Guanglian Aviation Industry Co., Ltd.

300900 SHE

Weekly Summary

Guanglian Aviation Industry Co., Ltd. closed at 18.9200 (-0.53% WoW) . Data window ends Mon, 22 Sep 2025.

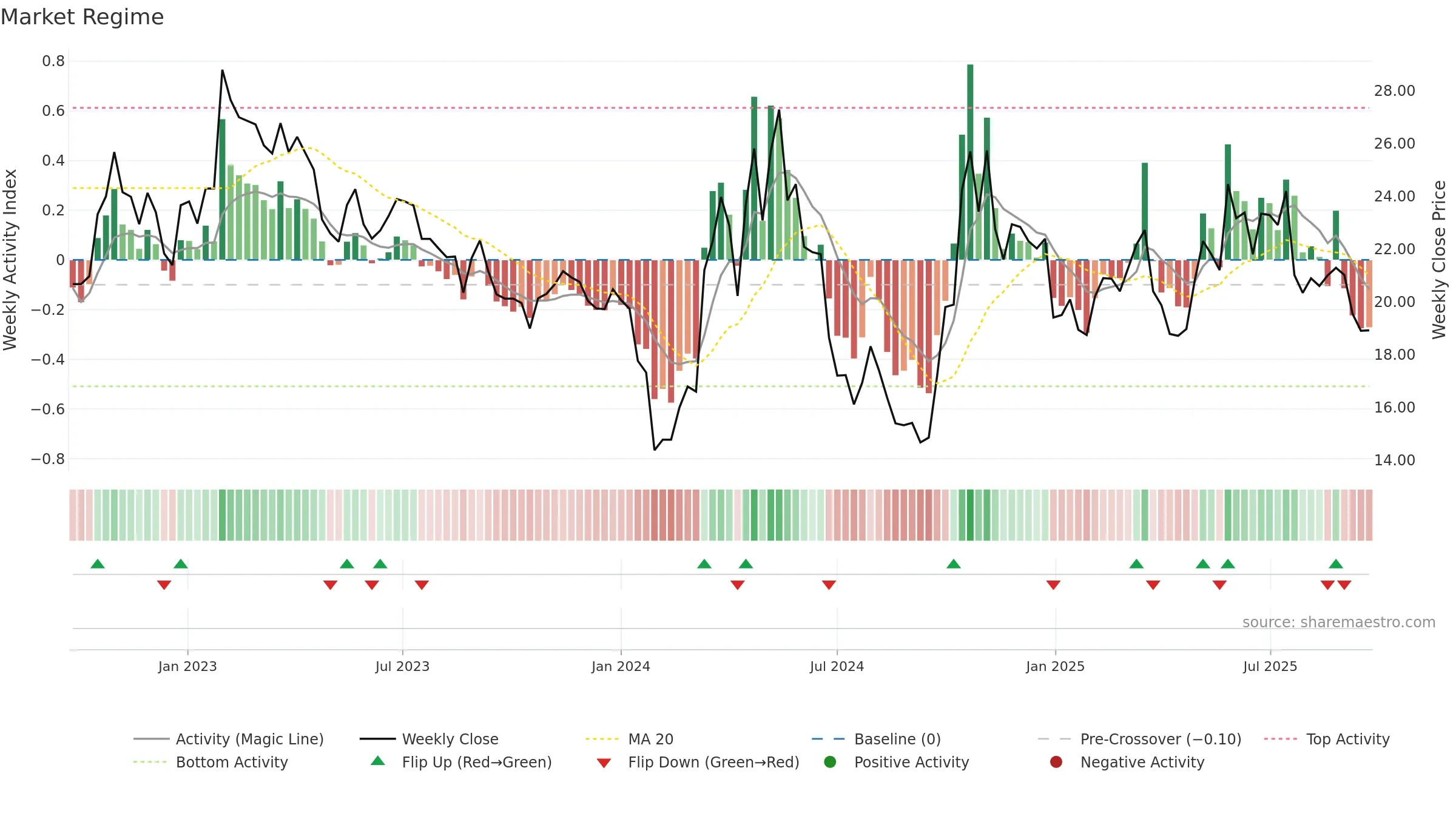

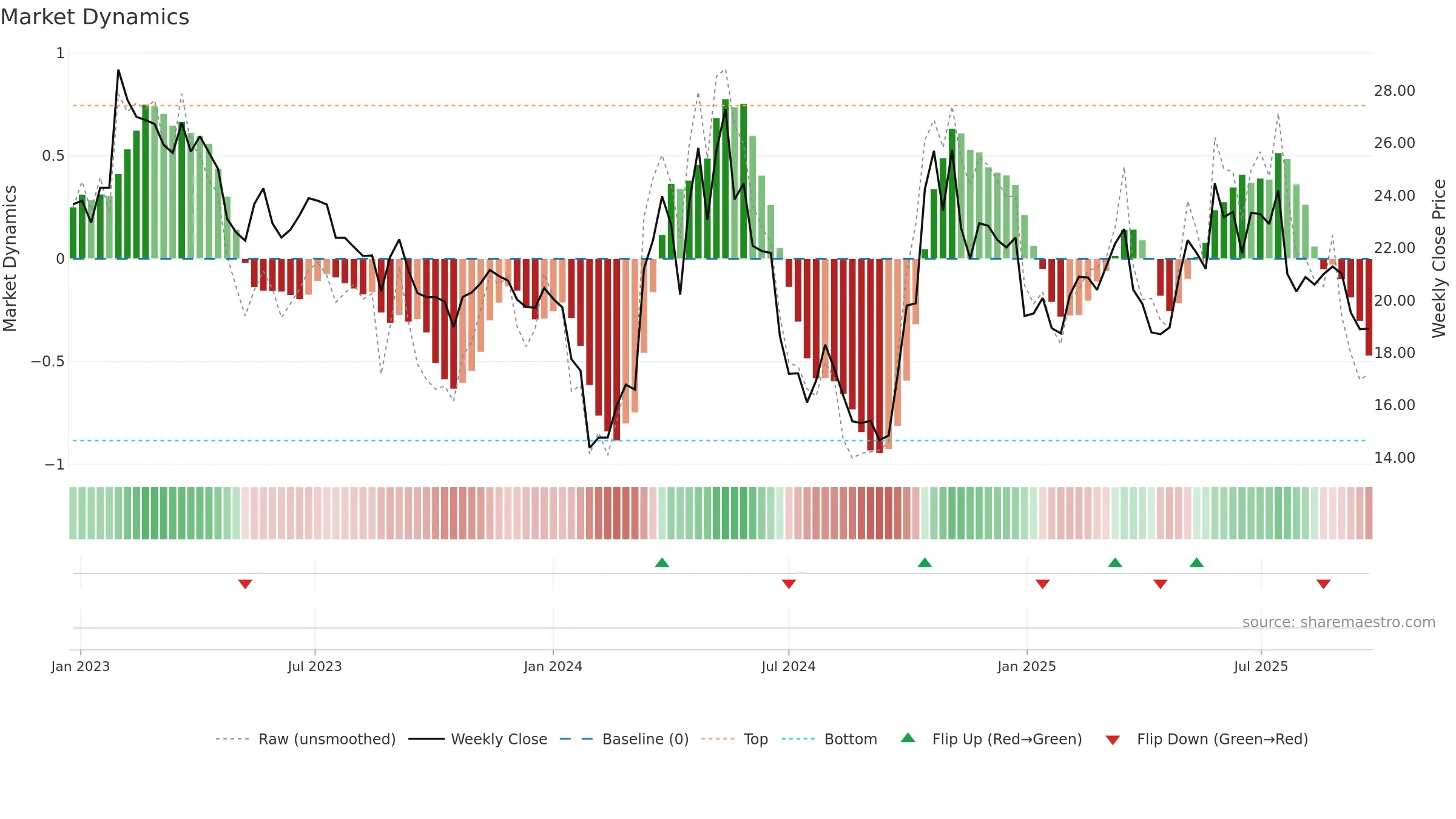

How to read this — Price slope is downward, indicating persistent supply pressure. Low weekly volatility favours steadier follow-through. Volume and price are moving in the same direction — a constructive confirmation. Returns are positively correlated with volume — strength tends to arrive on higher activity. Weak MA stack argues for caution; rallies can fail near the 8–13 week region. Price sits below key averages, keeping pressure on the tape.

Down-slope argues for patience; rallies can fade sooner unless participation improves.

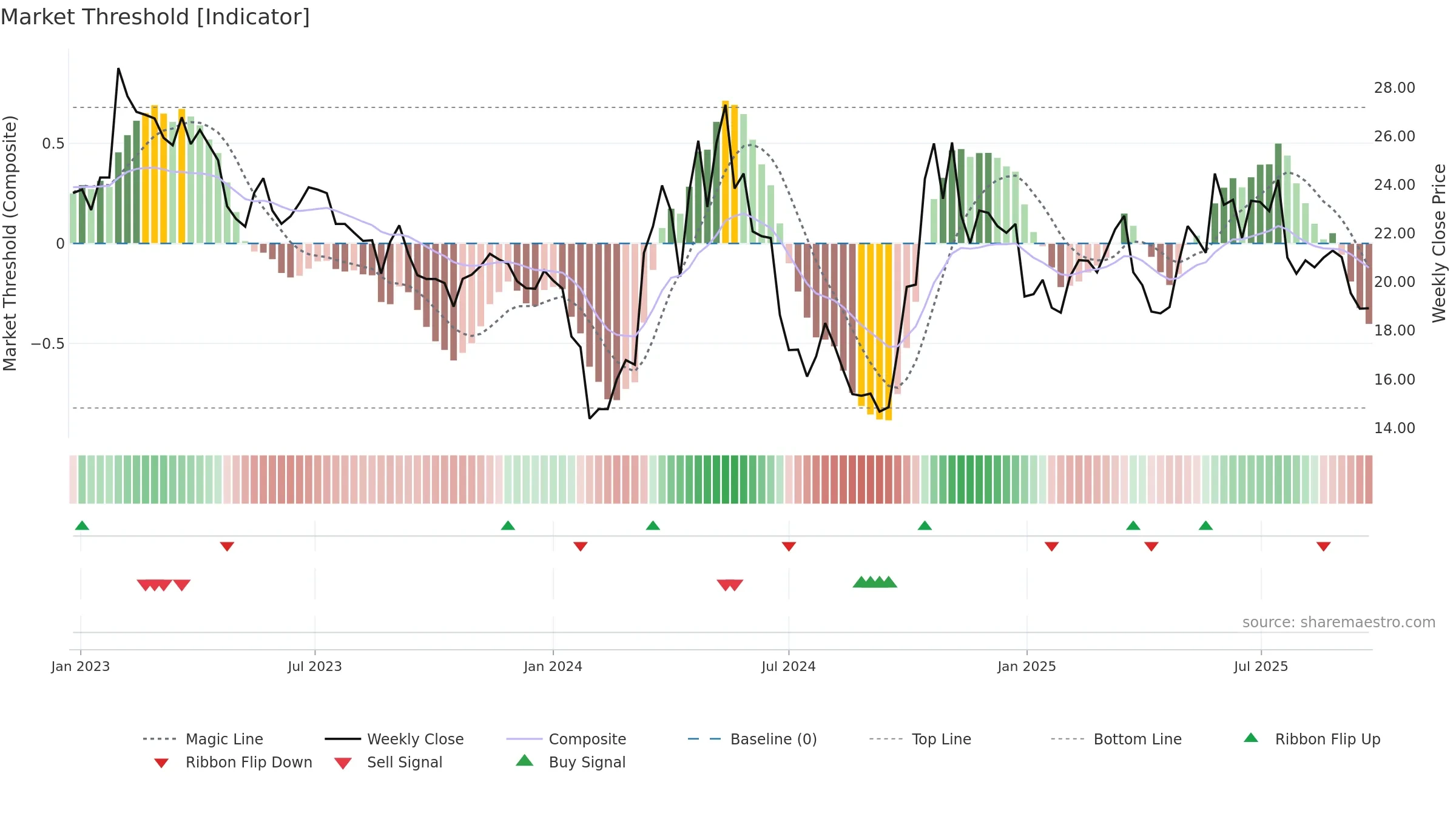

Gauge maps the trend signal to a 0–100 scale.

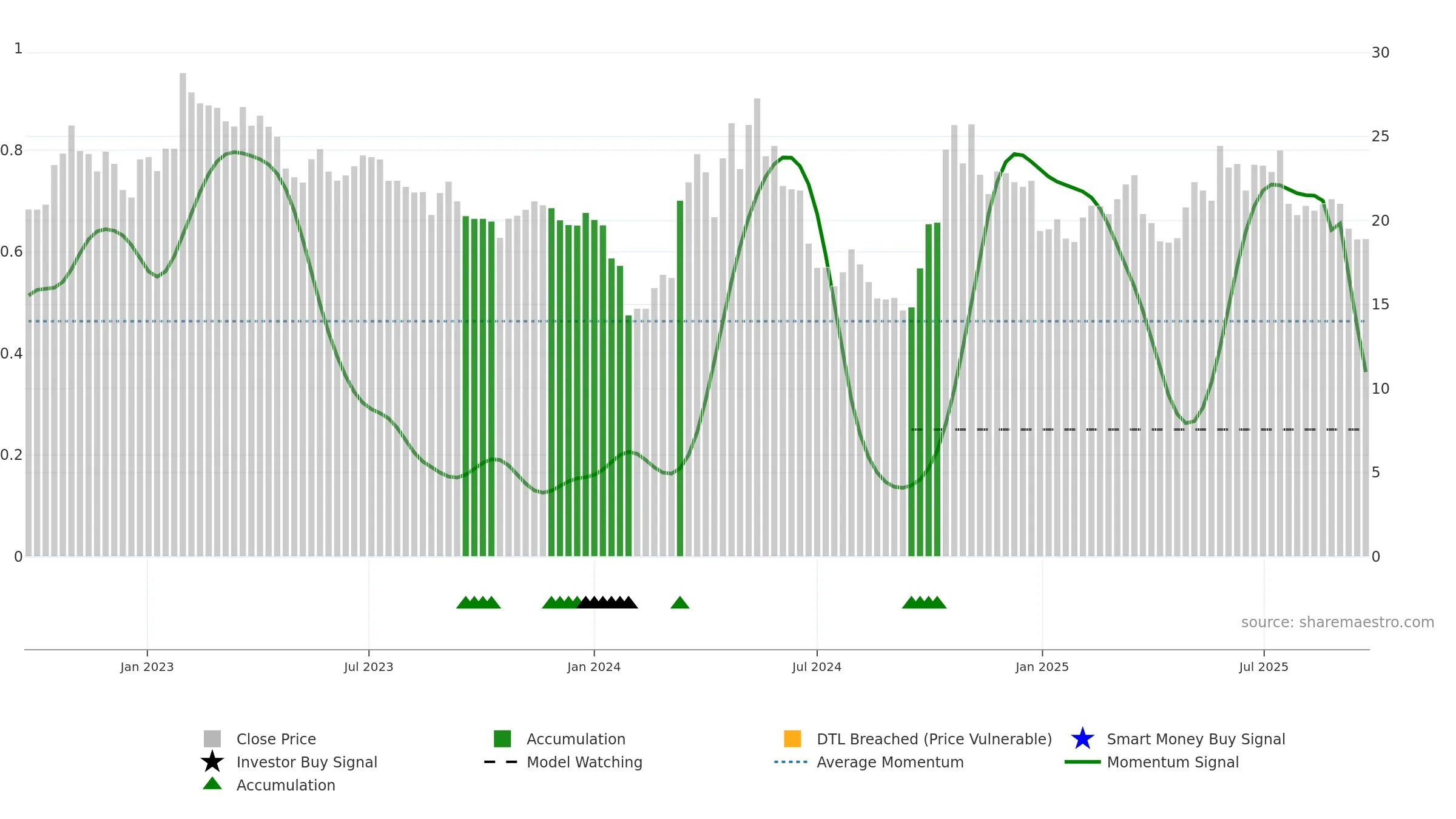

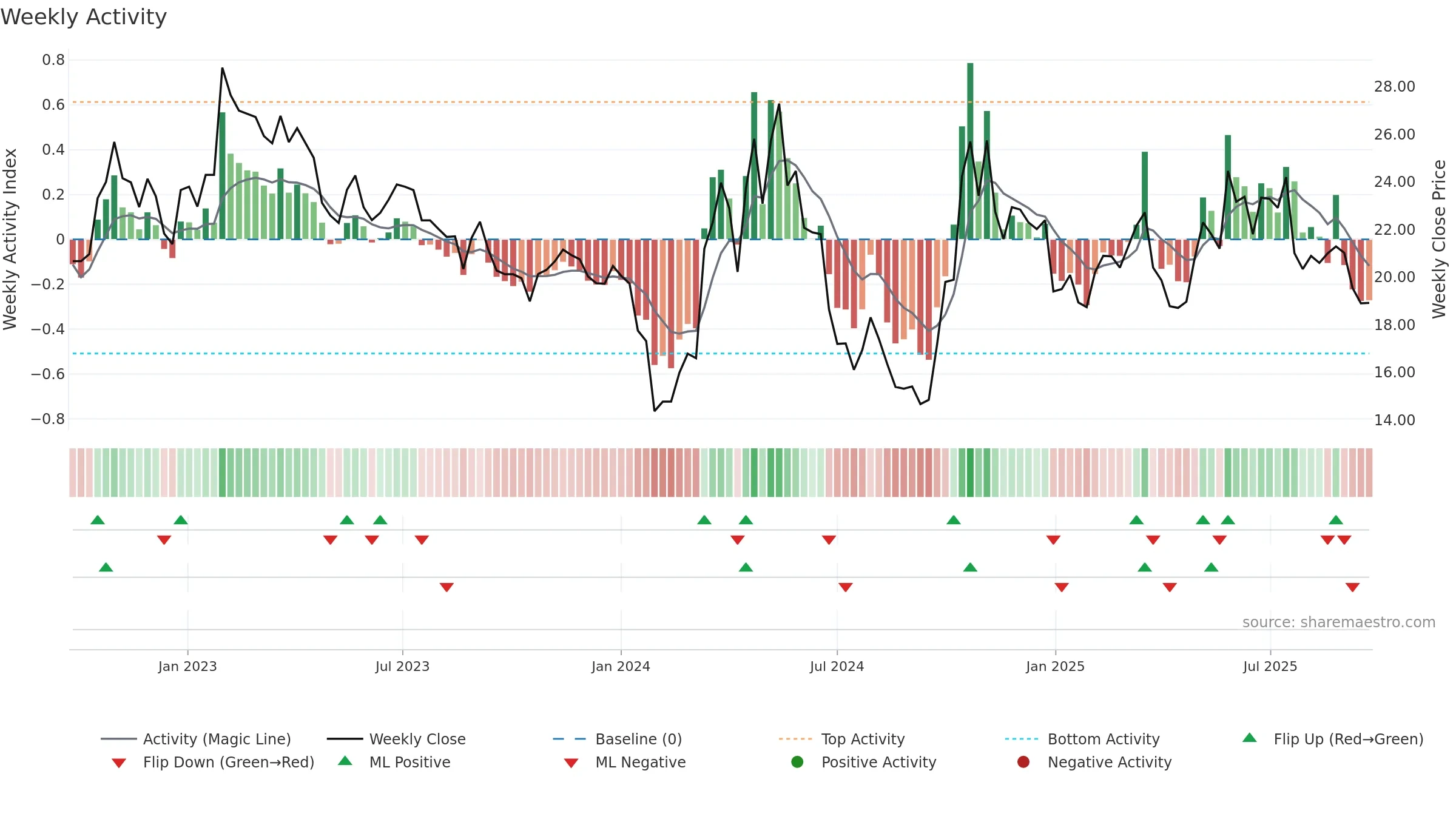

How to read this — Bearish zone with falling momentum — sellers in control. Loss of the ~0.50 midline after strength suggests regime shift. Sub-0.40 print confirms downside control.

Bias remains lower; rallies are suspect unless gauge reclaims 0.50/0.60.

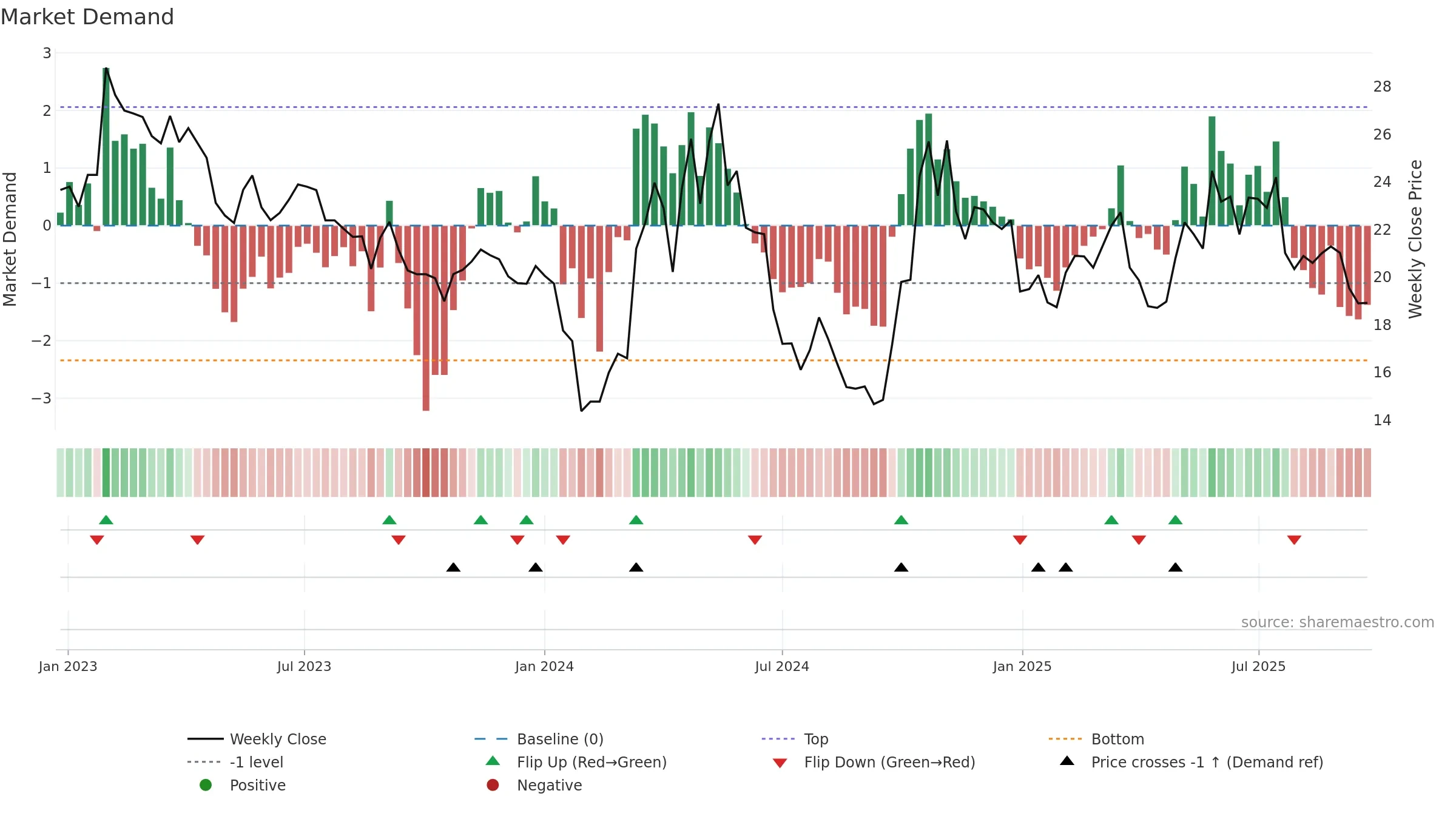

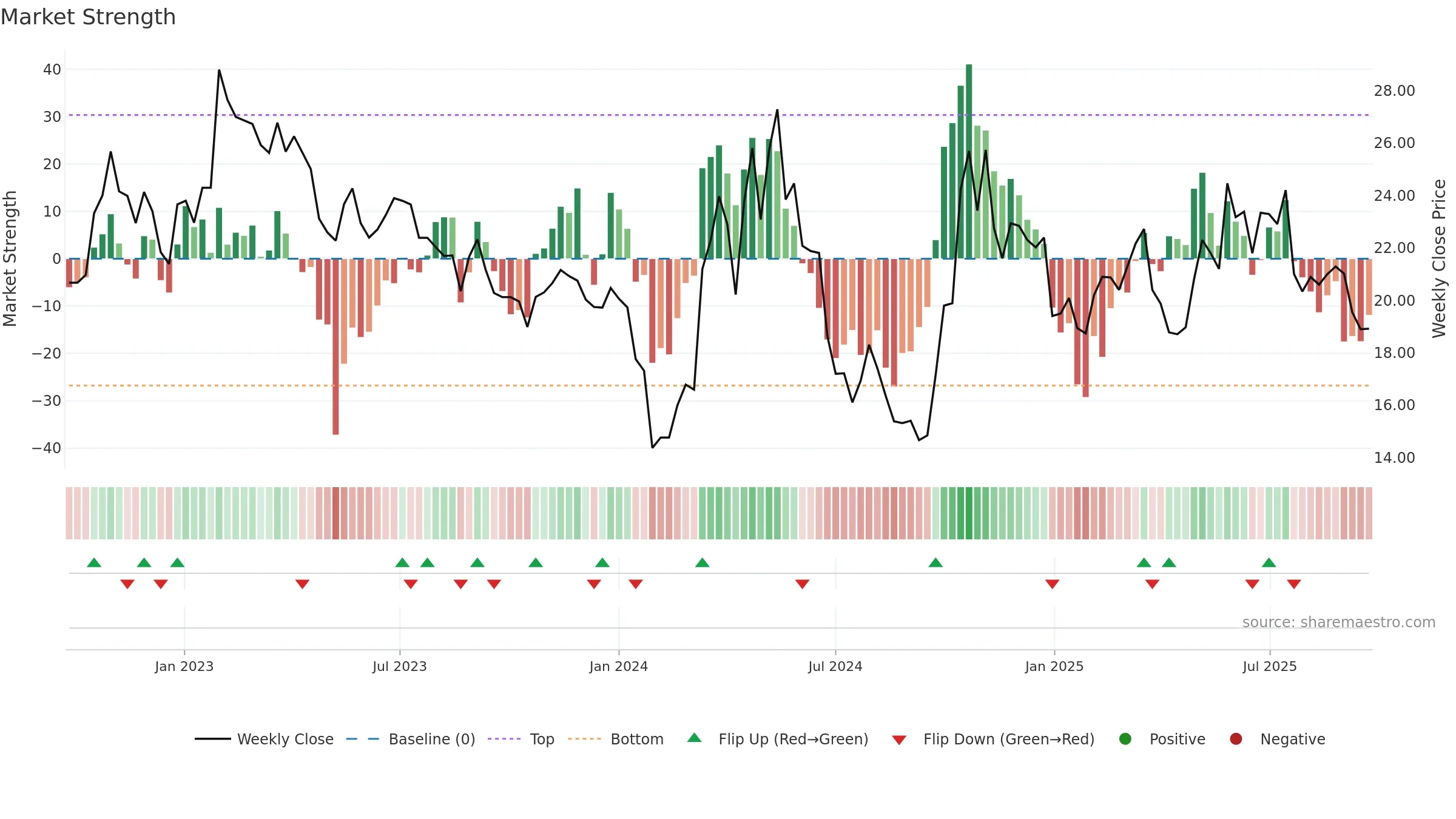

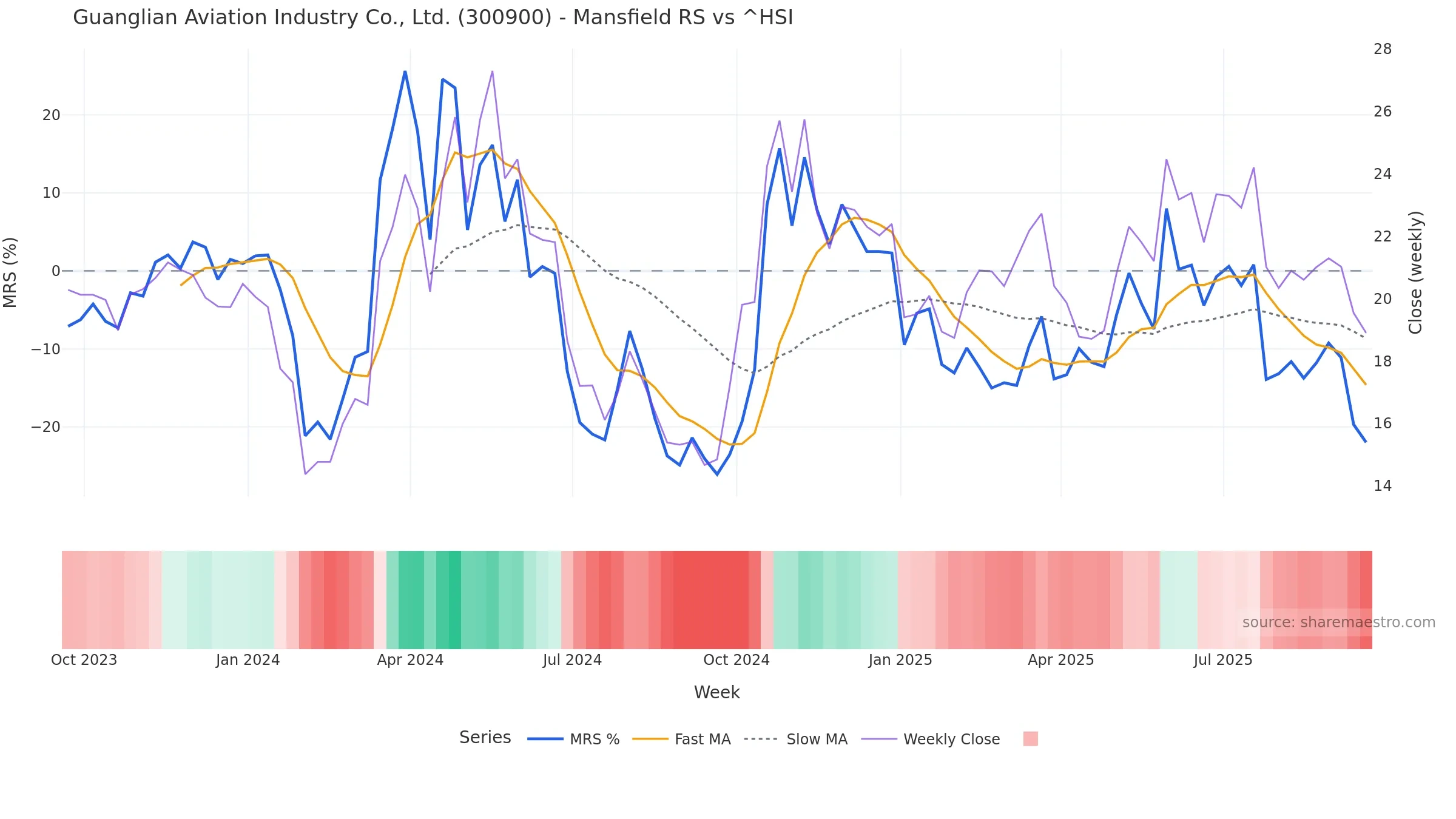

Relative strength is Negative

(< 0%, underperforming).

Latest MRS: -21.98% (week ending Fri, 19 Sep 2025).

Slope: Falling over 8w.

Notes:

- Below zero line indicates relative weakness vs benchmark.

- MRS slope falling over ~8 weeks.

The flag is positive: favourable upside skew with supportive conditions.

Conclusion

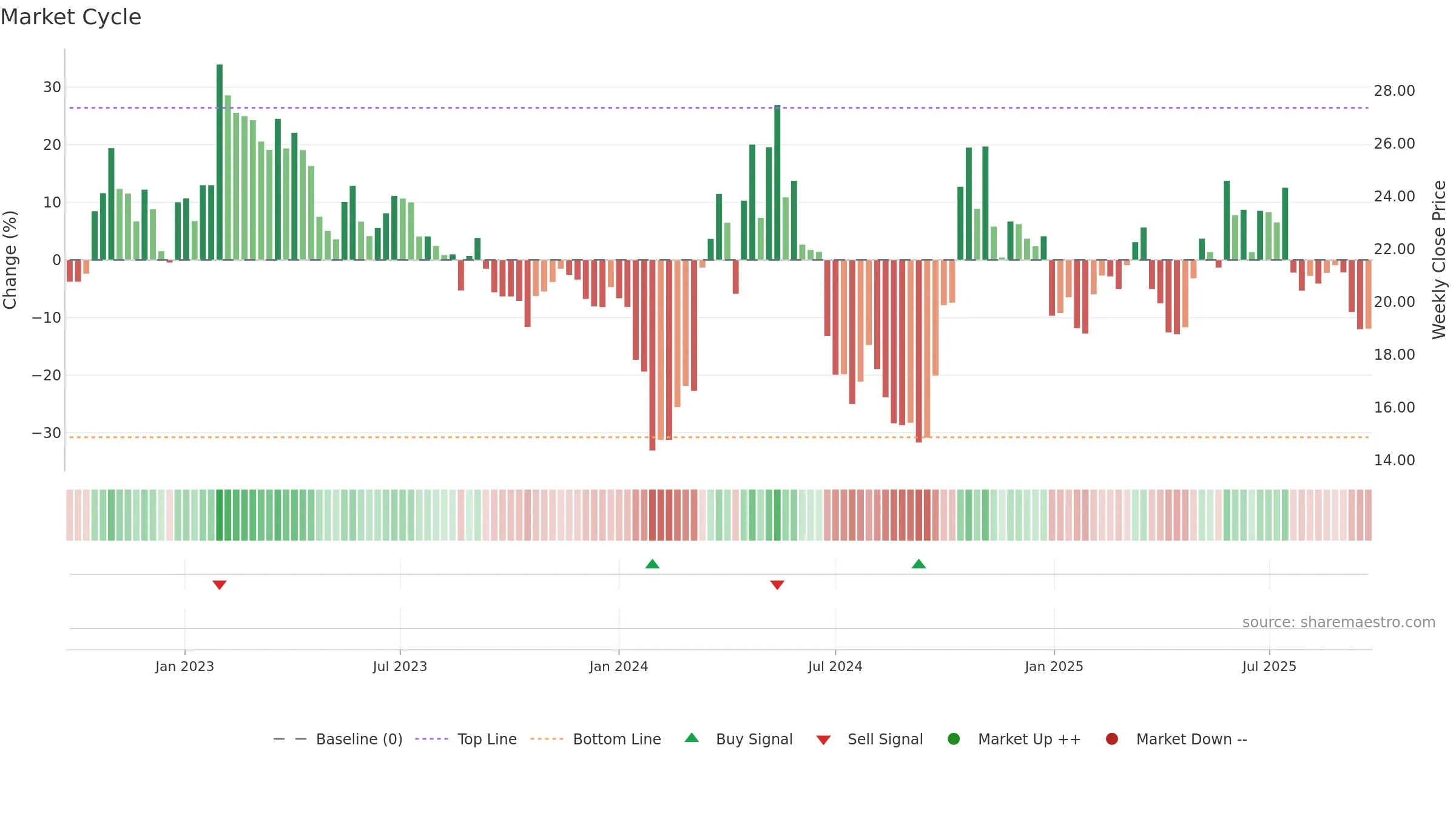

Negative setup. ★☆☆☆☆ confidence. Price window: -9. Trend: Downtrend Confirmed; gauge 36. In combination, liquidity confirms the move.

- Liquidity confirms the price trend

- Low return volatility supports durability

- Bearish control with falling momentum

- Momentum is weak/falling

- Price is not above key averages

- Weak moving-average stack

Why: Price window -9.43% over 8w. Close is -11.13% below the prior-window high. Return volatility 1.35%. Volume trend falling. Liquidity convergence with price. Trend state downtrend confirmed. MA stack weak. Momentum bearish and falling. Valuation stance positive.

Tip: Most metrics include a hover tooltip where they appear in the report.