United Microelectronics Corporation

2303 TPE

Weekly Report

United Microelectronics Corporation closed at 41.1000 (-0.24% WoW) . Data window ends Mon, 15 Sep 2025.

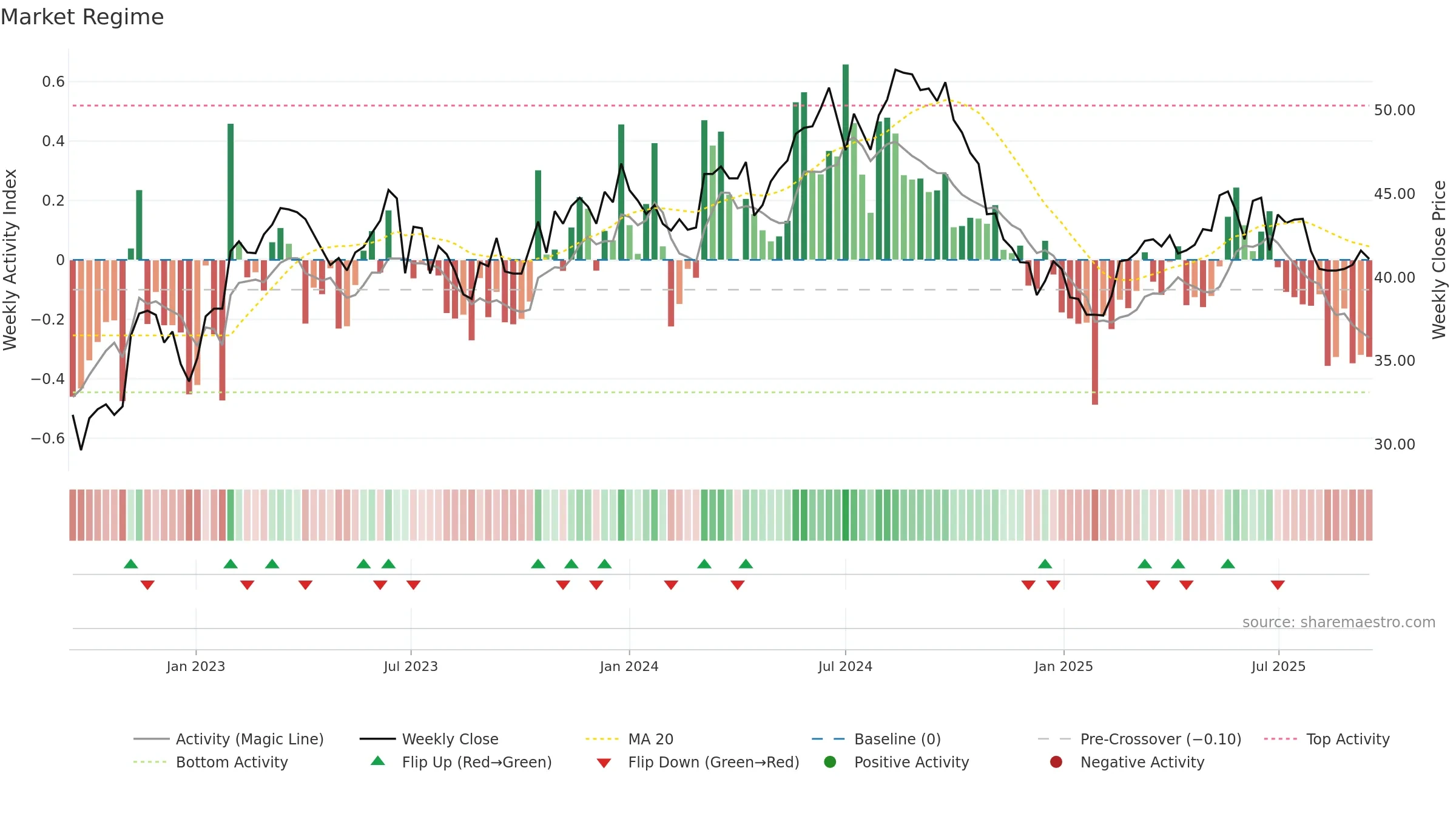

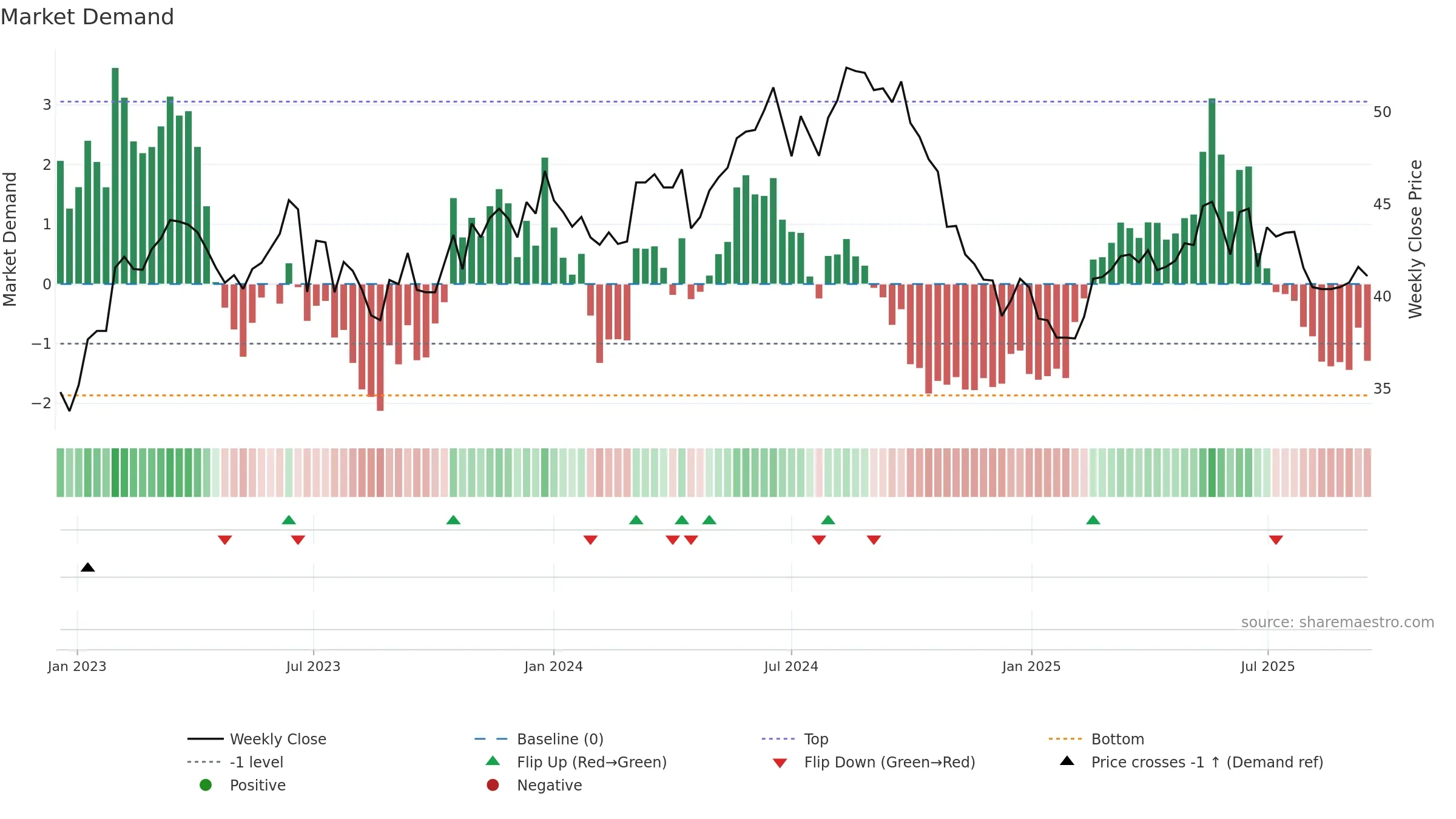

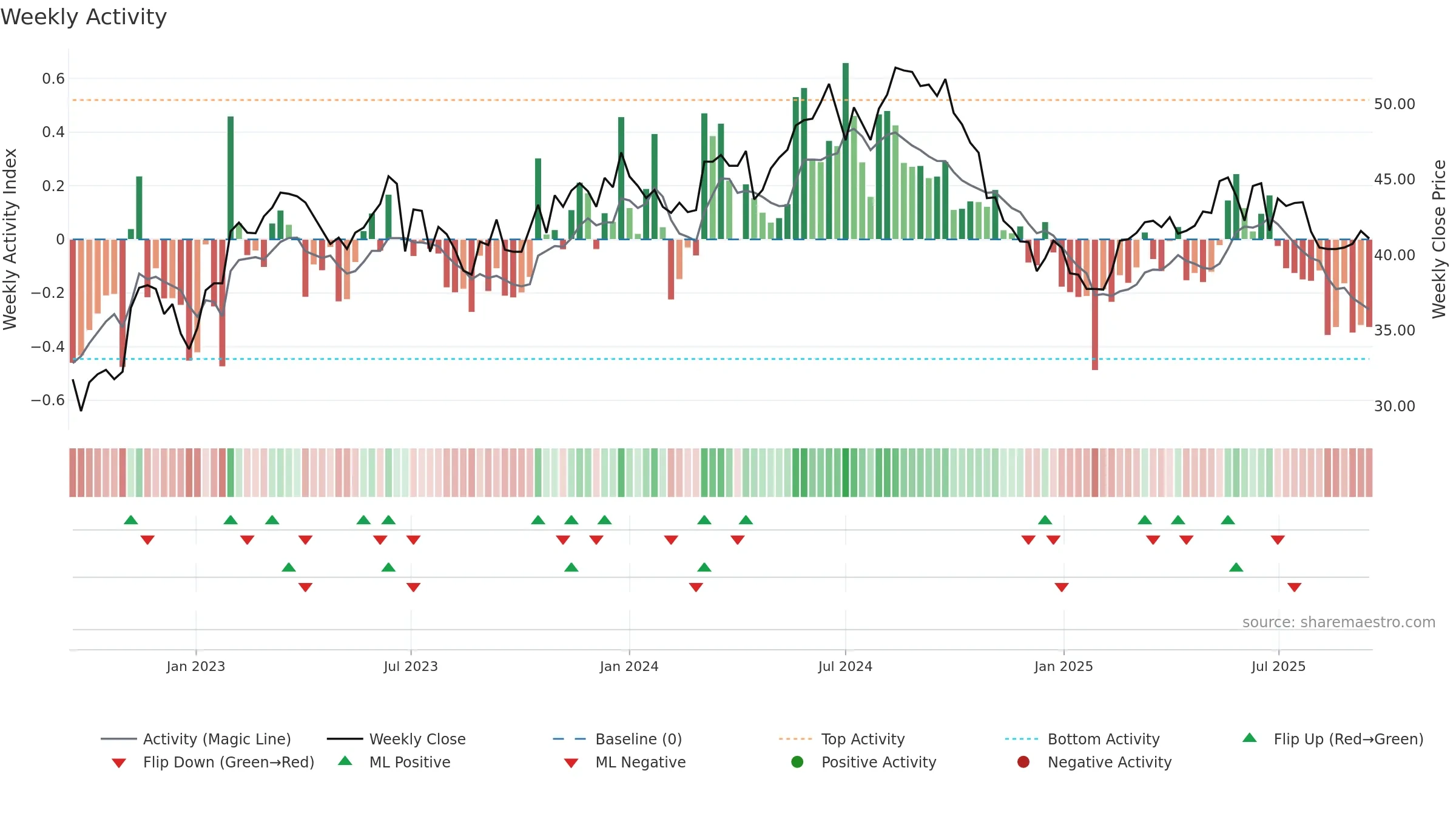

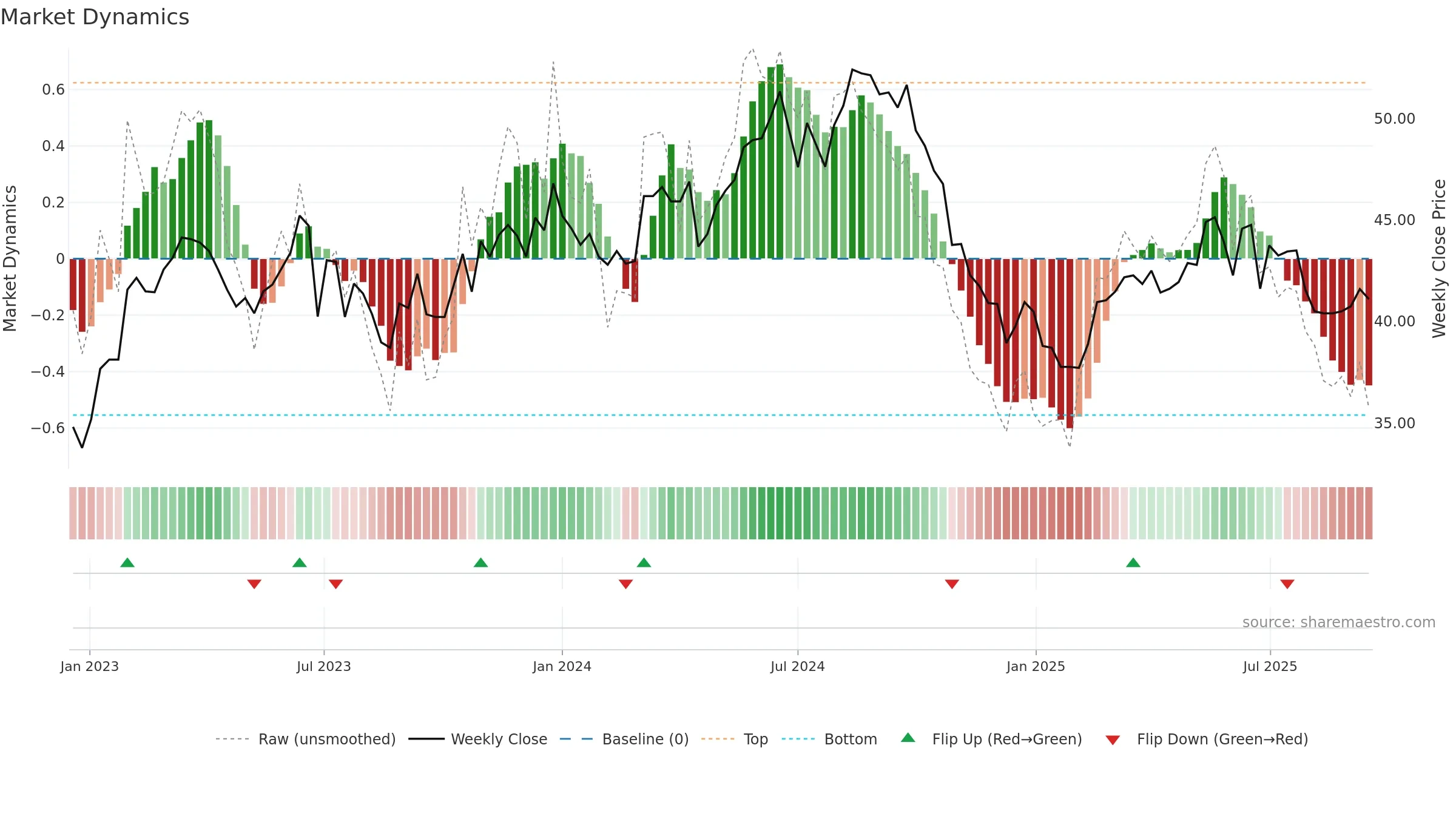

How to read this — Price slope is upward, indicating persistent buying over the window. Low weekly volatility favours steadier follow-through. Volume trend diverges from price — watch for fatigue or rotation. Returns are negatively correlated with volume — strength may come on lighter activity. Distance to baseline is narrowing — reverting closer to its fair-value track. Fresh short-term crossover improves near-term tone.

Up-slope supports buying interest; pullbacks may be contained if activity stays firm. Because liquidity isn’t confirming, prefer evidence of fresh demand before chasing moves.

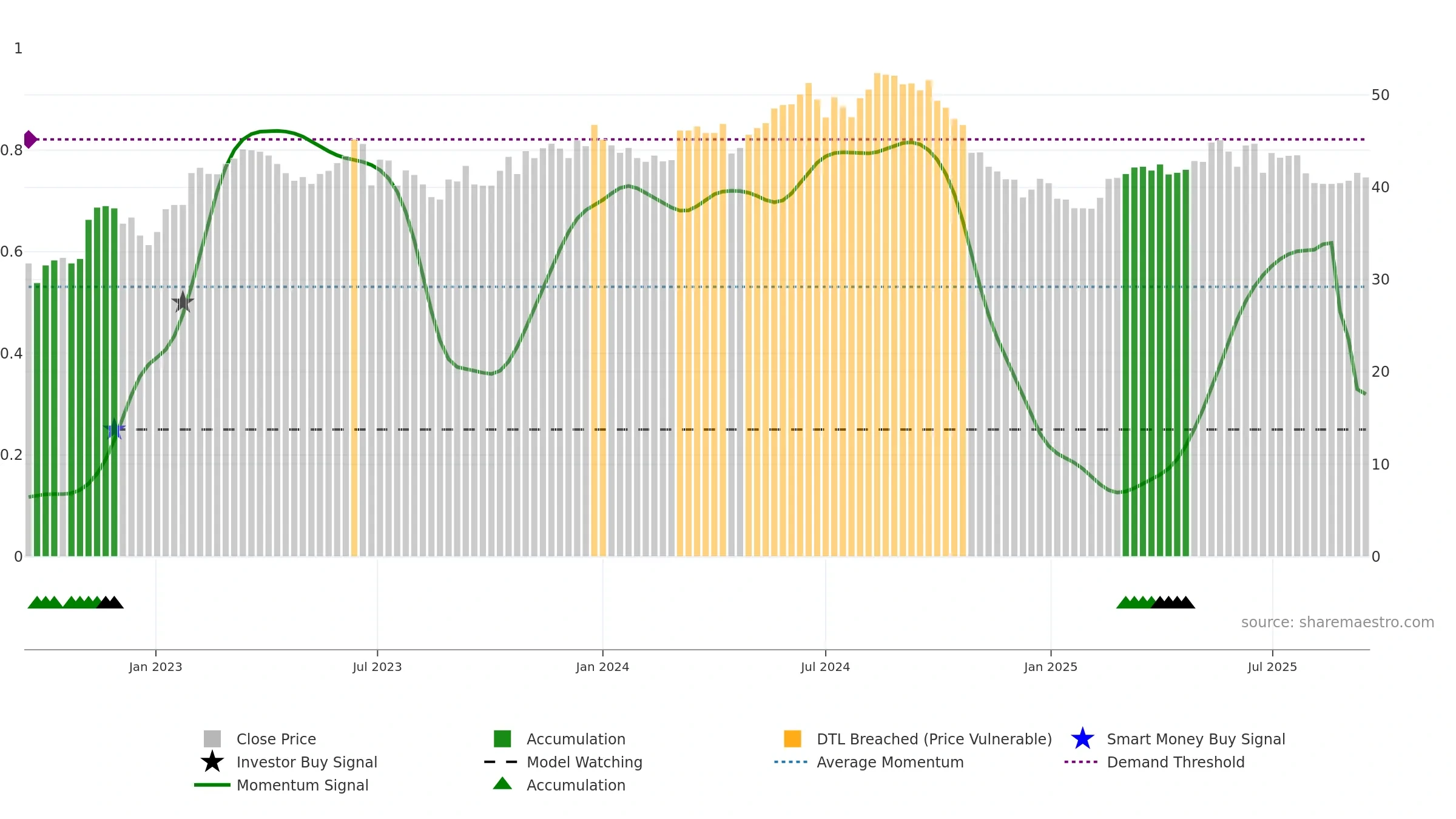

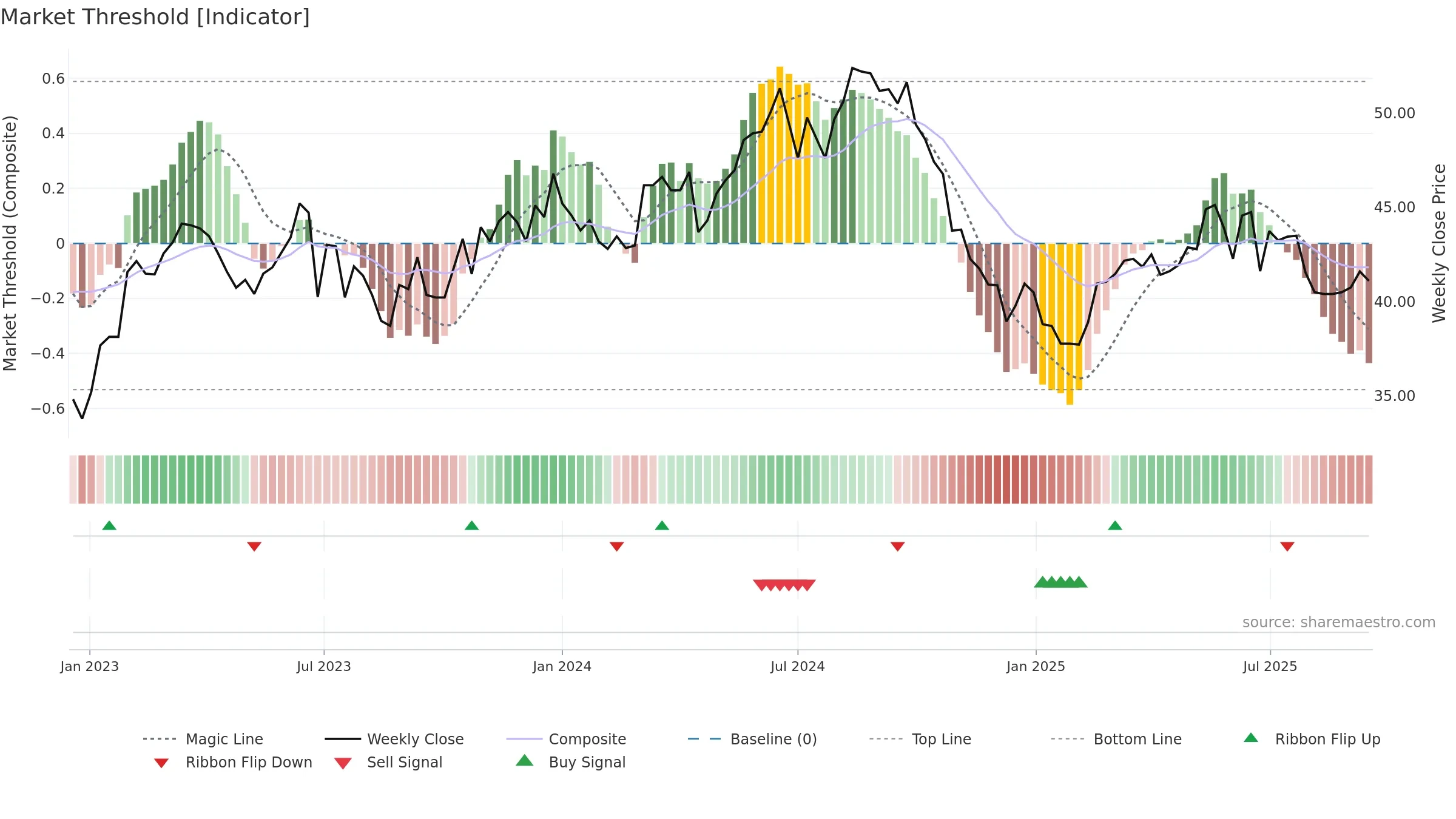

Gauge maps the trend signal to a 0–100 scale.

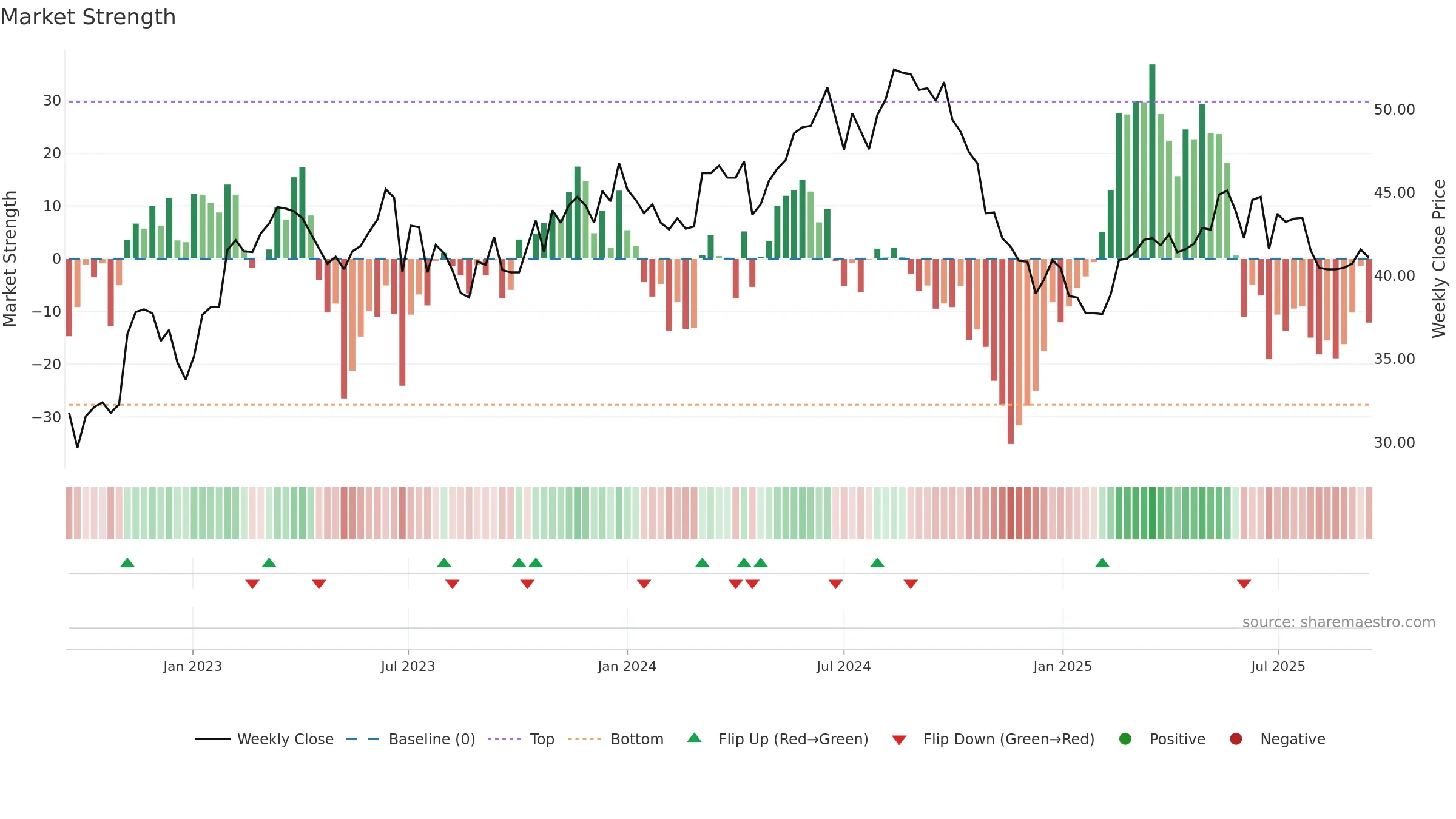

How to read this — Bearish zone with falling momentum — sellers in control. Sub-0.40 print confirms downside control.

Bias remains lower; rallies are suspect unless gauge reclaims 0.50/0.60.

Price is below fair value; potential upside if momentum constructive.

Conclusion

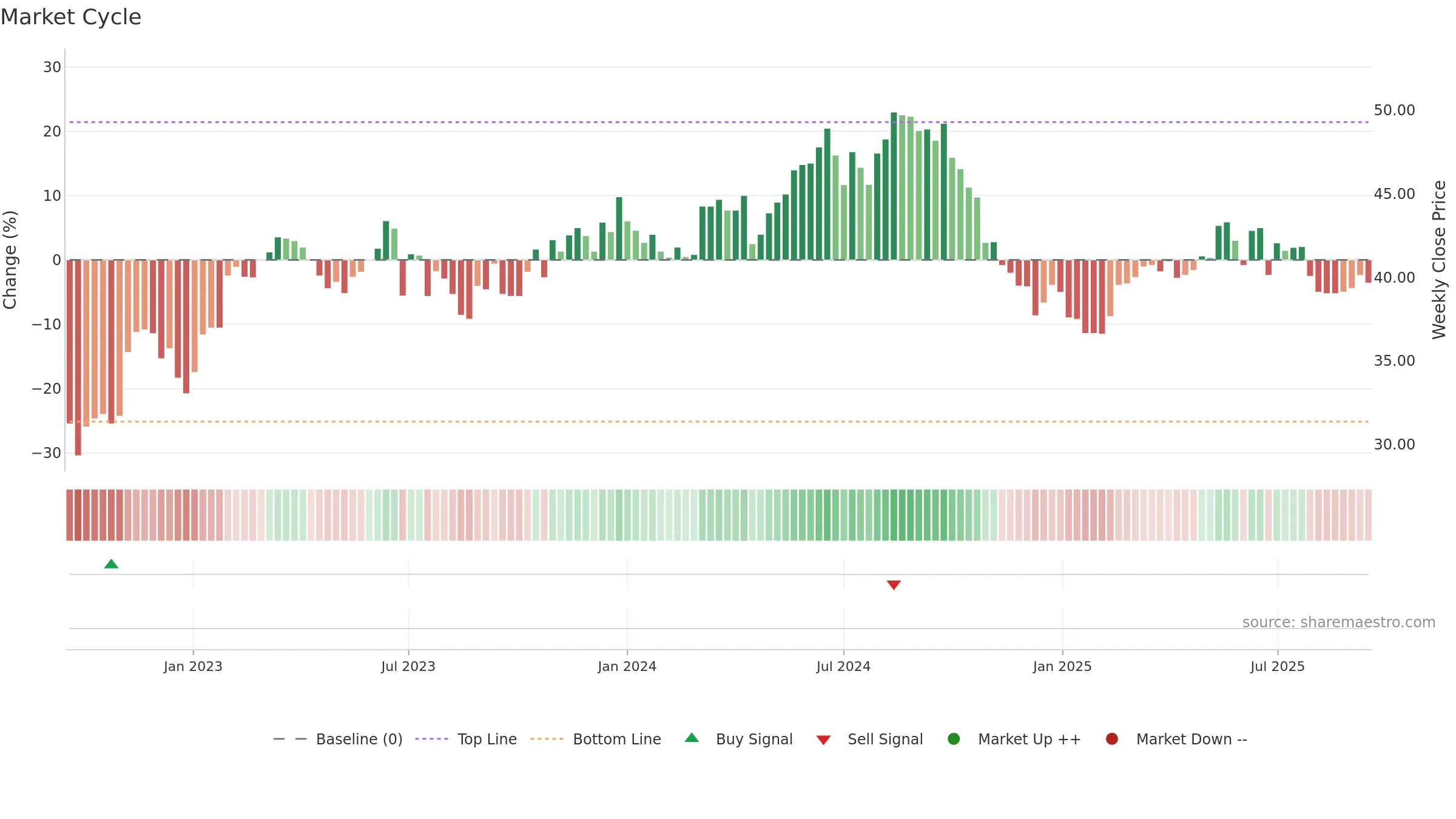

Negative setup. ★☆☆☆☆ confidence. Price window: -1. Trend: Downtrend Confirmed; gauge 32. In combination, liquidity diverges from price.

- Low return volatility supports durability

- Bearish control with falling momentum

- Momentum is weak/falling

- Price is not above key averages

- Liquidity diverges from price

Why: Price window -1.08% over 8w. Close is -1.20% below the prior-window high. Return volatility 1.44%. Volume trend falling. Liquidity divergence with price. Trend state downtrend confirmed. 4–8w crossover bullish. Momentum bearish and falling. Valuation supportive skew.

Tip: Most metrics include a hover tooltip where they appear in the report.