Century Aluminum Company

CENX NASDAQ

Weekly Report

Century Aluminum Company closed at 27.5700 (2.34% WoW) . Data window ends Fri, 19 Sep 2025.

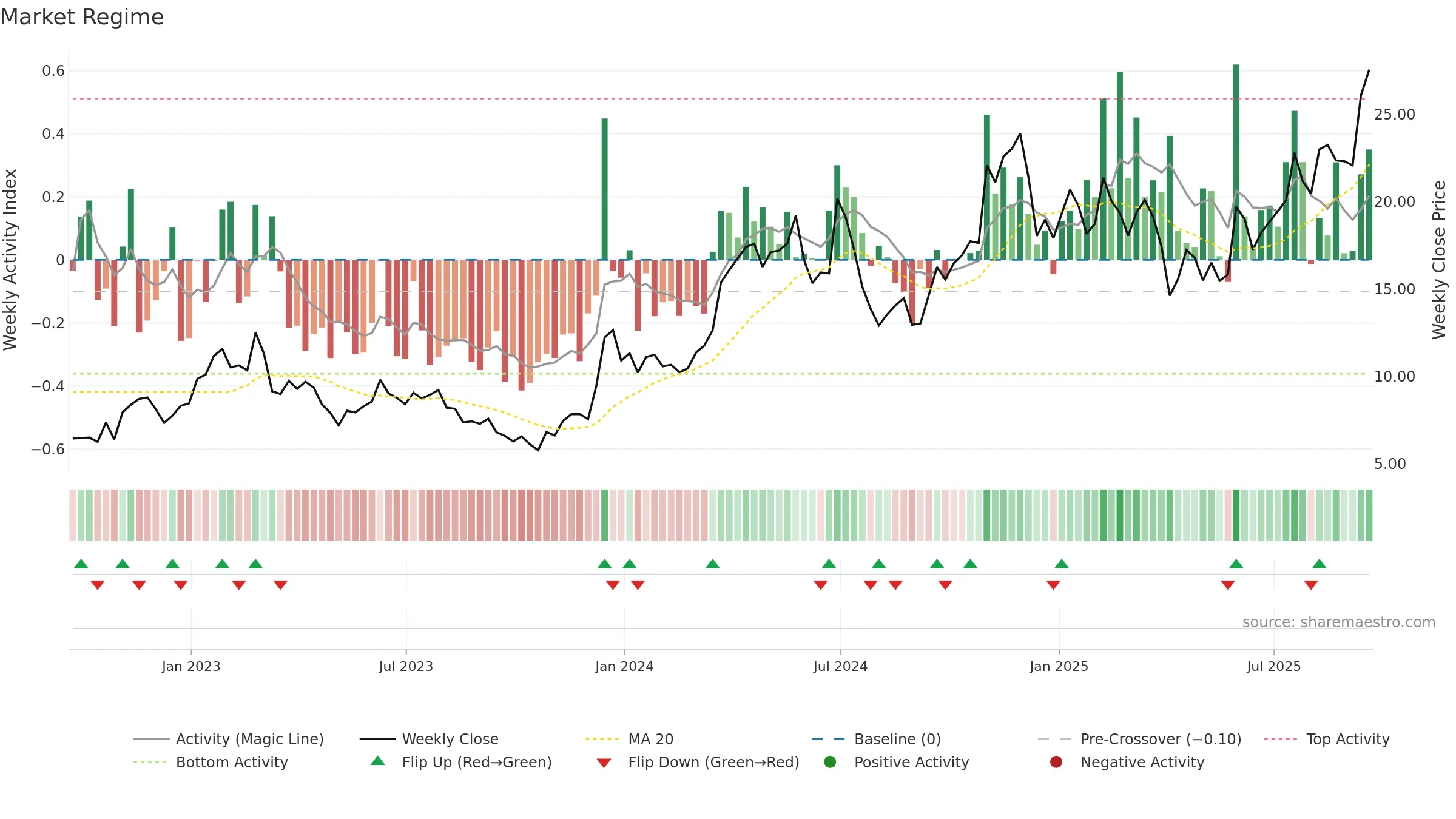

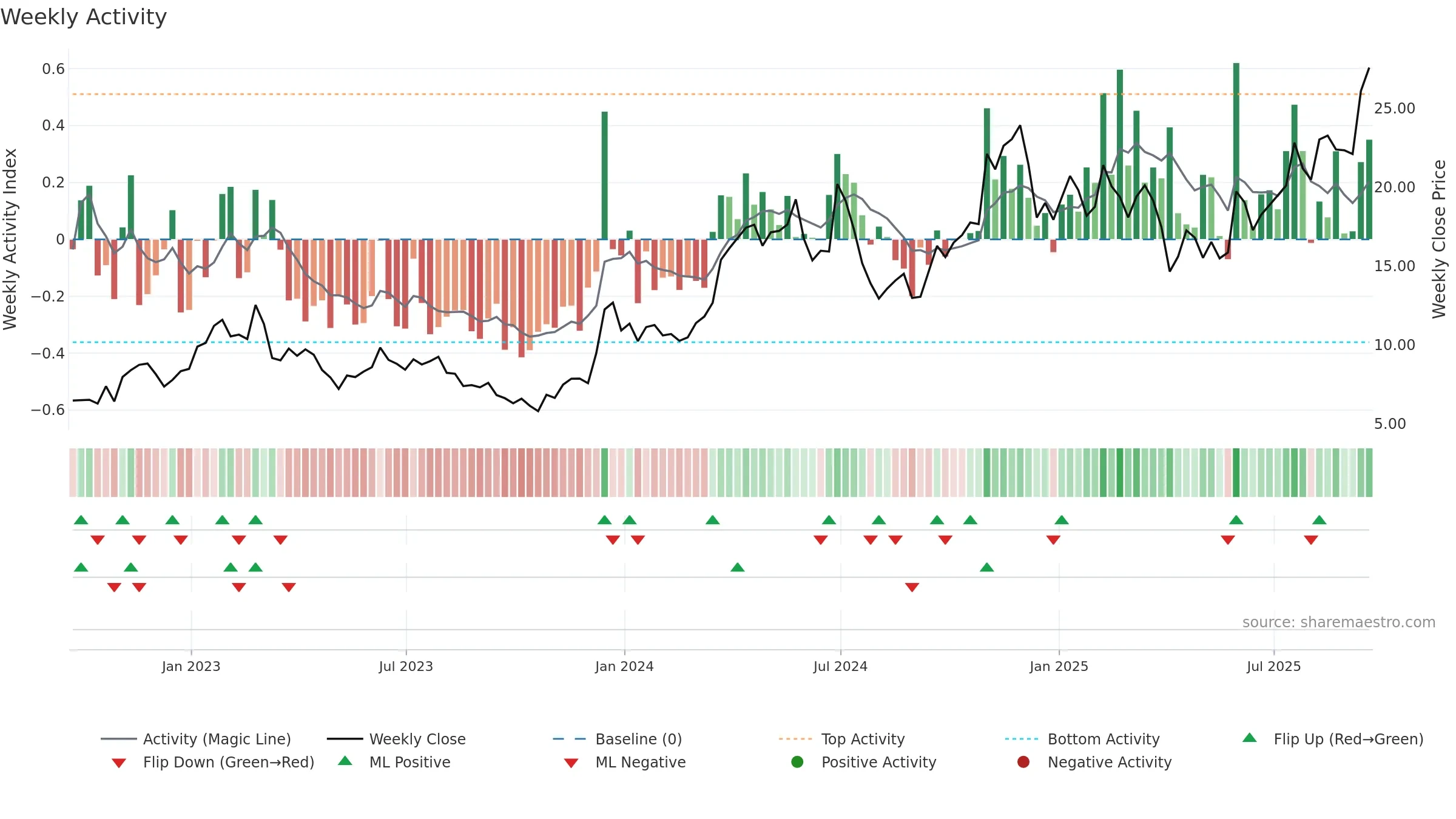

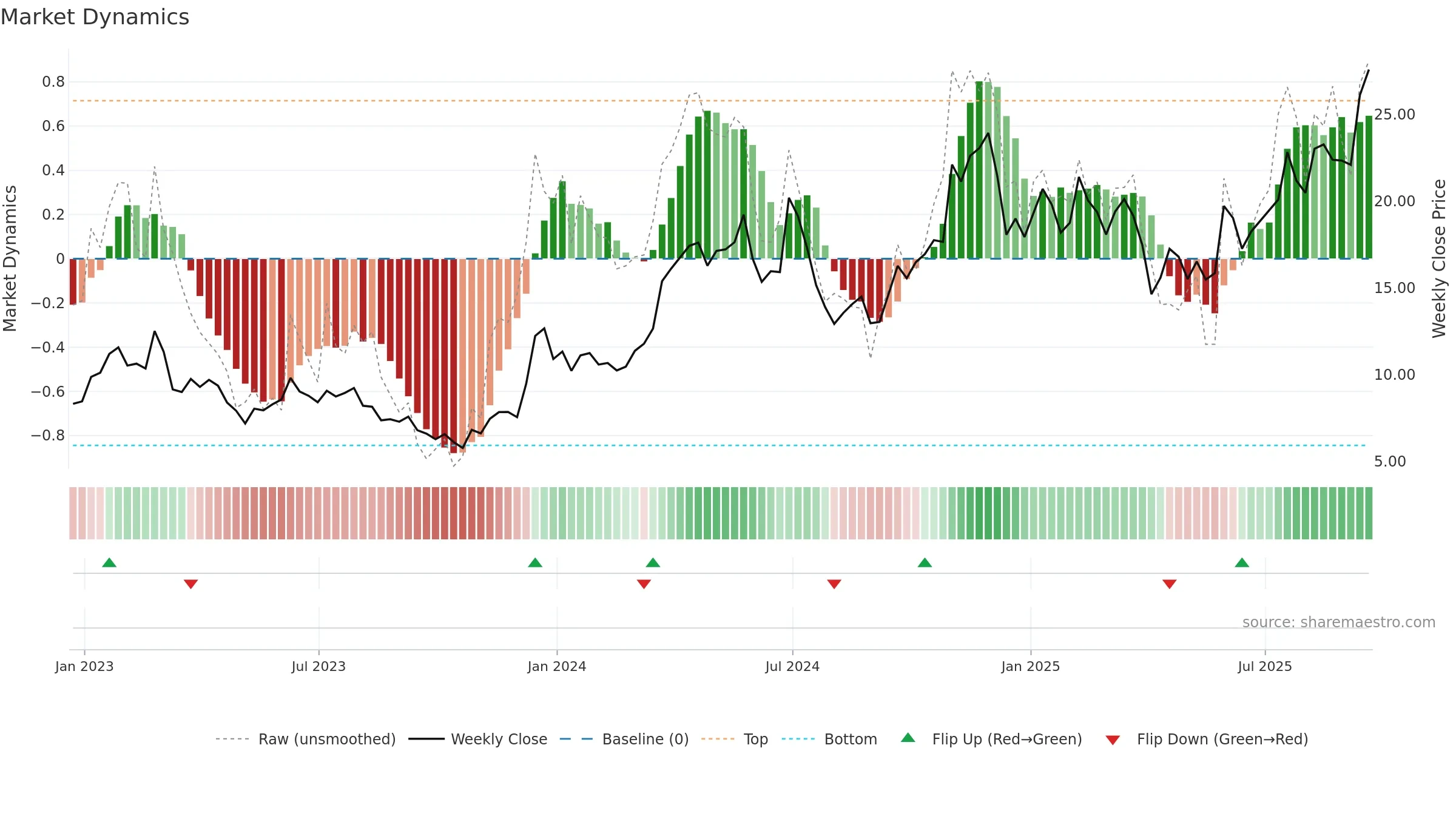

How to read this — Price slope is upward, indicating persistent buying over the window. Volume and price are moving in the same direction — a constructive confirmation. Returns are positively correlated with volume — strength tends to arrive on higher activity. Price is stretched above its baseline; consolidation risk rises if activity fades. Constructive MA stack supports the up-drift; pullbacks may find support at the 8–13 week region. Price holds above key averages, indicating constructive participation.

Up-slope supports buying interest; pullbacks may be contained if activity stays firm.

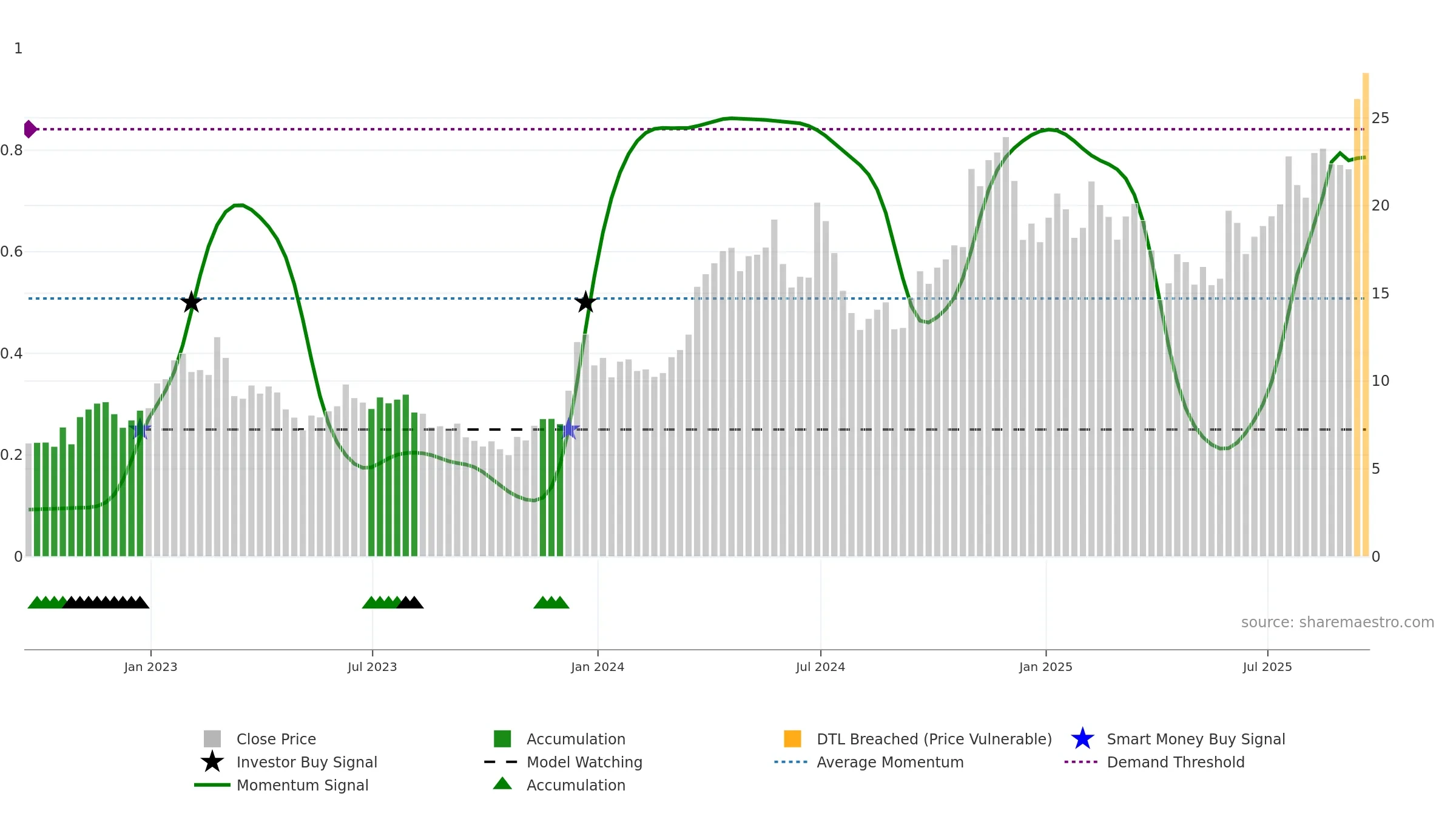

Gauge maps the trend signal to a 0–100 scale.

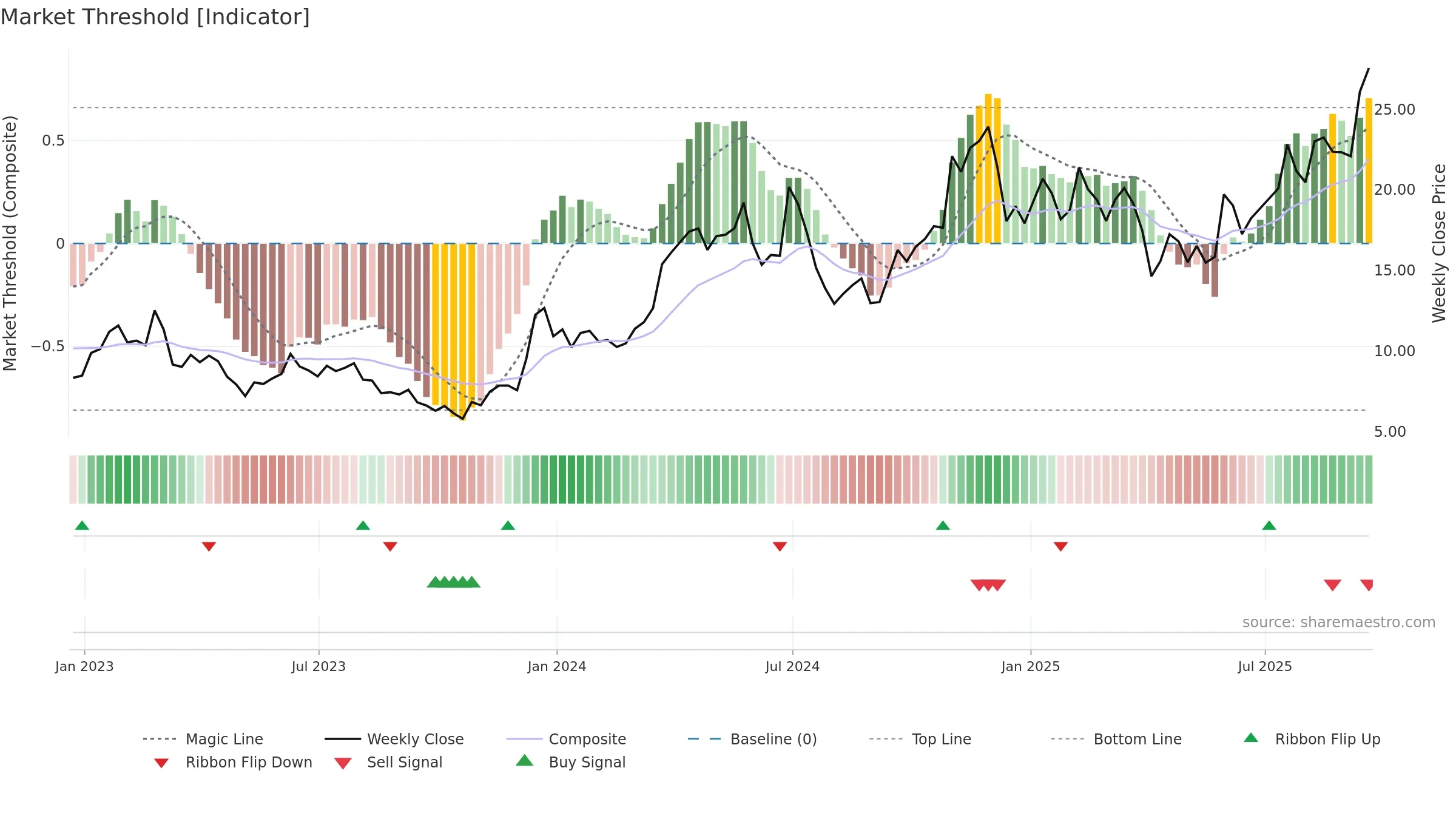

How to read this — Gauge is elevated but momentum is rolling over; topping risk is rising.

Stay alert: protect gains or seek confirmation before adding risk.

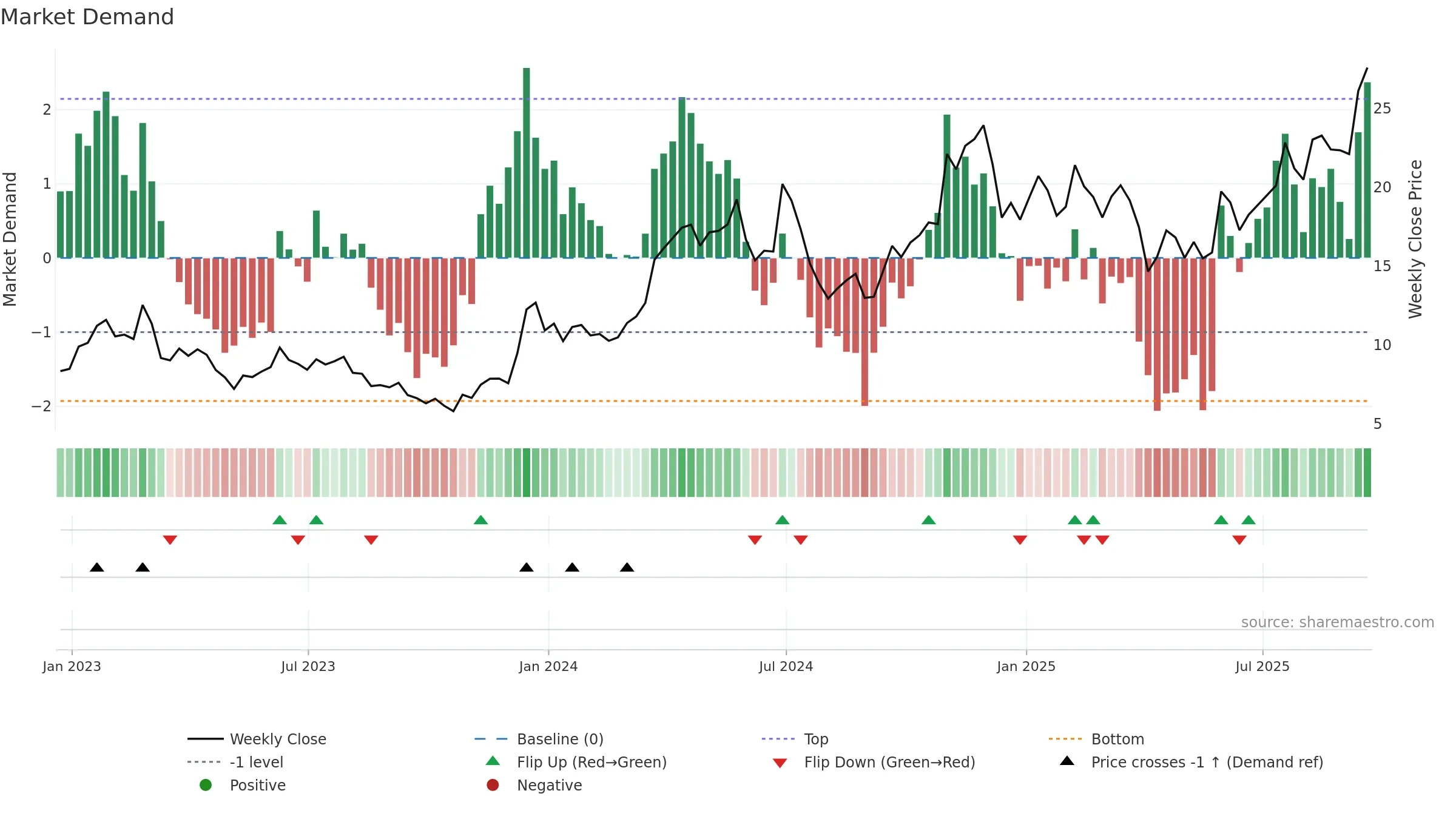

Price is below fair value; potential upside if momentum constructive.

Conclusion

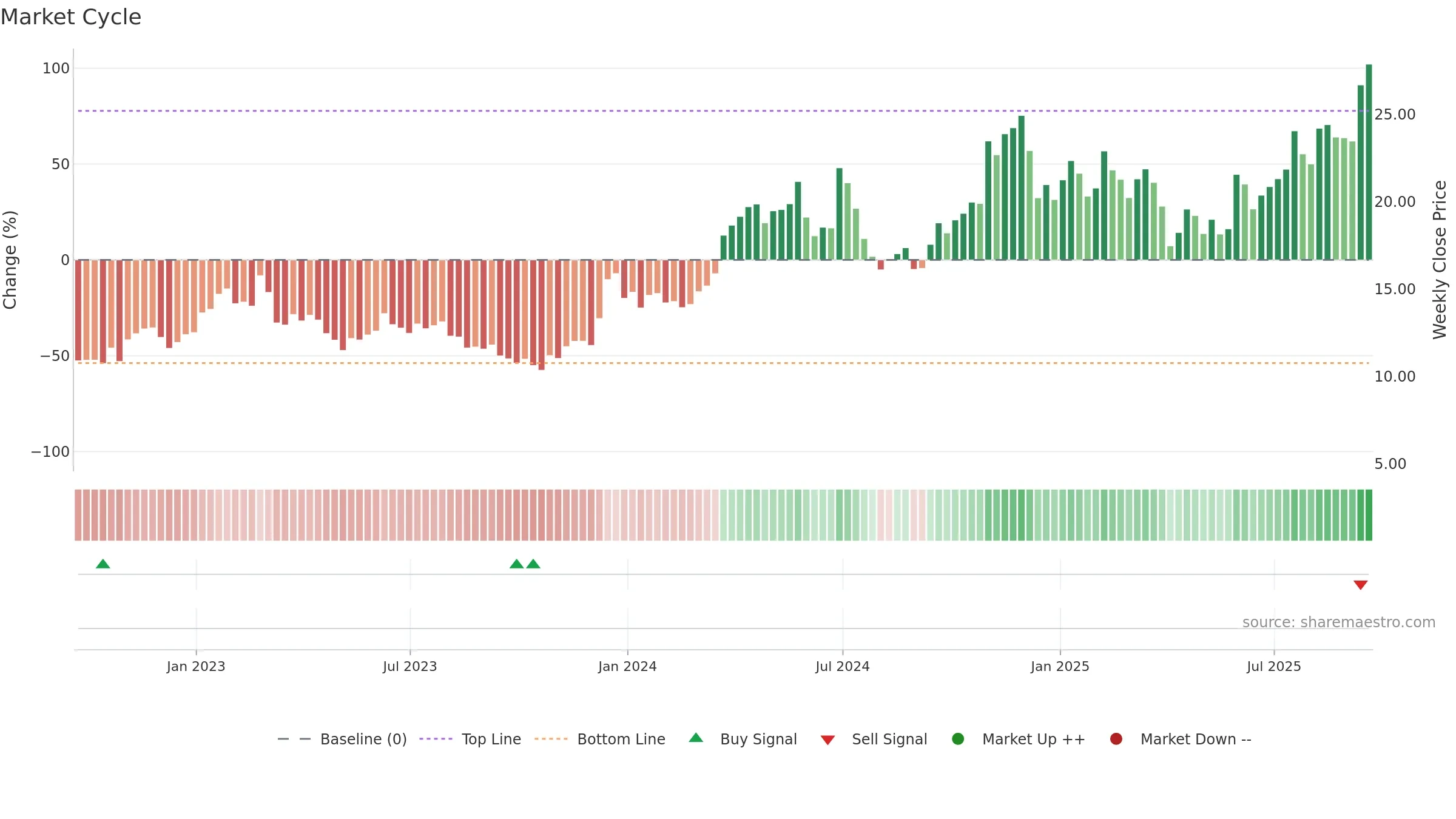

Positive setup. ★★★★☆ confidence. Price window: 34. Trend: Uptrend at Risk; gauge 78. In combination, liquidity confirms the move.

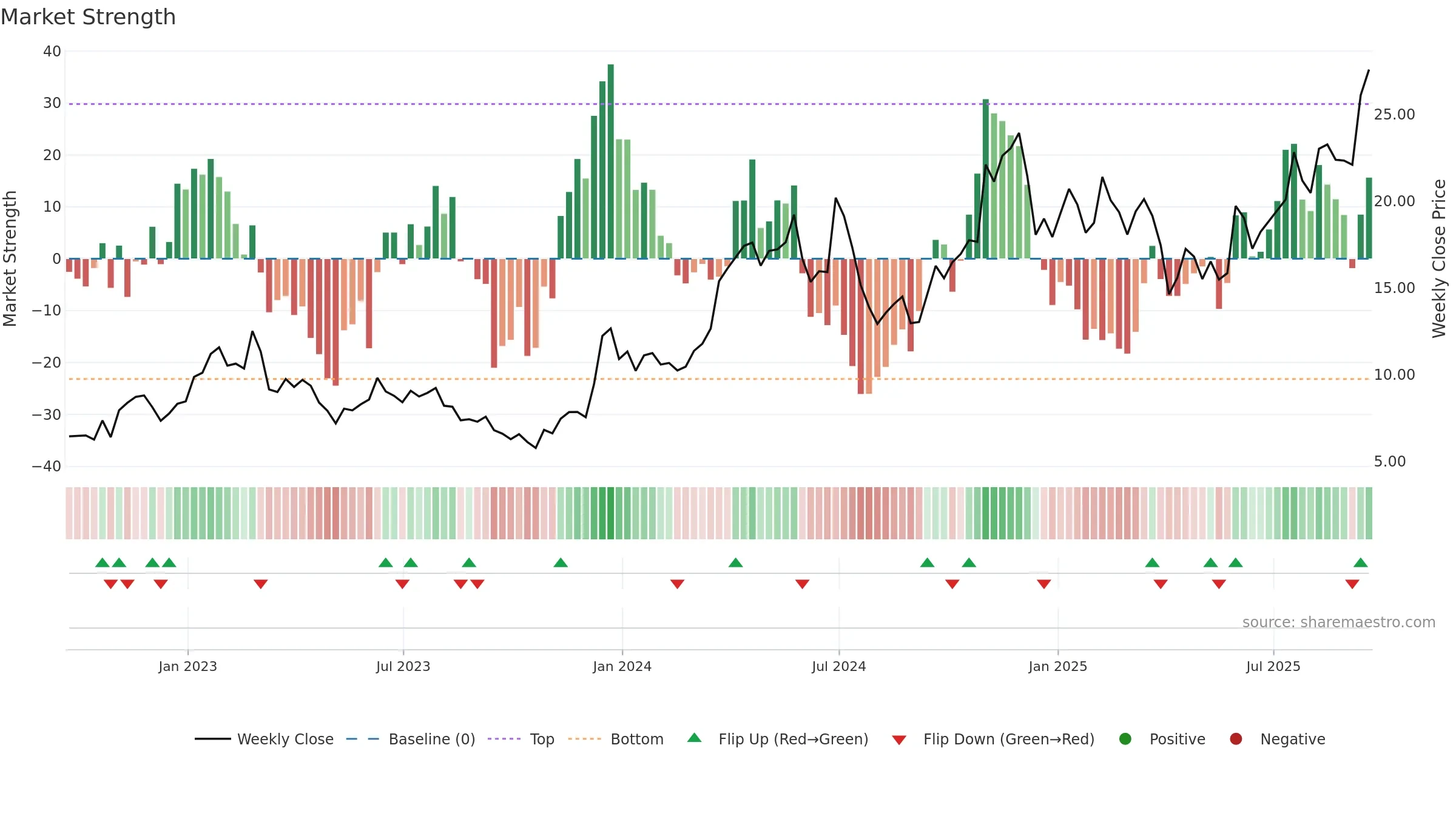

- Momentum is bullish and rising

- Price holds above 8w & 26w averages

- Constructive moving-average stack

- Liquidity confirms the price trend

- High-level but rolling over (topping risk)

Why: Price window 34.68% over 8w. Close is 5.67% above the prior-window high. Return volatility 2.17%. Volume trend rising. Liquidity convergence with price. Trend state uptrend at risk. MA stack constructive. Baseline deviation 1.00% (widening). Momentum bullish and rising. Valuation supportive skew.

Tip: Most metrics include a hover tooltip where they appear in the report.