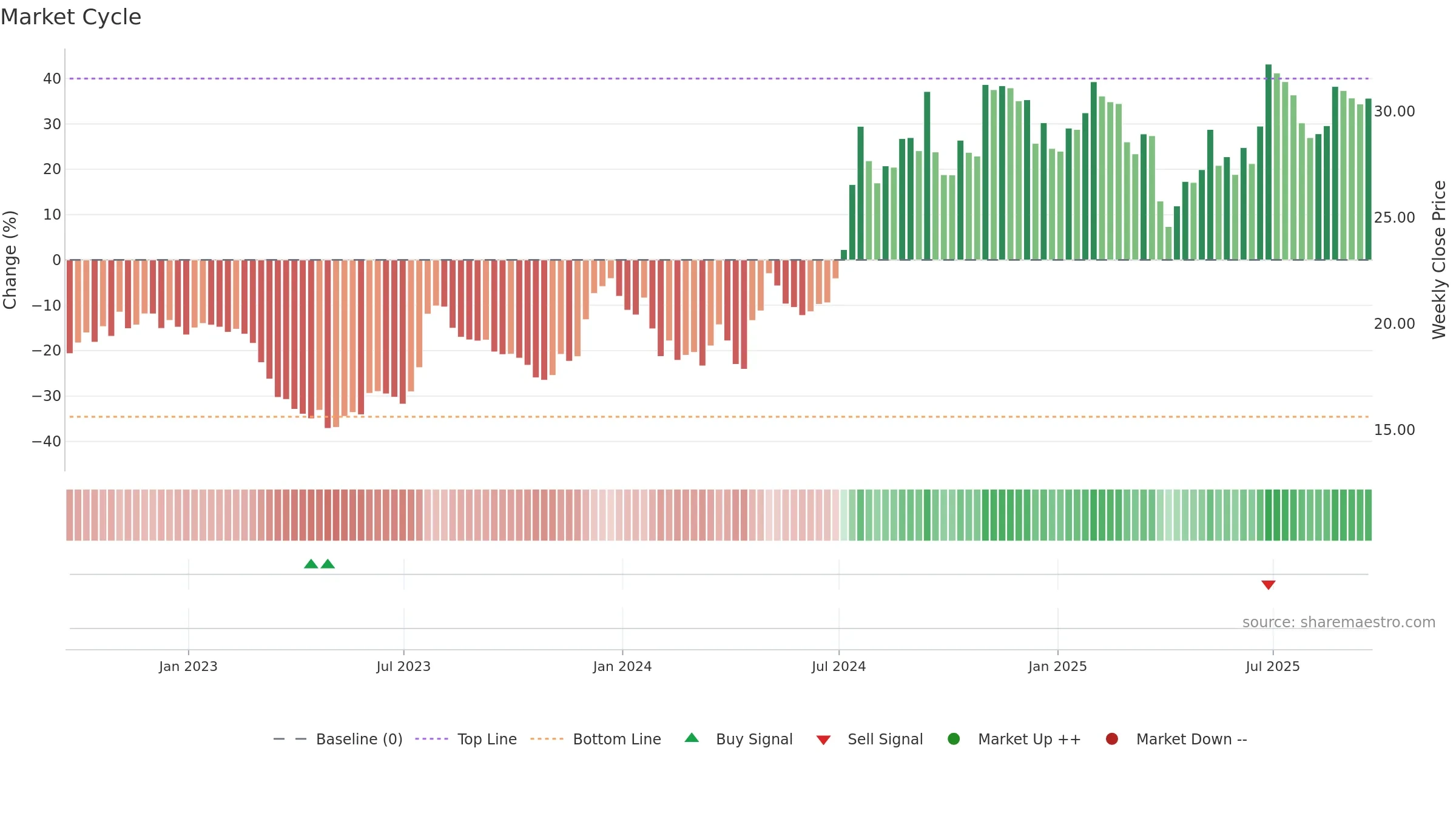

The flag is positive: favourable upside skew with supportive conditions.

Conclusion

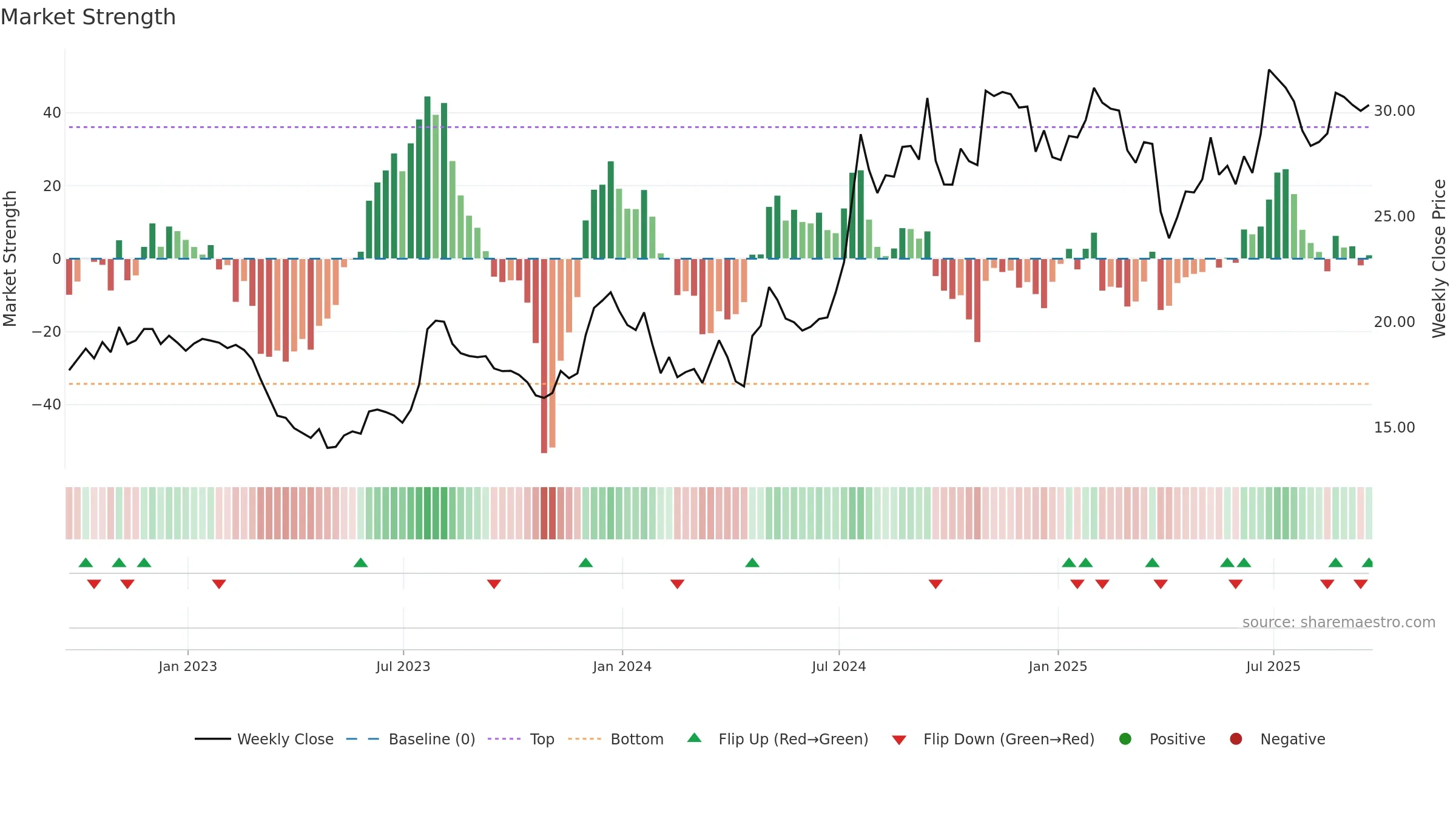

Neutral setup. ★★★☆☆ confidence. Price window: 6. Trend: Uptrend at Risk; gauge 70. In combination, liquidity confirms the move.

- Price holds above 8w & 26w averages

- Liquidity confirms the price trend

- High-level but rolling over (topping risk)

- Momentum is weak/falling

Why: Price window 6.85% over 8w. Close is -1.88% below the prior-window high. Volume trend rising. Liquidity convergence with price. Trend state uptrend at risk. Momentum bullish and falling. Valuation stance positive.

Tip: Most metrics include a hover tooltip where they appear in the report.